Our Most Brilliant Idea

Ideation and wealth creation are mere expressions of life’s central impluse: growth.

Ideas ambulate humanity across history. A new and useful idea is an innovation that can benefit everyone for the rest of time. Therefore, it is critical we construct socioeconomic structures conducive to the creation of new ideas: civilization can only advance amid an everlasting flow of fresh knowledge. Free trade is the means by which we maximize ideation and its physical manifestation: wealth creation. Anything that impedes trade — like central banking — is (by definition) a terrible idea. Contrarily, all accelerants to free trade — like money — are among the most brilliant ideas we’ve ever had.

“A pile of rocks ceases to be so when somebody contemplates it with the idea of a cathedral in mind.”

— Antoine De St-Exupery

Ideas are the origins of everything we say, do, or make. The purpose of any economy is to generate and share useful ideas through free trade (to achieve what economists call the division of labor or knowledge specialization). Civilization emerges not by an aimless concourse of variation, but rather it is molded in the image of our ideas, which we express through action to remake the face of the Earth. Better ideas, or sharper knowledge, equip mankind to more intelligently harness the gifts of the Earth to satisfy his wants to ever-higher degrees in ever-less time. In ideological space, competition is free and fierce: only the most useful ideas survive the test of time.

Resultant knowledge encodes the patterns of action we use to etch our imaginations into the world around us. The market chooses winning ideas, only to be widely distributed as material riches, finer manners and morals, and more profound art.

Our lives are lived by enacting our ideas.

As HG Wells said:

“Human history is, in essence, a history of ideas.”

Or as William Durant elaborates:

“History as a laboratory rich in a hundred thousand experiments in economics, religion, literature, science, and government — history as our roots and our illumination, as the road by which we came and the only light that can clarify the present and guide us into the future.”

Pouring forth from our forebears is this civilizing heritage of ideas sharpened through free trade and expressed in the tools, techniques, and cultures we make for ourselves. As we trade, our ideas become better, giving everything we say, do, or make more want-satisfying qualities. Consider how our language has evolved from grunts to enunciations, or how our behaviors have been shaped by culture, or how our transportation technologies have progressed from wagons to airplanes. Substantive ingredients for all modern miracles surrounding us today have always been available, but prior to their invention, we simply lacked the ideas necessary to manifest them. As the living generation responsible for ideation, our aim must be to forge our ideas into finer form for posterity:

An aim we accomplish through innovation.

Innovation is simply a reconfiguration of the raw materials of nature by indexing them to our most useful idea structures. Said differently: creativity is taking known elements and reassembling them in accordance with new knowledge. Sharpening knowledge to better satisfy ourselves requires fires from the ideological collisions and frictions innate to trade.

Trade is mankind’s “meta-idea” — the generative idea of all our best ideas. Meta (from the Greek μετά, meaning “after” or “beyond”) is a prefix meaning more comprehensive or transcending: trade is an idea about improving ideas. It presupposes that anyone may know something everyone else does not, incentivizes them to teach the rest of us, and lets us all capitalize on any such learning opportunities. Trade indicates to us whether we are ill-informed in pursuing a goal that can save us from harm or help us achieve it more easily.

Wealth generation is inseparable from ideation: the more we know, the more effortlessly we satisfy our (present and potential future) wants through innovation, and the more wealth we gain.

Author Matt Ridley captures the spirit of this relationship between free trade and innovation in these words:

“Innovation is the child of freedom and the parent of prosperity.”

Free market capitalism is an idea unequaled in its generation of innovation. It proved the most successful economic model for expanding trade, ideation, and wealth creation in the 20th-century ideological contention between American capitalism and Soviet communism. Misguided by utopian promises, Soviet Russia attempted to replace the profit motive intrinsic to American Capitalism with appeals to nationalistic faith and devotion, thereby poisoning the wellspring of learning engendered by trade.

Under the moralistic camouflage of Communism (“from each according to their ability, to each according to their needs” was the Marxist slogan), some of the most gruesome atrocities in history were perpetrated. Soon into the Soviet experiment, productivity collapsed, and millions starved or were slaughtered by the state. When governments play God, civilizations burn in hell. Soviet Russia rediscovered what wise Aristotle had warned centuries earlier:

“When everybody owns everything nobody takes care of anything.”

American capitalism outcompeted Soviet communism. Capitalism is a socioeconomic system premised on the three pillars of private property rights, rule of law, and honest money.

Private property rights represent an exclusive relationship between individuals and any portion of nature they invest their time in reshaping, rights they can then exchange with similarly self-sovereign people.

Rule of law is a mechanism for nonviolently resolving private property disputes.

Honest money is the private property unimpeded market processes naturally select as most tradable. Since Capitalism optimizes for trade, it supports this generative source of new ideas by incentivizing economic cooperation and (peaceful) competition.

Indeed, the stability of rules is the bedrock of peace: with fixed and simple laws, market participants are forced to play the game well to make an honest living.

As Bastiat said:

“When goods don’t cross borders, soldiers will.”

In an elemental sense, trade is the water that sustains innovation, and its steadfast flow is a source of peace. Capitalism is the socioeconomic “water well” built to protect this everlasting ideological wellspring of civilization — trade.

“Great minds discuss ideas. Average minds discuss events. Small minds discuss people.”

— Eleanor Roosevelt

As the ultimate token of trade, money is an indispensable tool for ideation. In trade, everything is valued at some ratio of everything else. For instance, a car might be worth 132 chairs, or a house worth 11 cars. Money is the medium through which we more easily calculate these exchange ratios: a tool that simplifies trade by standardizing its intermediation.

Like all tools, money lets us achieve greater results with less effort, and the time-saving tools impart is wealth. Specifically, money allows us calculate, negotiate, and execute trades more quickly. Without money, a constant recalculation of countless exchange ratios among different economic goods would be necessary.

With money, all exchange ratios are compressed into a single number — the money-expressed market price. In this way, money is an accelerant to trade and (its invisible twin) ideation. Standardization to one money creates economies of scale in trade. Such economization is what drives the market to coalesce around a single money — as we saw with gold and (its former currency abstraction, and now apparition) the US dollar:

Money is the medium through which market participants express their ideas, preferences, and values. Pricing systems are economic telecommunication networks endlessly echoing and coordinating market action by dynamically informing everyone of everyone else’s trades.

For instance, when you buy a car and sell a house, the economy responds adaptively by producing more cars and fewer houses. Even when you purchase public equity, you are expressing the idea its expected future cash flows are worth more than its current price, and the marketplace absorbs this thesis when you execute the trade.

Price signals perpetually prime incentives to ensure resources are allocated in accordance with the current aggregate composition of market participant preferences. Entrepreneurs engaging in trade give rise to truthful pricing as they strive to buy low, sell high, and profitably serve one another.

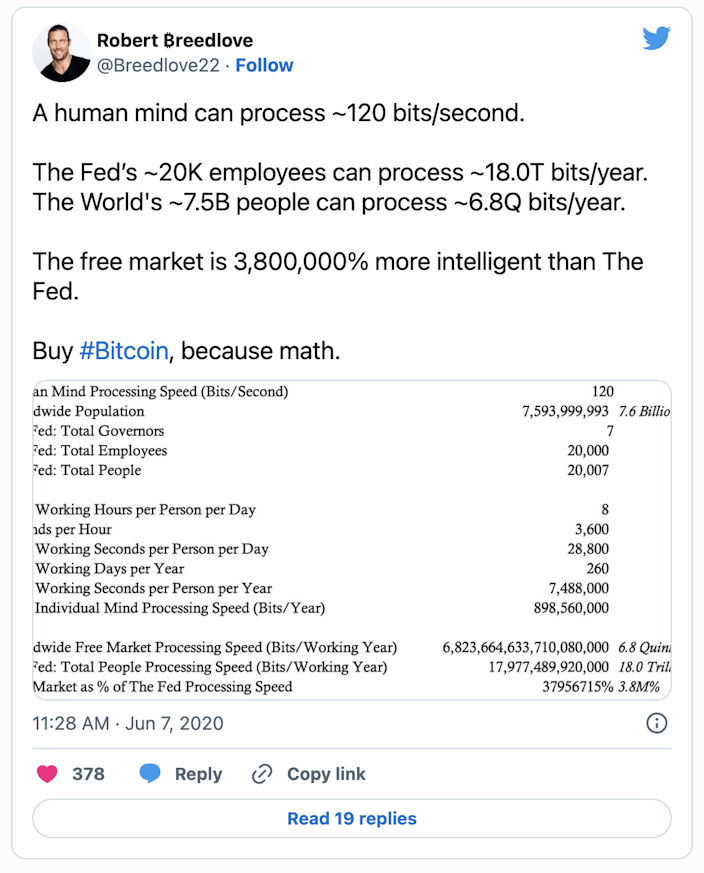

A genuinely free market is a forum of unhampered and voluntary exchange where ideas compete, combine, and transform. Seen this way, the free market may be considered the ultimate distributed computing system — a nexus of consciousnesses driven by human action and interconnected by prices.

Money improves the extensibility of our minds. Thinking is an expression of rationality: the act of comparing all relevant factors to any course of action. By cognitively generating different aspects and avatars relevant to any given situation, humans create mental staging areas for future action.

As with the root word of rationality — ratio — thinking involves contrasting one thing against another. When we extend our thinking into money, we gain insight into the collective mind of other market participants through price signals, which themselves are expressions of rationality: ratios of exchange denominated in monetary terms.

By consolidating the rationality of all market actors into the market price, ideation explodes. In this way, free markets are idea-generating supercomputers. This is why American innovation is unrivaled. Mankind makes the world his own by channeling energy across the ideological field lines fashioned in his extended mind — the free market.

“Man’s mind, once stretched by a new idea, never regains its original dimensions.”

— Oliver Wendell Holmes

Contrary to popular misconception, money is not a government creation. Money is emergent — it is simply the most tradable good in any given market. As people seek to satisfy their wants through trade, they steadily seek to trade their goods for more tradable goods to get closer to obtaining the object (s) they desire.

As this process unfolds, a specific asset gains the highest liquidity — whether it is salt, cattle, or gold — this most exchangeable good is (by definition) money. Money, then, is an inexorable outcome of free trade.

As global markets converged, they coalesced around precious metals as money due to their superior monetary properties of durability, divisibility, portability, recognizability, and scarcity.

Gold — which excelled all other metals in scarcity — became the dominant money of the world precisely because its supply was the least changeable. Central banks eventually coopted gold and built a pyramid scheme on it called fiat currency. When central banks monopolized the market for money, it became unfree.

Violating free market capitalism, as Soviet Russia learned the hard way, is a really bad idea — it runs countervailing to the natural human proclivity for trade, ideation, and wealth generation.

As Marcus Aurelius poeticizes our capacity for collaboration:

“We were born to work together like feet, hands, and eyes, like the two rows of teeth, upper and lower. To obstruct each other is unnatural.”

Clearly, obstructing the ability of market participants to express their ideas through trade is a breakdown in the “rules” of Capitalism. All frictions on free trade are dissipative to both innovation and wealth creation. An actual Capitalist society necessitates unbreakable rules of trade such as the equitable rule of law, inviolable private property rights, and unstoppable honest money.

In such a purely Capitalistic system, individuals would have no way to create value for themselves other than giving society what it wants (even if its wants are as yet unarticulated). But our over-regulated world today is a far cry from this ideal.

All regulations are limitations on free market forces that constrict ideation and its physical manifestation: wealth creation. The ultimate expression of legal regulation is monopolization, in which all peaceful competition is suppressed through coercion or violence.

Today, the money market is not a free market, as it is forcibly dominated by cartels of central banks — legal monopolies that distort prices, reduce trade, and interrupt ideation.

Tellingly, central banking was also a key component of Soviet communism — an exclusive state-owned banking monopoly was the 5th measure in Marx’s 1848 Manifesto to the Communist Party. True capitalism has never existed precisely because the rules of money have always become twisted by interventionists pursuing their own pecuniary gain in every market known to history. Legal impediments erected by governments to insulate central bank monopolies on money from free market capitalism are manifold. Such artifice destroys accountability, ingenuity, and virtue.

With unbreakable capitalistic rules, the “game” of macroeconomics would impose an organizing principle onto humanity, encouraging us to find better ways of saying, doing, or making things by betting against each other in the marketplace as opposed to lying, stealing, or taxing.

When rules cannot break, play is fair, and want-satisfactions escalate. As “players” prove one another wrong in the marketplace — by discovering and selling better means of satisfying wants — the resultant productivity gains diffuse into society through trade. An environment conducive to continuous learning at scale is cultivated through Capitalism.

Said differently: when ideas compete freely, more wealth is created — most often in the form of better tools, services, or knowledge. Mises describes this inextricable relationship between ideation and market competition in his masterwork Human Action:

“But competition does not mean that anybody can prosper by simply imitating what other people do. It means the opportunity to serve the consumers in a better or cheaper way without being restrained by privileges granted to those whose vested interests the innovation hurts.

What a newcomer who wants to defy the vested interest of the old established firms needs most is brains and ideas. If his project is fit to fill the most urgent of the unsatisfied needs of the consumers or to purvey them at a cheaper price than their olde purveyors, he will succeed in spite of the much talked of bigness and power of old firms.”

To use Ray Dalio’s term: free markets are idea meritocracies: unhampered trade networks that incentivize the cultivation and infusion of the best ideas into civilization. Implicit in the meta-idea is the presupposition innovation can only be nurtured, not legislated.

Here, the ignorance of MMT advocates clamoring for “the activation of idle capital through inflation” rears its head: proceeds from theft via inflation can mobilize people and capital, but only in an unintelligent way since bureaucrats lack both the accountability and distributed computing power endogenous to the free market, and only until this parasitization of value from the productive economy kills it.

In simple economic terms: free markets make mankind more productive; monopolies, or unfree markets, make mankind less productive. Further, the condition of our collective mind closely mirrors the state of our money. We only think in dollars today because they were once redeemable for gold. Central banks have hijacked the monetary extensibility of our minds (the old “bait and switch” tactic) and corrupted our capacity to perceive the world clearly:

Free minds need freely selected money. By embracing a free market paradigm in the totality of our actions, we become more free-thinking, intelligent, and wealthy. Another way to think about the free market is as a system of error detection and correction: through prices, it incentivizes the discovery and resolution of unsatisfied wants (socioeconomic errors).

Central bank induced inflation distorts this error correction system and causes dissatisfactions to swell. This market manipulation is (ostensibly) justified by the self-deceptive intentionality of central bankers to “manage the economy, ” as if any human had ever successfully managed any complex system without triggering a cascade of unintended consequences. Conviction in the utility of their necessarily limited knowledge, as opposed to the free market processes which continually revivify knowledge, is the black core of central bank malevolence. As John Milton, author of Paradise Lost, brilliantly observed:

Evil is the force that believes its knowledge is complete.

Central banks could repent merely by admitting this gargantuan error in ideology and letting the free market clear its 100+ years of mistakes. This would be painful at first, but undoubtedly in the long-term best interests of civilization — like a drug addict finally entering rehabilitation. But hubris and greed will almost certainly prevent such an ideal outcome.

To summarize the argument: free market pricing is an error-clearing system, and central banking ameliorates its capacity for error detection and correction; acting as if its knowledge of markets is complete, central banking is evil incarnate — an institution of economic tyranny as misguided as Soviet Russia. In the ideological sphere, freedom is as creative as tyranny is destructive.

“An Idea Is Salvation By Imagination.”

— Frank Lloyd Wright

Quintessential to the idea of any money is that both present and future market participants will freely accept it in trade. The likelihood of a money being accepted by the broadest possible set of trading partners is primarily based on how reliably it maintains its scarcity across time. To maximize this store of value function, a money must be resistant to misappropriation — whether by inflation, counterfeit, or confiscation (all of which are theft).

The money most resistant to involuntary exchange (aka theft) tends to become the most widely adopted voluntary medium of exchange. Put another way: in free market competition, the most theft-proof money wins. Those who erroneously choose a less theft-proof money are disfavored by market processes when their wealth is compromised by thieves through inflation, counterfeiting, or confiscation. Another way to say it: market participants adopt the money, which minimizes the need to trust one another. Central banks continue to hoard gold because it is trust-minimized money. Bitcoin exhibits even greater trust-minimization qualities and is therefore disruptive to gold.

Money is the best idea we’ve ever had, for without it, all the other marvelous ideas generated by markets would not exist. As the most tradable thing, money is the highest instantiation of our meta-idea, offering us unbridled optionality in market exchange. As a technology, free-market-selected money maximizes both human freedom and cooperation.

Historically, gold reduced the incentives to violence because it was a more securable form of wealth than food, land, and most other assets. In this way, gold greatly constricted the scope of assets worth fighting over, thereby inducing unparalleled social cooperation, trade, and wealth generation. This has profound moral implications too: when money is hard to steal, society becomes hard-working; when it is easy to steal, society drifts toward kleptocracy. Let me state the argument in a single sentence: gold was the greatest tool we ever had to incentivize ourselves to civilize ourselves.

“If the aim of humanity is to build civilizations, then our most brilliant idea was the use of gold as money.”

The global gold standard improved trade (our meta-idea) in a trust-minimized way and standardized the world to a single monetary protocol — thereby maximizing time-savings in trade and its associated wealth creation (two sides of the same coin).

Again, wealth creation is absolutely dependent on ideation: using gold as money led the world into an unequaled effulgence of novel ideas and innovations, ushering in an era known colloquially as both The Gilded Age and La Belle Époque:

A brilliant idea indeed, but far from perfect: because gold is physical, it is still vulnerable to theft. Because gold is heavy, economies of scale related to its use as money led to the centralization of its custody in bank vaults (since it is cheaper to transact in paper abstractions of gold than physical gold). An anti-capitalist institution — the central bank — festered around these centralized gold hoards.

These deceptive and evil institutions operate with flagrant disregard for the tenets of capitalism: central banks are above the law, practice perpetual private property confiscation via inflation, and peddle the most dishonest money in history. All central bank business models are critically dependent on the divisibility, portability, and recognizability shortcomings of gold:

If gold were perfectly divisible, there would be no reason to abstract it into paper currency.

If gold were perfectly portable, it would be encoded as information, and there would be no need to place trust in banking custodians as final settlement could be conducted at the speed of light.

If gold were perfectly recognizable, there would be no economic gain from the “public stamp” of national currencies as anyone could verify the veracity of money themselves instantaneously.

Indeed, these technological failings of gold formed the attack surface repeatedly exploited by central banks. Fortunately for citizens of the 21st century, free trade — which has been exponentially enhanced by the internet and digital technologies — has generated an even more brilliant idea that promises a permanent ending to the thieving schemes of central banks.

“There Is One Thing Stronger Than All The Armies In The World, And That Is An Idea Whose Time Has Come.”

— Victor Hugo

America was founded on the three pillars of free market capitalism: private property rights, the rule of law, and honest money. The American Constitution authorized states to issue gold or silver currency, outlawed income tax, and prohibited national central banking.

Unfortunately, upon successful implementation of the American central bank (after two failed attempts), the private property rights foundational to free market capitalism became vulnerable to limitless violation via inflation.

An example of this failure came with the “Great Gold Robbery of 1933” (aka Executive Order 6102): an unconstitutional decree and blatant violation of private property rights. All government decrees by fiat are lies (including fiat currency), for truth need never be forced. Free market forces always zero-in on truth.

Bitcoin is the ideological synthesis of gold and the internet; it perfectly exemplifies the three pillars of free market capitalism undergirding the idea of America in a form that cannot be perverted by fiat decree. As its money supply cannot be changed, its holders are immune to confiscation via inflation, thus perfecting their private property rights (Pillar 1).

Disputes within the Bitcoin network are settled consensually. It is impractical to employ violence in an attempt to sway this process, thus perfecting the process of nonviolent dispute resolution embodied by the rule of law (Pillar 2).

By perfecting these first two pillars of free market capitalism, Bitcoin is a self-fulfilling prophecy predestined to perfect its final pillar by becoming the final evolution in free-market-selected honest money (Pillar 3). As the only sacrosanct money in existence, Bitcoin is purified capitalism: a permanent implementation of the soundest socioeconomic “water well” in history:

Competition and collaboration are the trades of life. The conservatism of energy is truth — organizations, methods, and tools that accomplish the greatest results with the least effort tend toward dominance as they are willingly embraced by market participants whose “skin is in the game.”

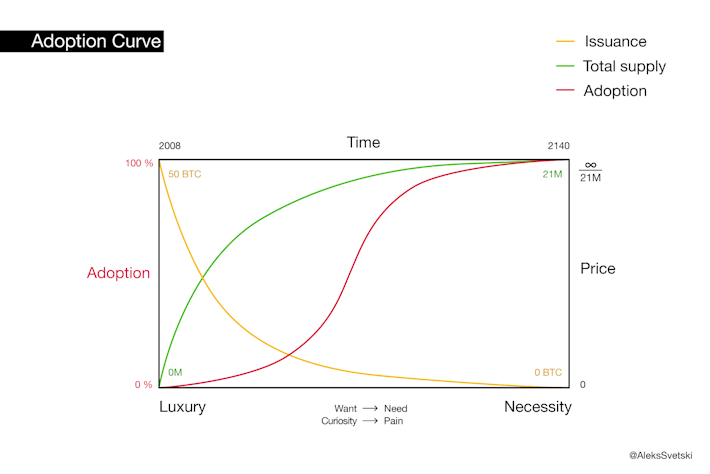

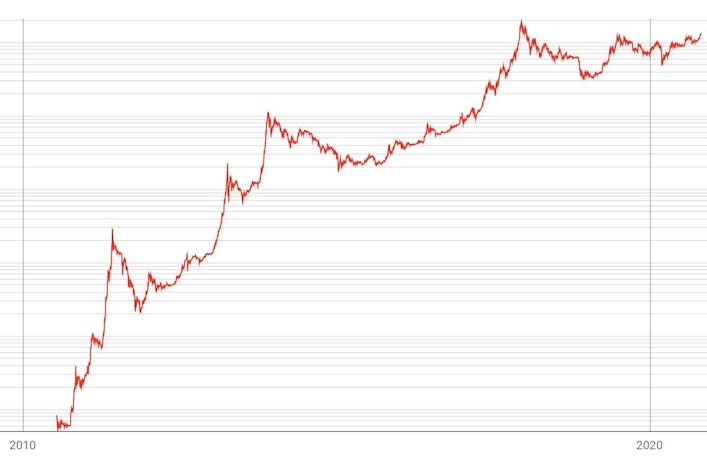

Strict adherence to thermodynamic principles is the way all-natural systems grow (there is no other way). Monies, moralities, and strategies that best amplify productivity outcompete on the free market for ideas — submission to this truth is freedom. Bitcoin is a system that minimizes competitive asymmetries by maximizing accountability and thereby incentivizes fair play and error-clearing in the market. Modeled on the unbreakable rules of the universe — thermodynamics — Bitcoin is best known for its meteoric growth pattern:

We are what we build, and we build what we are. Ideation and wealth creation are mere expressions of life’s central impulse: growth. Without adequate levels of exchange, the growth of organisms and economies deteriorates. On this point, nature is ruthlessly clear: when you’re finished changing, you’re finished.

As we age, we experience a slowing of blood flow, which presages a breakdown of body and mind. Physical exercise can provide some protection by increasing our metabolic exchange of oxygen, water, and nutrients, thereby keeping us smarter, healthier, and more energetic as we age.

As William Durant eloquently describes this decline into senescence:

“It is a physiological and psychological involution. It is a hardening of the arteries and categories, an arresting of thought and blood; a man is as old as his arteries, and as young as his ideas.”

What is true for the individual market participant microcosm is true for the global market macrocosm: impeding free trade constricts ideological “blood flow.” It makes the “socioeconomic superorganism” (aka humanity) more vulnerable to disease and death. Close-minded constituents conjure a build-up of misfitness to reality for the collective. Creating blockages to trade via regulation and confiscation — the implicit purpose of central banking — is cancerous to the free market paradigm that invigorates our economic vitality, social morality, and the advancement of civilization.

All individuals seek to attain freedom, goods, and power for themselves. Governments are simply a multiplication of ourselves and our desires, without external governance, and armed with weapons of mass destruction. No amount of tears can wash away the blood war sheds; only practicality, properly implemented, can prevail. Absent a battle to fight — whether moral or physical — people become weaker. Arraying armies against an enemy gives people cause for unity. Perhaps Bitcoin will serve as a moral alternative to war — a peaceful yet disciplinary force on humanity.

American Pragmatist William James believed a “moral equivalent” of war was necessary to end its horrors:

“So far war has been the only force that can discipline a whole community, and until an equivalent discipline is organized, I believe that war must have its way.”

If this proves true, Bitcoin will become a new organizing mode for civilization: like a religion born from economic and computer science, a wisdom tradition that defunds and destroys central bank war machines and ideologies. Warfare is Darwinism writ geopolitical, and its atrocities will be endless until all nations agree, or are forced, to yield their self-arrogated sovereignty to a higher authority — a “superstate” hodling individual sovereignty as its axiomatic mantra. Bitcoin — a public utility that facilitates trade flows of private property — is the bridge between communistic utopianism and capitalistic pragmatism and could grow to become the superstate to which all nations bend the knee. Perhaps this ultimate usurpation of the nation began with the Genesis Block on day one, or perhaps it is still yet to transpire one day. For now, we can only say: Bitcoin is money.

Money is the ultimate token of trade, and trade is mankind’s meta-idea. Whatever wins as money on the free market is a brilliantly formulated, civilizing idea. Capitalism is the socioeconomic system that optimizes for the expansion of trade’s scope by respecting free market principles, foremost of which is individual sovereignty. Bitcoin — an honest money offering its holders inviolable private property rights and perfected rule of law — is the capstone innovation of capitalism. It is as if all trade throughout history led us to the emergence of this idea: an unstoppable, incorruptible, and highly accessible money.

Considered in combination, these ideas make Bitcoin mankind’s most brilliant idea yet — a salvific foundation on which we can build a future civilization characterized by more ingenuity, morality, and prosperity.

Like ideas, Bitcoin exhibits non-corporeality, virality, and antifragility — it can be moved at the speed of light and stored in the mind. By virtue of its resistance to theft and rootedness in the thermodynamics of work, Bitcoin portals us into a world of untold liberty, elevated morality, and enhanced productivity. Bitcoin gives us the freedom to trade without central bank interference, store our wealth in a place resistant to seizure, and embrace truth in a world drowning in deception.

Salvation: to see each thing for what it is — its nature and its purpose. To do only what is right, say only what is true, without holding back. What else could it be but to live life fully — to pay out goodness like the rings of a chain, without the slightest gap.

— Marcus Aurelius

Thank you for reading Our Most Brilliant Idea.

Follow me on Twitter: https://twitter.com/Breedlove22

Stack sats with me, get $10 in free Bitcoin through this link: https://www.swanbitcoin.com/breedlove

Journey with me as I write my first book: https://bit.ly/3aWITZ5

If you enjoyed this, please send sats: https://tippin.me/@Breedlove22

Or, send sats via Lightning Network with Strike: https://strike.me/breedlove22

Or, send sats via PayNymID: +tightking693

Bitcoin accepted here: 3CiBznmvP2jXVSPR9bUWZwSNtbe9ubp36M

Translations:

Thank you for feedback during the writing process: Jimmy Song Brandon Quittem @Greg Z Zach_of_Earth

My sincerest gratitude to these amazing minds:

@real_vijay, Saifedean Ammous, Brandon Quittem, Dan Held, Naval Ravikant, @NickSzabo4, Nic Carter, @MartyBent, Pierre Rochard, Anthony Pompliano, Chris Burniske, @MarkYusko, @CaitlinLong_, Nik Bhatia, Nassim Nicholas Taleb, Stephan Livera, Peter McCormack, Gigi, Hasu, @MustStopMurad, Misir Mahmudov, Mises Institute, John Vallis, @FriarHass, Conner Brown, Ben Prentice, Aleksandar Svetski, Cryptoconomy, Citizen Bitcoin, Keyvan Davani, @RaoulGMI, @DTAPCAP, Parker Lewis, @Rhythmtrader, Russell Okung, @sthenc, Nathaniel Whittemore, @ck_SNARKs, Trevor Noren, Cory Klippsten, Knut Svanholm @relevantpeterschiff, Preston Pysh, @bezantdenier

And anyone else I forgot 🙂

Sources:

b. Rational Optimist by Matt Ridley

c. Meditations by Marcus Aurelius

d. Fallen Leaves: Last Words on Life, Love, War, and God by Will Durant

e. Manifesto to the Communist Party by Karl Marx

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Robert Breedlove

Robert Breedlove is founder, CEO, and CIO of Parallax Digital, a global Bitcoin-focused hedge fund and consultancy. He considers himself a freedom maximalist and believes he’s found his life’s work in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?