Saving with Bitcoin

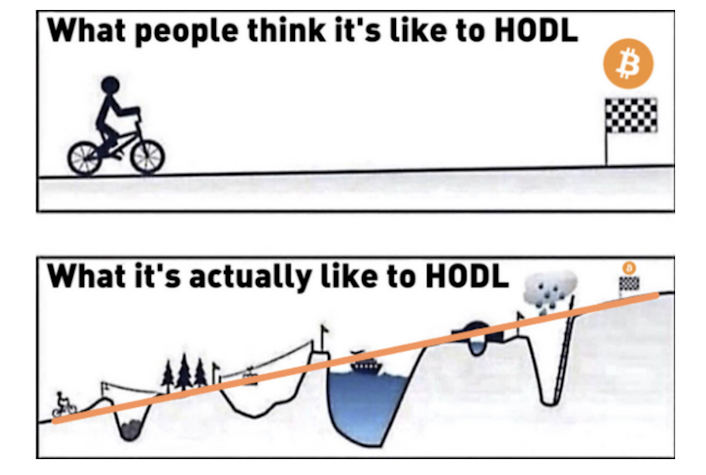

You should be investing in Bitcoin for its volatility — able to wait out price dips, even to accumulate during them, and celebrate the dramatic price rises when they take place.

Bitcoin is a volatile asset. At this point, we should all accept that high volatility is a fundamental characteristic of Bitcoin today.

You’ve probably enjoyed this volatility as the price rocketed to ATHs. Although by now, you may have also experienced the downside of this volatility. Earlier in the year, Bitcoin was down >50% from its highs in a span of ~3 months.

You should be investing in Bitcoin for its volatility — able to wait out price dips, even accumulate during them, and celebrate the dramatic rises when they occur.

In this piece, we will go over why it’s a fool’s game to try to trade a wild market like Bitcoin, why Bitcoin’s volatility represents an opportunity, and why steadily purchasing Bitcoin through recurring purchases is a great strategy to accumulate Bitcoin for the long term.

Bitcoin is a rollercoaster ride, and the wise move for most riders is to strap in, hold on tight, and don’t get thrown off. It may make you nervous and nauseous sometimes, but the right answer was never to jump off the rollercoaster. No, the answer is to always hold on tight and enjoy the ride.

Despite the volatility, every single person who has held Bitcoin for +4 years has made money on it, and you can, too, by taking some small actionable steps today.

Bitcoin will chop you up with its volatility without mercy. One day it will make you feel doubt, fear, panic, and you’ll smash that sell button. The next day the price will soar, and you’ll feel elation, greed, and panic, and you’ll buy back impulsively. Back and forth it goes.

Bitcoin preys on the human emotions in all of us. Some rare traders have the ability to control these emotions and time the market successfully. However, a vast majority of investors that trade Bitcoin don’t control their emotions; they fall victim to them. They overtrade, lose money, pay hefty capital gains taxes, and are left with less bitcoin than if they had just bought and done nothing.

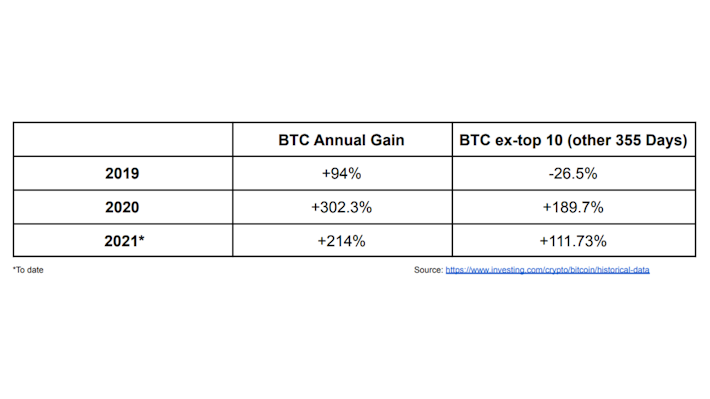

Beyond the emotional component, another reason trading bitcoin is a risky endeavor is historically a majority of Bitcoin’s annual gains come from ~10 days every year. Said differently, traders need to manage to time it right on 10 random days each year.

The consequence of missing those 10 days has proven to be severe.

Take a look below at how much gains you missed out on if you missed the top 10 days 👇

As you can see, the opportunity cost of missing those big green days is HUGE.

Furthermore, ex-the top 10 days between 2013 — 2017, bitcoin was actually down annually 25%! ¹ So if you missed the 10 best trading days during those years, you actually somehow managed to lose money despite the massive gains in Bitcoin over that time period.

The data here shows how the odds are stacked against you when you try to time this wild market.

This is why the recommended strategy for most to survive Bitcoin’s high volatility is not to attempt to trade it but rather learn to save in Bitcoin and then continuously build your position over time.

Bitcoin is not for trading. It’s for saving.

To win in Bitcoin, you must learn how to mentally survive its volatility long enough in order to benefit from it.

Allow me to explain…

If there was no volatility, there would be no opportunity. Bitcoin’s volatility results from its 21 million fixed supply and its fluctuating demand as it continues to gain adoption across the globe.

Bitcoin is still at the beginning of its adoption cycle. Only a small percentage of the world’s population currently owns Bitcoin, let alone understands it. Many people are speculating on Bitcoin without fully comprehending what they’re investing in. This volatility is a result of the information asymmetry around Bitcoin today. Each day new people learn and buy Bitcoin for the very first time, and each day someone loses faith or simply needs to sell some. This results in short-term price spikes and sell-offs as the world collectively tries to make sense of this disruptive technology.

As knowledge spreads and adoption accelerates, more and more people will begin to understand Bitcoin for what it is: a premier savings technology. The information asymmetry will fade away, and the volatility will wane with it. The world will grow accustomed to it, learn to love it, and Bitcoin will become as normal as using the internet is today.

But today… Today, we are early.

Their misunderstanding is our opportunity. As the Bitcoin network continues to grow in demand, coupled with the fact that we know that there’s a fixed supply, that means only one thing can happen if adoption continues at this pace — the price of Bitcoin will continue to rise.

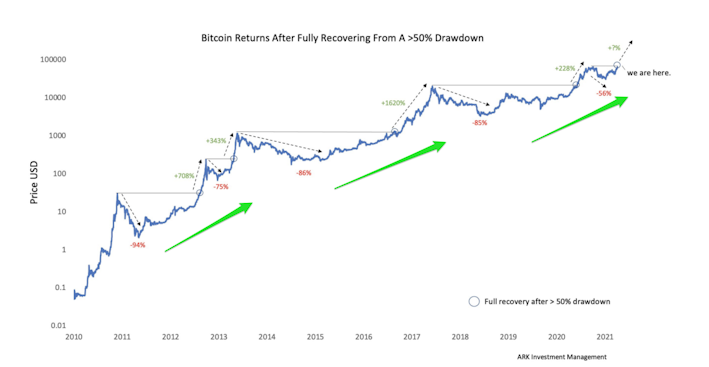

That’s exactly what we see in the data. When in doubt, zoom out.

Take a look at the fantastic chart below.

Source: ARK Investment Management

As you can see, even though there have been several major price drawdowns, bitcoin has recovered every time and has been trending in one direction: up and to the right.

The short-term volatility should be thought of as a distraction as demand for Bitcoin continues to steadily increase. The winning move has always been to hold through the short-term volatility and keep buying Bitcoin as it continues to be adopted as the primary savings technology.

But as I mentioned before, this is no simple task.

Volatility is hard. It’s easy to let emotions take control and make bad decisions when your life savings are involved.

So what can you do?

If you are too overextended like the person below, you risk putting yourself in a stressful situation that could lead to emotional decisions and poor outcomes.

It’s hard to sit on your hands and survive Bitcoin’s volatility when you risk losing everything if the price falls in the short term. That’s why it’s vital to tailor your Bitcoin allocation to your own risk tolerance, your own financial situation, and your own conviction level.

The good news is that an investing strategy has proven low-stress and profitable. It helps prevent emotional decisions benefiting from Bitcoin’s upward long-term volatility.

Dollar-cost averaging (DCA) is a tried and true way to build a position over time that can pay off in a big way. Not only can you accumulate a lot of bitcoin with DCA, but it’s also low stress, so it keeps you in the game. It’s a strategy that helps you survive the volatility we touched on earlier and benefit from Bitcoin’s growth.

DCA is a strategy where an investor buys a pre-determined dollar amount of an asset at regularly scheduled time intervals.

For example — if an investor had $1,000 dollars, they could choose to DCA $100 worth of bitcoin every week for 10 weeks.

Now DCA implies that you should start with a certain amount of dollars that you can invest, then buy daily/weekly/monthly until the funds are invested, and then you’re finished. However, with Bitcoin, the right strategy is to continue to save what funds you can indefinitely.

That’s why I think a more appropriate term for this strategy is a Bitcoin Savings Plan.

You should think of Bitcoin as a savings technology. It is a place to store wealth for many years in an asset that can’t be inflated away or taken from you by anyone.

When asking yourself how much Bitcoin you should buy, what you really should be asking yourself is, “How much money can I afford to save this week/month/year?”

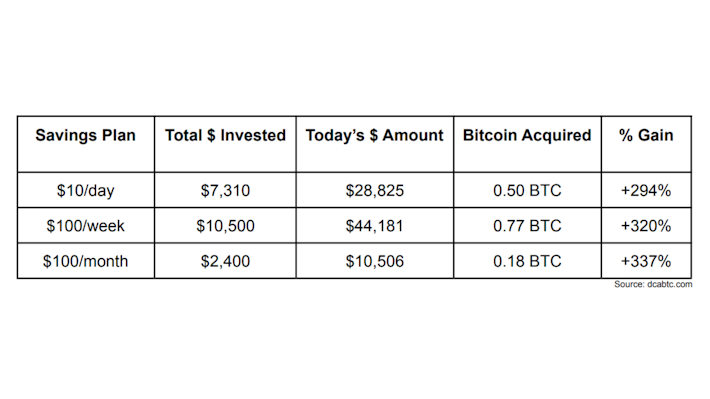

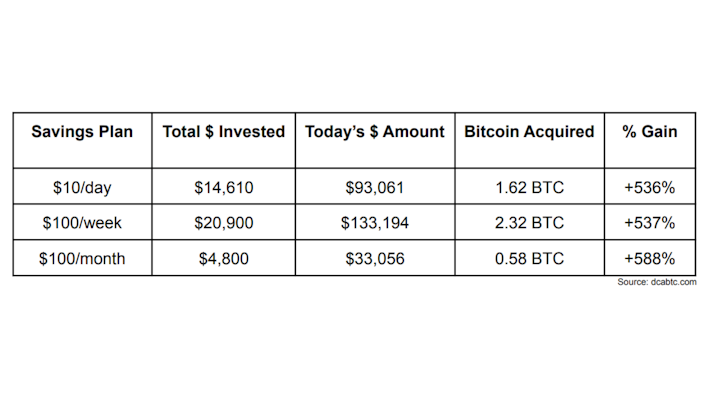

This strategy has been wildly profitable historically. What may seem like a small investment of $10/day can compound into tremendous wealth in the future.

Check out the statistics if you have continuously saved in Bitcoin over the last 2 or 4 years:

As you can see, a seemingly small amount of savings can go a long way with Bitcoin.

An added benefit of this strategy is it allows you to take advantage of the short-term volatility and gives you peace of mind to accumulate Bitcoin for the long term.

Let’s use an example to help illustrate this point:

Meet Chad and Sally.

They both discovered Bitcoin on the same day back in May 2021.

They both have the same amount of funds to invest, $27,000.

They decide on two very different investment strategies.

Chad decides to put every penny of his savings all in at once.

Chad purchases 0.54 BTC for $27,000 at a Bitcoin price of $49,838.

Sally decides to set up a Bitcoin Savings Plan buying $1,000 worth of Bitcoin every week.

6 months later, Sally has accumulated 0.62 BTC at an average Bitcoin price of $45,364.

The key takeaway from this example is that by using a Bitcoin Savings Plan, Sally acquired ~15% more Bitcoin than Chad by accumulating at a lower average entry price.

Purchasing continuously over time, like Sally, allows an investor to take advantage of any downward volatility by steadily building a position as the asset falls in price. It takes human emotions out of the equation and helps investors pull the trigger when the price is low. All Sally had to do was stick to her plan.

It’s important to also consider the differences in the emotional journeys that both Sally and Chad experienced over these past 6 months.

If we think about Chad above, he put all his savings in at once. He then had to watch those savings decrease in value by nearly half as the Bitcoin price dropped. This is no doubt a stressful situation. Chad would likely be watching the Bitcoin price daily, have trouble sleeping, and wondering if he had made a mistake. He might doubt his investment and be worried that his savings were gone. This can lead to panic selling right at a time when he should be buying.

Then we consider Sally’s experience. All Sally had to do was stick to her original plan. In fact, she was actually benefitting from bitcoin’s price drop.

If Bitcoin goes up, great! Sally already owns some. If Bitcoin goes down, great! Sally can buy Bitcoin at a lower price and lower her overall entry price. That’s why setting up automatic recurring purchases is a win-win strategy. Set it and forget it.

By now, you know that the winning strategy here is to survive the short-term volatility and hold Bitcoin for many years. Which of these investors do you feel were more likely to hold through the recent volatility, Chad or Sally?

Sally’s experience was much less stressful than Chad’s. As a result, she was likelier to not be shaken by the volatility and survive to reap the rewards today.

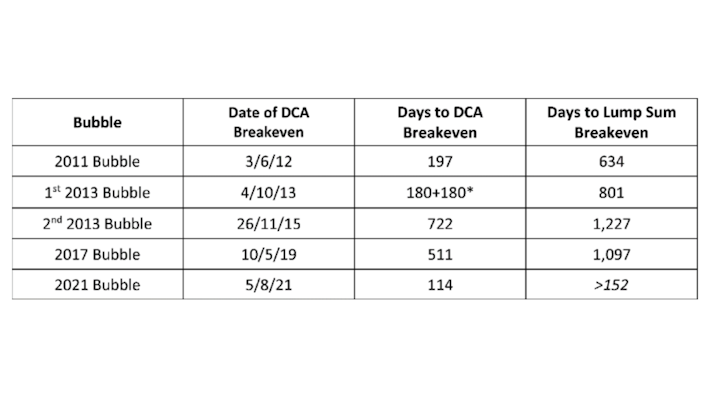

The chart below puts the stress of each strategy in numbers.

Source: Hass McCook (@FriarHass) as of 09/20/21

This chart displays how long it took an investor of each strategy to break even from the cycle tops.

If you consider Chad, he just broke even on his initial investment this month. He has been underwater and sweating it this whole time.

On the other hand, Sally broke even on her initial investment months ago and has been in profit and feeling good about her investment.

A Bitcoin Savings Plan allows people the peace of mind to not sweat the short-term price action and think for the long term. All you have to do is set it and forget it, go outside, enjoy life, and let Bitcoin continue on its path to global adoption.

Bitcoin is a volatile asset, and attempting to time this market is a fool’s game that often ends in ruin. I hope this piece helped open your eyes to the opportunity that lies before you. We are still incredibly early in Bitcoin’s adoption cycle, and the majority of the world is still sleeping on this amazing savings technology.

A strategy that encourages investors to continuously purchase Bitcoin on a recurring basis has proven to be effective at growing a position, removing emotions from the equation, and lowering an average entry price, all while benefiting from the long-term price appreciation of Bitcoin.

The beauty of creating a Bitcoin Savings Plan is it’s a strategy that gives you peace of mind as you consistently accumulate Bitcoin for years and years to come.

Here at Swan, we feel that this is the single best strategy to successfully invest in Bitcoin. Create a Bitcoin Savings Plan at Swan and start saving for your future, your kids’ futures, and your grandkids’ futures, today.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?