Why Bitcoin is Different (Part 2)

Bitcoin is a brand new technology that differs from anything else that has come before or after it. But where the beginners run into confusion is how Bitcoin differs from other cryptocurrencies.

Bitcoin is a brand new technology that differs from anything else that has come before it or after it. The goal of this series is to clearly distinguish the difference between Bitcoin and other cryptocurrencies. It is far too common for beginners to fall for the false promises and deceptive narratives that altcoins sell. Sophisticated investors also get duped into buying altcoins by thinking they’re diversifying risk across a new asset class when in reality they are diversifying out of hard money and into high-risk venture capital bets or outright scams.

The reason these mistakes happen is that it takes a deep understanding of various factors, such as the underlying technology, game theory, monetary economics, and network economics, to fully comprehend why Bitcoin is different.

In Part 1 of this series, we discussed how Bitcoin is unique because of its decentralization, its rules-based monetary policy, and its energy usage which creates an honest competitive environment for nodes to come to consensus. These factors have allowed Bitcoin’s monetary policy to remain unchanged, reinforcing market participants’ trust in its scarcity. In Part 2, we will dive into Bitcoin’s network effect, why Bitcoin will serve as the only digital money in the future, and why all innovation can and will be built on top of the Bitcoin protocol.

From my own studies, I reached the conclusion that all, if not most of the value in the total cryptocurrency market cap today will be captured by Bitcoin in the future. Let’s further break down why there’s Bitcoin, and then there are sh*tcoins.

Bitcoin’s Network Effect Won the Race Long Ago

The appropriate comparison for a global digital monetary protocol is NOT a company like MySpace, but rather another protocol we all use today, TCP/IP (the Internet). Like with our one-and-only global Internet, in the future there will be only one global monetary protocol, Bitcoin. Bitcoin is the clear Schelling Point because it solves the most important problem of all (money itself) and has a security model that cannot be surpassed. Most market participants will therefore choose Bitcoin as more users adopt it and more applications are built on it just like what we saw happen with TCP/IP during the Protocol Wars.

Bitcoin’s security model cannot be surpassed because Bitcoin represents the “zero-to-one” moment where digital scarcity was created for the first time. It has established itself over the past 13 years as a reliable store of value because it has never suffered a hack, never changed its rules, and has overcome every attack that it has faced. It has done this while preserving the monetary policy set by Satoshi Nakamoto in the Genesis Block. Bitcoin has proved over time that it is a robust, resilient, monetary network. Only time can build trust like that, and with Bitcoin being the very first widely accepted cryptocurrency, no other altcoin can compete with Bitcoin on that front.

A network effect occurs when a network becomes more valuable to the users as more people use it. Bitcoin’s network effect can be thought of as a combination of the number of its users, its liquidity, its brand, its hash rate, the value people store in it, and the general trust in the scarcity of bitcoin, the asset. Bitcoin already dominates all other cryptocurrencies in terms of its network effect and given what we know about the Lindy Effect, this dominance will likely continue to expand. Unless Bitcoin somehow suffers a catastrophic event, no other cryptocurrency will be able to compete with Bitcoin’s powerful network effect.

Economic Systems Trend Towards One Money — and Bitcoin Will Be It

Bitcoin is an economic good competing in the free market of money. Other currencies and assets are competing with Bitcoin on the basis of being used to facilitate trade, preserve present work for future consumption, and communicate value between market participants. Bitcoin accomplishes this task better than any other money in existence. Bitcoin is superior because it perfectly embodies all of the things we want in a money: it’s portable, divisible, scarce, durable, fungible, verifiable, and permissionless.

Since money is a zero-sum game (you have to sell dollars to buy bitcoin), we can expect Bitcoin, as the better money, to drive out weaker currencies. In economics, this concept of good money driving out the bad money is explained by Theirs’ Law.

Part of the reason this occurs is that the more people that use one money, the more liquid that money becomes in the economy. The more liquid that money becomes in the economy, the better it serves its function as a tool to facilitate trade and coordinate accurate price signals throughout the economy. This in turn increases the number of people who want to use it. The result is a positive feedback loop that leads to economies adopting one single monetary medium.

Unchained Capital’s Parker Lewis explains this concept well:

While an individual can choose to hold one or multiple currencies, one is definitionally going to perform that function more effectively. One will preserve future purchasing power better than the other. Everyone intuitively understands this and makes a decision based on the inherent properties of one medium relative to another…It is not coincidence that the market converges on a single medium because each individual is attempting to solve the same problem of future exchange, which is interdependent on the preference of others.

Bitcoin Obsoletes All Other Money

Bitcoin holds its value better than any other money, and because of its superior monetary properties, more and more people will eventually choose it as their preferred money. Right now, there is still information asymmetry surrounding Bitcoin. Bitcoin is so different and so new that most people in the world still don’t understand it. But as time passes, more people will learn about it, become familiar with it, and this information asymmetry will diminish. More people will come to understand that Bitcoin is the best money and will act accordingly.

As adoption grows it becomes impractical for someone to use a less liquid and less secure form of money. It would be like someone speaking a different language when everyone else around them is speaking English. They would be communicating value in less effective money with no trading partners in the market economy. That’s why all market economies eventually converge on the most liquid and secure monetary good to facilitate trade, and today, that superior monetary good is Bitcoin.

Only Money Requires a Blockchain

“Blockchain technology” is a technology best described as a difficult to change, slow, and costly database compared to its traditional, centralized counterparts. Development is slow-moving, a blockchain is expensive to maintain, difficult to upgrade and it does not scale well. Many “Blockchain, not Bitcoin” advocates in the last bull run realized this only after they wasted millions of dollars and man-hours on enterprise blockchain projects (See IBM and Microsoft). What they ultimately discovered was that a blockchain is not very useful if you need the ability to add new features, keep out people you don’t want using the system, make changes, or scale quickly to reach millions of users. It turns out companies like to have those capabilities when building products.

Since blockchains are also more expensive compared to centralized databases, the only reason to use one is if you want a database that is resistant to change, permissionless, and decentralized. The only real use case that we’ve discovered for a database with those traits is for money itself. Money benefits from being immutable and decentralized, so it’s a good use case for a blockchain.

Bitcoin Developer and Author, Jimmy Song, eloquently describes this idea,

The Bitcoin blockchain is the most robust and proven money utilizing blockchain technology. Bitcoin has shown that while it’s difficult, it is still possible to run a decentralized ledger in a trustless manner. Bitcoin accomplishes this by being extremely simple in its design. You can track which addresses contain which bitcoin, and you can send/receive transactions whose addresses you own — and that’s basically it. Other projects that claim they will build a decentralized computer on a blockchain that can somehow run hundreds or thousands of applications simultaneously and quickly while remaining decentralized are either incredibly naive themselves, or taking advantage of other people who are naive and don’t understand basic software architecture realities.

The essence of what blockchains provide is decentralized, authoritative, expensive to alter data. This is not a surprise as these properties are exactly what you want for sound money like Bitcoin. Unfortunately, what non-monetary projects generally need, given that it’s software for an industry that’s regulated, changing and growing, is a centralized, upgradeable and scalable system. Each need is made greatly more difficult when combined with a blockchain. In other words, blockchain is the wrong tool for the job.

Why Blockchain is Not the Answer

What altcoin founders inevitably discover is that decentralized blockchains don’t scale well for applications other than money. This leads to decisions made by the altcoin teams to sacrifice decentralization for efficiency so that they can deliver on their promises of decentralized apps, NFTs, and fast transaction times. They sacrifice the most important traits — security and decentralization — for increased functionality and efficiency.

The question then becomes — What’s to stop another competing crypto project from making the decision to sacrifice even more decentralization and security for more efficiency and functionality? The answer is, in short — “nothing”.

This is exactly what we’ve seen play out with competing Layer 1 smart contract protocols like Ethereum, Solana, and Binance Chain. Solana and Binance Chain came later and chose to be even more centralized so they could tout faster speeds and lower fees than Ethereum. This dynamic will continue to occur when the next new exciting crypto comes along, and the next, and the next, until users will simply wonder, “why do I need to use a blockchain at all for this?” It’s slow and expensive, and if these cryptos are centralized anyways, then why not just use a traditional database on Amazon Web Services?

Indeed — good question.

This is the essence of the Bitcoin vs. ‘crypto’ debate. It doesn’t make sense to make another version of “decentralized blockchain money” because it’s impossible to compete with Bitcoin’s immutable monetary policy, decentralization, and network effects. Everything Bitcoin does cannot and need not be reinvented, and the things altcoin founders claim they can do that Bitcoin can’t A) can be built on Bitcoin eventually or B) can be done better today with existing technologies like centralized databases.

All Innovation Will Eventually Be Built on Bitcoin

One of the biggest strengths of Bitcoin is its resistance to change. This is a very different approach to the Silicon Valley Ventrue Capital framework of “move fast and break things.” For Bitcoin, this is a strength, not a weakness, because we are not building the next app here. We are building the foundation of the digital monetary protocol. Every change and upgrade to Bitcoin should be slow, meticulously reviewed, intentional, and methodical in nature to avoid making a mistake and jeopardizing the integrity of Bitcoin.

It’s much easier to build and go to market with a useless centralized token than to build on top of a truly decentralized platform like Bitcoin, but it isn’t better. While some have fallaciously stated that it’s impossible to build on Bitcoin, in reality, it’s just that Bitcoin is intentionally slow-moving by design. Bitcoin is the foundation and future of programmable money because it is the most secure, distributed, permissionless network, and this is impossible to replicate. Developers should take advantage of Bitcoin’s unique traits and build on top of it instead of trying to compete against it.

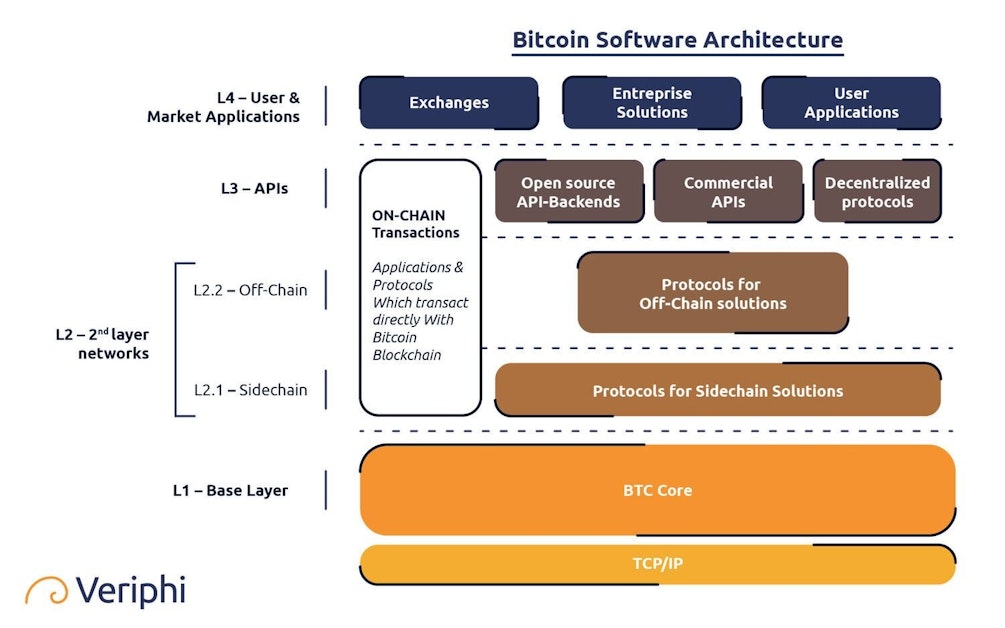

Bitcoin is taking a different approach to scaling than altcoins. Instead of trying to put all the data and transactions into one base layer, Bitcoin will have many different layers on top of its secure base layer. These layers will offer users different levels of decentralization, transaction speeds, and functionality while maintaining the security, decentralization, and immutability of the base layer for settlement.

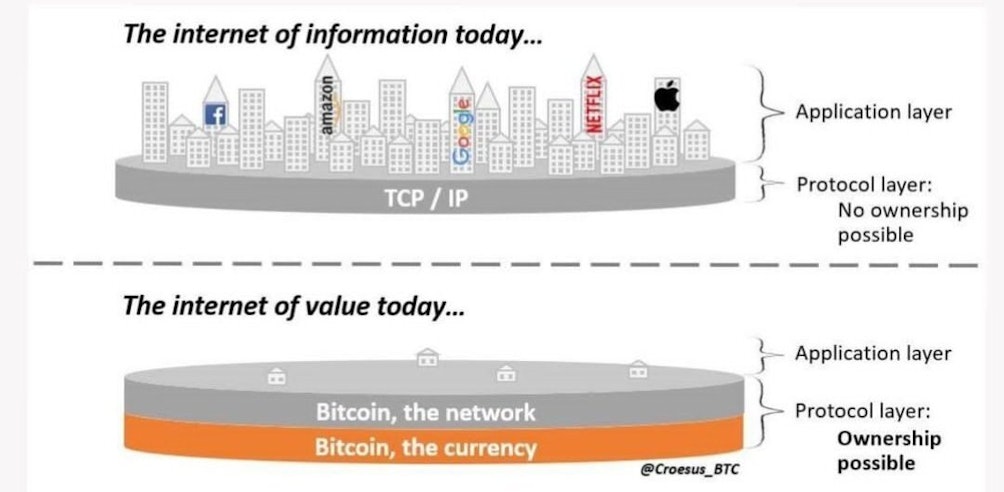

Think of the diagram above — Google and Netflix were built atop the Internet layer, not woven into it. The Internet itself didn’t change, but what you could do on it was limited only to the imaginations, creativity, and ingenuity of developers who chose to build on top of it rather than trying to re-invent it.

Below is a good graphic attempts to depict how Bitcoin’s base layer will underlie an entire layered ecosystem of functionality and innovation.

An example of this layered scaling approach can be observed in the traditional payment system we have today with mobile apps like Venmo/Cash App layered on top of credit card networks, which are layered on top of Fedwire or the Federal Reserve’s National Settlement Service. These layers solve different problems and have different requirements and trade-offs. The same layered approach will be taken in Bitcoin. In fact, it’s already happening with developments such as Lightning, Liquid, Impervious, and others.

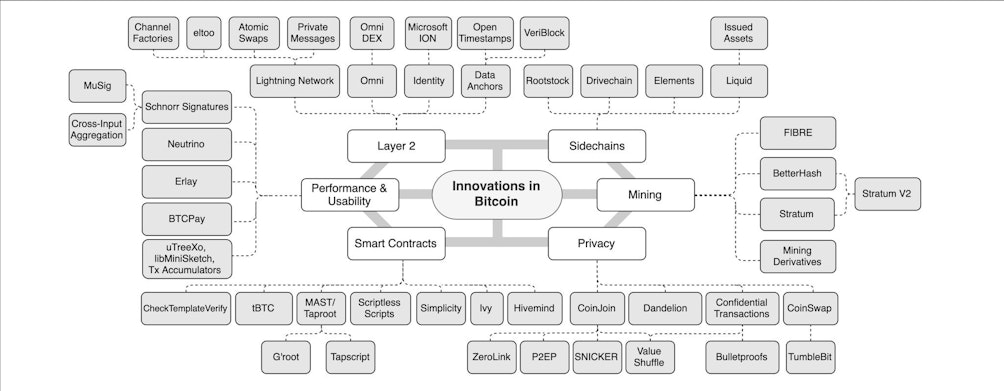

Below is a diagram mapping out some of the innovations occurring on Bitcoin.

The takeaway is that all of the promises of altcoins will eventually be built on top of the most distributed, secure, and open monetary network, Bitcoin. It will take time because of the slow-moving nature of Bitcoin’s development, but it will happen because none of these other altcoins can replicate Bitcoin’s scarcity, security, and decentralization. As altcoins continue to move fast and break, Bitcoin will slowly and methodically add functionality and other improvements on top of a global monetary infrastructure that is unbreakable. Like the classic tale of the tortoise and the hare, Bitcoin will win in the long run and ultimately make these altcoins irrelevant.

Altcoins are False Advertising, Bitcoin Needs No Advertising

All other cryptocurrencies are constantly pushing solutions to problems that don’t exist, whereas with Bitcoin, the whole world seems to be one big unpaid advertisement for it. Whether it’s the censorship of donations, confiscation of assets by governments or entities, collapsing currencies in emerging markets, or decades-high inflation in the US, the world is in desperate need of permissionless, sound money that can’t be inflated, censored, or seized.

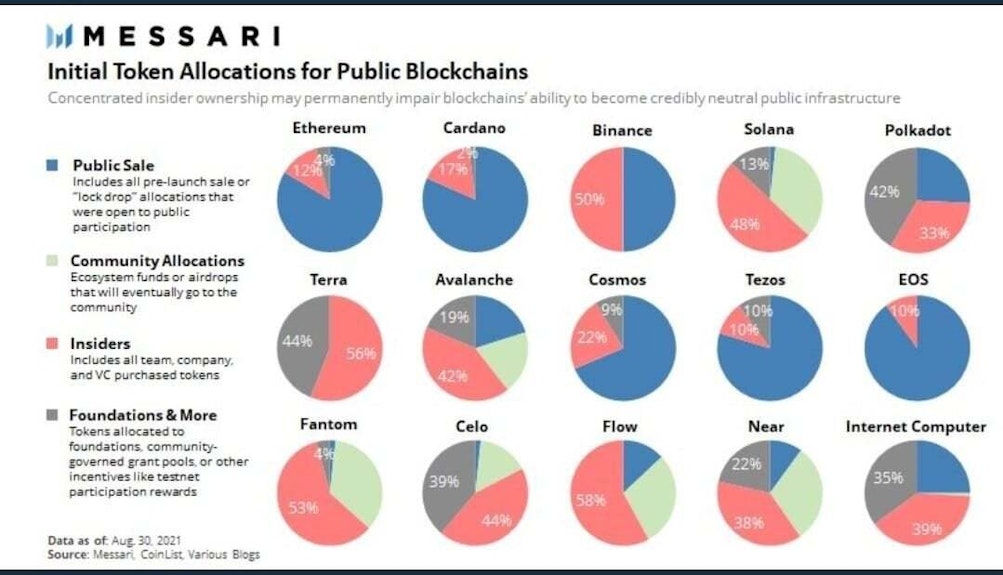

Maybe the biggest difference between other cryptocurrencies and Bitcoin is the incessant marketing that altcoins do to pump their coins. Bitcoin has no marketing team because Bitcoin is leaderless and its value speaks for itself. Altcoins need to constantly run advertisements full of buzzwords about how “decentralized” they are, how “fast” their transactions are, or how they are “better than Bitcoin, ” because their promoters are always trying to sell you on something. One of the reasons they do this is to pump the value of their own coin when they themselves hold a portion of the coin’s supply.

The truth is, many altcoins consist of a centralized founding team that creates a token, grants themselves a percentage of the supply, and then sells it to the public under the guise of it being a decentralized, secure, and revolutionary token, when it’s, in fact, none of those things.

Below is a chart that shows some major altcoins and the percentage of the total supply that is controlled by the founding teams for various reasons.

Most of the other platforms are primarily launchpads for dishonest projects that give worthless tokens in exchange for something of value, only to have the wealth disappear along with the founders not long after.

They often market their token as a secure solution or that you can trust them with the tokens they control. However, there have been countless hacks in the altcoin space. Last year we saw the largest altcoin hack at the time result in $600 million dollars stolen, and these heists occur with such frequency now that the total dollar amount lost to altcoin hacks is well into the billions today. Bitcoin on the other hand has never been hacked in its entire history. Its track record speaks for itself.

Altcoins also attempt to create the illusion that their token is decentralized. However, this is almost always just an illusion. Team members and insiders typically hold a majority of the coin’s supply. There is also usually a founding team that is able to unilaterally control the protocol. This kind of false advertising is so prevalent within the altcoin space that it led to SEC Commissioner Hester Peirce inventing a term for it, “DINO” — short for “Decentralized in Name Only”. This lie is always exposed whenever these altcoins inevitably run into problems that require the team to interfere with the protocol to fix it, proving that it was never decentralized in the first place.

A prime example of this was when Solana engineers and insiders had to hard fork its protocol after suffering a denial-of-service attack. This isn’t meant to pick on Solana, I had many examples to choose from. The takeaway here is if Solana was truly decentralized, they would not have been able to unilaterally hard fork the protocol, but that’s precisely what happened. And yet, when you go to their website, it reads, “Solana is a decentralized blockchain built to enable scalable, user-friendly apps for the world.” This is textbook altcoin marketing from a protocol that is DINO.

You see, bitcoiners don’t need to hire a marketing team because Bitcoin is sound money that fixes a real problem in this world. Bitcoin’s value proposition speaks for itself, and if you ever find yourself in need of storing your wealth in an undebaseable, incorruptible money, then Bitcoin will always be open to anyone who needs it.

Bitcoin is different from all other “crypto” contenders because of its network effect. Its purpose of being sound money justifies its usage of a blockchain, and its superior properties make it the money most likely to continue to see global adoption. Its resistance to change has allowed more and more people to place trust in Bitcoin’s scarcity, resulting in a powerful network effect that reinforces itself over time. Since economic systems converge on one money to facilitate trade and create a pricing system, one can conclude that Bitcoin will capture most, if not all, of the value in the market due to its superiority as money. In the end, all of the dreams of altcoins will eventually be built on top of the Bitcoin network to create a new, layered monetary system.

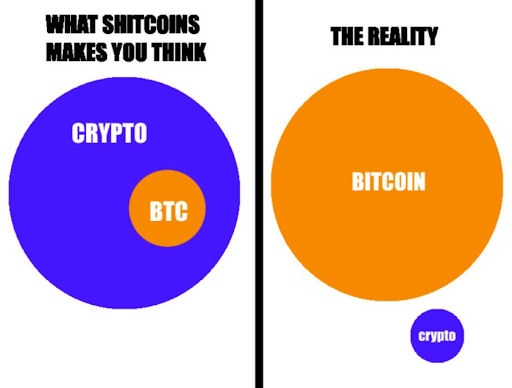

I hope this series helped clarify why Bitcoin is different from other cryptocurrencies. With how much money is spent on marketing by these sh*tcoin promoters, it is easy to feel like the cryptocurrency space is represented accurately by the picture on the left below.

The reality is displayed on the right side here. The peddlers of altcoins like to make people believe that all the innovation is occurring in this crypto space when in reality most of it is inferior technology or outright scams trying to capitalize on the success of a truly innovative technology, Bitcoin.

Don’t get fooled by the altcoin marketing. Don’t put yourself through the “Sh*tcoin Cycle”. And don’t diversify in this new asset class. If you want to gamble on high-risk digital penny stocks, then go right ahead and buy some altcoins. If you want to save for the long term in a sound money that protects your wealth against inflation, confiscation, and censorship, then Bitcoin is the only right choice for you.

Swan Bitcoin is giving away $10 in free Bitcoin if you sign up today!

This blog offers thoughts and opinions on Bitcoin from the Swan Bitcoin team and friends.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?