Swan Signal Monthly: January 2021 Newsletter

Bitcoin hit a new all-time high of $42,000 in early Janurary and has since pulled back to $33,000. Is this a buying opportunity?

Welcome to the January 2021 edition of the Swan Signal monthly newsletter. Bitcoin hit a new all-time high of $42,000 in early January and has since pulled back to $33,000.

Is this a buying opportunity?

Read on to find out.

Ready to start investing in Bitcoin?

You can get started through SwanBitcoin.com today. New users can make one-time buys OR set up an automatic recurring purchase plan (ex: $50/week).

In the meantime, we hope you find our monthly Bitcoin newsletter valuable!

In this month’s letter:

Liftoff: a short essay about Bitcoin

A curated list of recent Bitcoin content

Behind-the-scenes updates from the Swan team

Bitcoin is trading at $33,000 at the time of publication. This is down 22% from the recent all-time high of around $42,000. Should we be worried?

No, we should not be worried. In fact, it’s healthy to see pullbacks in a bull market.

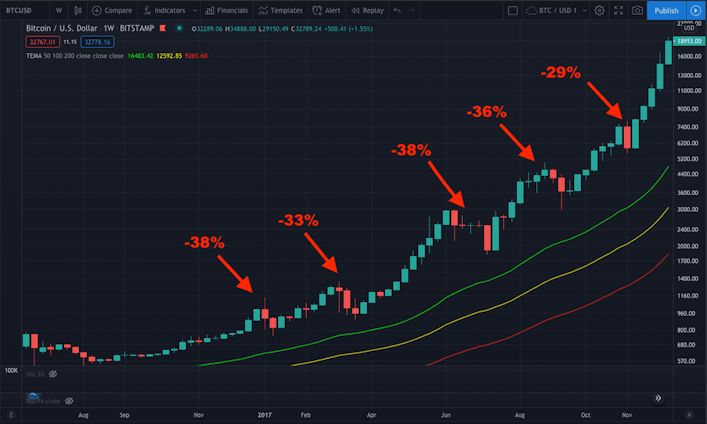

For some historical context, Bitcoin rose from $1,000 to $20,000 in 2017, and during that run, we saw five ~30% pullbacks. Buying during those pullbacks turned out to be wise moves.

Swan customers have been buying this dip in earnest 💪

We’ve noticed that any time the Bitcoin price drops by 5 — 10%, existing Swan customers log into their dashboard and make on-time buys. In fact, our biggest volume days are when the price dips 🙂

As a reminder, our new “buy instantly” feature is available for all Swan Customers.

Swan customers aren’t the only ones buying this dip…

In fact, we’re seeing increased institutional investors buying Bitcoin like never before.

Harvard, Yale, and other University endowments have been quietly buying Bitcoin for over a year.

Ray Dalio said, ‘Bitcoin is one hell of an invention’ and is considering adding BTC to a new fund he’s creating.

Michael Saylor, CEO of MicroStrategy, is teaching thousands of C‑level executives how to put Bitcoin on their balance sheet on February 3rd.

The world’s largest asset manager, Blackrock, is offering their clients exposure to Bitcoin.

Anthony Scaramucci of SkyBridge Capital launched a new Bitcoin fund and said, “Bitcoin is better at being gold than gold is at being gold.”

Over $40b worth of Bitcoin is sitting on Corporate Balance sheets, and more to come.

Elon Musk just said, “Bitcoin is really on the verge of getting broad acceptance by conventional finance people.” Wonder if Tesla is quietly accumulating BTC?

In other words, there’s a wall of institutional money buying Bitcoin now, and the future looks very promising.

Get started buying Bitcoin today by setting up an account at SwanBitcoin.com.

Swan Customers can buy Bitcoin in three ways:

Buy Instantly with your linked bank account

Wire Transfer for larger purchases (between $5k and $10m)

Set up an automatic recurring purchase plan (ex: $500/week)

Start Investing in Bitcoin with Swan

“I stack like a gangster on Swan. Easy, lowest fees around. The ‘Smash Buy’ feature puts Coinbase and Cash App to shame. Auto-withdrawing my multisig cold wallet gives me peace of mind. Fantastic!”

Max Keiser

Swan is the easiest and safest way to accumulate Bitcoin.

We’ve pulled together some great Bitcoin content from around the web for you…

Deep dive into Bitcoin, the history of Gold, and the past, present, and future of banking in a Bitcoin world.

Stoneridge Asset Management recently launched a Bitcoin fund. They recently published their 2020 annual shareholder letter describing their Bitcoin thesis. They’re incredibly bullish on Bitcoin.

Vijay Boyapati “Bitcoin 101” on What Bitcoin Did Podcast

Vijay is one of the best at articulating the value proposition of Bitcoin. This is a perfect episode for beginners, be sure to pass along to your friends and family.

Bitcoin Tidbit: What is a “pseudonym?”

A pseudonym is a fictitious name that a person or group assumes for a particular purpose. Bitcoin’s creator used the pseudonym “Satoshi Nakamoto” to conceal their identity. There is a misconception that Bitcoin addresses are anonymous, however in reality they’re pseudonymous.

Swan is dedicated to producing great content to educate and raise awareness about Bitcoin. Our blog, Swan Signal, features thoughts and opinions on Bitcoin from the Swan team and industry experts.

Our weekly live broadcast, Swan Signal Live, pairs notable guests for compelling discussions about Bitcoin and economics. The live broadcast is then published as audio on the Swan Signal Podcast feed. Subscribe to receive new episodes.

Swan Signal Live 45: Lyn Alden and Jeff Booth

Great discussion on technology as a deflationary force, long-term debt cycles, and Bitcoin as a solution to unpayable sovereign debt.

Swan Signal Live 46: Preston Pysh and Andy Edstrom

A lively discussion on the latest in Bitcoin, macroeconomics, and finance. There’s a reason these two >guys are regulars on the Swan Signal Live show 🙂

Why Bitcoin is not a Ponzi Scheme by Lyn Alden

Lyn Alden methodically breaks down why Bitcoin is NOT a ponzi Scheme in a recent guest post on the Swan Signal blog. Lyn is known for her sharp wit and unmatched clarity in her writing.

Sovereignism Part 1: Digital Creative Destruction by Robert Breedlove

Robert explores the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age.

Behind the Scenes at Swan

Swan hit another record-breaking month in terms of new members and total Bitcoin bought 🚀

Product Update: all Swan customers can choose between buying Bitcoin instantly OR setting up an automatic recurring purchase plan.

Clubhouse: Swan team has been hosting bitcoin rooms on Clubhouse, join our club Café Bitcoin to be notified of future events.

Facebook: we launched a new Facebook group “Cafe Bitcoin” to help educate people about Bitcoin. Join the group and invite your friends!

Robert Breedlove joined the Swan Team! Robert is the managing director of Swan Private which helps corporations and high net worth individuals build generational wealth with Bitcoin. Stay tuned for the Swan Private public launch.

Swan Bitcoin Advisor, Max Keiser, just launched a newsletter called the “Daily Dose.” If you like Max, you’re going to love this. Sign up here

Swan Force has grown to over 2,500 members! Join Swan Force to get paid to recruit Bitcoiners. When you recruit someone to Swan, you’ll earn 25% of all Swan fees for 3 years.

Thank You!

Wow. The energy surrounding Bitcoin (and Swan) is explosive right now.

2021 is poised to be an incredible year and we’re so glad to fly alongside you. 🦢

As always, Swan is here to ensure investing in Bitcoin is easy, fast, and safe. Click here to get started today!

Thanks,

The Swan Team

P.S. Feel free to reach us at SwanBitcoin.com/support.

P.P.S. As part of our commitment to education, we’re offering you and your friends a free copy of Inventing Bitcoin by Yan Pritzker. Share this link around!

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brandon is an entrepreneur, writer, speaker, and passionate Bitcoiner. His articles have been read by more than 2 million people online. Most well known for exploring the parallels between bitcoin and mycelium.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?