Swan Signal Bitcoin Blog

This blog offers thoughts and opinions on Bitcoin from the Swan Bitcoin team and friends. Swan Bitcoin is the easiest way to buy Bitcoin using your bank account automatically every week or month, starting with as little as $10.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

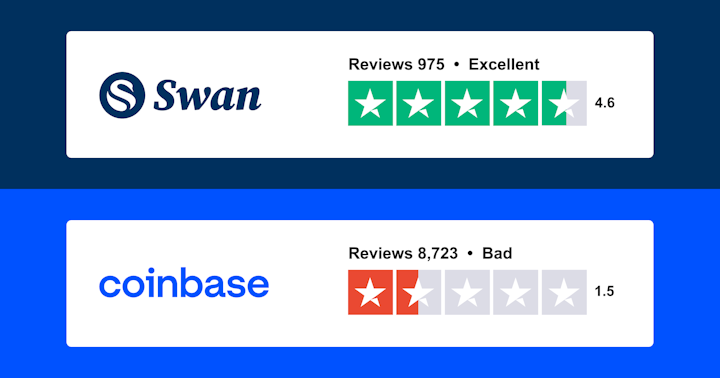

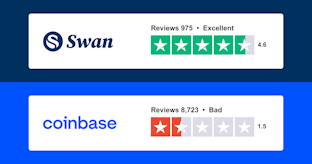

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?

Best Bitcoin ETF Fees: Compare Top Providers

By Matt Ruby

Spot Bitcoin ETFs are here! Learn all about their fees, why they matter, who has the lowest and how they’ll impact Bitcoin in the future.

A Changed Bitcoin At $50k

By Sam Callahan

Although $50k was close to the cycle high in 2021, the current environment makes it easy to believe that this time, $50k marks the beginning, not the end, of an extraordinary bull run.

BITO vs. GBTC Compared: Which is Best in 2024?

By Drew

BITO vs. GBTC in 2024… Which is best? Neither. Learn why!

GBTC was the Genesis of the Crypto Credit Contagion (Part II)

By Sam Callahan

There are many reasons to criticize DCG and Genesis. Moreover, the drama highlights why holding Bitcoin is a superior option for investors. No fees or if your money benefits a company that doesn’t align with your values.

2030 & 2040 Bitcoin Price Predictions (Insights From Top Experts)

By Drew

Max Keiser predicts Bitcoin to be worth $200K in 2024. Fidelity Investments predicts one Bitcoin to be worth $1B in 2038, Hal Finney predicted $22M per Bitcoin in 2045. Let’s look into these in detail…

Is Coinbase Safe & Trustworthy in 2024? (Read This First)

By Drew

Even though Coinbase has many security measures in place to protect customer funds it is not entirely safe. We analyzed over 9k poor customer reviews to analyze security and safety of the platform in 2024.

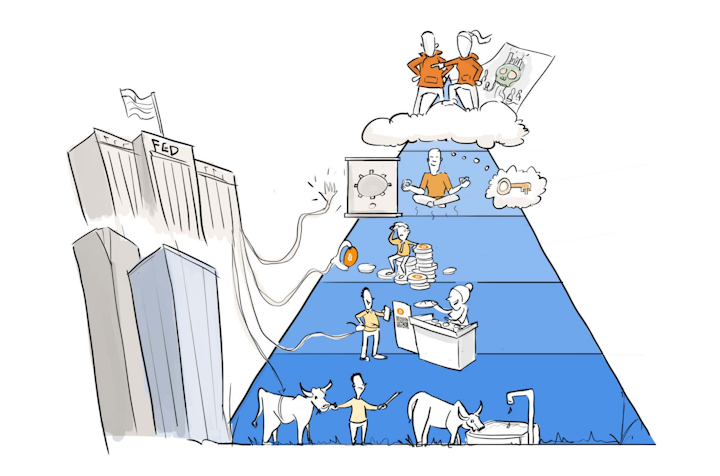

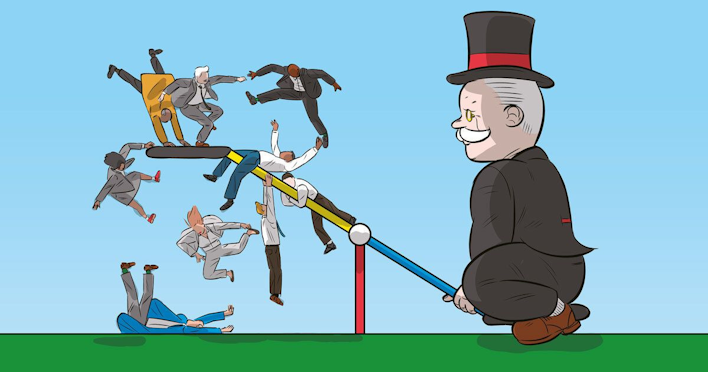

What Is Cantillon Effect? (Top 3 Reasons You Should Care in 2024)

By Mickey Koss, Drew and Matt Ruby

The Cantillon Effect reveals inflation’s uneven impact. Bitcoin, however, has a Reverse Cantillon Effect. As a result, Bitcoin is an escape from the vicious cycles of money printing.

How the Byzantine General’s Problem Relates to You in 2024

By Matt Ruby

The Byzantine Generals Problem, a perplexing game theory dilemma, was the reason decentralized money could never work. Until Bitcoin came along and solved it via the blockchain. Now, money will never be the same.

How to Buy Bitcoin with Cash at Walmart in 4 Easy Steps

By Drew

Buying Bitcoin at Walmart is easy. Select a Bitcoin wallet. Choose a P2P exchange. Bring required documents. Submit details. That’s it! In this article we dive into a step by step with all the details.

How Many Satoshis Are in a Bitcoin? (1 BTC = 100M Sats)

By Drew

Like a dollar can be broken down into cent-sized units called satoshis. One Bitcoin is equal to 100M satoshis. In this article, we learn why satoshis are so important to Bitcoin adoption!

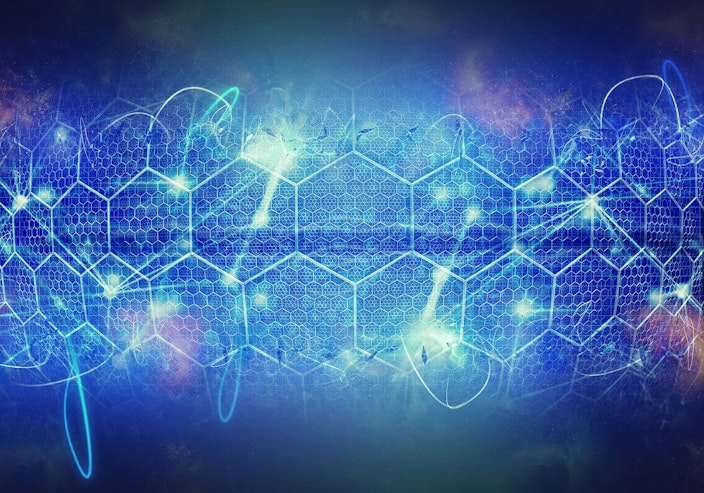

Next Bitcoin Halving: April 19th, 2024 History and What to Know!

By Drew

Every four years, the Bitcoin network experiences an event known as the “Halving.” What is a Halving?…

How Much Does It Cost to Mine a Bitcoin? $20K With 4.7c/Kwh

By Mickey Koss

Mining a Bitcoin depends on your energy rate per Kwh, it costs $40K to mine a Bitcoin at 10 cents per Kwh and $20K to mine a Bitcoin at 4.7 cents per Kwh. Learn how and if its right for you!

6 Most Trusted Bitcoin Investment Sites (What to Know in 2024)

By Brandon Quittem

With so many Bitcoin investment sites, choosing the right one for you can feel a bit overwhelming. Going Bitcoin-only in 2024 with automatic recurring purchases is a smart business decision. Learn why with Swan below!

Delete Coinbase in 3 Easy Steps!

By Cory Klippsten

You may have wondered “How do I get my money out of Coinbase?” This guide is focused on how to transfer Bitcoin from Coinbase, and then delete your account forever!

What Are Bitcoin Ordinals? (Why Inscript Your BTC)

By Drew

Seen by some as an innovation in data storage and network security, while others view them as a passing fade and drift from Bitcoin’s original intent as a currency. Let’s explore!

Trillion-dollar Deficits are Keeping the Economy Afloat

By Sam Callahan

The reckless nature of government fiscal policies suggests a future where financial instability may hinge on the balance between innovation and traditional policy decisions.

Best 6 Bitcoin & Crypto IRAs for 2024: Which Wins?

By Drew

Bitcoin IRAs have exploded in popularity. This guide breaks down the most popular Bitcoin IRAs and Crypto IRAs of 2024 and will help you pick the best one for your goals and situation.

Bitcoin Liberation: Yan Pritzker’s Personal Journey to Freedom

By Yan Pritzker

Bitcoin is about so much more than merely “number go up.” It’s a tool to reclaim individual economic freedom from those who seek to take that freedom away. And that is something to be optimistic about!

3 Easy Ways to Run Your Own Bitcoin Node

By Stephan Livera

To further improve your Bitcoin self-sovereignty, it’s essential to learn how to use operate a Bitcoin node. Learn how to best run your own Bitcoin node with Swan below!

Swan Support: Best Ways to Contact Swan Bitcoin Support in 2024

By Drew

Swan Support is the best in the industry for Bitcoin customer service. We are here for all your inquiries and issues. Learn the best ways to contact Swan Support in 2024 below!

Best Bitcoin Exchanges for 2024: Which Wins & What to Know

By Drew

With so many Bitcoin exchanges out there, how do you pick the right one for you? We are here to help choose between three of the best Bitcoin exchanges: Swan Bitcoin, Binance and Coinbase.

7 Best Coinbase Alternatives 2024 (What You Need to Know)

By Drew

The uncertainty surrounding compliance and regulatory problems for Coinbase is intensifying. Bitcoin-only Swan is one of the most popular Coinbase alternatives for buying Bitcoin in 2024. Here is why!

What is Bitcoin Cold Storage? (The Safest Solution for 2024)

By Mickey Koss

Setting up cold storage can be intimidating, but it is actually quite simple. You will gain all the confidence you need to effectively use and manage your private keys with multiple cold storage options.

Are “Ordinals” Worth Worrying About?

By Stephan Livera

Ordinals and Inscriptions are not ideal for monetary users of Bitcoin, but they are not currently a systemic issue for Bitcoin. Learn why with Stephan Livera!

Bitcoin: Solving the Fundamental Problem of Money

By Tomer Strolight

Bitcoin’s rate of supply discovery is slowing down, by half, every four years — a first for any commodity! Satoshi solved not just the double-spending problem but also the fiat imalleable supply cap problem!

5 Reasons to Be Bullish Heading into 2024

By Sam Callahan

While past performance is not a guaranteed indicator of future results, the combination of these catalysts suggests a heightened interest and investment in Bitcoin and another green candle year!

Alto Crypto IRA Review 2024: What 1K+ Reviews Tell Us

By Drew

Alto Crypto IRA is a well-know self-directed Bitcoin and crypto IRA platform. Alto lets investors trade altcoins in their retirement account. But how does it stack against Bitcoin-only Swan IRA in 2024? Let’s find out!

Tax-Free Billions: Step by Step How Peter Thiel Has $5B in His Roth IRA

By Drew

Few stories have captivated the public’s imagination quite like that of Peter Thiel’s Roth IRA. Here is the journey from a modest contribution of $1,700 to +$5 billion, step by step.

Is Binance in Trouble? Yes, Here Is Why… (March 2024)

By Drew

The uncertainity surrounding Binance hasn’t become any clearer. How much trouble might Binance find itself in and what can we expect in 2024 from the world’s most popular exchange? Let’s dive in!

BitcoinIRA Review 2024: What to Look Out For!

By Nick Payton

Investing in Bitcoin with a tax-advantaged IRA is a smart move to preserve and grow your wealth. BitcoinIRA has the brand name but offers many altcoins with big red flags! Let’s see how compares to Swan Bitcoin in 2024.

The Race is On: Eleven Bitcoin ETFs Launch

By Sam Callahan

These ETFs will act as a top-of-funnel and will become an initial touchpoint for many future Bitcoiners.

Will a Record Flood to Cash Flow into Bitcoin Next?

By Sam Callahan

If the Fed decides to cut rates then expect the floodgates to open, and Bitcoin will be one beneficiary as it sucks up the liquidity, potentially driving its price to new heights in the coming year.

BitcoinIRA Fees: Top Things to Know in 2024

By Drew

In this guide, we uncover BitcoinIRA fees and expose hidden costs and complex jargon. We’ll go over BitcoinIRA custodial, management, onboarding, trading, and security fees in 2024.

Will Bitcoin Follow Gold’s Monetary Rise and Fall? And a Look at Bitcoin’s Scaling Strategy

By John Haar

Bitcoin can achieve its ultimate goal — to be a neutral base layer of a new monetary system for billions of users worldwide

Bitcoin: Reuniting a Deeply Divided World

By Tomer Strolight

Bitcoin’s unchangeability is the fix we have needed for money throughout history.

A Fed Pivot Releases Animal Spirits

By Sam Callahan

It seems like things are all lining up for Bitcoin to have an explosive year in 2024.

Swan Bitcoin 2023 Give Guide

By Alex Davani

We can all agree there is nothing greater than the gift of Bitcoin. This holiday season, please join the Swan family in the joy of giving (with a Bitcoin-centric twist).

Argentina: How Fiat Policies Ruined a Once Prosperous Nation

By Sam Callahan

If Argentina embraces Bitcoin, perhaps it can start to resemble the prosperous nation it once was and its people can finally experience something they haven’t felt in a long time — hope.

I’m Bullish and Don’t Care Who Knows

By Isaiah Douglass

All-Time High Bullishness — Why Today Feels Different!

A Recap of the 2023 Pacific Bitcoin Festival

By Nick Payton

Pacific Bitcoin redefines the boundaries of what an event could be by seamlessly blending the best of Bitcoin education, entertainment, and social connections. It was more than just a conference.

5 Reasons to Focus on Bitcoin Only

By Brandon Quittem

Unlike other cryptocurrencies, over the long term, Bitcoin has provided exceptional returns, peace of mind, and security for HODLers, their families, businesses, and employees.

Feast or Famine? Breaking Down the State of the Economy

By Sam Callahan

As Americans continue to feel misled by their government and struggle with the cost of living, Bitcoin increasingly becomes a viable alternative.

What Bitcoiners Need to Know About Hashes (But Are Afraid to Ask)

By Tomer Strolight

Bitcoin leans heavily on a process called hashing to achieve many of its unique properties… But what actually is hashing?

Why Bitcoin is the Ultimate Asset for Your IRA

By Rapha Zagury and Brandon Quittem

Adding Bitcoin to your IRA can provide asset diversification, as well as the potential for higher returns and a measure of protection against monetary debasement.

Preparing for an Inflationary Soft Landing

By Sam Callahan

Investors need to consider that we may be entering a period not seen in the developed world in decades, similar only to those experienced in emerging markets.

Bitcoin: A Digital Benchmark For Tracking Fiat Debasement

By Sam Callahan

As economies around the globe grapple with the fragility of their currencies, the rising adoption of Bitcoin signals a collective move towards the hardest money man has ever known.

What’s New and Coming in Lightning

By Stephan Livera

As Lightning Network Usage Grows, Splicing, BOLT12, Offline Payments, and LSPs are Poised to Deliver Big Improvements for Users.

A Bond Bloodbath is Spiking Heart Rates

By Sam Callahan

Bond yields are rising as investors are beginning to question the sustainability of these policies as the budget deficit grows larger and inflation remains elevated.

Yours Truly, Bitcoin

By Tomer Strolight

I do hope this letter has helped to bridge the understanding between you and me.

Bitcoin Core’s Development Priorities in 2023

By Evan

Developers have been busy shoring up the Bitcoin Core node software. Here is what they are up to.

The Government is Spending Like There’s No Tomorrow

By Sam Callahan

As the government spends frivolously to prevent a recession, the traditional monetary system seems to be growing more fragile as it fractures under the weight of enormous amounts of debt.

Bitcoin: Demystifying Money

By Tomer Strolight

Only Bitcoin completely demystifies how money works and, even more importantly, will continue to work.

Bitcoin: A Buoy in the Waves of Inflation

By Sam Callahan

As uncertainty remains the status quo in the traditional financial system, Bitcoin’s system remains predictable and reliable.

2023 Is a Ripe Environment for Central Bank Failure

By Sam Callahan

The history of the Bank of Amsterdam underscores the vital role trust plays within the monetary system today. As more individuals choose Bitcoin over traditional fiat currencies, its adoption and significance will grow.

Accounting for Bitcoin in a World of Rising Oil Prices

By Sam Callahan

These are thin markets right now, so when major news hits, expect the volatility to continue. And remember… volatility works both ways!

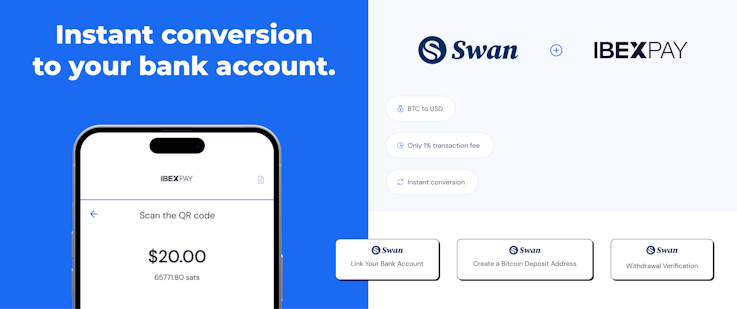

IBEX Joins Forces with Pacific Bitcoin Conference

By Swan Bitcoin

Swan is thrilled to announce our partnership with IBEX at the 2023 Pacific Bitcoin Conference.

Bitcoin: More Relevant, More Urgent, More Ready — Part 2

By Ulric Pattillo

Three more personas that inhibit Bitcoin adoption for themselves and others around them.

Bitcoin Awakens from Its Summer Slumber

By Sam Callahan

This drawn-out period of low volatility serves as a coiled spring. The only question is in which direction will the price eventually break.

The Speed of Transactions vs. the Speed of Settlements

By Lyn Alden

This draws from chapter 8 of Lyn Alden’s new book, Broken Money, and focuses on a key reason why the world became more and more financialized.

Bitcoin: An Endless Chain of Mysteries

By Tomer Strolight

There are so many mysteries that draw us into Bitcoin. And there always will be.

Tether: The New Big Bitcoin Buyer in Town

By Sam Callahan

Tether has now become a significant, price-insensitive regular buyer of Bitcoin.

Bitcoin — The Natural Choice For Artificial Intelligence

By Tomer Strolight

AI agents will need to use money and Bitcoin is the best money for the job. This results in Bitcoin both benefiting AI and benefiting from AI.

The Phoenix Trade

By Sam Callahan

Bitcoin isn’t just “not going away, ” it’s growing stronger every day.

The Bitcoin Breakthrough

By Tomer Strolight

The changes Bitcoin will bring about to society will be significant.

Swan is Supporting the Mining Disrupt Conference

Join us on July 25-27, 2023 in Miami for the World’s Largest Bitcoin B2B & Bitcoin Mining Conference & Expo!

What’s Driving Bitcoin’s Price in the Current Debt & Inflation Predicament

By Sam Callahan

Fulfilling its destiny as a hedge against reckless fiscal and monetary policies, Bitcoin has proven its mettle in its first fourteen years of existence. Let’s look at the current debt and inflation predicament.

Miami Bitcoin 2023 Conference Wrap-up

By Drew

The Bitcoin 2023 Conference took place in Miami from May 18th — 20th. Here are our top takeaways!

The Charmed Life of a Baby Boomer Named James

By Mark Harvey

The baby boomers left us with a debt/GDP ratio of 120%, and grandkids that can’t afford to buy a house. What is the current generation to do? Enter Bitcoin.

The Inflation/Deflation Tug-of-War

By Sam Callahan

Overall, the economy and central banks are in a tense tug-of-war. Inflation and disinflation are going back and forth. Which side will gain the upper hand?

The Substance of Bitcoin

By Tomer Strolight

Bitcoin is a carefully and precisely engineered solution to a crucially important human need — the need for a reliable, universal medium to use as money.

The Great Institutional Bitcoin Capitulation

By Sam Callahan

For once, the big financial institutions are late to the game, and it’s beautiful to see.

The Essence of Bitcoin

By Tomer Strolight

Bitcoin’s essence is that it is a good idea, for the good of humanity, whose time has come, and which cannot be stopped.

Green Shoots and Lawsuits

By Sam Callahan

As investors become more optimistic about the state of the economy and asset prices, we’ll see if Bitcoin can join in on the party as it overcomes the regulatory calamities ensnaring the broader cryptocurrency industry.

Three Innovations Being Built on Bitcoin Today

By Sam Callahan

The Bitcoin ecosystem is a hotbed of continuous developments, pushing the boundaries of what is possible with this transformative technology.

How Bitcoin and Lightning Can Boost Productivity

By Sam Callahan

The emergence of Bitcoin and the Lightning Network offers promising solutions that could potentially reverse negative trends and revitalize US productivity.

My Top 3 Takeaways from the MicroStrategy World Conference

By Dante Cook

The crowd was buzzing all week with an electric energy that was a perfect blend of anticipation and curiosity.

The Bullish Case For Bitcoin Custodians

By Andrew Mahowald and Pretyflaco

By rallying around a nuanced yet challenging standard for assessing custodians, we can minimize risk and maximize the speed of Bitcoin adoption.

The Right Questions to Ask to Avoid Bitcoin IRA Icebergs

By Terrence Yang and Jeremy Showalter

The Swan IRA is uniquely designed and features a distinctive account setup that incorporates various levels of legal compliance, regulatory oversight, custodial services, and high-level institutional security measures.

The Truth is on Our Side

By Drew

Bitcoin shines the truth on many lies. It is as much a movement as an investment…

The Banking System vs. Bitcoin

By John Haar

It’s agreed that there are problems in the banking system. The proposed solutions are wildly different. A look at the recent U.S. banking failures, the nature of banking crises, and how Bitcoin is different.

Bitcoin: More Relevant, More Urgent, More Ready

By Ulric Pattillo

In March of 2023, a banking crisis arose as an active threat to depositors of two banks and a potential threat to many.

Binance: Raising Eyebrows Since 2017

By Sam Callahan

It has become increasingly evident that Binance’s questionable business practices provide enough circumstantial evidence to warrant caution among users and investors.

The United State of Bitcoin

By Tomer Strolight

Where the US constitution declared that we are all equal, Bitcoin, within its context of money, ensures we are all treated equally, under completely transparent rules.

Bitcoin’s Moment

By Drew

Born from the ashes of the 2008 financial crisis, Bitcoin was is an engineered solution to the inherent flaws and vulnerabilities within centralized banking structures.

A New Peaceful Transition of Power

By Tomer Strolight

In democracies we rely on elections — Proof of Votes — and hope all goes well. In Bitcoin power transitions peacefully through Proof of Work.

The Bullish Case for Stratum v2

By Pavlenex

Stratum v2 is the missing piece of the decentralization puzzle for Bitcoin.

Dollar Cost Averaging vs. Lump-sum Investing

By Sam Callahan

The best strategy is the one that allows an investor to hold through Bitcoin’s volatility and sleep well at night, whether it’s DCA or lump-sum.

Monetary Debasement vs. Supply Shocks

By Lyn Alden

Price inflation, being a multi-faceted phenomenon, usually has multiple causes at once, and those individual causes become relevant over different time periods.

Specter Desktop Relaunches with New UI and Improved User Experience

By Moritz Wietersheim

Secure your bitcoin. Verify your transactions. Protect your privacy.

The Implications of Open Monetary and Information Networks

By Lyn Alden

For proponents of privacy and open networks to win, the technology must be easy to use, too costly to stamp out, and well-understood by the public.

Swan Bitcoin IRA is Live!

By Jeremy Showalter and Zane Pocock

Secure your retirement with the Swan IRA by diversifying your savings with tax-advantaged Bitcoin in Traditional and Roth IRAs.

Why a CBDC Will NOT Promote Financial Inclusion

By Sam Callahan

A CBDC would increase costs, reduce privacy, and create more barriers to financial inclusion, not less.

Inscriptions: Just a Fad, or Real Threat to Bitcoin Becoming Decentralized Money?

By Stephan Livera

Even if Ordianals are not a short-lived fad, what’s the most likely outcome? Low-value inscriptions will likely be priced out by financial transactions over time as Bitcoin gets adopted by more people. Learn why below!

A New Separation of Powers

By Tomer Strolight

We must realize that the original crafters of government separated powers because it was people who couldn’t be trusted. But in Bitcoin, we have separated power altogether from people!

Bitcoin: The Shipping Container of Money

By Dante Cook

What the history of shipping containers can teach us about Bitcoin.

Why Bitcoin Exists

By Tomer Strolight

Bitcoin was not created so that some people could “get rich quick.” It was created to preserve the integrity of money — to make the most of your precious time, your energy, and your life.

Bitcoiners, It’s Winning Time

By Cory Klippsten

We believe that a global, Nasdaq-listed, Bitcoin-only financial services company will play a key role in winning the race to avoid the war, so we’re building it.

10 Reasons to Be Bullish on Bitcoin in 2023

By Sam Callahan

2023 is shaping up to be an exciting year where the industry builds to deliver even more value for Bitcoin users and investors around the world.

Swan Announces Four New Senior Hires in January 2023

By Cory Klippsten

Sheetal Ray joins as COO, Raphael Zagury as CIO and Head of Research, Gaurav Gollerkeri as GM of Swan Personal, and Guilherme Gomes as CRO.

Fixed Supply Money Does Not Lead to Economic Collapse

By John Haar

And why it is in fact the only intellectually and ethically defensible monetary system.

Bitcoin is the Future of Money, Not Just Another Cryptocurrency

By Stephan Livera

We need an open, sound and scarce monetary system: Bitcoin. Accept no substitute.

The Themes That Will Define Bitcoin in 2023

By Stephan Livera

Some trends that emerged in 2022, from regulatory developments to technical and cultural innovations, will grow to define Bitcoin in 2023.

Debunking Bitcoin Misconceptions: It’s Not Stored Time, Energy or Violence

By Stephan Livera

Metaphors and analogies are critical for helping newbies understand Bitcoin, but they are dangerous when taken too far.

Bitcoin and Crypto: A Simple Story Vs. a Convoluted Yarn

By Tomer Strolight

Bitcoin’s story is a simple one: it is money you can count on. Simply holding it until you need to spend it. The stories spun by the Crypto Industry are anything but simple, or even logical when examined closely.

GBTC was the Genesis of the Crypto Credit Contagion

By Sam Callahan

Learn how GBTC works, how it’s associated with the recent crypto contagion, and why buying spot Bitcoin and taking self-custody helps you avoid all of these risks today.

Assessing Risk in Bitcoin Custody

By Yan Pritzker

Swan encourages our clients to withdraw their Bitcoin to self-custody by offering free and automatic withdrawals.

A Recap of the 2022 Pacific Bitcoin Conference

By Nick Payton

By focusing on learning, entertainment, and social experiences, Pacific Bitcoin blurred the line between a conference and a festival.

Green Eggs and Ham

By Allen Farrington and Anders Larson

Decentralized Finance: The Good, The Bad, And The Ugly

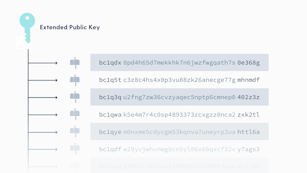

What is an XPUB?

By Gigi

“What’s in a name? That which we call a rose. By any other name would smell as sweet.” — William Shakespeare

The Race to Avoid the War

By Cory Klippsten

Let us proceed — together, united, yet decentralized — and win this race, for one and all, so that we may never have to fight the war.

Swan’s Fastest Path to Self-Custody in Less Than 24 Hours

By Jeremy Showalter

These services are applicable for individuals, businesses, and retirement savers.

The FTX Fiasco and the Fallout to Come

By Sam Callahan

Expect the fires from FTX to continue to burn and claim more victims along the way. If anything, this event has provided a tough lesson on why Bitcoin is different and why self-custody is vital.

Why Selling Some Bitcoin at a Loss Can Maximize Your Hodling Potential

By Steven Lubka

How to sell your bitcoin for tax advantages without interrupting your strategy to hold for the long term.

History Happens Right Before Your Eyes

By Tomer Strolight

Technology has brought forth its champion to slay fiat money. And we all know who that champion is: Bitcoin. Bitcoin will be the resolver of a historic tug-of-war over control of the wealth of humankind.

Swan Bitcoin and Trezor Integration

By Cory Klippsten

Start a Bitcoin Savings Account through Swan Bitcoin with Trezor.

Proof of Work vs. Proof of Stake

By Tomer Strolight

Proof of Work, at its heart, is the removal of trust from the system of money, and replacing it with something that can’t be faked: real work.

Finding Liberty in Parallel: Bitcoin and the Free Cities Movement

By Stephan Livera

Rising movements to establish free, autonomous jurisdictions around the world are working alongside Bitcoin to establish parallel liberty.

The Great Miner Squeeze of 2022

By Sam Callahan

Bitcoin mining is truly a game of survival of the fittest, and right now, the creme is being separated from the crop. By the end of this squeeze, Bitcoin’s security layer will be more efficient than ever before.

Bitcoiners Must Fight the FATF and it’s AML Regime

By Stephan Livera

The Financial Action Task Force and its anti-money laundering policies are antithetical to Bitcoin and an attack on human rights everywhere.

Swan Launches Fundraiser With Bitcoin Policy Institute

By Steven Lubka

Our goal is to support best-in-class policy and academic research that properly assesses Bitcoin’s benefits and risks. It’s critical that the research on #Bitcoin is fair and accurate.

Parts 1-9 of The Timechain Codex Now Available in PDF Format

By FractalEncrypt

A Graphic Novel by FractalEncrypt based on “Bitcoin Astronomy” by Dhruv Bansal.

5 Reasons Why All Bitcoiners Should Attend a Bitcoin Conference

By Nick Payton

Meet your favorite Bitcoiners and make memories you’ll never forget.

Bitcoin Privacy: Best Practices

By Gigi

There is a sacred realm of privacy where essential rights and liberties into which the law, generally speaking, must not intrude.

With Fiat Currencies Crumbling, It’s Time to Denominate in Bitcoin Terms

By Stephan Livera

As fiat currencies crash against the USD, it makes sense to start using Bitcoin denominations, even for day-to-day expenses.

Swan Acquires Specter Solutions

By Cory Klippsten

Swan has launched Specter Labs division focusing on open source, privacy, and self-custody.

Swan Product Principles and the Third Rail

By Jeremy Showalter

Swan products are where humans meet Bitcoin.

You Can Believe the Maximalists: Bitcoin is Seperate From Crypto

By Stephan Livera

A recent column by the Financial Times’ Jemima Kelly demonstrated some misunderstandings about Bitcoin’s decentralization and singularity.

Bitcoin and the U.S. Growth Problem

By Sam Callahan

Bitcoin and economic growth are the only reasonable ways out of this debt problem.

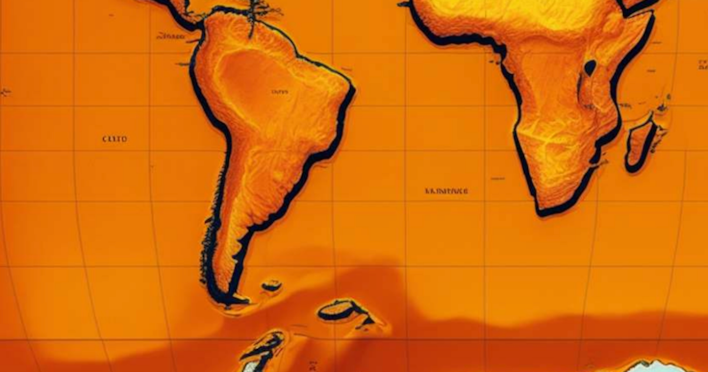

4 Initial Takeaways from the 2022 Global Crypto Adoption Index

By Sam Callahan

The highest adoption rates continue to take place in countries with high inflation, increased capital controls, and where economic instability is the norm.

Bitcoin: From the Void

By Tomer Strolight

How Bitcoin Uses Both Nothing and Chaos to Create Something the Likes of Which We Have Never Seen Before.

The Euro: A Train That’s Running Out of Track

By Sam Callahan

The Euro was a poorly designed political construct from the beginning, and now we are seeing its vulnerabilities reemerge in a time of crisis. Can it survive?

Traders Lose, Stackers Win

By Stephan Livera

Instead of trying to become a trader where you are up against highly capitalized professionals, for most people it is more productive to set up a savings plan to acquire pristine assets with a good risk/reward ratio.

Bitcoin Is a Monumental Event in Human History

By Erik Cason

Bitcoin has the possibility of ending the financialization of state war by ending fiat money and restoring natural law and money to our planet.

We Are All In This Together

By Gigi

The state will come for all of us, low-hanging fruits first. Bitcoiners always knew this.

How Legacy Finance Perceives Bitcoin

By John Haar

Observations from a 13-year career at Goldman Sachs.

Bitcoin, Bitcoiners, Truth, Beauty and Love

By Tomer Strolight

One truth Bitcoin shows us is that we are sovereign — not just over our monetary wealth, but also over our emotions, not just over where we spend our money, but also over where and how we spend our time.

A Look At the Lightning Network

By Lyn Alden

Examining the scaling method of the Bitcoin network and its evolution from a store of value to a medium of exchange.

The Problem with NFTs

By Nick Payton

NFTs are marketed as ownership, usually of some digital artwork, secured using “blockchain technology” and “crypto.” Are they a scam?

The Blocksize War’s Cyber-Solider Freedom-Fighters

By Tomer Strolight

The Blocksize Wars were “fought”… but by whom? And what do we really mean by fighting?

What Can You Do For Bitcoin?

By Stephan Livera

Bitcoin might seem inevitable, but you can still take an action hand in pushing it forward.

In Defense Of Bitcoin Full Reserve: Not Anti-Credit, But Anti-Fiduciary Media

By Stephan Livera

As we continue to debate the proper roles of crypto and lending, Bitcoin full reserve can be the future for credit and commerce.

CPI Inflation Hit a 40-Year High, but the Dollar is Still King

By Sam Callahan

Swan Private Market Update 7/15/22. Investors currently fear a coming recession as the Federal Reserve continues on its mission to tame CPI inflation.

How We Should Really Think About Bitcoin Maximalism

By Stephan Livera

There has been a lot of digital ink spilled about the concept of Bitcoin Maximalism, but there are things the critics don’t understand.

Digital Assets are Useful Today Despite What the Naysayers Say

By Sam Callahan

If Bitcoin protects even one family, one person, or one child from the ravages of hyperinflation, then it is worthy of our time, and a useful technology for the world.

Bitcoin and the True Meaning of Inflation

By Steven Lubka

Bitcoin is often described as an inflation hedge, so why hasn’t it worked?

Re-Run the Numbers

By Cory Klippsten and Wicked Smart Bitcoin

How Today’s Higher Rates and Lower Prices Impact the Case to Borrow to Buy Bitcoin

Bitcoin Bear Markets: We’ve Been Here Before

By Stephan Livera

New Bitcoiners are likely upset with the Bitcoin price right now, but we’ve been here before and there are some silver linings.

A Fed Hike for the Ages, But Can the Economy Handle it?

By Sam Callahan

Swan Private Market Update 6/17/22. There’s no need to mince words when describing the markets over the last two weeks, it’s been ugly.

Fact Check: DARPA Funded Report on Blockchain Centralization

By Yan Pritzker and Tomer Strolight

In this analysis, we examine and fact check the claims in the recent DARPA blockchain report which claims that Bitcoin’s blockchain is susceptible to centralized control.

Why Bitcoin is the Path to Economic Stability

By Tomer Strolight

Bitcoin’s reliability is leading the world on a path towards greater economic stability.

Bitcoin and the One-Hit Wonder Altcoins

By Sam Callahan and Cory Klippsten

Don’t get stuck holding the bags of the one-hit wonders of each Bitcoin bull cycle. Instead, hold onto the asset that you know will be a top player in this cycle, the next cycle, and every single cycle to come: Bitcoin

Beware of Ponzi Tokens: A Hex On You

By Ryan Maestro

Of the 19,000 listed crypto projects, 99% of them are scams to enrich the person who created them. The Hex token, and Richard Heart, are no different.

Dark Moon: The Inevitable Collapse of Luna

By Cory Klippsten and Sam Callahan

Luna/UST went from a collective market capitalization of ~$50 billion to now down 99%. The collapse of the Luna/UST Ponzi scheme occurred even faster than anyone expected, but this implosion was perfectly predictable.

Market Headwinds Continue to Blow as the Fed Stands Firm

By Sam Callahan

Swan Private Market Update #9 — The markets continued to experience turbulence over the last two weeks as investors grapple with rising risks of inflation, hawkish Fed, economic conditions, and the Russian-Ukraine War.

Response to Cole South’s ‘Why I Don’t Own Bitcoin Anymore’

By Stephan Livera

A recent blog post outlined an investor’s rationale for abandoning Bitcoin, and necessitated a Bitcoiner’s response.

Coinbase and the Insider Exchange Dump

By Sam Callahan

Bitcoin is very different from all other cryptocurrencies. In fact, it shouldn’t even be considered the same asset class.

Bitcoin: An Empire For Us All

By Tomer Strolight

The rise and fall of an empire: It is a story that has repeated itself throughout human history. Where does Bitcoin fit in?

Satoshi’s White Paper — the Hard Part Explained

By Tomer Strolight

Dissecting some of Satoshi’s Whitepaper to make it easier to understand.

The Why and How of Getting a Bitcoin Job

By Stephan Livera

If you’re dedicated to Bitcoin, getting a job in the industry can be incredibly rewarding as it fulfills the desire to advance the technology.

Investigating the Dubious Investigations of Bitcoin

By Scott Wolfe

Some challenging stories are begging to be properly investigated and told. The question is always which investigative journalists have the willingness, integrity and editorial freedom to take these on?

Bitcoin Is Not Your Typical Investment

By Tomer Strolight

Heads They Win, Tails You Lose. You’ve been told you should be investing in stocks & bonds — a game full of world-class professionals playing against you. Bitcoin is the fair game, and an easy one to play.

The Turkish Lira’s Freefall and the Bitcoin Parachute

By Sam Callahan

As the national currency of Turkey continues to plummet, Bitcoin represents an escape hatch for citizens looking to preserve wealth.

Why Bitcoin is Different (Part 2)

By Sam Callahan

Bitcoin is a brand new technology that differs from anything else that has come before or after it. But where the beginners run into confusion is how Bitcoin differs from other cryptocurrencies.

Swan and Specter Integration Announcement

By Nick Payton

Specter is an ideal desktop wallet for Swan users. The purpose is to give customers a seamless stacking experience into their Bitcoin wallets, especially into their multi-sig cold storage.

Bitcoins! Get Yer Bitcoins! Get ’em While You Can

By Tomer Strolight

The 'Window of Oppurtunity' to buy Bitcoin closes a little more every single day.

Why Bitcoin is Different (Part 1)

By Sam Callahan

Bitcoin is a brand new technology that differs from anything else that has come before or after it. But where beginners run into confusion is in how Bitcoin differs from other cryptocurrency.

Bitcoin and the Most Valuable Brand of the 21st Century

By Tomer Strolight

Bitcoin provides value that surpasses the brand value of the U.S. dollar, as the code provides the utility of superior money.

Goldbugs Don’t Understand Money

By Spencer Schiff

One of the most persistent falsehoods prograted by goldbugs is the idea that monetary goods must have direct utility.

How to Get the Most From In-Person Bitcoin Events

By Stephan Livera

Bitcoin events are great expressions of the Bitcoin ethos and critical touchpoints for newcomers and technology innovators alike.

The Zen of Knowing Your Opinion on Bitcoin Doesn’t Matter

By Tomer Strolight

At the end of the day, the fact that our opinion has no bearing on Bitcoin is a good thing.

Why Bitcoin is What Millennials Are Looking For

By Tomer Strolight

Bitcoin is the system that can make millennials' hopes and dreams come true, and this is becoming increasingly clear to more of them each day.

Why Gen Z Needs Bitcoin

By Sophie Tobert

Growing up marked by a decaying financial system, we have the chance to change the narrative set before us and create a world grwoing up in for future gnerations.

How Bitcoin is a New Form of Property (5 Minute Read)

By Tomer Strolight

Read how Bitcoin is unique and powerful property, which comes with certain responsibilities.

Reflecting On the Year in Bitcoin: Our Progress and What We Take For Granted

By Stephan Livera

The progress that the Bitcoin community made in 2021 reminds us to take nothing for granted, and to make the changes we want to see next year.

Is it Time For Bitcoiners to Get on 'Zero Fiat'? Not Yet

By Stephan Livera

We’ll all eventually transition to holding zero fiat money, but most people cannot afford to go full Bitcoin just yet.

How Bitcoin Really Works (5 minute read)

By Tomer Strolight

A quick and accurate explanation on how Bitcoin really works. Suitable for beginners and experts alike.

Swan Bitcoin 2022 Gift Guide

By Kristin Thompson

The HODLday season is a time for remembering the important things in life like family and friends and, of course, Bitcoin! Which is why we created the perfect gift guide for Bitcoiners.

Saving with Bitcoin

By Sam Callahan

You should be investing in Bitcoin for its volatility — able to wait out price dips, even to accumulate during them, and celebrate the dramatic price rises when they take place.

Why Libertarians Should Prioritize the Bitcoin Strategy Above All Others

By Stephan Livera

Bitcoin offers libertarians the perfect vehicle for starving the state of its outsized control over personal freedoms.

A Review: the Great Hash Rate Migration of 2021

By Sam Callahan

Bitcoin miners have relocated to safer pastures within the U.S. because the values and goals of America and Bitcoin are much more aligned compared to Communist China.

What Happens to Bitcoin if the Internet Goes Down?

By Rigel Walshe

While the Internet is by far the most efficient system of communication for the Bitcoin network to use, it could continue on with the reduced speed and functionality on any communcations systems known to man.

Why I’m Driven to Build Swan Advisor Services

By Andy Edstrom CFA, CFP

We will deliver the industry’s best education team to advisors so that when clients are ready to withdraw Bitcoin to cold storage or engage in collaborative custody, they’ll be armed with the knowledge to do it safely.

Bitcoin is Generational Wealth

By Tomer Strolight

“Bitcoin is Generational Wealth” is a short film exploring Bitcoin’s potential across generations.

The Bitcoin Platform for Financial Advisors

By Cory Klippsten

Swan Advisor Services Tailors Swan’s best in purchase and custody platform to the needs of financial advisors and wealth managers.

The Bearish Case for Bonds

By Sam Callahan

Bonds are not as safe today as they are marketed to be. It’s time bond investors begin to protect themselves against the Fed policies that are leading to erosion of the real value of their bond holdings.

Bitcoin’s Energy Usage Isn’t a Problem. Here’s Why.

By Lyn Alden

Whether Bitcoin continues to be successful or fails, there’s no risk of the network using too much energy in the grand scheme of things.

5 Ways To Earn Bitcoin

By Camila Campton

What if I told you there are ways to earn extra Bitcoin or get off zero if you don’t own any? Whether you are just starting to stack sats or a Bitcoin veteran, here are 5 ways to add more BTC to your freedom stash.

Bitcoin, Perfect Money For Humanity

By Nozomi Hayase

The Internet of Money transcends borders and protects people of all nations from resource wars, exploitation, and dictatorship. Bitcoin guards us against wealth confiscation, helping us steward our precious planet.

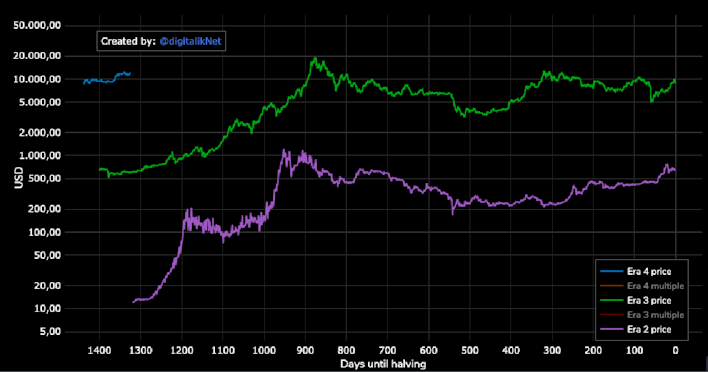

The Diminishing Influence of Halvings on Bitcoin’s Price

By GeertJanCap

The price of any asset is determined by its supply and demand. Bitcoin’s programmed halving of supply has a diminishing effect its price.

How Much of the World’s Population Owns Bitcoin Today?

By Sam Callahan

One of the biggest blindspots investors have when they first come across Bitcoin is that they view it solely as an asset. Bitcoin is digital gold — you can send over the internet.

Why Every Investor Should Have Bitcoin in Their Portfolio

By Sam Callahan

It doesn’t matter if you’re a young person starting to invest, a parent saving for their kid’s education or a retiree protecting your nest egg, Bitcoin has a place in everyone’s portfolio.

Is Bitcoin’s Price Too High to Invest?

By Sam Callahan

Whenever someone discovers Bitcoin there are twom phases that typically occur, the first is that wish they could buy it cheaper, and the second is that in hindsight, they should have bought more.

Why Bitcoin Will End the Worst Heist in History

By Tomer Strolight

The money stealing time machine is called “government decificts and debt.” Each annual theft called the deficit, and the total amount stolen across history is called the debt.

Why Bitcoin’s Rules Are Enforced By Physics

By Tomer Strolight

History shows that fiat systems collapse. The monetary units of these systems become worthless upon those collapses. Science shows that the laws of physics do not collapse. They are eternal.

Swan Signal Monthly: March 2021 Newsletter

Bitcoin hit a new all-time high of $62,000 this past month, pulled back to $48,000 and is now right back up to $52,000. Historically, in bull markets, this means Bitcoin is about ready to start another leg up.

Bitcoin: Fee-Based Security Modeling

By Lyn Alden

The ideal state for the Bitcoin network is to reach equilibrium in the free market where blocks are always full, mostly with large transactions. Fees are high in absolute terms, low in percentage-of-value terms.

Gifting Bitcoin — The Ultimate Orange Pill

By Sam Callahan

As many people discover convincing a friend or family member to buy Bitcoin can be a challenging task. Swan Bitcoin makes it easier than ever with their gifting program.

The Ultimate Safe Haven

By Spencer Schiff

Bitcoin will be considered the safest asset in human history, thanks to its resistance to debasement, censorship, and confiscation.

Bitcoin’s Real Energy Expenditure: A Comparative Analysis

By Nick Payton

We must compare Bitcoin’s enivronmental and socio-economic impacts to the financical systems it aims to replace.

Is Tether a Treat to Bitcoin?

By Daniel Matuszewski

It’s clear Tether is not the driver of Bitcoin’s rallies. Instead, Tether’s growth is evidence of the genuine demand for a digital dollar that arose naturally in the world’s first 24/7 global financial marketplace.

Sovereignism Part 1: Digital Creative Destruction

By Robert Breedlove

Exploring the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age.

The Rise of Bitcoin Nomadism: Is it Right For You?

By Stephan Livera

The Bitcoin economy is enabling more people to choose their own adventures around the world and optimize their lifestyles.

Am I Too Late For Bitcoin

There are different levels of Bitcoin adoption. By segmenting BTC adoption, it becomes easier to see why the wide range of estimates exists but, more importantly, how early adoption of BTC as a preferred store of value.

Bitcoin Is Time

By Gigi

The relentess beating of this clock is what gives rise to all magical properties of Bitcoin.

Why Bitcoin is Not a Ponzi Scheme: Point by Point

By Lyn Alden

Lyn Alden compares and contrasts Bitcoin to systems that have Ponzi-like characteristics, to see if the claim that Bitcin is a ponzi holds up.

Bitcoin Misconception #1: “Bitcoin is a Bubble”

By Lyn Alden

Bitcoin looks a lot more rational when you look at the long-term logarithimic chart, especially as it relates to Bitcoin’s 4-year halving cycle.

Swan Signal Monthly: December 2020 Newsletter

By Brandon Quittem

Earlier this month Bitcoin broke through the all-time high price, and psychological barrier of $20,0000, driven by short-term retail trader speculation.

Op Ed: Pitching Bitcoin During the Holidays

By Brekkie von Bitcoin

The HODLdays are a time for friends and gift-giving, but as good Bitcoiners, we already know that the best gift of all is Bitcoin.

Swan Signal Monthly: November 2020 Newsletter

By Brady Swenson

Bitcoin has undoubtedly made improvements since 2017: Better onramps, custody solutions, new-Bitcoin only companies, the Lightning Network, and more. However, a story in 2020 is how the world around Bitcoin has changed.

Saving With Bitcoin Was Never So Cool As In 2020

By Stephan Livera

Through technical development, privacy initiatives, multisignature tools, a savings narrative and more, Bitcoin’s 2020 was super cool.

Bitcoin is Hope

By Robert Breedlove

A fundamentally dishonest money, fiat currency ruins relationships with the intrinsic entropy of nature and our fellow humans. To rejuvenate hope, we must set sights upon honest money, entrepreneurship, and civilization.

Welcome to Bitcoin TV

By Cory Klippsten

Bitcoin TV makes it easy to sit back and learn all about this revolutionary new money.

Bitcoin is For Everyone

By Reed Wommack

We serve HNWI clients wishing to purchase Bitcoin. Even more importantly, we help great-grandmas, college students, veterans, and fast food workers buy their first Bitcoin and begin saving for their future.

Our Most Brilliant Idea

By Robert Breedlove

Ideation and wealth creation are mere expressions of life’s central impluse: growth.

Can the Government Shut Down Bitcoin

By Reed Wommack

At some point on everybody’s Bitcoin journey, they begin to realize that Bitcoin may actually be a better form of money.

Investing in Bitcoin Like a 401k

By Brady Swenson

The best way to approach investing in Bitcoin is regular contributions over time like a 401k.

Why You Should Hold Bitcoin as a Corporate Treasury Asset

By Brady Swenson

When companies like Square and MicroStragegy start buying Bitcoin, it’s time to pay attention. But, smaller private companies are also making this move. Here’s why you should consider doing the same.

Choose Bitcoin

By Brekkie von Bitcoin

I believe a line has been drawn in the sand between people, projects, and companies that support Bitcoin and those that do not, and in some cases, actively work against it.

Swan Signal Monthly: August Newsletter

By Brady Swenson

Business intelligence software company MicroStrategy, a public company traded on NASDAQ, announced in August that it has adopted Bitcoin as its primary treasury reserve asset.

On Bitcoin’s UX

By Gigi

Why the internet doesn’t feel as clumsy anymore is twofold: (1) we got used to the novel concepts the internet brought with it, and (2) countless layers of abstraction make interacting with the base layer easier.

Is Bitcoin for Criminals?

By Reed Wommack

Many people continue to associate Bitcoin with unlawful beahvior, but in reality, less than 1% of Bitcoin transactions are actually used for illegal activities.

Why I Joined Swan Bitcoin

By Gigi

A picture on my wall that says: “You literally ought to be asking yourself all the time what is the most impotant thing in the world I could be working on right now, and if you are not working on that why aren’t you?”

Swan Signal Monthly: July 2020 Newsletter

By Brady Swenson

Our July 2020 monthly newsletter includes: Liftoff: A curated list of recent Bitcoin content from Swan and around the web Behind the scenes updates from the Swan team

Accepting Scarcity: A Bitcoin Meditation

By Reed Wommack

This essay focuses solely on the conceptual world of logic, language, and concepts, excluding the mystical and non-conceptual realm, which is also deserving of exploration through meditation and mysticism.

My Path Towards Bitcoin

By Stephanie Sprague

Despite living in the Information Age, many people don’t know enough to buy Bitcoin. With this kind of thinking, no one would’ve ever shared personal details on Facebook or banked electronically.

The Biggest Misconception in the Markets? Thinking We’re Dealing With a Sound Currency

Massive government intervention in markets is underway, but what happens to Bitcoin as a result?

Rampant Inflation Is on the Way and Here’s What it Means for Bitcoin

By Yan Pritzker

Once people realize what’s happening to their money, they will start buying Bitcoin.

Coronavirus, Financial Crisis, and the Epic Bitcoin Crash of March 2020

By Brady Swenson

A roundtable conversation about the current epidemic chaos and how it will impact Bitcoin, the global financial system, remote working, and more.

Bitcoin and the Technological Evolution of the Financial System

By Bitcoin Tina

We are living in hyperbitcoinization, or the repricing of the world in Bitcoin. Bitcoin is a better store of value than gold. For the same reasons people hold gold, Bitcoin will be valued at least on par with gold.

Exploding Three Myths About the Upcoming Bitcoin Halving

By Yan Pritzker

The next Bitcoin halving is almost here. We explore whether the halving is priced in, if other coins are a model for Bitcoin, and fear of a mining death spiral.

Is Bitcoin the Myspace of Crypto?

By Yan Pritzker

Sound money requires a commitment to decentralization, and properties hard to change and attack. Altcoins are built by centralized teams with a profit motive, not a happy accident of a growing ecosystem by cypherpunks.

Is Bitcoin Like the Dutch Tulip Bubble?

By Yan Pritzker

Is Bitcoin’s price in a bubble? Is this the Dutch Tulip Craze all over again? The answer might surprise you…

Does Bitcoin Have Any Intrinsic Value?

By Yan Pritzker

Bitcoin represents economic liberty. If you own Bitcoin, you have portable wealth. You can walk away from a failing regime and not lose your life savings.

The Three Futures of Digital Money

By Yan Pritzker

As money rapidly turns digital, we must contemplate three possible futures of money: central bank-managed, corporate-issued, and decentralized.

What is a Bitcoin Fork?

By Yan Pritzker

Unlike a stock split, the new shares still refer to the original company; a Bitcoin fork creates new assets out of thin air at zero cost and grifts them to existing holders. A fork does not affect the 21M supply limit.

What is Bitcoin?

By Yan Pritzker

Find out why Satoshi Nakamoto invented Bitcoin to solve the problems of the modern financial system including lack of privacy and monetary debasement.

How Bitcoin Challenges Keynesian Economics

By Brady Swenson

We’re in the midst of two great economic experiments. The Keynesian ideal of central control of money is being challenged by a novel money called Bitcoin.

Ten Million Bitcoiners: The Intransigent Minority

By Cory Klippsten

Not too many years from now, the number of Bitcoiners in the United States of America will cross ten million. When we hit that milestone, it’s game over: Bitcoin wins.

Swan Signal Monthly: January 2021 Newsletter

By Brandon Quittem

Bitcoin hit a new all-time high of $42,000 in early Janurary and has since pulled back to $33,000. Is this a buying opportunity?