The Bitcoin Platform for Financial Advisors

Swan Advisor Services Tailors Swan’s best in purchase and custody platform to the needs of financial advisors and wealth managers.

Bitcoin’s global adoption has been breathtaking since its introduction in late 2008. What started as a blueprint for a peer-to-peer digital money has evolved into an asset with a trillion dollar market capitalization. External attacks, dismissal from legacy institutions, and extreme volatility have been hallmarks of Bitcoin’s emergence into the mainstream consciousness.

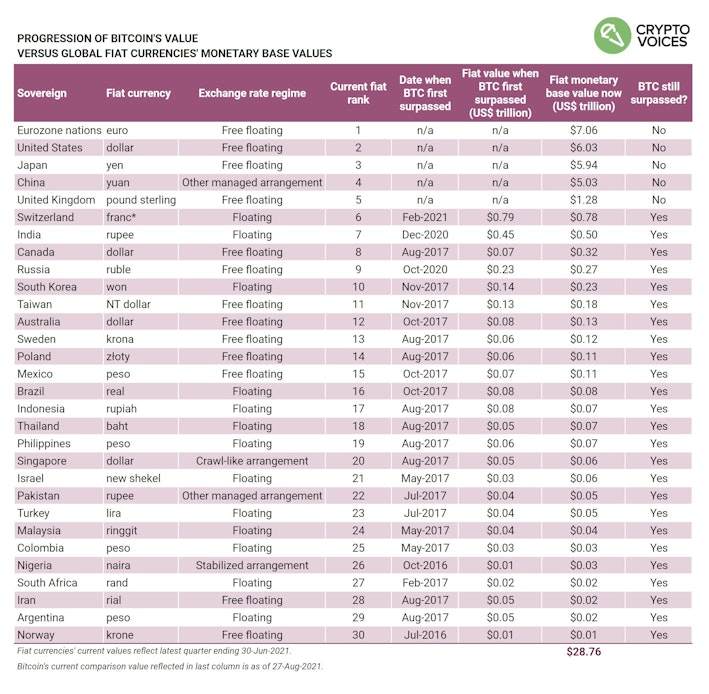

Despite constant adversity, the Bitcoin network has surpassed all but five sovereign currencies in terms of dollar value, firmly claiming its spot as a legitimate monetary asset on the global stage. The question now becomes, as a fiduciary, how do I safely and securely incorporate Bitcoin into my clients’ portfolios?

A July 2021 survey published by the Wall Street Journal indicates that 14% of financial advisors use or recommend cryptocurrencies. This figure is up from 1% from the same survey conducted in 2020.

To date, it’s been hard for those in the industry who have embraced Bitcoin to plug the asset into their day-to-day client reporting and portfolio management tools. It should be easier for financial advisors to help their clients buy and hold Bitcoin directly and maintain that position within their fiduciary relationship. That’s why we are building Swan Advisor Services.

At Swan, we have chosen to build a Bitcoin-only business because Bitcoin is the only cryptoasset that truly is a responsible long-term investment. That deep focus gives our advisor partners significant advantages, as we extend your team with deep expertise, educational infrastructure, and world-class client services.

Swan Advisor Services tailors Swan’s best-in-class purchase and custody platform to the needs of financial advisors and wealth managers. It wraps the company’s core purchase, custody and client support functions within a layer of account management, reporting and analytics to give you clear visibility into your clients’ Bitcoin positions.

Swan’s team of Bitcoin experts stands ready to partner with advisors as you get your clients up to speed on this emerging asset class. You can rely on Swan’s educational and service expertise to educate and answer client questions about Bitcoin.

We’re here to be your Bitcoin partner so you can focus on relationship building. Bitcoin represents a rare asymmetric risk-return opportunity that could be a cornerstone of wealth creation for decades to come. Swan Advisor Services is the key tool your firm needs to capture the growth of the asset class and make it actionable in driving fee revenue.

There are exciting developments in the works and we can’t wait to share more details with you.

In the meantime, sign up to get priority access to Swan Advisor Services.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Cory Klippsten is the CEO of Bitcoin financial services firm Swan.com. He is a partner in Bitcoiner Ventures and El Zonte Capital, serves as an advisor to The Bitcoin Venture Fund, and as an angel has funded more than 50 early stage tech companies. Before startups, Klippsten worked for Google, McKinsey, Microsoft and Morgan Stanley, and earned an MBA from the University of Chicago. He grew up in Seattle, split 15 years between NYC and Chicago, and now lives in LA with his wife and daughters. His hobbies include basketball, history and travel (Istanbul and Barcelona are favorites).

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?