Sovereignism Part 1: Digital Creative Destruction

Exploring the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age.

A 12-part essay series exploring the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age. This series is based on the 1997 masterwork: The Sovereign Individual.

Digital Creative Destruction

“Technology is advancing much faster than our ability to understand its implications.”

— Ken Goldstein

Statism is a system of socioeconomic organization that originated in the Industrial Age. Statism includes all state implementations of capitalism, communism, fascism, and all other state-isms; it does not refer to these ideologies in any pure sense. Statist implementations arose in the 20th century when the only known mode of sustainable human organization was a top-down, centrally controlled nation-state. Like feudalism before it, which fell to the Gutenberg printing press, statism has fallen behind the technological realities of its era. In the 21st century, digitization is devouring every inefficient technological implementation: from media and dating to advertising and travel. In the sphere of statism, digital tools are antiquating analog nation-states by radically empowering individuals in novel and profound ways.

All states are shaped by technology. Mankind exists in continual pursuit of more energy-efficient modes of self-organization to preserve the productivity liberated by the division of labor while minimizing expenditures necessary for security. This is the purpose of society. By subdividing labor ever more deeply, mankind’s global treasury of knowledge grows ever-richer, informing the development of better tools and systems. As man has achieved more decentralized modes of securing property and persons, new states have emerged: the world has endured a long progression from the tyranny of ancient Egypt to the representative democracies of Western Civilization. In succession with these socioeconomic “phase changes, ” vast amounts of creative energy are freed in the form of productivity, profits, and capital accumulation. Optimizing for individual choice is the most energy-efficient strategy for socioeconomic organization. Capitalism outcompeted communism (destroying the USSR in the process) for this reason: voluntarily adopted rules (free markets) do not incur the same enforcement and security costs as systems with imposed rules (unfree markets).

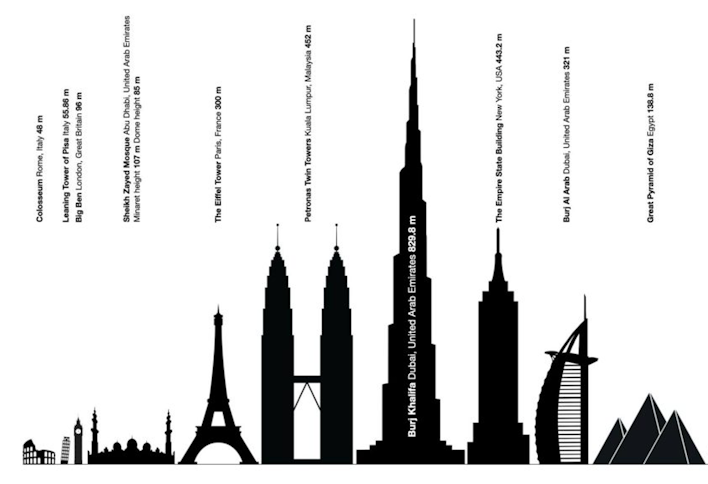

Capitalism triumphing over communism is the classic Schumpterian process of “creative destruction, ” where innovation obsoletes older and less energy-efficient tools and systems, liberating energy for allocation to other aims. Tremendous economic returns emerge in the wake of this destructive yet creative process. Consider, for instance, that 84 times more man-hours (human energy) were necessary to construct the Great Pyramid of Giza than the Burj Khalifa skyscraper in Dubai, yet due to the knowledge specialization of modernity, the Burj stands at a staggering 830 meters — 7 times as tall as the ancient Pyramid. A spectacular testament to modern (albeit marginalized) capitalism, the Burj Khalifa was constructed by orders of magnitude more efficiently than the Great Pyramid of Giza (498 times taller per man-hour).

Socioeconomic systems which best preserve productivity by efficiently securing the division of labor, win.

As a socioeconomic system, capitalism allocates energy more intelligently than communism. Organizational wellbeing is maximized when individual sovereignty is prioritized. Capitalism did this well but was hampered by state intervention in the monetary and legal spheres. Even more deeply rooted in free market principles, sovereignism promises to be an unrivaled allocator of energy toward the higher satisfaction of human wants.

Energy is Truth

“If you want to find the secrets of the universe, think in terms of frequency, vibration, and energy."

— Nikola Tesla

Harnessing energy for self-generation is the aim of all life. Energy is more efficiently converted to mechanical work in strongly bonded systems. In physical systems, these bonds are molecular; in economic systems, these bonds are property. Stronger bonds equal greater energy efficiency. Considerations of energy efficiency shape the tools and systems mankind creates for itself. Thermodynamically sound structures — those which maximize the utility of absolutely scarce energy — tend to become favored in free market competition. Stronger bonds translate into higher power capacity: the ability to retain energy over time without dissipation. In a universe where life continuously competes for its share of finite energy, profligacy is ruinous. As the most accurate portrayal of reality, energy is truth. Conservation of energy, then, is conservation of truth — the key to success in competitive conditions for organisms and organizations alike.

Trade and money are foundational to socioeconomic organization. People exchange their energy to produce the fruits of labor. Money is the medium through which people trade energy. Ideally, money is as scarce as the energy necessary to produce the fruits of labor to which it lays claims. As the base layer operating system of human cooperation, this “thermodynamically sound” money would have profound implications on the socioeconomic systems it upholds. Such a monetary medium would need to be as agnostic to political machinations and criminal actions as the thermodynamic reality of absolute energy scarcity it securitizes. Stopping the allocation of human energy into “management of” (more accurately, politicking over the power to manage) the money supply, mankind liberates his energies to construct more robust socioeconomic structures on the unshakable foundation of immutable money.

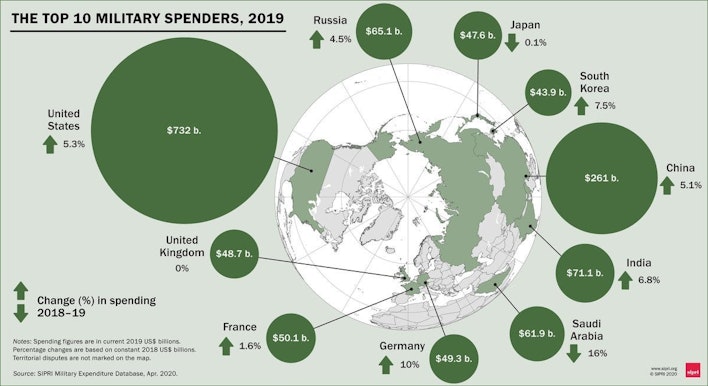

“War is the continuation of politics by other means.”

— Clausewitz

Thermodynamically sound money would establish a “neutral territory” where all that matters is how much you can contribute to the productivity of society. Military rank, political affiliation, and proximity to the printing press as determinants of position in the global wealth hierarchy would be largely eliminated. By giving society a source of indisputable truth around which it can self-organize, much violence in the world would be disincentivized and defunded. When rules can’t be bent, and money can’t be easily confiscated through political measures, the pursuit of peaceful cooperation becomes the most productive strategy. Immutable money enervates politics and its Clausewitzian continuation: warfare.

Sovereignism Rises

“All human rights may be distilled into one — choice.”

As you may have guessed by now, this ideal, thermodynamically sound, and apolitical money is Bitcoin. As a 12-year-old digital disruptor to one of the world’s most ancient and important tools — gold — Bitcoin is a tectonic shift in human organization. Gold is the 5,000-year-old base layer monetary operating system for all modern systems of human governance: an ancient sovereignty system corrupted by central banking. Breaking the centralized stranglehold on money by disrupting it at the base layer, Bitcoin forces a total revamping of the socioeconomic systems derived from money — including the rule of law, private property rights, and various institutional forms. Nobody knows what shape this mega-political transition will take, but it will certainly be an organic, bottom-up emergence since top-down control over this paradigmatically new sovereignty system simply does not exist. To state it plainly: Bitcoin is a momentous monetary innovation enabling a new mode of non-nation-state human organization, a “purified” form of capitalism free of nation-state interference and deserving of its own neologism. Let us call the new mode of socioeconomic organization enabled by encrypted digital money sovereignism.

Bitcoin energizes a revolution in socioeconomic organization known as sovereignism.

To fully explore the implications of sovereignism, let’s begin with the inviolable first principle of socioeconomics: man must act. Action requires energy and implies purpose, as all conscious decision-making involves the attempted achievement of an aim. The aims of man are always toward the alleviation of anxiety (what Austrian economists call “want satisfaction” or “reduced uneasiness”). Mankind is the dominant species on Earth because he uses technologies and organizational systems to channel energy across spacetime with more intelligence and toward more profound purposes than any other animal.

Our higher aims require the channeling of energy at larger spatiotemporal scales, with more sophistication and with greater precision. Used properly, technologies and socioeconomic systems help us alleviate anxieties more easily. Tools amplify the force of our work efforts, increasing the ratio of outcomes to energy expended.

Systems of socioeconomic organization — like capitalism, socialism, and, now, sovereignism — let us engage in concerted action to intensify collective output through the concentration of individual attention on ever-narrower phases of production (the productivity gains resulting from the division of labor). In this sense, tools are organizations, and organizations are tools: both are useful for enhancing the overarching purpose of human life — the execution of action aimed at anxiety alleviation. The tools and organizations are best fit for energy conservation win over time.

Tools and organizations are both means for more intelligently channeling energy across spacetime. The hydroelectric dam and the nation-state have this in common — they are both intelligently designed reservoirs and allocators of energy; the dam for hydraulic energy of water and the nation-state for the metabolic, political, and productive energy of populations. Both, at least temporarily, harness and channel the entropic onslaught of (ecological and human) nature. But in the end, both give way to the decentralizing tendencies of the very nature they seek to contain: water always flows to the lowest places, and people always self-organize in ways that most favor their economic interests.

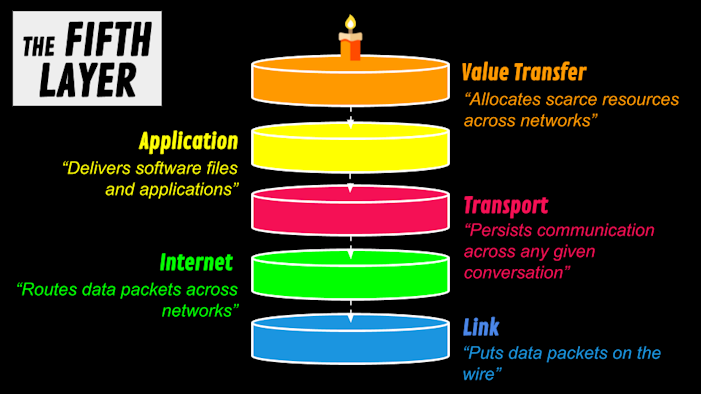

The ultimate man-made tools for decentralizing power away from top-down institutional control are open-source digital organizations, like those composing the many layers of the internet protocol suite. Wikileaks, the Arab Spring, the George Floyd protests are just a few examples proving the internet poses a major threat to centralized power structures. Social movements like this are mere tremors of the coming nation-state collapse. As the only non-state digital money, Bitcoin is the value layer of the internet — the first viable competitor to the sovereignty system gold provided historically.

Bitcoin is the monetary layer of the internet protocol suite, a sovereignty system competitive to gold. Image credit: @anilsaidso

An extension of the self-organizing internet ecosystem, Bitcoin is the world’s first self-sovereign digital organization. These organizational forms are the most advanced way of harmonizing individual and collective willpower.

A self-sovereign digital organization like Bitcoin is self-governing and can split in the event political differences threaten organizational cohesion (see Bitcoin cash fork). As an intrinsically more adaptive, fluid, and volitional system for allocating socioeconomic energy across spacetime, Bitcoin outcompetes the closed-source, analog, and compulsory organization of nation-states.

Bitcoin is an indisputable sovereignty system reconciling individual exchanges made within the socioeconomic collective. It obviates the need for nation-states and exists with absolute agnosticism to the man-made systems of law and order which incubated it during its early years. Leveraging the power of human nature and incentives as two of its indispensable operating components, Bitcoin harnesses human energy to scale its network.

As a loss-minimized system for storing and transferring the fruits of labor, Bitcoin’s fixed money supply generates its own demand (validating Say’s Law) as ever-more wealth is plundered via inflation. This is why everyone ends up on Bitcoin’s payroll eventually. A new breed of global citizen is now emerging: inhabitants whose influence, voice, and capital can completely transcend locality, and its various local authorities. Compulsion finally cedes to civilization as sovereignism rises.

Free Market Governance

“Microprocessing will subvert and destroy the nation-state.”

— The Sovereign Individual

Sovereignism succeeds by reducing the economic returns traditionally associated with violence and coercion. Citizens will demand contract law and property assurances of equal integrity to those offered by Bitcoin, otherwise they will not part with their money. In the same way, summoning a stranger to be your private driver for the evening would seem crazy 25 years ago; digital technology will continue to change the nature of trust and human interaction. But when money digitizes, the implications are much more significant.

Multi-signature capabilities of Bitcoin are already being explored as a means for facilitating private contract governance independent of state courts. This has the potential of growing into a decentralized alternative to the traditional justice system. Since money can no longer be censored or stolen, the socioeconomic structures developed atop this base layer operating system will leverage encryption to strive for an equivalent censorship-resistance.

But like all new births, the transition to this decentralized state of unparalleled civilization is bound to be messy. When the economic returns of organizing violence at scale decline, the business models premised on protection from violence (governments and nation-states) necessarily shrink and become more localized. This macroeconomic counter-swing of the pendulum means violence will become more small-scale and randomized: akin to what prevailed in the (truly decentralized) age of hunters and gatherers. Like paleo diets, yoga, meditation, Ayurvedic medicine, entheogens, and even Bitcoin (Austrian economic money) — sovereignism is yet another example of how ancient ways are resurgent in the digital age.

Ancient ways — such as yoga, meditation, Ayurvedic medicine, paleo diets, entheogens, and even Austrian economics (Bitcoin) — are resurgent in the digital age.

As surely as capitalism outcompeted communism, sovereignism will outcompete statism in all its forms. By empowering individual freedom in radically new ways, societies adhering to organizational principles consistent with sovereignism (broad industrial privatization, debureaucratization, consensual taxation, Bitcoin, etc.) will generate more wealth than the command-and-control economies of more rigid nation-states, and attract more citizens. More competitive jurisdictions mean less tolerance for bureaucratic wastefulness. As citizens wake up to this new reality, the modern obsession with state politics will fade into a relic of a bygone era.

Contrary to modern misconceptions, economics drives politics; politics do not drive economics. The legislator’s pen does not create wealth, it can only distribute it. As political bureaucracies swell to the point of being unsustainable by their underlying productive economies, desperation will cause government overreach to explode, forcing market actors to shelter wealth any way they can. And in the 21st century, capital will find no more unassailable domain than the digital. As capital flees into the digital domain to escape escalating taxation and inflation, government revenues will fall rapidly, causing them to fragment and fail. As a result, organized crime is likely to grow in scope during this transition.

In truth, the nation-state is “organized crime” — the apparatus of compulsion and coercion intended to insulate the productivity gains generated by a peaceful division of labor. Legal and police systems protect market actors from endogenous threats to the economic wellspring of free trade while the military neutralizes exogenous threats. The nation-state was 20th-century society’s best way of wielding violence to preserve peace.

But the technological realities of the 21st century significantly change the calculus of violence. Since digital capital cannot be unilaterally seized via taxation or inflation, the level of protection services nation-states actually provide will come to reflect their actual production costs over time. Said differently: in the digital age, nation-states will be forced to compete and earn the loyalty of their citizens, like any other free market enterprise, and will therefore only be able to charge market rates for their (decreasingly necessary) services. Traditional legal and police systems required for enforcing contract law, preserving property rights, and peacekeeping in the Industrial Age may quickly find themselves facing irrelevance in a world where these services are more efficiently provided by self-organizing digital networks. Coupled with the collapsing tax capacities of governments, many former state-provided services will fall to software.

Digital Darwinism

“Efficiency will become more important than the dictates of power in the organization of social institutions.”

— The Sovereign Individual

As nation-states falter, barriers to market entry, participation, and exit will fall too, thereby exacerbating free market competition and wealth generation. In digitally enabled, hyper-competitive marketplaces, power law distributions predominate and winner-take-all effects proliferate: Facebook, Apple, Amazon, Netflix, Microsoft, and now Bitcoin are all examples of this Darwinian digital paradigm. Choice and experimentation will become the defining variables of redefining socioeconomic organization. New modes of securing life, liberty, and property will be tried, failed, and iterated upon. The ever-present threat of capital flight into unreachable digital space will force institutions wishing to survive to deal with citizens honestly. When governments are dematerialized by software, they will become almost unrecognizably agile, innovative, and fragmentary. Encryption embroils nation-states in digital acid: dissolving even their most rigid power structures and transforming their incentive structures from within. Only the most productive and accountable governmental functions will remain. With the restrictions of locality largely diminished, only the most valuable services will earn customer capital and attention. Meritocracy supplanting bureaucracy is distinctive to sovereignism.

Digitization makes results matter more than decrees, meaning merit will ascend the social hierarchy of values. A world in which all spatiotemporal bounds are lifted will become an “age of excellence.” For instance, it is (already) no longer good enough to be the best cover band in your city: thanks to YouTube, you now need to be the best cover band in the world, and across all time, to compete successfully for the attention of your target audience. Cover bands must even compete with the original band they’re covering in an era defined by digital media! When sales demonstrations are conducted over digital media instead of in-person, executives will deploy only their most adept salespeople no matter where they live. Minimized bureaucratic barriers will maximize the promotion of merit and mitigate political forcefulness in business.

With less to be gained from the use of force, efficiency becomes more important than magnitude in terms of channeling energy across spacetime. When effectiveness trumps fiat in this way, institutions disintegrate and reorganize, with the resultant economic gains largely accreting to the “cognitive elite” who successfully presage and prepare for the mega-political shifts underfoot. Those who synchronize their affairs to adapt to this fluid, borderless, and self-organizing digital zeitgeist (largely by being among the first to move their savings into Bitcoin and diversify their citizenship options) will dethrone the “ruthless capitalists” of the Industrial Age to crown themselves the “sophisticated sovereignists” of the Digital Age.

Digital technology broadens the scope of human possibility, making the manifestation of sovereignists’ imaginations in all their multi-faceted forms seem feasible. Streaming video, encrypted communications, and unstoppable money let man “bend spacetime” to his will. But attached to these advanced capabilities are new costs and risks. Lacking social safety nets and other government welfare programs will force individuals to become more self-responsible than they were accustomed to being in the Agricultural and Industrial Ages (hereafter referred to as The Analog Ages). Successful sovereignists will be those who embody the timeless wisdom of Voltaire:

Sovereignists who rise to the occasion will no doubt be tested, as nation-states will fight back in an attempt to retain their traditional powers over populations. Nation-states will lose leverage over self-emancipated “sovereign individuals, ” who will be armed with the tremendous optionality engendered by digital networks, markets, and capital. Increasingly desperate, targeted extortion may become the weapon of choice for failing governments. Only those sovereignists running the best opsec will survive such militaristic measures. As the reality of an existentially threatening digital future dawns on them, nation-states are unlikely to pull any punches in the subsequent power struggle — as The Sovereign Individual describes it:

“Just as monarchs, lords, popes, and potentates fought ruthlessly to preserve their accustomed privileges in the early stages of the modern period, so today’s governments will employ violence, often of a covert and arbitrary kind, in the attempt to hold back the clock. Weakened by the challenge from technology, the state will treat increasingly autonomous individuals, its former citizens, with the same range of ruthlessness and diplomacy it has heretofore displayed in its dealing with other governments.”

Strive as they might, nation-states will succumb to software. Fighting the free flow of data is as futile as fighting the tide.

Bursting of the Dams

“In the digital age, the threats of physical violence that have been the alpha and the omega of politics since time immemorial will diminish.”

— The Sovereign Individual

Nation-states, like dams, can only interrupt the inexorable flow of nature’s self-organizing tendencies for so long. As taxing capacity plummets, diseconomies of scale will ensue, making smaller nation-states more economically competitive and, therefore, attractive to sovereignists. Glimmers of this transition are already evident, with cities like Miami announcing programs to draw forward-thinking entrepreneurs into residency.

Due to a variety of technological advances, the advantages of scale in a combat will be diminished. Thematically, digitization reduces the size that organizations must attain to be effective in the use of violence. Guns can be 3‑D printed, cheap anti-aircraft drones can be launched, hackers can cripple militaries, and capital can be mobilized without a trace. Asymmetries of cost and effect paradoxically result in more symmetrical power structures. When the cost of defense plummets, offensive strategies become less lucrative.

In this (re-)decentralization of sovereignty, the world will undergo a reversion to a symmetry of violence last seen during the age of hunters and gatherers. However, this reversion will (somewhat counterintuitively) generate more peace on balance since sometimes the power to take an action is more important than actually taking it. Similar to the ever-present threat of capital flight forcing institutions to be more honest in their dealings, the ever-present threat of localized violence will encourage peaceful interaction among sovereigntists at scale.

Armed with advanced weaponry enabling them to “punch above their weight” compared to nation-states, combat advantages will accrue to the most versatile and adaptive organizations. Equal access to armaments, downloadable in digital space or buyable in unhampered markets, means sovereignists will mostly accord politely with one another. Although appealing at a civilizational level, achieving this symmetry of power involves a reconfiguration of institutional structures, an event likely to exhibit great turbulence: like nature restoring balance by bursting a dam.

Non-adaptive structures never stand the test of time. As the most adaptive mode of socioeconomic self-organization, sovereignism outcompetes all others.

Greater symmetry of and reduced incentives for violence mean less mass murders, less school shootings, and less government war-mongering. However, sovereignists will still face threats like extortion and ransom, which nation-states may wield indiscriminately as they struggle to remain relevant while dissolving in a flood of digital acid. Demand for protection from failing governments will grow. Opsec will be of paramount importance for anyone of means. Private security details are likely to become increasingly common among sovereignists. State-assigned identities will be abandoned and aliases adopted. As digital technology revolutionizes mankind in every respect, our laws will become antiquated, our institutions inverted, our morals reshaped, and our perceptions permanently altered. Sovereignism will shake the (illusory) sense of socioeconomic stability derived from violence monopolies and portend a total breakdown of the heavily politicized 20th-century nation-state organizational model. As The Sovereign Individual words it:

“Market forces, not political majorities, will compel societies to reconfigure themselves in ways that public opinion will neither comprehend nor welcome. As they do, the naïve view that history is what people wish it to be will prove wildly misleading.”

A popular counterargument to the rise of Bitcoin-enabled sovereignism is that “nation-states will never allow it.” Such a line of thought is inherently flawed since it considers nation-states to be single, indivisible, and autonomous organizations. In truth, nation-states are (more or less tightly) interwoven constellations of individuals connected through common economic interests, trade networks, sociocultural similarities, or geopolitical affiliations. Nation-states are not singular socioeconomic aggregates, as the mental models of many dissenters falsely assume. The authority holding these outdated organizations together is, again, derived (either directly or indirectly) from their equity stake in the world’s only analog sovereignty system: gold.

As the level of service, these nation-state complexes render declines relative to its cost, the incentives for individual citizens to exit these violently imposed monetary monopolies will increase commensurately, causing an eventual “rush for the exits” into Bitcoin. State police, judges, and regulators alike will face these pressures in their roles as citizens, and only the most stupid or jingoistic will ignore the economic pressures to exit failing fiat systems. As influential state constituents start acquiring Bitcoin, they become aligned with its success, and the power structures cohering every nation-state will be dissolved from the inside out. Self-sovereignty is in unceasing and universal demand on the free market; Bitcoin immutably speaks this truth to power. Sovereignism will see nation-state power structures stand naked before truth.

Although this transition may seem alarming and potentially chaotic, the end-game of sovereignism is an explosion of wealth and a commensurate human flourishing in the wake of nation-state dissolution. Self-organizing digital organizations stand to become the greatest testaments to Schumpterian creative destruction known to history. The breaking of the nation-state dam — a complex of artifice, confiscation, and conscription — will unleash human ingenuity to a virtually incomprehensible extent. If this thesis holds true, history will regard the internet as merely a prerequisite innovation for Bitcoin: the real catalytic breakthrough in the civilizational conversion to sovereignism.

Sovereignism will eclipse statism in the 21st century. This mega-political transition is already well underway, and its consequences are more evident by the day. In part 2, we will examine Bitcoin as a catalyst to sovereignism. Functioning as “the ultimate offshore bank” for 21st century sovereignists, Bitcoin is the key innovation in a world rapidly submerging into the ungovernable waters of the digital high seas.

Thank you for reading Sovereignism Part I: Digital Creative Destruction.

Subscribe to my YouTube Channel: bit.ly/321Lzm0

Follow me on Twitter: https://twitter.com/Breedlove22

Stack sats with me, get $10 in free Bitcoin through this link: https://www.swanbitcoin.com/breedlove

Journey with me as I write my first book: https://bit.ly/3aWITZ5

If you enjoyed this, please send sats: https://tippin.me/@Breedlove22

Or, send sats via Lightning Network with Strike: https://strike.me/breedlove22

Or, send sats via PayNymID: +tightking693

Or, send dirty fiat dollars via PayPal: https://www.paypal.com/paypalme/RBreedlove

Or, send dirty fiat dollars via Venmo: https://venmo.com/code?user_id=1784359925317632528

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Robert Breedlove

Robert Breedlove is founder, CEO, and CIO of Parallax Digital, a global Bitcoin-focused hedge fund and consultancy. He considers himself a freedom maximalist and believes he’s found his life’s work in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?