BITO vs. GBTC Compared: Which is Best in 2024?

BITO vs. GBTC in 2024… Which is best? Neither. Learn why!

Two major players have consistently captured the attention of institutional and other Bitcoin investors: BITO (ProShares Bitcoin Strategy ETF) and GBTC (Grayscale Bitcoin Trust).

This article delves into a comprehensive comparison of BITO and GBTC, aiming to provide clear insights for both seasoned and novice investors navigating the Bitcoin landscape.

We’ll explore their distinct characteristics, benefits, performance, fees and drawbacks, focusing on how spot Bitcoin ETFs fit into the broader context of Bitcoin investment strategies.

BITO (The ProShares Bitcoin Strategy ETF): An Overview

GBTC (Grayscale Bitcoin Trust): An Overview

The Decision: BITO vs GBTC? Neither! Buy Real Bitcoin Instead

TL; DR: BITO, the ProShares Bitcoin Strategy ETF, offers a taste of Bitcoin through futures contracts.

Meanwhile, GBTC, the Grayscale Bitcoin Trust, tempts investors with direct exposure to Bitcoin’s price movements. Despite ALL of GBTC’s competitors lowering their spot Bitcoin ETF fees just before 11 spot Bitcoin ETFs were approved by the SEC — GBTC notably did not.

They remain at 1.5% — the highest of any provider.

But here’s the twist — what if I told you that neither BITO nor GBTC is your best bet?

BITO (ProShares Bitcoin Strategy ETF): An Overview

Key aspects:

Structure: BITO operates as an ETF, trading on stock exchanges and offering intraday liquidity.

Investment Focus: It primarily invests in Bitcoin futures contracts, not directly in Bitcoin.

Fees: BITO charges a management fee, usually lower than GBTC’s fee structure.

Performance: As BITO tracks Bitcoin futures, its performance may not precisely mirror the spot price of Bitcoin. It’s influenced by the futures market dynamics.

Pros

ETF Structure: BITO, being an ETF, offers greater liquidity and is traded on major stock exchanges. This makes it easier to buy and sell during market hours.

Lower Fees: Generally, BITO has a lower fee structure than GBTC, which is more cost-effective for investors.

Regulated Framework: BITO operates within a regulated framework, providing a sense of security for investors wary of the unregulated nature of cryptocurrencies.

Futures-Based Exposure: Offers exposure to Bitcoin futures, which might be more appealing for investors looking to avoid the direct volatility of Bitcoin.

Cons

Indirect Exposure to Bitcoin: As it invests in futures contracts, BITO does not provide direct exposure to the actual price movements of Bitcoin.

Futures Market Risks: Futures contracts can introduce contango and backwardation risks, potentially affecting returns.

Active Management Risk: The Fund is actively managed and its performance reflects the investment decisions that ProShare Advisors makes for the Fund. ProShare Advisors’ judgments about the Fund’s investments may prove to be incorrect.

GBTC (Grayscale Bitcoin Trust): An Overview

GBTC offers investors a traditional investment vehicle to gain exposure to Bitcoin’s price movements without the challenges of buying, storing, and safekeeping Bitcoin directly.

GBTC holds actual Bitcoin as a trust and its shares trade over the counter.

Structure: GBTC is a trust, not an ETF. It trades over the counter (OTC) and doesn’t offer the same liquidity as ETFs like BITO.

Investment Focus: GBTC holds actual Bitcoin, offering more direct exposure to Bitcoin’s price.

Fees: The annual fee for GBTC tends to be higher, accounting for security, storage, and insurance of the held Bitcoins.

Performance: GBTC’s price can deviate significantly from the underlying Bitcoin price, often trading at a premium or discount.

Pros

Direct Exposure to Bitcoin: GBTC holds actual Bitcoin, directly exposing its price movements.

Simplicity: It’s a straightforward way for investors to gain exposure to Bitcoin without the complexities of managing Bitcoin wallets and keys.

Traditional Investment Vehicle: As a trust, it can be held in certain tax-advantaged accounts, like IRAs.

Cons

Higher Fees: GBTC typically has a higher fee structure due to the costs of securely holding physical Bitcoin. Grayscale has BY FAR the highest Bitcoin ETF fee (1.50%) of any Bitcoin ETF that was approved.

Premiums or Discounts: GBTC can trade at significant premiums or discounts to the underlying Bitcoin price, affecting investment value.

Less Liquidity: Being an OTC product, it lacks the same level of liquidity as a standard ETF.

ETF Conversion Risk: May be forced to “sell & rebuy” Bitcoin as part of the ETF conversion process and may involve capital gains taxes.

To stay on top of all the daily inflow and outflow changes, check out our new Daily Bitcoin ETF Show, hosted by Dante Cook.

Key Comparisons: Fees and Performance

Performance Metrics: BITO performance is tied to the futures market, which can differ from the spot price of Bitcoin. GBTC’s performance is more directly correlated with Bitcoin’s worth but also subject to premiums or discounts based on market demand for the shares.

Fees Impact: BITO has a lower fee structure that is attractive for cost-conscious investors. GBTC’s higher fees cater to the trust’s direct exposure to Bitcoin and additional security measures.

Current Spot Bitcoin ETF Fees as of February 26th, 2024

Grayscale: The Grayscale Bitcoin Trust (GBTC) fee is 1.5% — the fund holds 502,713 BTC with Coinbase.

BlackRock: iShares Bitcoin Trust (IBIT) fee is 0.25% fees for the first 6 months (or $5 billion) — the fund holds 52,026 BTC with Coinbase.

Fidelity: Wise Origin Bitcoin Trust (FBTC) fee is 0.25% (with 0% fees until July 31, 2024) — holds 46,238 BTC in self-custody.

Ark/21 Shares: Ark/21 Shares Bitcoin Trust (ARKB) fee is 0.21% (0% fees for first 6 months or $1 Billion) — holds 14,390 BTC with Coinbase.

Bitwise: Bitwise Bitcoin ETF (BITB) fee is 0.20% (0% fees for first 6 months or $1 billion) — holds 13,576 BTC with Coinbase.

Invesco: Invesco Galaxy Bitcoin ETF (BTCO) fee is 0.25% (0% fees for first 6 months or $5 billion) — holds 6,864 BTC wth Coinbase.

VanEck: The VanEck Bitcoin Trust (HODL) fee is 0.20% of the fund — holds 2,885 BTC with Gemini.

Valkyrie: Valkyrie Bitcoin Fund (BRRR) fee is 0.49% (0% fees for first 3 months) — holds 2,635 BTC with Coinbase.

Franklin Templeton: Franklin Bitcoin ETF (EZBC) fee is 0.19% — holds 1,363 BTC with Coinbase.

WisdomTree: WisdomTree Bitcoin Trust (BTCW) fee is 0.30% (0% fees for first 6 months or $1 Billion) — holds 201 BTC with Coinbase.

Want to known more about spot Bitcoin ETF fees? Check out our complete overview.

The Sharpe Ratio is a measure used to assess the performance of an investment relative to its risk, with a higher Sharpe Ratio indicating a more favorable risk-adjusted return.

GBTC currently boasts a Sharpe Ratio of 4.46, significantly outperforming the BITO, which has a Sharpe Ratio of 1.70.

This comparison highlights the differing risk-adjusted returns between these two investment vehicles over a 12-month rolling period.

Each investment vehicle offers unique attributes, and understanding their respective trade-offs is crucial for investors.

BITO vs GBTC | Performance and Concerns

BITO is intricately linked to its futures contracts, which can lead to what is known as 'roll decay.'

WTH is roll decay?

Roll decay is a phenomenon typically associated with futures-based ETFs like BITO.

BITO doesn’t invest directly in Bitcoin — it holds futures contracts.

Futures contracts are agreements to buy or sell the asset at a predetermined future date and price.

They have expiration dates, and to maintain exposure to Bitcoin.

BITO must periodically 'roll' its futures contracts to later-dated ones.

The issue of roll decay arises particularly in a market situation known as 'contango.'

GBTC provides a more direct way to gain exposure to Bitcoin — it holds real Bitcoin. However, its structure as a trust, not an ETF, has led to significant variances in its trading price compared to the actual value of the Bitcoin it holds.

GBTC initially traded at a premium, but has more recently seen a shift to trading at a discount, raising concerns about its effectiveness as an investment vehicle for Bitcoin exposure.

Widening GBTC Discount | BITO’s Growing Appeal

The discount on GBTC has been a point of contention and a significant factor in its performance evaluation. This discount essentially means that the shares of GBTC are trading at a lower price than the Bitcoin value they represent.

Over time, this discount has not only persisted but widened, raising questions about its attractiveness to investors who might prefer a more accurately priced exposure to Bitcoin.

In contrast, BITO has been gaining appeal, particularly among those seeking an investment product that aligns more closely with traditional ETF structures.

Despite the concerns regarding roll decay, BITO offers a unique type of exposure to Bitcoin that might be more familiar and appealing to traditional investors.

Why?

Its structure as a futures-based ETF means it avoids some of the regulatory and structural challenges GBTC faces.

BITO vs. GBTC | Drawdown Comparison

Drawdown refers to the peak-to-trough decline during a specific record period of an investment, indicating the potential risk or loss from an investment.

Here’s a breakdown of factors influencing the drawdowns of BITO vs. GBTC.

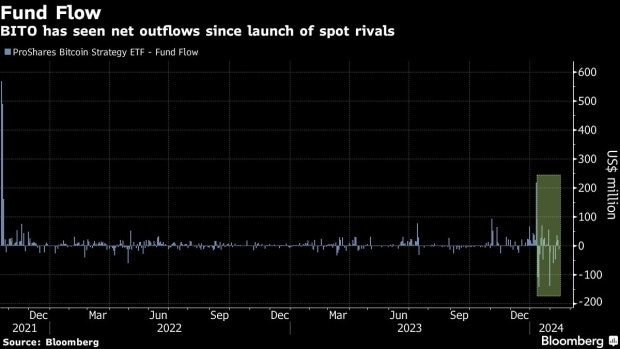

Since the introduction of spot rivals, BITO has experienced a net outflow of $254 million, according to data gathered by Bloomberg. Until December, BITO had accounted for 92% of the trading volume among U.S. Bitcoin-linked ETFs.

BITO Roll Decay

As we mentioned above, roll decay is a critical concern for BITO investors. This phenomenon is intrinsic to futures-based ETFs like BITO, which do not hold the underlying asset directly but instead invest in futures contracts for the asset.

These contracts have set expiration dates, necessitating a process known as 'rolling over,' where expiring contracts are replaced with new ones.

The challenge arises in a market condition called 'contango,' where future contracts are priced higher than the current spot price of the asset.

In such scenarios, BITO may sell futures contracts at a lower price and purchase new contracts at a higher price, leading to a loss in the fund’s value due to roll decay.

BITO Performance | Dividend Prospects

While BITO aims to track the price of Bitcoin, the roll decay can lead to discrepancies between the ETF’s performance and the actual price movements of Bitcoin. This aspect is a crucial consideration for investors looking for a direct correlation with Bitcoin’s price.

Regarding dividends, BITO presents an interesting case. Typically, ETFs tied to commodities or futures contracts do not distribute dividends in the conventional sense, as they don’t hold dividend-paying assets.

However, BITO might generate income through its futures positions or other investment strategies. Any potential 'dividend' from BITO would be unique to its operational structure and market conditions and might not align with traditional dividend expectations.

BITO vs. GBTC | Volatility Comparison

Unlike GBTC, BITO’s volatility is influenced by factors inherent in the futures market.

Unpredictability of GBTC Discount to Bitcoin

GBTC is structured as a trust that holds Bitcoin, allowing investors to gain exposure to Bitcoin’s price movements without directly owning the Bitcoin — a risk factor with many unintended consequences.

However, unlike traditional ETFs, GBTC shares often do not trade in perfect alignment with the net asset value (NAV) of the Bitcoin they hold.

This discrepancy has led to GBTC trading at either a premium or a discount to its NAV.

GBTC has predominantly traded at a discount. This means its market price is lower than the value of the Bitcoin per share it represents.

This discount has been notably unpredictable, fluctuating based on various factors such as market sentiment, investor demand, and regulatory developments.

Top 4 Implications of GBTC’s Unpredictable Discount

Investment Risk: Investors in GBTC are exposed to the risk of not only Bitcoin’s price fluctuations but also the variability of the discount. Even if Bitcoin’s price rises, the discount can widen, potentially leading to underperformance relative to direct Bitcoin investments.

Valuation Challenges: The fluctuating discount complicates the valuation of GBTC as an investment. Determining the right entry and exit points becomes more challenging when the discount level is volatile and seemingly detached from Bitcoin’s market performance.

Market Sentiment Indicator: The discount level can also be a barometer for broader market sentiment towards Bitcoin. A widening discount might reflect decreasing confidence or increasing regulatory or market concerns. In contrast, a narrowing discount could signal growing investor optimism.

Strategic Considerations: The fluctuating discount might present strategic opportunities for some investors. A deep discount could be viewed as a buying opportunity, assuming it will eventually narrow. Conversely, a small discount or a premium might signal a good time to sell.

BITO Structure | Impact on Performance

BITO is structured differently from a direct Bitcoin investment or a spot Bitcoin ETF.

Instead of holding Bitcoin, BITO invests in futures contracts traded on the Chicago Mercantile Exchange (CME).

This futures-based approach allows BITO to provide exposure to Bitcoin’s price movements without the challenges of holding the actual cryptocurrency, such as storage and security concerns.

However, this structure has important implications for BITO’s performance.

The primary concern is the impact of 'roll decay, ' an inherent aspect of futures-based ETFs. Roll decay occurs when the fund rolls over expiring futures contracts to later-dated ones, often at a higher price in a market condition.

This can lead to the ETF’s performance slightly lagging behind the actual spot price of Bitcoin, especially in prolonged contango market conditions.

Moreover, the futures market can sometimes behave differently from the spot market, leading to potential disparities in performance. These factors include:

Futures market liquidity

Varying costs of rollover

Occasional divergence between futures and spot prices

… can influence BITO’s tracking efficiency.

Making the Decision: What to Consider!

Investment Goals: Consider whether you want direct exposure to Bitcoin’s price (GBTC) or prefer the derivatives market (BITO).

Risk Tolerance: GBTC’s direct exposure to Bitcoin’s price can be more volatile. BITO’s exposure to futures may involve different types of market risks.

Cost Sensitivity: BITO’s lower fees might be more appealing if fees are a significant consideration.

Liquidity Needs: BITO’s ETF structure provides easier entry and exit points if you prioritize liquidity.

Account Type: If you’re investing through a particular account type (like a Swan Bitcoin IRA account), check which product is compatible.

BITO and GBTC cater to different investor needs and risk appetites.

BITO is preferable for those seeking an ETF structure with lower fees and indirect exposure to Bitcoin via futures.

GBTC suits investors seeking direct exposure to Bitcoin’s price movements despite potentially higher fees and the risk of trading at premiums or discounts.

With all the complexities and downsides, is there a great alternative to BITO and GBTC?

YES!

Don’t settle for mere exposure through a financial product like BITO or GBTC!

Whether you invest through Swan’s IRA product, or just DCA — Swan ensures you are in control of your Bitcoin journey and own actual Bitcoin.

If you are looking for a tax-free way to invest in Bitcoin, learn how Peter Thiel has +$5 billion in his Roth IRA and then catch out the best Bitcoin and crypto IRA options for 2024.

No recurring fee for Swan’s personal, business, or trust

Competitive pricing of 0.99%

Self-custody or multi-sig Swan Vault has a low recurring fee

Secure your financial future with real Bitcoin from Swan Bitcoin!

For more information, contact Terrence Yang, Swan Managing Director, at terrence@swan.com or 312.448.8012 (text or call) for details.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?