Rampant Inflation Is on the Way and Here’s What it Means for Bitcoin

Once people realize what’s happening to their money, they will start buying Bitcoin.

We currently have governments and central banks worldwide stepping up to try to save their economies from imploding. But as we know, they are imploding because everybody’s on lockdown, and productivity is grinding to a halt. There’s going to be a lot less stuff produced. There will also be a lot less demand for that stuff as people are locked in their homes and unable to go to restaurants, bars, stores, museums, or anywhere else.

The government is trying to solve this with money. They’ll be printing lots and lots of money. They’re going to make it easy for people to take out loans. Mortgage rates will go down. Small business loan rates will go down. There will be tax breaks. We’re going to see helicopter money (i.e., people getting money directly from the government).

Source: The Financial Times

So you have to ask yourself: What does this all mean for money? As they produce more of it, each individual money unit loses value (i.e., inflation). Usually, we have a little bit of inflation every year. The government will tell you that the inflation rate is about 2%, but that doesn’t match reality. Just look at things like education, housing, the stock market, etc.; the price of those things is increasing at a rate higher than 2% in recent years.

We had maybe a trillion dollars worth of base money going into the financial crisis of 2008. We came out of that crisis with about 4 trillion. We’re going to see much bigger prints this time. The Fed’s balance sheet is already at $4.6T and growing as it continues to buy more and more assets to rescue the market.

There’s only one asset on this planet that is inflation proof: Bitcoin. The supply of Bitcoin cannot be inflated. Even the supply of gold can be increased if it becomes profitable. With Bitcoin, that’s just not possible.

“There’s only one asset on this planet that is inflation proof, and that is Bitcoin.”

— Yan Pritzker

What does this all mean for Bitcoin?

Well, in the long run, it means that once people realize what’s happening to their money, they will start buying Bitcoin since it’s the only thing that will not be subject to monetary policy manipulation. Unfortunately, Bitcoin, like everything else, took a drop recently. This was to be expected since there was a mass panic sell-off of all assets, which was forecast by many in the space.

Bitcoin isn’t quite where it needs to be regarding market cap and penetration to survive unscathed events like this. We only have $150 billion worth of Bitcoin, so it will suffer during an event like the coronavirus. But it’s important to understand that Bitcoin’s design is to be inflation proof, seizure proof, and censorship-resistant. Those characteristics are unchangeable, whether there’s a crisis or not. As more people wise up to this, we will see more and more demand for Bitcoin. And you know what that means for Bitcoin’s price.

“Bitcoin’s design is inflation proof, seizure proof, and censorship resistant. Those characteristics are unchangeable, whether there’s a crisis or not. And as more people wise up to this, we’re going to see more and more demand for Bitcoin.”

— Yan Pritzker

It’s important to remember that we are entering into the halving in May, where the amount of new Bitcoin being produced will be cut in half. It’s quite a striking coincidence that this will happen at a time when the amount of every other money being produced in the world will go up tremendously.

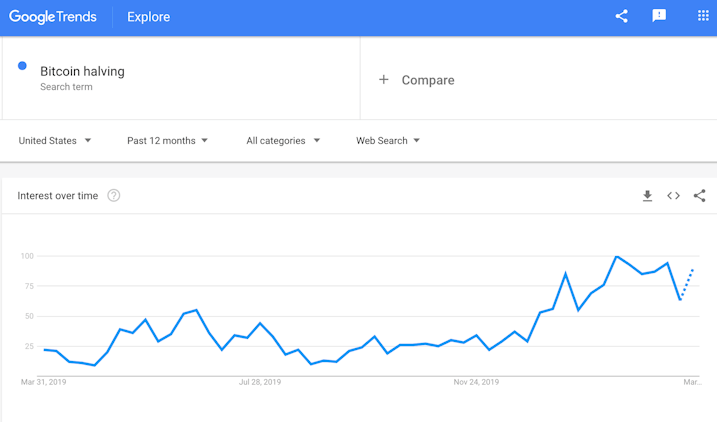

Google Trends for “Bitcoin halving” (captured on March 27, 2020).

While every other market in the world is dropping, Google Trends for “Bitcoin halving” are at an all-time high. People are wising up to this.

The question is: Do you want to be the first to know that, understand it, and act on it? Or do you want to be the last?

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Yan Pritzker is the co-founder and CTO of Swan Bitcoin, the best place to buy Bitcoin with easy recurring purchases straight from your bank account. Yan is also the author of Inventing Bitcoin, a quick guide to why Bitcoin was invented and how it works.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?