How Much of the World’s Population Owns Bitcoin Today?

One of the biggest blindspots investors have when they first come across Bitcoin is that they view it solely as an asset. Bitcoin is digital gold — you can send over the internet.

What happens when 3 billion adults globally own Bitcoin? 🚀

Read more to find out 👇

One of the biggest blindspots that investors have when they first come across Bitcoin is that they view it solely as an asset. Bitcoin is digital gold that you can send over the internet. To be clear, if you think this, you’re not wrong. However, what people miss is that Bitcoin is more than just digital gold.

It’s also a revolutionary technology.

Bitcoin is an open monetary network that allows for the free flow of value between individuals across the globe without having to ask permission from anyone. The internet allows for the free flow of information, and Bitcoin will allow for the free flow of value.

Distinguishing between Bitcoin the network and Bitcoin the asset is an important step to better understanding how early you are in Bitcoin’s story. By viewing Bitcoin through the lens of a disruptive technology that will disrupt one of the largest markets in the world, money itself, you can start to appreciate just how small Bitcoin is today compared to what it could become in the future.

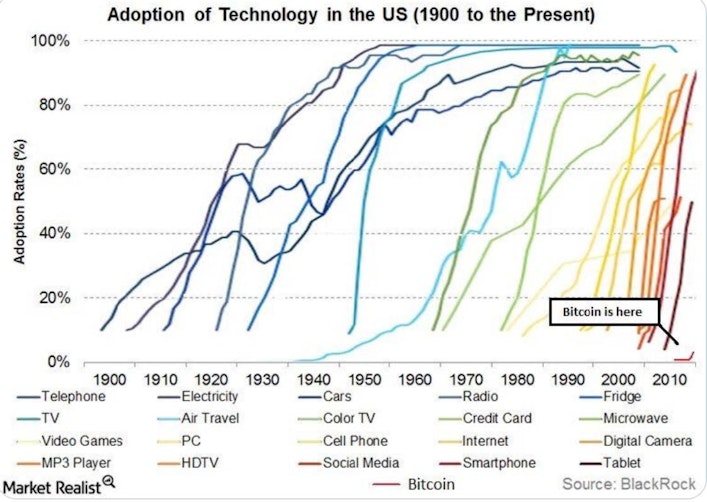

If you missed it, Bitcoin is that tiny red line in the bottom right corner there in the chart. The two main takeaways from the chart are:

1.) How young is Bitcoin as a technology

2.) The similar pattern of how these technologies get adopted.

Technologies like the internet, cell phones, TV, and cars get adopted gradually than suddenly by society. Bitcoin will be no different. This makes sense when you stop and think about it.

Let’s use the example of email in the early ’90s. Back then, only a small percentage of the population was using it and could foresee its massive potential. Even though email was a considerable improvement on the traditional mailing system, it still took time for the majority of society to understand it and utilize its benefits. Fast forward a decade later, and everyone uses email every day.

Bitcoin is a drastic improvement in the money that we use today. It can be accessed by anyone, it’s scarce, it can be divided into millions of pieces. It can essentially teleport anywhere, anytime, to anyone in the world. As the previous chart proves, it is only a matter of time before better technology makes its way into the mainstream. Right now — Bitcoin is email in the early 1990s. In the future, everyone will use it every day.

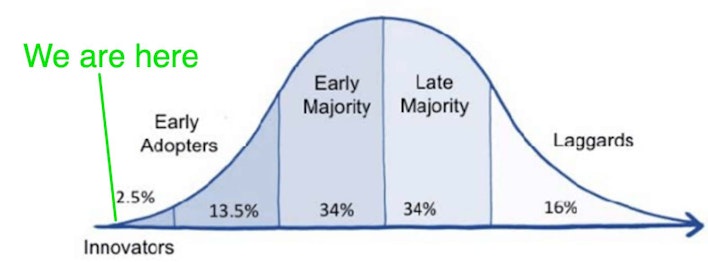

Today it’s estimated that 100 million people own Bitcoin or ~1.3% of the world’s population. As such, we are very much still in the “Innovators” stage in the adoption cycle of Bitcoin as a technology.

An early Bitcoin investor, Wences Casares, made a keen observation back in the day. Mainly he noticed that the amount of users of the Bitcoin network is directly proportional to the Bitcoin price. In other words, the more users, the more valuable the network becomes and the higher the Bitcoin price. Wences observed that historically Bitcoin’s price closely follows the equation (how many people own Bitcoin) x $7,000.

Now I don’t pretend to understand the calculation behind this, but I do know that Wences’s equation remarkably still holds true to this day.

100 million bitcoin owners today x $7,000 / 21 million Bitcoin = $33,333/Bitcoin.

Crazy right!?

So what does Bitcoin’s price look like at 3 billion owners using the same equation?

3 billion Bitcoin owners x $7000 / 21 million bitcoin = $1 million/Bitcoin.

You read that correctly.

So if Bitcoin continues to gain adoption at its current rate, and billions of people adopt it worldwide as a better form of money, then 1 bitcoin could possibly reach 1 million dollars per bitcoin or ~30x higher than today’s prices!

You are so, so early.

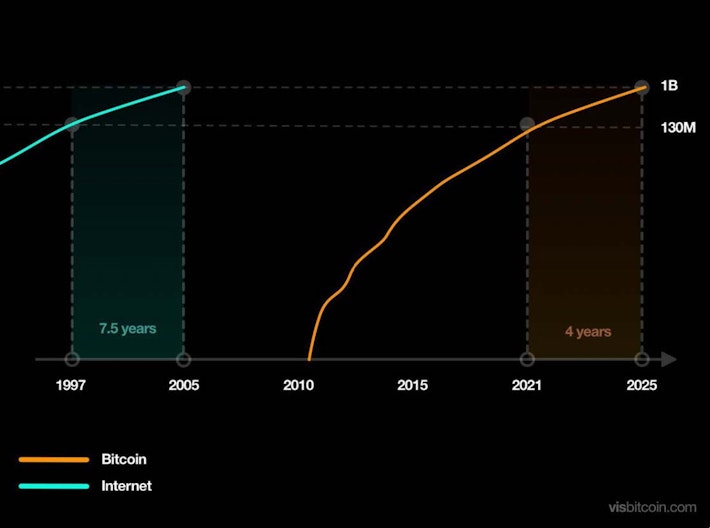

When we consider Bitcoin as a technology rather than an asset, there’s no doubt that the people buying bitcoin today will be considered early adopters. However, the growth Bitcoin has achieved in just 12 years has been nothing short of breathtaking.

The chart above displays how Bitcoin has achieved the same number of users in 11 years that it took the internet to acquire in 14 years. Bitcoin’s network is growing faster than the internet did. If we assume that same growth rate and move it out into the future, Bitcoin will have roughly 1 billion users by 2025.

If you’ve followed Bitcoin for several years, this growth rate shouldn’t surprise you. We’ve seen major adoption from public companies like Microstrategy and Square putting Bitcoin on their balance sheet, to large institutions like insurance company MassMutual purchasing it, all the way to recently El Salvador adopting Bitcoin as legal tender.

Bitcoin’s network is growing quickly because it’s a breakthrough technology that will have radical implications for the world. It allows for the free flow of money between anyone, anytime, anywhere in the world without restriction. We are lucky to be alive to witness its ascension as a technology, but it’s growing fast.

You might want to pick some up today because, at this pace, in just a few short years, Bitcoin could very well have billions of people using its network. As such, its price will likely be significantly higher than it is today.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?