The Phoenix Trade

Bitcoin isn’t just “not going away, ” it’s growing stronger every day.

Swan Private Market Update #37

This Market Update report was originally sent to Swan Private clients on August 11th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

“From the ashes, a fire shall be woken, A light from the shadows shall spring.” — J.R.R. Tolkien

Today, when investors look out on the economy, it isn’t easy to be long-term optimistic. To be clear, I am talking about the economy, not financial markets. Financial markets have become completely distorted from underlying economic activity ever since central banks started to intervene in the markets whenever asset prices began to decline. But when one looks at the precarious U.S. fiscal situation, the amount of leverage in the system, the high levels of inflation, historic wealth concentration, and rising populism, it’s easy to see why many Americans are feeling pessimistic about the future.

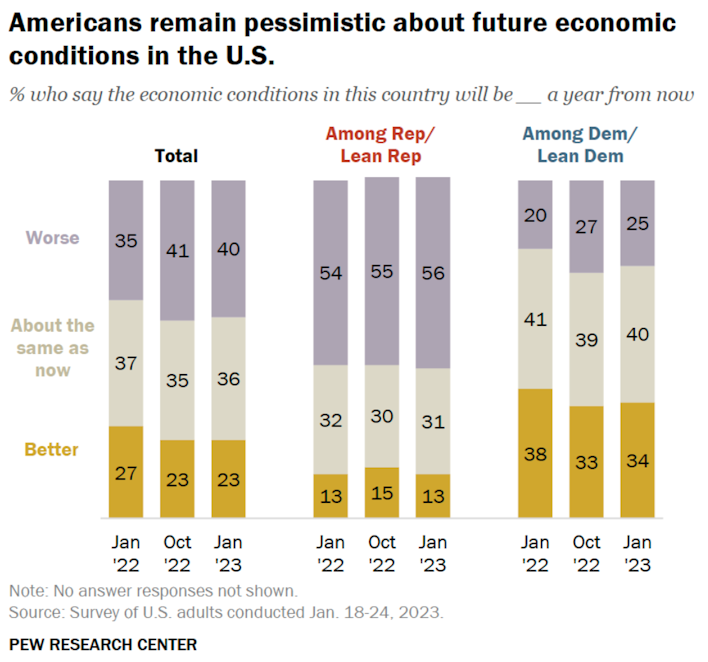

A recent PEW study found that 40% of Americans believe that economic conditions in this country will be worse a year from now.

Survey of U.S. adults conducted Jan 18-24 2023

This is likely because the current system no longer serves most of the population. Only around 50% of Millennials and Gen-Xers are out-earning their parents when they were the same age. The American Dream feels increasingly elusive.

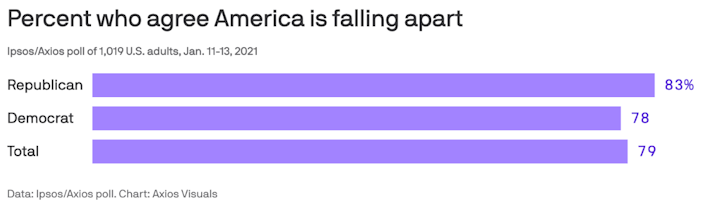

As a result, a feeling of hopelessness permeates our world. There is a growing sense that the current financial system is broken, leading to division and tension in our society. This is likely why nearly 80% of U.S. voters, regardless of political party, agree that “America is falling apart.”

Much of these issues can be traced back to poor governance and the irresponsible monetary and fiscal policies that have compounded for decades to create the faltering system we have today.

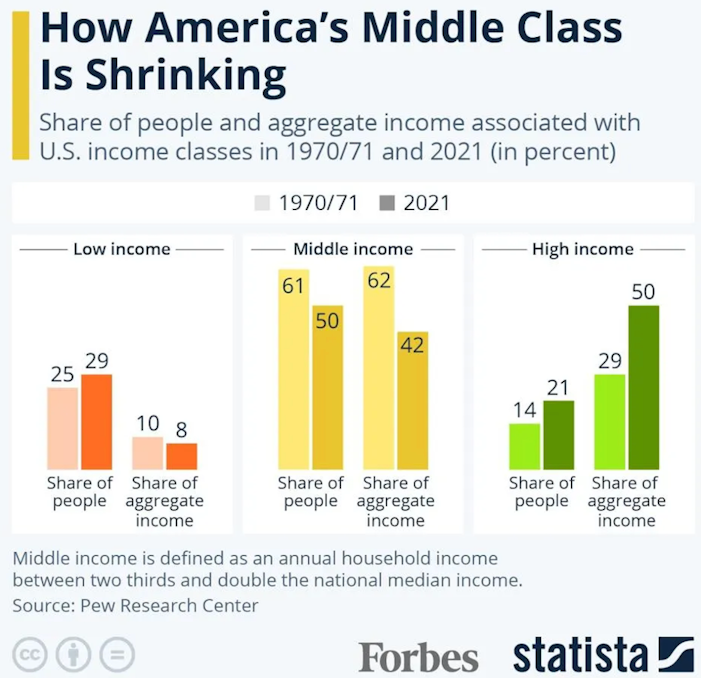

Central banks and governments have done immeasurable harm with their decisions to saddle future generations with debt and keep interest rates near zero for nearly a decade after the Global Financial Crisis. The result has been a highly leveraged, more fragile financial system that benefits the rich while hollowing out the middle class.

America’s middle class has been slowly shrinking since the 1970s, and this trend has only accelerated.

Each time central banks and governments have intervened to “save the day” in the past, the debt in the system has inflated. This occurred during the famous “Greenspan Put” in 1987, the Long Term Capital Management collapse of 1998, the Global Financial Crisis of 2007/2008, and the recent pandemic response. This growing debt and accommodative monetary policy have a long-term drag on economic growth. It also results in rising asset prices, exacerbating income and wealth concentration.

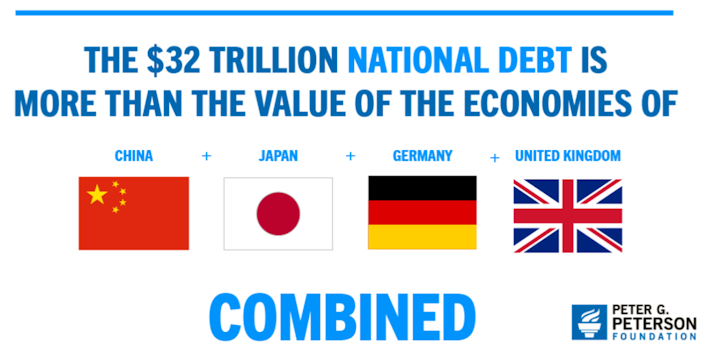

From $9 trillion at 2007’s end, the US national debt has skyrocketed to over $32 trillion. To truly grasp the enormity of this debt, consider the statistic below:

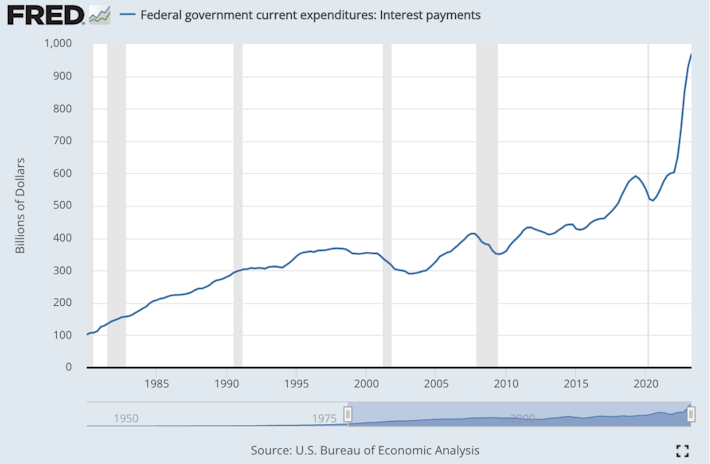

To make matters worse, the Federal Reserve’s decision to hike interest rates by 5.25% since April 2022 has caused the annual interest expense on the U.S. public debt to soar exponentially. It is expected to surpass a whopping $1 trillion by the end of the calendar year.

FRED

At this juncture, barring some productivity miracle, the U.S. government has limited options to address this debt problem. The first solution is austerity, meaning it can cut spending. However, this isn’t the trend we’re observing. On the contrary, politicians continue to spend recklessly.

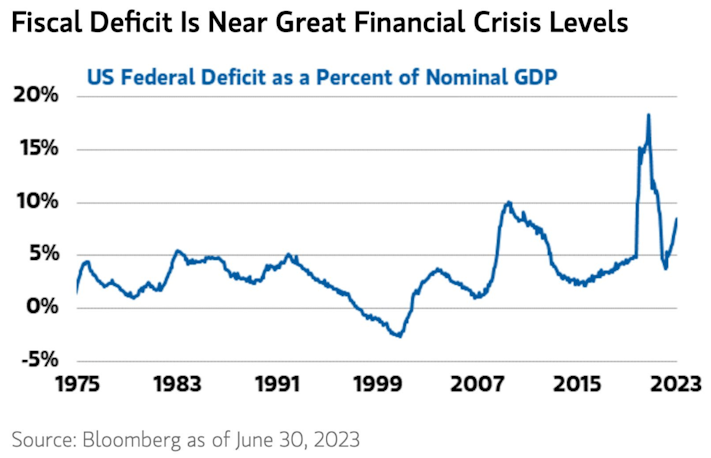

The fiscal deficit for this year is at $1.4 trillion, a staggering 170% increase compared to 2022. It is currently at levels not seen since the Global Financial Crisis when considering it as a percentage of nominal GDP.

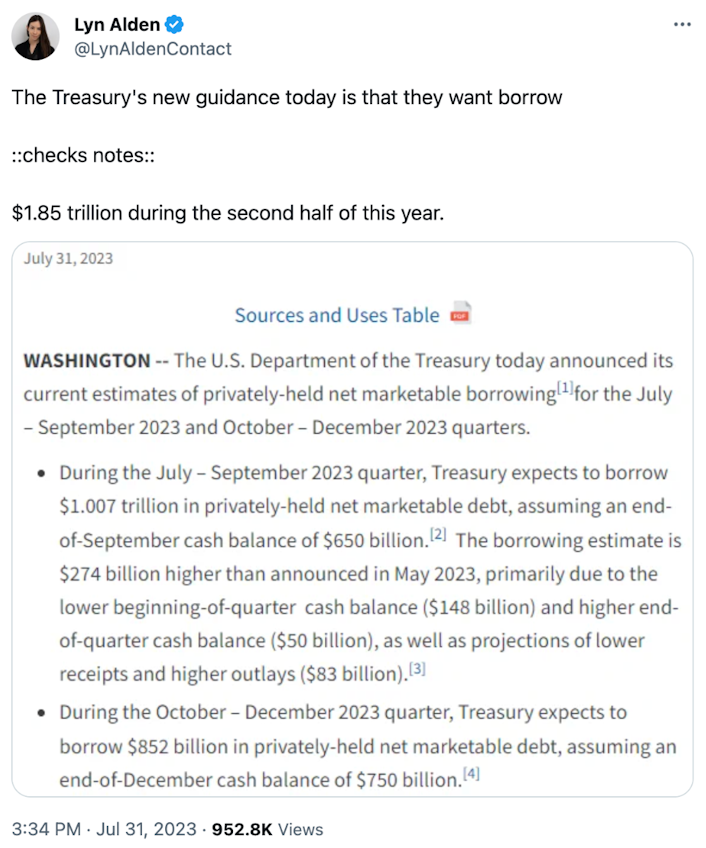

Furthermore, the Treasury provided more guidance regarding their plans for the remainder of the year, indicating an intention to borrow a “measly” $1.85 trillion.

The takeaway? Don’t expect the government to curtail its spending anytime soon, especially with an election year on the horizon.

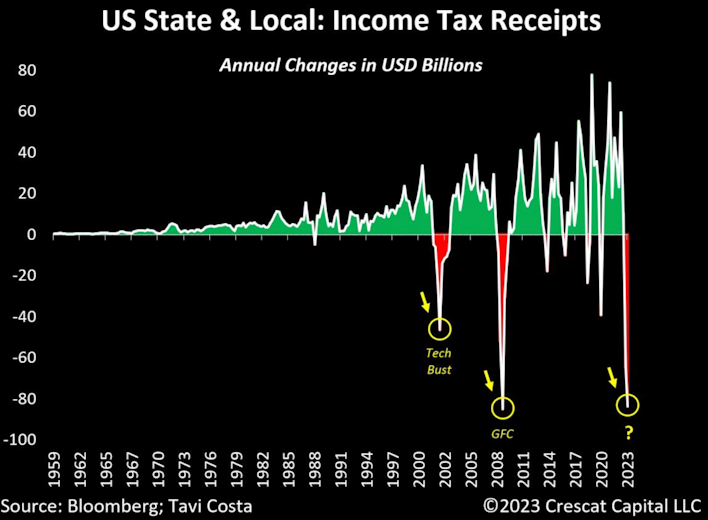

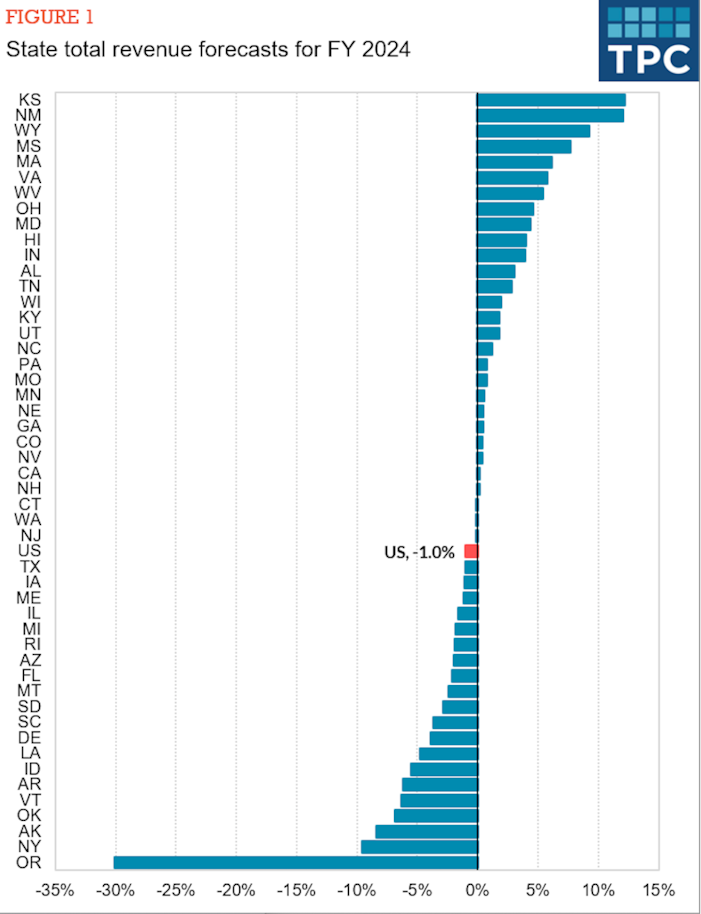

The second strategy for governments to escape this debt predicament is to bolster tax revenues. But despite the ongoing spending, state and local tax revenues have declined annually at a rate not seen since the Global Financial Crisis.

There has been a substantial decline in state tax revenues for the first 11 months of this fiscal year. Over this period, state tax revenues have declined 5.3% in nominal terms.

Moreover, the forecast is not looking any better next year. State total revenue projections for the fiscal year 2024 are predicted to decline a further 1% YoY.

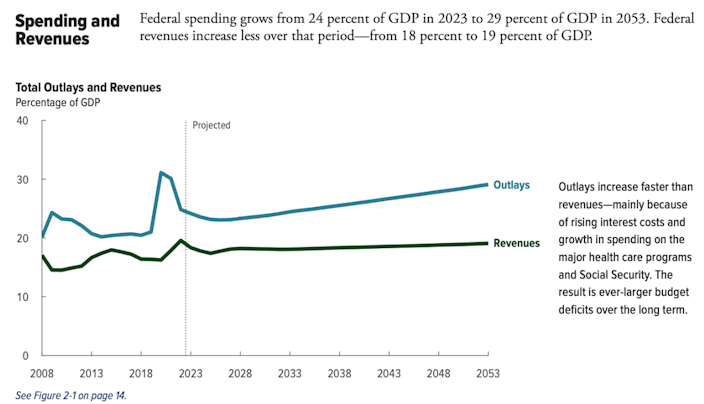

Interestingly, the government concurs with these forecasts. The Congressional Budget Office’s own long-term projections foresee this trend persisting. Government expenditures are projected to outpace revenues, primarily due to rising interest costs.

CBO

It’s crucial to note that this reduction in tax revenues is occurring even as the stock market is making new highs seemingly daily. The Nasdaq is currently experiencing its best-ever start a year, surging 39.3%, yet tax revenues are dwindling. What happens when a recession comes around, asset prices fall, and tax revenues decline further? 🤔

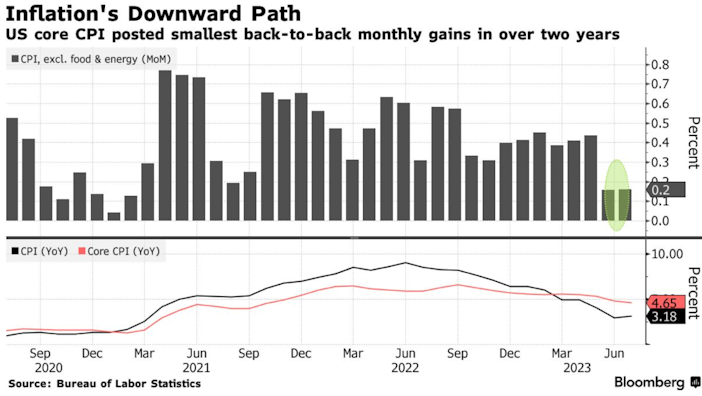

A third avenue for improving the debt situation involves the Federal Reserve reducing interest rates to decrease the interest expense on the debt. Also, the Fed could keep real interest rates negative and allow inflation to run higher, inflating away the debt over time. Nevertheless, the Fed has signaled its intention to maintain rates higher for longer as inflation has declined. Unless there are significant disruptions in the Treasury or labor markets, we shouldn’t anticipate any rate cuts in the near future.

That said, the market currently assigns an 89% probability that the Fed will pause its interest rate hikes at its next meeting after both headline and core CPI inflation continued to fall year-of-year this month.

So Congress continues to spend, tax revenues continue to fall, and interest rates are likely to stay around current levels barring some kind of deflationary impulse. All of this paints a dire picture of the state of the U.S. government’s fiscal affairs. This led to Fitch downgrading U.S. debt to an AA+ rating, citing:

Erosion of governance

Rising deficits

Rising government debt levels

Fiscal challenges due to high debt and high-interest rates

Further Fed tightening

Risk of recession

All of these seem like pretty logical reasons for Fitch to downgrade the debt, but Treasury Secretary Janet Yellen disagrees.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

She called Fitch’s decision ‘“flawed” and “entirely unwarranted.” She reported that she found the decision “puzzling.”

Former Secretary Larry Summers also chimed in, “The idea that this is creating the risk of a default on U.S. Treasury securities is absurd, and I don’t think that Fitch has any new and useful insights into the situation.”

This goes back to Fitch’s first reason for downgrading the debt…“Erosion of governance.” We have been led by incompetent leaders for far too long, who still lack the humility to admit their mistakes. As a result, we should expect the same mistakes to be repeated and the same negative consequences of those decisions to continue to compound.

To be running these levels of fiscal deficits, with declining tax revenues, stock markets up, and the unemployment rate at multi-decade lows, poses a question, what happens to the deficit if a recession does come around?

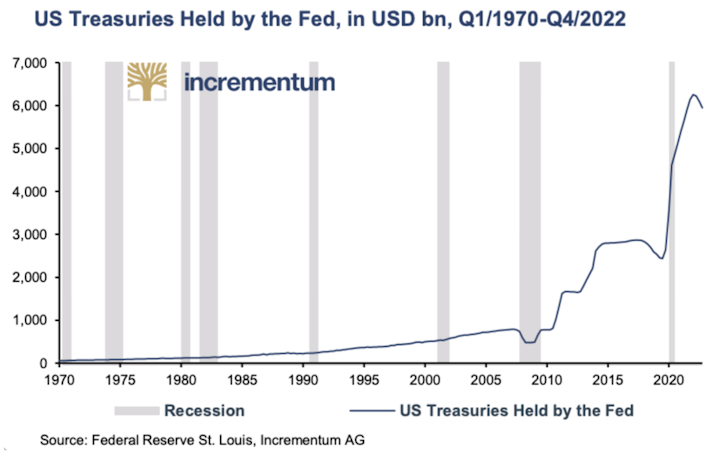

Well, if history is any guide, we know what will happen. The Federal Reserve will eventually take the role of lender of last resort, the Treasury will issue a bunch of new debt, and most of it will end up on the Fed’s balance sheet. The chart below highlights how the Fed’s balance sheet has grown exponentially since 2008.

In that scenario, the Fed and the government will flood the market with liquidity, and the release valve will, once again, be the dollar. In other words, inflation will return again with a vengeance.

This will only worsen the long-term outlook for the economy and continue the worrisome trends that many Americans, specifically young Americans, are feeling today. Wealth will continue to be concentrated to a tiny portion of the population, the middle class will continue to shrink, the American dream will fade farther and farther out of reach, and tensions will rise.

We are experiencing the end stages of the entire debt-based monetary system. The one asset that offers a value proposition of a brand new monetary system is Bitcoin.

We are already seeing that play out today. As Entrepreneur and Author, Jeff Booth, likes to say…

Bitcoin has continued to impress this year in terms of price action and fundamentals.

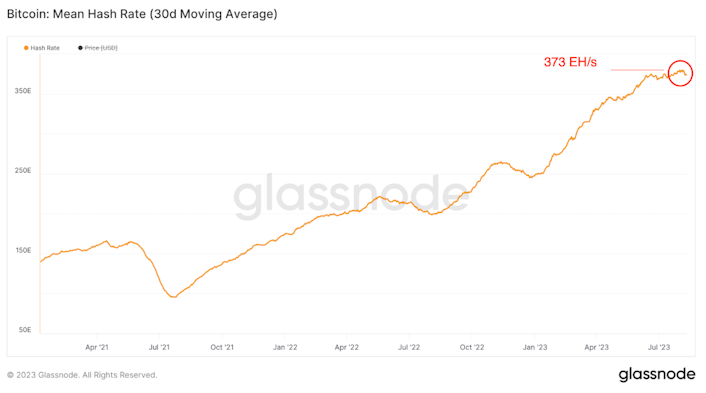

Bitcoin’s hash rate has soared nearly 50% year-to-date.

The number of addresses with a balance of over $1,000 recently hit an all-time high of 7.37 million.

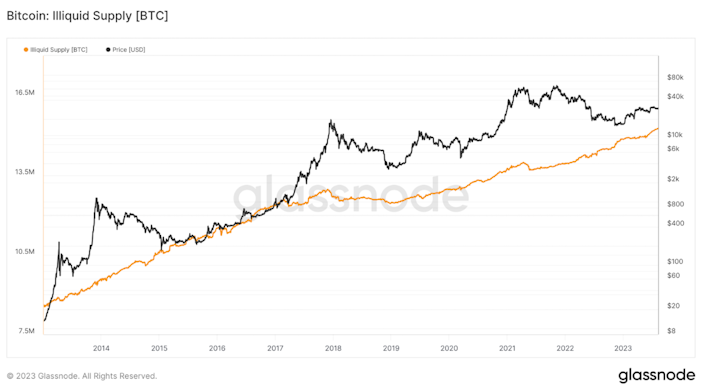

The total amount of supply held by entities considered illiquid is currently at all-time highs, with 15.27 million BTC. Investors continue to hold onto their Bitcoin.

The fundamentals continue to paint a rosy picture for the new monetary system just as the fundamentals for the old system are deteriorating.

These come as demand for Bitcoin remains robust. This time, it is the institutions that continue to buy up Bitcoin.

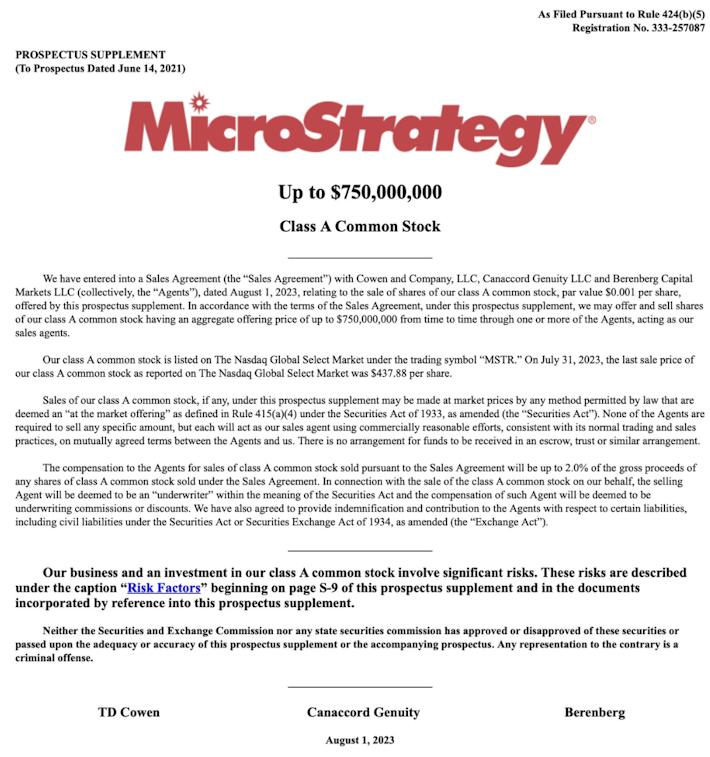

Microstrategy recently announced it had bought an additional 420 BTC and will raise up to $750,000,000 in equity to buy more Bitcoin and fund other initiatives.

USD stablecoin issuer Tether announced that it had purchased 1,529 Bitcoin in Q2 alone. It continues to follow its new reserve strategy announced in May that it will purchase up to 15% of its net operating profits into Bitcoin every quarter.

Lastly, Billionaire David Rubenstein, Co-Founder of the private equity giant Carlyle Group, recently made positive comments on Bloomberg that “Bitcoin is not going away.”

Bitcoin isn’t just “not going away.” It’s growing stronger every day. It is a function of the environment it finds itself in. Currently, debt levels are soaring, politicians continue to spend, and society suffers from these policies. Luckily, a new system that no one can manipulate, abuse, or control is rising like a phoenix from the ashes.

Market Overview

Tradingview, Prices as of 08/11/23

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?