The FTX Fiasco and the Fallout to Come

Expect the fires from FTX to continue to burn and claim more victims along the way. If anything, this event has provided a tough lesson on why Bitcoin is different and why self-custody is vital.

As the world starts to learn the truth behind FTX and Sam Bankman-Fried, the collapse of FTX comes as no surprise to many of the analysts and industry insiders who follow these markets closely.

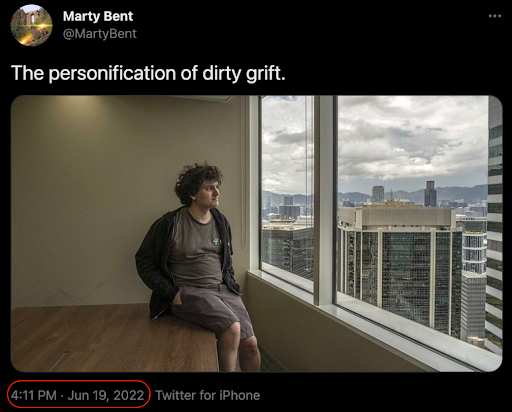

No, I personally didn’t expect FTX to be revealed as a full-blown Ponzi scheme, but I did question their business practices and actively recommended that people not use FTX. The idea that this FTX fiasco was not foreseeable is simply not true. The signs were there. Many Bitcoiners, including Swan CEO Cory Klippsten, have been publicly critiquing both FTX and SBF for many months now.

When CoinDesk reached out to Swan to comment on the now seminal story that revealed Alameda Research’s absurd balance sheet, to his credit, Cory was the only CEO in the industry who had the courage to be quoted in the piece, brilliantly stating,

It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token.

CEO of Swan Bitcoin

I, for one, was flabbergasted when I saw the leaked financials of Alameda’s balance sheet, which consisted of billions of dollars worth of illiquid, garbage cryptocurrencies. On top of that evidence, I watched a debate between SBF and Erik Voorhees on October 28th, which left me with the feeling that something was deeply wrong with SBF and FTX.

Here’s what I wrote in a Swan Slack channel after I watched the debate…

I watched that debate between Erik Voorhees and SBF last week, and I got some mad Do Kwon vibes watching SBF. SBF’s behavior on that video was telling. The dude is hiding something. He looked unhealthy, avoiding eye contact, touching his face, resting leg syndrome, etc.

Lead Analyst at Swan Bitcoin

I write this not to say, “I told you so, ” I had no idea that FTX and Alameda Research was a Ponzi scheme and that SBF was a gigantic fraud. But rather, I make this point because mainstream media, “crypto” proponents, and TradFi people will act like no one could have seen this coming, and I don’t believe this is true. Individuals like Cory and others were warning people of a possible outcome like this because, unfortunately, Bitcoiners have become well-versed in the “shitcoin playbook” and can spot these scams from miles away.

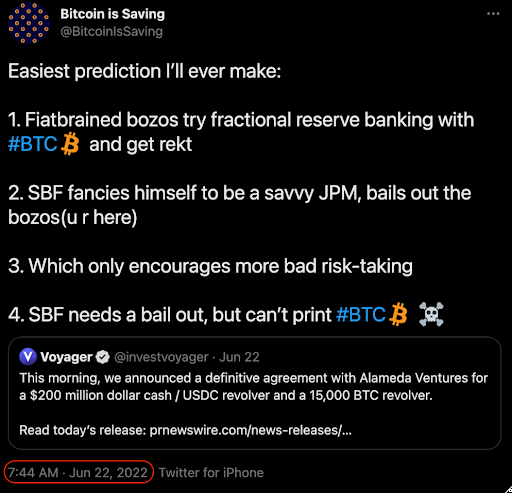

Here is another respected Bitcoiner predicting this very outcome back in June, after FTX was bailing out failing crypto lenders, and SBF was being hailed as the “JP Morgan Chase of Crypto.”

Here’s another from nearly two years ago!

Bitcoiners consistently warn of the risks of crypto casinos, crypto lending products, and shitcoins because we have seen people get burned by them time and time again. Bitcoiners have zero tolerance for scammers and frauds, having witnessed people lose everything by putting their trust in the wrong lender, exchange, or project.

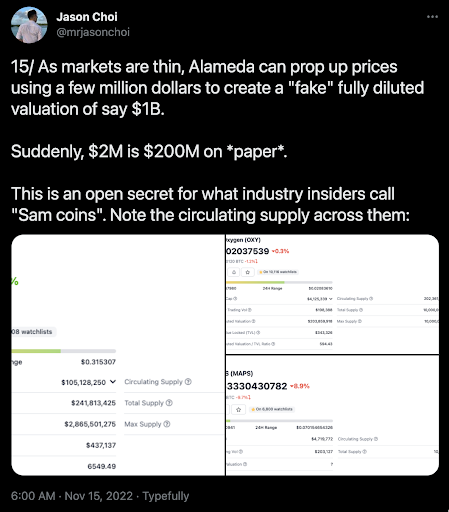

It’s important to understand that a lot of this comes down to the fact that these scams are possible because shitcoins can be created out of thin air at no cost to the issuer. These shitcoins are centralized, worthless tokens that serve only to enrich the issuers and the early investors. New tokens can be created with a click of a button and deceptively promoted to enrich insiders before being dumped on naive and trusting retail investors who are sold a marketing story that the token is “the next big thing” or “the next Bitcoin.” This is a big reason why the FTX fraud grew to the size it did. Same playbook, different shitcoin.

Bitcoin, of course, is different. It is a decentralized, censorship-resistant, leaderless, and scarce digital commodity. This is precisely why we only recommend Bitcoin to our clients at Swan and relentlessly educate people about the importance of taking self-custody.

To be abundantly clear, if you have any bitcoin with a lender or exchange, you should be taking self-custody of your bitcoin to remove counterparty risk. Please reach out to Swan if you need any assistance with this.

I won’t go into too much detail here about what happened exactly with FTX and Alameda Research. If you would like to read a full post-mortem on the collapse, here are 5 pieces of content that I think did a great job of explaining the situation in detail for those interested in reading more about what transpired.

The TL; DR is:

FTX created worthless tokens out-of-thin air, like FTT, SER, MAPS, and OXY. It then used these tokens to make its balance sheet appear more robust than it really was by pumping the illiquid tokens’ values and then inflating its balance sheet with them.

FTX then used its inflated balance sheet to raise copious amounts of money from VC investors who apparently did little to no due diligence before writing fat checks to SBF. In the end, FTX quickly became a company valued at $32 billion dollars in January 2022 after launching only two years prior.

Matt Levine writes, “FTX’s two largest asset balances, “before this week, ” were $5.9 billion of FTT ($553 million at post-crash prices last Thursday) and $5.4 billion of SRM ($2.2 billion post-crash). Something like two-thirds of the money that FTX owed to customers was backed by its own tokens that it had made up.”

This entire shell game came crashing down when Alameda got burned in the spring as markets started to take a turn. As the story goes, Alameda became insolvent during the credit contagion that began with the blowups of Terra Luna and Three Arrows Capital. Out of that mess, FTX had to lend nearly 10 billion dollars to Alameda for the trading firm to avoid insolvency.

To make matters worse, FTX used customer funds illegally to loan this money to Alameda, with FTT as collateral to secure the loan. Things hit the fan when the price of FTT crashed after Binance CEO CZ publicly announced plans to sell Binance’s entire FTT position, totaling $584 million dollars. This action tanked the price of FTT and only attracted more speculators, which dropped the price of FTT even more.

FTX tried to raise cash to stop the bleeding and pay its debt obligations, but it could not stop the implosion from occurring. It is now known that FTX had about an $8 billion hole in its balance sheet when all was said and done. As the crisis unfolded, FTX suffered a bank run when customers raced to withdraw funds (billions of dollars in days) from the exchange as rumors around its insolvency swirled. At that point, since FTX was essentially running a fractional reserve bank, FTX was toast. FTX and Alameda were both insolvent, and a few days later, FTX filed for bankruptcy.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Since then, the story has become even more bizarre. SBF remains in the Bahamas, reportedly being held by authorities. Other FTX officials are rumored to be on the run, trying to escape to Dubai, where they do not face any extradition laws. There has been a hack of FTX where hundreds of millions of funds were stolen and are now sitting in ETH. SBF built a backdoor to alter financial records without altering FTX compliance systems. And Alameda had an exclusive API key that allowed them to front-run FTX clients. There are more nefarious activities, which you can read all about in the post-mortems shared above. In addition, there is now a consumer class-action lawsuit against FTX and SBF with Tom Brady and the Golden State Warriors named in the suit, and the FBI is currently mulling over extraditing SBF back to the US.

Time will tell how this dynamic situation will play out, but it is now crystal clear that FTX and Alameda Research were outright fraudulent operations and that SBF should now be mentioned among legendary scammers like Bernie Madoff, Tom Petters, and Charles Ponzi himself.

The question becomes…what happens next? What will the fallout be for Bitcoin from this FTX fiasco?

Below are 5 outcomes that I believe we should expect to occur in Bitcoin moving forward.

1 — Contagion

One thing that all Bitcoiners should expect is that there will be more credit contagion from this mess. Now being discovered is the ridiculous amount of leverage that was in the system between FTX and all these lending desks. In addition, we still don’t know how many hedge funds, institutions, and startups custodied their funds on FTX who can no longer access them.

High levels of indebtedness in an industry can create vulnerabilities, amplify shocks, and increase instabilities. Increased levels of debt create greater interconnectedness and counterparty risk that leads to cascading liquidations that compound on one another. This can lead to contagion effects when one credit default leads to further falling asset prices, which leads to more defaults, and further falling asset prices, etc.

We are seeing this play out today with the FTX collapse. A perfect example of this can be observed within the Solana ecosystem.

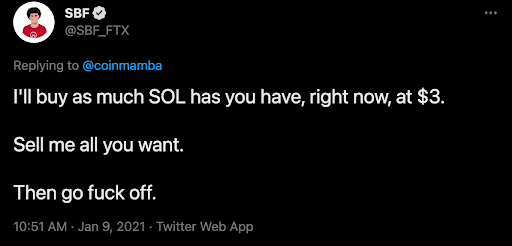

It was well known that SBF was a huge investor in the Solana ecosystem. Here is an infamous tweet where he publicly announced his Solana purchases:

Not only that, but FTX created multiple tokens on the Solana platform that they then used to inflate their balance sheet, including Serum (SER), Oxygen (OXY), and Bonfida (FIDA).

Once the price of FTT started to tank, SBF and FTX began selling anything they could to meet their margin calls and remain solvent. This can be observed by looking at the price drops in all these illiquid Solana tokens.

The next question you should be asking yourself is, “Who holds a lot of Solana on their balance sheet?” Solana was a darling of institutional investors and hedge funds who all pumped this centralized token to the moon and now are caught with their pants around their ankles. We will most certainly see more funds become impaired from this price action. In that case, they will need to sell off assets to meet their own margin calls, and the contagion continues. It took over 6 months for the contagion to manifest itself from the Terra Luna and Three Arrows Capital blowups. I expect it may take several weeks or months before we see more bodies float to the surface from this FTX fraud.

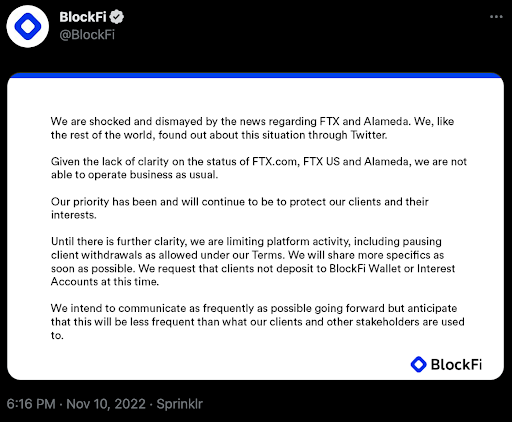

We have already seen major cryptocurrency companies announce bankruptcy since the FTX fiasco began. BlockFi sent out this tweet on November 11th and froze customer withdrawals.

According to the WSJ, BlockFi is now preparing to file for potential bankruptcy after halting customer deposits and withdrawals

Several other cryptocurrency lenders and exchanges, many owned by FTX, have begun halting withdrawals and deposits, which is never a good sign, including Japanese crypto exchange Liquid, crypto lender Salt, and large crypto lender Genesis Global Digital.

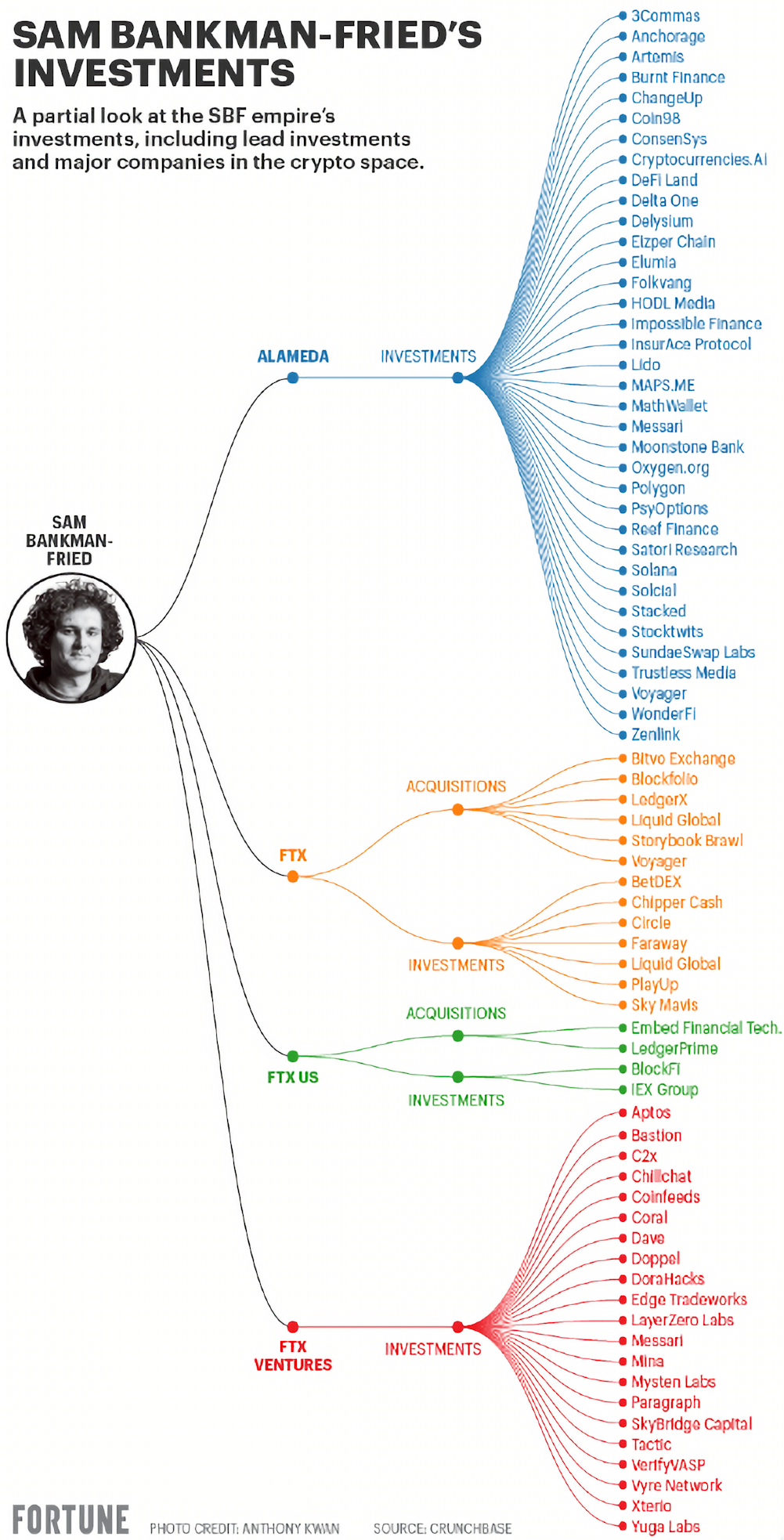

SBF had a massive amount of investments and acquisitions that now will be impacted in various degrees of severity. We have not yet seen all the damage that has been done by this destruction of wealth. Here is a great graphic that shows the extent of SBF’s fingerprints:

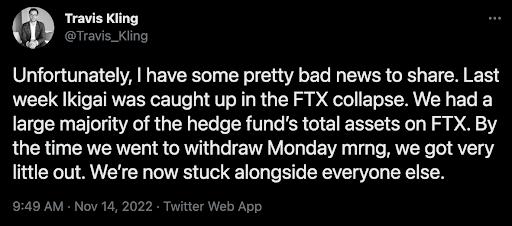

The other way that this calamity will impact the market is hedge funds and other entities that did not protect themselves properly from counterparty risk when it came to the custody of their fund’s assets. An example of this was when Ikigai, a crypto hedge fund, announced that a majority of the fund’s assets are stuck on FTX and it may need to “move into winddown mode.”

Galois Capital also announced it had 50% of its assets locked up on FTX worth $100 million, and Multicoin Capital was another firm with 24% of its assets held on the exchange worth approximately $863 million. All of these entities were victims of SBF’s fraudulent operation. I have empathy for them, but it is honestly mindblowing that these firms held a significant portion of investor funds at a single counterparty with a shady operator of a mostly offshore business. But here we are. There are most certainly entities that we don’t know about yet that will reveal themselves over the coming weeks and months.

Moral of the story — the fallout from this FTX collapse is just getting started. The second-largest cryptocurrency exchange, valued at $32 billion dollars doesn’t go bankrupt in days to only leave a little bit of damage. There will be more body bags. We will discover more exchanges, hedge funds, mining companies, startups, and other institutions that had exposure to FTX in some form or fashion.

There will be more blood. Expect it.

Probably the biggest silver lining from this entire mess has been that more people are understanding why it is so important to self-custody their bitcoin. At Swan, we are constantly advocating that people take self-custody because (1) it removes counterparty risk, (2) it is how bitcoin was supposed to be used in a self-sovereign way, and (3) it helps decentralize the bitcoin in circulation.

Yet no matter how many times we say it, meme it, or write it, some people, unfortunately, need to learn the hard way before they understand why self-custody is important. This FTX event and the contagion that has followed has woken people up to the merits of “not your keys, not your coins.” With each entity that freezes withdrawals, individuals are realizing that they did not actually own any bitcoin when they gave it to a third party to hold on to.

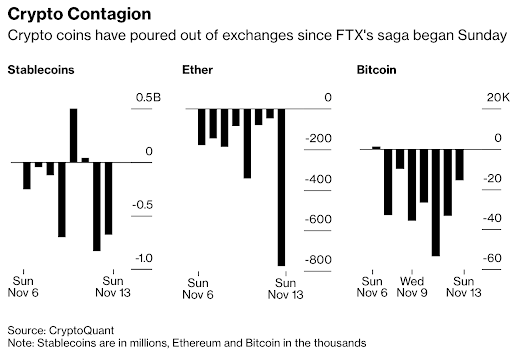

For the week of November 6th to November 13th, exchange users withdrew $3.7 billion worth of Bitcoin, $2.5 billion of Ether, and $2 billion worth of stablecoins, according to data provider CryptoQuant.

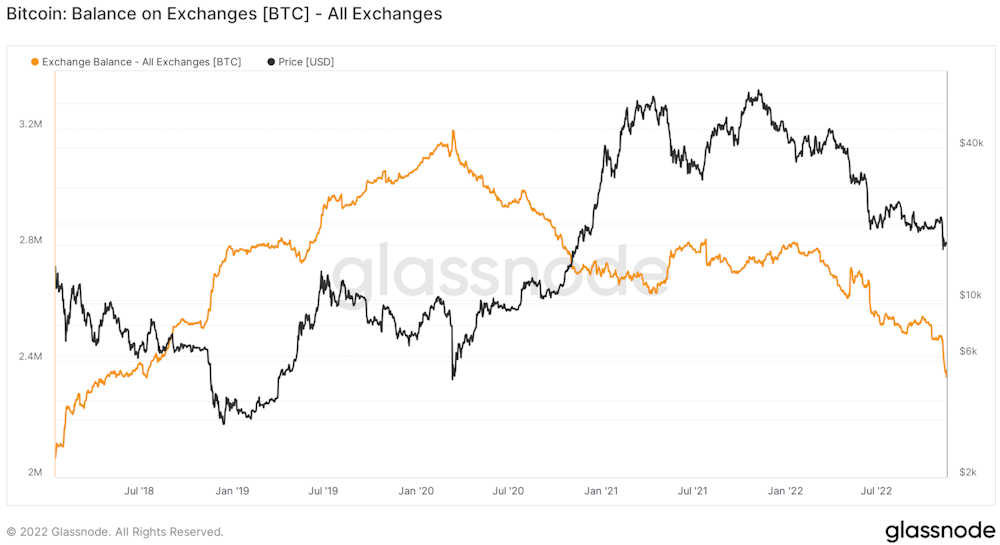

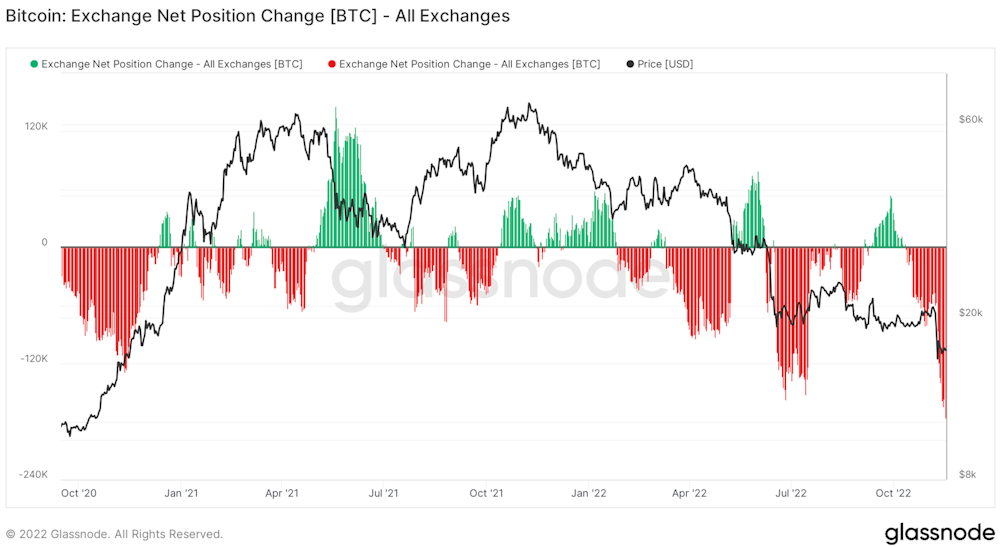

We are now seeing record outflows of bitcoin across all exchanges as people are taking self-custody of their bitcoin. According to Glassnode, the total balance of Bitcoin on exchanges has hit a nearly 5-year low of 2.3 million bitcoin.

Below, you can see this trend playing out in the net position change of bitcoin held on exchanges as well.

Over the past 7 days, we have seen more bitcoin being withdrawn from exchanges than ever before. This is an excellent sign for long-term adoption. This is bullish for Bitcoin and Bitcoiners long term.

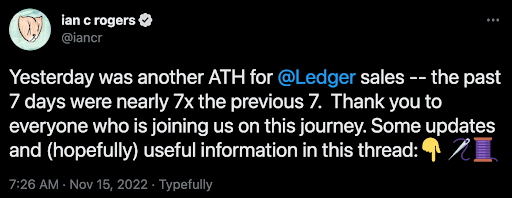

Furthermore, we have seen reports from hardware wallet providers like Ledger report record sales since the FTX collapse.

Another hardware wallet provider, Trezor, also reported a 300% surge in sales revenue since the FTX contagion. The firm is nearly certain that the uptick is due to investors seeking to take self-custody of their bitcoin after the FTX collapse.

On top of that, I have spoken with numerous collaborative custody companies throughout the industry who have all reported increased demand over the past two weeks.

This is the biggest silver lining of all this. More people taking self-custody of their bitcoin is very bullish. Many of these investors have learned this lesson the hard way, but it is vital that individuals use bitcoin in a self-sovereign manner to avoid calamities like this that can occur with “trusted” third parties.

The best time to take self-custody of your bitcoin was when you first bought it, and the second-best time is today.

Another potential silver lining to all of this is that the industry as a whole will likely move to adopt standards and practices to increase transparency and help prevent situations like this from occurring again. Proof of Reserves is the idea that centralized exchanges can cryptographically prove the assets they hold on their balance sheets by providing wallet addresses or regularly signing transactions or messages with the corresponding public keys.

However, this disclosure would be incomplete without also knowing an exchange’s liabilities. Users need to know whether the assets the exchange holds match the outstanding liabilities on its balance sheet. This could be achieved by the exchange aggregating all of its liabilities, concealing user identities via splitting up individual user accounts and publishing them strategically in Merkle Trees and then having users verify that their deposit is included.

Showing both sides of the balance sheet would also be more reliable if an independent auditor was involved in the process. This would give cryptographic proof that an exchange is solvent with the added reassurance that an auditor was involved. Perhaps this would help prevent fraud and some of these credit contagion events from occurring in the future. Although this is not completely trustless, it is better than nothing for users who choose to custody their bitcoin with a centralized party.

The hope is that Proof of Reserves becomes an industry standard. If you get every exchange agreeing to perform Proof of Reserves, then it becomes a red flag in the mind of users if an exchange does not do it. The only conclusion a user would have if an exchange did not do Proof of Reserves is that they are being dishonest about their operations and would be exposed as insolvent if they did perform the procedure. This may become a self-regulating standard that has the potential to protect users from using shady exchanges moving forward. Since the FTX and Alameda collapse, over 30 exchanges have agreed to start performing Proof of Reserves, including Binance, the largest crypto exchange in the industry.

To be clear, proving the liabilities side of the balance sheet requires some degree of trust. Auditors have been known to fail miserably at their jobs. Just look at Enron, Wirecard, or Archegos Capital Management. These were all audited entities…and these were all massive frauds.

Therefore, Proof of Reserves does not remove counterparty risk and, thus, is not a viable alternative to taking self-custody of your bitcoin. There is no better solution to avoiding these kinds of blowups than taking self-custody of your bitcoin. Not your keys, not your coin.

For this reason, exchanges should do better to make withdrawing bitcoin as easy and cheap as possible, and builders should continue to build tools and custody solutions that make it easier for users to custody their funds. Widespread adoption of Proof of Reserves would merely be an improvement that would increase transparency, mitigate counterparty risk, and elicit better self-regulatory practices throughout the industry.

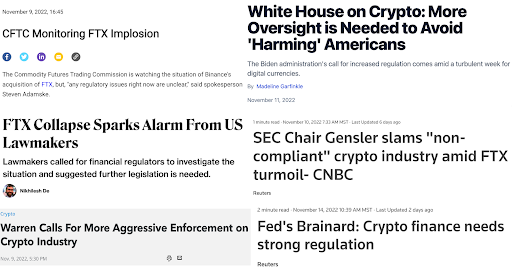

This event will most surely result in a regulatory backlash against the broader crypto industry. There is a lot of blame to go around for why this occurred, but at least some of it can be placed on regulators who failed to provide regulatory clarity and pushed investors towards shady off-shore exchanges like FTX.

Politicians now have all the fodder they need to bring down the hammer on the broader cryptocurrency industry after over one million users were burned in this fraud.

Regulation will surely be pushed through more aggressively now in the name of consumer protection. Here is just a few notable headlines in the wake of the FTX collapse to highlight the tone in DC right now.

The good news is that SBF’s Digital Commodities Consumer Protection Act (DCCPA) bill is, for all intents and purposes, dead in the water. This bill contained harmful language and was essentially SBF’s selfish attempt to create a regulatory moat around FTX.

From here, it will be vital for Bitcoiners to educate policymakers on the nuances of this technology to ensure that overreaching regulation does not stifle innovation and result in regulatory capture. It’s important to understand that in the US, this industry is already heavily regulated. This FTX collapse was a result of fraud, not a lack of regulation.

However, there are some possible regulatory responses that would make some sense. For instance, it was absurd that SBF owned and operated both a major exchange and a prop trading firm that acted as the main market maker for that exchange. This would be akin to Ken Griffin owning the New York Stock Exchange. The fact that regulators allowed this questionable business relationship to persist is in part to blame for what transpired here.

Future regulation will likely focus on where many of these issues occurred — centralized exchanges. The end result will likely be more disclosure laws, more transparency, and more legal assurances around the separation of operational and client funds.

Another area of focus for future regulation will likely revolve around tokens as a construct. All of these events would not have been possible if SBF couldn’t create these centralized tokens out of thin air and play paper shell games to create the illusion of a robust balance sheet and obfuscate the reality of the liquidity conditions on his platform. Furthermore, there could be registration and disclosure standards around early investor and founding team token holdings and vesting schedules to improve transparency and protect retail investors.

In a recent interview with Natalie Brunell, Michael Saylor responded to a question about the regulatory outlook for the broader crypto industry,

If regulators act progressively and provide a path to registration of a digital commodity, digital token, digital security, digital exchange, and digital currency…then what you would see is a collapse of all the true scams. You would see the VCs that had been trying to launch these other things, they would need to go through a registration process, and now you would have full disclosure and transparency…You would see 99% of the tokens go away.

Michael Saylor

CEO of MicroStrategy

There have already been proposals for how to go about regulating this industry responsibly, like SEC Commissioner Hester Peirce’s Token Safe Harbor Proposal 2.0. Maybe now that blood is in the streets, regulators will start to take proposals like this more seriously to help prevent these shitcoin scams from proliferating and harming consumers.

That said, an example of bad regulation would be one that conflates Bitcoin with all of these other centralized cryptocurrencies. Bitcoin is a decentralized digital commodity, whereas a vast majority of other cryptocurrencies can be better thought of as centralized digital securities. Bad regulation would be using the collapse of a centralized crypto casino Ponzi scheme as an excuse to pass laws that hinder Bitcoin’s adoption. Such regulations could, for example, hinder individuals' ability to run a node or hold bitcoin in a wallet. This collapse was not Bitcoin’s fault, this was the result of human greed and deception.

It is going to be an uphill battle for the industry in Washington DC, but now is the time to get credible proponents in DC to advocate for Bitcoin and educate policymakers on why Bitcoin is different from other cryptocurrencies. I already know of multiple industry insiders who have been on the ground tirelessly lobbying policymakers on how to regulate this industry responsibly since the FTX collapse began. If done correctly, regulation could be a boon for Bitcoin adoption as it provides regulatory clarity for institutional investors and helps rid the industry of bad actors and scam artists.

The last outcome of all of this is I believe we are starting to see a trend where people are starting to understand why Bitcoin is different.

Only Bitcoin is decentralized, scarce, censorship-resistant, and verifiable for anyone that runs a node. Only Bitcoin has a fixed supply, a perfectly predictable issuance schedule, and is fully transparent.

The root cause of all these collapses is the trust that is required, and that trust has been breached repeatedly. This is exactly what Satoshi Nakamoto said long ago.

Every one of the victims of the FTX fiasco could have avoided hardship had they simply bought bitcoin, held their own keys, and taken self-sovereignty of their wealth. Bitcoin enables them to do that.

None of this would have been possible if SBF wasn’t able to create centrally-controlled tokens out of thin air and pump the price of them to inflate the balance sheet of FTX and Alameda. With Bitcoin, no one can control it, and no one can print more of it. It is digital sound money. Fraud can’t change this, and it never will.

I am beginning to see cryptocurrency influencers and other mainstream pundits stating that they are starting to understand why Bitcoin is unlike the rest and why self-custody is important. This terrible event only served to create more Bitcoiners who now get why there is Bitcoin, and there are shitcoins. Out of this fire will rise more self-sovereign Bitcoiners.

Despite this crypto carnage, Bitcoiners will continue to move forward in a principled fashion. We will continue to push people not to trust but verify; to take responsibility for their wealth; to hold their own keys; and to support an ethical, fair, decentralized, and transparent monetary protocol. Here at Swan, this is our mission. To create 10 million Bitcoiners who understand and use Bitcoin as it was meant to be used.

Expect the fires from FTX to continue to burn and claim more victims along the way. If anything, this event has provided a tough lesson on why Bitcoin is different and why self-custody is vital. Hopefully, this message will be better received in the future now that so many have been burned by shitcoins and centralized third parties.

Today, leverage is being cleared from the system in a painful fashion. The grifters and bad actors are being exposed for what they are. In the short term, the road will be rocky for Bitcoin, but in the long term, I believe this will be a healthy cleanse that will further drive home Bitcoin’s uniqueness and create countless new Bitcoiners in the process.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?