Why Every Investor Should Have Bitcoin in Their Portfolio

It doesn’t matter if you’re a young person starting to invest, a parent saving for their kid’s education or a retiree protecting your nest egg, Bitcoin has a place in everyone’s portfolio.

Sound too good to be true? Read on 👇

It doesn’t matter if you’re a young person starting to invest, a parent saving for their kid’s education, or a retiree protecting your nest egg; Bitcoin has a place in everyone’s portfolio.

Bitcoin offers many unique benefits when added to a traditional portfolio, including increased returns, decreased risk, and protection from inflation. Where many see it as a speculative asset, in reality, Bitcoin is a top-performing asset where a little bit can make a significant impact on a portfolio.

Bitcoin is a new form of money where the supply is fixed by math instead of determined by a small group of central bankers. It functions outside the control of any single government or entity. There will only ever be 21 million Bitcoin, and this programmed scarcity allows it to act as a store of value. As more people view Bitcoin as a store of value, the demand for it increases, and with it, the price.

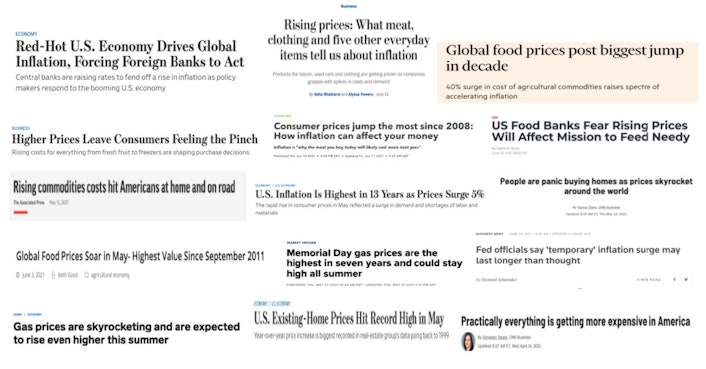

Bitcoin’s fixed supply could not be more opposite to what we’ve seen happen to the US dollar. The dollar’s supply increased by over 25% in the last year alone! The US printed > $12 trillion in just 2020. People are now starting to feel the effects of this printing ripple through the economy in the form of inflation. Investors are worried, and rightfully so. Take a look at some of the news headlines over the past few months.

Inflation is defined as the rise in the prices of goods and services in the economy. Last month the main inflation measure, the CPI, was reported at 5%. That may not sound like a lot on the surface, but when you frame it a little differently, I think the number hits closer to home.

“At a 5% annual inflation rate, your cash will lose 40% of its value in 10 years.”

(Please read that again slowly)…

Inflation is watching everything around you get more and more expensive as your savings can buy less and less. Furthermore, if your income doesn’t rise with the prices, well, then life starts to feel unaffordable. That’s why investors are looking for assets besides dollars to store their wealth to protect themselves against the risk of their savings being devalued, and more and more people are choosing Bitcoin.

Let’s put it this way — if it’s been raining for weeks, and everyone is warning you that it’s about to flood, wouldn’t you buy a little flood insurance just in case?

Bitcoin can be thought of the same way, except with Bitcoin, you’re buying wealth insurance. Since no more than 21 million bitcoin can ever be printed, the supply will never inflate like the US dollar, and each bitcoin will hold its value over time.

Bitcoin is protection against inflation, and everybody needs that protection in their portfolio today. Inflation is already here. The only question now is, how long will it last?

With financial and political instability, civil unrest, and a global health crisis, it’s never been more important to spread your bets out and diversify your money across different assets to protect yourself.

Most people agree with the idea that you shouldn’t put all your eggs in one basket, so they invest in real estate, stocks, bonds, etc. But they fail to realize that all those assets are 100% exposed to the traditional financial system. Bitcoin is different. It functions all on its own, 24 hours a day / 7 days a week / 365 days a year, without any single entity controlling it.

Because of this unique independence from the old financial system, Bitcoin historically is not correlated to any assets. It marches to the beat of its own drum. This non-correlation makes it the perfect asset to add to a portfolio to diversify and reduce risk. Bitcoin can offer downside protection when all the traditional assets in your portfolio are falling because Bitcoin doesn’t historically move with other assets.

“Bitcoin’s correlation to other assets between 2015 – 2020 is an average of .11, indicating that there is almost no relationship between the returns of bitcoin and other assets.”

— Fidelity Digital Assets

This unique trait of lacking correlation to other assets is extremely rare in investing and makes Bitcoin a must-have addition to everyone’s portfolio to decrease risk in the high-risk environment we find ourselves in today.

The beauty of Bitcoin is because of its uncorrelated nature and performance record, an investor only needs to allocate a very small percentage of their funds for it to make a meaningful impact on their portfolio.

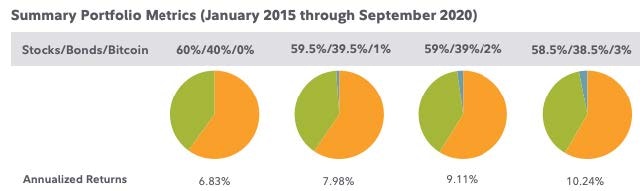

Check out the graphs below. A 1% Bitcoin allocation returned over 15% more than a portfolio of just stocks and bonds while decreasing the risk of the portfolio. In other words, it boosted the returns while making the portfolio safer at the same time.

Essentially you can receive all the benefits of Bitcoin, the inflationary protection, the risk reduction, and the huge gains with only using a small amount of your money. If Bitcoin goes to zero, you lose 1%. No big deal! But if the price of Bitcoin continues to soar, then you could benefit greatly from your 1% position. The risk-reward with Bitcoin is unparalleled in the investing world.

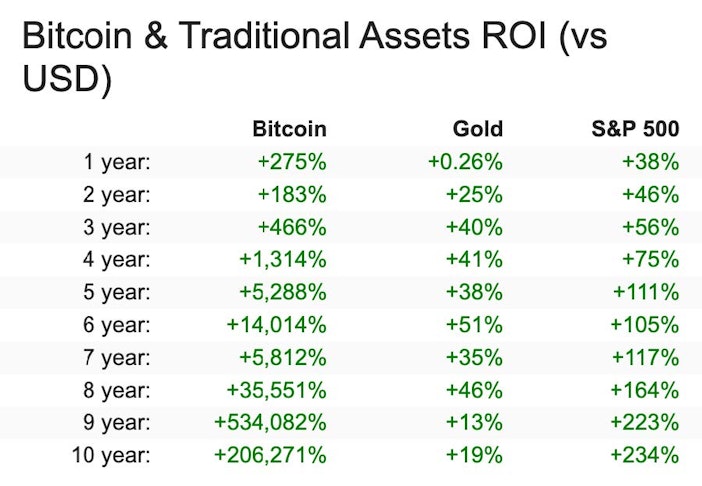

A 1% allocation gives you a lot of bang for your buck because the performance of Bitcoin through the last decade is hard to match. It’s been the best-performing asset in nearly every year for the past 10 years. Plus, when you compare it to other stores of value that investors look to in times of inflation like gold and stocks, Bitcoin is the obvious winner.

By now, I hope you’re asking yourself — Can I afford to take 1% of my stocks/bonds/cash and put it into the best-performing asset of the past decade, knowing now that it also reduces risk and adds inflation protection?

To me, this is an absolute no-brainer, and it’s exactly why everyone reading this should own some Bitcoin in their portfolio. Buy wealth insurance today. Buy Bitcoin.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?