Is Bitcoin’s Price Too High to Invest?

Whenever someone discovers Bitcoin there are twom phases that typically occur, the first is that wish they could buy it cheaper, and the second is that in hindsight, they should have bought more.

Not convinced you’re early to Bitcoin? Keep reading 👇

Whenever someone discovers Bitcoin, two phases typically occur, the first is that they wish they could buy it cheaper, and the second is that, in hindsight, they should have bought more.

Everyone feels like they’re late to the game when they find out about Bitcoin. They feel like Bitcoin is too expensive and that they missed the boat, but this is flawed thinking.

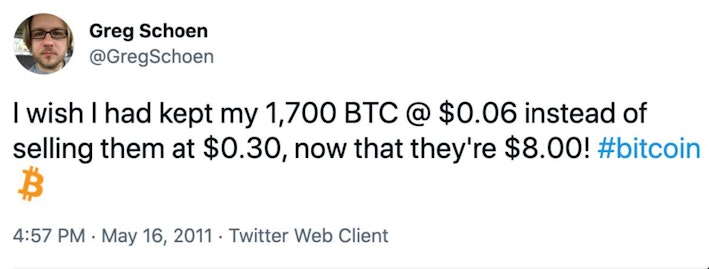

Take it from Greg in 2011:

Nowadays, we laugh at the idea that somebody could think $8/bitcoin is expensive. However, back then, it probably really did feel that way. Similarly, although 1 bitcoin costing $32,500 might sound high today, that same price may look dizzyingly cheap years from now as Bitcoin adoption continues to grow globally.

It’s key to remember that over long periods, Bitcoin has returned extraordinary gains for investors. That’s why it is more important to buy it and hold it for a long period of time rather than try to time the market to get in at a lower price.

What I am referring to above is the concept of lengthening your time horizon. When investing in Bitcoin, you should view it as a long-term investment rather than a short-term trade to get rich quickly. If you start thinking in years instead of weeks or months, it will change how you view the price of Bitcoin.

Ask yourself this — if you plan to hold Bitcoin for 5 years, 10 years, or 20 years, are you really going to care if you bought Bitcoin at $30,000, $40,000, or $50,000? The answer is probably not. You expect it to be much, much higher by then.

When looking at the price of Bitcoin, it helps to “zoom out” to get a general idea of how Bitcoin has continued to grow as an asset over time. One can easily observe this trend by looking at the all-time chart of Bitcoin.

The main takeaway is that it’s not about what price an investor buys but how soon they decide to buy Bitcoin at all.

As they held it, they could benefit from the price appreciating as Bitcoin’s adoption continued to grow over the years. When it comes to Bitcoin, it is time in the market that matters, not timing the market.

By buying Bitcoin today, what you are really betting on is that the usage of Bitcoin will continue to spread. It’s reasonable for investors to conclude that the price of Bitcoin will be magnitudes higher years down the road if the positive trend of Bitcoin adoption continues. As more and more people find value in Bitcoin, the demand for the asset increases, resulting in the price rising due to Bitcoin’s fixed supply. Since we already know Bitcoin’s supply is fixed, let’s see what Bitcoin’s demand has looked like over the last 12 months.

In the past year alone, we’ve witnessed public companies, hedge funds, insurance companies, and now countries all adopt Bitcoin. On top of that, payment providers like Paypal, Visa, and Square began offering access to Bitcoin for their millions of clients and merchants.

Lastly, billionaire investors like Bill Miller, Stanley Drunkenmiller, Paul Tudor Jones, and Ray Dalio have all endorsed Bitcoin. The demand for Bitcoin appears to be healthy and growing, and thus we can expect the price to continue to increase with its adoption as the years tick on.

The truth is that despite Bitcoin being >$30,000, we are still extremely early in its adoption. Bitcoin is an ambitious technology that aims to one day allow for the free flow of trillions of dollars worth of value on its network. It’s attempting to become a widely accepted store of value which is why it is often compared to gold.

Gold is frequently compared to Bitcoin because they share many of the same properties. Like gold, Bitcoin is scarce, divisible, durable, and portable. Yet Bitcoin improves on gold’s properties by being a natively digital technology. Bitcoin is a scarcer gold that you can divide up into millions of pieces and send through the internet with a tap of a finger.

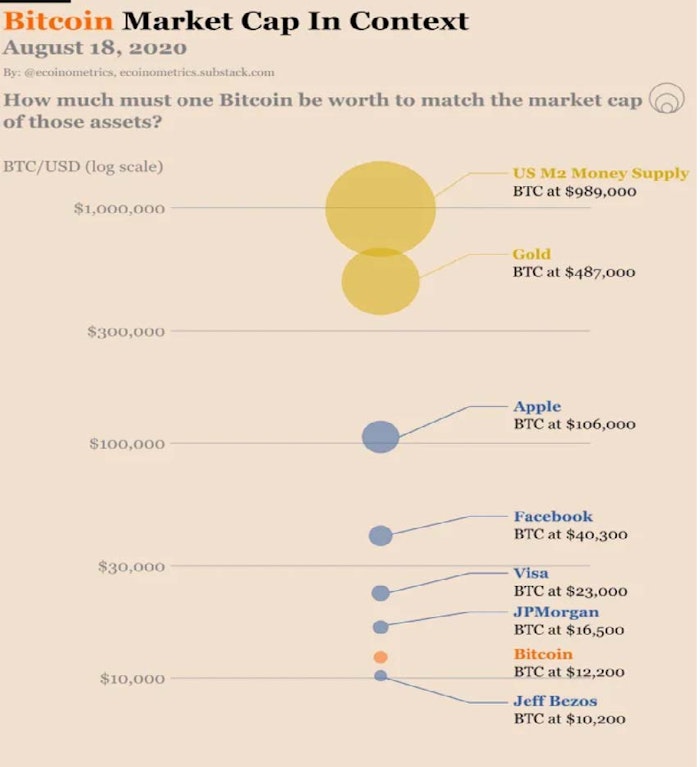

Thus, investors can reasonably expect that Bitcoin may reach and perhaps even exceed the market cap of gold in the future.

In the graphic above, you can see that if Bitcoin reached gold’s market cap, then 1 Bitcoin would equal nearly $487,000 or ~15x higher than today! At its current price, Bitcoin’s market cap is not even larger than Facebook’s, a single public company. That’s how early you are.

As you can see, even though the price of Bitcoin today might appear expensive, the potential investment opportunity here is MASSIVE. Investors need to look at Bitcoin through a long-term lens to benefit from its growing adoption.

We are still in Bitcoin’s early days. If it continues on its path to becoming a widely accepted store of value, then in the future, $34,000/bitcoin will seem just as ridiculously cheap as $8/bitcoin does today.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?