Goldbugs Don’t Understand Money

One of the most persistent falsehoods prograted by goldbugs is the idea that monetary goods must have direct utility.

One of the most persistent falsehoods propagated by gold bugs is the idea that monetary goods must have direct utility. Even those who concede that Bitcoin has strong monetary attributes insist that its inability to replicate gold’s metallic properties is a critical failure. This kind of reasoning stems from a fundamental misunderstanding of money.

Firstly, it’s important to remember that a portion of the market value of monetary goods reflects demand that exists simply because holders expect demand from other holders. This characteristic is necessarily shared by all such goods.

The idea of a money without a monetary premium makes as much sense as the idea of a book without pages. Yet, some gold bugs bizarrely argue that anything with such a premium is in a “bubble” destined to implode. The logical conclusion to this line of thought is that gold must have been overvalued for the past few thousand years and is long overdue for a crash. Moreover, it would follow that money itself should never exist and that humans should be forever stuck with a barter system.

The more sophisticated gold bugs avoid such an obvious self-contradiction by instead arguing that it makes sense for money to have a monetary premium as long as it also has utility value. In a recent podcast episode, my dad (Peter Schiff) made the following case:

“There is some monetary premium with respect to gold, but bitcoin doesn’t have a monetary premium because in order to have a premium, you have to have some value that the premium is built on. Bitcoin has no value. It’s 100% monetary premium. But without a base, it doesn’t matter because you can’t have a premium unless you build it on top of something.”

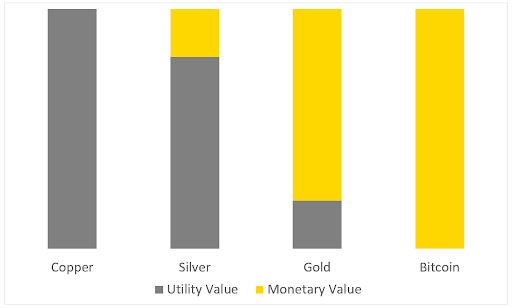

Part of this argument is superficial and likely stems from Bitcoiners’ usage of the term “monetary premium” to describe the difference between a good’s utility value and total market value. The word “premium” can be interpreted to mean that the utility value is the base from which the monetary value grows. This concept is reinforced by charts such as the one shown above. However, the word “premium” can easily be avoided, and different charts can be used to illustrate monetary value without showing utility value as a base.

Putting aside semantics, the fundamental underlying argument is that a good’s monetary value is dependent on its direct utility. In this framework, the utility value is likened to the foundation of a building; without a foundation, a collapse is inevitable.

Although superficially compelling, this analogy simply doesn’t stand up to scrutiny. While a good’s utility value is supported by its direct uses, such as industrial applications, its monetary value is supported by its monetary attributes, such as credible long-term scarcity and censorship resistance. Therefore, the utility value and monetary value are independent from each other. Each can survive on its own because each has its own base of support.

To illustrate this point, we can imagine a scenario where all of gold’s industrial and ornamental uses suddenly vanish.

Would its monetary value disappear as well?

No, because its monetary attributes would remain intact.

But how would people have any conception of what its purchasing power should be?

That wouldn’t be an issue either; in Man, Economy, and State, economist Murray Rothbard explained:

“if on day X gold loses its direct uses, there will still be previously existing money prices that had been established on day X minus 1, and these prices form the basis for the marginal utility of gold on day X.

Similarly, the money prices thereby determined on day X form the basis for the marginal utility of money on day X plus 1. From X on, gold could be demanded for its exchange value alone and not at all for its direct use”.

Not only is it possible for money to have only monetary value, but it is actually the most desirable situation. Contrary to popular belief among gold bugs, direct utility is actually a hindrance to monetary goods because of how fluctuations in industrial demand can impact their purchasing power.

Therefore, Bitcoiners who deride gold as being “just a shiny rock” are not only incorrect (because gold does have industrial uses) but also are inadvertently making gold seem like better money than it actually is.

The conclusion of this analysis is that Bitcoin’s improvement on gold is two-fold: it discards the counterproductive non-monetary properties while also upgrading the monetary properties. The result is the creation of a good that is optimized to be supreme money.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Spencer Schiff is a Research Analyst and Educator at Swan Bitcoin. He is a former gold bug, turned Bitcoin advocate. For years now the well known economist and gold bug Peter Schiff has continuously spoken out against bitcoin. His son, Spencer, has taken the other side of that argument and continues to present ground breaking research to prove why Bitcoin is the ultimate asset to own in today’s world.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?