Gifting Bitcoin — The Ultimate Orange Pill

As many people discover convincing a friend or family member to buy Bitcoin can be a challenging task. Swan Bitcoin makes it easier than ever with their gifting program.

Gifting Bitcoin Is a Great Way to Introduce People to Bitcoin

Bitcoin Makes a Great Gift Because It Keeps on Giving

Previous Methods of Gifting Bitcoin Had Their Limits

Swan Has a New Approach to Gifting Bitcoin that Overcomes These Challenges

As many people discover, convincing a friend or family member to buy Bitcoin can be challenging. Sometimes it feels like no matter how compelling of an argument you make, certain people are just not ready to take these necessary steps that will put their wealth in their own hands.

There are many reasons why a loved one might not feel comfortable making their first Bitcoin purchase. Often they don’t understand what it is or why it’s important, or maybe they don’t know how to buy it, and the process intimidates them.

It’s common for Bitcoiners to feel like Morpheus from The Matrix when trying to convince a loved one to take the “orange pill.”

As in the movie, we need to recognize that some people are simply not ready to reach out and swallow the pill themselves. The good news is, there’s a way around waiting for them to make the decision; you can do it for them…by gifting them Bitcoin.

Over the years, the best methods to gift someone Bitcoin have evolved. Recently, Swan introduced Swan Gifting, which we believe is the easiest and safest way to gift Bitcoin today.

Gifting a loved one bitcoin is one of the most effective ways to facilitate their ownership of bitcoin. Rarely will anyone reject a gift. In fact, they will often thank you for it.

And, with inflation at the highest levels seen in decades, there has never been a better time to gift someone some Bitcoin. Your loved one’s savings are at risk of eroding away rapidly from inflation. Most people don’t realize that although the amount of money in their savings account hasn’t changed, its purchasing power has.

Consider, for example, An example of this concept is the increasing prices of food and beverages at sports events or concerts. The amount of nachos or soda hasn’t changed; the dollar’s purchasing power has.

One dollar today does not buy as much at the concession stand as it used to. Inflation has eroded the purchasing power of those dollars.

This is an important area where Bitcoin can help. Unlike dollars, bitcoin is money that holds its value over time. It’s a revolutionary savings technology that allows individuals to save for the future with money that cannot be inflated. In fact, bitcoin is likely to increase in purchasing power due to its network effect and scarcity. Historically, Bitcoin’s average 5-year compounded annual growth rate is 107%!

Let’s face it, many gifts seem to find their way to trash eventually. But Bitcoin is a gift that truly keeps giving.

Let’s take a look at some popular gifts over the last 5 years and see how much purchasing power your friend or family member would have today if you gifted them some Bitcoin instead.

Bitcoin’s value vs Consumer products

The moral of this story is that by gifting your friends and family Bitcoin, you are giving them a gift with the potential to give them everything they want and more as it pays off later through Bitcoin’s price appreciation.

Whereas you would be hard-pressed to find someone still using the same iPhone you gifted them in 2017, your Bitcoin gift would still be valuable that they would cherish today and beyond. By gifting them Bitcoin, you can give your loved ones something that may make a meaningful difference in their futures.

There are several common ways to gift Bitcoin. As a useful warning, it is important to note that if you are gifting it to someone who does not yet appreciate its potential value, they might lose it or forget about it. You will want to be mindful of this fact and choose a method appropriate for the recipient’s appreciation of Bitcoin at the time you give the gift.

In earlier days, gifting people with paper wallets was quite popular. A paper wallet stores private keys on a piece of paper like the ones shown below.

Paper wallet Bitcoin

These came with a whole host of risks.

First, there were many instances where people lost funds due to mishandling the private keys on the paper wallet. Also, paper wallets have privacy concerns both upon creation and because they promote address reuse. Lastly, since the paper wallet is made of paper, it is rather fragile and susceptible to damage or being lost by the gift receiver.

Water damaged Bitcoin Paper Wallet

Hardware wallets are another way to gift Bitcoin by sending the Bitcoin to a hardware wallet and then gifting the person the wallet with the Bitcoin stored on it.

Hardware Wallets: Coldcard and Trezor

This method of gifting is an improvement from a paper wallet but still comes with its own setbacks. First, the wallets themselves cost money and could be considered a gift in their own right. Wallets can be an expensive addition to a gift on top of the Bitcoin itself.

In addition to the cost, most beginners do not understand how to interact with these wallets and would require instruction on how to access their gifted bitcoin properly. There is the risk that the receiver will lose the wallet or mismanage the private keys due to inexperience.

Most importantly, if the gift giver sets up the wallet themselves, they have knowledge of the seed phrase associated with the wallet.

In other words, the giver could access the gifted Bitcoin at any point in the future. Now if you are gifting a person some Bitcoin, you likely care about the person and would therefore not be incentivized to steal from them but still, not exactly an ideal situation.

In general, we recommend using these hardware wallets to take self-custody. Still, there is a learning curve, cost, and other factors associated with them that make them less than ideal for gifting purposes.

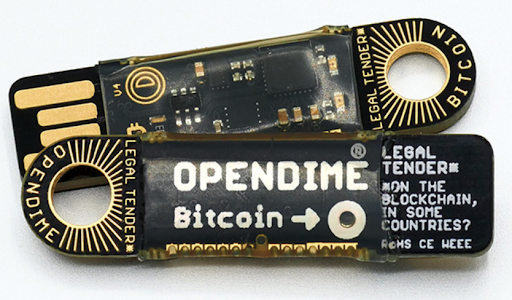

Another way to gift is with a type of hardware wallet called an Opendime.

Here at Swan, we love to gift people Opendimes loaded with some Bitcoin. They are a way to gift Bitcoin on a USB-like stick without ever knowing their private key or seed phase.

It is the first Bitcoin bearer instrument that allows someone to gift Bitcoin in physical form. When the gift receiver is ready to spend their Bitcoin, they can access the private key by breaking a seal on the device itself (denoted by the white circle).

Opendime Bitcoin Wallet

Although Opendimes are a great gifting option, they still have some drawbacks. Opendimes themselves cost money and could be an expensive addition to a small gift. On top of that, because the private keys can only be unsealed on the device itself, if the gift receiver loses the Opendime, then the Bitcoin is lost with it too. An inexperienced person without proper education may not understand how to use it, or they may mishandle or lose the small device.

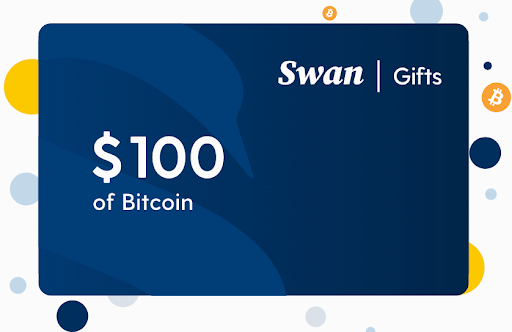

Recently, the Swan team decided to evolve the way people gift Bitcoin. Swan Gifts is a new way to gift Bitcoin. It is a gift of bitcoin that comes with a customer support team attached and without the costs and risks involved in previous gifting methods.

When you gift Bitcoin through Swan, you are not just giving them Bitcoin; you are also gifting them a personal Bitcoin assistant that will be there to answer their questions, educate them, and guide them on the right path towards taking self-custody of their Bitcoin.

Swan will hand-hold your loved ones through the onboarding process, educate them on proper security practices to protect them against scammers or hacks and point them toward the right educational resources.

You no longer need to worry about teaching someone all the ins and outs when gifting Bitcoin. You can outsource all of their questions to the education team at Swan.

In addition to the concierge benefits, there are zero costs or wait times associated with gifting through Swan Gifts. Simply get the email address of the recipient, and you can send Bitcoin to them within minutes.

Gifting Bitcoin with Swan

One last thing — if you send a gift through Swan and are also a member of our Swan Force Referral Program, you will be credited with the referral and receive 25% of all their fees for 1 year. Not too shabby.

The main reason that gifting Bitcoin is such a powerful way to orange pill someone is because what you are really gifting them is “skin in the game.”

“Where your money goes, your mind follows.”

— Robert Breedlove

When someone has “skin in the game, ” they are invested personally. Now that some of their net worth is tied to Bitcoin, they are much more likely to stay up to date with the industry and take the necessary time to learn about it.

Nothing will excite someone more about Bitcoin than seeing their purchasing power increase as Bitcoin adopts continue to grow.

Gifting Bitcoin should aim to get them to understand and get excited about it. Gifting Bitcoin is actually just a “Trojan Horse” to get your loved ones to finally start educating themselves about it.

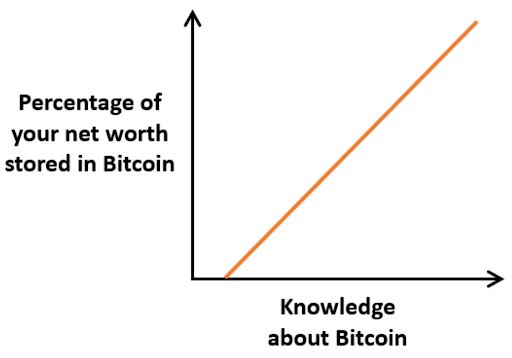

Bitcoiners know what happens after someone becomes knowledgeable about Bitcoin.

% --> Knowledge

We are in this together. We’ve already sent thousands of gifts through Swan, and tons of those gift receivers are now buying more Bitcoin and setting up Bitcoin Savings Plans.

The question now is not whether or not to gift Bitcoin, but to whom will you send it?

Orange pill your friends and family

In addition to gifting Bitcoin to friends and family, if you’d like to buy Bitcoin for yourself we’re giving away $10 for doing so!

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?