Choose Bitcoin

I believe a line has been drawn in the sand between people, projects, and companies that support Bitcoin and those that do not, and in some cases, actively work against it.

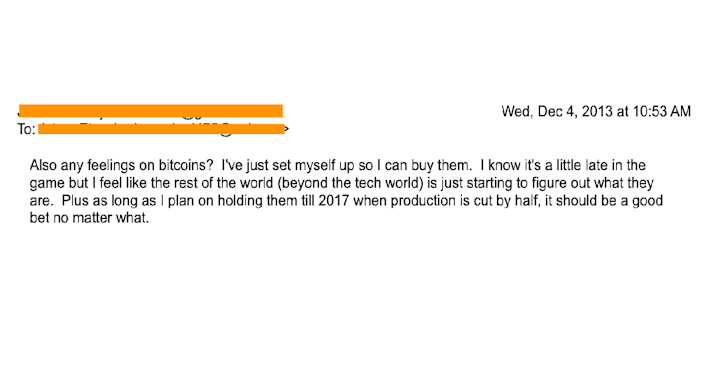

So I’ll start by saying that I am by no means a “Bitcoin OG, ” but I have been around longer than some folks. I can still remember repurchasing my first bit of Bitcoin in 2013, right at the top, directly before we crashed…

The day we crashed was when I became a HODLer, and at the time, I hadn’t even heard the word before. I hadn’t read the White Paper. Heck, I didn’t even know what a blockchain was. But “Magic Internet Money” made sense to me. It’s like gold in World of Warcraft, right?

I am also Jewish, and being part of a culture that’s been persecuted for so long can prepare a person pretty well for understanding the concept of sound money, especially money that is unconfiscatable. I don’t want to get into all that history but suffice it to say, if Bitcoin had been around in the years leading up to WWII, my family that fled to the United States could have done so with far more than just the clothing on their backs.

But back to 2013…

At the time, there weren’t many options for buying Bitcoin. Mt. Gox was still functioning. Localbitcoins was around and didn’t require KYC back then, but I hadn’t heard of it yet.

And then there was Coinbase.

“Holy sh$t. Look at this, ” I said to myself. Coinbase had a polished app, and despite the wait time back then between depositing USD and the ability to buy Bitcoin, I was impressed, and for a good reason. At the time, Coinbase was revolutionary, and while I vehemently disagree with how they’ve evolved as a company over time, it’s fair to say that Coinbase is responsible for onboarding a considerable number of Bitcoiners, including me. And for that, they should be commended.

But times have changed. Coinbase has changed.

And most importantly, the Bitcoin ecosystem has changed… For the better.

Bitcoin, for me, is not just about revolutionizing the global monetary system by introducing sound money. Bitcoin is about choice. You don’t have to use it. No one is forcing you, and hopefully, no one ever will, even if, at that point, you’d be stupid not to. This ability to choose is part of why I love Bitcoin so much.

As the regulatory landscape shifts, it’s wise for investors to consider safeguarding their holdings by moving them from Coinbase into secure cold storage. Additionally, converting altcoins to Bitcoin and opening an account with a Bitcoin-only company could prove to be a strategic move in light of these changes.

Coinbase is facing potential regulatory challenges and uncertainties on all fronts including, a Wells’ Notice by the U.S. Securities and Exchange Commission (SEC). It has led many crypto investors to seek alternatives.

** UPDATE: It was reported n July 31st, ahead of initiating legal proceedings against the exchange, the US Securities and Exchange Commission instructed Coinbase to halt trading in all cryptocurrencies except for Bitcoin. This move indicates the agency’s intention to exert regulatory jurisdiction over a broader section of the market.

According to Brian Armstrong, the CEO of Coinbase, the SEC provided this recommendation before taking legal action against the company, which is listed on Nasdaq, for its failure to register as a broker.

Understanding that Bitcoin is a choice was a big Aha moment for me. Understanding the corollary to that idea, that I could use Bitcoin to opt out of the legacy system, was an even more significant Aha moment.

But back in 2013, when it came to buying Bitcoin, there really wasn’t much of a choice. If you were a noob like me, Coinbase was the go-to and, frankly, the only option that wasn’t sketchy for an outsider. It would be a while before I’d read the White Paper and the Cypherpunk Manifesto and came to understand the importance of things like privacy. So even while LocalBitcoins could have been a better option back then, it just wasn’t something I cared about. Since those early days for me, I have changed a lot.

I care about privacy. I care about individual sovereignty. I care about “unfucking” the financial system and promoting the hardest, soundest money we have ever seen and ever will see.

I care about Bitcoin, but more than that, I care about ensuring the future of Bitcoin.

This may not be obvious to everyone, but I believe a line has been drawn in the sand between people, projects, and companies that support Bitcoin and those that do not and, in some cases, actively work against it.

As I said before, the Bitcoin ecosystem has changed for the better. Just as Bitcoin gives us a choice to opt out of the legacy financial system, Pro-Bitcoin companies (real Pro-Bitcoin companies…) have sprung up and are seizing the opportunity to give the people a choice.

And now I am asking you to make a choice.

I am asking you to choose to support Bitcoin. This doesn’t mean you have to go out and learn the intricacies of coding and elliptic curve cryptography. You do not have to be a core dev to support Bitcoin, although if that is your goal, you have my respect and admiration!

What I am really asking you to do, is to think carefully about how you interact with the Bitcoin ecosystem. Understand that your actions, even something as simple as how you buy Bitcoin, can have unforeseen consequences.

Choose to support companies and projects not in it for the quick buck but for the long haul. Give your support and your hard-earned (and quickly depreciating) fiat money to companies and projects that actually care about Bitcoin and, in so doing, care about you as well.

Luckily the list of companies and projects like this is growing every day. Some good examples include Coinkite for trusted hardware solutions, CasaHodl and Unchained Capital for custody solutions, Fold and Lolli for earning sats back, and River Financial and Swan Bitcoin for onramp solutions. Even in the area of KYC-free Bitcoin, there have been huge strides, and I would highly recommend anyone interested to head over to Bisq and see what it’s all about.

Like Coinkite, CasaHodl, Unchained, and others, Swan Bitcoin is a mission-driven company, so I decided to join Swan as a full-time team member.

We care about Bitcoin, Bitcoiners (and precoiners!). At Swan, we like to say that education is our marketing. We pride ourselves on being the safest and best way to auto-stack BTC, but more than that, it’s our mission to educate and help create 10 million Bitcoiners, a true intransigent minority that cannot be stopped. This is part of why to become a Swan member. You have to commit to automatic dollar cost averaging. Not only is the constant buy pressure of auto-stacking good for Bitcoin, but dollar cost averaging is a proven method for accumulating assets while dampening your exposure to volatility.

Why is that important?

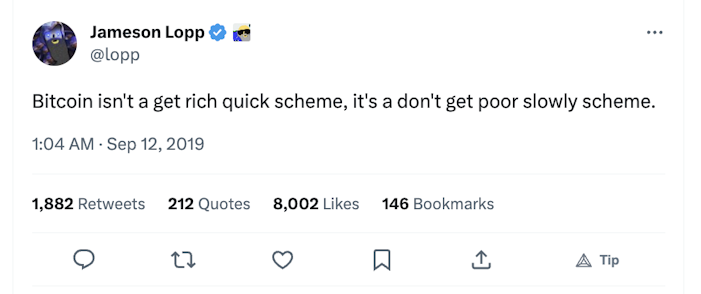

Because Bitcoin is absolutely not a get-rich-quick scheme. In the words of Jameson Lopp:

On top of giving our customers the easiest, safest, and best way to dollar cost average into Bitcoin with recurring buys, we also offer the option for Bitcoiners to set up automated, recurring withdrawals. We want our customers to reach the point where they are comfortable with self-custody, whether with a hardware wallet or a multi-sig solution.

Contrast our business model with the onramps you’re already familiar with. They have high fees, a total lack of respect for financial privacy, and often promote false narratives and guide you towards unproven, highly risky quote-unquote assets…

I think it’s important to point out there is nothing wrong with trying to make money, but the smartest companies, in my opinion, are the ones that understand that profits are best realized when they come secondary, as a result of the mission, not the other way around.

This is something I was taught and believe to this day:

If you work hard at doing what you love, at something important that you’re genuinely passionate about, then money will follow. Companies like Coinbase have lost this thread and deviated from the core ethos of Bitcoin. It’s my belief that profit alone has become their mission. As a result, I believe they will trend toward obsolescence.

Why?

Because now we have alternatives that better serve consumers. And this time… I choose Swan Bitcoin.

So what will you choose?

Well, that’s up to you. Do your own research and see what makes the most sense. If you live in the U.S., I hope you consider stacking with Swan, but at the end of the day, I just hope you choose Bitcoin. And in the meantime, head over to BitcoinDevList and support ongoing Bitcoin development.✌️

Converting altcoins to Bitcoin and opening an account with a Bitcoin-only company could prove to be a strategic move in light of these changes. If you are a U.S. citizen and are seeking a Coinbase alternative platform to buy Bitcoin, consider Swan Bitcoin.

Don’t hesitate to reach out anytime with any questions. Once you are ready to take control of your financial future, here is how to delete your Coinbase account in three easy steps.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brekkie von Bitcoin

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?