What Is Cantillon Effect? (Top 3 Reasons You Should Care in 2024)

The Cantillon Effect reveals inflation’s uneven impact. Bitcoin, however, has a Reverse Cantillon Effect. As a result, Bitcoin is an escape from the vicious cycles of money printing.

The Cantillon Effect describes how inflation impacts people unequally and helps insiders get a leg up on ordinary folks. Here is a quick summary of how it works:

New money is injected into the economy by the government

Certain groups (e.g., banks, Wall Street, etc.) get access to this money first

These groups gain an arbitrage opportunity — they’re able to spend money before prices increase across society

This piece will examine the following:

How the Cantillon Effect Happens

The Fed prints money to boost the economy

That money goes from central banks to private banks to Wall Street to regular folks

Insiders early in that chain get to spend the money first, before inflation takes hold, and thus get to acquire goods and services at a discounted rate

How Bitcoin Helps

Bitcoin has a fixed supply

This returns scarcity to the monetary system since the government can’t print more of it

As a result, savings in Bitcoin are able to outpace the rate of monetary inflation

Bitcoin’s Reverse Cantillon Effect

As the government keeps printing money, Bitcoin becomes a refuge

Bitcoin lets you opt-out of unfair fiat currency systems

Bitcoin’s limited supply creates, in effect, the opposite of the Cantillon Effect

About the Cantillon Effect

The Cantillon Effect explains the unequal impact of inflation. When new fiat money is created, it goes from from central banks to private banks to Wall Street to regular folks. That means there’s a lag time between when the money is printed and inflation is seen across the economy. During that period, banks, Wall Street insiders, and others can buy goods and assets before prices go up.

In effect, they acquire goods at a discounted rate while ordinary people wind up paying higher prices. Yet again, banks and asset owners get a financial advantage while those who are less “connected” suffer.

Inflation winds up being a regressive tax on regular citizens.

So what’s this got to do with Bitcoin?

Unlike conventional currencies, Bitcoin’s value isn’t tethered to government printing but arises organically from increased purchasing power, similar to a wealth effect.

The wealth effect is a behavioral economic theory suggesting that people spend more as the value of their assets rises.

How the Cantillon Effect Happens

Step 1: Government’s Quantitative Easing Policy

What happens when governments increase spending? Newly printed money emerges from central banks and is delivered into the economic system through one of these mechanisms:

Government deficit spending

Quantitative easing (QE)

How these work…

What is government deficit spending?

Governments run into fiscal deficits when they spend more than they take in from taxes and other revenues. An increase in the fiscal deficit can have both a positive and negative impact:

The good: It (typically) temporarily boosts a sluggish economy by giving individuals more money to buy goods/services and invest in the market.

The bad: However, it may also create long-term deficits that are detrimental to economic growth and stability.

What is quantitative easing?

Quantitative easing is a monetary policy strategy central banks use to…

Reduce interest rates

Increase the supply of money (which can lead to monetary debasement)

Drive more lending to consumers and businesses

The biggest problem and danger of quantitative easing is the risk of inflation. When a central bank floods the economy by printing new currency, the total supply of dollars increases, causing inflation as a result.

Step 2: Debt-Fueled Spending

When the government spends the money, it does so by borrowing and running a higher deficit. Instead of raising taxes to drive more revenue, the government borrows the money.

In the U.S., for example, the government is currently running a debt of $34.2 trillion, which keeps getting bigger and bigger.

Why do we care if the government has a high debt? The following steps explain…

Step 3: Fed Keeps Printing Money

To lower interest rates or bail out financial tumults, the Fed performs a kind of financial alchemy (or financialization) in which it prints money and acquires more bonds.

As bond prices grow, interest rates and yields gracefully come down. Low-interest rates mean more businesses and people can borrow money.

Step 4: Low-Interest Rates Boost Activity

This quantitative easing policy fills the pockets of Wall Street banks with crisp, fresh cash, eagerly awaiting investment.

With interest rates at an all-time low, the wealthy elite and businesses seize the opportunity, leveraging their resources to expand operations (or acquire appreciating assets).

Step 5: Prices Start to Increase for Ordinary People

But hold on!

As these new dollars circulate through the economy, they silently increase the prices of life’s essentials.

Average folks find themselves priced out of asset ownership (e.g., buying a home or car), while inflation’s relentless surge makes investing more challenging.

Ordinary people wind up unable to afford increasing prices. All of a sudden, people find themselves paying $8 for a dozen eggs. Ugh!

Result: A Society in Turmoil

The result? Wealth inequality!

Some argue for increased government intervention as a solution to that. But remember, the government has two central policies, and both involve spending. This relentless money printing continues to fan the flames of instability is how the Cantillon Effect works.

How the Cantillion Effect Looks

Escape The Cycle By Saving in Bitcoin

It’s a doom loop we keep witnessing in the American economic system…

We are addicted to new money: The system is currently leveraged to the eyeballs. U.S. total debt stands at $34.2 trillion and grows larger daily. Without this money printing, the system would collapse spectacularly.

Debt Spirals: Debt begets more debt. And with debt levels this high, the Federal Reserve is only one small emergency away from another round of quantitative easing, starting the entire Cantillon process over again.

Luckily, Bitcoin is here to rescue us…

NGU (Number Go Up) Technology: As the money supply increases exponentially, asset prices will too. Bitcoin may be the younger generations’ only hope to achieve a secure financial future. (More on NGU.)

Final Thoughts

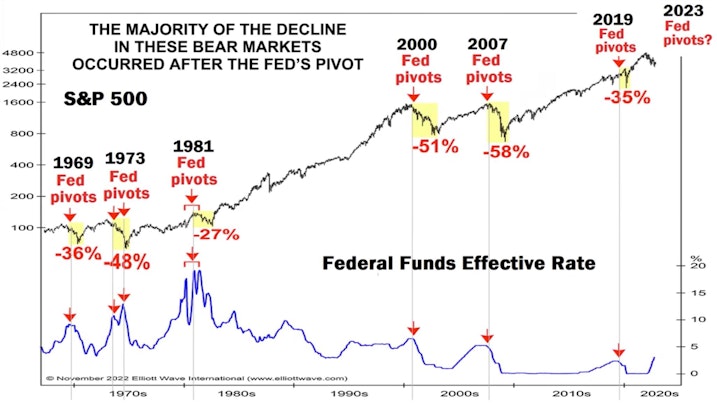

The impact of the Cantillon Effect needs to stay top-of-mind as we experience additional increases in the money supply. A potential Federal Reserve pivot moment is near, which means the money printer will likely start up again. And when that happens, remember that inflationary effects will not be distributed evenly.

Elliot Waves International

Keep an eye on where the money enters the system. During quantitative easing, new money enters the system through Wall Street. And now, with Spot Bitcoin ETFs available to Wall Street traders, Bitcoin is increasingly becoming a sponge for this excess liquidity.

Spot Bitcoin ETFs smashed records on their first day of trading, with over $4.6 billion in trading volume, the highest ever for an ETF launch.

Spot Bitcoin ETFs from BlackRock and Fidelity Investments saw more than $2 billion of net inflows during their first 12 trading days. The Grayscale Bitcoin Trust experienced more than $5 billion in net outflows.

Stay on top with all things Bitcoin ETF with our Daily Bitcoin ETF Show, hosted by Dante Cook.

This excess liquidity may flow from bonds into Bitcoin investment tools, like Bitcoin IRAs and spot-Bitcoin ETFs.

The more you understand the impact of the Cantillon Effect, the more you realize the power of Bitcoin’s Reverse Cantillon Effect. As the government keeps printing money, Bitcoin becomes a refuge. In effect, Bitcoin becomes “true money” that lets us opt out of unfair fiat currency systems.

In a world devoid of monetary scarcity, Bitcoin’s limited supply leverages the Cantillon Effect and lets us benefit from it. If you enjoyed reading this, check out our article about the Byzantine Generals Problem.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Mickey Koss became a freelance writer in the Bitcoin space in an attempt to build a proof of work portfolio for when he left the Army. He graduated from West Point with a degree in Economics before serving in the Army for nearly a decade. He became orange pilled in graduate school and is now a regular contributor to Forbes, Bitcoin Magazine, and Bitcoin News. He’s been on popular podcasts such as BTC Sessions’ Why Are We Bullish, and is a regular on Café Bitcoin.

Matt Ruby is a seasoned content writer helping educate million worldwide about Bitcoin for Swan. Matt work with tech companies to create words, videos, and other content that makes them seem human. He specializes in taking boring/drab tech topics and making them interesting, educational, funny, and accessible to regular people.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?