The Inflation/Deflation Tug-of-War

Overall, the economy and central banks are in a tense tug-of-war. Inflation and disinflation are going back and forth. Which side will gain the upper hand?

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” — Milton Friedman

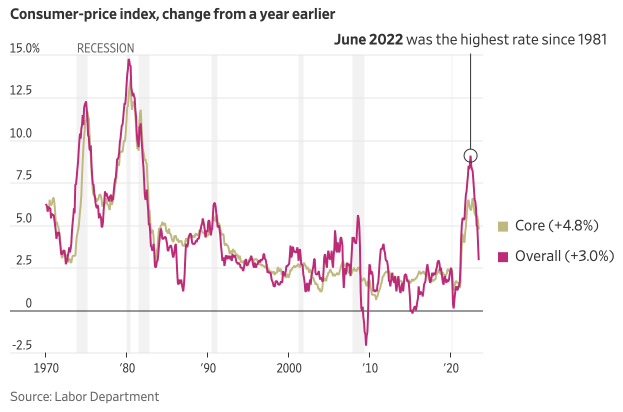

Since the pandemic and economic lockdowns of 2020, the world has struggled with a surge in global inflation. Today, CPI inflation has finally begun to subside in the U.S. Headline CPI inflation came in at 3% YoY, while core CPI remained more sticky at 4.8% YoY.

This disinflation has primarily come from the normalization of supply chains, falling commodity prices (especially energy), and tighter monetary policy in the form of higher interest rates, which has indirectly reduced economic activity.

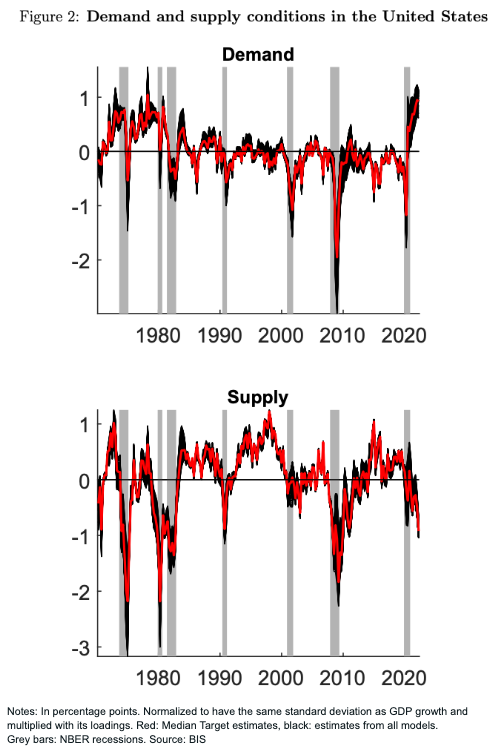

The pandemic in 2020 and recession that soon followed resulted in a steep fall in demand while supply chains were disrupted. However, as things began to open back up and demand — now boosted by massive fiscal stimulus packages and monetary easing — came back online, the supply chains were still dysfunctional.

This created an environment where too much demand was chasing too little supply — a perfect inflationary cocktail.

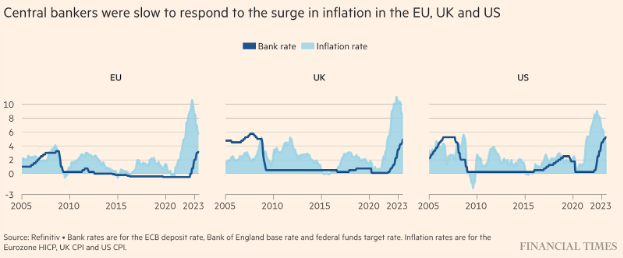

On top of that, central banks around the globe were slow to respond to the rise in prices. As the inflation rate steadily rose, central bankers seemed to be asleep at the wheel.

This led to central banks rapidly trying to play catch up by raising interest rates at the fastest pace in history in an attempt to crush demand and bring inflation down. However, lucky for them, the supply side of the inflation equation did a lot of the heavy lifting for them. Supply chain bottlenecks have reduced, and improved global trade efficiency has helped bring down price levels, much to central bankers’ delight.

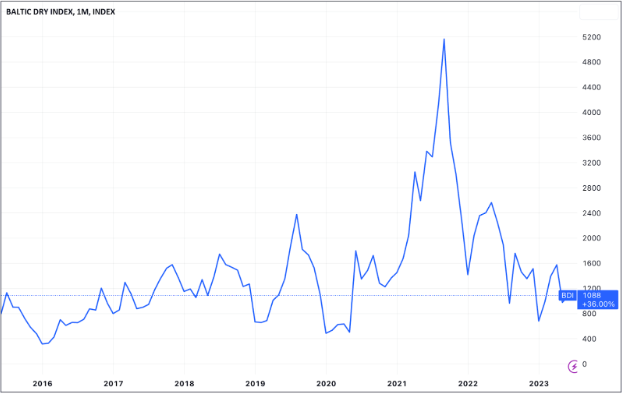

There are numerous ways to illustrate how supply chains have normalized over the past year or so.

The first is the Baltic Dry Index (BDI), a shipping and trade index that measures changes in the cost of transporting various raw materials, including commodities such as coal, grain, and iron ore. The index is used by economists and traders as a leading economic indicator because it can provide insights into global supply and demand trends.

The BDI has dropped nearly 80% since it peaked in September 2021.

Tradingview

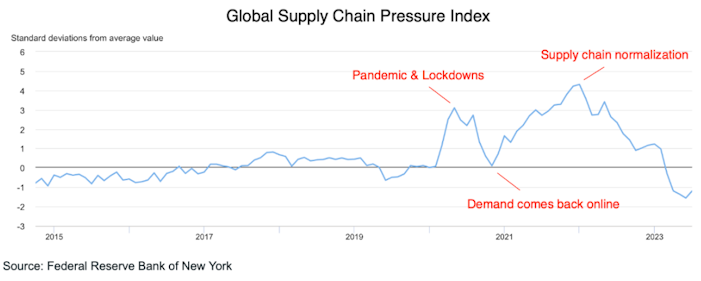

The second way to observe this trend is by looking at the Global Supply Chain Pressure Index (GSCPI). GSCPI is a metric that combines various global transportation measurements and supply chain-related components of the PMIs from various economies with the goal to measure the potential of supply chain disruption. The higher the GSCPI, the more likely there will be supply chain disruptions.

One can observe how GSCPI spiked during the pandemic and lockdowns but has now decreased significantly since. It now sits at one of the lowest readings dating back to 1997, indicating supply chain pressures have eased tremendously.

Another way to view this progress is by tracking the S&P Goldman Sachs Commodity Index, which is an index of all commodities. When looking at this index, one can observe how we experienced a rapid rise in the price of all commodities off the lows of 2020, only for them to peak in early 2022. Today, according to this index, commodity prices are down 28.2% since that time. This signals that supply chains have eased.

Tradingview

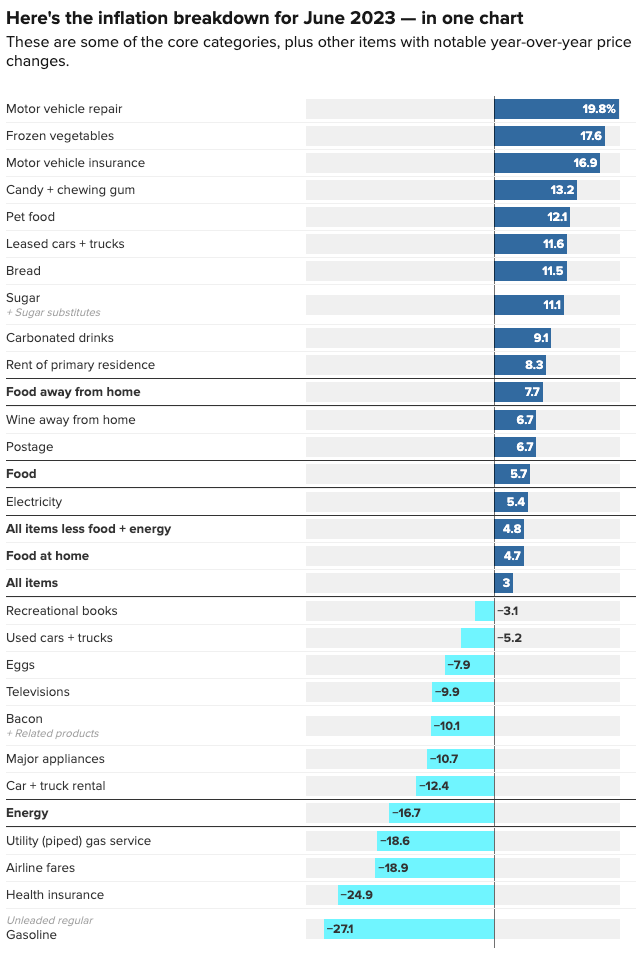

Energy has contributed greatly to this recent disinflation. When digging in deeper to the June 2023 CPI report, gasoline prices are down 27.1% YoY.

BLS, CNBC

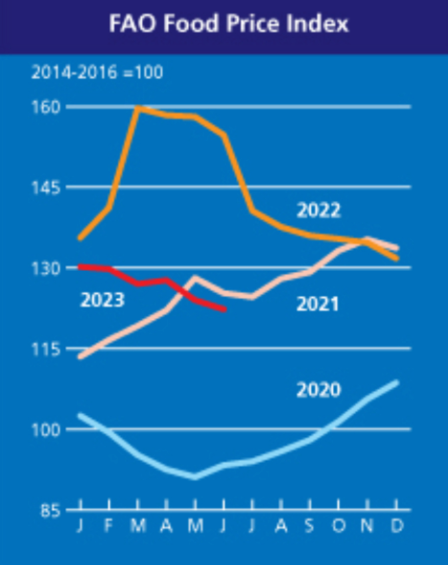

Food prices have also come down steadily off their highs in 2023. The FAO Food Price Index continues its downward trend, down another 1.4% in May, and now 23.4% off its peak reached in March 2022.

FAO

The decline in the costs of essentials like fuel and food in 2023 has provided consumers with more discretionary income, allowing them to continue spending in the economy.

This recent disinflation also may help buoy the U.S. consumer because we have now seen back-to-back monthly positive real wage growth after nearly 6 quarters of consecutive negative growth.

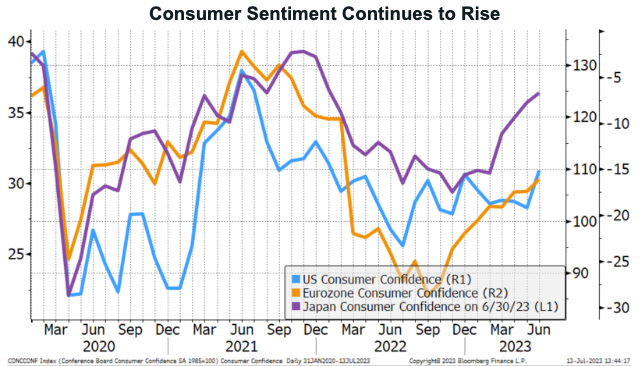

This recent trend change could be why we have observed a rise in consumer sentiment of late.

@JeffreyKleintop

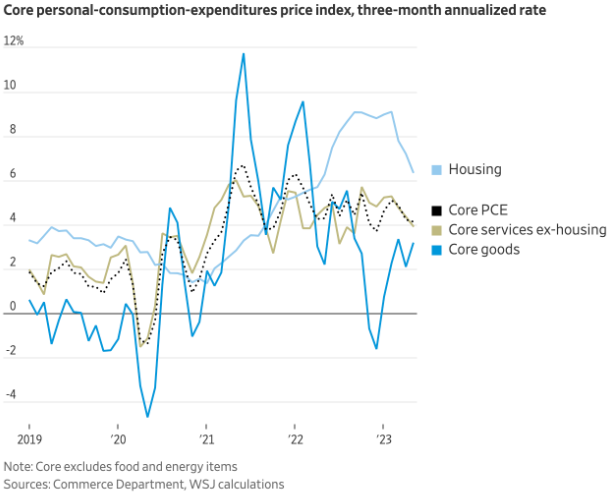

Most of the consumer spending continues to be in the services sector as households are spending their money on eating out, entertainment, and travel. This can be seen below when looking closer at the inflation data. Core services ex-housing remains elevated, well above the Fed’s 2% target, at about 4% YoY.

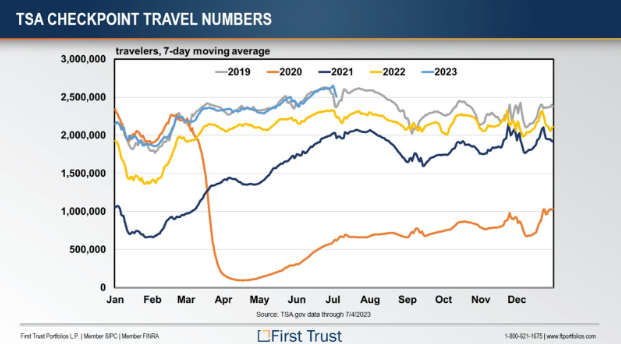

This was never more evident than when Americans broke a new air travel record over the July 4th weekend.

TSA checkpoint travel numbers confirm that air travel is back, if not higher, than pre-pandemic numbers. People continue to travel after being cooped up in their homes during the pandemic.

Further evidence of consumer strength is provided by the number of ticket sales at live events. Live Nation posted record Q1 revenues and attendance in 2023.

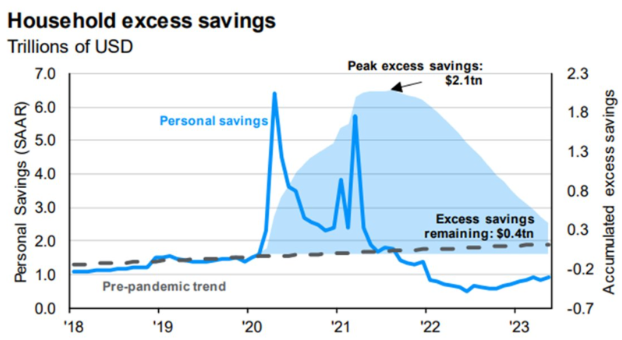

All of this continued strength from the consumer could be inferred as a long-standing consequence of the extraordinary fiscal and monetary policies in response to the pandemic, which saw household excess savings explode.

@lawhon_sam

Households still have excess savings remaining from those stimulus programs and continue to drain them. Some analysts expect household excess savings to be completely drained by the end of the year. However, as of today, it still provides the consumer with ample ammo to continue to spend in the economy.

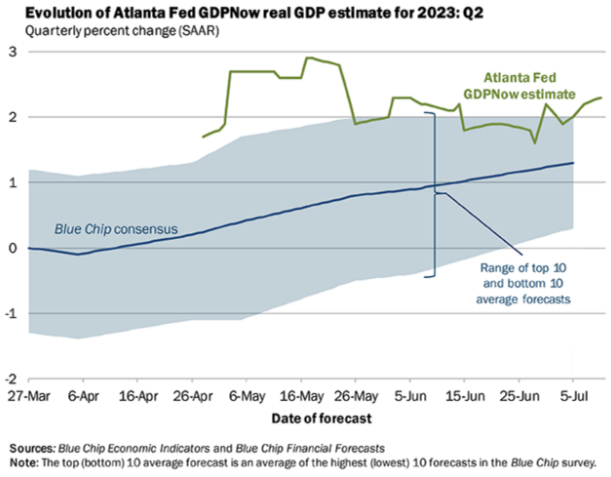

Signs that the economy is still running hot can also be seen in the Atlanta Fed’s GDPNow metric, which estimates a Q2 real GDP growth of 2.3%.

The inflation surge that began in 2021 has started to subside. But does this signal a sigh of relief, or the calm before the storm? The fear that’s starting to take hold now is that everyday consumer, already stretched thin, might just break. This could trigger a ripple effect, leading to deflation, and ultimately, a recession.

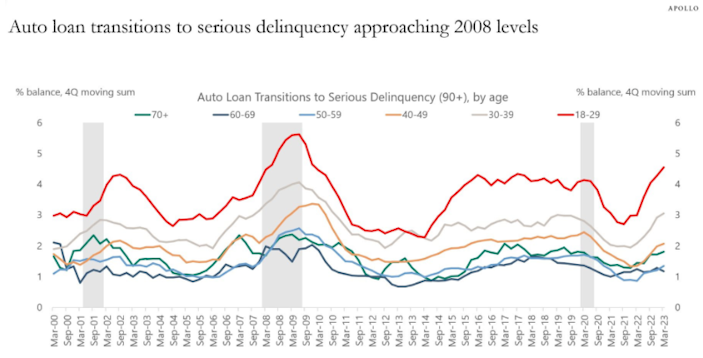

Troubling signs have begun to surface, indicating consumers are nearing their breaking point. For instance, rising auto loan delinquency rates signal a worrying trend.

Apollo

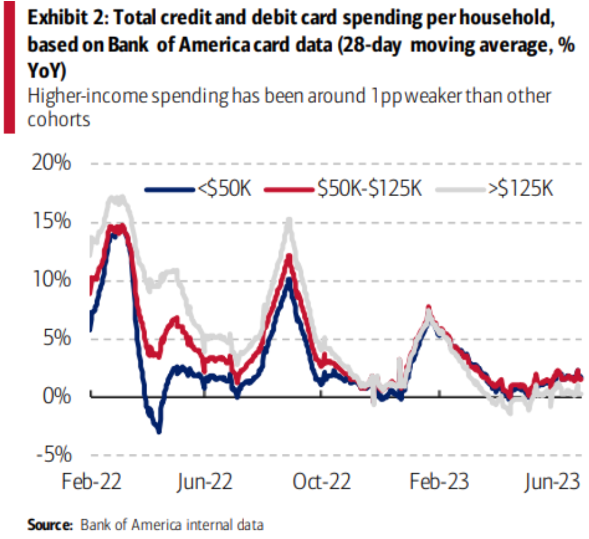

In addition, there has been a noticeable dip in total credit and debit spending among high-income households. Considering that the highest income quintile (top 20%) contributes to around 40% of consumer spending, this is a notable data point.

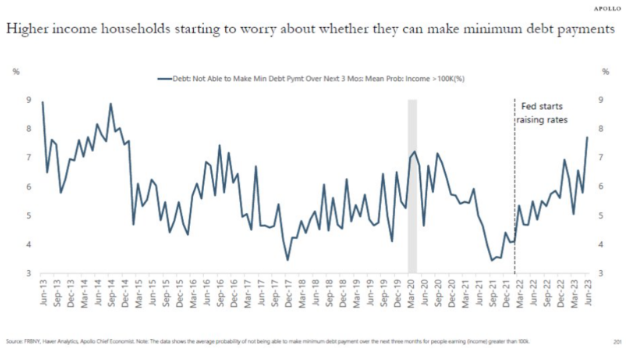

Financial worry is casting a shadow over these high-income households, and questions are beginning to surface like: “Can we continue to meet our minimum debt payments?”

With personal balance sheets appearing increasingly grim, high-income consumers may start to tighten their belts more.

Perhaps this gives us a clue as to why same-store weekly retail sales have gone negative year-over-year for the first time since 2020.

In the midst of all this, around 43 million Americans are bracing themselves to restart their student loan payments after over three years. With an average monthly payment of $395, this cohort is facing the reality of having less discretionary income. A significant portion of their income will be redirected towards repaying their student loans, resulting in less money flowing into the economy.

Yet, despite these troubling signs, consumers are holding strong, and inflation and the economy remain hot. All of this comes back to the unprecedented fiscal and monetary policies conducted during the pandemic, which flooded the economy with trillions of dollars.

The BIS recently published its annual report, which admitted what many market observers already suspected — these policies have directly triggered the inflation surge. The report remarks,

“With the benefit of hindsight, the extraordinary monetary and fiscal stimulus deployed during the pandemic, while justified at the time as an insurance policy, appears too large, too broad and too long-lasting. It contributed to the inflation surge (Graph 20) and to the current financial vulnerabilities.” — BIS, 2023 Annual Report

With asset prices still elevated, real wage growth now positive, households still flush with cash, and the economy still running hot, inflation remains too high. It begs the question, “Has the ‘cure’ been worse than the ‘disease?’ Were these policy responses more costly than beneficial? It appears that the BIS is correct in its assessment that the massive policy responses to the pandemic were too large and, thus, inflation rages on.

Although inflation has shown signs of abating, mostly related to easing supply chains and dropping commodity prices, the Fed might have a harder time reining in more stubbornly persistent inflation than anticipated and getting CPI down to its 2% target.

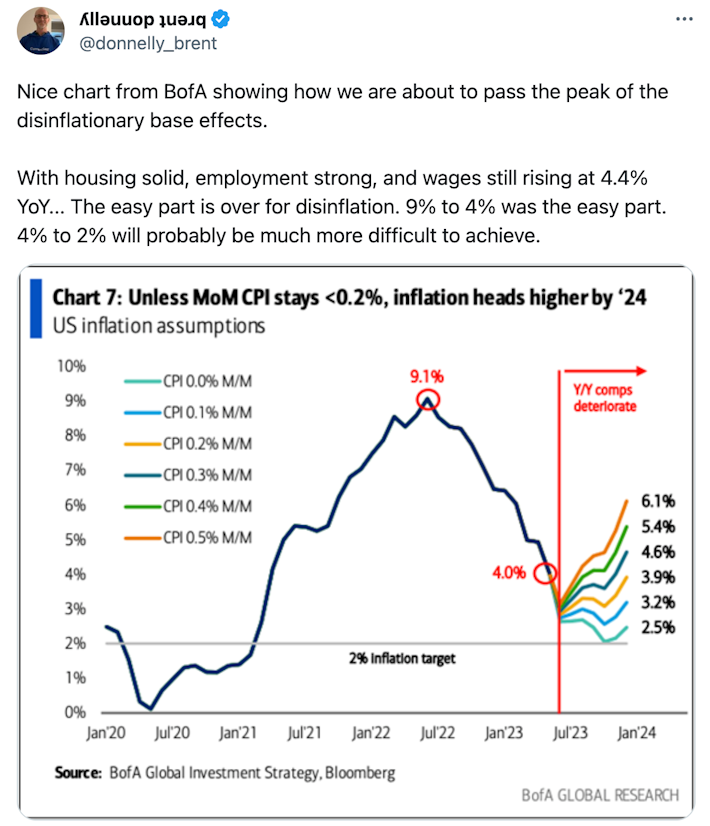

President of Spectra Markets, Brent Donnelly, said it well,

The Fed’s Christopher Waller gave us a sense of where Fed officials’ heads are at with inflation in a recent speech,

“While I expect inflation to eventually settle near our 2 percent target because of our policy actions, we have to make sure what we saw in yesterday’s inflation report feeds through broadly across goods and services and that we do not revert back to what has been persistently high core inflation. The robust strength of the labor market and the solid overall performance of the U.S. economy gives us room to tighten policy further.”

Therefore, expect the Fed to persist with rate hikes, despite the recent downward surprises in inflation data. On the one hand, we see signs of inflation slowing down, disinflation taking hold, supply chains recovering, and commodity prices dropping. On the other hand, consumer sentiment remains high, wage growth is accelerating, and GDP growth is robust.

Caught between a rock and a hard place, the Fed was already behind the curve and is now in danger of overshooting, potentially triggering a recession just when their tightening policies are starting to show their impact. However, with the sheer amount of money that was injected into the economy over the past several years, we may find ourselves in a new norm of elevated inflation for the foreseeable future.

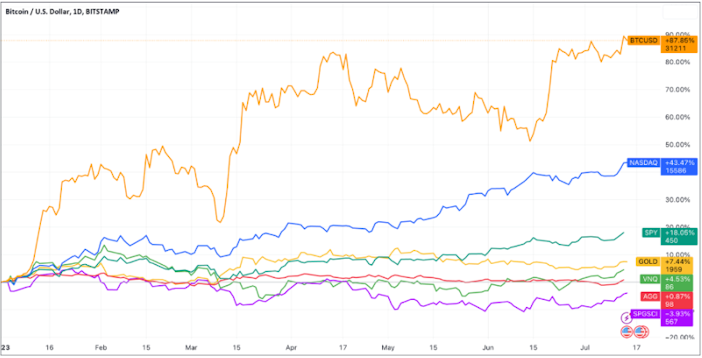

In that scenario, investors will want to hold scarce, hard assets. Bitcoin continues to perform well during this period of persistent inflation. Since those inflationary government and central policies were enacted, Bitcoin has nominally greatly outperformed bonds, stocks, and gold.

Tradingview

Bitcoin is now up 87.8% year-to-date, having well-outperformed major stock indices, bond indices, commodity indices, and real estate indices.

Tradingview

Overall, the economy and central banks are in a tense tug-of-war. Inflation and disinflation are going back and forth. Which side will gain the upper hand? Only time will tell. But it would be prudent for investors to consider ways to diversify their portfolios with assets that protect their purchasing power during these turbulent times, and Bitcoin has proven that it can do just that.

Tradingview, Prices as of 07/14/23

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?