Swan Signal Monthly: December 2020 Newsletter

Earlier this month Bitcoin broke through the all-time high price, and psychological barrier of $20,0000, driven by short-term retail trader speculation.

Welcome to the December 2020 edition of the Swan Signal monthly newsletter. Bitcoin broke new all-time highs this month and all signs point to explosive price action ahead.

We’re thankful for your willingness to take a chance on a fledgling company this year and we hope we have served you well. Thank you for being an early Swan adopter, it means so much to us.

Many of our members are taking advantage of our newly supported Buy Instantly feature. We’re also supporting wires of $2,500 to $10,000,000 if you’re looking to make a big buy before the end of the year. Check these out on your Swan dashboard.

Check out your Swan Dashboard

Before we dive in, we just want to remind you that, as part of our commitment to education, we’re offering a free copy of Inventing Bitcoin by Yan Pritzker. The book is a great introduction to the Bitcoin system, highly rated on Amazon, and often recommended by Bitcoiners. Share it with friends and family over the holiday season!

We’ll follow up with more Bitcoin education and some notes on why Swan is a great way to start stacking.

In this month’s letter:

Liftoff: a short essay about Bitcoin

A curated list of recent Bitcoin content

Behind-the-scenes updates from the Swan team

Earlier this month, Bitcoin broke through the all-time high price and psychological barrier of $20,000.

The 2017 bull run where Bitcoin reached $20,000 was driven by short-term retail trader speculation. These traders were driven by the fear of missing out (FOMO) on USD gains.

As we’ve discussed many times here in the Liftoff, the investors we’re seeing buying up a lot of Bitcoin right now are fundamentally different.

These investors seem to be buying Bitcoin to hold for the long term (HODL). Both individuals and corporations are feeling the fear of missing out on the adoption of Bitcoin as a reserve asset.

While we saw speculative USD-based FOMO during the last bull run, during this run, we are witnessing the beginnings of BTC-based FOMO (we call it HODL FOMO).

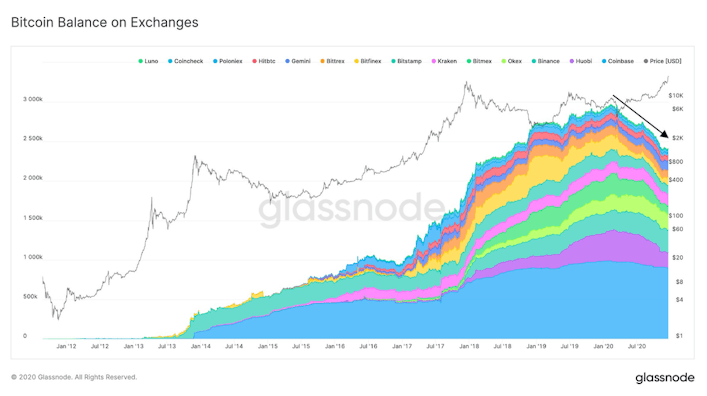

The big buyers realize there are only 21M Bitcoin and they don’t want to be left behind in a race to accumulate their own position. In the following chart, you can see this HODL FOMO phenomenon in a historical context. As the price started to run up from March 2020 low, you can see Bitcoin held on exchanges dropped precipitously.

Why? Large investors, companies, and institutions started taking large positions in Bitcoin, such as Paul Tudor Jones, Stanley Druckenmiller, MicroStrategy, Square, MassMutual, Guggenheim, and more.

These investors are not leaving Bitcoin on exchanges in hopes of trading them for USD at a higher price, as investors did in 2017. They are taking their Bitcoin off the market to hold for the long term in fear of letting their competitors front-run them and missing this opportunity to buy and hold Bitcoin as a reserve asset at these relatively low prices.

The consequences of this trend, should it continue, could be shocking. As Bitcoin available on exchanges dries up, the supply shock could make the Bitcoin price shoot up very quickly until sellers are willing to part with their Bitcoin again.

As this cycle continues, Bitcoins that become available at higher prices are bought up by investors looking to sweep them off the market into cold storage, creating another supply shortage, and so on.

With few sellers and increasing demand driven by HODL FOMO, we could see Bitcoin prices that surprise us all. We will continue to watch this trend.

“When you come across this kind of customer service experience, you’ve made a fan for life… Swan is the only platform I will recommend from now on.”

“Yeah, [Swan] has consistently proven to be solid. I’m a customer for life… building them into my regular habits was easy and is helping us build generational wealth.”

Swan is the easiest and safest way to accumulate Bitcoin.

We’ve pulled together some great Bitcoin content from around the web for you…

Niall is an author, historian, and economist who recently became bullish on Bitcoin. Learn about the history of money, the rise of Bitcoin, and what the financial future holds.

Congressman Warren Davidson on Noded Podcast

Hear what a Bitcoiner in Congress thinks about political philosophy, the legislative process, regulatory actions, and monetary economics as they relate to Bitcoin holders and node operators.

Vijay Boyapati “Case for Bitcoin” on The Investor’s Podcast

The author of “The Bullish Case for Bitcoin” breaks down Bitcoin fundamentals. Learn how money evolves, why Bitcoin matters, and Vijay’s long term price targets. Beginner friendly.

Bitcoin Tidbit: What is the “Bitcoin Blockchain?”

The blockchain is a public record of Bitcoin transactions in chronological order. It’s shared among all Bitcoin users so everyone can verify that all transactions are valid.

Swan is dedicated to producing great content to educate and raise awareness about Bitcoin. Our blog, Swan Signal, features thoughts and opinions on Bitcoin from the Swan team and industry experts.

Our weekly live broadcast, Swan Signal Live, pairs notable guests for compelling discussions about Bitcoin and economics. The live broadcast is then published as audio on the Swan Signal Podcast feed. Subscribe to receive new episodes.

Lively discussion of recent Bitcoin news including Niall Ferguson’s resounding endorsement of Bitcoin, Guggenheim Investments eyeing a $530m BTC position, future government actions towards Bitcoin, and more.

Hear from two deep thinking Bitcoiners as they discuss why making regular recurring Bitcoin buys is so important to them, Bitcoin’s user experience, and the moral failings of fiat currency.

Three Bitcoin podcasters discuss Microstrategy’s recent move to raise debt to buy Bitcoin, the looming Bitcoin shortage on exchanges, and Bitcoin vs Gold.

Join former Wall Street legends discussing the fiat collapse, Bitcoin as “the big long, ” game theory of Bitcoin, Bitcoin narratives, and how the world economy is changing.

Behind the Scenes at Swan

Swan had yet another record-breaking month in terms of new members and total Bitcoin bought

We launched one-time buys for all Swan customers! Head to your Swan dashboard to buy instantly with ACH.

For larger purchases between $2,500 and $10,000,000 you can wire money from your bank to your Swan account. Your funds will be available to purchase Bitcoin within 24 hours.

Zane Pocock joined the Swan Team! Zane is an excellent writer, technically savvy, and a talented marketer.

Swan Force has grown to over 1,200 members! Join Swan Force to get paid to recruit Bitcoiners. When you recruit someone to Swan, you’ll earn 25% of all Swan fees for 3 years.

Help your friends and family learn about Bitcoin by sending them Yan Pritzker’s book Inventing Bitcoin (FREE).

Thank You!

What an exciting time to be in Bitcoin! Both Swan and Bitcoin are growing fast and we couldn’t do it without your support.

Any questions about Swan or Bitcoin more generally? Our growing support staff loves answering your questions 🙂

Feel free to email us at support@SwanBitcoin.com.

Once more, we want to express our deep gratitude for you and all our Swan members. Together we can help bring about a bright orange future just a little bit faster.

Thanks,

The Swan Team

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brandon is an entrepreneur, writer, speaker, and passionate Bitcoiner. His articles have been read by more than 2 million people online. Most well known for exploring the parallels between bitcoin and mycelium.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?