Market Headwinds Continue to Blow as the Fed Stands Firm

Swan Private Market Update #9 — The markets continued to experience turbulence over the last two weeks as investors grapple with rising risks of inflation, hawkish Fed, economic conditions, and the Russian-Ukraine War.

Swan Private Market Update #9

This report was originally sent to Swan Private clients on May 20th, 2022. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin. Learn more and schedule a call with our team here.

Benefits of Swan Private include:

Dedicated account rep accessible by text, email, and phone

Timely market updates (like this one)

Exclusive monthly research report (Insight) with contributors like Lyn Alden

Invitation-only live sessions with industry experts (webinars and in-person events)

Hold Bitcoin directly in your Traditional or Roth IRA

Access to Swan’s trusted Bitcoin experts for Q&A

Get more information here

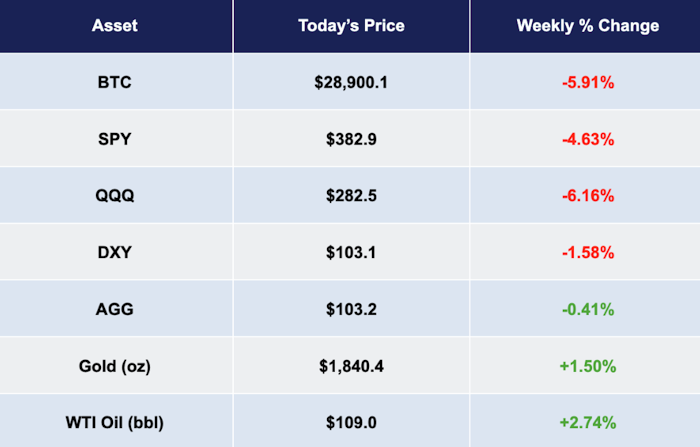

The markets continued to experience turbulence over the last two weeks as investors grapple with the rising risk of recession due to inflation, a more hawkish Federal Reserve, deteriorating economic conditions, the continued adverse effects of the Russian-Ukraine War, and new COVID lockdown developments in China.

On Wednesday, stocks resumed their sharp selloff as the Dow and S&P 500 suffered their worst single-day percentage declines since 2020. Since our last market update, the S&P 500 is down -5.65%, and the Nasdaq is down -7.46%. Stocks are getting hammered as inflation fears and weak earnings continue to hit market sentiment hard.

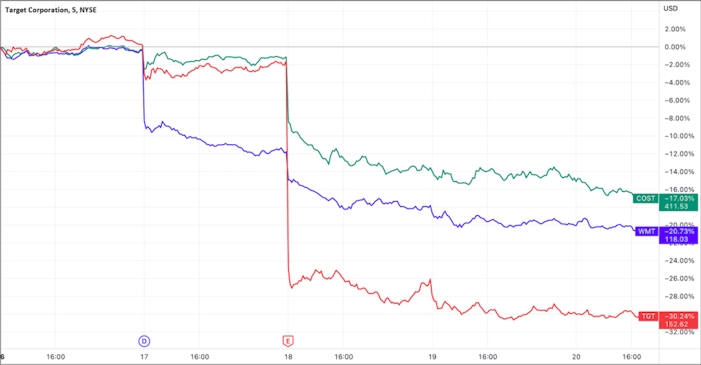

This was never more evident than when the stocks of some of the largest retailers in the world, Walmart, Target, and Costco, all crashed after disappointing earnings reports. Both Walmart and Target saw their worst selloffs since 1987. On the week, Target is down -30.24%, Costco is down -17.03%, and Walmart is down -20.73%.

These retailers cited rising fuel and freight costs, increased labor costs, and slowing sales growth as the main culprits of their earnings misses.

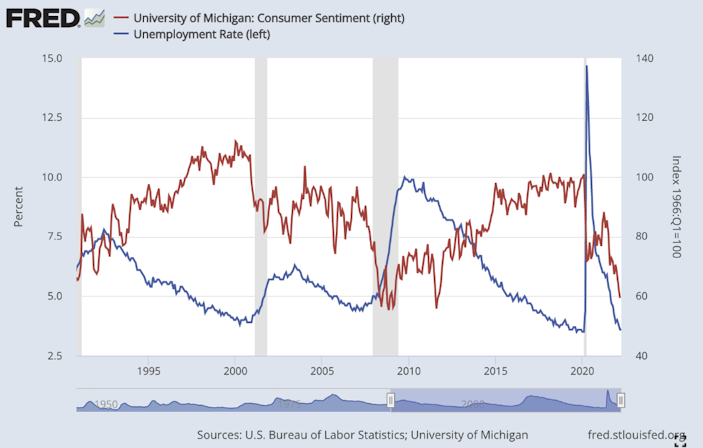

This can be interpreted as a sign that consumers are beginning to feel the pinch of inflation due to the rising costs of essentials like gasoline and food. According to Yardeni Research, households are now spending ~$5,000/yr on gasoline, up 79% YoY. This comes as consumer sentiment currently sits at its lowest level since 2011, according to the University of Michigan Consumer Sentiment Index.

The Federal Reserve might actually see these developments as positive given their goal to slow down this overheated economy. Even with the stock market bleeding out, investors shouldn’t expect the Fed to come to the market’s rescue anytime soon. The recent messaging from Fed officials has been clear…reducing inflation by tightening monetary policy is their top priority.

Inflation is clearly much too high, and monetary policy must be repositioned to address this.

Charles Evans, 5/17/22

Chicago Fed President

You’d still have a strong labor market if unemployment were to move up a few ticks, ” he said. “I would say there are a number of plausible paths to have a soft, as I said, softish landing…Restoring price stability is an unconditional need. It is something we have to do. There could be some pain involved.

Jerome Powell, 5/17/22

Fed Chairman

The Fed is sending the message that it’s committed to tightening financial conditions and bringing down inflation even if it means falling asset prices and rising unemployment. The US CPI increased at a slower rate for the first time in 8 months in April, coming in at 8.3% YoY, but the Fed wants to see that number much closer to their 2% target. The big question becomes, what could make the Fed pivot on its policy stance?

The first thing to consider is the Fed’s mandate of maximum employment. Today, the unemployment rate sits at 3.6%, a half-century low. However, we are beginning to see cracks in the labor market with increased news of layoffs from companies like Netflix, Wells Fargo, Robinhood, and increasing weekly jobless claims.

When referring back to the low consumer sentiment mentioned above, this is usually a leading indicator of rising unemployment. Typically we see consumer sentiment drop before periods of high unemployment. If consumers reduce their spending, this impacts corporate earnings, leading to an increased risk of layoffs and recession. The chart below highlights how consumer sentiment typically moves inversely to the unemployment rate during recessions.

If this pattern holds true, and the unemployment rate eventually moves inversely to consumer sentiment and spikes off its multi-decade lows, it could force the Fed to reverse course.

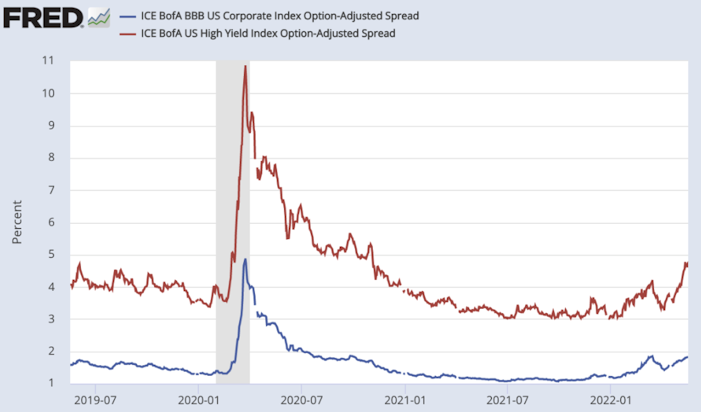

The second thing to consider is the corporate bond market, which has been experiencing increased volatility of late. If the corporate bond market starts to have serious issues, this could spark contagion and a cascade of bankruptcies given how much debt is in the system today. The Fed is likely keeping a close eye on this part of the market as it raises rates to combat inflation.

We’re starting to see signs of increased credit risk in both the investment grade and high yield corporate bond markets gauged by corporate credit spreads, which is the yield minus the risk-free rate (US Treasury bond). The higher the corporate credit spread, the more investors want to be compensated for taking on the added risk. Observe below how both the investment grade and high yield spreads are starting to creep up to levels not seen since November 2020.

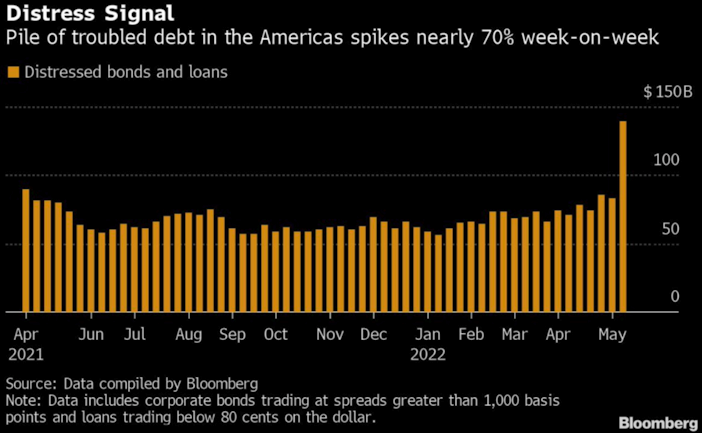

Furthermore, we saw the amount of distressed corporate debt spike to $139.1 billion this week, up 67% from the week prior.

If the corporate credit market continues to roll over and show increased signs of distress, this could cause the Fed to pump the brakes on its aggressive rate hikes to prevent a deflationary debt spiral from occurring.

All in all, we are in a challenging period in the market, and asset prices across the board have suffered in this uncertain, inflationary environment. The sector that continues to outperform is commodities, specifically energy. It further drives home the point that it’s critical for investors to have a well-diversified portfolio to endure the volatile market we find ourselves in today.

The Fed is trying to navigate a “softish” landing for the economy as they raise rates to fight inflation in a period of slowing economic growth. We shall see if they will be able to handle the turbulence and successfully crash land, or if they will capitulate and provide a parachute for this falling market.

A “Stablecoin” Implodes and Drags Bitcoin’s Price Down With It

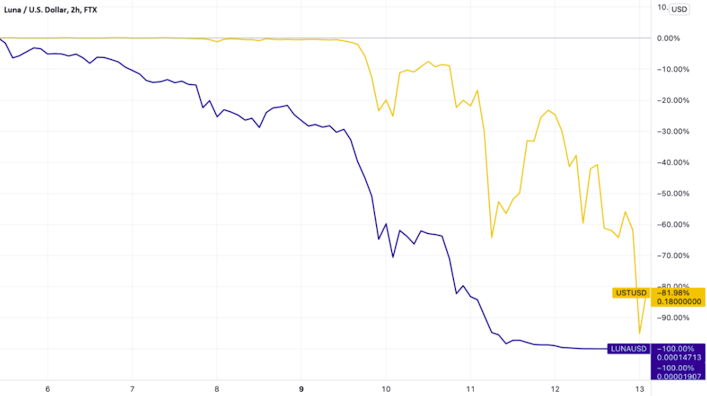

It has been a memorable past two weeks in the Bitcoin world. Swan CEO Cory Klippsten has been publicly warning about the risk of the algorithmic stablecoin, Luna/UST, imploding since late March. The elaborate Ponzi scheme finally blew up last week in spectacular fashion when UST broke its peg. (read full post-mortem linked below)

On May 5th, Luna/UST was a top 10 cryptocurrency with a combined market capitalization of over $50 billion. By May 13th, Luna/UST’s combined market capitalization had crashed to $1 billion, down -99%. Over $50 billion dollars worth of wealth — destroyed in days.

During the collapse, the Luna Foundation Guard reportedly sold an estimated 80,000 BTC ($2.3 billion) from its LFG reserves in a failed attempt to save its peg, tanking Bitcoin’s price in the process.

Due to the broader macroeconomic backdrop, the Luna/UST collapse, and general fear in the market, Bitcoin currently sits at $28,876, down -19.38% since our last market update. It has traded in a range of $29,000 — $31,000, which has shown to be a key support level the previous two times Bitcoin has seen heavy selling pressure.

With the Luna/UST fiasco alone resulting in billions of Bitcoin being sold, it’s quite impressive that Bitcoin was able to absorb the heavy selling pressure and find a price floor of around $30,000 in that environment.

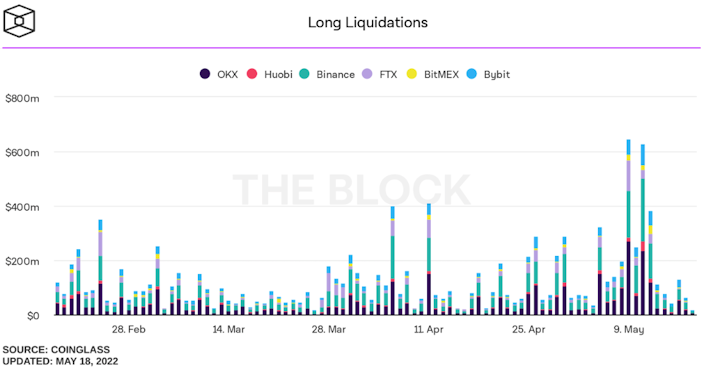

During bear markets, it’s important to remember that blow-ups like this, of obvious frauds and scams, need to happen before we can continue onto the next bull run. This is true for leverage as well. During the seven days around the Luna/UST crash, the volatile price action liquidated a combined $2.69 billion dollars of Bitcoin long positions.

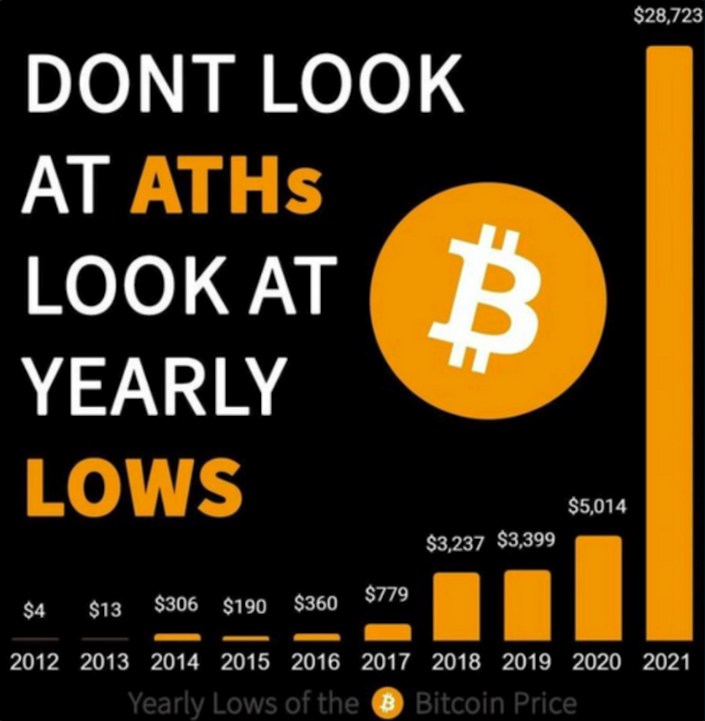

In the long term, it’s a good thing to wash out these overleveraged traders and have their bitcoin transferred over to long-term investors to build a healthy base of convicted holders to begin the next bull cycle. This has been the long-term trend of Bitcoin observed over the years. Bitcoin finds support and consolidates at higher levels than the previous yearly low. Although Bitcoin technically wicked down below 2021’s low during the Luna/UST crash, it has now found support above it.

Outside the price action, we continue to see steady news of building throughout the Bitcoin industry. Block Head Jack Dorsey announced Block’s new initiative to develop an open-source bitcoin mining ASIC chip. One of the reasons cited was “to cut back on concentration around Chinese manufacturers of bitcoin mining ASIC chips.” Another product release occurred when CoinCorner announced the Bolt Card, a new NFC (near-field communication) card that works like the tap function of a VISA card but on the Lightning Network. It makes it easier to make in-person payments at stores using the Lightning Network.

In more exciting news, one of the largest landowners in Texas, Texas Pacific Land Corporation, and bitcoin mining company JAI Energy have announced a strategic alliance to develop a 60 MW facility in West Texas. Texas Pacific Land Corporation owns around 880,000 acres of land in Texas.

On the regulatory front, the Financial Accounting Standards Board unanimously voted to consider setting clear rules for companies that hold Bitcoin regarding accounting and reporting procedures. The current rule as it stands makes Bitcoin less attractive from an accounting perspective for companies who hold Bitcoin on their balance sheet. Currently, accounting rules cause companies to take charges when prices move lower but do not allow them to mark their holdings higher when prices rise. If accounting treatment becomes more clear and less onerous, it should make it incrementally easier for companies to hold Bitcoin on their balance sheets.”

Lastly, President Buykele welcomed 32 central banks and 12 financial authorities to El Salvador “to discuss financial inclusion, digital economy, banking the unbanked, El Salvador’s Bitcoin rollout and its benefits in the country.” We now have institutions from 44 different countries being educated by a President of a sovereign nation on why they should consider adopting Bitcoin for their respective countries.

Despite Luna/UST failing miserably and causing panic in the market, Bitcoin continues to truck along, working exactly as intended since day 1. It’s another example of Bitcoin’s antifragility in that it was able to function perfectly while a top 10 cryptocurrency went to zero within days. In many ways, we should be grateful that Luna/UST imploded before it grew to become an even larger systemic risk.

In the short term, Bitcoin’s price will continue to remain volatile as it weathers the same turbulent macro environment that every other asset is currently experiencing. In the medium to long term, the risk of Luna/UST blowing up is now behind us, the leverage has been cleared out, and Bitcoin remains an increasingly adopted asset that functions outside the traditional financial system with near-perfect 99.99% uptime.

If you are interested in learning more about Swan Private to receive Bitcoin advisor services click here.

This report was originally sent to Swan Private clients on May 20th, 2022. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin. Learn more and schedule a call with our team here.

Benefits of Swan Private include:

Dedicated account rep accessible by text, email, and phone

Timely market updates (like this one)

Exclusive monthly research report (Insight) with contributors like Lyn Alden

Invitation-only live sessions with industry experts (webinars and in-person events)

Hold Bitcoin directly in your Traditional or Roth IRA

Access to Swan’s trusted Bitcoin experts for Q&A

Get more information here

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?