More Holes Than Suisse Cheese

There are lots of words to describe the last week when it comes to the traditional financial system, but orderly is certainly not one of them.

Swan Private Market Update #29

This Market Update report was originally sent to Swan Private clients on March 24th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

The week began in dramatic fashion as the banking crisis spread overseas when the large European bank, Credit Suisse, came under severe distress after years of scandals and poor risk management finally caught up to the controversial bank. In our last market report, we warned that Credit Suisse was a bank to keep an eye on, and we didn’t have to wait long before the 167-year-old institution was on the brink of collapse. After clients had pulled around $120 billion in deposits from Credit Suisse in the last three months alone, the trend accelerated last week, with $10 billion worth of deposits leaving per day.

We noted in our last update that a Credit Suisse failure would be one catalyst that could make the recent bank failures become systemic. This is because Credit Suisse was deemed a Global Systemically Important Bank by the Basel Committee on Banking Supervision, which means that it was determined that a Credit Suisse failure would trigger a wider financial crisis and threaten the global economy.

Because of this, when Credit Suisse began teetering over the weekend, Swiss regulators and the Swiss National Bank (SNB) were quick to step in to try to lend a hand. Credit Suisse was given a $54 billion line of credit from SNB to help provide liquidity for the troubled bank.

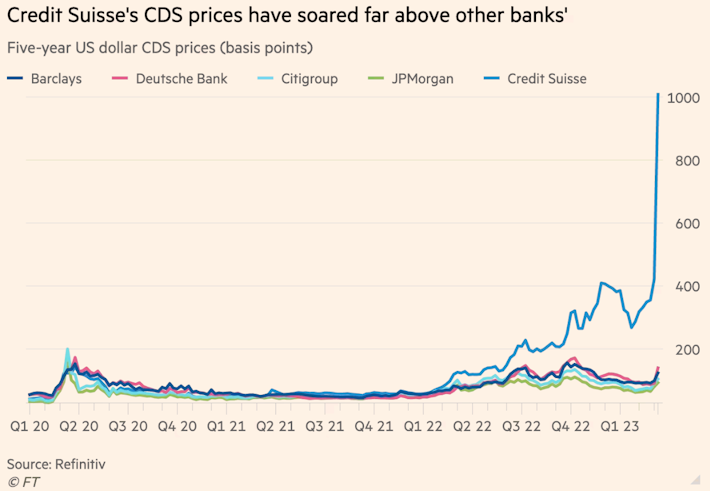

But this line of credit did nothing to quell market concerns. The 5-year Credit Default Swap (CDS) price for Credit Suisse, the cost to insure against its default, spiked.

This led to Swiss regulators changing laws and circumventing shareholder votes and effectively forcing Credit Suisse’s rival UBS into acquiring the troubled lender on Sunday night to prevent the crisis from spreading across global markets Monday morning. If they didn’t find a buyer quickly, the Swiss authorities were even considering nationalizing the bank to safeguard the country’s financial system.

In the end, UBS acquired Credit Suisse for pennies on the dollar. Last Friday, Credit Suisse’s stock was trading at $2.03/share for a market value of $8.06 billion. UBS acquired Credit Suisse two days later at $0.83/share at a market value of $3.25 billion, down about 60%. Under the terms of the deal, Credit Suisse shareholders received around $3.1 billion, while, controversially, about $17.3 billion in bonds were completely written down to zero. This acquisition creates a new megabank, with the combined assets of UBS and Credit Suisse totaling to around twice the size of Switzerland’s GDP.

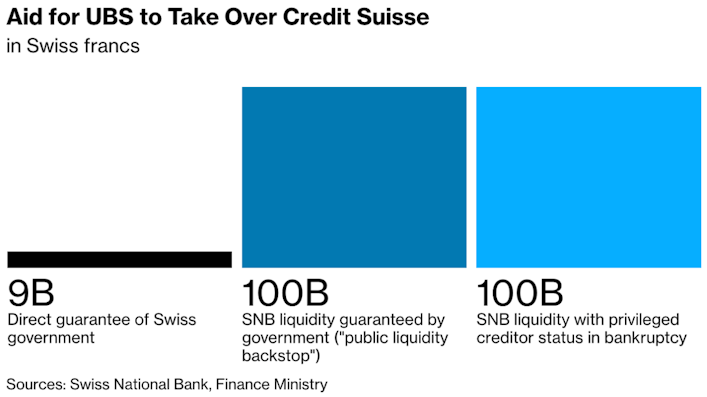

Furthermore, UBS only agreed to this deal if significant government protections and guarantees are in place.

Here are some of the government guarantees provided to UBS as part of the deal:

the Swiss National Bank offered UBS an emergency liquidity loan of up to $109 billion that’s protected in the event of a default

Another $109 billion liquidity facility that the bank can draw on that is guaranteed by the Swiss government

Swiss authorities agreed to protect UBS to up $9.8 billion in losses from Credit Suisse assets

In other words, this was a private acquisition of a bank with a pseudo-bailout attached that will be paid for by Swiss taxpayers. Bloomberg estimates that these government protections will cost every taxpayer in Switzerland an estimated $13,500 each. Once again, a troubled bank’s losses have been socialized.

It’s important to note that just because Credit Suisse was saved in the nick of time, it doesn’t mean that the risk has disappeared. After the merger, the cost of the 5-year CDS of UBS spiked to the highest levels since 2012. The risk has only been transferred to a new, larger institution.

During this Swiss debacle on Sunday night, central banks and policymakers across the globe rushed to assure the public that the global banking sector was indeed strong and resilient despite the shotgun acquisition of a Global Systemically Important Bank that is deeply integrated into the global financial system.

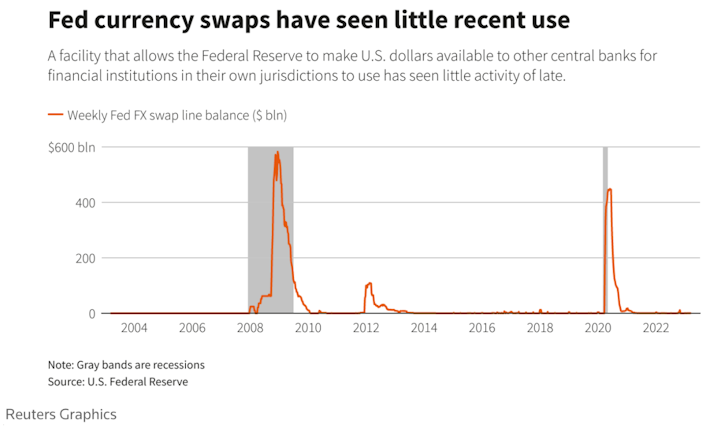

That same evening, in a joint statement, the Federal Reserve, the Bank of Canada, the Bank of England, the Bank of Japan, and the Swiss National Bank announced that they will be moving their dollar swap line arrangements from weekly to daily to “enhance the provision of dollar liquidity.”

These arrangements haven’t seen much use since March 2020, and only get utilized during times of severe financial stress.

This can be interpreted as premeditated action from central banks to make sure that the pipes are in place if liquidity conditions continue to worsen for these troubled banks. It’s a sign that this is a liquidity crisis, not a credit crisis like in the Global Financial Crisis of 2008.

This swap line announcement comes after the Federal Reserve announced a new one-year liquidity program, the Bank Term Funding Program, that allows banks to put up their underwater bonds as collateral for loans with the key caveat that the Fed will value these bonds at face value. This was done to help provide liquidity for these banks that are holding long-duration bonds, but need to service fleeing depositors now. This loan program prevents them from having to sell these bonds at a large loss, which would only spook depositors more, increasing the risk of the bank collapsing. (See: Silicon Valley Bank)

To further provide access to liquidity, the Federal Reserve eased requirements for banks to access its discount window, which is typically used as a last resort for banks that need liquidity due to the stigma associated with it. These loans carry a high rate of interest and must be paid back. For instance, the last time use of discount window spiked in 2008, every one of these loans were paid back in full, although one must remember that a key reason for this was the bailouts enacted by the Fed and Treasury during the GFC.

Last week, a record $152.9 billion was borrowed by banks from the discount window.

This historic discount window activity shows that liquidity is drying up in the system and these banks are desperate to get their hands on some dollars.

Other metrics of liquidity in the system are hinting at the same idea of low levels of liquidity in the system.

The MOVE Index, a measure of Treasury bond market volatility, and a gauge of implied bond market liquidity, spiked to its highest levels since the Global Financial Crisis last week.

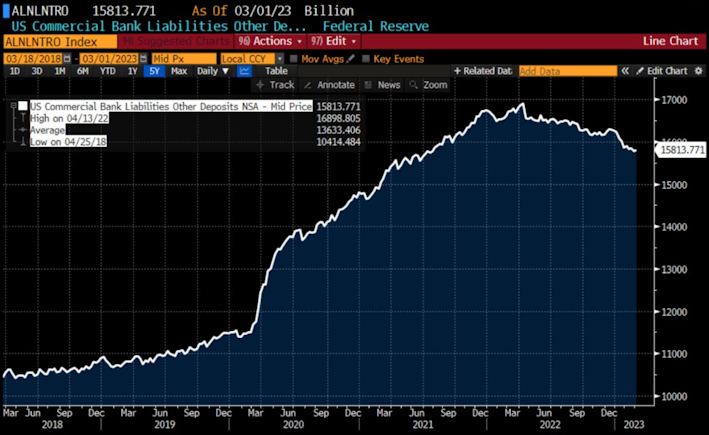

In addition, another measure of liquidity, Other Deposits and Liabilities (ODL), a measurement of M2 money supply minus physical currency and money market accounts has been contracting rapidly this year, down over $1 trillion from its peak.

All of these data points together, along with the recent actions from the Federal Reserve, tell us that dollars are becoming hard to come by for banks.

This low liquidity environment and subsequent banking crisis escalated right into the Fed’s FOMC meeting this week, where many market participants were anticipating a potential pause to the rate hikes. However, the Fed stuck to its guns and hiked the federal funds rate an additional 0.25 bps to continue its fight to bring down inflation.

With this latest interest rate increase, the Fed is choosing to focus on price stability despite signs of financial instability developing domestically and overseas as a direct result of the rapid pace of interest rate hikes over the last year. With this recent action, the Fed is showing that it believes its liquidity facilities such as the new Bank Term Funding Program, reactivation of the daily USD swap lines, and easing access to the Fed’s discount window, will be enough to patch any cracks forming in the financial system while they continue to hike rates. Right now, the Fed is trying to ride two horses with one ass. On one hand, they are attempting to stabilize the banking sector by providing more liquidity for the system, while on the other hand, they are continuing to tighten financial conditions to try to fight inflation.

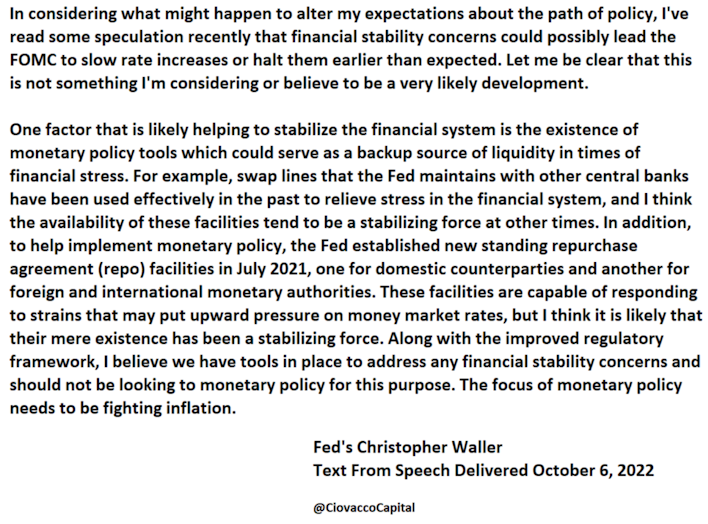

This speech from Fed Governor Christopher Waller from last October is an interesting read and perhaps highlights the Fed’s thinking here as it continues to raise rates despite signs of financial instability.

And yet, even if Fed officials are right in their belief that its liquidity programs will be enough to fill the holes in these banks and keep them afloat, they do little to address the underlying dynamics of why depositors are fleeing these banks.

The first dynamic is that the Fed’s decision to raise interest rates is making it more attractive for depositors to leave their banks in search of yield in Treasuries or money market funds that now provide much higher levels of interest compared to accounts at a bank.

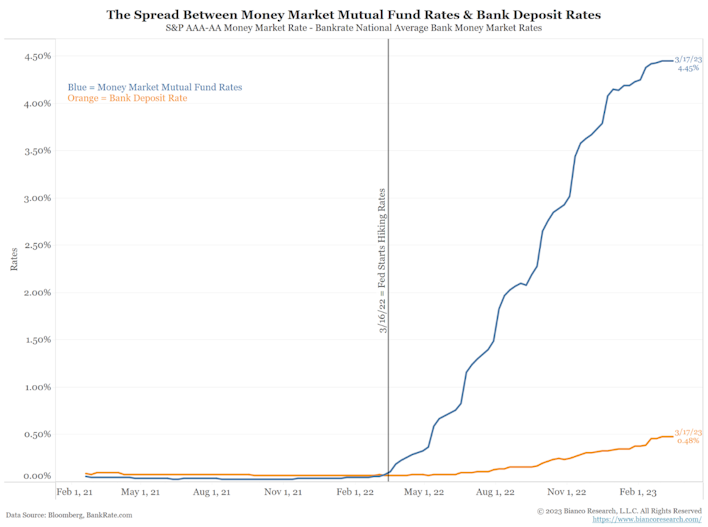

Below is a great chart from Jim Bianco that shows the huge difference between money market fund rates and bank deposit rates.

The Fed hiking an additional 0.25 bps on Wednesday only served to widen this spread even more, making it more enticing for depositors to continue to flee their banks for these higher-yielding investment vehicles.

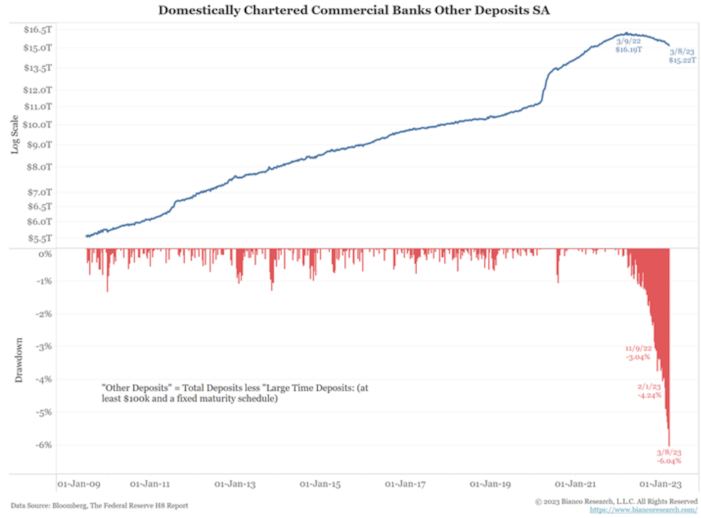

Jim Bianco continues to show here how bank deposits were already being drained at the fastest rate since the Global Financial Crisis BEFORE these bank crises even began.

The second dynamic is that these deposits are primarily flowing out of smaller banks into these investment vehicles for higher yields as well as into larger banks due to fears of continuing bank contagion.

In a hearing last week, an extraordinary exchange occurred when Treasury Secretary Janet Yellen was questioned by Senator James Lankford from Oklahoma on the recent joint decision by the FDIC, Federal Reserve, and Treasury to insure all depositors of Silicon Valley Bank and Signature Bank.

Senator Lankford: “Will the deposits in every community bank in Oklahoma regardless of their size be fully insured now…every community bank in Oklahoma, regardless of their size, will they get the same treatment that SVB just got?”

Secretary Yellen: “A bank only gets that treatment if a supermajority of the FDIC board, supermajority of the Fed board, and I, in consultation with the President, determine that the failure to protect uninsured depositors would create systemic risk and significant economic and financial consequences.”

Senator Lankford: “So what is our plan to keep large depositors from moving their funds out of community banks and into the banks?”

Secretary Yellen: “That is happening because depositors are concerned about the bank failures that have happened and whether or not other banks will also fail.

Senator Lankford: “No, it’s happening because you are fully insured no matter what the amount is if you are in a big bank, you are not fully insured if you are in a community bank.”

What Senator Lankford is explaining above is exactly what we are seeing in the data. Large banks have reported a surge of inflows since the SVB collapse as billions of dollars worth of deposits, presumably from smaller banks, have moved their funds due to the assumption that their deposits would be fully protected by the FDIC, Fed, and Treasury if these large banks failed because they would be deemed too systemically important. The same can’t be said for smaller banks.

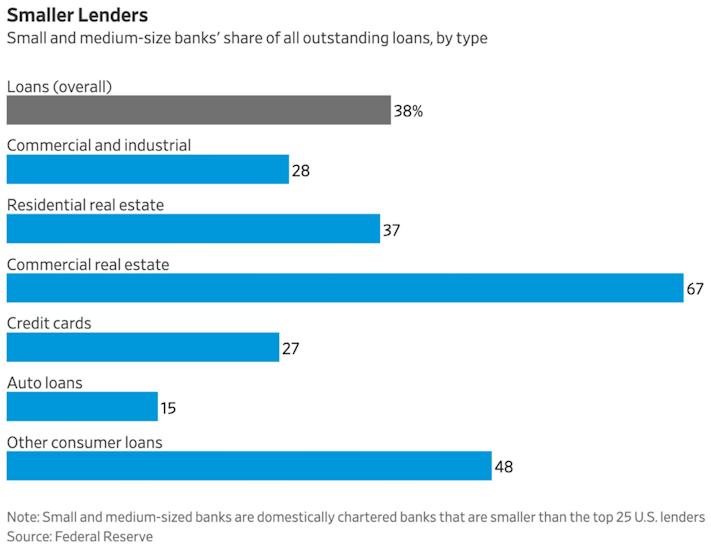

This is an extremely problematic dynamic due to how important smaller lenders are to lending in the economy. Smaller lenders make up 38% of the total loans in the economy and are especially critical for real estate, small businesses, and farmers.

Not only that, but these smaller lenders have less cash/assets on hand to weather any kind of significant drain on their deposits compared to their larger counterparts.

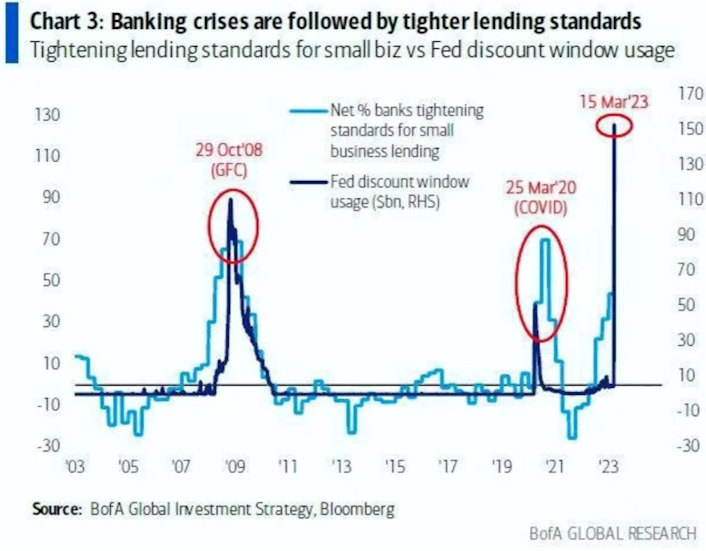

With their largest and cheapest source of funding shrinking, these small banks will need to turn to more expensive sources of capital and likely will need to reduce the amount of the loans they make in the economy. This follows a trend of previous banking crises where tighter lending standards become the norm.

With more small banks at risk of seeing their deposits flee, not only are they themselves at risk of going under, but the businesses and households that depend on them for financing them will find it harder to access capital. This is how a liquidity crisis can quickly turn into a credit crisis.

We saw a prime example of this earlier in the week with the regional bank PacWest, which needed to shore up capital after 20% of its depositors, or $6.8 billion, have fled this year alone. PacWest has been using the Fed’s liquidity facilities, already having borrowed $10.5 billion for the discount window, and $2.1 billion from the Bank Term Funding Program. Its stock is currently down -65% in the last month.

And herein lies the conundrum, will the Fed’s liquidity programs and the Treasury’s backstopping of uninsured deposits be enough to stop this banking crisis from spreading as the Fed’s interest rate hikes exacerbate the very problem in the process?

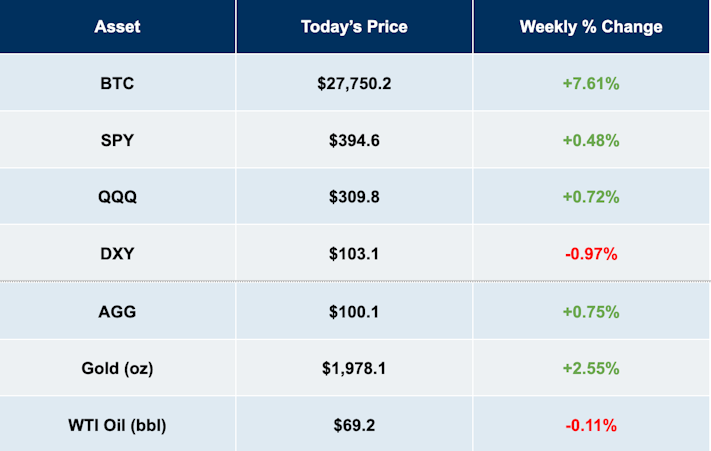

These are big question marks as it stands today, and it’s one reason why owning an asset that functions outside this fragile banking system is so important. This could be part of the reason why Bitcoin has been soaring amidst this banking crisis. Investors are perhaps waking up to the fact that it’s beneficial to own an asset that they can truly own outside of the banking system.

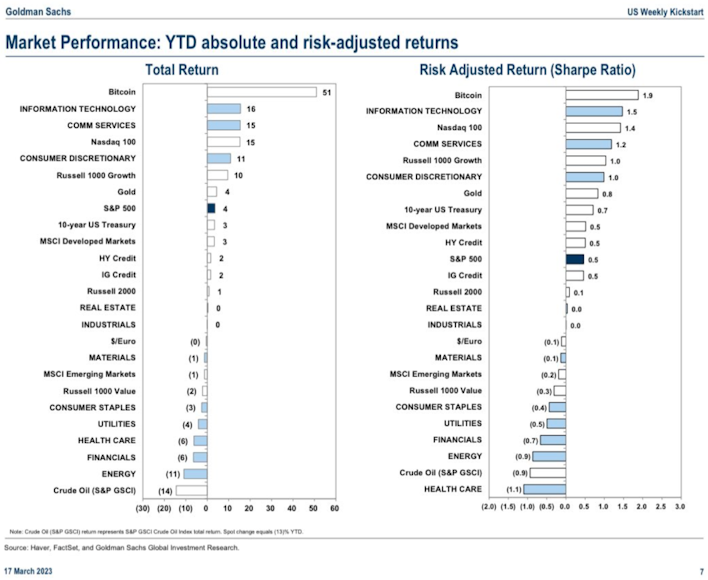

It has certainly been a good start to 2023 for Bitcoin. On both an absolute and risk-adjusted basis, Bitcoin is the best-performing asset class year-to-date.

Bitcoin represents a safe alternative to the inherent instability of fractional reserve banking. Additionally, Bitcoin has often been described as a sponge for global liquidity and, right now, central banks are doing their best to try to provide more liquidity to the system.

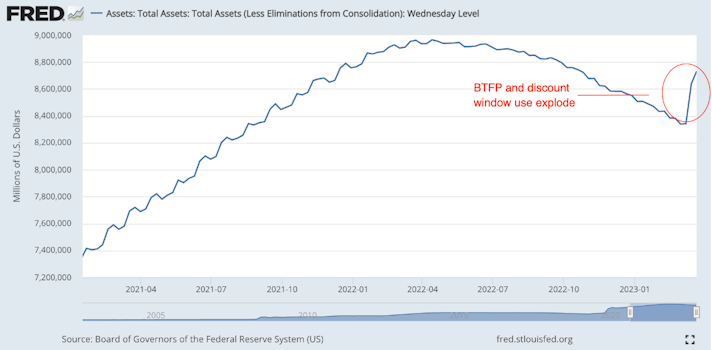

Since the beginning of the Fed’s new programs, the Fed’s balance sheet has exploded +$390 billion, erasing around 5 months of quantitative tightening in a little over one week.

Time will tell if this recent explosion in the Fed’s balance sheet will prove to be a temporary blip, or if this is the start of a new period of balance sheet expansion. If more banks come under pressure and this crisis starts to spiral out of control, we should expect the Fed and Treasury to do everything in their power to prevent a collapse of the banking system.

For Bitcoin, there are reasons to believe that it would benefit in the long run in either scenario. Bitcoin has no counterparty risk, which is the exact kind of asset investors should want to own during a credit crisis. Also, in the event that the Fed tries to pump liquidity into the system, Bitcoin should benefit in that scenario too as a scarce hard asset.

Last weekend, I was in Austin at Bitcoin Takeover, and this was confirmed when speaking to multiple individuals who work at Bitcoin-only companies throughout the industry, who said that business has been booming since the bank crisis began. This has certainly been the case here at Swan as well.

This is only anecdotal evidence, but it helps to corroborate the idea that investors are waking up to Bitcoin in this environment of bank failures, emergency liquidity programs, and weekend shotgun acquisitions.

Bitcoin is an antifragile money that benefits from disorder. It’s an alternative monetary system that gains market share and mind share when the monetary system it’s competing against becomes more unstable. There are lots of words to describe the last week when it comes to the traditional financial system, but orderly is certainly not one of them.

Market Overview

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.