What’s New and Coming in Lightning

As Lightning Network Usage Grows, Splicing, BOLT12, Offline Payments, and LSPs are Poised to Deliver Big Improvements for Users.

Bitcoin’s payment technology has probably advanced more than you realize. Now, an instant and cheap self-custodial lightning experience is already available. The experience is not quite at the level of fiat payments in the likes of CashApp, Venmo, or Paypal, but it’s well on the way there. If your view of Bitcoin payments is that they’re slow, expensive, and not scalable to many people, you need to update your views, as this view is likely from the 2015-2017 blocksize war era or perhaps in the early lightning network era of 2018-2021.

But if you are a regular user of lightning apps, you probably already see it for yourself. Now, of course, we should acknowledge that most Bitcoiners in Western world nations are interested in HODLing rather than spending sats. This is generally due to tax reasons and mostly because they anticipate Bitcoin’s price to rise significantly in the medium to long-term future. But nevertheless, it’s nice to know that the network is rapidly improving, and should you want to easily transact, you can! After all, once there is broader Bitcoin adoption, it’s likely that tax laws will change as they did in El Salvador with Bitcoin as legal tender, taking away the capital gains tax law issue.

Swan Bitcoin Market Update #40

This Insight Report was originally sent to Swan Private clients on October 13th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

The Lightning Network is a network of payment channels. By using one on-chain transaction to open a channel and another to close that channel — users can take many transactions “off the chain” by only settling out on-chain once when that channel is closed down. Not only this, but Bitcoin’s lightning network allows you to route payments through the network, even if you do not have a direct channel with your intended recipient. Payment routing occurs using multiple ‘hops’ passing through multiple nodes on the network. Using the Lightning Network doesn’t mean a user can completely avoid using Bitcoin on-chain, but rather, they are able to reduce their use of the blockchain, which saves fees and speeds up transactions for small to medium-value transactions.

Lightning network faces criticism from some people who argue that “nobody uses the Lightning network.” But at the same time, if you look at some of the statistics around the ecosystem, Lightning transactions are increasing considerably.

As examples:

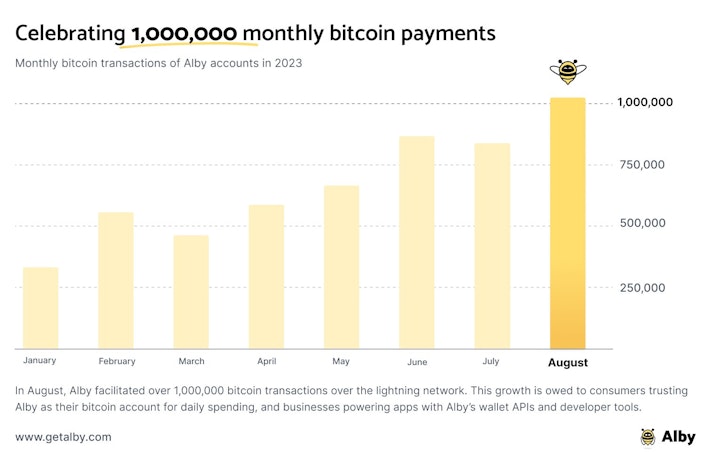

Alby, a popular Lightning browser extension, reported 1M transactions for the month of August 2023.

Wallet of Satoshi is on track for about 820,000 LN payments in September 2023 (per Kevin Rooke’s stat tracking.)

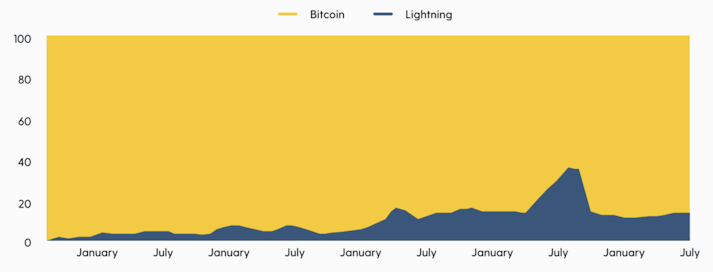

Bitrefill (a Bitcoin commerce site selling vouchers) is noting growth in Lightning use as a proportion of Bitcoin transactions.

More and more Bitcoin and crypto exchanges are supporting lightning over time, e.g., Coinbase, Binance, and others have recently announced support or that they are working on it.

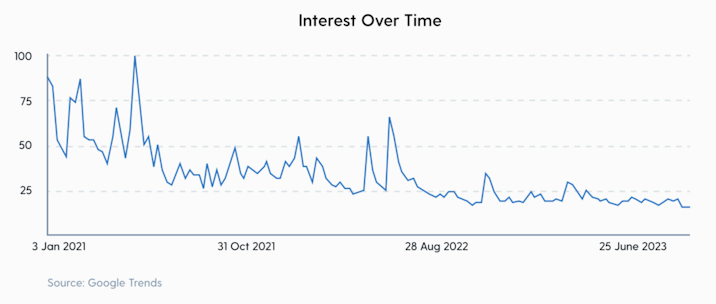

This is all occurring despite the fact that Bitcoin’s price is down from the all-time high (circa $69,000 to $26,200 in late September 2023), and overall Bitcoin search volume is down.

Global Bitcoin search volume from 1/1/21 to 26/9/2023:

Big improvements are here or coming soon for Bitcoin’s Lightning Network. Here’s a walkthrough of some highlights:

Splicing relates to being able to resize a Lightning channel with one on-chain transaction rather than having to spend an on-chain transaction to close a channel and another on-chain transaction to reopen the channel. This technique will lower the cost of running a Lightning node for many Lightning node operators, and this, in turn, flows through to cost savings for end users. Notably, Phoenix Wallet by the ACINQ team has splicing enabled on the Android version of the app, with iPhone support coming soon.

What does this mean in plain English for end users?

This provides a unified experience of on-chain and Lightning. The user no longer has to think about managing channels, and they are able to seamlessly spend on-chain or spend using Lightning, with greatly improved simplicity.

For example, with Phoenix, users previously had to pay 1% for a swap-in fee for taking in on-chain funds and putting them into a Lightning channel. Now, this fee is gone and replaced with only the miner fee to ‘splice in’ the on-chain Bitcoin into a Lightning channel that is immediately spendable by the user.

The main fee Phoenix users will face is 0.4% for spending using Lightning or occasional on-chain fees when receiving on-chain. This is a dramatic simplification of the fees and experience. It makes it far easier for an average end user to use Lightning in a self-custodial way, and ACINQ’s service has very high payment reliability. It’s now becoming more feasible to actually earn your salary in Bitcoin or Lightning and actually spend using Lightning at Lightning-enabled merchants. The other great point is that users who want to use, say, Phoenix as an on-chain wallet can still do so without necessarily paying high swap in or out fees for every on-chain transaction, as the fees for on-chain transactions are simply the miner fees that would be paid anyway with any on-chain wallet.

And this isn’t all. Splicing could evolve in the future to provide even more benefits such as increased privacy or increased cost savings. This could happen where lightning nodes are communicating with each other and coordinating multiple operations to be batched into one transaction. Some Bitcoin surveillance firm heuristics rely on the notion of multiple inputs being spent being controlled by the same user, and if splicing enables multiple parties to collaborate on transactions, this could undermine blockchain surveillance, resulting in a privacy improvement.

Collaborating on other transactions across Lightning could also result in on-chain cost savings for users. Imagine a world where multiple channels can be resized and an on-chain payment made, all with one on-chain transaction! For more information on splicing in theory and practice, listen to relevant episodes SLP490 with Dusty Daemon and SLP513 with Bastien Teinturier. Or, of course, try it out yourself with Phoenix Wallet.

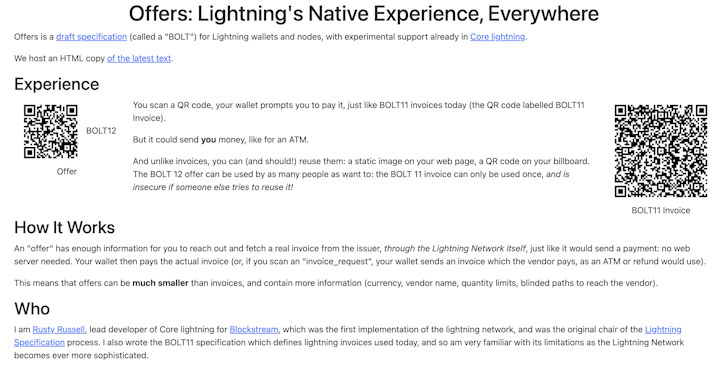

Bolt12 relates to a new experience for Lightning. Currently, with Lightning, there are generally single-use invoices, which, as the name implies, are not designed to be reused. But with Bolt12, aka “Offers, ” we can have static QR codes or strings that can be utilized by users to fetch new invoices from each other. This means users could create a Bolt12 code that relates to their wallet and post this up to receive donations or to receive regular ongoing payments. It also means streamers, content creators, or fund-raisers could use a single QR code to take donations cheaply and quickly.

Historically, people used to put up a single Bitcoin address to take donations or, in some cases, even for regular commerce. Generally, re-using Bitcoin addresses is seen as a privacy no-no. And this approach was also more costly, as each donation required going on-chain for the sender. But now, in a Lightning-enabled future with Bolt12, you can put up a single QR code and actually receive donations without re-using Bitcoin addresses and without the donor/sender having to spend on-chain.

Spelling this out further, when you sign up today for online services, they usually ask for your email so they can send you notifications, product information, marketing, etc. It’s become the generalized way to send messages for e-commerce. But there is no easy way to send or receive money, as this usually involves one person having to type in credit card details, banking details, or wire details.

Imagine, in the future, when you sign up with services, and when they want to make a payout to you, they can simply make a payment to you using your bolt12 code. This can dramatically simplify your experience and speed the process by making it so you only have to paste in a Bolt12 code to receive payment, just like you would enter in your email address today to receive emails. This can dramatically simplify the process for users to earn sats, get reward payouts, or even receive refunds in an e-commerce context.

Taking it one step further, your Bitcoin lightning wallet apps could incorporate a contact list where your contacts have their bolt12 codes registered. You could then pick a contact and instantly make a lightning payment to that person without even having to use a custodian! You could settle up with friends and family for dinner or other shared expenses or make periodic payments to vendors or merchants.

At that point, lightning would have a similar experience to typical fiat fintech apps like Venmo, CashApp, or PayPal — but it could be done without custodians and done using Bitcoin. What an incredible world that would be.

For more information on Bolt12, see Bolt12.org or listen to the creator, Rusty Russell, on SLP298.

Now, to properly enable that future above, what’s needed is further development in what’s called asynchronous payments, also known as offline payments. In Lightning today, generally, both parties to the channel need to be online to send or receive funds. This can present an issue for mobile users if they are periodically offline or in areas with bad connectivity.

To fix this, there is new work to enable LSPs (Lightning Service Providers) to assist in such cases. Casual Lightning users on mobile will typically have an LSP help them by providing Lightning liquidity to their node, and it may also assist by helping notify them to go online and check their payments and channels. In the future, with asynchronous payments, the sender’s LSP could notify your LSP that you have an incoming payment. Your mobile application could then 'wake up' and signify to your LSP that you are now available to take the payment, and at that point, the payment can be forwarded from the sender’s LSP over to you.

In the earlier years of Bitcoin, people would commonly use an on-chain address to take payment even hours or days later. In the Lightning context, this changed because of the online requirement. I.e., Lightning invoices are set with an expiry period, and the sender must generally respond and make the payment within a set period of time. This clunkiness that previously existed for security reasons can be removed with asynchronous payments. Users can end up getting the ‘best of both worlds’!

They can have the fast, low-fee payments of Lightning and take away some of the downsides, such as the always-online requirement, with this clever workaround.

Industry participants are coming together to work on an LSP specification to provide a unified API (Application Programming Interface). This will enable direct p2p (peer-to-peer) messages between lightning nodes and users.

This will also enable greater competition and collaboration between different Lightning applications and LSPs. Currently, casual lightning users are reliant on an LSP that is built into the wallet application, and this can cause a type of ‘vendor lock-in.’

For example, if you use the XYZ app, you might have to use XYZ LSP, and if you use the ABC app, you might have otherwise had to use ABC LSP.

But in the future, once an LSP specification is in place, you can more easily have lightning apps that are LSP-agnostic. So you could have XYZ app, but use ABC’s LSP. So you could have one lightning app that makes use of a different LSP channel or even use multiple different LSPs for privacy or payment reliability reasons. This can all be done without the end user giving up the custodianship of funds, as the LSP is merely assisting with liquidity and user experience.

Other benefits here may include:

Making it easier for wallet app developers to build — as they can now focus on building their wallet or app rather than also having to develop and build an LSP.

In this way, it lowers the bar to creating and innovating apps in Lightning increased competition between LSPs, providing the user with more choice.

Some LSPs may choose not to service particular jurisdictions for legal and regulatory reasons, so this may enable them to still operate for users based in other jurisdictions. For example, the Blocktank LSP won’t serve users from the USA but could serve users from other jurisdictions.

There’s still work required, and even when complete, it will still require periodically interacting with Bitcoin on-chain. This means that if you want to remain self-sovereign, you will need to periodically “go to chain, ” whether that is to open new channels, do splice in/out transactions, use swap/in-out functions, or to close channels. It’s also important that in order to keep Lightning secure, that you are able to do an on-chain transaction in case your counterparty goes offline or tries to cheat you.

Is it likely that many people will continue to use custodial Lightning for various convenience or cost-saving reasons?

Yes, But the key point is that overall Lightning use is growing over time and that the ability to use Lightning self-custodially is improving rapidly, too.

Imagine a future where more people can natively live on Lightning. They could earn their pay using Lightning, and they could also spend using Lightning. In that future, users may only need to periodically interact with Bitcoin’s base chain.

Over time, of course, we should expect that fees will rise as more and more people want access to Bitcoin. Bitcoin’s “Not your keys, not your coins” ethos will mean that more people will want to actually own some coins on-chain rather than trusting custodians.

Though some may have had false expectations about how quickly Lightning would develop in the early years of its being live on the main network (around 2018), Lightning is quickly advancing now. Applications such as Phoenix Wallet for iPhone or Android are probably leading examples of what is possible today.

As it becomes more widely accepted across payment processors and integrated into more apps that we use, Lightning can become the default for lower-value commerce online and also for in-person commerce. The future of Internet commerce will change as Lightning becomes widely adopted and supported. It will become a much smoother experience, and we are already seeing this in various Bitcoin communities around the world.

The future for Lightning is bright, and it’s worth trying out some modern Lightning apps to see for yourself.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?