I’m Bullish and Don’t Care Who Knows

All-Time High Bullishness — Why Today Feels Different!

There are momentous shifts in history and demarcation lines which measure progress. I felt this way about Bitcoin in the summer of 2020 — I wrote:

“I think the story of the decade will not be COVID-19, but the continual rise and use of Bitcoin.”

Over three years later, I’m more bullish today.

Why? Let me explain.

I recently sat down with a friend I made at the local Bitcoin meet-up. We’ll grab a coffee and discuss Bitcoin, political content, and our mutual faith. Often, his retired father joins us as well. They are highly intellectual and well-read. He is a software engineer by trade and gets the “nerdy” side of Bitcoin beyond my wildest dreams. He was raised in a libertarian minded-household. So, the idea of sound money, freedom, liberty, and property rights has been discussed for years. While we agree on 95% of things, he recently pushed back on my bullishness around Bitcoin as we talked about allocations of personal net worth.

His main counterpoint is that gold is mispriced and that it should be physically held by folks to insulate them against what the rest of the decade holds. He feels that the “Bitcoin has won” argument is too readily championed by Bitcoiners without enough critical counterpoints. I tend to agree that gold is mispriced and has had its price manipulated for years. Over the past ten years, the price of Campbell’s tomato soup has been a better inflation hedge than gold. Central Banks and governments around the globe have done this by using gold swaps, leases, and futures contracts.

My friend further argues that the announcements of the BRICS countries and massive gold purchases by China and Russia over the last five years point to a return to gold as the global money. I don’t disagree that the BRICS nations will try a gold-backed currency, but I feel it will still ultimately fail due to centralization and trust issues. That’s where a natively digital bearer asset — Bitcoin — steps up to solve this problem.

Bitcoin is not centrally held like gold — when large swaths of an asset are held by governments and institutions, manipulation seems to follow. Bitcoin has historically, and with innovative tools and advancements in custody, avoided this trap. I and my colleagues at Swan work daily to ensure this doesn’t change. A large majority of Bitcoin is held in self-custody or a multi-signature set-up. Individuals, companies, and nation-states are truly able to hold their own wealth vs. trusting a counterparty that punishes them if they step out of line (see Russia and Canadian Truckers, for example).

“And it’s worked…. Out of all the bitcoin ever bought, in all time, by users of the Swan App, Swan.com, and Swan Private Client Services, 82.5% of that Bitcoin has been taken into self custody. So you guys give yourselves a round of applause!”

– Cory Klippsten

Here at Swan, we’ve seen 82.5% of Bitcoin move into self-custody. We’ve recently launched our collaborative custody solution, Swan Vault, to help those looking for a middle ground from a full DIY or fully custody model. Allowing for the ease of custody that retains control of Bitcoin in the owner’s hands is what fundamentally prevents paper Bitcoin and the ETF IOUs from suppressing the price for any duration of time. Bitcoin wins by being distributed and not in the hands of a few centralized third-parties.

Speaking of ETFs — the “fake news” of an ETF approval might have sparked the glowing embers of this bull run — as we’ve seen a 25% plus move since the infamous Cointelegraph tweet. My previous role was as a financial advisor, so I’ve seen the impact of ETFs on the investment landscape. ETFs are a fantastic vehicle for millions of Americans to allocate and diversify their traditional investment holdings. However, an ETF for Bitcoin is like asking for training wheels on a Ducati Superbike — it’s suboptimal, inefficient, and potentially dangerous.

However, the marketing departments at Blackrock and the like will absolutely be talking to ALL their customers about how an allocation to Bitcoin improves returns, lowers risk, and enhances the likelihood of accomplishing goals in a financial plan. Rapha Zagury, our CIO at Swan, has had this information publicly available for months via our Nakamoto Portfolio tool.

An ETF brings dollars into the fund, and those dollars have to buy the underlying asset 1:1 — which is why the spot bitcoin ETF has been all the rage. So if we see $20M flow into the ETF vehicles, that’s $20M of buy pressure into the Bitcoin spot market. Simply stated — ETF approval equals a large, consistent buyer in the market absorbing supply. Galaxy Research reports they see a spot Bitcoin ETF drawing in over $14 billion in investment inflows in the 12 months after launch.

I do, however, believe the US investor is in the process of being woken up from their slumber on Bitcoin to grasp what you and I already know. Owning Bitcoin helps offset rising prices, and Bitcoin being a “bearer asset” in an uncertain world is extremely valuable.

That last point, I believe, will become clearer to Bitcoin ETF investors in 2025 and 2026 as they see the price appreciation of their Bitcoin ETF and inquire to move it to self-custody for the advantages that will increasingly offer as Bitcoin becomes better understood and more widely accepted. If they don’t, they’ll be forced to wait and hope something changes or sell, realize a capital gain, and pay unnecessary taxes. That’s why I mentioned the ETF could be dangerous — it’s counterparty risk on counterparty risk and a tax hit that can be avoided by getting the real thing. If you have people in your life talking about getting exposure via an ETF — encourage them to come to Swan to get the real thing.

Friends don’t let friends buy Bitcoin ETFs.

One of the biggest concerns I’d often hear my traditional finance friends and colleagues suggest is that if I was correct on the long-term impact Bitcoin could have — there is no way governments would allow for that to happen. I’m not naive to think the powers at hand will just step aside and quietly allow Bitcoin to remove the power that’s held by controlling the money.

However, Victor Hugo said it best, “No force on earth can stop an idea whose time has come.”

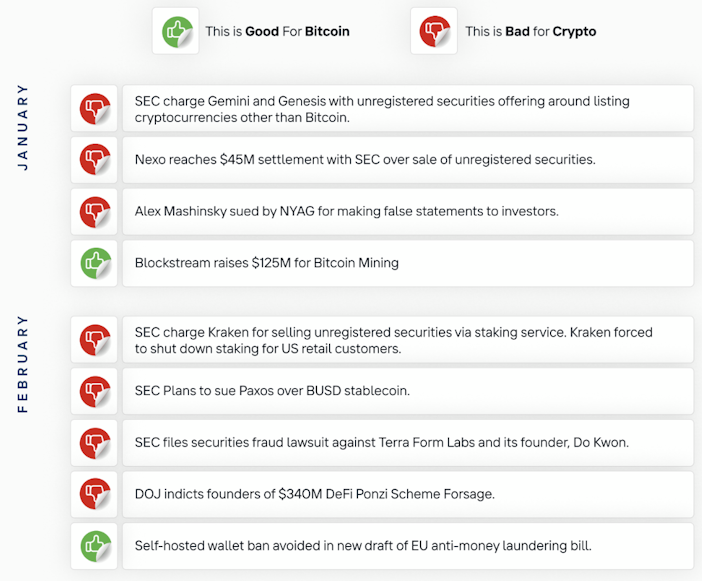

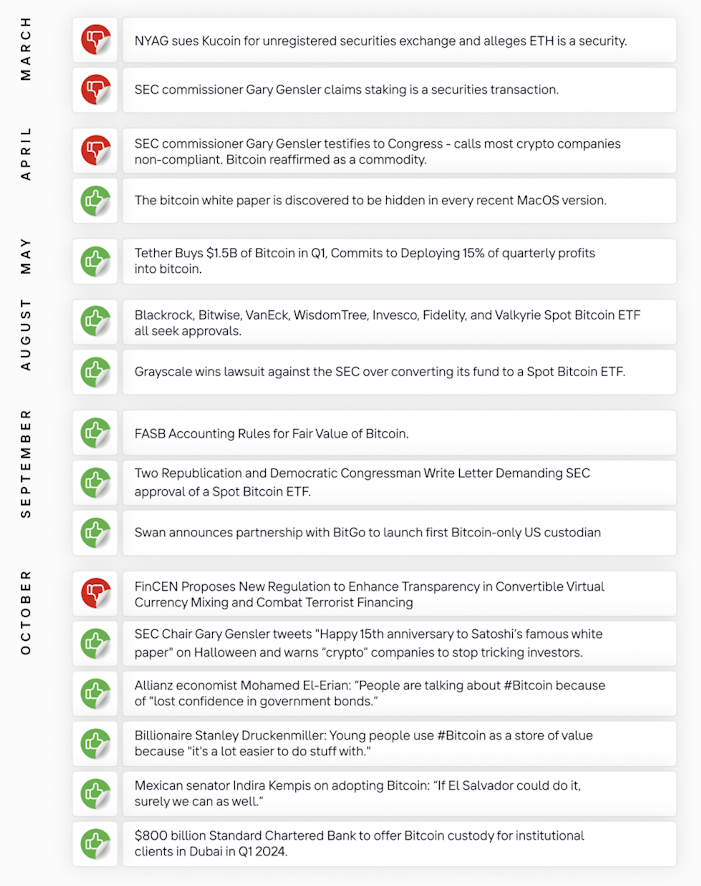

It’s Bitcoin time, and no government can prevent that. Just look at the timeline we’ve seen this year alone in Bitcoin news from a societal, regulatory, and political standpoint. Note, meanwhile, that the “crypto” news has been brutal.

We have a new buyer in the market, and the consensus around Bitcoin is

warming. Mix in a supply issuance reduction, and things will really start to get interesting. The halving is an event whose impact on price is hotly debated in Bitcoin circles. The question is not if it will happen (it will, and Bitcoin’s code is preprogrammed) but whether it is fully priced in already?

First, what is the halving?

Every ten minutes or so, as each new bitcoin block is mined, Bitcoin miners are rewarded with the block subsidy and transaction fees paid by participants wanting to move their Bitcoin. The block subsidy “halves” every four years (technically every 210,000 blocks); the next one is estimated to occur in late April 2024.

The current subsidy is 6.25 Bitcoins per block and will be cut in half to 3.125 Bitcoins per block. That’s a reduction from 900 Bitcoins per day to 450 Bitcoins per day. None of that is up for debate.

The debated part is, “Does this matter for the price of Bitcoin?”

Well, our sample size of past halvings is not large enough to draw statistical conclusions — as it has only happened three times before — 2012, 2016, and 2020 — but those events saw the price increase 100x, 30x, and 8x, respectively, post-halving. Those are meaningful increases, and they happened approximately a year to 18 months post-halving. So April 2025 — October 2025 would be a timeframe for new all-time highs IF the halving matters and takes as long to get fully priced in as before.

So why would it not matter?

First, 93% of all the supply of Bitcoin to ever be issued is already in the market. So, the number of new Bitcoins coming online is low. In my view, that’s really the only significant leg to stand on for the non-halving-matters crowd.

I tend to think it does matter, even if it’s only a psychological factor. Understanding absolute scarcity is hard, but seeing the amount of new issuance drop into an asset that is seeing bigger and bigger demand (remember, we have ETFs coming) has a meaningful psychological impact. 450 Bitcoins per day at today’s prices is $15.75M per day; that’s not a lot of fresh supply.

The HODL Waves from Glassnode show holders of Bitcoin haven’t moved their coins at an increasing rate — more than 70% of Bitcoin has not moved in over a year. Almost 30% haven’t moved in more than five years. Bitcoin is a savings asset, and people are waiting for another bull market before deciding if they need/want to sell or if they will continue to hold. These figures are all at all-time highs. Reducing the amount of coins for sale stokes those embers even higher.

You’ll often hear other crypto folks accuse Bitcoin of being stale or stagnant. The truth is actually totally different. But first, the “move fast and break things” model of Silicon Valley is not something we want in our monetary system.

Bitcoin, by design, takes the approach of less is more, and the default action should always be to “do no harm.” The growth of the Bitcoin-only ecosystem today is incredible. While I won’t be able to do justice to all the happenings across Bitcoin, here are some that have captured my attention.

BitVM — allows for simple to complex computations to be enforced on Bitcoin’s blockchain — all without having to make any changes to Bitcoin’s core code. The heavy lifting of all of the computing power is handled off-chain, and then being able to complete or challenge that computation on-chain if another separate party asserts a dishonest outcome. Today, BitVM is in the discussion and prototype phase. However, what I think it shows is that we can run and have very complex systems running, with Bitcoin being the final verification settlement mechanism.

Timeout Trees (Lighting Network) — the second layer Lightning network has seen massive growth over the last several years. However, while I am incredibly bullish on Lightning, it’s not perfect.

One scaling challenge is the number of channels needed to onboard the world and the opening and closing of those channels, given the finite block space on the Bitcoin blockchain. Timeout Trees help solve the issue of creating “channel factories, ” which have themselves been suggested as one solution for this dilemma. Timeout trees allow for a lot of opening and closing of Lightning channels without introducing issues that would impact a group of people leveraging a channel factory. In short, timeout trees allow for large multi-party channels and improved user experiences without creating a custodial solution (which has been the most common solution thus far).

Value for Value on the Lightning Network — The idea of value for value has been burgeoning within the Lightning and NOSTR ecosystems. Today, thanks to Lightning, all content creators have a direct way to monetize their content.

Lightning enables the micropayments globally, instantaneously, and inexpensively.

Recently, Mash and Marty Bent and his company, Truth for the Commoner (TFTC), announced a partnership for independent media monetization.

The goal is to amplify independent content creators to allow them to make a living doing their best work free of the editorial constraints that traditional media outlets and companies have on staff. There is podcasting 2.0, which was made famous by Adam Curry, and you have several podcast players that allow you to pay the creators as you listen and boost segments you find most appealing.

Fountain and Breez are the two most widely utilized, but these developments are beginning to move Bitcoin from a store of value to a medium of exchange as consumers look for content in today’s world of noise.

Summary

As I sit with my thoughts on why I’m so bullish, I don’t want to try to get too cute and over-analyze it. The left end of the bell-curve analysis is this: most of the Bitcoin isn’t moving; The supply is getting cut in half; We have an ETF approval on the horizon, which increases demand; We have a political environment that is broken and corrupt, but still warming to Bitcoin; And, We have technological advances and improvements to Bitcoin that continue to grow how we all can interact and use it.

The probabilities are heavily skewed to Bitcoin’s price appreciating from here. While we cannot predict price, one thing is true: we can control how much we save from free cash flow, what assets we hold, and how we secure our Bitcoin. Let us here at Swan know what, how, and who we need to help as we enter one of the most bullish periods for Bitcoin we’ve ever seen.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Isaiah Douglass

Swan Account Executive

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?