Riding the Lightning Network

The Lightning Network: Cheap Global Payments for All

For many years, a prime focus of organizations such as the Bank of International Settlements, the IMF, and the World Bank has been making retail cross-border payments, including remittance payments, cheaper and faster for end-users.

Yet despite the international community’s efforts, cross-border payments continue to be plagued with issues including high fees, slow settlement times, poor transparency, and limited access.

Technology has advanced at an exponential rate with the growth of the Internet. Domestic payments have benefited from this progress in the form of improved efficiency and lower costs, but international payments have not seen the same improvements. The world is connected technologically but not financially.

Despite these technological advances, it can still take as long as 10 days to transfer money to different jurisdictions, and that transaction can come with costs as high as 15% in some countries. Believe it or not, cross-border payment systems today still use message formats developed nearly 50 years ago for the SWIFT network, an interbank messaging system.

Part of the problem has been a lack of competition from the private sector due to the walled gardens incumbent banks have built. High barriers to entry stem from high fixed costs, complex regulatory requirements, lack of interoperability in data standards, outdated legacy platforms, and the economic scale required to perform sufficient liquidity and risk management to facilitate global payments. All of these reasons make it difficult for new entrants to innovate in this industry.

Despite all of these constraints, the free market finally provided the competition these incumbent banks so desperately needed. Bitcoin and the Lightning Network have arrived to show the world that we finally have the technology available to bring cheap global payments to everyone in the world.

1. High Costs

" Among the long-standing issues, it is striking that in spite of technological progress and the decline in information processing costs, digital payments have remained stubbornly expensive.”

- Hyun Song Shin, Head of Research at the BIS (2021)

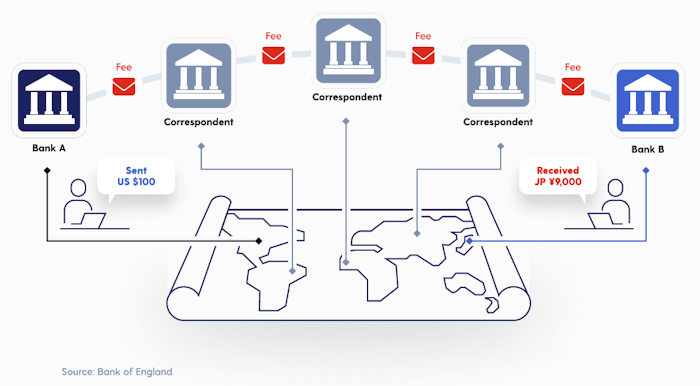

To understand why cross-border payments still cost so much, we need to better understand today’s system. I mentioned the SWIFT messaging network above, which allows banks from different jurisdictions to communicate with one another in a standardized manner, but banks don’t actually send funds through the SWIFT network. They use something called the Correspondent Banking Network (CBN) for that task.

Correspondent banks are a network of intermediary banks that connect disconnected financial institutions in order to settle funds between jurisdictions. Transactions can involve multiple stops at these intermediaries, increasing costs and delays. The friction associated with this model involves differing regulatory risks in each jurisdiction, compliance costs, foreign currency exchange costs, and the risk of loss of funds or fraud.

Depending on the jurisdictions, sometimes, one single cross-border payment can involve several correspondent banks and multiple currency exchanges, each one with its own fees for processing and foreign exchange until the payment finally settles at its intended destination.

The average cost of sending a cross-border payment through the CBN is ~10%. These fees are from SWIFT messaging fees, transaction fees, and foreign currency exchange fees.

These fees add up with each intermediary that’s used and average out to around $25-$35 of fees per $200 transaction. The smaller and more secluded the jurisdiction is, the more expensive the payment is.

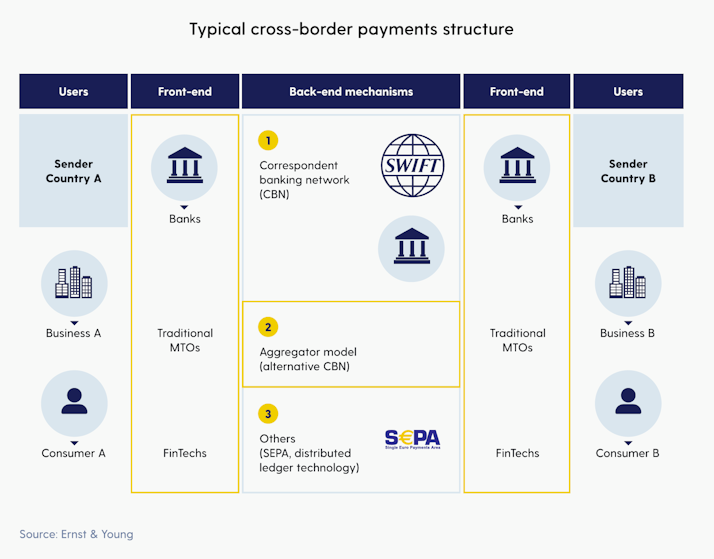

In 2022, 96% of the estimated $156 trillion dollars in cross-border payments will be done between banks using the CBN explained above. But what about the individual or small businesses that need to send smaller amounts of money internally?

This smaller cohort typically sends international micropayments using traditional Money Transfer Operators or MTOs, such as Western Union, TransferWise, and Moneygram.

These MTOs are financial companies that facilitate cross-border payments for consumers using their own internal systems or other alternative cross-border banking networks.

Below is a good graphic that displays the cross-border payment structure used by different user types today.

Typical Cross-Border Payments Structure

Compared to the CBN used to facilitate bank-to-bank payments, MTOs are not much better in terms of cost for end-users.

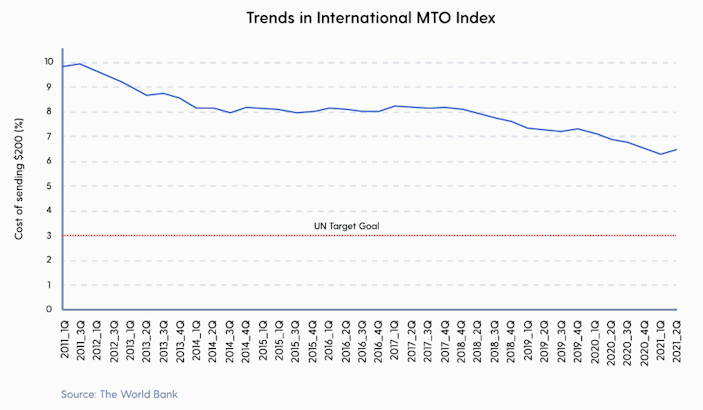

According to the World Bank’s most recent data, the global average remittance payment cost per transaction for MTOs was recorded at 6.57% in Q2 2021.

Said differently, if an individual wants to send a $200 dollar cross-border payment to their family back home, the family will only receive $186.86 dollars after fees. This may not seem like a large difference to you, but these costs can greatly impact a family’s living standards and quality of life in a poor, developing nation.

Keep in mind, that’s only the average cost as well. The MTO costs vary widely across different jurisdictions. In more remote, less developed jurisdictions, the cost to send a cross-border payment can be greater than 10%. These costs remain well above the UN’s target goal of 3% by 2030.

The high costs associated with cross-border payments in our traditional financial system are simply unacceptable given the technological capabilities we have at our disposal today, and disproportionately affect individuals transacting small dollar amounts in the poorest regions across the world.

2. Slow Settlement Times

One of the biggest challenges with cross-border payments is how long it takes for them to settle. An average international payment takes 2-3 days to clear, which stands in stark contrast to domestic payments, which typically show up in one’s bank account in mere seconds. In certain jurisdictions, these delays can even take as long as 10 business days depending on the number of intermediaries involved to process the transaction.

These long delays are caused by many factors including incompatible data formats between correspondent banks, complex compliance checks, limited operating hours across multiple timezones, and long transaction chains involving multiple intermediaries.

To fix this issue, SWIFT has been working on a new system called SWIFT global payment initiative (gpi) that works to reduce the settlement times of international payments and allow banks and users to track payments on the SWIFT gpi’s cloud solution.

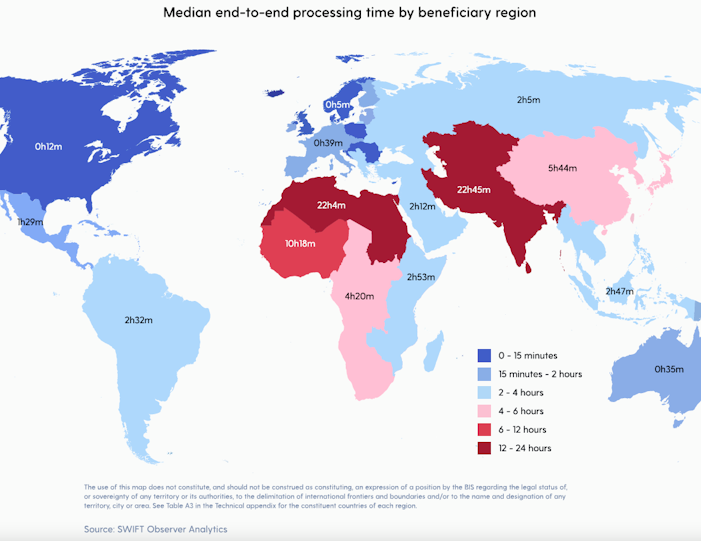

Below is the median end-to-end processing time for each beneficiary region using the SWIFT gpi. The average payment processing time was eight hours and 36 minutes, or one business day, while the median time was one hour and 38 minutes.

Although the processing time using the SWIFT gpi improved upon the 2-3 day average, after all of these years, it’s underwhelming that an average of one business day is the best the international community can come up with in 2022. Also, the processing times differ drastically between jurisdictions and are noticeably worse in smaller emerging markets.

Today international payments still remain stubbornly slow, especially in emerging markets where many families depend on cash sent from family members working abroad for their livelihoods.

3. Lack of Transparency/Interoperability

Transparency- or lack thereof- is a big problem in cross-border payments today that adds friction and increases costs for users of all types. Cross-border payments remain unpredictable and opaque. Users are not made aware of where the payment is at any time, nor the fees accumulated throughout the process until after the payment has settled. The complexity of the fees makes it very difficult for users to understand them.

In a survey conducted by Capital Economics in 2021, 55% of American consumers said they understood the costs, but only ~20% of that same cohort correctly identified the costs.

In another survey by Wise, they found three in four Singaporeans were unaware of hidden costs of cross-border payments, with 88% underestimating fees.

Lack of transparency with fee structures is part of the issue, but another is the lack of transparency in tracking the funds between banks and other service providers. This difficulty in the tracking of funds is partly because many of these correspondent banks, MTOs, and fintech companies are not interoperable. In today’s diverse financial ecosystem, customers cannot move funds between services because they are all using different data standards and communication tools. This incompatibility leads to more delays, increased compliance checks, and more fees.

The opaque nature and lack of interoperability of the cross-border payments industry today lead to higher costs, slower processing times, and a worse experience for users and banks alike.

4. Lack of Accessibility

Today, bank account penetration remains low, with an estimated 1.7 billion unbanked people worldwide. Many people do not have access to the correspondent banking network or money transfer operators used for cross-border payments, and these solutions are especially unavailable in developing nations.

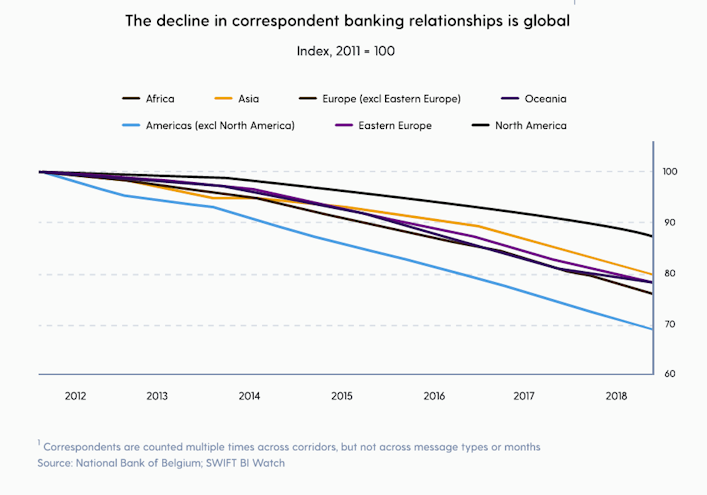

This is partly due to the steady decline in the number of correspondent banks over the past decade. Most banks can’t afford the high fixed costs of facilitating cross border payments and shut down, impacting accessibility for those who need it most.

Today, this outdated cross-border payment system is simply not accessible to billions of people, especially in emerging markets.

" There is no omnipresent system that connects various banks across the world through which international payments can be transacted,”

- Marc Recker, Managing Director & Global Head of Product, Institutional Cash Management at Deutsche Bank

I have some good news for you Marc — that omnipresent system you dream of — it already exists.

Bitcoin is an open monetary system that enables every bank and individual in the world to connect on one standardized protocol. It is a decentralized, digitally-native monetary network that is globally accessible and allows people to reliably send and receive payments that settle with cash finality.

It is a system that solves all the problems that have plagued cross-border payments for decades. It’s completely transparent, has relatively low fees, every entity that uses it is interoperable with one another, and anyone with a mobile phone and internet connection can access this network. Unlike bank accounts, mobile phone penetration in developing nations has rapidly increased.

According to PEW research, over 83% of adults in emerging markets own a mobile phone.

The alleged knock against Bitcoin is that the fees can be high, and it doesn’t have the transaction speed capacity necessary for it to scale globally. However, Bitcoin is software, and solutions can be built on top of software.

The Lightning Network is a second layer payment protocol built on top of the Bitcoin network that optimizes for speed and cost.

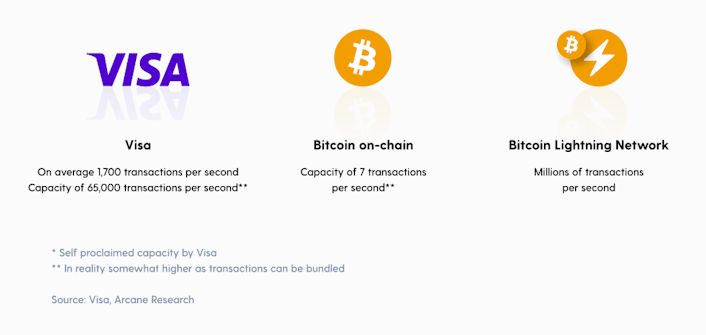

Theoretically, the Lightning Network can allow for millions of transactions per second that can settle at practically no cost. Below is a graphic that highlights how the Lightning Network improves Bitcoin’s shortcomings regarding payments.

Bitcoin on-chain Transactions per second vs. Visa Transactions per Second vs. Lightning Network

The Lightning Network is a technology that allows individuals to send small international payments, without any bank intermediaries, nearly instantly and essentially for free. It is a groundbreaking innovation in cross-border payments, and it’s just beginning to be adopted.

This year we have seen the Lightning Network explode in usage across the globe as people wake up to its advantages over the incumbent system.

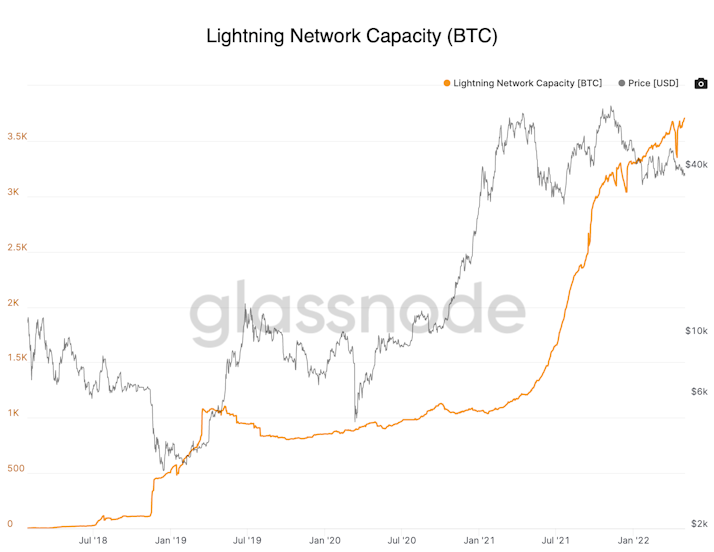

The total amount of Bitcoin currently deployed for transfers over the Lightning Network now stands at 3,705 BTC, or $147.56 million dollars.

That means the total amount of liquidity on the Lightning Network has increased 300% over the last year alone!

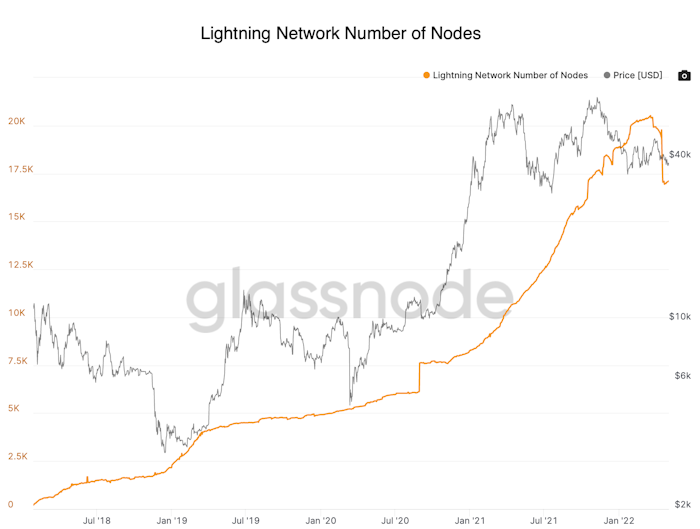

Furthermore, the total amount of Lightning nodes on the network has increased 63.86% over the last year to a total of 17,104 nodes online.

As more and more nodes come online, the Lightning Network’s efficiency improves, liquidity increases, and more products and services will be built on top of it. Usage is growing rapidly, made possible by a whole ecosystem of companies and projects.

The significant adoption occurring on the Lightning Network is evidence of the vast improvements it offers users compared to all other options that exist today to send cross-border payments.

We are already seeing how the Lightning Network is improving the lives of individuals in an emerging market today. El Salvador adopted Bitcoin as legal tender in September 2021. El Salvador is heavily reliant on remittances. It received over $6 billion dollars in remittances in 2020, or 23% of its GDP.

According to an IMF report, it was estimated that the potential benefits of using the Bitcoin network for remittance payments could save El Salvadorans $54 million dollars, or 0.25% percent of GDP, per year. Also, the adoption of Bitcoin has already significantly increased financial inclusion by allowing more than 60% of the population to have access to the financial system in only 2 months. This occurred in only a few months of Bitcoin adoption after decades of unsuccessful initiatives where previously only 23% of the population was banked.

El Salvador is only months into adopting Bitcoin, but it is already providing El Salvadorans with more financial access and making it easier and cheaper to send funds outside their borders. It shows how this new system is already proving to be a massive improvement over the outdated legacy cross-border payment system.

The cross-border payment industry has been ripe for disruption for many years, but high barriers to entry have prevented competition from entering the space. Bitcoin and the Lightning Network together will make cross border payments faster, cheaper, more transparent, and more inclusive, which will have widespread benefits for increasing economic growth, international trade, and improving financial inclusion across the globe.

The future of cross-border payments has arrived.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?