A Review: the Great Hash Rate Migration of 2021

Bitcoin miners have relocated to safer pastures within the U.S. because the values and goals of America and Bitcoin are much more aligned compared to Communist China.

This should lead one to think, “If a country has to ban something more than once, can they really ban it?”

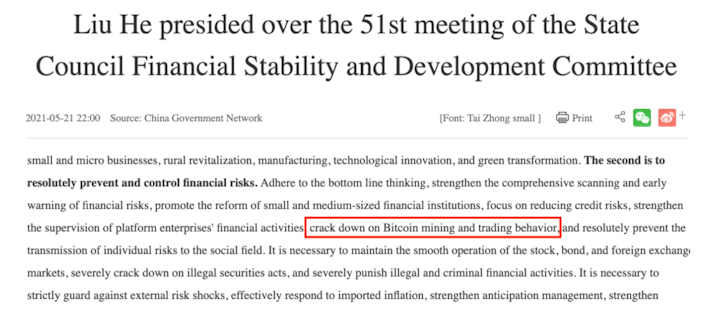

However, regardless of how ineffective this ban will be, the Chinese authorities proved to be more severe about this crackdown compared to previous ones.

After the announcement, Chinese Bitcoin mining operations were forced to shut down entirely, and cryptocurrency trading was made illegal. Chinese miners had no choice but to leave the country in search of a new home for their mining operations.

In many ways, this was the scenario that Bitcoin critics had cautioned about for years. They warned that the Chinese government would attack Bitcoin, the network would fail, and Bitcoin’s price would fall to zero. Make no mistake, this ban was an attack on Bitcoin. With little warning, the Chinese government forced miners to shut down their equipment, drastically reducing Bitcoin’s hash rate in the process. Shortly afterward, the Bitcoin price dropped ~50%.

Yet, this did not result in Bitcon’s death like critics falsely predicted. On the contrary, it provided further evidence of Bitcoin’s resiliency. The network continued to function with perfect uptime despite the attack. On top of that, Bitcoin’s hash rate continued to make an impressive recovery since the ban.

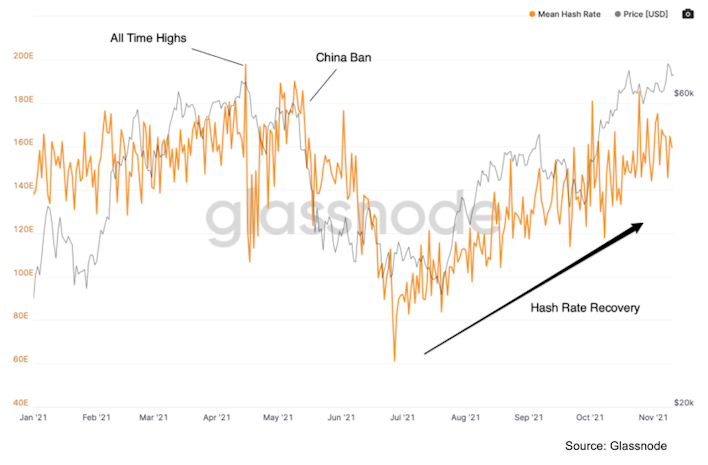

Bitcoin’s hash rate has now recovered to around 160 Exahash from its all-time high of 197 Exahash before the China ban.

This chart is evidence of the healthy recovery the Bitcoin network has been experiencing since July. Bitcoin’s energy usage is fundamental to its security. The larger the hash rate, the more hash power an attacker would need to obtain to successfully perform a 51% attack. This is no doubt a positive on-chain development to see.

In addition to the hash rate recovering, the mining difficulty adjustment has increased 8 consecutive times since July. This indicates that the unplugged Chinese miners are continuously coming back online.

The difficulty adjustment working just as Satoshi Nakamoto intended is a beautiful thing to witness. As the Chinese miners turned off their machines, the hash rate fell abruptly. Like clockwork, the difficulty adjustment also dropped, making it easier for surviving miners to mine blocks. This incentivizes miners to stay on the network because it’s more profitable for them to do so. The difficulty adjustment is Bitcoin’s own internal mechanism to keep miners happy while at the same time enticing more miners to plug into the network. From this chart, we can clearly see that reinforcements have arrived.

Meanwhile, during the largest state-level attack in its 12-year history, Bitcoin’s network has continued to run flawlessly. Approximately every 10 minutes, every block was mined right on schedule. Bitcoin’s elegant design and robust security have been on full display for all to see during this hostile stretch of time.

When the Chinese miners got kicked out of their country, they abruptly had to unplug their equipment, transport all of it, locate viable energy resources, get political approval to deploy their equipment, then rebuild their operations in a new country. This obviously takes time, but the on-chain data above indicates that many of these miners have found new homes.

The question then becomes — where did all this hash rate go?

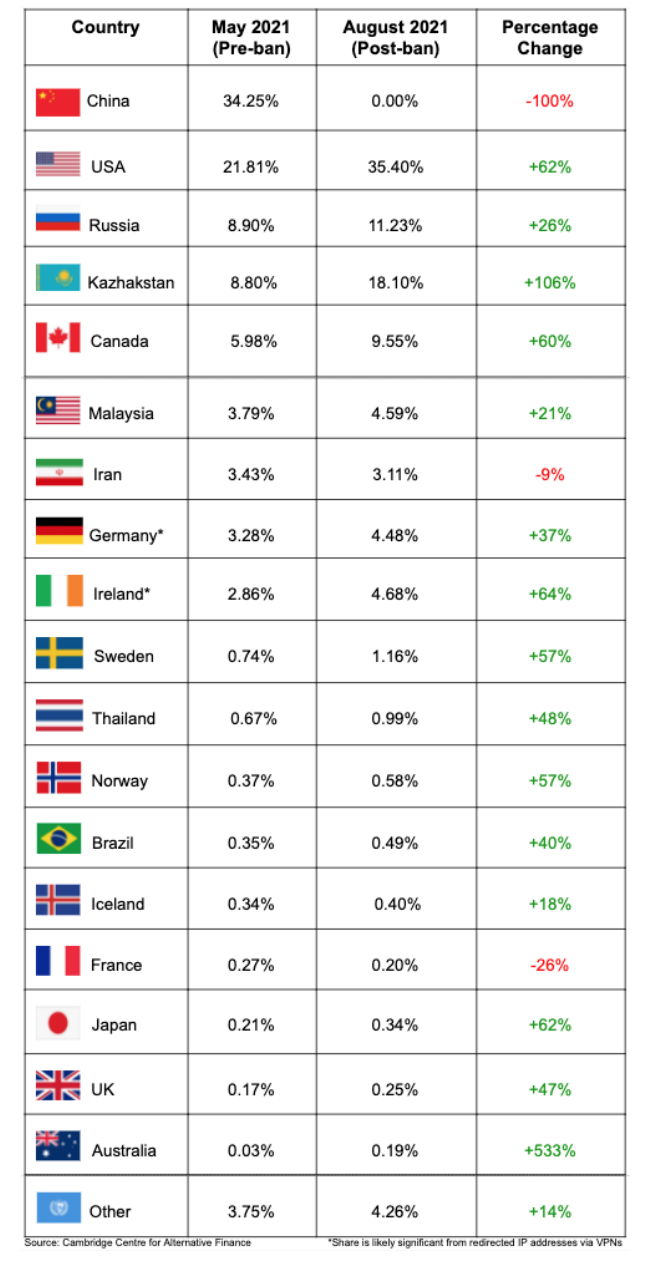

The data finally arrived last month from the Cambridge Centre for Alternative Finance (CCAF), showing where the Chinese hash rate likely migrated to.

The country that saw the greatest change in its hash rate relative to its pre-ban levels was actually the land down under Australia. Its hash rate has increased over 5x over the time period. This could be explained by the fact that Australia has close financial and political relations with China and simply because Australia is in close proximity to mainland China. Exiled miners likely sought refuge in Australia to plug back into the network quickly.

The biggest winners in terms of share of the total hash rate were:

The USA welcomed 14% of the total hash rate, up 62%

Kazakhstan gained 10% of the total hash rate, up 106%

Canada received 4% of the total hash rate, up 60%

“Other” increased their total share of the hash rate 0.51%, up 14%.

The biggest losers during this period were China (obviously), France, and Iran. Iran’s drop in hash rate can be explained by its own short ban on Bitcoin mining after mining was blamed for unplanned blackouts across the country. France’s drop could be a result of the uncertainty surrounding its cryptocurrency tax laws that may have scared miners away from the country.

Note: There are some limitations with this data that I will address at the end of this piece.

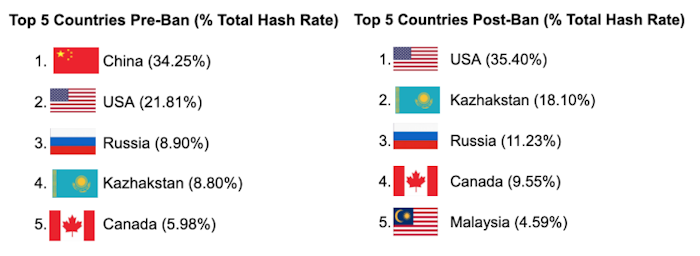

The USA is now the undisputed hash rate leader controlling 35.40% of the total hash rate. The USA, Kazakhstan, and Russia combined now control 64.73% of Bitcoin’s total hash rate.

The United States becoming the hash rate leader over China is no doubt bullish for Bitcoin long term. The United States has a history of embracing new innovative technologies, plus there is a healthy rule of law there that theoretically supports and protects capitalism, democracy, and property rights.

For all intents and purposes, this should be a safer home for Bitcoin miners compared to China, where the Chinese Communist Party rules with an iron fist. China rules from the top-down and generally dislikes things they can’t control. It makes sense that they dislike Bitcoin because they can’t wield it to exert their power and will over the Chinese people.

Bitcoin and the principles upon which the United States was founded are a match made in heaven. Namely, personal freedom, equality of opportunity, distribution of power, and property rights.

Bitcoin does not discriminate, is open to all, and allows individuals to take personal ownership of their wealth like no other asset in history. Many Bitcoiners call Bitcoin “freedom money” because it brings sovereignty back to the individual and brings balance to the power between the state and the people.

What better place for freedom money than the land of free?

Bitcoin miners have relocated to safer pastures within the US because the values and goals of America and Bitcoin are much more aligned compared to Communist China.

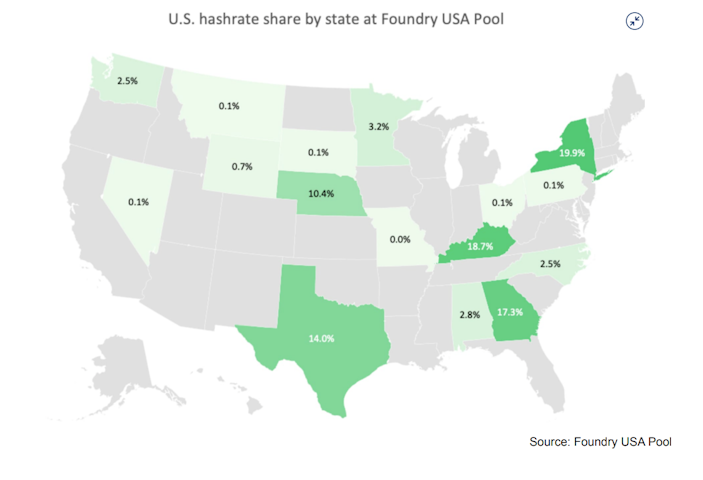

There’s another benefit to consider regarding hash rate migrating to the U.S. Take a look at this graphic from Nic Carter’s recent presentation at the recent Texas Blockchain Summit. It displays the U.S. hash rate distribution using data from the U.S.’s largest mining pool, Foundry USA Pool.

This image displays how Bitcoin is increasingly becoming more decentralized across state lines. Unlike most countries where one government rules over the entire country, the United States comprises 50 individual semi-sovereign states with their own states’ rights and state laws.

States’ Rights are supported by the 10th Amendment of the U.S. Constitution, which reserves for the states:

“The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

Strong state government is fundamental to the ideals this nation was founded on and more consistent with the vision of the republic put forward by the Founding Fathers.

To avoid tyranny and ineffective central planning, every state is free to enact policies that work for its own population. Each state in America has its own property laws, taxes, politicians, and cultures. This has never been more evident than today. In other words, there’s a reason why every state has its own flag.

Recently I visited California and Texas, and I am not being dramatic when I say I felt like I was walking in two separate countries. This is the sad truth of America in 2021. America has become increasingly divided socially and politically over the last decade. U.S. society as a whole no longer has a clear shared set of social and political values anymore.

This division has made the idea of states’ rights more popular than ever. Americans are moving to states specifically because they align with the states’ values, freedoms, and laws. America is balkanizing, and Bitcoin benefits from this.

For Bitcoin, this means the largest share of its hash rate is now being spread out across a nation that can be thought of more as a nation of nations today. This state decentralizing dynamic within the USA is pretty unique and just another reason to be bullish about the hash rate migrating from China to the Disunited States of America.

In the end, after analyzing the CCAF data, the China ban has been a huge net positive for Bitcoin. In a lot of ways, it was one of the best geopolitical outcomes to happen to Bitcoin in its entire history.

Bitcoin went from having a large share of its hash rate within a single hostile jurisdiction to now having that same hash rate distributed geographically across dozens of jurisdictions. 34.5% of the hash rate just went from being located in one nation with one ruling government to being spread out amongst many different institutions, cultures, and laws.

Bitcoin’s hash rate is now more decentralized than it’s ever been before, making it much more resistant to attacks. Bitcoin has never been more de-risked than it is now after the China ban.

Another bullish takeaway from the data was the growth in the share of the total hash rate of the “Other” nations. “Other” nations increased their total share of the hash rate by 0.51%, up 14%. This means that more and more small nations are hosting Bitcoin miners, and the hash rate is decentralizing more.

The CCAF data shows at least 5 nations now host a share of the hash rate in August that didn’t have a material share before the ban: Zambia, Cambodia, Myanmar, Afghanistan, and Honduras. 5 new mining nations that are now plugged into the Bitcoin network and are incentivized to protect it.

This is good for Bitcoin.

There are some reasons to be concerned here. It’s not a good thing for the majority of Bitcoin’s hash rate to be located in any one nation, no matter how good a jurisdiction may appear to be for Bitcoin. Foundry USA Pool just became the world’s largest mining pool in the world.

The US has abundant energy resources, which makes it a logical destination for Bitcoin miners. I see the miner migration to the US, therefore, accelerating with the real risk being that the US eventually acquires too much of the total hash rate. This centralization of hash rate would be a negative development for Bitcoin, no matter where it occurs.

Ideally, we want to see the top countries’ shares of the total hash rate decrease over time as the hash rate distributes spatially across more and more countries, further decentralizing the hash rate.

The good news is — the trend has been clear so far.

Bitcoin’s hash rate IS becoming more decentralized over time. If that continues, Bitcoin will just harden and grow ever stronger over time. I expect the hash rate distribution to continue to change as some nations choose to embrace Bitcoin and benefit from it. In contrast, others choose to shut themselves off from it at their own expense.

As you can see, Bitcoin didn’t just survive this disorder; it thrived on it. Whatever doesn’t kill Bitcoin only makes it stronger.

To all the investors who stayed away from Bitcoin because they believed misconceptions like “China can control Bitcoin, ” “China can ban it, ” or “China can kill Bitcoin, ” perhaps it’s time to challenge your original assumptions. China did ban it, but Bitcoin didn’t die. Instead, Bitcoin continues to grow more decentralized and more secure by the day.

It’s amazing to see the resiliency of the Bitcoin network during this great miner migration. The price crashed, but it’s now nearing all-time highs. The hash rate was cut in half, but it is slowly climbing with every miner that returns to the network. Bitcoin’s network uptime remained at 99.99% despite suddenly losing ~50% of its hash rate without warning. That’s simply incredible. Bitcoin is the most anti-fragile network in the world, and it has earned that title through proof of work.

There are some limitations with this data that I would like to address here. First off, I highly doubt that 100% of the Chinese hash rate has left Mainland China, as the CCAF data claims. It’s much more likely that a small percentage of Chinese miners have gone underground since the ban and are mining off-grid secretly in the country. That being said, I think it’s safe to say that a majority of the Chinese hash rate has indeed migrated elsewhere.

Another limitation is that it’s difficult to ascertain exactly where the hash rate is coming from, given the rise in popularity of VPNs and other proxy services. The CCFA makes a specific note of this with regard to its hash rate recordings from Ireland and Germany. There are no known major mining operations located in these countries today, and yet the data shows that ~9% of Bitcoin’s hash rate is coming from there.

These hash rate readings are likely the result of redirected IP addresses from VPN services, not from miners actually located in these countries. Despite this limitation, the CCFA combines data from many mining pools across the globe and remains the best resource available today to gain insights into the geographic location of Bitcoin’s hash rate.

Lastly, when looking at the hash rate distribution in the United States. The data above is only from the largest mining pool in the world, Foundry USA Pool (21.4% EH/s). This data fails to capture the hash rate contributions from other smaller US mining pools such as Luxor, Marathon, and Rhodium. Therefore, this data should be viewed as incomplete and only gives us a piece of the picture of domestic hash rate distribution today.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?