7 Best Coinbase Alternatives 2024 (What You Need to Know)

The uncertainty surrounding compliance and regulatory problems for Coinbase is intensifying. Bitcoin-only Swan is one of the most popular Coinbase alternatives for buying Bitcoin in 2024. Here is why!

A very important reason to seek out an alternative to Coinbase is their support for so many cryptocurrencies. These tokens are, at best, complete gambles, or, at worst, outright scams. The future of these tokens is uncertain. Bitcoin is a well-established, widely accepted, digital asset in good standing with the U.S. government. We recommend using Bitcoin-only companies.

Coinbase’s high costs, frequent outages, and unstable trading behaviors. Luckily, numerous Coinbase alternatives in the crypto market offer security and ease of use.

TL; DR: Don’t have much time and just want to check out the list of the best Coinbase alternatives?

No problem, here they are:

Swan Bitcoin — Fees 0.99%, Trustpilot ratings 4.6 out of 5 stars

iTrustCapital - Fees 1%, mainly for IRA only, TrustPilot ratings 4.7 out of 5 stars

Kraken — Complex fee structure, Trustpilot ratings 2.0 out of 5 stars

Binance - Current legal trouble, Trustpilot ratings 2.5 out of 5 stars

Robinhood - Current trouble w/SEC about fees, Trustpilot ratings 1.3 out of 5 stars

Bitstamp - Complex fees, Trustpilot ratings 2.2 out of 5 stars

1. Swan Bitcoin

Fees: 0.99%*

Custody Provider: BitGo Trust Company

Trustpilot Rating: 4.6 out of 5 (out of +1k reviews)

Apple App Store: 4.8 out of 5

Google Play Store: 4.6 out of 5

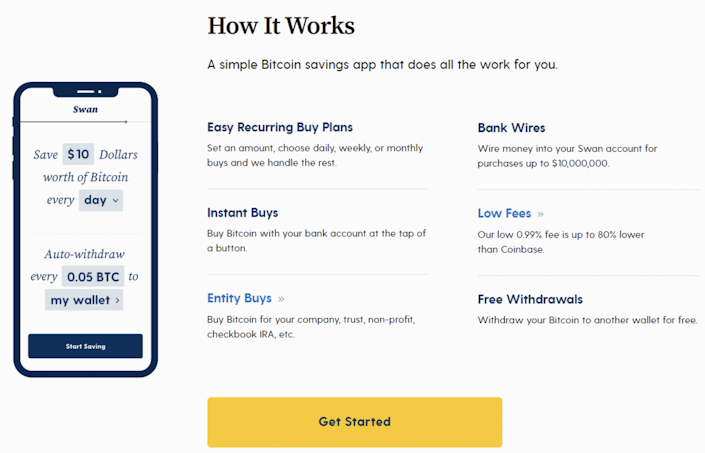

Swan Bitcoin is a U.S.-based company founded in 2019 by Cory Klippsten, Yan Pritzker, and Brady Swenson. Swan has made it easy for anyone to invest in Bitcoin from the get-go.

The user-friendly and intuitive platform simplifies investing in, storing, and learning about Bitcoin.

One of Swan’s key features that makes it the best Coinbase alternative is its ability to automate Bitcoin purchases at regular intervals, helping create a disciplined, low-time preference investment strategy to build wealth over time.

Swan offers investors free withdrawals into self-custody of purchased Bitcoin with a secure, non-custodial Bitcoin wallet. This gives investors complete control over their digital assets and an added layer of security.

Fees

Swan charges a 0.99% fee on all Bitcoin buys, that’s all. No deposit fees, no withdrawal fees, no hidden fees.

Key Features

Enhanced Knowledge Base

Swan’s knowledge base includes comprehensive educational resources, in-depth market analysis, and up-to-date information on Bitcoin and other related cryptocurrencies.

Unparalleled Expertise in Bitcoin

Whether understanding technical aspects, market trends, or potential risks, Swan’s experts work round the clock to guide you every step of the way.

Advisor Services

Swan offers Swan Advisor Services to help financial advisors integrate Bitcoin into their clients' investment portfolios seamlessly.

Personalized Consultation

Investors get advice and strategic recommendations tailored to their financial goals and risk tolerance, ensuring Bitcoin becomes an accessible and beneficial asset.

Reliable Self-Custody Options

Swan’s Specter Labs offers a range of safe and easy-to-use self-custody options for Bitcoiners who prefer to be in direct control of their wealth.

Swan Support

Swan Support is the best in the industry for Bitcoin customer service.

Fees: 0.25% — 2.5%

Custody Provider: Uphold Vault

Trustpilot Rating: 3.3 out of 5 (out of +8.7k reviews)

Apple App Store: 4.6 out of 5

Google Play Store: 4.4 out of 5

Uphold offers a seamless and user-friendly experience for accessing and transacting a variety of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), among others. Note that we do not recommend buying or holding any altcoins, only Bitcoin.

It also supports traditional fiat currencies like the U.S. dollar, Euro, and British pound, allowing users to convert between cryptocurrencies and fiat currencies easily.

Fees

In the U.S., U.K. and most of Europe, our fees are typically:

Stablecoins: 0.25%

Major Market FX: 0.25%

BTC, ETH: 1.4% — 1.6%

Altcoins: 1.9% — 2.5%

Precious Metals: 1.9% — 2.5%

The complete fee schedule is available on their website.

Uphold

Key Features

Easy Conversion

Provides seamless conversions between cryptocurrencies and fiat currencies for convenient and fast exchanges, allowing investors to manage their portfolios and benefit from price fluctuations.

Protected Digital Wallets

Investors can safely store their cryptocurrencies and digital assets in a digital wallet protected by multi-factor authentication and encryption.

Instant Transfers

Uphold members can easily send and receive cryptocurrencies or fiat currencies to and from other Uphold users worldwide without delays or transaction fees.

Fractional Ownership

Users can fractionally own cryptocurrencies, stocks, commodities, and real estate and diversify their investments through a single platform.

Prepaid Debit Cards

They also get prepaid debit cards to spend cryptocurrencies at any location that accepts regular debit or credit card purchases.

Fees: 1%

Custody Provider: Coinbase, Fireblocks

Trustpilot Rating: 4.7 out of 5 (out of +2.9k reviews)

Apple Store App: 5.0 out of 5 (only 1 review)

Google Play Store: 4.1 out of 5 (only 11 review)

iTrustCapital is a cryptocurrency investment platform for investors to buy and sell crypto and hold digital assets in their individual retirement accounts (IRAs) and 401(k) accounts.

While iTrustCapital sells Bitcoin, it also platforms many atlcoins.

They does not have a monthly, yearly, or maintenance fees to utilize our platform. Our only fees include:

1% transaction fee for the buying and/or selling of cryptocurrencies

$50 over spot, per ounce for gold

$2.50 over spot, per ounce of silver

IRA and 401(k) Accounts

Specializes in cryptocurrency investment options in tax-advantaged retirement accounts. Users can invest in digital assets while enjoying the potential tax benefits of retirement accounts.

Diverse Cryptocurrency Selection

Offers a range of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and others.

Secure Storage

Employs institutional-grade security measures to protect users' digital assets. iTrustCapital partners with BitGo, a reputable custodian, to store cryptocurrencies in offline wallets to protect against hacking and theft.

Seamless Trading

Offers a simple and intuitive interface for trading cryptocurrencies. Users can easily buy, sell, and trade assets within their IRA or 401(k) accounts.

Fees: 0.9 — 1.5%

Custody Provider: Etana

Trustpilot Rating: 2.0 out of 5 (out of +2.4k reviews)

Apple Store App: 4.7 out of 5

Google Play Store: 4.2 of out 5

Kraken is one of the world’s largest and most well-established cryptocurrency exchanges. It provides a user-friendly interface and a robust trading platform for beginners and experienced cryptocurrency traders.

Kraken allows users to trade a wide range of cryptocurrencies as an exchange. It also supports trading pairs with fiat currencies, such as USD, EUR, CAD, JPY, and GBP, for easy conversion between cryptocurrencies and traditional money.

Therein lies the problem. Kraken has gotten itself into regulatory trouble due to its operations within the cryptocurrency ecosystem.

Fees

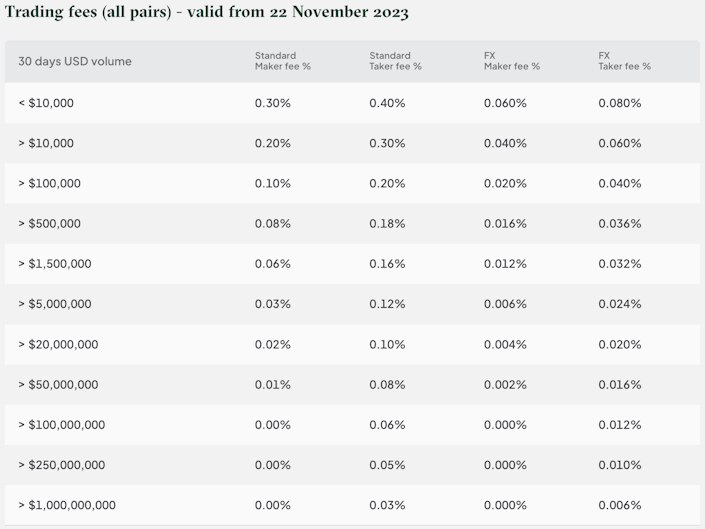

Kraken has a complex fee structure that changes based on the volume and amount of trading you do on the exchange.

Instant Buy (on average) charges a 0.9% flat fee for buying stablecoins

1.5% flat fee for all other cryptocurrencies

Between 0.10 cents and $35 withdrawal fees on fiat withdrawals, depending on the payment method chosen

To minimize fees on Kraken, you need to use Kraken Pro, which enables you to pay less based on higher volumes.

Kraken

Check out the complete table of fees on their website.

Key Features

Trading Options

Offers various trading options: spot trading, where users can buy and sell cryptocurrencies at current market prices; margin trading, for trading with borrowed funds; and futures trading, where users can speculate on cryptocurrency price movements.

Advanced Trading Tools

Charting tools, order types (such as market orders, limit orders, and stop loss orders), and advanced regular trading, like trailing stops, help users execute their trading strategies effectively.

Security Measures

Keeps most crypto asset holdings in cold storage. This means they stay offline and less vulnerable to hacking attempts.

Fiat Currency Support

Users can deposit and withdraw supported fiat currencies and easily convert between cryptocurrencies and fiat currencies, facilitating seamless integration with the traditional financial system.

UPDATE: On November 20st, 2023, the U.S. SEC officially charged Kraken for 'Operating as an Unregistered Securities Exchange, Broker, Dealer and Clearing Agency.'

According to the SEC, Kraken allegedly:

Provides a marketplace that brings together the orders for securities of multiple buyers and sellers using established, non-discretionary methods under which such orders interact, and thus operates as an exchange.

Engages in the business of effecting securities transactions for the accounts of Kraken customers, and thus operates as a broker.

Engages in the business of buying and selling securities for its own account without an applicable exception, and thus operates as a dealer.

Serves as an intermediary in settling transactions in crypto asset securities by Kraken customers, and acts as a securities depository, and thus operates as a clearing agency.

In February of 2023, Kraken agreed to cease offering or selling securities through crypto asset staking services or staking programs and pay a civil penalty of $30 million.

On December 28th, 2023 Bloomberg reported India is set to crack down on and ban local access to overseas crypto exchanges like Binance.

Fees: Start at 0.6%. fees of 0.5% for instant buys and debit card fees of 3.75%

Custody Provider: Ceffu

Trustpilot Rating: 2.1 out of 5 (out of +5.1k reviews)

Apple Store App: 4.2 out of 5

Google Play Store: 4.1 out of 5

Founded by Changpeng Zhao in 2017, Binance is a pioneering cryptocurrency exchange that has quickly grown into one of the industry’s largest and most influential platforms.

With its comprehensive range of features, user-friendly interface, and commitment to security, Binance has simplified trading digital assets.

Binance has been one of the biggest contributors to the spread of cryptocurrencies in recent years. That has also led to their downfall. We do not recommend buying or holding any cryptocurrencies, only Bitcoin.

Binance has a complex fee structure based on the type of trade.

0.1% trading fee

0.5% fee instant buy/sell

Binance also has several hidden fees, such as withdrawal fees, which are different for every type of currency.

For Bitcoin, fees are 0.0001 — 0.0005 of the amount you withdraw. The fees get more complex and higher once you start trading odd altcoins and cryptocurrencies.

Trade fees start at a 0.6% taker and 0.4% maker fee for trading non-Bitcoin crypto worth less than $10,000 in 30 days

Binance

Check out the complete fee schedule on their website.

Binance Futures

Trade digital asset derivatives with leverage.

Binance Launchpad

Participate in token sales and potentially invest in promising blockchain projects.

Binance Earn

Stake cryptocurrencies, participate in savings programs, or earn interest on the holdings.

Binance Coin (BNB)

Use BNB to pay for trading fees, participate in token sales on Binance Launchpad, and enjoy additional benefits within the Binance ecosystem.

Binance Academy

Get resources, articles, and videos to understand blockchain technology, cryptocurrencies, and various aspects of the crypto industry.

Binance.U.S.

Launched in September 2019 and headquartered in Florida, Binance.U.S. was established to serve U.S. consumers and adhere to U.S. regulations.

Only a 2.1 / 5 stars +5.1 k reviews

66% of reviews resulting in 1-star ratings

75% of reviews resulted in a negative (1 or 2-star ratings)

According to a recent Kaiko Insight Report titled: The Crypto Liquidity Concentration Report, 2023 — Binance:

Represented 30.7% of the worldwide market depth

Controlled 64.3% of the global trading volume

What to Know: The eight largest exchanges combined dominate an impressive 91.7% of market depth and 89.5% of trading volume.

NOTE: On October 16th, Binance.US announced it will no longer allow USD withdrawals. You can download the PDF version here. Does this mean Binance International might be in trouble?

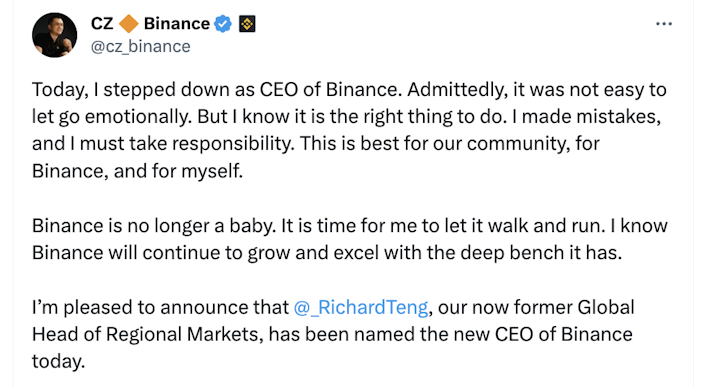

UPDATE: On November 21st, 2023, Binance CEO Changpeng Zhao"CZ” agreed to a settlement with U.S. federal prosecutors. The settlement requires Zhao to plead guilty to violating criminal U.S. anti-money-laundering laws.

On the same day, CZ announced the news on Twitter:

Zhao was personally subjected to a $50 million fine as part of CZ’s plea. Binance was required to pay $4.3 billion in fines as part of the plea deal. CZ was released on a $175M bond and is scheduled to be sentenced in February 2024.

The settlement will allow Binance to continue operating (for now).

None of this came as a surprise to Swan. Binance has been raising our eyebrows for years and there are many newer red flag signs it might be in trouble.

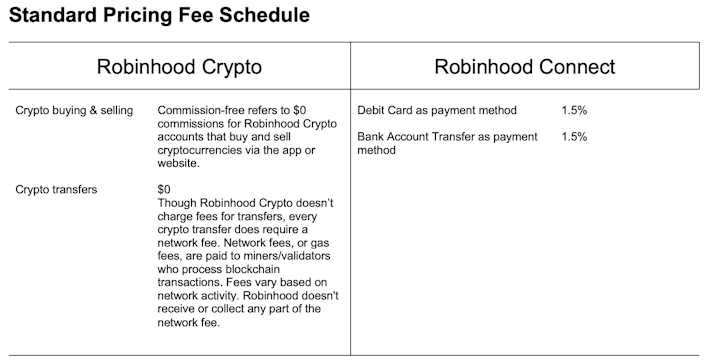

Fees: Order flow, 1.5% on withdrawals

Custody Provider: Self-custody

Trustpilot Rating: 1.3 of out 5 (out of +3.6k reviews)

Apple Store App: 4.2 of out 5

Google Play Store: 4.1 out of 5

Robinhood equips investors to navigate the cryptocurrency world safely with its user-friendly interface, commission-free trading, a wide range of supported cryptocurrencies, and robust security measures.

Instead of a commission fee on buying cryptocurrencies, Robinhood uses payment of order flow, which takes a share of your profit when you sell or withdraw your assets.

Robinhood

This is a controversial practice that the Securities and Exchange Commission might take them away altogether.

An additional instant withdrawal fee of 1.5% is added to a debit card or bank account.

Intuitive Interface

Novice and experienced traders alike can trade easily.

Zero Commission Trading

Trade commission-free, maximizing their investment returns and making the most of their cryptocurrency transactions.

Instant Deposits and Withdrawals

Take advantage of market opportunities by avoiding unnecessary waiting and depositing and withdrawing quickly according to market fluctuations.

Real-Time Market Data and Alerts

Get real-time price data and customizable alerts for effective investment monitoring.

Robinhood Financial

Easily integrate with Robinhood and access traditional stocks and cryptocurrencies within a single platform.

Fees: 1% — 1.5%

Custody Provider: BitGo

Trustpilot Rating: 2.2 out of 5 (out of +700 reviews)

Apple Store App: 4.5 out of 5

Google Play Store: 4.0 out of 5

With high liquidity and competitive trading fees, Bitstamp offers various order types, including market, limit, and stop orders, giving users greater control over their trading strategies.

Bitstamp’s user-friendly interface and commitment to transparency and reliability have earned it the trust of many traders worldwide.

Bitstamp uses a complex maker-taker fee model to determine trading fees. The fees are calculated based on your current pricing tier at the time of your order execution. Generally speaking, you are paying between 1% and 1.5% in trading fees.

Trust and Security

Bitstamp is one of the first cryptocurrency exchanges to receive a BitLicense, ensuring compliance with strict regulatory standards.

Liquidity and Competitive Fees

It helps seamlessly execute trades even during periods of high market volatility. Bitstamp’s trading fees decrease as trading volume increases, making it attractive for traders of all levels.

Global Accessibility

Bitstamp’s services are available to users worldwide for international cryptocurrency trading. It also offers multilingual customer support so users can get help in their preferred language.

Industry-leading Compliance

To ensure a secure trading environment, Bitstamp adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Although Coinbase is one of the most popular cryptocurrency exchanges and has established itself as a reputable platform, investors might consider alternatives for several reasons.

Coinbase received a Wells Notice on April 27, 2023 indicating the SEC is investigating possible violations by and may take legal action against the company.

Coinbase charges some of the highest fees in the cryptocurrency industry, especially for smaller transactions and retail investors.

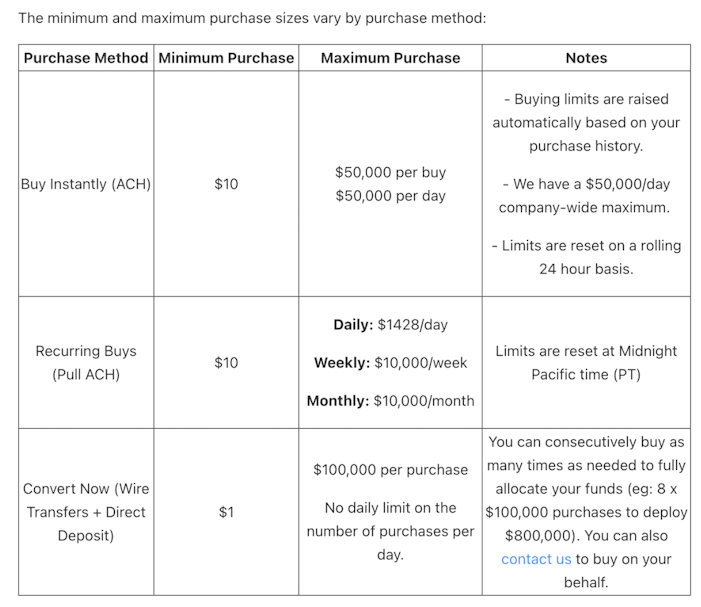

A variable fee is charged, ranging from 1% to 3.99%, depending on the size of the transaction and the payment method used.

“Coinbase generates most of its revenue through trading, listing, and custodial fees. Because of this, Coinbase is incentivized to list more cryptocurrencies, promote speculative trading, and discourage self-custody. To put this into perspective, in 2017 Coinbase only listed 4 coins: Bitcoin, Bitcoin Cash, Litecoin, and Ethereum. Today, Coinbase has over 160 cryptocurrencies available to trade in the US.”

— Sam Callahan, Swan Bitcoin

Coinbase has a notorious reputation for its poor customer service

Many users have reported issues with frozen or suspended accounts without explanation and no ability to receive personalized responses

Customers regularly complain about this on Twitter, Trustpilot, and forums like Reddit

Offers no live chat feature other than a bot with limited capabilities

Many users have to wait several days for answers, if they receive them at all

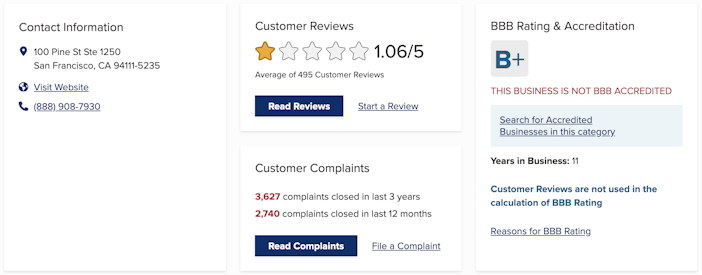

Only a 1.5 / 5 stars from over 9.5k reviews

79% reviews received a 1-star rating

84% of reviews resulted in a negative (1 or 2-star ratings)

Coinbase also has a near-worst possible score of 1.06 stars of 5-star rating with BBB.

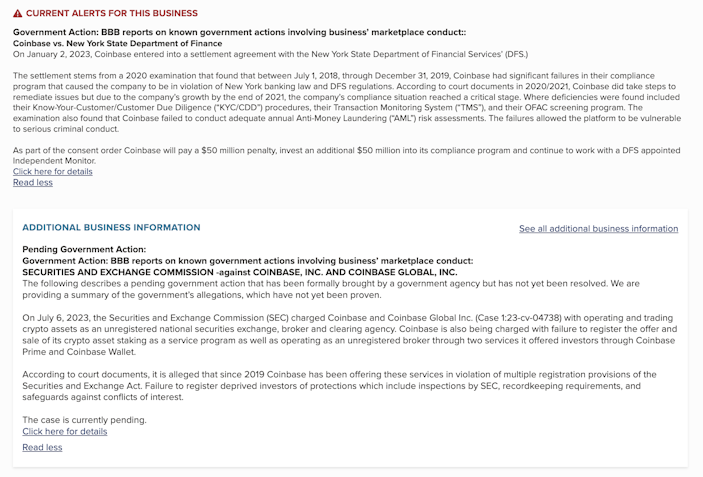

Furthermore, the following ⚠️ CURRENT ALERTS FOR THIS BUSINESS message can be found on the company BBB page:

Coinbase is well-known for:

Server errors, especially during periods of high volatility, making taking advantage of market volatility a massive pain point for investors.

In 2021, hackers stole crypto assets and user information from at least 6,000 Coinbase customers.

In 2023, a former product manager at Coinbase was sentenced to a two-year prison sentence for engaging in insider trading.

Bitcoin is the best-performing asset in the last 14 years. However, Coinbase still offers a vast range of cryptocurrencies for sale. The overwhelming majority of these listings underperform Bitcoin dramatically.

“Coinbase, for example, made an official recommendation of the following tokens to retail investors as ‘Top Picks, ’ each of which dramatically underperformed Bitcoin within weeks, with an average drawdown of -40.6%.”

— Sam Callahan, Swan Bitcoin

An announcement on October 17th revealed that Coinbase had halted trading for 80 pairs not denominated in USD for specific supported assets on Coinbase Exchange, Advanced Trade, and Coinbase Prime.

Coinbase has been known to freeze or limit user accounts without warning, often causing user frustration and loss of funds.

Several, possibly thousands of Coinbase users have complained that their accounts were blocked due to 'Regulatory Compliance' — halting customer funds.

Customers are prompted with the following message:

Multiple class action lawsuits have been filed against Coinbase Global Inc., the cryptocurrency exchange, and its subsidiary Coinbase Inc. Some have been dismissed, but not all.

The lawsuits claim that Coinbase fails to maintain adequate security measures for its customers' accounts and conducts business operations without the necessary registration as a broker-dealer.

What makes Swan the best alternative to Coinbase?

No Regulatory Hassles

The SEC has publicly stated that Bitcoin isn’t a security and doesn’t fall under the SEC’s regulatory mandate.

By focusing on this single asset class, Swan offers its clients a secure and hassle-free solution for accumulating Bitcoin while avoiding the complexities and regulatory challenges associated with the broader range of cryptocurrencies, trading options, and crypto exchanges that the SEC classifies as illegal securities offerings.

** UPDATE: It was reported on July 31st that, ahead of initiating legal proceedings against the exchange, the US SEC instructed Coinbase to halt trading in all cryptocurrencies except for Bitcoin. This move indicates the agency intends to exert regulatory jurisdiction over a broader market section.

Low and Transparent Fees

Swan’s exclusive focus on Bitcoin allows it to cut costs and pass on the savings in lower fees, making it a great Coinbase alternative for users who prioritize low fees and wish to focus on Bitcoin-only.

There are no inactivity fees, withdrawal fees, overdraft fees, custody fees**, or fiat withdrawal fees involved.

Unlike Coinbase, Swan also doesn’t charge a spread to its customers.

** There are no monthly fees for Swan entities or personal accounts. However, IRA accounts will incur a small monthly fee of $20 until your account reaches $100,000. If your account exceeds $100,000, an annual fee of 0.25% is deducted from your linked bank account.

Swan uses a chatbot feature and instantly connects users to a Swan representative. This functionality allows users to engage in real-time conversations, enabling swift access to Swan Support and assistance.

Better Asset Choices

Being a Bitcoin-only company, Swan avoids the risks of volatile cryptocurrencies. By focusing solely on Bitcoin, Swan mitigates the potential uncertainty and unpredictability of investing in other highly volatile and multiple digital assets.

Fewer Account Restrictions

Unlike Coinbase, Swan has a few account restrictions. It has a transparent framework openly available to the public.

Swan Bitcoin IRA

Swan recently launched a Bitcoin IRA product, offering its customer base a tax-deferred or tax-free solution. Swan offers self-managed Traditional or Roth IRAs, with Bitcoin held in a legal, regulated trust account maintained by a qualified and authorized custodian.

Qualified custodians like Swan ensure:

Asset protection

Regulatory compliance

Fraud prevention

Independent oversight

Unauthorized use of funds

Other Primary Swan Services

If you’re a high net-worth individual, family office, or corporation looking to buy $100,000 or more worth of Bitcoin, you can sign up with Swan Private for customized services.

Best-in-class user experience for secure self-custody

Secure key backup to minimize the risk of loss

Concierge onboarding available

Inheritance planning for Swan Private clients

Built on Bitcoin Core and Specter, a fully open-source stack

Swan Vault

Swan Vault and custody solutions is your reliable partner for everything related to Bitcoin.

Get Priority Access

Swan Force is another Swan entity to earn Bitcoin by helping other users and businesses engage with the Bitcoin ecosystem.

Swan has the best combination of fees and services and a sustainable business model with very low overhead costs and much lower regulatory risks.

Coinbase’s fundamental difference is that it offers access to more digital asset options. But, if you take a closer look, as we shared with you above—there is no strong case for buying these altcoins over Bitcoin.

If you care about customer service, education, and integrity and want a committed team of experts in your corner, available to help you whenever you need it, Swan Bitcoin is the best option to buy and hold Bitcoin.

Start securing your Bitcoin future with Swan today.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?