Why a CBDC Will NOT Promote Financial Inclusion

A CBDC would increase costs, reduce privacy, and create more barriers to financial inclusion, not less.

Central banks around the world have been hard at work developing Central Bank Digital Currencies (CBDCs). According to the Bank of International Settlements, 114 countries, representing over 95% of global GDP, are currently exploring a CBDC. (1)

A retail CBDC would be a form of digital money that’s a liability of a central bank and is directly available to the public. This is different than traditional commercial bank deposits or fast payment systems like Venmo and Zelle in that those are liabilities of the private institutions and hence have liquidity and default risk. These risks became evident during the Global Financial Crisis when several banks came under financial duress, and individuals’ savings were caught in the crosshairs.

Swan Private Insight Update #20

This report was originally sent to Swan Private clients on February 13th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

A retail CBDC would technically not have default or liquidity risk like a commercial bank deposit because it would be issued by the central bank itself, which happens to have access to a “money printer.” Thus, the rationale is, a retail CBDC would be a safer form of digital money than what is currently available to individuals in the marketplace and would lead to increased financial stability.

Other purported benefits of retail CBDCs are more efficient payments, more effective, targeted monetary policy transmission, and improved financial inclusion.

However, the reality is the risks imposed by a retail CBDC far outweigh any alleged benefits.

A CBDC risks becoming a tool of surveillance and control that can be abused by central banks and governments against the populace. A CBDC infringes on the privacy and rights of law-abiding citizens. It could also disintermediate commercial banks leading to increased financial instability, and expose the monetary system to cyberattacks and data breaches.

Lastly, a CBDC could result in a more inefficient and expensive payment system, and could lead to more financial exclusion.

Despite these risks, central banks have been plunging forward with their CBDC development. CBDC momentum is gaining, and now nearly 60% of central banks say it’s more likely that they will issue a retail CBDC in the next 1-6 years, up from only 20% in 2018.

2021 BIS central bank survey on CBDCs and digital tokens.

Due to this acceleration in CBDC development, it’s worth exploring whether or not claimed benefits from central banks are correct.

One of the most common perceived benefit pushed by CBDC advocates around the world is the idea that a CBDC will promote financial inclusion.

This perceived benefit is likely heavily advertised because promoting financial inclusion is a noble cause that few would argue against. Said differently, no one is going to refute that improving financial inclusion is an honorable goal, and if central bankers convince the public that a CBDC will help achieve this goal, then more people will be open to the issuance of a CBDC, regardless if the claim is true or not.

This idea that CBDCs would promote financial inclusion is peddled frequently by central banks and international financial institutions:

The European Central Bank:

“A digital euro should also benefit people who so far have limited access to digital payments and thereby support financial inclusion.” (2)

The Federal Reserve:

“CBDC may be one part of a broader solution to the challenge of achieving ubiquitous account access. Depending on the design, CBDC may have the ability to lower transaction costs and increase access to digital payments. In emergencies, CBDC may offer a mechanism for the swift and direct transfer of funds, providing rapid relief to those most in need.” (3)

The Bank of England:

“A well-designed CBDC may also help to boost financial inclusion in an increasingly digital world by being accessible to a broader range of people, potentially in different formats, than private sector solutions.” (4)

World Economic Forum:

Retail CBDCs can establish a more inclusive financial ecosystem. They can decrease the cost of transactions, eliminate barriers to lending, and power microfinance initiatives. At the same time, CBDCs should aim to help unbanked and underbanked individuals create financial identities. (5)

International Monetary Fund:

This digital currency could satisfy public policy goals, such as financial inclusion, and (ii) security and consumer protection; and to provide what the private sector cannot: (iii) privacy in payments. Let me start with financial inclusion, where digital currency offers great promise, through its ability to reach people and businesses in remote and marginalized regions. (6)

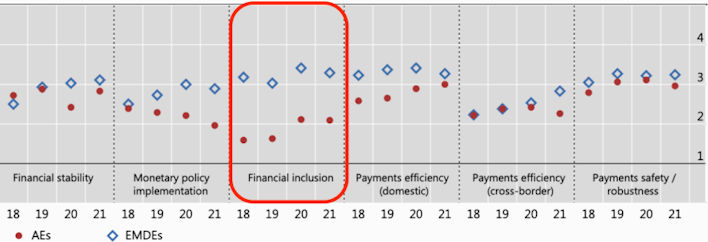

In a recent survey performed by the BIS, financial inclusion was listed as one of the main motivations for issuing a retail CBDC, and Emerging Market economies specifically rated this issue as “important.”

2021 BIS central bank survey on CBDCs and digital tokens.

But would a CBDC actually help improve financial inclusion as these central bankers claim?

To answer this question, we need to ask ourselves why people are excluded from the financial system in the first place.

Financial inclusion involves providing unbanked adults access to the financial system so that they can have access to basic financial services, which they can then use to improve their welfare.

According to an FDIC survey, an estimated 4.5% of Americans are still unbanked today, comprising ~6 million households. In addition, 14.1% of U.S. households — representing approximately 18.7 million households — were considered underbanked. (7)

The FDIC classifies households as “underbanked” as those that have a bank account but used money orders, payday loans, pawn shop loans, auto loans, or other products or services that are disproportionately used by unbanked households.

From the same survey, the FDIC discovered the main reasons why households are unbanked, highlighted in the chart below.

This survey highlights the real reasons why Americans remain unbanked today. The top response from households was they do not have enough funds to meet the minimum requirements to open a bank account. The fourth and fifth most cited responses were households can’t afford to pay all the unpredictable banking fees.

Note how a CBDC would do nothing to fix these underlying issues. The main reasons why American households remain unbanked today are not problems that can be solved with a new technology, like a CBDC. These are larger issues of high costs and wealth inequality worsened by harmful, inflationary monetary policies that would certainly be programmed into a CBDC.

In fact, the introduction of a CBDC would likely result in even higher costs for consumers.

The current leading design for a CBDC is an intermediated model where there remains a division of labor between the public and private sectors. In other words, this CBDC system design recreates the existing financial system that relies on private intermediaries.

BIS

In this design, the central bank would issue a CBDC, develop the underlying payment infrastructure, and provide oversight to the protocol, while the commercial banks and other regulated nonbank financial service providers would perform all the customer-facing roles like account openings, digital wallet custody services, managing CBDC holdings and payments, identity management, data security, and enforcing AML/KYC rules.

The takeaway here is all of these new services that the private sector would need to provide in a CBDC system would not come without significant costs. Therefore, there is no reason to believe that there would not be fees associated with a CBDC system.

Retail CBDC accounts would require compliance with AML/KYC rules and would significantly increase the burden and costs for the compliance and cybersecurity departments of these private financial institutions. There are also the operational costs of building and maintaining all of the technology to be interoperable with the CBDC payment infrastructure. There is the cost of creating wallets, maintaining the systems, and guaranteeing access to these new CBDC accounts. More importantly, there is no clear revenue stream to compensate the private sector for providing these new services.

The logical conclusion is that these increased costs would result in higher fees and other costs that would be pushed onto consumers. It seems incredibly unrealistic to believe that a costly high-tech CBDC system that would depend on fees from wallets is the best way to promote financial inclusion. This would only exacerbate some of the main problems cited in the FDIC survey as to why American households remain unbanked today.

This sentiment is shared by the Independent Community Bankers of America who wrote,

“Compliance functions are not costless — far from it — and therefore creating the technical and compliance infrastructure for CBDC wallets will require a compensation model that could include charging fees to users. The fees banks will be required to charge in order for CBDC wallets to be a viable business will significantly offset any potential benefit to financial inclusion presented by a CBDC. Currently, the price of deposit accounts to customers is subsidized both by a bank’s ability to lend against deposits and to collect interchange fees on transactions. Neither of these business models will be available with a CBDC, so customers may likely be required to pay for access to wallets with an account maintenance fee to offset bank investments to provide and maintain these services.” (8)

These community bankers do not like CBDCs, and it’s easy to understand why. Because of the cost and technological complexity of offering CBDC services, smaller financial institutions are less likely to have the technical capabilities or the profit margins to offer these services compared to larger banks and fintech companies. This would lead to further consolidation of the banking industry. This consolidation would limit competition and harm consumers and small businesses because they would have fewer choices and face higher costs and fees, leading to further financial exclusion.

This consolidation would be a continuation of a trend that has been happening for decades in the banking industry. The number of FDIC-insured financial institutions peaked in 1984 at 17,811 and has been in steady decline since, with 4,897 institutions functioning in 2021. In addition, the number of bank locations peaked in 2009 at 92,394 individual physical branches, and 13,089 branches have closed since then. (9)

NCRC https: //banks.data.fdic.gov/docs/ retrieved on Dec 7, 2021 • Created with Datawrapper

This consolidation accelerated rapidly after the Global Financial Crisis in 2008, after which institutional failures and emergency mergers and acquisitions ravaged the industry.

What was left, was the complete consolidation of the banking industry into effectively 4 megabanks: Citigroup, JP Morgan Chase, Bank of America, and Wells Fargo.

Federal Reserve, GAO

While the Treasury and Federal Reserve bailed out the banks they deemed too-big-to-fail, other smaller institutions were left to fail. Of the 414 insured U.S. banks that failed in the aftermath of the Global Financial Crisis, 85% were small institutions (<$1 billion in assets). (10) This devastated the urban and rural communities that depended on them for critical financial services.

This consolidation has disproportionately impacted small financial institutions that play an outsized role in providing financial services to underserved populations in the economy. Small banks make a majority of the loans to small businesses and farmers. According to an FDIC study, despite holding only 15 percent of total industry loans in 2019, community banks held 36 percent of the banking industry’s small business loans. (11)

Also, farmers specifically depend on these community banks for financing. From the same study, community banks are an important source of financing for U.S. agriculture, funding roughly 31 percent of farm sector debt in 2019, with half of that total financed by community-bank agricultural specialists. They build relationships with these farmers and help finance the people and businesses that feed our country.

The importance of community banks to underserved communities was never more evident than during the COVID-19 lockdowns. Community banks made 60 percent of all Paycheck Protection Program (PPP) loans—including more than 90 percent of PPP loans to communities with an average household income of less than $40,000 per year, and more than 75 percent of PPP loans to communities with a poverty rate of at least 20 percent.

Census Bureau. Bureau of Labor Statistics, United States Department of Agriculture, Johns Hopkins University

These community banks, perhaps the most important institutions for expanding financial inclusion, are the institutions that have slowly been closing or getting merged and acquired by larger competition due to bank deregulation.

In 1994, small banks were 84% of all banks in the US; however, today, that number stands at 48%.

Census Bureau. Bureau of Labor Statistics, United States Department of Agriculture, Johns Hopkins University

This shows how a majority of the branch and bank closures over the last twenty years have been small banks. The FDIC published an 8-year study titled, “Bank Branch Closures from 2008-2016: Unequal Impact in America’s Heartland, ” the authors wrote about how these small bank closures hurt the most vulnerable among us the most,

“Since bank branch closures occurred disproportionately in lower-income areas, especially in the new rural bank branch desert areas, low- and moderate income working families may have been impacted more by a loss of access to financial services. There appears to be a direct relationship between the lack of a nearby bank and the rate of unbanked families.” (13)

The FDIC’s own study concluded that these small bank closures are directly related to the number of unbanked households, or in other words, to financial inclusion. A CBDC would lead to an increased regulatory burden and would create technological hurdles that would challenge small banks disproportionately to large banks. A CBDC would lead to increased costs and fees for the consumer, and put community banks at risk, harming underserved communities the most. Thus, a CBDC would NOT promote financial inclusion.

To make matters even worse, a CBDC system would not only add compliance and operational costs to these community banks, but it would also drain these banks of their main source of cheap funding, bank deposits.

A CBDC is a form of public digital money issued by a central bank. It doesn’t have liquidity or default risk like bank deposits. Therefore, it is logical to expect that users would prefer to hold their savings in a CBDC because there is less risk. The Philadelphia Federal Reserve’s own study concluded that CBDCs would compete with commercial bank deposits, and individuals would choose the central bank-issued money over other deposits, especially in the event of a bank run, which could impair bank lending in the economy. (14)

There is a real risk of disintermediating the banking sector by introducing a CBDC because it would drain banks of their deposits, which comprise 71% of their funding. (15) This would, in turn, reduce lending in the economy, and threaten financial stability.

The American Bankers Association warned of this risk in a joint letter to the House Financial Services Committee in May 2022,

“In effect, a CBDC will serve as an advantaged competitor to retail bank deposits that will move money away from banks and into accounts at the Federal Reserve where the funds cannot be lent back into the economy…Losing this critical funding source would undermine the economics of the banking business model, severely restricting credit availability increasing the cost of credit, and causing a slowdown of the economy.” (16)

But central banks appear to be ignoring this risk and continuing with their CBDC development anyways. They seem to think they are smart enough to out-design the disintermediation problem by putting limits on how much funds individuals can hold in a CBDC account.

Call me crazy, but launching a CBDC with limits right out of the gate seems like a bad idea. I also don’t know of a single consumer out there saying, “Please, I want digital money with built-in limits!”

Having limits on money thwarts other purported benefits of a CBDC, like more efficient payments and financial inclusion. It would hinder global trade and payments by adding unnecessary restrictions and friction to money itself. Lastly, it is not hard to envision how this kind of power could be abused down the road.

But this is exactly the plan that central banks around the world are moving forward with.

The Bank of England’s Deputy Governor Jon Cunliffe recently came out and said in a speech,

“We propose a limit of between 10,000 pounds and 20,000 pounds per individual as the appropriate balance between managing risks and supporting wide usability of the digital pound, A limit of 10,000 pounds would mean that three-quarters of people could receive their pay in digital pounds as well as holding pre-existing balances in the same account, while a 20,000 pound limit would allow almost everyone to use digital pounds for day-to-day transactions.” (17)

The ECB recently announced that it will likely place a 3,000 to 4,000 euro limit on the Digital Euro, planned to launch in 2025. (18)

The ECB stated in a recent Digital Euro progress report that it indeed intends to incorporate the limits,

“The intention is to incorporate limit and remuneration-based tools in the design of a digital euro to curb its use as a form of investment. On the one hand, quantitative limits on digital euro holdings of individual users could limit individual take-up and the speed at which bank deposits are converted into digital euro. On the other hand, remuneration-based tools could be calibrated to make large digital euro holdings above a certain threshold unattractive compared to other highly liquid low-risk assets.” (19)

The ECB’s Fabio Panetta recently made this comment on the Digital Euro’s design,

“Quantitative limits on the holdings of individual users would limit the individual take-up or the speed of deposit conversion. Remuneration-based tools could be calibrated to make large digital euro holdings above a certain threshold unattractive compared with other highly liquid and low-risk assets.” (20)

Let me translate central bank talk for you:

Remuneration-based tools = negative interest rates

Quantitative limits = censorship and control

Personally, I struggle to see how the ECB having new “tools” for censorship and control would help build trust and improve financial inclusion given that trust is the second cited reason for why American households are unbanked.

ECB

So the ECB is planning to cap limits on CBDC accounts and charge fees on accounts that go over the limit, or impose a negative interest rate on the funds.

But the truth is, these tools will do very little to stem the flow of funds from bank deposits into CBDC accounts.

The American Bankers Association ran the numbers.

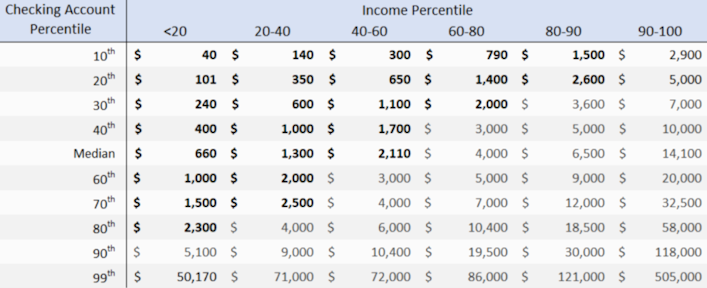

First, the ABA broke down what CBDC limits would be appropriate for the central banks to choose. They concluded that $2,500 would meet the needs of many lower-income households based on data from the Federal Reserve’s 2019 Survey of Consumer Finances. Furthermore, a limit set at $5,000 would cover average monthly household cash flows; and a cap set at $10,000 could be considered a reasonable ceiling, as it is the level at which banks begin to file suspicious activity reports.

Table 1 shows the Median Checking Account balance based on income percentile.

Fed Survey of Consumer Finances

The ABA found that limits of $2,500, $5,000, and $10,000 on a CBDC would still drain a significant amount of funds from bank deposits.

Table 2 illustrates that CBDC limits of $2,500, $5,000, or $10,000 would result in expected deposit losses of $445.7 billion, $720.9 billion, or $1.08 trillion, respectively.

Federal Reserve, ABA analysis

The banking industry held a combined $23.8 trillion in assets at the end of 2021. Therefore, deposit losses of $445.7 billion, $720.9 billion, or $1.08 trillion from a capped CBDC would result in aggregate funding gaps of 1.9%, 3.0%, or 4.5%, respectively. While these percentages may appear small, ABA analysis shows that this level of drainage on deposits would have a material impact on bank lending and, consequently, financial stability.15 And you best believe that small banks will have much more difficulty stomaching these deposit losses compared to larger banks. Prepare for more consolidation…

To summarize, a CBDC would drain a significant amount of funding from private banks by cannibalizing bank deposits. This could impact lending in the economy and increase financial instability, regardless of limits placed on CBDCs by central banks.

If a CBDC is launched, community banks will not only have more costs from the regulatory and compliance burdens of incorporating a CBDC, but they also will have their main source of funding drained. This would be a double whammy for small banks.

This is why a CBDC disproportionately impacts community banks, the very institutions that primarily provide services for underserved populations. As a result, a CBDC would NOT promote financial inclusion.

The second and third most cited reasons for why American households remain unbanked today are privacy concerns and they don’t trust banks.

A CBDC would require more trust in intermediaries and in the traditional banking industry in general. These intermediaries have blatantly breached the trust of the public over the last several decades. The financial services industry has paid over $347 billion in penalties since 2000. (21) It’s no wonder Americans don’t trust them.

Satoshi Nakamoto said it best,

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.” (22)

American households do not trust banks because the banks have shown they do not deserve to be trusted.

It’s not hard to see why a CBDC would not address these underlying problems of trust and privacy. In fact, a CBDC would worsen them. A CBDC would concentrate power to the Central Bank-Governmental Complex and become a tool for surveillance and control.

A CBDC would allow governments and central banks to track all financial activity in the economy at a much more granular level than today. A CBDC would have the ability to collect massive amounts of data on every financial transaction that occurs in the economy. This new technology would lead to government intrusion and threaten every American’s fundamental right to privacy protected by the 4th Amendment.

This all, of course, depends on the design of the CBDC system, but central banks have made it clear that cash-like anonymity will not be incorporated in a CBDC, and their current leading design is an intermediated CBDC system that recreates the existing banking system with all the same problems as before, but now they are more empowered with more tools to censor and manipulate.

Major central banks have already made it clear in their publications and in speeches that full privacy would not be afforded to users in a CBDC system due to interfering with AML/KYC policies.

The ECB has already taken a hard stance against privacy in their Digital Euro:

“Full anonymity is not considered a viable option from a public policy perspective. It would raise concerns about the digital euro potentially being used for illicit purposes (e.g. money laundering and the financing of terrorism). In addition, it would make it virtually impossible to limit the use of the digital euro as a form of investment — a limitation that is essential from a financial stability perspective.” (23)

On the other hand, the Federal Reserve has stated it would leverage existing tools in the private sector concerning privacy with its CBDC:

“A general-purpose CBDC would generate data about users’ financial transactions in the same ways that commercial bank and nonbank money generates such data today. In the intermediated CBDC model that the Federal Reserve would consider, intermediaries would address privacy concerns by leveraging existing tools.” (24)

In other words, a CBDC issued by the Federal Reserve would do nothing to address the privacy issues that persist in the financial industry, even though it’s the second most cited reason for why American households remain unbanked.

The Bank of International Settlements General Manager, Agustín Carstens, went a step further and inexplicably tried to argue that identity-linked CBDCs (lack of privacy) would actually enhance financial inclusion.

“My own view is that CBDCs without identity (purely token-based CBDCs) will not fly. First, they would open up big concerns around money laundering, the financing of terrorism and tax evasion. Second, they may undermine efforts to enhance financial inclusion, which are based on good identification and building up an information trail for access to other financial services…For these reasons, we need some form of identity in digital payments.” (25)

Apparently, Mr. Carstens is unaware of the literature around what actually drives financial exclusion today.

In the end, a CBDC would only lead to more financial surveillance and require more trust in centralized institutions at a time when Americans are growing more distrustful of intermediaries by the day. A CBDC would reduce the privacy of financial transactions and would allow the Central Bank-Governmental Complex to collect and analyze more data on everyday Americans than ever before. This could lead to a growing surveillance state as all economic activity is monitored and controlled by central planners through a CBDC system.

A CBDC will not address the underlying privacy or trust concerns that lead to unbanked Americans so, thus, a CBDC will NOT promote financial inclusion.

Whereas CBDCs have shown they would only worsen financial inclusion, Bitcoin shows great promise in its ability to address some of the reasons why American households remain unbanked today.

Bitcoin is a form of private, non-State digital money that is not controlled by any person or group of persons. Households that don’t trust banks or intermediaries will have no problem trusting Bitcoin because it removes the need for intermediaries altogether. One can trust the Bitcoin protocol specifically because it is trustless.

Bitcoin is an open monetary system that allows anyone with a phone and internet connection to send value to anyone, anywhere, without permission. There are minimal barriers to entry. There is no minimum account requirement to download a wallet and start sending or receiving bitcoin. There is no waiting for accounts to be approved. There is also no documentation required to start interacting with the Bitcoin protocol like in the traditional financial system. This makes it easy for underserved communities to use Bitcoin compared to the onerous, slow, and expensive process of opening a traditional bank account.

Bitcoin’s fees are predictable and much lower than traditional payment options. If you run a node, you can check the mempool, and know exactly how much fees you will be charge to include your transaction in a block. There are no hidden fees in Bitcoin like with traditional financial institutions. This help build trust in the Bitcoin protocol as trust in banks continues to erode due to the predatory nature of their fees.

Lastly, Bitcoin allows individuals to transact pseudonymously. Privacy is much more protected compared to a CBDC with built-in digital identification. Furthermore, the Lightning Network, Bitcoin’s second-layer payment protocol, offers even better privacy guarantees. I expect innovation to continue on Bitcoin and privacy to improve on the protocol over time. This addresses another underlying cause of financial exclusion.

All in all, Bitcoin is our best hope at promoting financial inclusion, not CBDCs. Despite this, central banks continue to ignore the private-sector innovation of Bitcoin that solves many of the issues facing the unbanked today and are instead wasting their time and resources developing a CBDC system that would only cause more problems and exacerbate the current ones.

This is what happens when a public institution tries to push a product in a top-down fashion that no one wants or asked for. The private sector has always been the best at innovating and responding to the needs of the consumers in the marketplace. Public institutions only drive out good innovation by introducing bad innovation. Luckily, the private sector has provided its own form of money that people are willingly using at an increasing rate. (Bitcoin — I’m talking about Bitcoin.)

This research is evidence that a CBDC would do more harm to financial inclusion than good by adding technical barriers to money itself, disintermediating small banks that are critical for providing financial services to underserved communities, while threatening our freedoms and the economy at large. If central banks were serious about promoting financial inclusion, they would stop wasting their time and resources developing CBDCs, and start embracing Bitcoin as a working solution to the problem.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Here are some notable organizations who echoed the notion that a CBDC would NOT promote financial inclusion:

1.) “The creation of a CBDC, however, in and of itself does not solve financial inclusion, and it is not obviously clear that a CBDC would be any more advantageous for financial inclusion than existing financial products and solutions.” (26) — Visa

2.) “Overall, the IIF is skeptical that a retail U.S. CBDC itself would materially improve financial inclusion. Rather, a neutral effect appears more likely. A CBDC would neither be sufficient nor necessary to drive higher rates of financial inclusion.” (27) — Institute of International Finance

3.) “It is unlikely that a CBDC would meaningfully impact financial inclusion because the likely characteristics of a CBDC (e.g., a digital form, availability through intermediaries in accounts or wallets) do not readily address some of the most important reasons why consumers are unbanked today. Put another way, the causes of households’ unbanked status (i.e. lack of trust, privacy concerns, lack of broadband access, lack of documentation to fulfill KYC requirements) are varied, and complex, but not generally related to the absence of low-/no-cost digital payment tools or bank accounts.” (28) — Clearing House Association

4.) “We remain concerned that the issuance of a U.S. dollar CBDC as described in the Federal Reserve Board paper would not have a significant positive impact on financial inclusion given the documented reasons for individuals as to why they are underbanked or unbanked.” (29) — JP Morgan Chase

5.) “It appears that CBDC does not have a unique proposition with respect to financial inclusion. Why, then, do so many central banks place such high expectations on CBDC as a means to promote greater financial inclusion?” (30) — The World Bank

That’s a great question, World Bank.

6.) “Increasing digitalization could create financial inclusion issues as barriers around trust, digital literacy, access to IT, and data privacy concerns create a digital divide.” (31) — Bank for International Settlements, Federal Reserve System, Bank of England, European Central Bank, Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank

You read that correctly, even the central banks’ own research states that a CBDC could create more barriers to financial inclusion, not less. This directly contradicts what these central bankers say publicly on the matter.

1. https://www.atlanticcouncil.org/cbdctracker/

2. https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog220713~34e21c3240.en.html

3. https://www.federalreserve.gov/newsevents/speech/brainard20210524a.htm

4. https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf?la=en&hash=DFAD18646A77C00772AF1C5B18E63E71F68E4593

5. https://www.weforum.org/agenda/2022/10/4-ways-to-ensure-central-bank-digital-currencies-promote-financial-inclusion/#: ~:text=Build%20financial%20identity, underbanked%20individuals%20create%20financial%20identities

6. https://www.imf.org/en/News/Articles/2018/11/13/sp111418-winds-of-change-the-case-for-new-digital-currency

7. https://www.fdic.gov/analysis/household-survey/2021report.pdf

8. https://www.icba.org/docs/default-source/icba/advocacy-documents/letters-to-regulators/comments-on-cbdc-consultation-paper.pdf?sfvrsn=1a421d17_0

9. https://ncrc.org/wp-content/uploads/dlm_uploads/2022/02/The-Great-Consolidation-of-Banks-and-Acceleration-of-Branch-Closures-Across-America-FINALc.pdf

10. https://www.gao.gov/products/gao-13-704t

11. https://www.fdic.gov/resources/community-banking/report/2020/2020-cbi-study-full.pdf

12. https://www.icba.org/newsroom/blogs/main-street-matters/2021/11/10/paycheck-protection-program-data-show-community-banks-served-those-most-in-need

13. https://ncrc.org/wp-content/uploads/2017/05/NCRC_Branch_Deserts_Research_Memo_050517_2.pdf

14. https://www.philadelphiafed.org/consumer-finance/payment-systems/central-bank-digital-currency-central-banking-for-all

15. https://www.aba.com/-/media/documents/comment-letter/aba-comments-on-fed-discussion-paper-money-and-payments-05202022.pdf?rev=f951926825b14ad9b6c901e68b36f22d

16.https://www.consumerbankers.com/sites/default/files/Joint%20Trades%20Hill%20Letter%20on%20CBDC.pdf

17. https://www.reuters.com/markets/currencies/consumers-face-20000-pound-limit-digital-pound-bank-england-says-2023-02-07/

18. https://www.coindesk.com/policy/2022/06/15/ecb-would-limit-digital-euro-to-maximum-15t-euros-panetta-says/

19.https://www.ecb.europa.eu/paym/digital_euro/investigation/governance/shared/files/ecb.degov220929.en.pdf

20. https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220929~91a3775a2a.en.html

21. https://violationtracker.goodjobsfirst.org/industry/financial%20services

22. https://p2pfoundation.ning.com/forum/topics/bitcoin-open-source

23.https://www.ecb.europa.eu/paym/digital_euro/investigation/governance/shared/files/ecb.degov220929.en.pdf

24. https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

25. https://www.bis.org/speeches/sp210127.pdf

26. https://www.federalreserve.gov/files/cbdc-public-comments-8-20220624.pdf

27. https://www.federalreserve.gov/files/cbdc-public-comments-8-20220624.pdf

28. https://www.federalreserve.gov/files/cbdc-public-comments-9-20220624.pdf

29. https://www.federalreserve.gov/files/cbdc-public-comments-9-20220624.pdf

30. https://blogs.worldbank.org/allaboutfinance/cbdc-and-financial-inclusion-changing-paradigm-part-2

31. https://www.bis.org/publ/othp42_system_design.pdf

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?