Swan Signal Monthly: November 2020 Newsletter

Bitcoin has undoubtedly made improvements since 2017: Better onramps, custody solutions, new-Bitcoin only companies, the Lightning Network, and more. However, a story in 2020 is how the world around Bitcoin has changed.

Welcome to the November 2020 edition of the Swan Signal monthly newsletter.

In this month’s letter:

Liftoff: a short essay on an important topic

A curated list of recent Bitcoin content

Behind-the-scenes updates from the Swan team

Bitcoin has undoubtedly made steady incremental improvements since 2017, such as more users, better onramps, improved custody solutions, new bitcoin-only companies, more education, improved scalability, Lightning Network development, and more. However, the big story in 2020 is how the world around Bitcoin has changed.

Here are 5 ways this bull market is different than in 2017…

M2 Money supply is increasing rapidly of late

In 2017 the economy seemed stable, unemployment was low, and the future seemed bright. Everything changed with the events in 2020, leading to 20% of all dollars in existence being printed.

When more dollars flood into the system, the purchasing power of each unit must decline. For investors, currency devaluation means taking a defensive position with scarce assets like gold.

However, everyone is starting to realize that Bitcoin is better than gold and more practical in a digital society. Rick Rieder, the CIO of Black Rock (the world’s largest asset manager), says, “Bitcoin is taking some of gold’s place.”

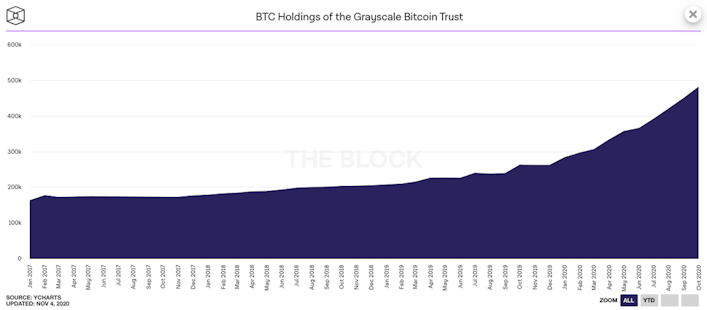

#2 A New Class of Investors (The Rise of GBTC)

Grayscale now holds over $10B worth of Bitcoin in their institutional-friendly investment vehicle. Investors like it because it’s available in tax-advantaged accounts and can be acquired through mainstream brokers like Fidelity.

While Greyscale is an inefficient (expensive) way to acquire BTC, the demand is exploding. This speaks to a new class of investors entering the market.

Most millennials and “crypto-natives” prefer buying BTC outright from places like Swan so they don’t have to pay the high fees and premiums of GBTC. However, many companies, institutions, and individuals are desperate to get exposure to Bitcoin, so they’re willing to pay the premiums.

#3 Corporations Have a lot of Cash and They’re Starting to Buy Bitcoin For Their Treasury

MicroStrategy’s stock price after it started buying Bitcoin

In August of 2020, Michael Saylor, the CEO of the billion-dollar enterprise software company MicroStrategy, announced they were converting their corporate treasury to Bitcoin. Since then, their stock has increased by over 275%.

Corporate treasuries around the world have noticed. Quickly after, Square announced a $50M allocation to Bitcoin. Currently, over 4% of the outstanding BTC supply is owned by corporate treasuries.

The big players haven’t even started to move in yet. Apple alone has $200B in cash on its balance sheet, which is over half the entire market cap of Bitcoin. Even if corporations dip their toes in, Bitcoin’s price will skyrocket.

#4 Square and PayPal Alone Buying Most of the New Bitcoin Supply

Square’s Cash App has seen exponential growth in Bitcoin sales throughout 2020 with no signs of stopping. In Q4 2020, PayPal began selling Bitcoin to their ~300M customers. Square and PayPal alone are buying most of the new supply entering the market.

In 2017 the Bitcoin protocol issued 1,800 new BTC per day. In 2020, the protocol was only issuing 900 BTC per day due to the programmed supply issuance schedule.

Less new supply entering the market and increased demand in 2020 means that basic supply and demand forces will increase prices.

#5 Bitcoin Has Been De-risked

Those who pitched Bitcoin in 2017 received scrutiny from peers and faced severe career risk which made it easy to dismiss Bitcoin

Since then, we’ve seen the U.S. Office of the Comptroller of the Currency (OCC) declare national banks can legally custody Bitcoin.

U.S. Congressman Patrick McHenry said, “Bitcoin is an unstoppable force.” Legendary Investors like Paul Tudor Jones and Stan Druckenmiller are going on national television explaining why they’re investing in Bitcoin. Citibank Analyst calls a $300k Bitcoin price by 2021. And, of course, major corporations and banks such as Square, Visa, IBM, and Fidelity are investing in Bitcoin projects.

These combined events have effectively de-risked Bitcoin as an asset. This monumental shift led to larger pools of capital entering the space.

We’ve pulled together some great Bitcoin content from around the web for you…

Bitcoin is Winning The Covid-19 Monetary Revolution by Niall Ferguson

One of the world’s leading economic historians, Niall Ferguson, gives historical context to Bitcoin’s rise as an alternative money.

The Investors Podcast

Swan advisors Robert Breedlove and Preston Pysh explore Bitcoin and money from first principles. A perfect introduction for the Bitcoin curious.

Share this one far and wide.

Bitcoin Tidbit: What is the “Bitcoin market cap?…”

“Market Capitalization” is the best way to measure the total value stored in Bitcoin. To calculate market cap, multiple the unit price (~$19K) x the outstanding supply (~18.5M) which gives you a Market cap of about $350B. In November 2020, Bitcoin broke the previous all-time high market cap of $330B from back in 2017. Very impressive growth in only 12 years, however, Bitcoin’s market cap is still 50x smaller than gold. Lots of room for growth.”

Bitcoin is Fourth Turning Money w/ Brandon Quittem on What Bitcoin Did

Breaking down the Fourth Turning thesis, demographics, cycles in history, and how Bitcoin acts as an instituion to rally around during a crisis period.

Bitcoin at 12 (Years Old) by Nic Carter

Written for the 12th anniversary of the Bitcoin Whitepaper’s publication, this piece captures the spirit of why so much intellectual capital rallies around Bitcoin

Swan Signal Live 36: Marty Bent and Alex Gladstein

Election day special! Join us for a discussion about democracy, freedom and how Bitcoin is used as a tool to defend individual privacy.

Our Most Brilliant Idea by Robert Breedlove

A must-read. Markets enable trade and specialization which increases idea generation that leads to wealth creation. Robert explains how markets work much better when operating on a sound money standard.

Swan Signal Live 37: Robert Breedlove and Brandon Quittem

Deeply philosophical discussion spanning a wide range of topics including historical cycles, order vs entropy, Bitcoin as a moral obligation, Bitcoin and property rights, and how free markets are a positive force in the world

Behind the Scenes at Swan

Swan had another record-breaking month in terms of new customer signups and total Bitcoin acquired by customers 🚀

Robert Breedlove expanded his role at Swan! Robert is the CEO of Parallax Digital and a well-respected writer in the Bitcoin space. In addition to his role as an advisor, Robert will be publishing monthly articles on the Swan Signal blog.

Phil Gibson joined the support team at Swan. He’s helping onboard new Swan customers and crushing support tickets. Phil also hosts a Bitcoin podcast called A Boy Named Pseu.

Swan is now accepting wire transfers directly from your Swan Dashboard.

Swan is adding the ability to buy now soon. Sign up here for early beta access.

Thank You!

Both Swan and Bitcoin are at the beginning of something great. We really appreciate your support.

As always, you can head to your Swan Dashboard to increase your plan size, setup auto-withdrawals, and wire funds for one-time purchases.

Thanks,

The Swan Team

P.S. Have friends and family who are curious about Bitcoin?

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brady is a frequent guest on Bitcoin media such as Bitcoin Magazine, Bitcoin Rapid Fire, Bitcoin Audible, and Crypto Cousins. He also hosts two well-known Bitcoin podcasts, Citizen Bitcoin and Swan Signal Live.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?