What Are Bitcoin Ordinals? (Why Inscript Your BTC)

Seen by some as an innovation in data storage and network security, while others view them as a passing fade and drift from Bitcoin’s original intent as a currency. Let’s explore!

Throughout 2023, Bitcoin ordinals have emerged as a hotly debated topic among Bitcoin enthusiasts. Proponents view them as a potential game-changer in data storage and a boon for Bitcoin network security.

However, skeptics criticize them as a deviation from Bitcoin’s primary purpose as a peer-to-peer currency.

But what are Bitcoin ordinals?

This blog post dives into Bitcoin ordinals' brief history, the network upgrades that led to its creation, and the broader implications for the Bitcoin industry.

Short on time? No problem. You can jump to any section below…

Understanding Bitcoin Ordinals: Serial Numbers for Sats

The Mechanics of Bitcoin Ordinals and Digital Artifacts

Bitcoin NFTs vs. Traditional NFTs

Debating the Merits and Drawbacks of Bitcoin Ordinals

Navigating the Bitcoin NFT and Ordinals Market

Conclusion: A Balanced View of Bitcoin Ordinals

The Concept of Bitcoin Ordinals

Bitcoin Ordinals are very similar to serial numbers. They act as a unique identifier for each unit of Bitcoin, known as a "satoshi or sat" (short for “Satoshi Nakamoto”).

Just as every U.S. paper dollar bill carries a serial number, each satoshi is assigned a serial number based on its mining order.

The Emergence of Bitcoin Inscriptions

Bitcoin inscriptions are akin to digital captions attached to individual sats. These inscriptions can include:

Text

Images

Audio

… even digital games. Their integration with ordinals leads to the creation of unique Bitcoin artifacts, which we will explore next.

Bitwise recently disclosed the wallet address for its Bitcoin ETF — a first among the top 11 issuers of spot Bitcoin ETFs.

Following this disclosure, the wallet has attracted a variety of contributions, including Bitcoin ordinals and unique satoshis and has amassed inscription donations valued at $6,083 and boasts a collection of more than 16,000 inscriptions.

Swan Bitcoin

Creating Digital Collectibles

Bitcoin ordinals and inscriptions are primarily used to create "artifacts" or digital collectibles akin to sports cards on the Bitcoin network. These artifacts, also known as Bitcoin NFTs, use ordinals as serial numbers and inscriptions for attaching an image.

They have found applications in data storage, domain names, and, most notably, the BRC-20 protocol. The BRC-20 standard opens up new possibilities for the Bitcoin network, allowing it to use decentralized finance (DeFi) protocols and various blockchain-based applications.

BRC-20 artifacts differ from traditional NFTs in several ways. Unlike Ethereum NFTs, which rely on smart contracts and centralized servers, they are stored directly on the Bitcoin blockchain.

The Bitcoin blockchain has undergone two essential modifications — SegWit and Taproot — which have since facilitated the emergence of ordinals.

SegWit Upgrade

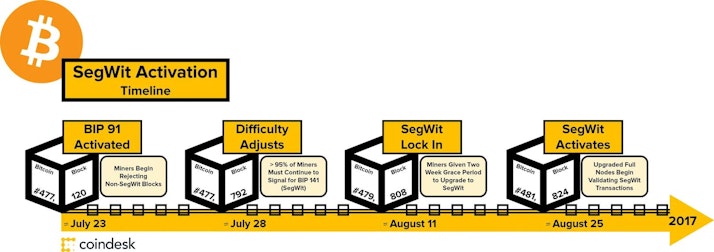

In 2017, the Bitcoin community implemented SegWit or segregated witness data to increase network capacity and improve scalability.

Before SegWit, the OP_RETURN function included the arbitrary data on the transaction block:

Transaction time

The sender/receiver’s address

SegWit modifies storing data, separates signature information from transaction data, optimizes block space, and reduces transaction fees.

This revision modified the structure of Bitcoin transactions and boosted the block size capacity from 1 MB to 4 MB.

Taproot Upgrade

The Taproot upgrade, implemented on November 14th 2021, enhanced Bitcoin’s protocol by introducing Schnorr Signatures, MAST, and Tapscript, significantly improving privacy, scalability, and smart contract flexibility.

Schnorr what? WTH is a MAST? In simple terms, Taproot:

Batches multiple signatures and transactions together, making verifying transactions on the network easier and faster.

Scrambles transactions with single and multiple signatures together. It made it more difficult to identify transaction inputs on Bitcoin’s blockchain.

The Taproot Assets Protocol is for issuing assets on the Bitcoin blockchain.

Taproot Assets leverages newly created assets and their transfers in an efficient and scalable manner.

Multiple assets can be created and transferred in a single Bitcoin UTXO, while witness data is transacted and stored off-chain.

Critics' Perspective

Critics argue that ordinals and artifacts detract from Bitcoin’s original purpose as a decentralized financial system.

They raise concerns about network congestion, increased transaction fees, and slower processing times, potentially undermining Bitcoin’s role as an economic system.

Advocates' Stance

Supporters tout the unparalleled security of the Bitcoin blockchain for data storage, attracting new users with diverse interests beyond money.

They highlight the potential economic benefits for miners, thereby bolstering network security.

Bitcoin ordinals represent a fascinating evolution in the Bitcoin ecosystem, offering potential benefits and challenges. Ordinals are not just a technological curiosity but a development that could redefine the scope of digital assets within the Bitcoin framework.

While they promise to expand Bitcoin’s utility, they also come with a set of challenges that must be thoughtfully considered.

Investing in Bitcoin is a strategic decision for securing your financial future.

Don’t waste your hard-earned Bitcoin. Rather than risking your rare and valuable Bitcoin on fleeting digital trends, consider the long-term and tax-free benefits of holding onto your Bitcoin.

By focusing on sustainable investment strategies, you ensure that your Bitcoin remains a valuable asset for years to come.

Buy Bitcoin with Swan today!

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?