Tell Me About Bitcoin

Preston Pysh is a Swan Advisor.

Bitcoin was created to put a global, digital peg on fiat currency. Since 1971, money around the world has not had a peg. This can work, but not over a long period because governments around the globe will debase their fiat money to create growth through financial engineering. It’s the classic Tragedy of the Commons — only between nations with their fiat money. To date, this has occurred via the bond markets, which now have no yield on a real basis.

I’m sure you’ve noticed that existing fiscal and monetary policies are polarizing social classes globally. This is the result of overusing inflationary economic policies with no monetary peg. Do yourself a favor and Google: Cantillon Effect. Since Bitcoin has a fixed supply of coins and it runs on a decentralized protocol (similar to the Internet Protocol (IP) or Transmission Control Protocol (TCP)), it has been forcing fiat currencies to conform to its rules for ten years now.

Until 1971 productivity and compensation rose in lockstep. After the dollar was removed from the gold standard in 1971, productivity continued at the same pace while compensation went essentially flat. This is the Cantillon Effect at work.

Yes, it is — for now. This is a new form of currency, and the current market capitalization is very low relative to existing fiat currencies. As a result, you get volatile swings. Additionally, the Bitcoin protocol has a four-year cycle based on a game theory incentive structures used to execute fiat currency. This cycle is straightforward, and it’s important to understand why the volatility peaks every four years. To better understand this cycle, please read this paper.

Have you heard the buzzword blockchain?

Imagine if I could send you a digital picture. Once you receive that digital picture, you are the only person who can possess it. You can’t copy it or send a copy of it to another family member. Well, that’s what the Bitcoin blockchain enables. Bitcoin has done this with 21 million Bitcoins.

And before you say that’s not enough units for the entire world, please realize that you can break 1 Bitcoin into 108 units. Or in other words, there are 2,100,000,000,000,000 total units. There will never be any more than that because of blockchain technology.

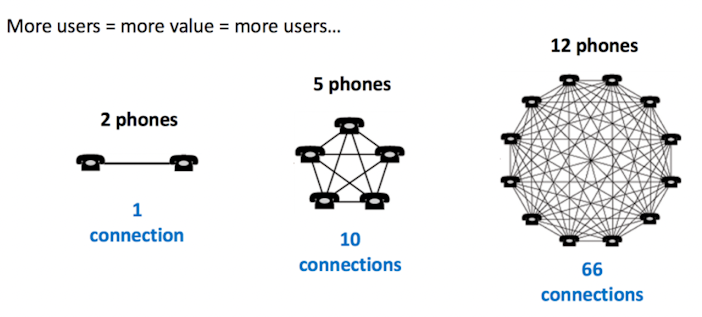

First, remember, bitcoin is an open-source decentralized protocol. When studying how protocols reach mass global adoption, you need to understand network effects over communications channels. Although Wikipedia isn’t a protocol, it can serve as an example.

Anyone could copy the open-source code for Wikipedia, change the name, and then try to adopt new users and overtake Wikipedia as the global source on the internet. This doesn’t happen because of network effects. Bitcoin has the strongest protocol network effect for pegged money.

Here’s an important article highlighting why it’ll likely stay that way.

Have you heard the buzzword blockchain?

During the early years of protocol growth, this was a significant concern. Today, the opposite is occurring. You have state governments like Wyoming already passing legislature to protect Bitcoin holders.

Additionally, countries like Germany, Australia, South Korea, and many more are already passing laws to protect ownership. Here is an hour-long podcast conversation only addressing this question — recorded in 2020.

You know there’s something systematically wrong. The world you knew 20 years ago is not what you have today.

Guess what?

The fiat money, fiscal spending, and inflationary monetary policy are causing it. Future bailouts and a further debasement of fiat currency will only strengthen this trend because it’s applying more of the same policies that brought us to this point. Bitcoin is the answer to this runaway global policy and broken incentive structure.

No single-paged paper will answer the depth of questions you have. Here is a great resource that’s organized to help answer any questions you might have:https://tinyurl.com/btc-resource

Find Preston Pysh on Twittter at @PrestonPysh

Download this document at: https://tinyurl.com/Bitcoin1pager

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Preston Pysh

Preston Pysh is a Swan Advisor.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?