What Bitcoin ETFs Mean for You

Bitcoin ETFs are here.

Bitcoin stands apart from conventional investment assets like stocks and bonds. Unlike these, Bitcoin offers direct ownership, enabling individuals to hold, transfer, and spend it, like they can with cash. Stocks and bonds require intermediaries for transactions, which introduce fees, taxes, and the hassle of conversion. Bitcoin allows for direct, peer-to-peer transactions, eliminating these complexities.

Despite these differences, Bitcoin has captured the investment world’s attention. Financially speaking, Bitcoin has been the best-performing asset over the past 15 years.

Stock Comparison — PortfoliosLab

Bitcoin’s performance has drawn the interest of America’s largest investment firms. Many applied to create Bitcoin ETFs — exchange-traded funds. These ETFs could attract lots of investors and capital, and can be expected to fuel further appreciation of the dollar value of Bitcoin.

As investments go, Bitcoin is much more similar to a commodity (like gold, other metals, grains and meats, crude oil, and the like). Like these other commodities, Bitcoin doesn’t generate dividends or interest payments, but it can be sold for cash. Like all commodities, its price at any given time is based on the convergence of buyers’ demand and sellers’ supply in a free market.

However, Bitcoin also has several major distinctions from commodities.

First, Bitcoin is digital. In fact, Bitcoin is the first digital commodity ever to exist. Although there are countless imitations and knock-offs, none have the history, integrity, absolute scarcity, user base, liquidity, or security of Bitcoin.

Second, unlike other commodities, the quantity of Bitcoin that exists and ever will exist is capped at a maximum supply. No matter how much the demand for Bitcoin grows, the supply will never exceed 21 million Bitcoins. (Each single Bitcoin can be split into one hundred million subunits, called satoshis, just like each dollar can be split into one hundred subunits called cents.)

Cointelegraph

Third, since it acts as a cash substitute, Bitcoin does not necessarily need to be sold for government-issued cash when you want to buy things with it.

Finally, while it is impractical to take custody of actual commodities like large amounts of gold, pork bellies, or barrels of oil in your house, Bitcoin is actually quite easy to custody for yourself.

Bitcoin ETFs are investment instruments allowing individuals to gain exposure to Bitcoin’s market price. These funds are available through brokers that trade stocks, bonds, and various other commodity-tracking ETFs.

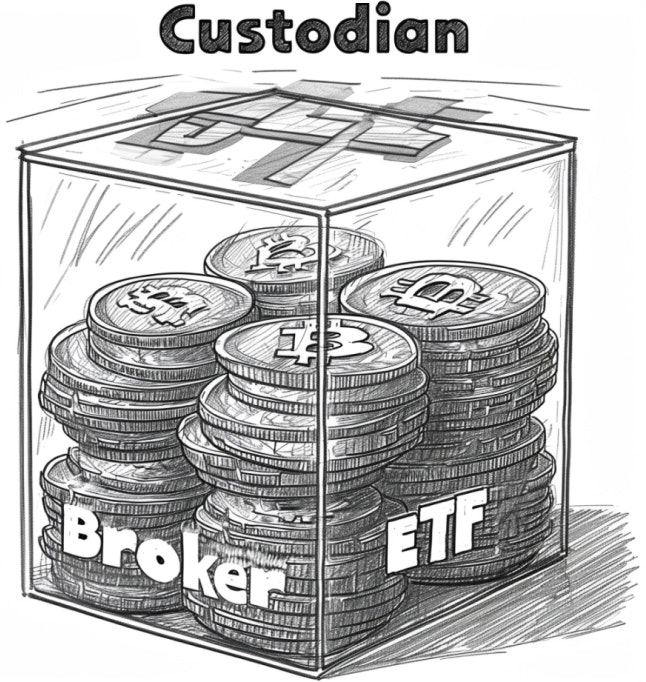

I. With ETF’s you’re not directly holding Bitcoin. The ETF is holding Bitcoins. Your broker is holding your ETF shares.

When investing in a Bitcoin ETF, you do not directly possess or have access to Bitcoin. Your financial institution acquires shares in the ETF, which they hold on your behalf. The ETF, not you, holds the actual Bitcoin. In fact, the ETF uses yet another party, a custodian, to hold the Bitcoin on their behalf. This lack of direct ownership does not allow for the ability to utilize, transfer, or spend the investment as you could with actual Bitcoin. The only action you can take is to sell your ETF units for dollars.

II. ETFs charge management fees.

ETFs charge fees. If you own Bitcoins directly, there is no charge to hold them as there are no middlemen. Over time ETF fees can compound and add up substantially.

III. ETFs can only be bought and sold during stock exchange hours.

The markets that trade ETFs are only open on weekdays from 9:30am Eastern to 4:30pm Eastern, and are also closed on holidays. Occasionally these markets are temporarily shut down for technical, regulatory, or political reasons. On the other hand, Bitcoin exchanges are often available 24/7/365. The actual Bitcoin network itself, on which you can send and receive Bitcoins directly, has not had a single second of downtime in over 13 years.

IV. ETFs have greater restrictions than real Bitcoin when realizing losses for tax purposes

Bitcoin offers a distinct advantage over Bitcoin ETFs in terms of tax strategy: Bitcoin ETFs are subject to tax rules that do not allow losses to be declared unless you remain out of the market for 30 days. However, real Bitcoin requires no wait; you can engage in tax loss harvesting instantly and without being out of the market!

V. ETFs are subject to the same tax rules as stocks and bonds.

If you want to access the purchasing power of ETF units you must sell them, thereby converting them into US dollars. This triggers a taxable event that must be recorded and reported (unless the ETF units are held in a tax-sheltered account such as an IRA). Meanwhile, you can use Bitcoin anywhere in the world, anytime with anyone who wants to accept Bitcoin as a form of payment.

Bitcoin is, however, subject to the same tax rules as property (IRS 2014-21) in the United States, and is considered a commodity like gold, oil, or corn. In some other jurisdictions, Bitcoin is also considered legal tender and can be used as a form of payment (with potential tax considerations).

Note: If you’d like to hold Bitcoin in your retirement portfolio check out our Swan IRA retirement calculator and open an account in less than 2-minutes or book a call with one of our specialists.

VI. With ETFs, you must rely on the honesty and competence of middlemen that stand between you and the actual Bitcoins.

Bitcoin is a new type of asset designed to eliminate middlemen. It functions as person-to-person electronic cash that you can hold by yourself, providing unprecedented protection from theft, seizure, or dilution. Bitcoin ETFs do not provide these features of Bitcoin.

Owning actual Bitcoin rather than shares in an ETF steers clear of many of the fees, inconveniences, and risks associated with Bitcoin ETFs.

When you purchase pure Bitcoin from Swan, we give you a choice. You can hold it directly yourself, have a qualified custodian hold it directly in a trust legally belonging to you, or use our “collaborative” custody solution, Swan Vault, that enhances security. You can switch between these different options whenever you want with no switching fees.

We will provide you with extensive training and education to let you use Bitcoin the way it was intended.

Note: Individuals or entities buying over $100,000 worth of Bitcoin in a year qualify for Swan Private which includes a personally dedicated expert to answer your questions and execute buys for you. You can set up an introductory call at swan.com/private.

Bitcoin represents a very exciting new breakthrough: It is money that does not suffer from the loss of long term purchasing power known as inflation. It is money that you can send to anyone, anywhere in the world, without relying on any intermediaries. It has many other extraordinary and even hard-to-believe features. This breakthrough and its associated advantages are being discovered by more and more people each day.

As the adoption, acceptance, and value of Bitcoin grows you’ll enjoy and appreciate the benefits of owning actual Bitcoin.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

PS, If you’ve already bought a Bitcoin ETF and want to switch to real Bitcoin, we can help.

What Bitcoin ETFs Mean for You

Bitcoin’s performance has drawn the interest of America’s largest investment firms. Many big banks are now offering Bitcoin ETFs. What does this mean for you?

Swan has made this Bitcoin ETF guide available for free download.

Owning actual Bitcoin, rather than shares in an ETF, removes many of the risks and fees associated with trusting a financial institution to properly manage your savings.

When you purchase REAL Bitcoin (instead of an ETF), you’re given you a choice. You can hold it directly yourself, have a qualified custodian hold it directly in a trust legally belonging to you, or use our “collaborative” custody solution that enhances security.

Download the FREE ETF ReportSwan Bitcoin

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?