The Bitcoin Breakthrough

The changes Bitcoin will bring about to society will be significant.

Bitcoin is a breakthrough. It breaks through barriers and dead ends that many of the most important institutions in our civilization find themselves facing. It finds paths through to the other side of problems that were thought to have no solution — problems that we thought we simply must live with as a part of life.

But this is the very nature of what breakthroughs do. They create a tremendous runway for all kinds of progress, not just in the fields they directly affect but in almost everything that touches those fields. And the fields that Bitcoin represents a breakthrough in touch almost everything.

Swan Private Insight Update #25

This report was originally sent to Swan Private clients on July 17th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

In the early days of a breakthrough, it is often hard to understand it, predict its outcomes, or even recognize that it is a breakthrough at all. But history shows there is no stopping a breakthrough whose time has come. When such a dramatic breakthrough occurs, it takes time for civilization to come through to the other side and become undeniably transformed by that breakthrough.

Let us consider the mass-produced automobile pioneered by Henry Ford.

When the breakthrough of mass-assembled, personal transportation machines relying on oil as their energy source occurred, very few people foresaw that it would lead to the end of horses being used as the primary transportation method. Far fewer envisioned the total transformation of cities, homes, work, and nearly every aspect of human life that would result from this breakthrough invention.

Nations that failed to adopt the automobile (and oil as its source of motive power), whatever their reason, fell far behind those that did. As cars became more abundant and advanced, criticism of their dangers and threats did not discourage their use. In fact, it only led to adaptations that made them safer, cleaner, more reliable, and ultimately, more widely adopted and more transformative upon our civilization.

Back at the time of the automobile’s invention, there were few roads suitable for them, leading many people to criticize the invention as impractical. Today, our nation is paved with millions of miles of roadways optimized for automobiles — not horses, bicycles, and pedestrians.

In short, there was no stopping this thing once it got started, and not getting on board meant being left behind in a world transformed by this breakthrough.

Just try to imagine what life would be like if the automobile breakthrough had not succeeded. Living without clean, fast, affordable, and accessible travel seems unimaginably primitive to us. But a life with horses as the main transportation source did not seem primitive to those who lived in the era where that was the case — an era that lasted thousands of years.

However, once the car came along, despite the early days being challenging for its early adopters, the die was cast, and the sun set on the long age of the horse and buggy, only to rise again on the age of the automobile

The horse population of the United States peaked at roughly 27.5 million horses in 1910. It then fell by 84% to below 4.5 million horses by 1959. Meanwhile, there are now over 278 million registered automobiles in the US — more than ten times the population of horses at their peak.

The legacy of horses lives on in the technological breakthrough that replaced them. We still refer to the energetic power of our automobiles in horsepower — how many horses’ strength we can magically muster up simply by pressing down on the right gas pedal of our cars. But there are no horses powering cars.

Horsepower is just a mathematical equivalency, and what is really going on inside our cars’ engines is something most of us don’t understand nor need to.

We can muster up the power of hundreds of horses without the effort of caring for a single one.

Of course, not everything is better because of the car. There are many people who long for simpler times and simpler lives that the automobile breakthrough wiped away. We can’t return to those days or recover what was lost by abandoning the automobile, though, but perhaps another breakthrough might guide us in that direction…

Bitcoin represents breakthroughs in at least several fields.

First, and quite obviously, Bitcoin is a breakthrough in what money is. Bitcoin is engineered money — engineered for personal use and personal benefit. Just as the automobile was an engineered form of personal transportation replacing both the horse (a natural form of personal transportation) and steam-powered locomotives (engineered but not personal transportation), Bitcoin stands to replace forms of money it renders primitive.

Bitcoin replaces gold, a natural form of money that has been widely abandoned in all monetary use cases except for store-of-value. Just as the horse was a suitable form of transportation until engineered replacements started to come along, Bitcoin is largely superior to gold in every attribute of money and the overall combined whole of the thing itself.

Bitcoin is more easily divisible and verifiable than gold. It is precisely scarce, and its scarcity is knowable and provable to all. Bitcoin can be backed up. It can be programmed. Bitcoin is not just lighter than gold; it’s weightless. Bitcoin can be secured and stored in ways gold cannot — ways that make it nearly impossible to steal or seize with brute force.

Those who genuinely long for a return to a sound money standard because they understand some of the ravages of what has been lost to our modern civilization through unsound money, and who are not merely romantically (or financially) attached to gold, are among the first to see Bitcoin’s tremendous breakthrough potential.

Bitcoin also replaces fiat money, a man-made invention that does a great disservice to ordinary persons, especially when the powers it grants to those in control are abused. Fiat money inflates away people’s ability to save money, making them vulnerable to governments’ incompetence and corruption. It also makes many people, if not all in reality, dependent on government influence or control for the provision of crucial services such as healthcare, education, self-defense, and even food and shelter.

The breakthrough in money that Bitcoin represents is such a tremendous leap that it leaves many in disbelief.

The same was true of the automobile, which in the early days was often called a 'horse-less carriage' and left people scratching their heads as to how a carriage could move without a horse to draw it, or what the advantages of such an invention would be. Bitcoin is a 'government-less money', which for many, is even more difficult to imagine.

This is perhaps the area where, in the long term, Bitcoin will have the most dramatic impact on our lives. Bitcoin is a liberating technology that will have a huge impact in reshaping, for the better, governments. This is because governments have themselves been reshaped by government monopolization of money, or as it is now commonly called, by fiat money.

Just as the automobile reshaped transportation, so too has fiat money reshaped government. But in the case of fiat, it has not been for the better.

In times before fiat, it was practically unheard of to hear politicians making promises to provide services they could not afford to provide with money they did not have. Instead, they often warned against making such things possible.

— George Washington, in his farewell address, said:

“… disorders and miseries which result gradually incline the minds of men to seek security and repose in the absolute power of an individual; and sooner or later the chief of some prevailing faction, more able or more fortunate than his competitors turns this disposition to the purpose of his own elevation on the ruins of public liberty.”

When the government took over money completely in 1971, the nature of the government itself changed. Spending money through deficits that would never be repaid and winning elections by promising to spend that money represented a breakthrough, albeit one with negative consequences outweighing the positive ones. It was a breakthrough of inflation, deficits, and the destruction of honesty in money.

Just take a look at the long-term chart of deficits below. Even the deficits incurred in World War 2 in the mid-1940s are microscopic compared to what they snowballed since 1971.

It only took five years of fiat money existing to pile up deficits larger than were necessary to fight and win the biggest and worst war in the history of the world — a war that took tens of millions of lives and whose victory required figuring out how to split the atom to invent the atom bomb. Today, deficits twenty-five or fifty times the size of the WWII deficits are commonplace.

Unlike fiat, Bitcoin is money that cannot be effortlessly conjured up in wildly increasing quantities — even by governments. In fact, its supply and issuance schedule forever, is restricted to a publicly known and easily verifiable quantity.

Moreover, the issuance is distributed not through political favor and power. Rather, it is issued to those who expend energy to earn that supply in a process that uses that expended energy to secure the previously issued and spent coins.

This is so fundamentally different from the government-monopolized, energy-free production of fiat money, that when they first are made aware of it, many people immediately conclude that governments will therefore stop Bitcoin or outlaw it.

It is amazing what such a statement reveals about what many people generally believe about government at this time in history. It demonstrates that people today implicitly accept that governments can and will dictate what money is, how much there will be, and who shall have it. But this was not true for thousands of years and will likely not be true for that many more either.

This mistaken belief — this misbelief — is very understandable and excusable. We have all grown up in a world of government-issued money and, not coincidentally, a world of growing government power to dictate many things through its power to direct money towards some things and away from others.

Perhaps it is more accurate to describe the more subtle method that has been used — directing floods of money towards some things and only trickles of money towards others. So it is not surprising that many people cannot envision a world where money is not something that the government issues, borrows, prints, taxes, and even freezes.

Nevertheless, let’s recall that it being difficult for many people to imagine a carriage that moved without a horse did nothing to prevent automobiles from actually moving. Likewise, being difficult to imagine money that is not in the control of the government does not prevent Bitcoin from being outside of the control of the government, which it is.

It might be useful to pause for a second here and revisit an earlier claim in this article, which stated that the government completely took over money. Perhaps it is equally accurate to say that money completely took over the government. Or perhaps it is most accurate to say that government and money became one and the same. Today, most of what we hear from politicians is about money, not political principles.

So Bitcoin is then not just a breakthrough in money. It is a breakthrough in government itself. This may not be immediately obvious, but when one thinks about the link between money and government, one quickly realizes that a revolution in money must mean some kind of revolution in government since the two are inextricably linked today.

Today’s democracies function on politicians getting elected by promising benefits that need to be paid for with money. And that money comes from a combination of taxation, borrowing, and issuing new money. In reality, it mostly comes down to issuing new money, as the debts only keep growing and are never paid down, and furthermore require their interest to be serviced with more newly issued money.

Imagine what a revolution it would be if politicians couldn’t credibly promise to spend money the government doesn’t actually have and can neither seize nor print. What platforms would they even run on?

Again, we find it hard to imagine because all we see today is the opposite.

Politicians today are very powerful people — ordering entire industries to change how they operate, sitting atop large, nationalized, or highly-regulated industries, and handing out and withdrawing financial benefits to and from the masses.

What if politicians were instead merely administrators of functions deemed necessary for the essential functions of government? What if they were evaluated and elected on their actual competence at these duties and not on the outlandish promises they made?

Might not the field of politics attract radically different types of people to run for office?

Might their campaigns rely on things other than dividing the population on the grounds of who should have their wealth taken away and who should be given wealth?

Might many things which have become politicized and controversial simply become private matters between the people they involve?

Might this not reduce our overall level of distress and anxiety as we then can judge a politician only on matters of proper government domain and not on every opinion they hold about every single issue that can be politicized because money can be spent on those issues through government decrees?

The revolution in government that Bitcoin represents is that of putting the government back into a box it properly belongs in.

At the end of World War 2, the West (and the rest of the world) was shocked by the evils committed by totalitarian governments in industrialized nations. “Never again” was one refrain that came out of it.

More than seventy years later, however, a view that government can and should fix totally everything is becoming more pervasive leading to a growing threat of totalitarianism’s return.

Even in the West, laws are regularly being passed that compromise freedoms, enlarge government surveillance and power, and move us all closer toward totalitarianism.

Meanwhile, the promises of enlarging the government to bring us prosperity or security succeed only in enlarging the government.

Government and money were fused into one single thing in 1971, with terrible consequences.

Bitcoin’s breakthrough is that it divorces money from the government, ending this dysfunctional union and allowing both money and government to function properly once more. These two things should not be one. They need to be separated. And Bitcoin single-handedly and unilaterally is a rebirth of money outside the control of the government, never to be reunited. This will end the government’s co-dependence on power over money and restore it to healthy and proper function.

This, of course, takes time. It took forty-five years from the launch of the Ford Model T until the first interstate highway was built. Just as we could not know how long it would take for automobiles to replace horses, we cannot know how long it will take for Bitcoin to replace fiat money. But the breakthrough is now underway, and Bitcoin is now even a talking point for many candidates campaigning for president. The breakthrough is afoot.

So much has been said about Bitcoin’s ties to energy that we can not avoid asking the question of whether Bitcoin is itself a breakthrough in our relationship with energy.

Once again, drawing on the breakthrough that was the automobile, we can see that it (along with the energy-fueled industrial revolution) played a huge role in leading our civilization toward massive production, utilization, and energy dependence.

Horses needed hay. The automobile required oil and gas.

An undeniable breakthrough occurred between coal’s use for heating and operating steam engines and gasoline to power automobiles and their internal combustion engines.

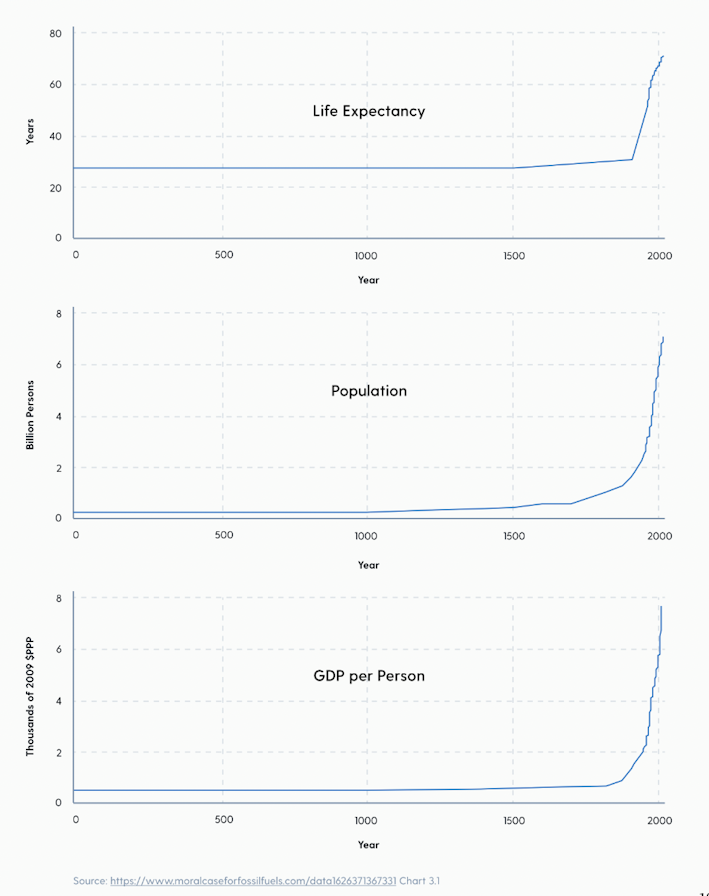

With these highly scalable technologies, the population, life expectancy, and wealth of humanity skyrocketed. Life expectancy more than doubled. The human population of the planet increased sevenfold, and GDP per person also increased more than sevenfold from the levels they had been at for thousands of years.

The more energy we were able to extract, store, generate, and distribute, the more we found we could do with it.

However, we now find ourselves at a time when the previous breakthrough appears to be plateauing. Life expectancy is flattening out, and real GDP per person is too.

The global reserve fiat currency of our day, the US dollar, is often referred to as the petro-dollar, emphasizing its connection to petroleum-based energy. This stuff feeds cars (and ships, trains, trucks, etc…). This petro-dollar regime had been fuelled by the need to ship petroleum from areas where it was abundant, such as the Middle East, to areas where demand was greatest, such as the United States and Western Europe. But today, much of this is changing.

Technological advancements in shale oil and alternative energy sources, as well as political movements aiming to restrict the use of fossil fuels like petroleum, are front and centre in energy.

So is Bitcoin a breakthrough in energy? If it is, what kind of breakthrough?

Although we are still in the early days, we already see one emergent application of Bitcoin’s relationship to energy production. It appears Bitcoin could completely turn the tables on the economics of how energy infrastructure is built. Although the explanation that follows is somewhat of an oversimplification, it does accurately describe the fundamental change that the existence of Bitcoin mining may make possible.

Before Bitcoin mining, the broad infrastructure for generating electricity was to build out two types of generating facilities. The first, baseload power, uses technologies that generate a steady amount of power. These are technologies such as hydroelectric and nuclear. They are often referred to as base loads because they provide the load of electricity that is continually demanded.

But electricity demand isn’t flat. It changes during different parts of the day, during different days of the week, and over the seasons. So, in addition to baseload power, we need sources of electricity that can be variably turned up and down to meet peak demand. These are technologies like gas and coal. For example, when it gets hot, and everyone needs to turn on their air conditioners, we can fire up a gas plant to generate the electricity needed until things cool down again.

Finally, there are solar and wind, which are touted as renewables.

However, these both have the drawback that they are neither reliable base loads nor reliable peak loads because the sun doesn’t always shine and the wind doesn’t always blow. Because of this inherent fact, they neither deliver a steady amount of power always nor can they be fired up at will when energy is needed. Using these latter two sources often creates undesired and unpredictable spikes or shortfalls in energy production.

The problem of balancing this electricity production exists because electricity must be consumed as it is generated — no batteries are capable of storing surpluses of energy the size of a city. If too little is produced, we have brownouts. If too much is produced, we get transformer explosions and fires.

Bitcoin mining fixes all of this. Bitcoin mining is an unquentiable demander for electricity. It allows for building out base load facilities whose production actually exceeds the minimum load, with the knowledge that the excess energy can be consumed by Bitcoin mining, thus stabilizing the demand and using the excess for generating income and securing Bitcoin itself.

Fortunately, reliable, baseload technologies of hydro and nuclear are both safe and clean technologies that produce no carbon emissions. In contrast, the peak load plants are the very ones that are under pressure to be shut down because of their emissions. Moreover, as Bitcoin’s demand for electricity is perfectly elastic, both wind and solar can be built without the worry that they may overload the grid because it’s too sunny or windy at times.

The positive feedback loop of Bitcoin mining adds to the financial case for building more base load and renewable energy sources could then lead to such a change in the composition of our energy infrastructure, resolving the dilemma currently faced.

That’s just the tip of what we might expect, but again, we can see that Bitcoin is potential breakthrough technology in allowing us to build out cleaner and renewable energy sources because it could eliminate the tradeoff of having to rely on fossil fuels for peak power supply.

If Bitcoin is a breakthrough in money, it is bound to be a breakthrough in the industry of money that we call finance. One of the sad effects of fiat money has been the financialization of many things.

Financialization is just another way of saying that the finance industry has gotten deeply enmeshed in these other industries.

Do you want a home?

You have to finance it.

Do you want a college degree?

You have to finance it.

Do you want to start a business?

You have to get it financed to compete with people who are getting their businesses financed. Everything needs financing.

But this financialization is actually an artifact of money that can be created out of thin air to finance everything financiers think they can get a return on. Under a fiat monetary system, financialization is another form of inflation — it is financiers creating money and then creating a need for that money to be able to access resources like housing, education, and operating a business.

If the ability to inflate the money supply for these things did not exist, they would simply be provided without the added premium of financialization. We wouldn’t get housing bubbles, trillions of dollars of unrepayable student debt, or the destruction of small businesses that cannot access the kind of financing big businesses can. It’s really that simple. And Bitcoin eliminates the ability to inflate the money supply for financialization.

Finally, Bitcoin also affects us personally. Bitcoin requires that we take personal responsibility for the functioning of the monetary system and for our own storage and security of our money. It is a big part of the Bitcoin journey to experience what it means to custody money for oneself — to learn how to save it, store it, use it, and have to work for it.

A pseudonymous Bitcoiner, going by the name Gunnar, wrote:

“When people are forced to take responsibility for their own actions, the production of goods and services will have to focus on quality, beauty, and durability. People saving in Bitcoin will simply refuse to give up their hard-earned time savings for junk.”

Many others have said similar things.

Bitcoin is scarce and precious, and hodlers think very hard about what they are prepared to accept in exchange for parting with it. This is radically different from how we think about money that is easy to come by, can be borrowed easily, and loses its purchasing power — all leading us to want to spend it on nearly anything at all.

We are at the dawn of a breakthrough. In time, this breakthrough will change everything. It’s hard to predict the precise nature of those changes or how long they may take because those all depend on the combined creativity of all humanity to apply this breakthrough.

However, just like the automobile represented a breakthrough that changed many aspects of our way of life that had been the same for thousands of years, rendering them primitive, we can expect the changes Bitcoin will bring about to be just as significant. The eventual changes will be historic, but to butcher, a common expression, don’t hold on to your horses.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Tomer Strolight is Editor-in-Chief at Swan Bitcoin. He completed bachelors and masters degrees at Toronto’s Schulich School of Business. Tomer spent 25 years operating businesses in digital media and private equity before turning his attention full time to Bitcoin. Tomer wrote the book “Why Bitcoin?” a collection of 27 short articles each explaining a different facet of this revolutionary new monetary system. Tomer also wrote and narrated the short film “Bitcoin Is Generational Wealth”. He has appeared on many Bitcoin podcasts including What Bitcoin Did, The Stephan Livera Podcast, Bitcoin Rapid Fire, Twice Bitten, the Bitcoin Matrix and many more.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?