Why Gen Z Needs Bitcoin

Growing up marked by a decaying financial system, we have the chance to change the narrative set before us and create a world grwoing up in for future gnerations.

I was born six months before 9 — 11, with the icons of the legacy system of global finance crumbling before me. When I entered first grade, my young friends told stories of their parents losing their homes in the Great Financial Crisis 2008.

As I began to understand money, I got used to increasing prices and was fascinated by listening to stories of the 15-cent hamburgers my parents enjoyed when they were my age.

More than any prior generation, Gen Z has been a victim of increasing government regulations.

We have seen freedom slowly slip away in all aspects of life. From the growth of content moderation within social media platforms in an attempt to censor free speech to invasive searches in airport security, and then lockdowns, curfews, and mandatory Covid-19 vaccinations, we’ve become accustomed to witnessing freedom crushing government regulations in every little aspect of our lives.

The Debt Challenge

Exploding college tuition prices and decreasing value of education have left us with insurmountable debt and no way to climb out of it. College tuition has risen almost twelve-fold since 1980, more than twice the rate of overall inflation. As a result, we’re on track to be the most indebted generation, with current 18-to-23-year-olds holding an average of $16,043 in debt.

Additionally, according to a survey by Cengage, half of recent college graduates chose not to apply to entry-level positions, feeling unqualified.

The Economist describes us as a more lonely, stressed, and depressed generation compared to previous generations, and we are projected to be poorer than our parents.

Although personal debt is a problem, public debt is a catastrophe, and as we begin our careers, we face the real possibility that our currency could collapse. The M2 money supply, already growing rapidly, has gone parabolic since the 2019 pandemic. The acknowledged U.S. national debt is about $30 trillion, $237,000 per taxpayer. Promises of Social Security, Medicare, and other social programs bring the United States government liabilities up to about $200 trillion, $500,000 per citizen (including kids!) Other countries’ finances are in similar shape.

Because this fiscal situation is global, our generation has no chance of keeping the world afloat using the current fiat system — we’re past our tipping point.

To make matters worse, our current leadership shows no signs of either understanding the severity of our financial problems or any willingness to do anything about it.

Our leaders have lost our trust. Collapse feels imminent.

Hope in Gen Z

However, there is hope in us, Gen Z. We are the Fourth Turning generation, and we will change the world. We understand the need for radical change — and we’re not afraid of it.

Looking to history as a guide, it’s clear that there’s a generational cycle that explains our current circumstances. William Strauss writes, “A Fourth Turning lends people of all ages what is literally a once-in-a-lifetime opportunity to heal (or destroy) the very heart of the republic.”

Gen Z has the weighty task of dismantling the current analog systems and reconfiguring to digital ones, and it’s our choice whether to heal or destroy what we know. Because we are digital natives, we have more insight and clarity into the connectedness of the problems set before us.

To restore society, young people must realize that fiat money is central to this coming era of creative destruction.

Bubbles, Big Macs, and Bitcoin

The unlimited printing of fiat money is the root of most of our problems. Many believe the attacks of 9⁄11 were in retaliation for the unending war in the Middle East.

These wars cost trillions of dollars and were paid for by money printing; there is no way the citizens would pay for them in taxes. The Great Financial Crisis was due to a housing bubble enabled by excessive money printing. A McDonald’s Big Mac now costs $5.65 due to this money printing.

Governments have too much power because they can print money and use it to bring tyranny. College tuition is unaffordable because of uncontrolled money printing. This extravagant printing of money is the epicenter of our problems, and Bitcoin fixes this.

Bitcoin is the radical solution that we need. It is as different from the fiat system as night is from the day. Bitcoin’s hard cap of 21 million coins means it is impossible for anyone to print more — even governments. This defunds endless wars. Also, without inflation to raise prices, when productivity increases, so does Bitcoin’s value, meaning the costs of Big Macs and college tuition will fall over time.

On a Bitcoin standard, borrowing money becomes far less attractive as it’s more difficult to pay off, so people and governments will be encouraged towards patience, hard work, saving up for purchases, and only purchasing things of high quality with lasting value. A college education has to get a lot more valuable for people to want to pay for it, or the industry will shrink dramatically.

Freedom is in Bitcoin

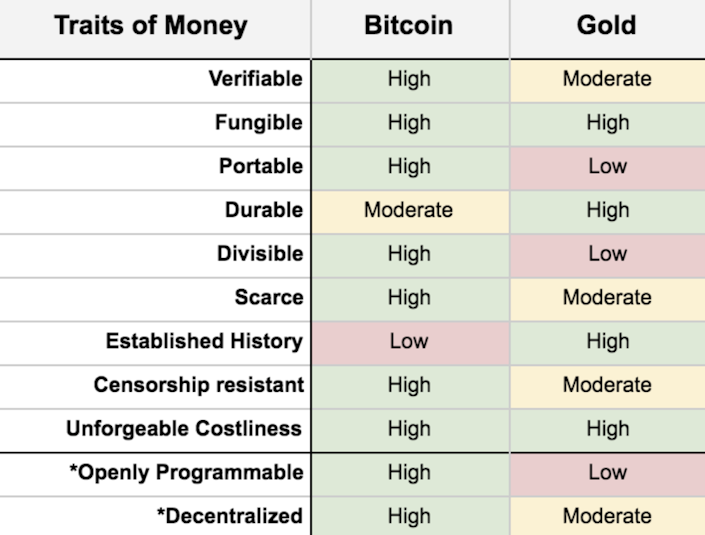

As a generation, we value honesty, certainty, and stability — all characteristics of Bitcoin. Honesty is enforced by the blockchain, a transparent record of every transaction to have occurred. With an exactly known supply and code that universally verifies every transaction, the nature of Bitcoin is much more specific than fiat, whose operations are known and controlled only by the few in charge of the Federal Reserve.

Some mistake Bitcoin as an unstable form of currency while looking at its volatility in the market. This is a misinterpretation that can turn people away from the opportunity that Bitcoin is. Because it’s still in its infancy and working through the growing pains of the price discovery phase, Bitcoin will be volatile in fiat currency terms.

However, an individual who owns one Bitcoin and stores the private key properly will forever own one 21 millionth of the total Bitcoin supply. Looking at it this way, it is the ultimate stable asset.

As old institutions break down and the national debt continues to make government promises a practical impossibility, our generation has the choice to be the heroes of the fourth turning; but we risk mistaking Bitcoin as a foolish investment.

Bitcoin is rules without rulers. It takes power away from a small, centralized group and gives it back to all individuals, with no one in between you and your money. Bitcoin restores freedom and inherently works to make money fully extricated from politics and unconfined by borders.

Bitcoin creates a society where governments must provide value in exchange for taxes paid. The implications of this are unending.

Swan Bitcoin IRA

Our Swan Bitcoin IRA product is an ideal path for a young Gen Z’er with a low-time preference investment horizon to get exposure to Bitcoin.

Also take a look at our comparison review of the Top 6 Bitcoin and Crypto IRA options and Why Bitcoin is the Ultimate Asset for Your IRA from our Swan Research department.

No matter what questions you have, we have the answers to help you avoid IRA icebergs and make the most informed choice possible.

Bitcoin is Hope For Gen-Z

Growing up marked by a decaying financial system, we have the chance to change the narrative set before us and create a world worth growing up in for future generations. Bitcoin is the revolutionary solution to extreme problems.

Knut Svanholm says in his video, Bitcoin: Everything there is, divided by 21 million, “Bitcoin is balancing on the edge of our understanding of the world between what is tangible and what can be imagined. The more we allow ourselves to imagine, the more useful it becomes.”

As Gen Z, let’s rise to become change agents by imagining a world that embraces Bitcoin.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sophie Tobert

Sophie is a sister, daughter, friend, and student who is passionate about freedom. She studies Management Information Systems at the University of Minnesota and enjoys traveling, coffee shops, and introducing her friends to Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?