History Happens Right Before Your Eyes

Technology has brought forth its champion to slay fiat money. And we all know who that champion is: Bitcoin. Bitcoin will be the resolver of a historic tug-of-war over control of the wealth of humankind.

History is not always some ancient moment in time. It is constant and changes rapidly over time. We get to witness some of it in the present.

History is neither merely what happened hundreds of years ago nor only wars and human catastrophes. If you zoom out just a bit, you can see that history happens all the time. Our civilization, our culture, our technology, and even we ourselves are changing — influenced by megatrends that shape all humanity. Changes often happen fast, but their imprint remains.

Even just taking a snapshot of highlights from a single year over a few 10-year periods reveals how much change occurs. Consider the years 2012, 2002, 1992, and 1982.

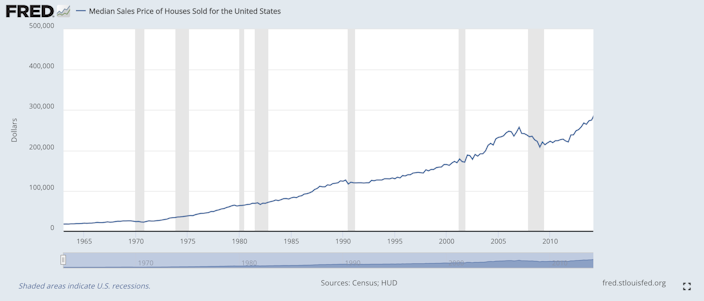

Only 10 years ago, the median house price had tumbled to $238,400, still coming off the housing crash of 2008. Ten years before that, it had been $188,700. And 10 years earlier, it was just $119,500, while in 1982, it was only $69,600. Today it’s $454,900.

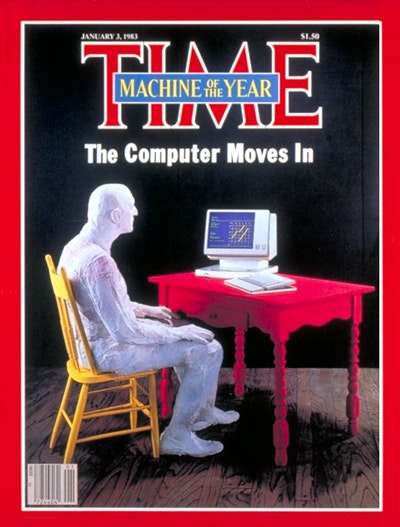

Technology, of course, has been wildly advancing, influencing the price of many things and the culture as well. It’s only been 10 years since Google Play came into existence. People once lived without apps! (Although iPhone users had a head start.) Twenty years ago, Apple launched the iPod, a revolutionary portable digital music player that changed the music industry. Thirty years ago, nobody had heard of an internet browser because it hadn’t been developed yet! And 40 years ago, the IBM Personal Computer had just finished its first year of being on the market, and it became the first inanimate object to be named Time Magazine’s “Man of the Year.”

Oh, how the news and culture have changed also. For example, in 1975, there was concern that an ice age was coming after America had experienced its coldest winter in a hundred years. In 1981, MTV, a TV channel dedicated then to showing music videos, had just come on the air. It seemed like a completely different civilization, but roughly one-half of America’s current population was alive at the time and experienced it.

Of course, all this took place under the dual forces of the ever-expanding creep of fiat currency and the rapid advancement of computing technology. These are probably the two strongest megatrends over the whole time period. One was exponentially inflationary; the other was deflationary. One was based on hard science, the other on wishy-washy, postmodern economic theories. One delivered goods that seemed magical; the other brought crisis after crisis. The battle between these two forces now appears to be at a climax, and history is about to be made again.

The coexistence of these two forces that defined history over the last 40 years may be coming to an end. Technology and central banking are clashing. Technology has brought forth its champion to slay fiat money. And we all know who that champion is: Bitcoin. Bitcoin will be the resolver of a historic tug-of-war over control of the wealth of humankind. As the government goes digital, digital goes at the government. We are here to witness the spectacle. And to be a part of it.

At Pacific Bitcoin, we are creating our own version of a time machine to explore the last 40 years of history through dialogue. Over two days, four separate panels will take the stage to discuss 1982, 1992, 2002, and 2012, focusing on the culture, the economy, and the technology of the times.

Join us at Pacific Bitcoin in 2024.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Tomer Strolight is Editor-in-Chief at Swan Bitcoin. He completed bachelors and masters degrees at Toronto’s Schulich School of Business. Tomer spent 25 years operating businesses in digital media and private equity before turning his attention full time to Bitcoin. Tomer wrote the book “Why Bitcoin?” a collection of 27 short articles each explaining a different facet of this revolutionary new monetary system. Tomer also wrote and narrated the short film “Bitcoin Is Generational Wealth”. He has appeared on many Bitcoin podcasts including What Bitcoin Did, The Stephan Livera Podcast, Bitcoin Rapid Fire, Twice Bitten, the Bitcoin Matrix and many more.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?