Raising the Ceiling As Tech Keeps Screaming

Politicians will continue to spend money they don’t have to paper over problems now, creating bigger ones for future generations to grapple with. Buy Bitcoin.

Swan Private Insight Update #23

This report was originally sent to Swan Private clients on May 12th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

All eyes have been on the White House and Congress this past month as the date at which the government can no longer pay its bills, also known as the “X-Date, ” rapidly approached. US Treasury Secretary Janet Yellen stated last week in a letter to Congress that it was “highly likely” that the government will not be able to pay all of its obligations and will default on June 5th if the debt ceiling is not lifted beforehand.

This uncertainty led to heightened volatility in the markets as assets attempted to price in the probability of a US default. The good news is, the worst outcome has been narrowly avoided as a bipartisan bill has passed that will suspend the $31.4 trillion debt ceiling until after the next presidential election and into early 2025.

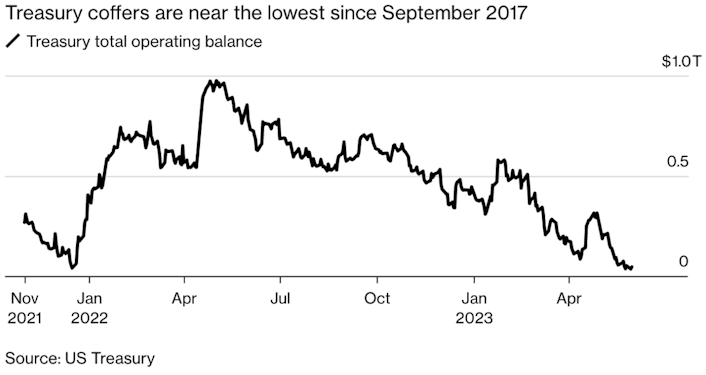

The deal came down to the wire as the Treasury’s total operating balance recently hit the lowest level since September 2017, with only $60 billion in cash left to fund the government’s day-to-day business.

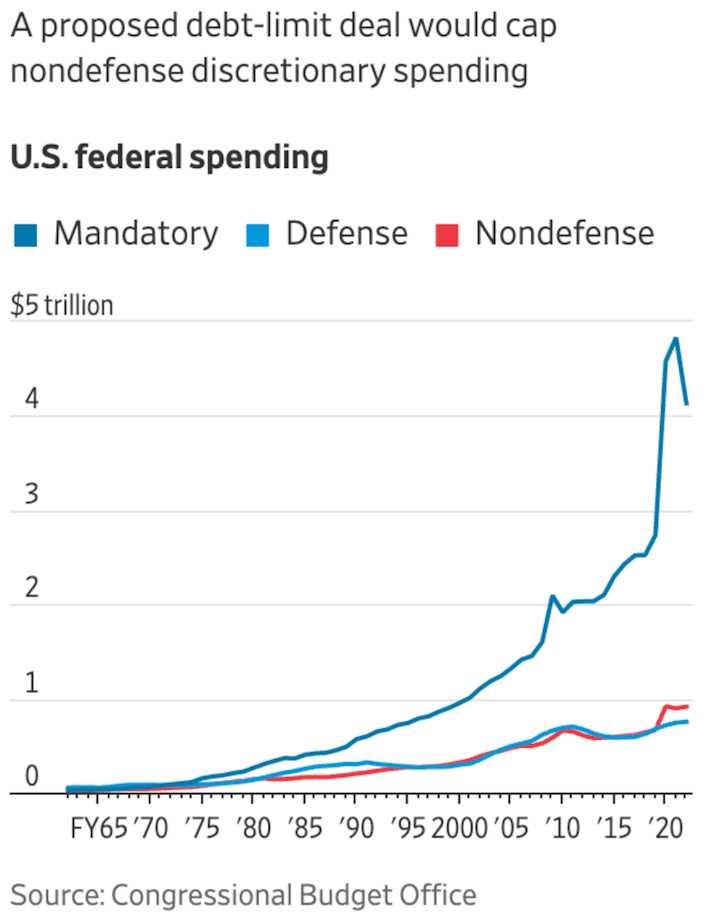

Ironically named the “Fiscal Responsibility Act, ” this bill will do little to reduce government spending. The fiscal bill will hold non-discretionary spending essentially flat in 2024, and allow for a 1% cap on spending increases in 2025. According to some estimates, this new legislation could allow for debt to increase to roughly $35 trillion in that time period.

This means that annual trillion-dollar deficit spending will continue unabated despite the high levels of inflation that US consumers are currently struggling with and that the Fed is desperately trying to get under control.

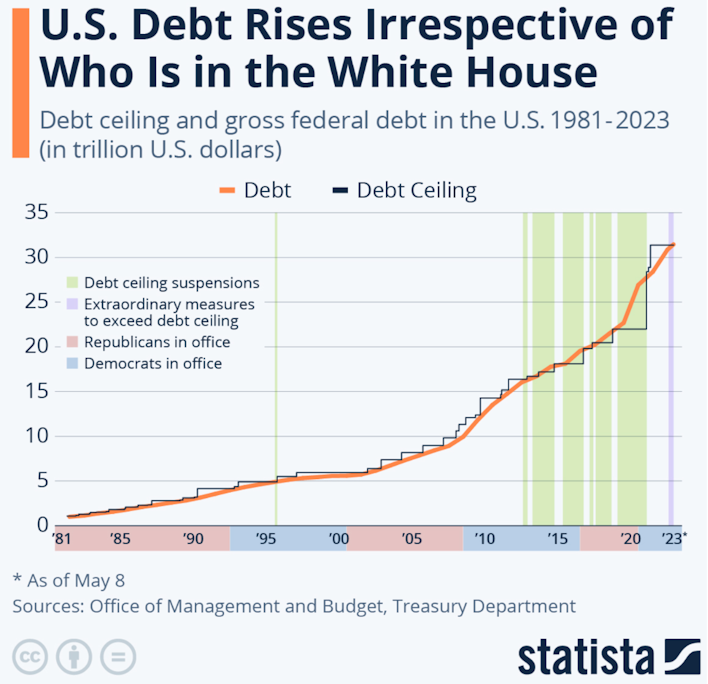

If there’s one lesson from this debt ceiling debacle, it’s that politicians will continue to spend and the debt will continue to rise. It doesn’t matter which political party is in office, the debt ceiling will get suspended, and the debt will inflate further.

Once again, the long-term fiscal problems are kicked down the road, this time until 2025 when we have to go through this whole charade again.

Despite the worst outcome being avoided with a last-minute debt ceiling agreement, some market participants have already shifted their focus to how a debt ceiling resolution will impact markets moving forward. When the debt ceiling bill gets passed, new debt will need to be issued and the Treasury General Account (TGA) will need to be refilled. This could negatively impact liquidity and could be a headwind for asset prices including equities, gold, and Bitcoin.

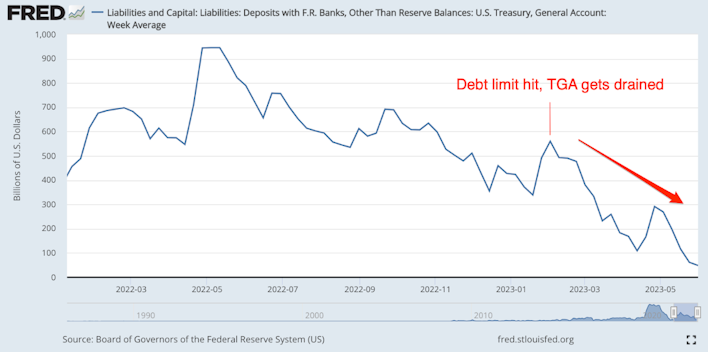

This all started back in January when the debt ceiling was hit and Yellen announced extraordinary accounting measures to avoid a default. Since the Treasury couldn’t issue any more debt, they drained the cash they had on hand in the TGA to fund its operations. You can see how they began to drain the TGA in earnest after the debt ceiling was hit in January below.

The importance of draining the TGA lies in its capacity to inject liquidity into the economic system. The TGA exists as a liability on the Federal Reserve’s balance sheet, and for balance, the Fed must ensure its assets correspond to its liabilities. As such, when the TGA is drained, there’s a corresponding rise in the Fed’s assets, specifically bank reserves.

In simpler terms, draining the TGA results in an uptick in bank reserves, which in turn could catalyze increased lending within the real economy. This explains why the process of draining the TGA has a pro-liquidity effect, promoting better liquidity conditions within the economic system and providing a tailwind for asset prices.

This is also the reason behind why we saw liquidity conditions improve while the Fed was raising interest rates and undertaking Quantitative Tightening (QT) around the same time.

Even though the Fed’s QT strategy aimed at reducing bank reserves in the system, the impact of draining the TGA counteracted these effects, hence helping to bolster the amount of liquidity in the system in the first two quarters of the year.

The problem is that now the TGA has all but been drained and needs to get refilled through the issuance of new debt. This is set to occur as the Fed continues to reduce bank reserves via QT. This would be a double whammy for liquidity in the system.

Ultimately, it depends on how the Treasury plans to raise debt and refill the TGA and at what speed. Some analysts feel that the Treasury may choose to issue more long-duration bonds because they offer cheaper yields given the current yield curve inversion, but the meeting minutes of the Treasury Borrowing Advisory Committee from last month foreshadowed what we should expect moving forward when it comes to the debt issuance,

“Dealers broadly agreed that there is ample scope to expeditiously increase the supply of bills. Respondents cited record-high money market mutual fund assets under management and the more than $2 trillion in the Federal Reserve’s Overnight Reverse Repo Facility as evidence of significant demand for short-dated, high-quality liquid assets. Dealers noted that the bill market could accommodate increases across benchmark tenors, but that the largest increases should occur in the shorter maturity bills.” — Treasury Borrowing Advisory Committee, May 3rd, 2023

Goldman Sachs estimates that the Treasury Department will issue $600 billion-$700 billion in T-bills 6-8 weeks after the deal is signed by President Biden.

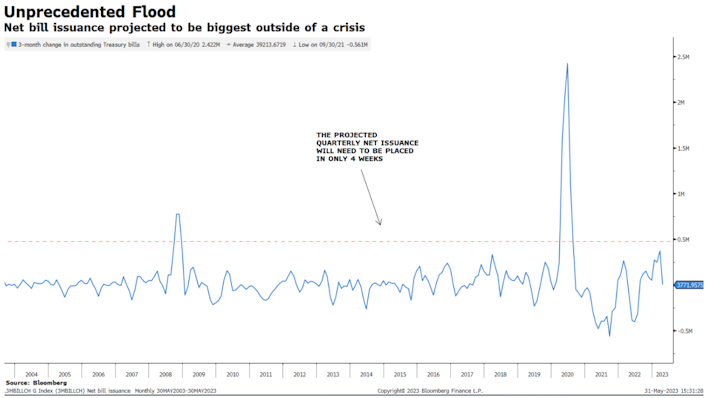

This coming bill issuance will make for the largest one outside of a crisis, with around $500 billion expected to refill the Treasury coffers in only 4 weeks to meet the Q2 quarterly net issuance after the debt ceiling bill is passed.

With Fed raising interest rates by 500 bps over the last year, the Treasury will find it much more expensive to issue these T-bills this time compared to years prior. The question becomes, who will be buying the debt that the Treasury issues?

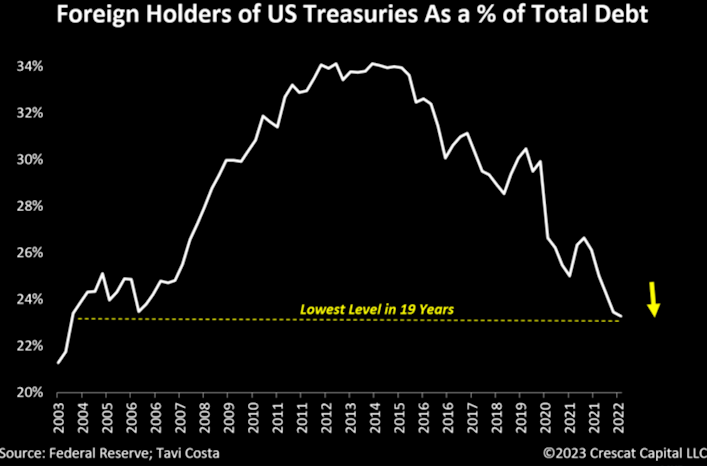

The worry is that, without the Federal Reserve performing QE and buying up the bonds, the demand for these newly issued T-bills will have to come from the private sector aka, commercial banks, foreign investors, and households.

Treasury demand from foreign investors has been on the decline for the last decade and this trend doesn’t seem to be reversing any time soon.

That leaves households and commercial banks to pick up the slack. If commercial banks need to step in with the demand, this would be problematic because they would need to sell bank reserves, which would suck liquidity out of the system, as mentioned above.

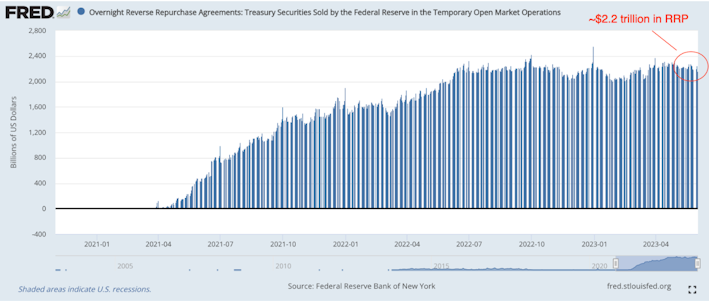

Yet the most likely outcome is also the most favorable one. It is that these T-bills will be funded by the over $2 trillion in cash sitting in the overnight Reverse Repo facility (RRP). The RRP essentially allows for money market funds to park cash at the Fed if there are not enough T-bills or other cash-like equivalents available close to Federal Fund’s rate.

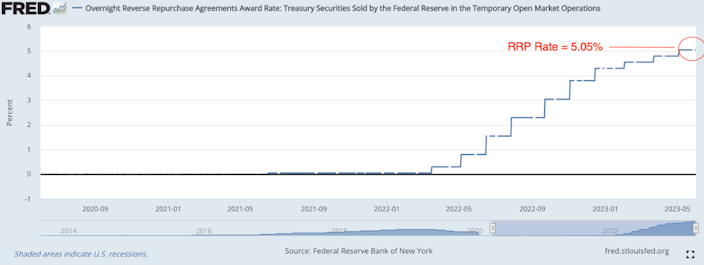

If the rates on the newly issued t-bills are attractive enough, money market funds should take cash out of the Reverse Repo facility and put it into these t-bills for the more attractive yield. Currently, the RRP rate stands at 5.05%.

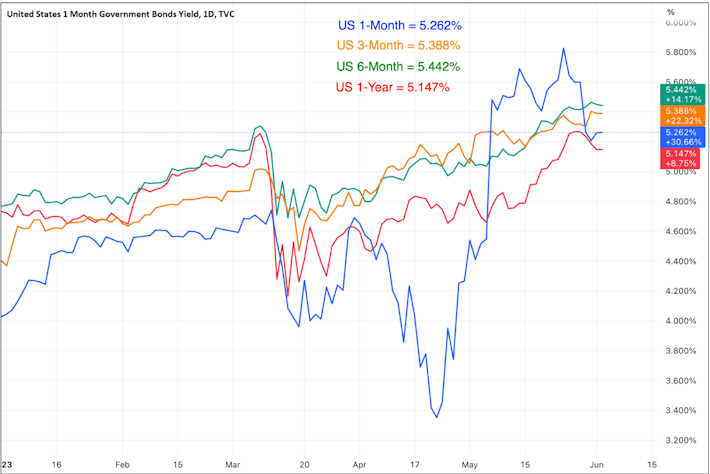

When we observe the current yields offered by the short end of the yield curve, we find that all the T-bills (1 year or less) are currently offering yields greater than the RRP rate.

This has led to growing optimism that the financing of the freshly issued t-bills won’t lead to a liquidity squeeze in the financial system. This stems from the possibility that the money market funds could step in and finance these t-bills using cash from the Reverse Repo Program facility, rather than relying on commercial banks that would have to deplete their reserves, thus staving off a sudden liquidity crunch.

In light of this, investors seem to have taken a more hopeful stance, as evidenced by the recent rally in equities, despite the ongoing concerns around the debt ceiling and liquidity dynamics. The Nasdaq and S&P 500 indexes have persisted in their upward trajectories this week, continuing the impressive year-to-date rallies of 33.2% and 10.4% respectively.

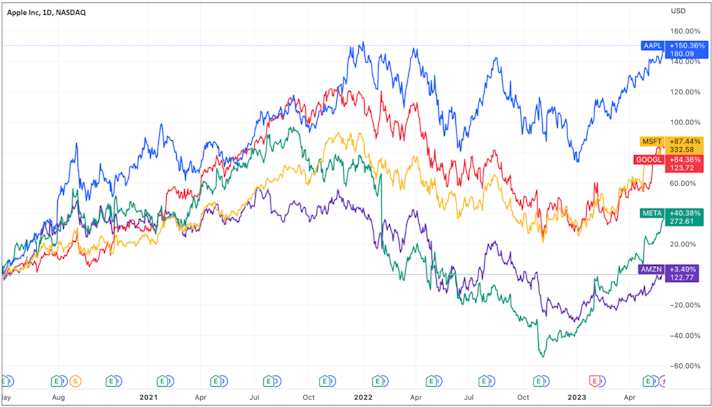

Leading this rally in the S&P 500 has been the tech sector, fueled by the burgeoning excitement around AI. The largest 5 tech stocks now make up 20% of the index’s market cap. The gap between the returns of the equal-weighted and the market cap-weighted S&P 500, indicative of big tech’s dominance, has never been more pronounced.

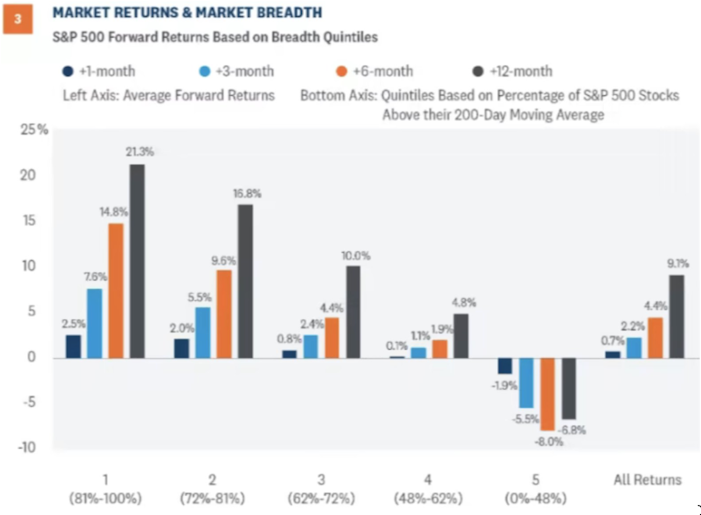

Some investors are voicing their concerns about the current lack of market breadth. They’re questioning the robustness and the sustainability of the current equity rally, but the evidence appears to be a mixed bag.

Let’s delve into it a bit. On the one hand, there does appear to be a correlation between S&P 500 forward returns and market breadth when looking at the percentage of S&P 500 stocks trading above their 200-Day Moving Averages. Today, the number of S&P 500 stocks trading above their 200-Day Moving Averages stands at around 42%.

Financial Times

But on the other hand, we have heard this story before. As recently as 2020, market participants were concerned about the lack of breadth in the stock market. Below is one of several headlines from around that time.

The article highlights how Goldman Sachs previously reported its unease about the potential weaknesses in the market. Their concern at the time was primarily due to the perceived dominance of Big Tech stocks in driving the overall index returns.

Fast forward to today, and the five tech behemoths mentioned in that piece have not faltered like Goldman Sachs expected, delivering an average return of 73.2% since the article was published.

Digging deeper into the data, we find an interesting pattern: a select group of high-performing stocks have often been the engine behind historical market returns.

Take, for instance, a study published by JP Morgan that analyzed the distribution of returns for the Russell 3000 Index from 1980 to 2014. The findings showed that 40% of all the stock components lost more than 70% of their value and never recovered. To put this into perspective, nearly all of the Russell 3000’s returns in that 34-year time period came from only 7% of the companies that outperformed all the others by two standard deviations.

This insight underscores a crucial market truth: tail drives everything. Right now, that tail is big tech and particularly AI. This was never more evident than in the meteoric rise in Nvidia stock price, which is now up 169% YTD, briefly becoming only the 5th company ever to cross $1 trillion in market cap.

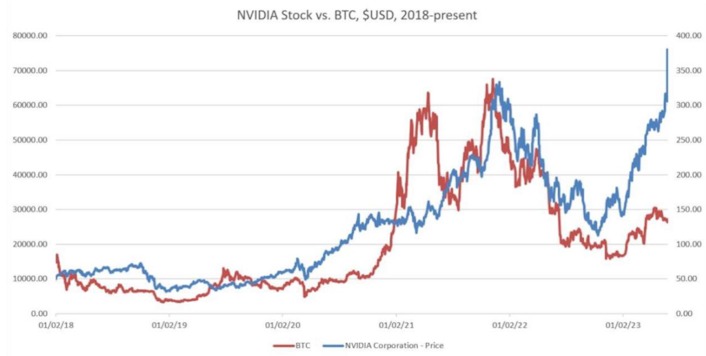

In recent years, the price of Bitcoin has tracked closely to other long-duration assets like tech stocks, suggesting that Bitcoin’s price may be lagging them right now. But even more intriguing, is the comparison between the valuations of a single tech stock and Bitcoin today, as depicted in the chart below.

Dan Tapiero

The fact that one semiconductor company has increased its market cap $618 billion in 2023 alone, greater than the entire market cap of Bitcoin, potentially the monetary protocol of the future, highlights just how early we are.

It serves as a reminder to zoom out when it comes to Bitcoin’s performance. Bitcoin has been trading in a range between $26k and $28k since early May. But when looking at the monthly chart, Bitcoin is clearly in a bullish breakout similar to what we observed before major bull markets in 2016 and 2019.

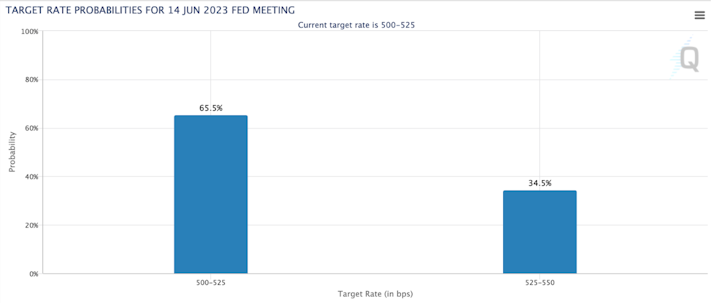

Overall, there are some potential green shoots out there for Bitcoin in the short term. First, there is the resolution of the debt ceiling drama — especially if the liquidity dynamics remain positive in its aftermath. Secondly, inflation data has continued to roll over. Thirdly, the unemployment rate has risen to 3.7%, which has resulted in the market now ascribing a 65% probability of a Fed pause at its next FOMC meeting, which could stoke animal spirits further.

One consideration to keep in mind is the very animal spirits that could trigger a rise in asset prices, can also inflame inflation. This is precisely what the Fed aims to avoid. In a potential domino effect, asset prices could rise, inflation could bounce, and interest rates could increase just as the Treasury is gearing up to issue $1 trillion in fresh debt. The Fed may have no choice but to tighten interest rates further, aiming to tighten financial conditions to quell demand and bring inflation under control.

Taking a step back, it seems we’re at an inflection point in the market. But despite the immediate uncertainty, the broader picture remains quite clear. The recurring drama around the debt ceiling, which unfolds every few years, serves as a stark reminder that we’ve crossed the Rubicon concerning our debt problem. Politicians will continue to spend money they don’t have to paper over problems now, creating bigger ones for future generations to grapple with.

Amid this backdrop, Bitcoin stands as a beacon of change. It offers a novel monetary system that avoids the fragility of the debt-based traditional financial system. As our leaders continue to postpone confronting the debt issue, Bitcoin is likely to reap the benefits. The continued deficit spending boosts Bitcoin’s long-term prospects, as it steadily carves out its niche as an alternative monetary system grounded on the principles of sound money.

Market Overview

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Climbing a Wall of Worry

By Sam Callahan

Market participants are scratching their heads and wondering, “Is this rally for real?” Let’s look at the data to discern some of the bullish and bearish arguments for where markets will move forward from here.

More Holes Than Suisse Cheese

By Sam Callahan

There are lots of words to describe the last week when it comes to the traditional financial system, but orderly is certainly not one of them.

Distrustful Banks and Trustless Money

By Sam Callahan

The credit-based traditional financial system is built on trust, and right now, that trust is breaking down in a world where trustless digital money exists.