Tether: The New Big Bitcoin Buyer in Town

Tether has now become a significant, price-insensitive regular buyer of Bitcoin.

Swan Private Insight Update #26

This report was originally sent to Swan Private clients on August 14th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

If you have been closely following the broader cryptocurrency ecosystem, you have almost surely heard of Tether — the controversial USD stablecoin.

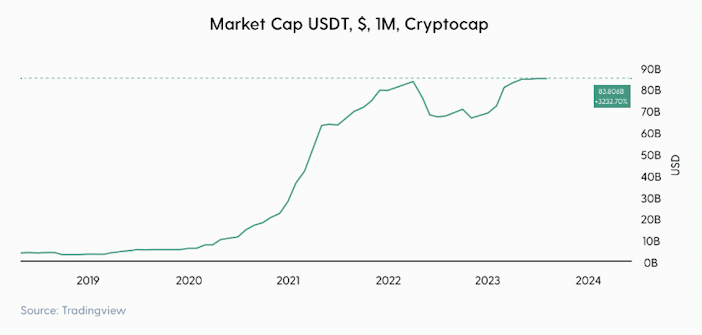

Tether’s market capitalization has exploded from a little over $2 billion in the Spring of 2018 to an astounding $83 billion!

As Tether has grown into a stablecoin behemoth, it has attracted its fair share of supporters and detractors. Some applaud Tether for increasing dollarization worldwide, promoting financial inclusion, and increasing accessibility to dollars in countries with unstable currencies and banking industries. Others believe that Tether is primarily used for illicit activities, and its issuers cannot be trusted due to the lack of transparency around its operations.

Tether has been in the spotlight for its success and dubious history. It is often the target of speculators who theorize that Tether is a ticking time bomb that will soon collapse and bring down the entire ecosystem. Most of the FUD (Fear, Uncertainty and Doubt) revolves around the contents of Tether’s reserves, supposedly backing the amount of Tether (often referred to as USDT) in circulation at a 1:1 ratio. The underlying concern is that these reserves must always match (or exceed) the USDT in circulation for the stablecoin to uphold its claim of being backed by U.S. dollars.

Note: These reserves have never been audited by an independent third party, leading many to question whether all of the dollars are truly present to back the stablecoins in circulation.

Despite the lack of transparency around the reserves and the near-constant speculation around whether Tether’s demise might be imminent, Tether has defied the doubters, continued to meet investor redemptions, and has grown into the largest USD stablecoin in the market today.

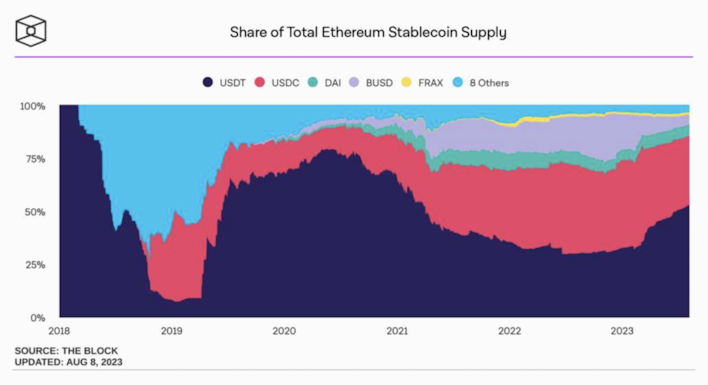

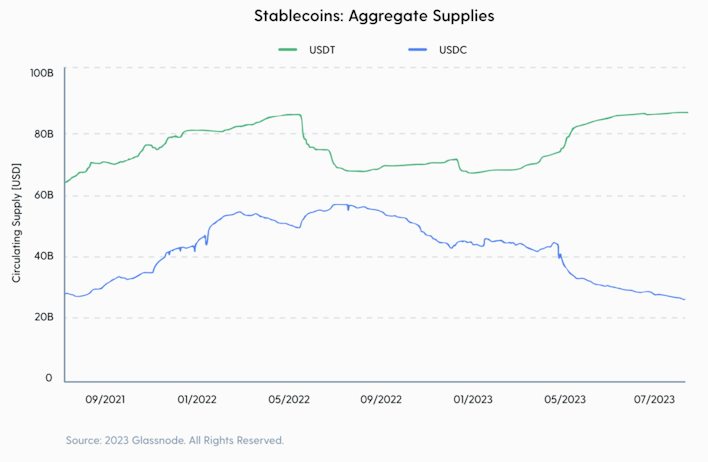

Today, Tether comprises over 50% of the global USD stablecoin market.

In addition, Tether has continued to gain market share since March, when the second-largest stablecoin, USDC, became embroiled in the Silicon Valley Banking collapse. During this event, $3.3 billion of Circle’s reserves were temporarily inaccessible.

Following this debacle, a growing number of investors have chosen Tether, as illustrated by the divergence in market caps since the banking crisis.

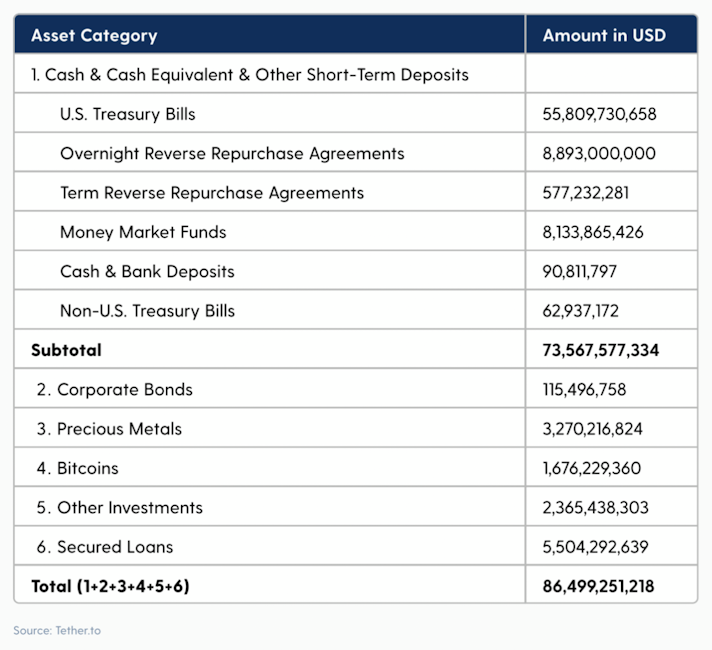

As Tether has grown, it has become an extremely profitable enterprise for the issuer, a powerful player in Bitcoin. Tether makes money by collecting a 0.1% fee per transaction when minting and redeeming USDT. It also brings in massive profits through its investment strategies. Tether takes the actual USD used to mint USDT. It invests a majority into Treasuries and cash-like equivalents. Still, it also invests in other assets, including precious metals and Bitcoin.

Tether’s reserve composition has always been under scrutiny since it settled a lawsuit in 2019 with the New York Attorney General. As part of the $18.5 million settlement, Tether was required to report the composition of its reserves every quarter in self-reported attestations, which it now publishes on its website.

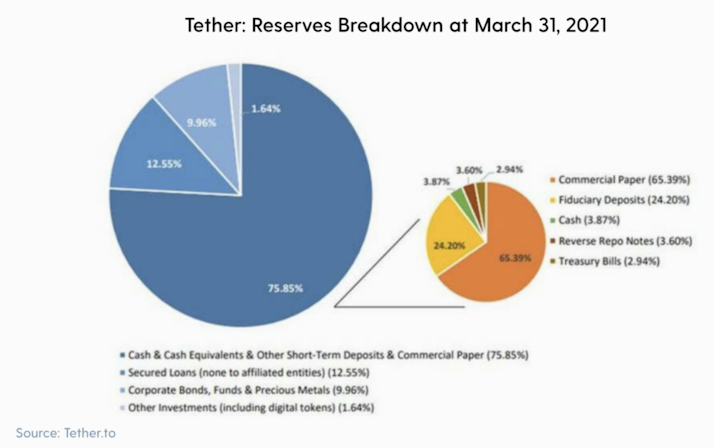

The first snapshot of Tether’s reserves dropped jaws, given the amount of commercial paper held. On March 31, 2021, 49% of its reserves were backed by unspecified, risky commercial paper.

Commercial paper is short-term, unsecured debt issued by companies. It’s not as liquid as Treasuries or cash. It fluctuates with market conditions, which could have made it challenging for Tether to meet redemptions and maintain a full backing of Tether’s circulating supply at any given moment. In addition, Tether did not reveal the ratings of this commercial paper, the borrowers of the loans, nor the collateral backing them.

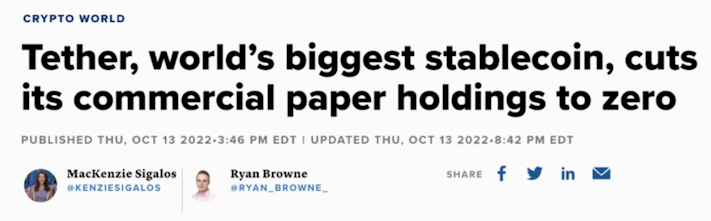

The reaction from the first reserves breakdown led to Tether publicly declaring that it would phase out the commercial paper and replace it with Treasuries. To Tether’s credit, that is precisely what transpired.

In October 2022, Tether revealed that it had reduced its commercial paper holdings to zero.

They decided to sell the commercial paper and replace it with much safer and more liquid T-bills. T-bills now make up a majority of Tether’s reserves.

As Tether sure up its reserves, demand for the stablecoin exploded during the bull market. Hypercharged by the rise of “Decentralized Finance (DeFi), the profits came rolling in. Despite the bear market wreaking havoc on most cryptocurrency industries, Tether’s profits increased. Even though 2022 devastated the entire cryptocurrency sector, Tether’s net profits increased by over $700 million in Q4 2022. It continued to bolster the composition of its reserves by adding more T-bills and ended the year with $960 million in excess reserves.

Excess reserves are the additional funds on hand that Tether has above the required reserves to back its USDT tokens in circulation at a 1:1 ratio to dollars. As Tether continued to make money, its excess reserves continued to rise.

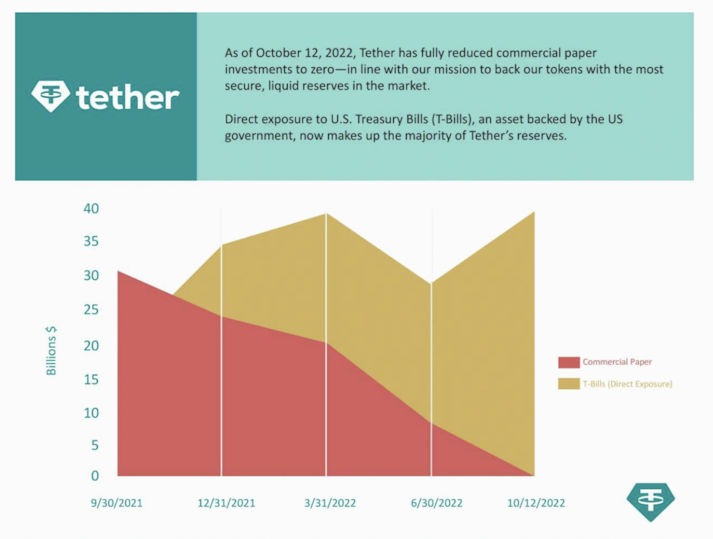

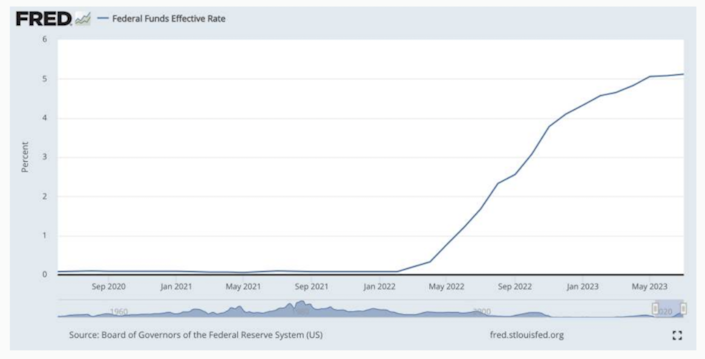

Funny enough, Tether has benefitted handsomely from being pressured to reduce its commercial paper and buy Treasuries in the wake of its NYAG settlement. Ironically, they have been a beneficiary of the Federal Reserve’s actions.

The Federal Reserve interest rate policy over the last couple of years has directly boosted the profits of Tether due to the substantial amount of Treasury bills it holds on its balance sheet as part of its reserves.

As Tether’s excess reserves were invested heavily in T-bills, and the Fed continued to increase the federal funds rate, this only served to pump Tether’s profits even further. Tether now holds around 84% of its reserves in Treasuries. To recap, when investors want USDT, they swap their U.S. dollars for USDT. Tether receives the dollars, turns around, and lends those dollars to the US government for a risk-free 5.25%.

If you listen closely, every time the Federal Reserve raises interest rates, you can hear a bottle of champagne popping at Tether’s HQ.

By the end of Q1 2023, Tether’s profits stood at $850 million, and its excess reserves had ballooned to a whopping $2.5 billion. The beauty of having this excess reserve is that it creates a giant buffer to handle a large wave of redemptions.

The question becomes, what should Tether do with all of its excess reserves? Well, there is one asset that comes to mind… Bitcoin.

As Tether was making nearly $1 billion in profits per quarter, it faced the decision of what to do with these excess reserves. Being self-proclaimed Bitcoiners, the Tether team made a logical choice. On May 17th, Tether announced in a blog post that it would use up to 15% of net realized operating profits to purchase BTC.

“Starting this month, Tether will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin (BTC). Tether anticipates that the current and future BTC holdings in its reserves will not exceed the Shareholder Capital Cushion and will further strengthen and diversify the reserves. As reflected in Tether’s Q1 2023 Assurance Report, as of the end of March 2023, Tether already held approximately $1.5 billion in BTC in its reserves. While it is common practice among many institutional investors to third-party custody their Bitcoin, Tether believes in the philosophy ‘Not your keys, not your bitcoin’ and takes possession of the private keys associated with all of its Bitcoin holdings.” — Tether.to

Tether CTO Paolo Ardoino was quoted as saying, “The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset… “Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential. Its limited supply, decentralized nature, and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike. Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.”

In essence, Tether just became one of the planet’s largest dollar-cost averagers of Bitcoin. Tether will effectively be rolling over some of its profits from the interest earned on its nearly $72.5 billion in T-bills, money market funds, and overnight reverse repos every quarter into Bitcoin. To put this into perspective, Tether is holding more Treasuries than entire countries like Spain and Mexico. Its profits are so substantial that it has become a meaningful buyer in the Bitcoin market due to this new reserve policy.

This buying strategy continued at the end of Q2 when Tether announced over $1 billion in net operating profits, up 30% quarter-over-quarter, and raised its excess reserves to $3.3 billion.

As part of its investment strategy, Tether added 1,529 bitcoin to its balance sheet or $45 million worth in Q2 alone. (Remember, this strategy will persist indefinitely as Tether continues to allocate up to 15% of its operating profits each quarter.)

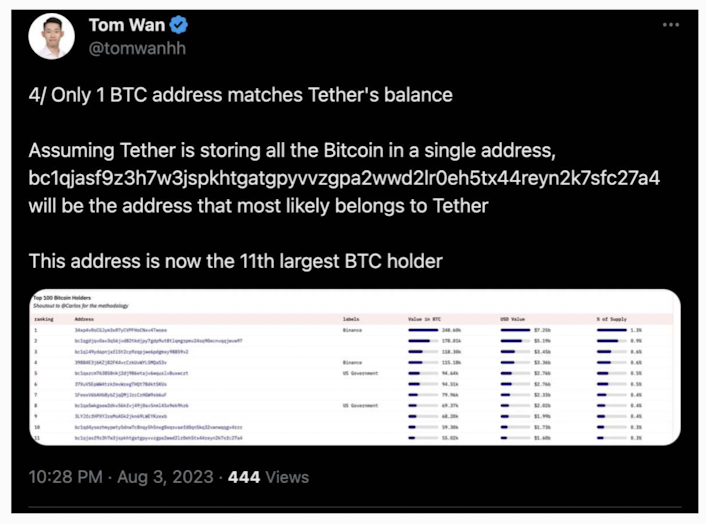

As a result, Tether’s Bitcoin holdings have grown considerably. As of June 30th, Tether now holds approximately 55,000 BTC.

21Co Analyst Tom Wan delved deeper, identifying Tether’s suspected BTC address, and determined that Tether now controls the 11th largest bitcoin address.

The point is, Tether has now become a significant, price-insensitive regular buyer of Bitcoin, joining the likes of MicroStrategy as an institution that acquires sats regardless of the price.

For Bitcoin investors, the prospect of a large institution like Tether consistently purchasing significant amounts of Bitcoin is enticing. But is this a healthy long-term development for Bitcoin?

There are undeniable risks associated with Tether holding such a significant, concentrated Bitcoin position. One example is the risk of Tether being forced to liquidate its position. If Tether faces a large wave of redemptions, it could be forced to sell a portion of its Bitcoin holdings if things took a turn for the worse. Many market participants feel it’s only a matter of time before regulators target offshore USD stablecoin issuers like Tether. If Tether faces regulatory challenges, that creates a lot of uncertainty around its Bitcoin holdings and increases the risk of them being seized or sold off.

While some might draw parallels between Tether buying Bitcoin and the algorithmic stablecoin Terra Luna’s actions before its epic collapse, the situations are vastly different.

Tether’s CTO, Paolo Ardoino, emphasized that Tether uses excess reserves to bolster its already 100% reserve assets, which diversifies and adds resilience to its reserves.

This is very different from Terra Luna, which used Bitcoin as collateral to back its stablecoin before it collapsed.

But let’s assume Tether operates honestly and avoids regulatory repercussions. Is it optimistic that they control so much Bitcoin?

Examining Tether’s history would lead some to answer “yes.”

Tether has never sold its Bitcoin holdings and has consistently demonstrated its commitment to Bitcoin by supporting and investing in the ecosystem.

Tether invests in sustainable Bitcoin mining facility in Uruguary

Tether invests in “Volcano Energy” the largest Bitcoin mining facility in El Salvador

Tether runs the annual Plan B Forum conference in Lugano, Switzerland

Tether launched Synonym to boost Bitcoin adoption through Lightning Network

Tether signed an agreement with the country of Georgia to support Bitcoin development

Tether launches Holepunch, a platform for fully encrypted peer-to-peer applications

Though Tether isn’t flawless, it has demonstrated its dedication to championing Bitcoin, funding Bitcoin education, and investing in Bitcoin infrastructure and development. This work accounts for something, but only time will tell if Tether will continue to be a good advocate for Bitcoin and help drive its adoption forward.

Tether continues to dominate the stablecoin market and has only grown stronger amidst regulatory pressure to be more transparent about the composition of its reserves. Since settling with the NYAG, it has divested all its commercial paper and heavily invested in Treasuries and cash-like equivalents.

Tether has become a prime beneficiary of the Federal Reserve’s monetary policies as interest rates soared on its massive Treasury holdings. We are witnessing a dynamic where a USD stablecoin issuer accumulates profits and uses those gains to steadily purchase Bitcoin every quarter. With the Federal Reserve not planning to cut interest rates any time soon, we can expect Tether to continue buying millions of dollars worth of Bitcoin each quarter for the foreseeable future.

While Tether comes with its share of controversies and risks, it has shown itself to be a staunch advocate for Bitcoin through its various investments and initiatives. Today, Tether’s investment strategy is capturing headlines as it has chosen to allocate to Bitcoin due to its diversification properties and upside potential as an emerging scarce, sound digital money. In the future, Tether, alongside companies like Microstrategy, will be seen as trendsetters.

Fast forward several years and corporations worldwide will follow in these companies’ footsteps, turning to Bitcoin to enhance their investment strategies and safeguard the value of their corporate treasuries.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?