How the Byzantine General’s Problem Relates to You in 2024

The Byzantine Generals Problem, a perplexing game theory dilemma, was the reason decentralized money could never work. Until Bitcoin came along and solved it via the blockchain. Now, money will never be the same.

Let’s be real. You don’t live in Byzantine (FYI, that’s what they used to call Istanbul), and you’re not a general commanding an army. So, why on Earth should you care about something called the Byzantine Generals' Problem?

To answer that, we need to zoom out: In truth, the Byzantine Generals' Problem is an analogy that demonstrates the challenge of reaching consensus in distributed systems — in most cases, that means a computing network spread across many computers (aka nodes).

But let’s zoom out even further: The real problem here is with money — specifically, what happens when centralized authorities control it.

Think of the 2008 financial crisis, which cost the global economy trillions of dollars, and how the public paid the price while large banks received bailouts.

Or consider how often central banks print money to stimulate a weak economy. The result: Money eventually winds up debased and devalued.

Also, a centralized financial system means governments can confiscate your money as they see fit. Unfortunately for asset holders, impoverished governments often turn to desperate measures.

Decentralized money (i.e., a peer-to-peer payment system that does not require a trusted third party) is a solution to all these issues. But to create decentralized money, the Byzantine Generals' Problem must be solved.

Explaining the Byzantine Generals' Problem

The problem represents a game theory query about what constitutes rational decision-making behavior. So, even though you may not care about ancient military strategy, the solution to this computing problem can have a huge impact on our monetary lives.

The riddle to solve: If there’s a decentralized network that prevents people from verifying the identity (or reputation) of other participants, how can anyone know who is actually telling the truth?

Without a central authority, how can everyone reach agreement?

Before we go further: Who is this piece for? The target audience is Bitcoin investors (and potential future investors) — typically, though not exclusively, younger folks (18-25 years old) — who have heard about the Byzantine Generals’ Problem, but aren’t 100% sure what it is or why it matters. They want it explained clearly and in a way that’s not sleep-inducing. Plus, they want to know if Bitcoin really solves it and how. This piece will be especially resonant for people new to Bitcoin, beginner investors, and/or anyone else skeptical about crypto in general and Bitcoin specifically. OK, let’s get back to it…

The Byzantine Generals' Problem uses game theory to clarify the riddle that Bitcoin must solve.

Swan Bitcoin

Here’s the scenario:

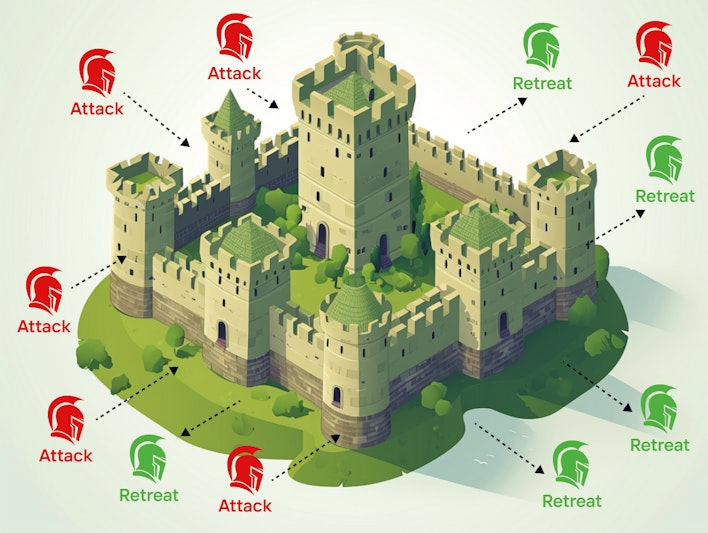

Multiple divisions of the Byzantine army are stationed at various locations outside a city they want to invade. Each division is led by a different general. They communicate with each other via messengers.

If the generals attack at the same time, they’ll win. But if the attacks come at different times, they will be defeated. So, the generals need to agree on a joint invasion plan.

But beware! There are traitors in their midst. The generals know these traitors will try to sabotage any attack plan by intercepting messages and inserting false plans. The generals have no way of telling if these messages have been changed.

The generals need to reach an agreement on their invasion without the traitors screwing up their battle plan. So, how can the generals organize a simultaneous attack?

What’s money got to do with it?

Monetary systems offer a real-world example of the Byzantine Generals' Problem. After all, society needs a currency that everyone can trust — and everyone also needs to agree on its value.

Historically, organizations have used metals, shells, and beads as currency to various degrees of success. Gold is the solution that’s been relied upon the most. However, there are issues with gold’s weight, purity, and portability. (As for shells, just go to a beach, and you’ll quickly realize the problem with using them as your currency.)

As a result, central authorities, typically nation-state governments, have taken control of money. In theory, that approach should inspire trust in the purity of a nation’s currency. Alas, that’s not how it usually goes.

Central authorities have constantly violated the trust placed in them.

The ideal solution would be decentralized money that is somehow verifiable, counterfeit-resistant, and trustless. Over the years, many have attempted to solve this problem and create money that exists separately from the government, but all have failed.

No one could solve the Byzantine Generals' Problem.

Until 2008. Enter Bitcoin.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

-Satoshi Nakamoto, the creator of Bitcoin

Blockchain to the rescue

So, how did Bitcoin solve this riddle? With a blockchain and a consensus mechanism called proof-of-work.

blockchain — a system in which a record of transactions, especially those made in a cryptocurrency, is maintained across computers that are linked in a peer-to-peer network

Bitcoin relies on a public, distributed ledger to store a history of all transactions. Remember how the Byzantine generals needed a way to agree on the same truth?

With Bitcoin, that truth is the blockchain. Instead of generals, there are nodes and miners. And instead of messages, there is the ledger and transactions. With the blockchain, every node agrees on which transactions occurred (and the order of transactions). That way, everyone can verify ownership.

The result: a decentralized, functioning, trustless money.

Wikipedia citation #31.

How does it do it? Via 'Proof-of-work.'

“Proof-of-work is a software algorithm used by Bitcoin and other blockchains to ensure blocks are only regarded as valid if they require a certain amount of computational power to produce, ” says blockchain developer Amaury Sechet. “It’s a consensus mechanism that allows anonymous entities in decentralized networks to trust one another.”

Under the proof-of-work algorithm, all Bitcoin miners must agree that a transaction is valid before it is added to the blockchain.

Miners validate transactions using the historical information on the ledger to check that the necessary account balances are available.

If they encounter a transaction that appears contradictory to the existing data, they have the power to reject it.

However, once a transaction has been validated, it’s recorded on the ledger permanently, meaning that anyone can trust the history of transaction data. Since every miner on the network has a copy of the same data, it can always be verified as true.

In order to add information (aka blocks) to the blockchain, a node must publish proof that the block they are adding required considerable work.

Since people must invest lots of energy to participate in mining — and receive Bitcoin as a reward — there’s an incentive to publish honest information. That’s why the Bitcoin network has never been successfully attacked.

Once a block is added, it’s extremely difficult to remove — and that makes Bitcoin’s past immutable.

immutable — in the context of a blockchain, implies that the data or ledger is permanent and tamper-proof, and its history cannot be modified or changed after its creation

The result is everyone on the Bitcoin network agrees on all transactions on the blockchain. Proof-of-work lets each node verify the validity of blocks using computer hash power.

If a node inserts false information, other nodes immediately recognize it as invalid, which means it winds up being ignored. Since every node can verify all information on the network independently,

FAQs

What is the Byzantine Generals’ Problem in blockchain?

The Byzantine Generals Problem is a challenge in computer science that portrays the difficulties of ensuring security in a distributed network.

To address the Byzantine Generals Problem, honest nodes must achieve consensus even with dishonest nodes in the mix. This implies that a majority of nodes must set a rule framework and agree on its enforcement within the network.

How does Bitcoin tackle the Byzantine Generals' Problem?

By solving the Byzantine Generals' Problem, Bitcoin allows a transaction to be consolidated into a block and appended to the blockchain only after network-wide agreement is achieved.

Did Satoshi achieve Byzantine Fault Tolerance?

Bitcoin, created by Satoshi Nakamoto, is the first time a decentralized currency has successfully solved the Byzantine Generals' Problem. Satoshi does this using the proof-of-work consensus method. In addition, Bitcoin is the first decentralized system to achieve BFT (Byzantine Fault Tolerance).

Why has Satoshi Nakamoto remained anonymous?

Remaining anonymous allowed Nakamoto to step back from the spotlight and encourage others to take ownership of the project’s development and direction. Nakamoto emphasized the importance of the technology itself, rather than his (or their) personal identity.

How did the financial crisis help create Bitcoin?

One of the responses to that crisis was Bitcoin. With its decentralized system and peer-to-peer technology, Bitcoin has the potential to dismantle a banking system in which a central authority is responsible for decisions that affect the economic fortunes of entire countries.

No longer do we need a central authority to validate transactions. Voila, the Byzantine Generals’ Problem is solved!

Kudos to Satoshi Nakamoto, the creator of Bitcoin, for figuring out a brilliant workaround to this dilemma. Those Byzantine generals would have loved to have Nakamoto fighting in their army. Just be glad he was fighting for you instead.

If you found this article about the Byzantine Generals' Problem helpful, check out our article about the Cantillon Effect.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Matt Ruby is a seasoned content writer helping educate million worldwide about Bitcoin for Swan. Matt work with tech companies to create words, videos, and other content that makes them seem human. He specializes in taking boring/drab tech topics and making them interesting, educational, funny, and accessible to regular people.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?