Is Binance in Trouble? Yes, Here Is Why… (March 2024)

The uncertainity surrounding Binance hasn’t become any clearer. How much trouble might Binance find itself in and what can we expect in 2024 from the world’s most popular exchange? Let’s dive in!

The uncertainty surrounding Binance has never been higher since it was issued a lawsuit by the U.S. Securities and Exchange Commission (SEC) on June 5th, 2022. Join us for this deep dive evaluation of Binance.

In this article, we’ll dive deeply into what CEO and founder Changpeng Zhao (also known as CZ) stepping down means, examine how and if Binance is in trouble, how these new developments will affect its customer base, and what is next for the world’s largest exchange!

Not a big reader, not a problem. Click any of the links below in the overview section to move directly to that section.

What is Binance?

Binance, the world’s largest cryptocurrency exchange platform, was founded in 2017 by CZ. It provides a platform for users to buy, sell, and trade various cryptocurrencies.

The exchange offers a wide range of features, including spot trading, futures trading, options trading, margin trading, and more.

Binance has a native cryptocurrency called Binance Coin (BNB), which can be used for discounted trading fees on the platform and other purposes within the Binance ecosystem.

Potential Consequences of Binance Non-Compliance

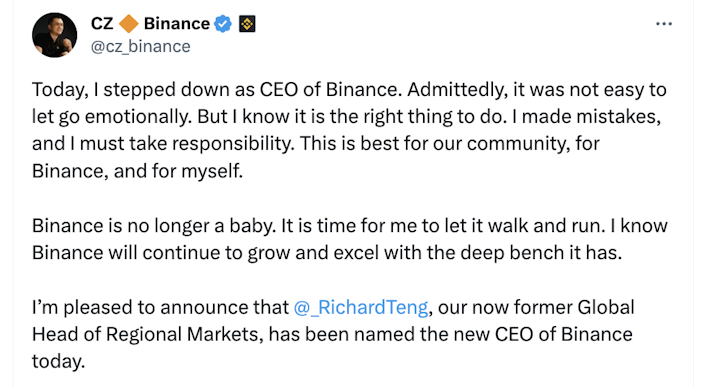

MUST KNOW: On November 21st, 2023, CZ agreed to a settlement with U.S. federal prosecutors. The settlement requires Zhao to plead guilty to violating criminal U.S. anti-money-laundering laws.

On the same day, CZ announced the news on Twitter:

As part of CZ’s plea, Zhao will be personally subjected to a $50 million fine. Additionally, Binance will be required to pay $4.3 billion in fines as part of the plea deal. CZ was released on $175M bond and is scheduled to be sentenced in February, 2024.

The settlement will allow Binance to continue operating (for now)… but the exchange’s legal troubles are far from over.

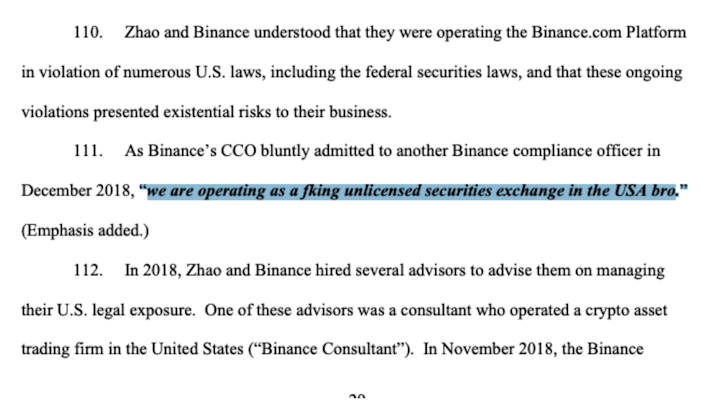

“We are operating as a fk’ing unlicensed securities exchange in the USA, bro.”

- Binance’s Chief Compliance, 2018

The above statement was found in internal communications during the discovery process by the U.S. government. This acknowledgment, first made in 2018, occurred only a year after Binance launched.

Reduced Market Access

Non-compliance has led to Binance being denied access to markets, facing operational restrictions, and encountering reluctance from governments and financial institutions to engage with them or their partners.

What Do These Troubles Mean to Investors?

The SEC emphasizes the risks and lack of transparency associated with these platforms. As a result, existing customers risk experiencing a range of adverse outcomes, including but not limited to:

Increased scrutiny of Binance operations

Potential disruptions in services

Withdrawal halt/pause

Increased KYC requirements to fulfill withdrawal requests

Potential legal and financial consequences for the exchange significant loss of liquidity

Main Takeaways Investors Should Understand

NOTE: In the entire 136-page document, Bitcoin was mentioned only six times — none with a negative connotation.

Serious Legal Concerns

With the increasing uncertainty surrounding Binance, many investors are withdrawing Bitcoin from the exchange and are seeking additional information on why Binance is in trouble.

Multiple government lawsuits indicate potential violations of laws or regulations by Binance, including but not limited to:

Fraud

Wash trading

Money laundering

None of this should come as a surprise to Swan Signal Blog regulars. On April 17th, Swan Lead Analyst Sam Callahan published an in-depth report titled Binance: Raising Eyebrows Since 2017.

NOTE: This report was originally sent to Swan Private clients on April 14th, 2023.

According to a recent Kaiko Insight Report titled: The Crypto Liquidity Concentration Report, 2023 — Binance:

Represented 30.7% of the worldwide market depth

Controlled 64.3% of the global trading volume

What to Know: The eight largest exchanges combined dominate an impressive 91.7% of market depth and 89.5% of trading volume.

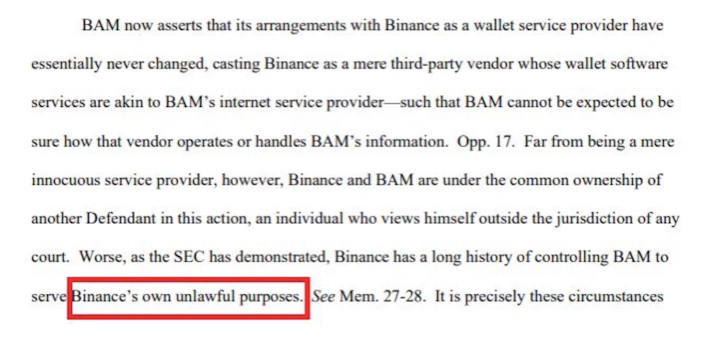

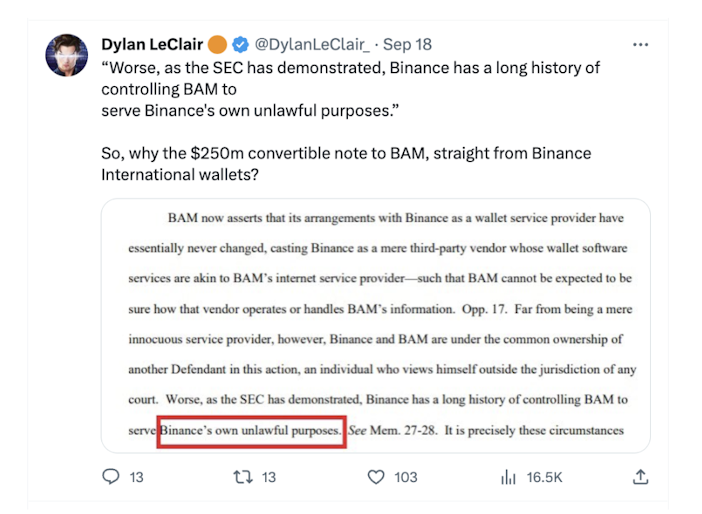

In the latest filing by the SEC, the regulator says that the Binance.US audit found it “very difficult to ensure the company was fully collateralized… Worse, as the SEC has demonstrated, Binance has a long history of controlling BAM to serve Binance’s own unlawful purposes.”

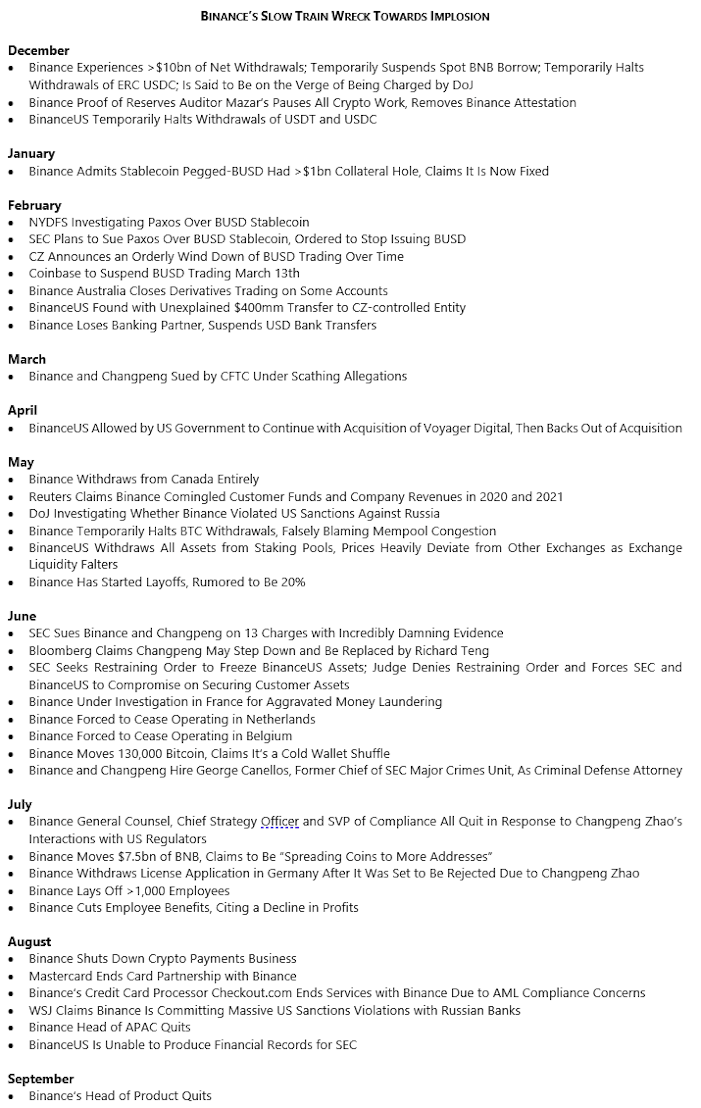

On September 5th, Ikigai Asset Management founder Travis Kling published a historical timeline outlining a history of “negative events” at Binance since December 2022, attracting attention from some of the exchange’s top brass.

“Yi He, a former talk-show host, has sweeping control over the crypto giant’s marketing and investment divisions. She is also founder Changpeng Zhao’s longtime romantic partner.”

Over the Christmas 2023 holiday weekend, the Wall Street Journal posted an exposé titled: The Crypto Queen Pulling the Strings at Binance.

Sept. 6, 2023: Helen Hai announces her resignation

Sept. 6, 2023: Vladimir Smerkis announces his departure

Sept. 6, 2023: Gleb Kostarev announces his resignation

Sept. 4, 2023: Mayur Kamat, product lead at Binance, announces his resignation

Aug. 31, 2023: Leon Foong, head of Asia-Pacific at Binance, announces his resignation

July 7, 2023: Steven Christie, senior vice president for compliance at Binance, announces his resignation

July 6, 2023: Patrick Hillmann, chief strategy officer of Binance, announces his resignation

July 6, 2023: Han Ng, general counsel at Binance, announces his resignation

July 6, 2023: Steve Milton, global vice president of marketing and communications at Binance, announces his resignation

July 6, 2023: Matthew Price, senior director of global investigations and intelligence at Binance, announces his resignation

October 19, 2023: Stéphanie Cabossioras stepped down from her position as the Executive Director of Binance France

October 19, 2023: Saulius Galatiltis has stepped down as chief executive officer of Bifinity UAB, a payment processor that serves as a gateway for fiat transactions by customers of the Binance cryptocurrency exchange

The week of September 13th, 2023, saw Binance.US cut ⅓ of its workforce.

During a summer meeting after the workforce reductions, employees openly expressed their concerns to Zhao, as revealed by messages reviewed by the Wall Street Journal.

An anonymous employee queried Zhao in the chat during the all-hands meeting, stating:

“Certain individuals who were laid off received no advance notice and only discovered their job status when they couldn’t access the system anymore. Is this a respectful way to treat them?

Is a two-week severance package considered respectful?”

Also recently reported by the WSJ, Binance faced another obstacle in late August when the Journal released a report about Binance customers' involvement with sanctioned Russian banks.

Binance made a blog post on September 27th addressing the sale to CommEx and why it will discontinue support for the Russian Ruble (RUB).

The decision follows the exchange’s denial of media reports, two months ago, suggesting its involvement in assisting customers in transferring funds from sanctioned Russian banks out of the country.

Ceffu

The SEC is particularly interested in Ceffu, an institutional crypto custodian and a partner of Binance. The regulatory body suspects that Ceffu has served as an intermediary between Binance .US and Binance Holdings, facilitating the movement of U.S. customer funds outside the United States.

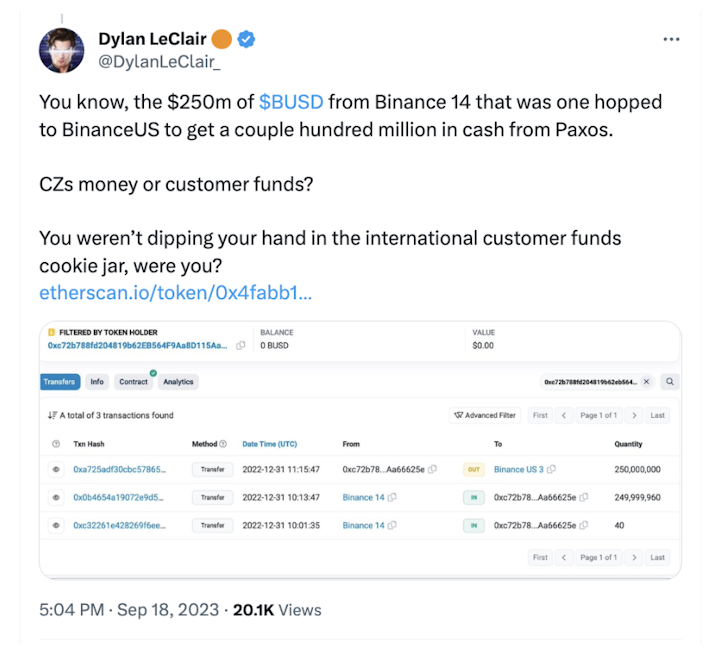

According to legal documents submitted by Binance.US’s legal team, BAM Management U.S. Holdings issued a convertible note worth $250 million to Zhao in December.

The documents state that Zhao utilized BUSD (Binance USD), with $183 million directed to Paxos Trust Company, the issuer of BUSD, to convert BUSD into USD.

Called out on Twitter

Dylan LeClair called CZ out on Twitter about the $250M of $BUSD from Binance that moved between Binance.US and the international exchange:

In response to these allegations, Zhao posted on Twitter regarding the claim, asserting that "Binance.US has never utilized Ceffu or Binance Custody."

However, newly unsealed SEC documents reveal that the American exchange "obtained custody software and support services from Ceffu," contradicting Zhao’s statement.

Reports of enigmatic financial transactions are not novel. Earlier in February, Reuters reported that Binance.US had transferred $400 million from its platform to Merit Peak Ltd., a trading firm overseen by CZ, as bank records and internal company messages indicated.

On October 16th, Binance.US announced it will no longer allow USD withdrawals. You can download the PDF version here.

Initial Focus on Bitcoin Trading

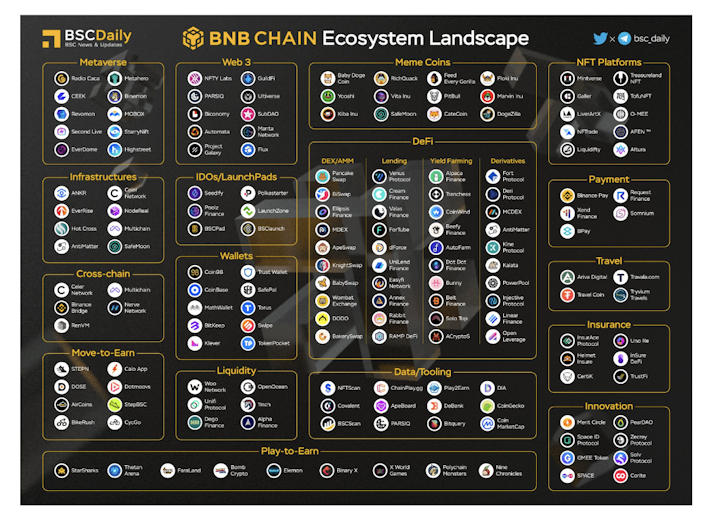

Initially, Binance had a limited selection of tokens, featuring cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and its native coin, Binance Coin (BNB).

However, it later gained fame for offering an extensive range of cryptocurrencies and digital assets. Binance continues to expand its token offerings and supports launching new projects through programs like the Launchpad platform.

Binance’s initial shift away from Bitcoin to a mostly altcoin-dependent exchange and business model can be attributed to several factors:

Broader asset options

Market demand and trends

Innovation and token launches

Competitive advantage

By expanding its altcoin offerings, Binance attracted traders interested in a broader range of cryptocurrencies. Altcoins often provide different features, use cases, or technologies than Bitcoin, which can appeal to traders seeking varied investment opportunities.

Binance recognized the growing interest and demand for altcoins among traders and adjusted its business model to cater to these preferences.

Binance has actively supported new altcoin projects through Initial Coin Offerings (ICOs) and token launches on its platform. ICOs provide the ideal conditions for a Cantillon Effect distribution of network control by the token team.

The Binance Launchpad: The Vessel All Unregistered Security Product Offerings Are Born

Binance Launchpad is a Binance-owned crowdfunding platform that assists crypto-startups in raising funds by offering their tokens to Binance users. It is the pioneer of the Initial Exchange Offering (IEO) mechanism, a widely popular method among crypto-startups to gather funds.

The Launchpad has come under increased scrutiny in recent years for several reasons:

Regulatory compliance concerns

Questions about project quality and due diligence

Allocation and fairness issues

Market volatility and speculation

Investor protection concerns

Definition and Implications of Unregistered Securities

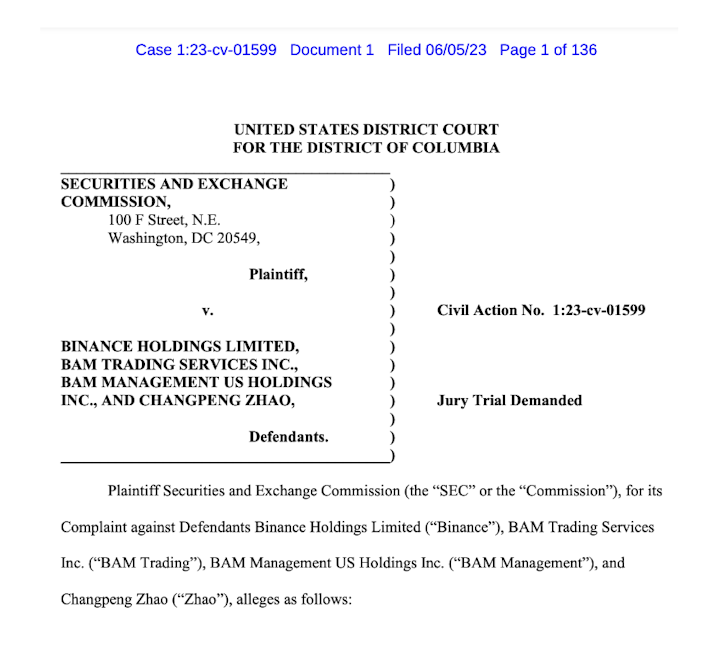

The SEC charged Binance Holdings Ltd., its U.S. affiliate BAM Trading Services Inc., and Zhao on June 5th with securities law violations and are accused of misleading investors by claiming to restrict U.S. customers from trading on Binance.com while allowing high-value U.S. customers to trade secretly.

Misleading Investors

Know Your Customer (KYC)/Anti-Money Laundering (AML)

Binance has a notorious reputation for allowing actors to use its exchange for various money laundering schemes, terrorist financing, and other illicit activities.

Exchanges must enforce strong KYC and AML measures to deter money laundering, terrorist financing, and illicit activities.

The U.S. has found evidence that American investors could easily access and use the platform due to lax KYC/AML account setup and maintenance standards.

SAFU?

SAFU stands for the 'Secure Asset Fund for Users.'

It was created by Binance in July 2018 as a protective measure for users' funds. Binance dedicated a portion of trading fees to grow the fund, ensuring it reached a substantial amount to provide user security.

The SAFU fund includes BNB, BTC, USDT, and TUSD wallets.

During unexpected maintenance, Binance CEO CZ tweeted a reassuring message to users:

In 2018, a YouTube video titled “Funds Are Safu" was uploaded by a content creator named Bizonacci, gaining rapid popularity as a viral meme. Since then, the community has adopted the phrase: “Funds are SAFU.”

Not your keys, not your coins!

In reality, your funds are never SAFU on ANY exchange. Any exchange operator can halt withdrawals of customer funds whenever they want, for any reason they desire, and for however long they would like.

There is nothing the end user can do once this happens.

Verify that Binance user assets are fully backed, at least 1:1. Please note that the vast majority of Binance’s corporate holdings are stored in wallets that do not form part of the proof-of-reserves calculations.

Binance Chain Hack

In a blog post from October 2022, Binance Chain was hit with a $570 million hack. BNB Chain detailed the attack that the hacker withdrew $2 million of the BNB cryptocurrency — worth around $570 million.

Due diligence safeguards investors from scams. This process provides insights into a cryptocurrency’s:

Legitimacy

Team

Technology

Use case and financial health

This aides in detecting red flags and reducing the risk of investing in dubious or subpar projects.

Importance of Thorough Due Diligence for Listed Cryptocurrencies

Due diligence involves comprehensive research and analysis of:

Fundamentals

Technology

Team

Market viability

Regulatory compliance

Legal Battles and Compliance Challenges

Binance has faced numerous legal battles and compliance challenges, including lawsuits and regulatory investigations including:

Alleged regulatory violations

Non-compliance with securities laws

Difficulties adapting to evolving regulatory requirements

Legal Challenges Faced By Binance in Various Jurisdictions

Binance operations have faced regulatory scrutiny and legal challenges in several jurisdictions, including:

United States (U.S.)

Binance had been operating in a limited capacity in the U.S. through its subsidiary, Binance.US. However, U.S. regulators have raised concerns about the compliance of Binance’s operations with local laws, including registration requirements and potential violations of securities regulations.

United Kingdom (U.K.)

The U.K. The Financial Conduct Authority (FCA) required Binance to halt regulated activities in the country and expressed concerns about:

Binance’s regulatory compliance

Ability to conduct proper due diligence

Anti-money laundering checks

On October 8, Binance tried to restore certain local services by partnering with Rebuildingsociety.com Ltd, a regulated entity.

Shortly after, on October 16th, Binance halted the onboarding of new users in the U.K.

China

Binance, founded initially in China, faced challenges when the Chinese government introduced strict regulations on cryptocurrency-related activities.

In 2017, Chinese authorities banned domestic cryptocurrency exchanges, leading Binance to relocate its headquarters to other jurisdictions.

Even though the website is blocked in China, $90 billion in monthly transactions are made by China’s Binance, accounting for 20% of volume worldwide.

Japan

In March 2018, the Japanese Financial Services Agency (FSA) issued a warning to Binance, stating that it was operating in Japan without the necessary registration.

Binance announced its plans to obtain a license to operate in Japan and comply with local regulations.

Canada

In March 2021, the Ontario Securities Commission (OSC) stated that Binance may have violated securities laws by operating an unregistered cryptocurrency trading platform. The OSC initiated an investigation into Binance’s activities.

India

In late December of 2023, Bloomberg reported India is set to crack down on and ban local access to overseas crypto exchanges like Binance.

Apple removed the apps Binance, Kucoin, OKX from App Store in India after government order.

Google pulled many crypto exchanges, including Binance and Kraken, from its Play Store in India on Saturday January 12th, 2024.

New Developments

On February 6th, Binance announced that it will soon delist Monero.

The Wall Street Journal published a new exposé titled: The Crypto Queen Pulling the Strings at Binance on December 24th, 2023.

“Yi He, a former talk-show host, has sweeping control over the crypto giant’s marketing and investment divisions. She is also founder CZ’s longtime romantic partner.”…

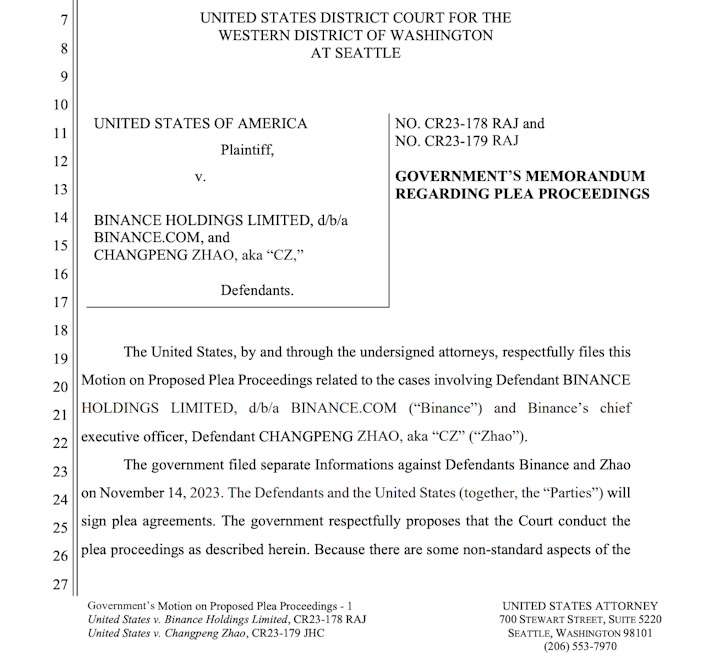

On November 21, 2023, Zhao pleaded guilty to violating the Bank Secrecy Act in a U.S. court. The charges were related to failing to implement proper know-your-customer (KYC) and anti-money laundering (AML) protocols for U.S. customers on Binance.

As part of his court agreement, Zhao posted $15 million in a trust account and will forfeit these funds if he violates the terms of his release. He has also secured two guarantors pledging $250,000 and $100,000. CZ’s sentencing is scheduled for February 23, 2024.

Additionally, Zhao and the DOJ agreed to a $50 million fine without mentioning prison time.

As part of the settlement with the U.S. Department of Justice, Zhao was required to resign from Binance. The company will pay $4.3 billion in penalties to various federal agencies and will be subject to oversight by multiple monitors for five years.

Binance also settled charges with FinCEN, OFAC, and the Commodity Futures Trading Commission, addressing issues related to money laundering, sanctions, and federal commodities regulations.

Yi He, who is both Zhao’s romantic partner and the mother of his three children, holds the position of the largest Binance shareholder currently working for the company.

She has extensive control over Binance’s marketing and investment departments and considerable influence over the company’s overall operations.

However, as per the plea agreement between Binance/Zhao and the authorities, Zhao is barred from “any present or future involvement in operating or managing” Binance for three years following the appointment of a monitor.

Impact of Binance Uncertainty on the Overall Cryptocurrency Industry

Binance uncertainty can significantly impact the entire cryptocurrency industry. Anytime the leading market maker finds itself in trouble, it may lead to:

Increased regulatory scrutiny

Additional compliance requirements

Loss of investor confidence

Heightened market volatility spillover effect

These situations generally lead to massive shifts in the exchange landscape, reinforced industry standards, and the evolution of cryptocurrency regulations.

So, is Binance in trouble?

Even though CZ is stepping down, the exchange is not out of the woods yet. Act accordingly. Get your Bitcoin off ALL exchanges today and consider moving it into a Bitcoin IRA.

Holding your Bitcoin in a Swan Bitcoin IRA gives you full control over your Bitcoin. Learn more about the top 6 Bitcoin and crypto IRA options here!

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?