Swan Signal Monthly: August Newsletter

Business intelligence software company MicroStrategy, a public company traded on NASDAQ, announced in August that it has adopted Bitcoin as its primary treasury reserve asset.

Welcome to the August 2020 edition of the Swan Signal monthly newsletter.

This month’s letter includes:

Liftoff: a short essay on an important topic

A curated list of recent Bitcoin content

Behind-the-scenes updates from the Swan team

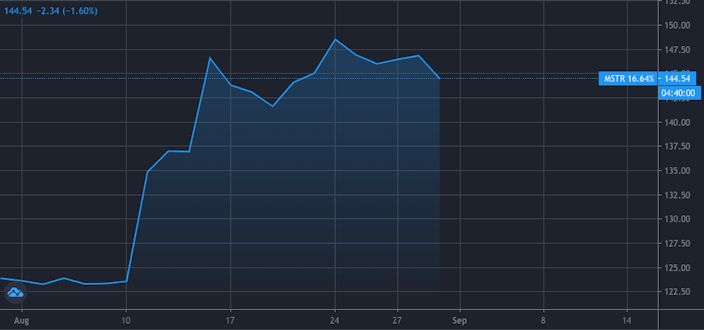

MicroStrategy bought $250 million worth of Bitcoin, a staggering 21,454 Bitcoins, or 0.1% of all the Bitcoins that will ever exist. MicroStrategy’s stock shot up 16% on the news and has sustained the gains over the past three weeks. That kind of price increase was undoubtedly noticed by CEOs of other public companies. Two of the company’s biggest shareholders, Black Rock, the largest asset manager in the world, and Vanguard, the largest provider of mutual funds in the world, certainly took notice as well.

Microstrategy’s stock price shot up 16% after the news.

This news comes on the heels of investors like billionaire Paul Tudor Jones revealing significant investments in Bitcoin. When more prominent players begin to get in the game, it gives validation to other wealthy players to do the same. We expect more news like this in the coming months.

Forbes made clear the meaning of MicroStrategy’s move.

One reason Bitcoin is so interesting is that it is readily accessible to anyone. It is an internet-based protocol for the transfer of value. Imagine being able to buy a piece of the early HTTP protocol that runs the Web. That would have accrued an incredible amount of value over the years. It’s still early. You can start accumulating Bitcoin right now before more corporations and big investors get in the game.

We have noticed a lot of customers increasing their plans lately. We just increased our per-purchase limit to $10,000. You can increase your plan anytime; just head over to your dashboard.

We’ve pulled together some of the best Bitcoin content from this past month for you.

Game Theory: Either You Play, or You Lose by Mark Moss

Corporations are putting BTC on their balance sheets. Mark uses game theory to explore the implications.

Sylvain Saurel: HODL is boring. And that’s why it works by Sylvain Saurel

Why good investments should feel boring and why regular recurring buys are the best way to accumulate Bitcoin.

Why MicroStrategy adding BTC to their corporate balance sheet is very bullish for Bitcoin. Bitcoin discussion begins at the 1:05:42 mark.

“Hodl” is a popular meme that refers to simply accumulating bitcoin rather than trading it. It originated from a famous 2013 post on the Bitcoin Talk forum where a user misspelled “holding.” The Bitcoin community quickly adopted the phrase and it has become one of the most used memes in Bitcoin. What started as a simple typo has become a rallying cry to hodl bitcoin for the long-term.”

On the Brink Podcast with Ray Youssef

Anexciting look into Bitcoin’s rapidly growing peer-to-peer usage in developing countries. Ray is bullish on Africa widely adopting BTC sooner than later.

Raoul Pal on Stephan Livera Podcast

Raoul Pal of Real Vision argues the merits of dollar cost averaging into Bitcoin, a favorable risk-to-reward ratio, and how market conditions have created the “perfect storm for Bitcoin.”

Swan is dedicated to producing great content to educate and raise awareness about Bitcoin. Our blog, Swan Signal, features thoughts and opinions on Bitcoin from the Swan team and industry experts.

Our weekly live broadcast, Swan Signal Live, pairs notable guests for compelling discussions about Bitcoin and economics. The live broadcast is then published as audio on the Swan Signal Podcast feed.

How central banking steals human time and corrupts human values, Nassim Taleb’s ideas, ancient wisdom, and the world’s future under a Bitcoin standard. Robert: “I do think we are in the early stages of a currency collapse.”

Monster episode where we cover gold, central banking, the devaluation of currencies, and how Bitcoin is going to suck value out of every other store of value. Saifedean: “Bitcoin is the way we euthanize the fiat standard, peacefully.”

Preston and Andy get extremely bullish on Bitcoin’s prospects for the next 18 months and over the long term. Andy: “It’s hard to see what the major risks are in the long-term.”

We just increased our per-purchase limit from $5,000 up to $10,000. You can increase your Swan plan here.

Daily buys are scheduled to go live in September (sign up here for Beta Access)

We welcomed Gigi (@dergigi) to the Swan engineering team (article and live stream announcement). Gigi is a widely respected Bitcoiner and author of 21 Lessons: What I Learned from Falling Down the Bitcoin Rabbit Hole. He has extensive software engineering and management experience. We’re excited to have him on the squad!

Our weekly Swan Signal Live video and podcast format is growing rapidly. We carefully pair two guests, leading to unique insights not found anywhere else. SSL airs on Twitter, Facebook, YouTube, and Twitch, or you can listen to the audio podcast at swansignalpodcast.com

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brady is a frequent guest on Bitcoin media such as Bitcoin Magazine, Bitcoin Rapid Fire, Bitcoin Audible, and Crypto Cousins. He also hosts two well-known Bitcoin podcasts, Citizen Bitcoin and Swan Signal Live.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?