The Bearish Case for Bonds

Bonds are not as safe today as they are marketed to be. It’s time bond investors begin to protect themselves against the Fed policies that are leading to erosion of the real value of their bond holdings.

Bonds are often touted as one of the safest investments an investor can make. As such, retirement portfolios are typically more heavily weighted to bonds. In fact, if you Google “Safe Retirement Investments, ” bonds are recommended in nearly every search result.

The 10-year US Treasury is even considered a “risk-free investment” in the finance world. Yet this couldn’t be further from the truth given today’s macroeconomic backdrop. There are real risks associated with bonds, but many investors are unaware of them, and these risks continue to grow.

Bonds are considered safe because they offer principal protection. When you purchase a bond, you receive fixed interest payments over its duration, plus the principal you paid when the bond matures. This differs from a stock that can drop 30% or more and has no principal protection. Investors are attracted to bonds because, unlike equities, they offer safety from a principal protection standpoint and provide a stream of income via interest payments. However, there are other risks to consider.

Bonds are considered safe because they offer principal protection. When you purchase a bond, you receive fixed interest payments over its duration, plus the principal you paid when the bond matures. This differs from a stock that can drop 30% or more and has no principal protection. Investors are attracted to bonds because, unlike equities, they offer safety from a principal protection standpoint and provide a stream of income via interest payments. However, there are other risks to consider.

Inflation risk, also known as purchasing power risk, is the risk that inflation will reduce the real value of the bonds. Bonds are subject to the risks of inflation because interest payments are fixed regardless of inflation. For instance, with a 5-year bond, you’ll receive everything you paid for the bond plus interest in 5 years, but if the interest payments don’t keep up with the rate of inflation during that time period, then you’ll lose purchasing power in real terms.

In the past, the Federal Reserve had managed inflationary risks by raising interest rates when signs of inflation appeared. Today, the Fed finds itself in a position not seen in many decades. The debt levels in the economy are so high that they now constrain the Fed’s ability to effectively manage inflation risk for bond investors. In addition, history shows us that the Fed may even want this inflation to occur to stimulate economic growth. Bond investors could find themselves hurt by the consequences of the Fed’s other priorities.

The pandemic prompted unprecedented policy responses from central banks and governments worldwide. The result was an explosion of debt levels. The Fed and Congress claim these responses were necessary to save jobs and keep food on the table for families as the unemployment rate rocketed to nearly 15% in 2020.

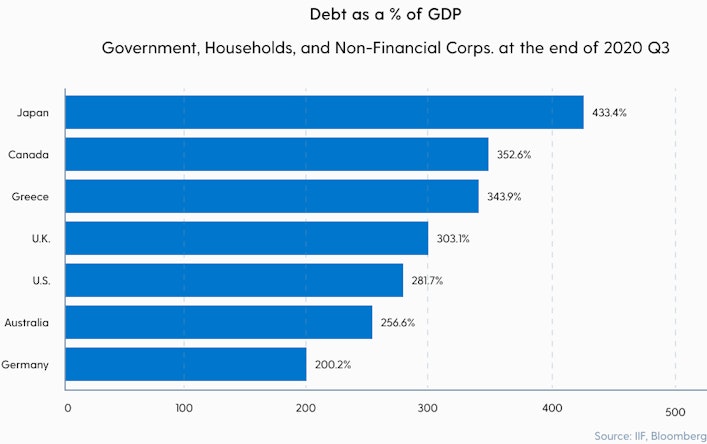

The world now finds itself up to its eyeballs in debt.

U.S. government, households, and corporate debt-to-GDP hit a historic high of 281.7%

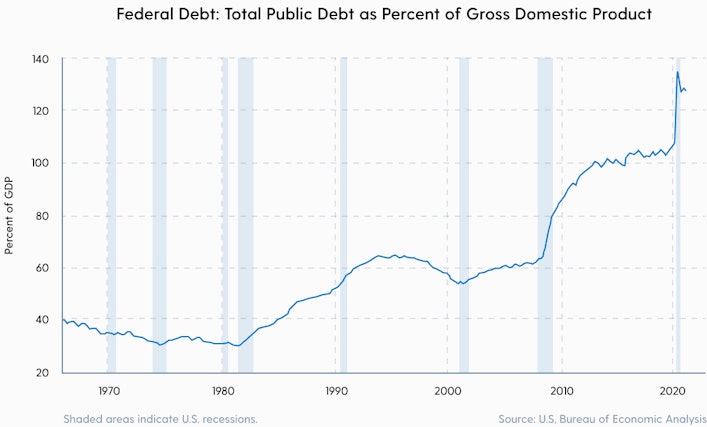

The U.S. government debt-to-ratio currently sits at 127%, levels not seen since WWII.

When a government becomes highly indebted, like the US is today, the debt becomes a drag on economic growth. High debt levels require the government to service the interest payments of the deficit with a greater percentage of the tax receipts instead of reinvesting those funds in the economy.

To avoid this stagnation in growth, historically governments have utilized a few methods to overcome an enormous debt burden:

Austerity measures — cutting government programs and benefits.

Defaulting on the debt or restructuring it — not paying the debt back.

Inflating the debt away in real terms — printing money.

The first two courses of action are extremely unlikely given the economic and political landscape the US finds itself in today. Politicians continue to spend money vigorously with no signs of slowing. A default on the debt would cause catastrophic bankruptcies throughout the highly leveraged global economy.

This leaves the only remaining option to drive interest rates lower while simultaneously letting inflation run hot. By keeping interest rates low, the Treasury’s borrowing costs stay down. The low rates also stimulate borrowing across the economy. This results in increased inflation and allows nominal growth to accelerate while reducing the real cost of the debt.

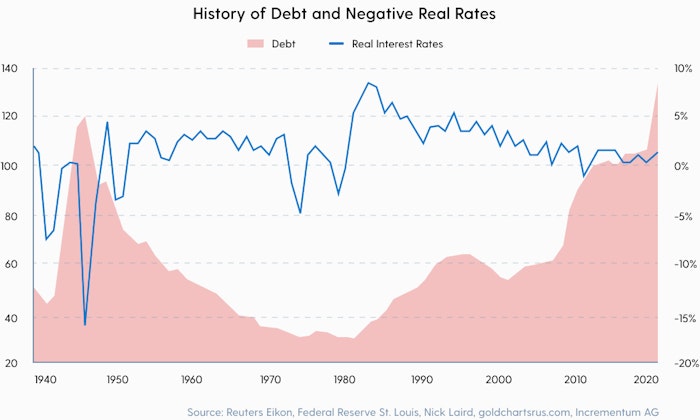

By suppressing interest rates below the rate of inflation, the total debt is eroded in real terms. This is known as financial repression and is a tactic the Fed has utilized when US debt-to-GDP ratios have gotten this high.

Let’s take a trip back in time.

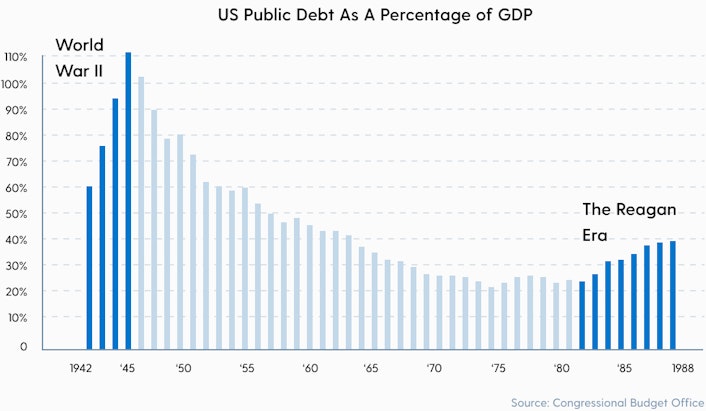

World War II was expensive. In 1942 the US Government essentially abandoned its monetary policy goals and spent large amounts of money to pay for the war. After the war, soldiers were returning home, and policymakers feared that we were headed for another depression. As a result, government officials deployed stimulative fiscal and monetary policies, and by 1945, public debt exploded to 110% of GDP, as shown below.

This surge in debt-financed federal spending caused a rise in inflation, similar to what we’re seeing today from the fiscal stimulus for the Covid-19 recovery.

Yet instead of responding to this rise in inflation by raising interest rates in 1942, the Fed implemented a strategy known as Yield Curve Control (YCC).

With YCC, the Fed pegged short-term bills at 0.38% and long-term government bonds at 2.5%, meaning that if long-term rates rose past 2.5%, they would agree to buy bonds with lower yield until the rates fell below the threshold.

They did this so that accurate interest rates would be profoundly negative and the debt would become a smaller percentage of the overall economy as the economy grew in nominal terms. This shrunk the debt-to-GDP ratio. In the previous chart, the green arrow shows how this strategy succeeded. The debt was never paid down, but inflation nearly cut the debt-to-GDP ratio in half from 1946 — 1955.

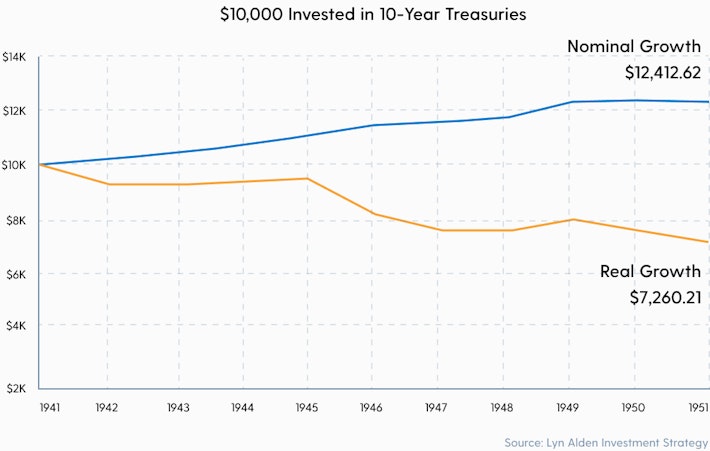

Without a rise in interest rates from the Fed, inflation ran hot in the 1940s. Annual inflation from 1942 — 1951 was an average of 5.8%, and in March 1947, it surged to a high of 20.1%. This caused the real yield of bonds to be deeply negative over that period of time shown below.

This ultimately resulted in the loss of purchasing power for bondholders during the post-WWII era, as shown in the following chart.

As you can see from the chart above, 10-year Treasury investors received all of their principal plus interest in nominal terms, but this was not nearly enough to keep up with the high rates of inflation. As a result, 10-year Treasury bondholders lost nearly 30% of their purchasing power in the decade following 1942.

Bond investors were the big losers post WWII, underperforming nearly every other asset class between 1942 — 1952. When considering our current debt problems and the Fed’s recent policy choices, it’s hard not to feel like history is repeating itself for bond investors.

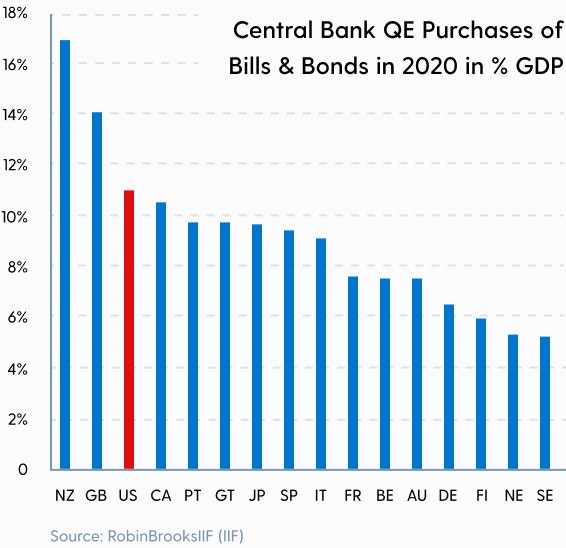

Similar to World War II, we recently saw the Fed and Treasury deploy extremely stimulative policies to fight the Covid-19 pandemic.

A few months ago, the Fed announced one of the most significant changes to its monetary policy in recent memory. Chairman Jerome Powell declared that the Fed will change how they target inflation. Instead of targeting 2% inflation, they will now target an average of 2%. They will allow the inflation rate to run hotter before hiking interest rates.

“(The Fed) seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

— Federal Reserve Statement on Longer-Run Goals and Monetary Policy Strategy amended effective August 27, 2020

The Fed may be giving us their playbook here if we read carefully between the lines. They are explicitly saying that they will allow inflation to run hot “for some time” by not raising interest rates or reducing their bond purchases. They will continue to suppress the rates even if inflation is high. This keeps the borrowing costs low for the Treasury Department allowing the spending spree to continue.

This is the WWII playbook, but instead of calling it Yield Curve Control, we see massive bond purchasing programs under a different name yet with the same outcome— the reduction of government debt as a percentage of GDP through inflation. As before, this comes at the expense of savers and bondholders.

The Fed achieves keeping interest rates low through their bond purchasing programs, better known as Quantitative Easing (QE). Simply put, the Fed purchases US government bonds to keep the interest rates low. Since bond prices and interest rates move opposite one another when the Fed buys bonds, bond prices rise, and yields fall.

The Fed continues to purchase $120 billion dollars worth of bonds every month to push bond yields lower. This equates to $834 million dollars worth of bonds purchased every hour for 18 months straight.

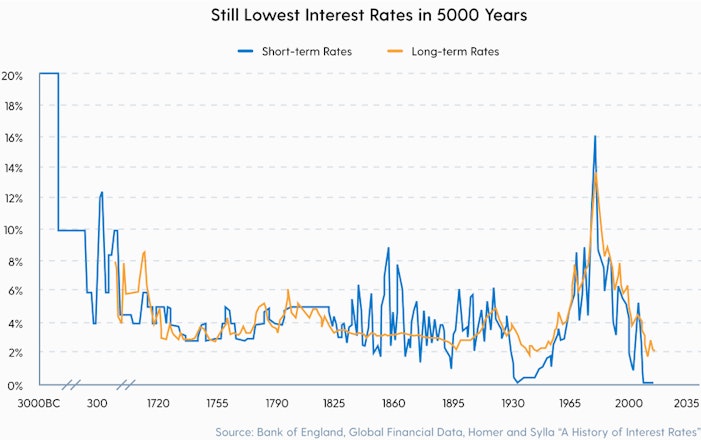

The QE programs have accelerated this trend in recent years, with the Fed doing everything in its power to keep rates low. As a result of this bond-buying spree, the Fed has now taken interest rates down to the lowest in 5,000 years.

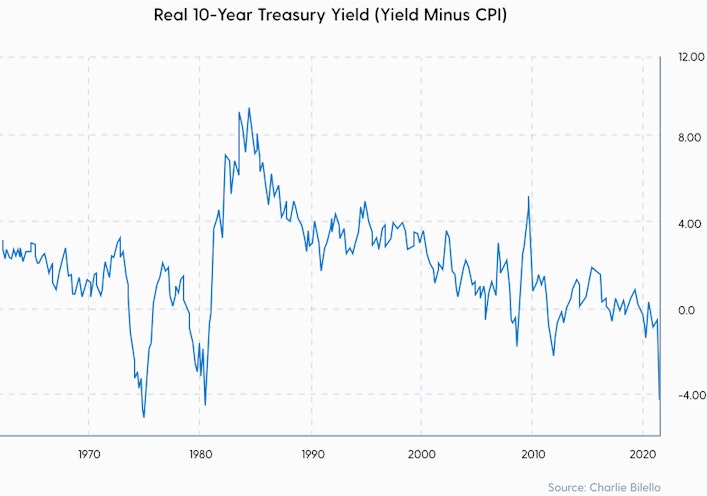

Inflation is now at the highest level we’ve seen in decades (CPI remained at 5.4% YoY in July). The Fed continues to suppress interest rates, which are now at the lowest levels in recorded history. Unsurprisingly, we are seeing bond investors bear the brunt of this inflation in real terms.

With all this in mind, let’s look at how bonds perform in today’s environment.

Negative-yielding global bonds across the globe are at an all-time record exceeding $18 trillion.

More and more bond investors are paying to lend out their own money and are taking a negative return on their principal when the bond matures. With negative-yielding bonds, they are giving up that principal protection that made bonds an attractive investment in the first place.

The 10-year Treasury real yield, adjusted for inflation, is at ‑4.125%, the lowest recorded yield since the early 1980s.

The “risk-free” 10 yr Treasury isn’t looking that risk-free at all. At the current inflation rate, the owner of these bonds will lose 20.6% of their purchasing power in 5 years.

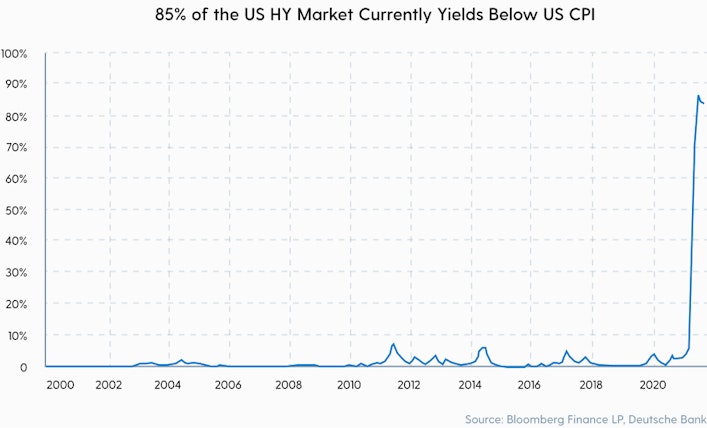

Even corporate high yield bonds, the riskiest type of corporate bonds, and therefore the highest yielding, crossed into negative real territory for the first time in history in July.

Even 85% of the U.S. junk bond market, the riskiest type of corporate bonds, and therefore the highest yielding, has crossed into negative territory.

From what we recognize about the history of highly indebted countries, it appears the Fed is achieving what it planned. They wanted higher inflation, and they got it.

When taking into account history, it could be argued that the Fed has an incentive to keep its interest rates low in order to liquidate its debt in real terms.

As Charlie Munger famously said, “Show me the incentives, and I will show you the outcome.”

When the Fed is incentivized to keep rates low and inflation high, we should not be surprised at the outcome we are seeing play out before us.

The question then becomes, “When will the Fed reduce its bond purchasing programs or taper in response to the inflation numbers?”

This past Friday at the Jackson Hole Economic Policy Symposium, Fed Chairman Powell hinted that tapering may come as early as the end of 2021 but will continue its bond purchasing program until the appropriate conditions are met.

“We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2 percent and is on track to moderately exceed 2 percent for some time.”

— Jerome Powell, August 27, 2021

The Fed is making it clear that they won’t be tapering unless they are 100% certain they can do so without causing an impediment to the economic recovery.

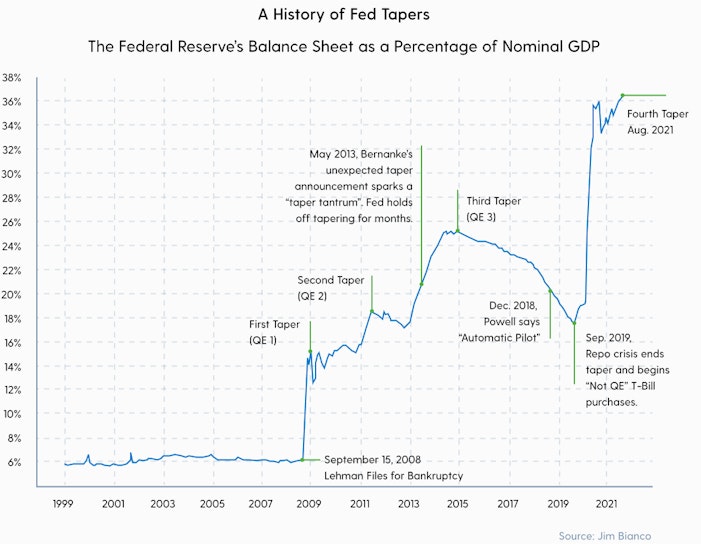

Yet when we look at the Fed’s track record over the last 10 years, every single time they have tried to taper their bond programs, it has resulted in market chaos and a quick return to more QE at the first signs of trouble.

Take a look at the chart below:

This chart shows how every previous taper attempt has led to even more Fed bond purchasing down the road. With debt levels higher today than in the last decade, it is reasonable to conclude that the Fed will have difficulty tapering its QE programs.

Furthermore, if they do taper and markets start to fall, the Fed will be quick to restart their bond purchases once again. Thus, we can expect the financial repression of bond investors to continue.

Economist Jim Grant said it best when he described bonds today as “reward-free risk.” If the Fed decides to taper in response to inflation, then bond prices will fall as interest rates rise. If bond rates fall to around zero or even go negative, then investors are essentially paying to lend their money and/or are receiving little income in the form of interest payments.

If bond rates remain where they are, below the rate of inflation, then bondholders will lose purchasing power in real terms. This is the lose-lose-lose situation that bondholders find themselves in today.

So what can be done about it?

In periods of high inflation, it is prudent for investors to consider divesting from assets like bonds that lose value in such environments. They are better off instead allocating hard assets that are scarce.

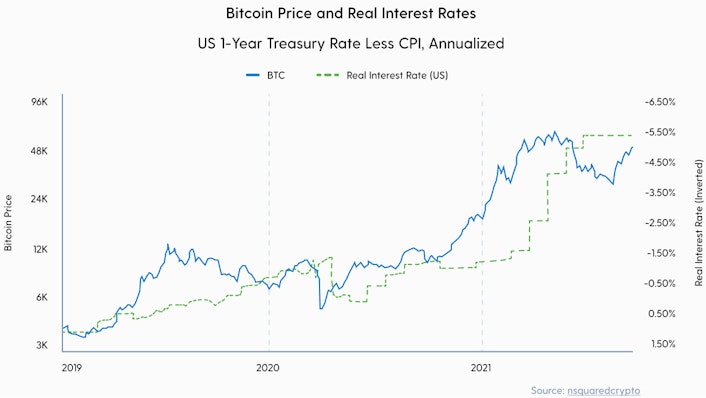

Today, that’s things like real estate, commodities, and Bitcoin. Bitcoin has all the characteristics of an inflation hedge, given its fixed supply of 21 million BTC. This hedging characteristic of Bitcoin is evident when you look at the chart below, which shows a correlation between Bitcoin’s price and real yields.

As the real yield becomes even more negative, Bitcoin’s price rises. This is a loud signal that Bitcoin could make an excellent addition to a traditional portfolio as an inflation hedge.

Bitcoin has returned on average 155% every year, over the last 5 years, well above the current rate of inflation. With this return profile, even a small Bitcoin allocation can make a world of difference for a typical bond investor’s portfolio to hedge against inflation.

Bonds need to be viewed through the lens of the world we’re in today, not what they used to be. We find ourselves in an extraordinary time of historically low rates and rapidly rising inflation. The fact is that bonds are not as safe today as they are marketed to be.

It’s time bond investors begin to protect themselves against the Fed policies leading to erosion of the real value of their bond holdings. They can do so by divesting a portion of their bond holdings into inflationary hedges such as Bitcoin.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?