Re-Run the Numbers

How Today’s Higher Rates and Lower Prices Impact the Case to Borrow to Buy Bitcoin

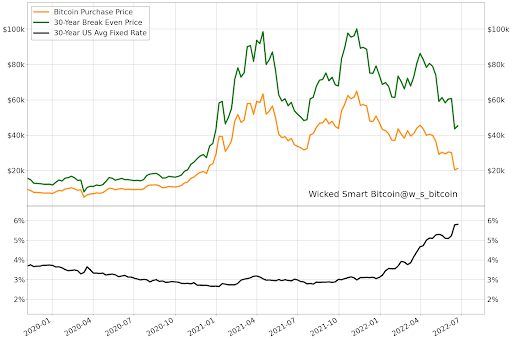

With 30-year mortgage and refinance fixed rates nearly doubling over the last year, is Michael Saylor’s advice to “go mortgage your house and buy bitcoin with it” still a good idea? Was it even a good idea in the first place?

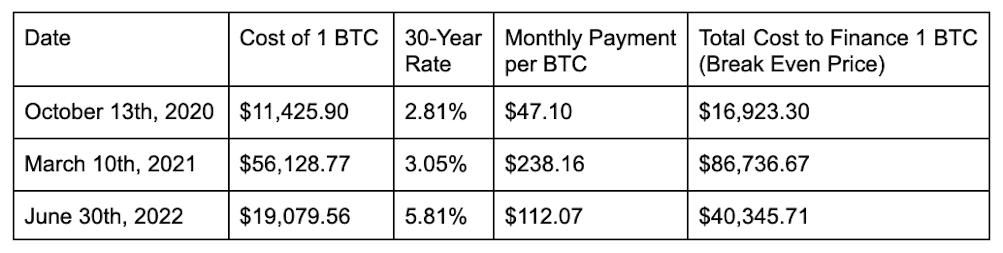

Saylor actually mentioned mortgaging your house to buy bitcoin very early on, before the 2020 bull run had really gotten started, during an episode of Swan Signal Live on October 13th, 2020. At the time, the price of bitcoin was around $11,400 and the average 30-year fixed rate mortgage in the United States was only 2.81%! I think we all wish we had listened to Saylor back then.

But, what about the now famous interview released later on and near the first ATH in March 2021 where Saylor again spoke about this strategy? Around this time, bitcoin had just experienced 5 solid green monthly candles of gains and was well into its 6th with the price cruising through $50,000. The bulls were out in full force and Saylor had become a Bitcoin celebrity, emboldened by the gains on Microstrategy’s newly acquired bitcoin.

Saylor made this statement on March 10th, 2021 when bitcoin was trading around $57,800 and the average 30-year fixed rate mortgage in the United States was still relatively low, at 3.05%. After 30 years, bitcoin would need to appreciate in value by 56%, to $90,000 or more, for this loan to break even in total paid costs versus the value of the bitcoin bought with it. Most people who believe in Bitcoin’s long-term outlook would probably laugh at the idea of bitcoin only being near $90,000 by 2051 so this may have seemed like a no-brainer to them.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

In today’s environment, with all of the macro uncertainty, rising rates, and a falling bitcoin price, you might be interested to see what it looks like now to mortgage your house to buy bitcoin. With bitcoin’s price hovering around $21,000 and the average 30-year fixed rate mortgage in the United States at 5.81%, bitcoin would only have to appreciate in value to $45,200, well below its all time high, before the year 2052 for this loan to break even in total paid costs versus the value of the bitcoin bought with it. In other words, Bitcoin would only need to increase 115% over the next 30 years for someone to break even using this strategy. So, even with the much higher interest rate, and higher percentage gains needed, this strategy may look appealing on the grounds that bitcoin only needs to retrace to about 65% of its all time high, within the next thirty years, thanks to its now drastically lower price.

There are a few warnings, however. It’s always important to note that there are risks associated with borrowing that may affect more than just the entry and exit costs.

We are in a period now where there is a lot of uncertainty about the economy — in particular, consumer prices are rising rapidly for many reasons, businesses are confronting solvency issues, and central bank policy aims to reduce demand for jobs. If you enter into greater mortgage obligations, you will be required to make monthly payments on it. Your ability to find the cash for these payments may be impacted if higher prices eat into the money you were planning to use to make those payments, or if your income is impaired.

You are not only exposed to the starting and ending prices of bitcoin — you must also make payments on the borrowed money the entire time. The table below illustrates the monthly payment and total costs to finance the borrowing of one bitcoin back on October 13, 2020, on March 10th, 2021, and now, on Jun 30, 2022.

Methodology:

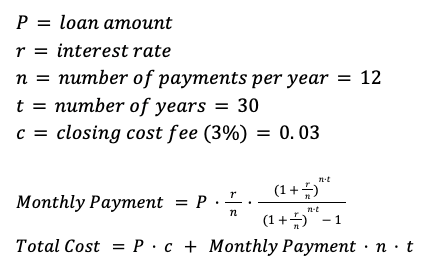

This analysis uses the formula below to calculate the monthly payment for each pair of historical bitcoin prices and historical rates. The monthly payment is then multiplied by 12 and by 30 to estimate the total 30-year cost of the loan. Please note, I’ve included a one time 3% closing cost in the formula.

Data:

30-Year Fixed Rate Mortgage Average in the United States (FRED)

BTCUSD Daily Close Exchange Rate (glassnode)

Github (Python scripts):

References:

Cory Klippsten is the CEO of Bitcoin financial services firm Swan.com. He is a partner in Bitcoiner Ventures and El Zonte Capital, serves as an advisor to The Bitcoin Venture Fund, and as an angel has funded more than 50 early stage tech companies. Before startups, Klippsten worked for Google, McKinsey, Microsoft and Morgan Stanley, and earned an MBA from the University of Chicago. He grew up in Seattle, split 15 years between NYC and Chicago, and now lives in LA with his wife and daughters. His hobbies include basketball, history and travel (Istanbul and Barcelona are favorites).

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?