Coronavirus, Financial Crisis, and the Epic Bitcoin Crash of March 2020

A roundtable conversation about the current epidemic chaos and how it will impact Bitcoin, the global financial system, remote working, and more.

John Vallis, Guy Swann, Gigi, and Hass McCook joined Swan Bitcoin team members Cory Klippsten, Yan Pritzker, and Brady Swenson to sound off on the current epidemic chaos and how it will impact Bitcoin, the global financial system, remote working, and more. (This conversation occurred on March 13, 2020.) You can also listen to the full conversation on the Swan Signal podcast or watch it on the Swan YouTube channel.

John Vallis (host of Bitcoin Rapid Fire Podcast Show): My biggest regret is not having that much dry power because I’ve been bullish for so long. Such a big drawdown makes me think, “What’s happening in the world? Are we turning a corner? Are we entering a new stage?”

Hass McCook (civil engineer with an MBA from Oxford who now focuses on Bitcoin): With Bitcoin, as in nature, everything goes back to the mean. The trick is auto DCA (Dollar Cost Averaging); that’s it.

It crashed, that’s fine. Do you still believe in it, though?

Do you still believe in it today like you believed in it yesterday?

Many people, especially newbies, are panicking because, psychologically, it’s not easy to be down such a big sum. Some people, for example, lost 25 — 50% of their net worth. That’s pretty rough. If you’re somebody that hasn’t been around for six years, you could start thinking, “Maybe the world isn’t ready for this.” But if you still believe today what you felt yesterday, then believe it tomorrow, and just auto DCA.

“The trick is auto DCA (Dollar Cost Averaging); that’s it. If you still believe what you believed yesterday today, then believe it tomorrow, and just auto DCA.”

— Hass McCook

Gigi (Bitcoin author and curator of bitcoin-resources.com): I wholeheartedly agree with what Hass is saying: If you want to stay sane, just auto DCA. Don’t look at the price. I stopped looking at the price around two years ago. I don’t care about the price movements that much.

As far as I’m concerned, Bitcoin is still Bitcoin. Nothing has changed in cyberspace. It’s still producing blocks every 10 minutes, and it’s only in the financial system that we’re experiencing this tsunami. Obviously, it’s one of the biggest pandemics we’ve seen so far, and it’s a crazy, crazy time. But nothing happened in cyberspace; Bitcoin is still marching on as strong as ever.

Brady Swenson (Head of Education for Swan Bitcoin and host/creator of Citizen Bitcoin podcast): Tick tock, next block.

John Vallis: I’m almost envious of people entering the space over the next 12 months. We’ve got the battle scars from being in space for three or more years. We’ve made all the mistakes, lost money, went through the emotional rollercoaster. Someone that enters today should get educated, develop their conviction, understand what this is, what it could be, and just auto DCA. Don’t make it a big part of your life; just have it running in the background and keep accumulating. Have that zen perspective, and then it doesn’t have to be this crazy thing that you’re obsessed with all the time. It’s your bet on the future. Let it happen; you don’t need to worry too much about it. I wish that was my approach from the beginning, but I’ve made all the silly mistakes.

Brady Swenson: Once you move past the price obsession, then you can just get obsessed by all the intellectual stimulation that Bitcoin’s about to drop on your ass.

Gigi: I’m not even sure if it will be easier for the people entering now. Bitcoin still has the potential to swing so insanely hard that I think it will be tough to stay calm and auto-DCA once Bitcoin takes off. We’re going to start hitting a new all-time high. On a longer time horizon, it’s obvious that the fiat currencies will depreciate in Bitcoin terms. And I think we all believe that to a degree of virtual certainty. I think all surprises in Bitcoin will continue to be on the upside.

Guy Swann (OG Bitcoiner and host/creator of The Cryptoconomy podcast): I’m literally all over the place. I went from panicked to exuberant to really, really panicked to just so jacked, like somebody was pushing me into the UFC ring. I haven’t had an auto DCA method before Swan Bitcoin.

Gigi: You haven’t experienced Bitcoin Zen yet; that’s the problem.

Guy Swann: I searched quantum computing in Google and sorted by date, and I was just like, what was causing this?

I basically came to the conclusion that tick tock, next block. None of that had changed. Monetary policy is the same. All that panic went away. I was like, “This shit’s on sale.” I went desperately hunting for fiat anywhere.

Cory Klippsten (Founder of Swan Bitcoin and GiveBitcoin): I don’t think that you’re ever going to get away from the financialization of this asset. Humans do that because their incentive is to do so. So you have to build something anti-fragile, or at least robust through those actions.

Gigi: What I find fascinating is how quickly public opinion changed. Some of the Bitcoiners were sounding the alarm starting almost two months ago. And people who understand exponentials and how these things tend to grow saw it coming and were sounding the alarm, and nobody took them seriously.

Everyone was like, “You’re insane, ” and “Why are you inciting panic?”

Now suddenly, everyone is panicked and a coronavirus expert. It’s weird how quickly this happened. So, in my opinion, it’s also an applied exercise in exponential growth. So that’s why I think it’s insanely interesting to watch all this.

John Vallis: The Bitcoin drop, I’m not fazed by it at all. It’s just what Bitcoin does, and yes, it can be an emotional rollercoaster, but my faith wasn’t tested. We’re turning a corner, and the scenario that we’ve all been talking about for the last several years, basically since ’08, seems to be coming to fruition now, with the virus as a catalyst. It feels like we’re at the beginning of this crazy period of uncharted territory.

Guy Swann: I think we actually have an advantage with Bitcoin. The markets are going to bleed for a long time. The legacy markets are going to be hurting. It looks like we found our bottom in 24 hours. Knock on wood, knock on wood, knock on wood. There’s a huge swath of people that were just buying everywhere. I know I was part of that. The whole legacy market is fluff on top of fluff on top of promises on top of liabilities.

Hass McCook: People may not have jobs to stack stats. So I think everyone’s going to be in for a rough ride. Probably not to the point where we’re all selling apples, but this will probably be more like the Great Depression than the Great Recession, in my opinion. I think this could be the big unwinding.

John Vallis: Every time this happens, Bitcoin’s anti-fragility is on display for those of us who see what’s going on. Whereas the exact opposite thing seems to be happening in the legacy system. We’re in the numbers of trillions now. That much capital is getting injected into the markets, and there’s not much of an effect. So the fragility of the legacy system is seemingly more and more apparent. The problems are becoming so evident that they are becoming more top of mind for many people.

“Every time this happens, Bitcoin’s anti-fragility is on display for those who see what’s happening. Whereas the exact opposite thing seems to be happening in the legacy system.”

— John Vallis

Cory Klippsten: I don’t care as much about the financial markets because it affects so few people. Capital attracts capital, and the US attracts help. The global system doesn’t want the US to go down. It seems like the world will rally to the cause and save our asses, and that’s probably just because the world runs on the dollar.

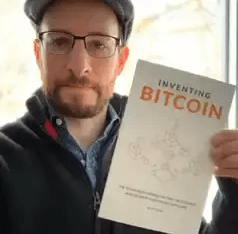

Yan Pritzker (Co-founder & CTO of Swan Bitcoin and author of Inventing Bitcoin): Everybody’s going remote. That’s what I see in all my chats. Tech companies they’re going remote because it’s easy for them. If they’re not tech companies, they’re coming up with all kinds of crazy last-minute ways to go remote because it’s not native to them.

It is a really interesting shift in our society happening very rapidly. Everybody’s forced to learn this new way of working. It may be a big productivity hit in the short-term. Still, it also may be a big productivity boost in the long-term as people learn to work better remotely and see what they can accomplish when they’re not distracted all day with other people in the office.

Cory Klippsten: What I love about remote working is it’s actually a lot like Bitcoin. You can mix and match the best people for the job on top of this remote work protocol. Why should we have to find some UX guy that happens to be in LA and can make it to the office in Santa Monica or something like that if the best guy for the job lives in a small town outside of Frankfurt?

You can just search for this global talent pool and find people in your tribe. We know how important it is to find people in every role who speak Bitcoin and give a shit. Those people are not necessarily going to live in one location. That’s got to be true for everything.

Cory Klippsten: I don’t care as much about the financial markets because it affects so few people. Capital attracts capital, and the US attracts help. The global system doesn’t want the US to go down. It seems like the world will rally to the cause and save our asses, and that’s probably just because the world runs on the dollar.

Yan Pritzker (Co-founder & CTO of Swan Bitcoin and author of Inventing Bitcoin): Everybody’s going remote. That’s what I see in all my chats. Tech companies they’re going remote because it’s easy for them. If they’re not tech companies, they’re coming up with all kinds of crazy last-minute ways to go remote because it’s not native to them. It is a really interesting shift in our society happening very rapidly. Everybody’s forced to learn this new way of working. It may be a big productivity hit in the short-term. Still, it also may be a big productivity boost in the long-term as people learn to work better remotely and see what they can accomplish when they’re not distracted all day with other people in the office.

Cory Klippsten: What I love about remote working is it’s actually a lot like Bitcoin. You can mix and match the best people for the job on top of this remote work protocol. Why should we have to find some UX guy that happens to be in LA and can make it to the office in Santa Monica or something like that if the best guy for the job lives in a small town outside of Frankfurt?

You can just search for this global talent pool and find people in your tribe. We know how important it is to find people in every role who speak Bitcoin and give a shit. Those people are not necessarily going to live in one location. That’s got to be true for everything.

“I’m excited to roll out something that just works, is super simple, and undercuts the fees of anybody else in the US. Set it and forget it, and just keep stacking.”

- Cory Klippsten

John Vallis: With the greater chaos circling around us, the more I get excited that Bitcoin simply exists and continues to do what it always has done. I’m super interested in all the developments that are happening in the space, the companies, the tech itself, Lightning, and all that stuff, but also just the meat and potatoes that this thing is still here, and there’s no reason for us to doubt it excites me.

In fact, my conviction and confidence in it continues to grow with each passing day. You can’t control the exterior environment. We’ve expected a lot of chaos. That’s why we’re in this space in the first place. It’s a tumultuous journey, and you’ve got to be ready for that. But just roughly every 10 minutes, tick-tock, next block.

Brady Swenson: Tick tock, next block.

Yan Pritzker: Now that we have this real flash crash, it will be in all the media:

“Bitcoin’s dead; it’s going to zero.”

It’s interesting to see the reaction from both sides. On one side, you have the “Bitcoin is dead” people; on the other, you have everybody in my Twitter feed buying. The next time Bitcoin goes higher, whether it be 10 or 20, or whatever the next milestone is, people will remember that it had “died” and then become very interested in why it hadn’t actually died. So I think it’s important to have these events so that people remember them.

John Vallis: We had this massive bloodbath in the market, right? But more than ever, I got several messages from people that have never really expressed interest in Bitcoin. I got messages saying, “How can I get involved in this? How can I get some?”

Yan Pritzker: Yeah, I had the same. Some people hesitated to buy for a long time, and I noted, “Hey, it’s on sale big time. This is a massive crash.”

People were interested in it, and people were like, “Okay, how do I buy, how do I buy?”

More people started thinking of it as a sale, and that has to do with the overall market.

Cory Klippsten: And it’s because the narrative from the last 10 years is that it is a hedge when markets crash. They may not have been watching the Bitcoin price over the last few months. Still, the stock market crashes, and in the back of their head, they’re like, “Oh, there was that Bitcoin thing which is what I was supposed to do when the market crashes.”

And then they come over and take a look at it. I think that’s the reaction of the people outside the space. The people inside the space reacted encouraging because of how quickly we just got over this. This was just, “Eh, Bitcoin is going to do what Bitcoin is going to do. Whatever.”

We had the biggest gaining day since 2011 a few months ago, so we probably did deserve the biggest one-day drop since 2013. That was in the cards.

Yan Pritzker: “We were overdue. It pumped 300% over a year, and that’s what nobody in the media would report. Bitcoin flash crash? Dude, it’s been on a massive bull run for a year. Are you kidding me?”

300% up. So, of course, we just needed a trigger.

John Vallis: I love the people in this space. Many people have a big portion of their net worth wrapped up in this stuff, and to see it go down by 30, 40, 50% in a night, and just be like, “Meh, we’re good. I’m still here; I ain’t going nowhere.” Man, that’s a unique mindset, and I love it.

Cory Klippsten: Well, how many BTC are in one BTC?

John Vallis: Yeah, exactly.

Yan Pritzker: Always one. I think when you hold Bitcoin and get used to that volatility, you get used to believing in yourself rather than being led by what everybody else around you is doing. If everybody else is selling Bitcoin and it’s going down by 50%, then you still understand the long-term value proposition of Bitcoin as freedom money, as a censorship resistant store of value. So you’re buying. Nothing has changed.

“I think when you hold Bitcoin, and you get used to that volatility, you get used to believing in yourself rather than being led by what everybody else around you is doing.”

— Yan Pritzker

John Vallis: That’s such a good point because the reason why a lot of us get emotional with these market things is because there’s nothing more truthful than a market. It’s just emergent collective behavior.

So when it’s tanking, it’s reality saying, “Hey, you’re on the wrong side of this. You’re not in reality.”

To have the conviction and the emotional stability to say, “No, I know what’s going on here more than what 'reality' is telling me.”

To hold true to that, it’s tough to develop, but once you get there, it’s such a zen, peaceful place. Being in Bitcoin is like a rite of passage. You either succumb to that emotional rollercoaster and end up just converting back to a herd mentality, or you make it through the challenges of that. You come out the other side transformed and more confident in your ability to develop your own perspective and have confidence in it. That’s such a gift of being in this space.

Gigi: Bitcoin is still Bitcoin. It’s still producing blocks. Nothing happened in cyberspace, nothing at all. It’s still smooth sailing for Bitcoin, and there is a very, very nice silver lining to the whole crypto crash and the global market meltdown that’s going on right now.

I think 99.99% of all the shitcoins won’t survive this. I think that’s a good thing to see as well. The Bitcoin narrative was right. Go for the sound money, go for the deep stability, build a stable system, go for robustness, go for maximum decentralization so that you can actually survive a global catastrophe like this. Bitcoin is fine.

The internet and the networks will be fine, and the miners will be fine. I think in terms of value, Bitcoin will recover surprisingly quickly. It’s not only retail investors now. Many people who have been in finance for a very long time, such as wealth managers and institutional investors, are taking notice. It won’t be just individuals that are eyeing Bitcoin. In the next few months, we will see in hindsight that Bitcoin is uncorrelated to the rest of the financial markets. Bitcoin won’t actually stay correlated in the next 6 — 12 months.

“Go for the sound money, go for the deep stability, build a stable system, go for robustness, go for maximum decentralization so that you can actually survive a global catastrophe like this. Bitcoin is fine.”

— Gigi

Brady Swenson: I was so proud of my wife last night. I said Bitcoin went under $4,000, and she was like, “Wasn’t it $10,000 a few weeks ago or something?”

That was the last time I told her about the price. I was like, “Yeah.” She goes, “Wow! Well, how can we scrape together some money to buy more?”

Yan Pritzker: Nice. We’re all in this space because we believe Bitcoin needs to exist and be robust, and it needs to have a good user experience and education, and these things need to exist to bring on the next wave of people. It’s going to take time for these things to feel like they’re comfortable, normal, and trustworthy. So I think we just have to wait.

Brady Swenson: It’s long-term thinking, strong hands.

Yan Pritzker: Strong hands.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brady is a frequent guest on Bitcoin media such as Bitcoin Magazine, Bitcoin Rapid Fire, Bitcoin Audible, and Crypto Cousins. He also hosts two well-known Bitcoin podcasts, Citizen Bitcoin and Swan Signal Live.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?