Bitcoin’s Energy Usage Isn’t a Problem. Here’s Why.

Whether Bitcoin continues to be successful or fails, there’s no risk of the network using too much energy in the grand scheme of things.

Bitcoin’s energy usage has been in the news for years.

It’s often criticized for using too much energy, not making efficient use of its energy, or in extreme cases, being an outright climate/energy disaster.

For example, back in December 2017, Newsweek ran a piece called,

“Bitcoin Mining on Track to Consume All of the World’s Energy By 2020”

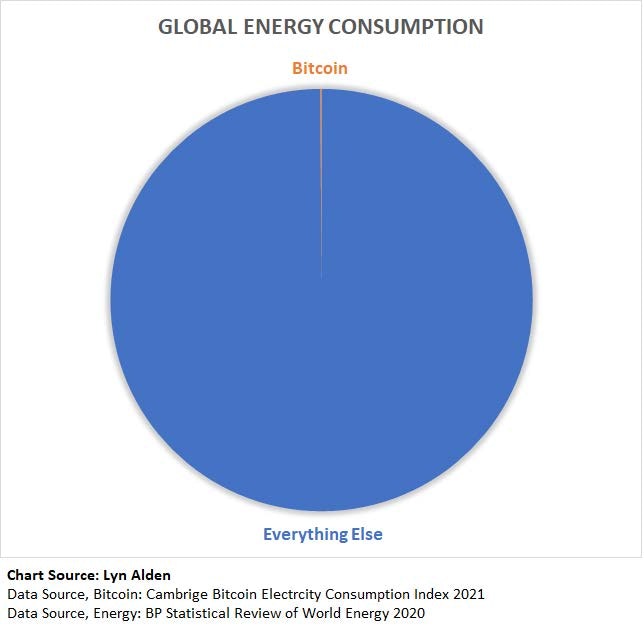

Well, here in 2021, I can obviously say that didn’t happen. The University of Cambridge is the most-cited source for estimating Bitcoin’s energy consumption, and they placed its estimated peak annualized rate at under 140 TWh so far.

Since the world uses over 170,000 TWh of energy per year, the entire Bitcoin network, at its peak estimated consumption level, uses less than 0.1% of the world’s energy consumption. That’s for a network with 100+ million estimated users.

Source: Lyn Alden

Bitcoin’s energy usage is a rounding error as far as global energy usage is concerned. And I mean that literally when scientists estimate that the world uses a certain amount of energy in a given year, they can easily be off by a couple percentage points in either direction, let alone a couple tenths of a percent. Bitcoin is estimated to use less than one-tenth of one percent.

Plus, a large percentage of the energy that Bitcoin uses is from otherwise-wasted energy sources.

In the very long run, if Bitcoin is wildly successful and becomes a systemically important asset and payment system used by over a billion people at 10 — 20x its current market capitalization, it should max out at just several tenths of one percent of global energy usage.

On the other hand, if it is unsuccessful and doesn’t grow much from current levels, its energy usage will stagnate and shrink as the block subsidies continue to diminish. I’ll dive into those numbers later in this piece.

The point is that the Bitcoin network is and forever will be a rounding error as far as global energy consumption is concerned, whether it’s successful or not. Its energy usage won’t exceed its long-run utility (however high or low that utility ends up being).

In fact, as someone with a background in electrical engineering, I was drawn to Bitcoin in the first place by seeing how efficiently its network uses energy. I could have picked any blockchain to invest in or could have avoided the digital asset space altogether, or could switch my investment to another blockchain at any time. And yet, when I crunch the numbers, I think Bitcoin makes particularly elegant usage of energy and is getting more energy efficient over time because it was designed properly.

If that’s the case and Bitcoin’s energy usage is practically irrelevant on the global scale, how can journalists make such large, sensationalized errors? The answer is that it often comes down to them not understanding the scaling process that the network is going through.

And it’s easier to sensationalize things for pageviews or political gain. For example, it’s commonly said that the Bitcoin network uses more energy than some countries. That’s true, but so does Google, Youtube, Netflix, Facebook, Amazon, the cruise industry, Christmas lights, household drying machines, private jets, the zinc industry, and basically any other sizable platform or industry. From that list, Bitcoin’s energy usage is the closest to that of the cruise industry energy usage, but Bitcoins are used by more people, and the network scales far better.

It’s important to understand whether or not Bitcoin is an environmental problem and whether or not it is energy efficient because these obviously affect its probability of being a good investment and a good payment network.

If Bitcoin did indeed have serious energy scaling problems, it would eventually fail against competitors in the private marketplace by not offering enough utility for its energy consumption.

From an engineering perspective, Bitcoin’s energy usage isn’t a problem when you actually run the numbers. Still, it takes an understanding of how it works to calculate it properly and what the trade-offs are if you use a different approach than what Bitcoin uses.

Let’s take a look at how that works.

Article Chapters:

Understanding Bitcoin’s Purpose

Why Bitcoin Uses Electricity

Bitcoin’s Efficient Scaling Pattern

How Bitcoin Uses Otherwise-Wasted Energy

Bitcoin’s Proof-of-Work vs Alternative Methods

Final Thoughts and Summary

Before we dive into its energy usage, it helps to summarize what bitcoins are used for, and what problems the network was designed to optimize for. From there, we can then look at the energy usage and decide whether or not it’s achieving its goal.

Bitcoin is not trying to be the cheapest payment network, although in many contexts it ironically can be, when you consider the Lightning network (one of Bitcoin’s second-layer scaling systems).

Instead, Bitcoin is trying to be a decentralized bearer asset and payment network, and for 13 years, has been succeeding.

In terms of the asset, bitcoins are something that users can self-custody with encryption if they want to, and that has a fixed supply. This makes bitcoins inflation-resistant and difficult to confiscate. In terms of the payment network, Bitcoin can be used to send payments that don’t rely on the permission or verification from any centralized entity. This makes the network censorship-resistant and interoperable with many different payment systems internationally.

Almost anything that claims to be more efficient than the Bitcoin network at making payments or storing assets for you is also more centralized. Centralized things inherently tend to be efficient. Sending payments between parties and tracking peoples’ balances can be as simple as updating an internal database, which is nearly free.

The problem, of course, is that centralized things don’t tend to be resilient, so there is a trade-off between efficiency and resiliency. When you put all your eggs in one basket, give that basket to your friend, and she drops the basket or refuses to give it back, you’re out of luck. Relying on a centralized entity cedes control to others, which rests on the premise that those others are moral and competent. Plus, as far as payment networks go, they’re tied to fiat currency, which is useful as a medium of exchange but, over the long run, doesn’t hold its value.

Bitcoin is a publicly distributed ledger with a series of private and public keys. As long as they have access to the internet (including satellite internet if need be), users can send bitcoins (including fractional bitcoins) to others by using their private keys. They can hold their private keys offline and receive Bitcoin when offline; they just need an internet connection to send them, confirm their balance, and those sorts of actions.

This ranks Bitcoins among the most portable and hard-to-confiscate assets in the world. They can be sent internationally between different parties, can be memorized and brought anywhere in the world, and can be stored offline with no counterparty. Considering that they also have a supply cap, it’s not surprising that folks in many emerging markets have turned to them rather than relying entirely on a local unsound currency that may be inflating at 10%, 20%, 50%, or 100%+ per year in some cases.

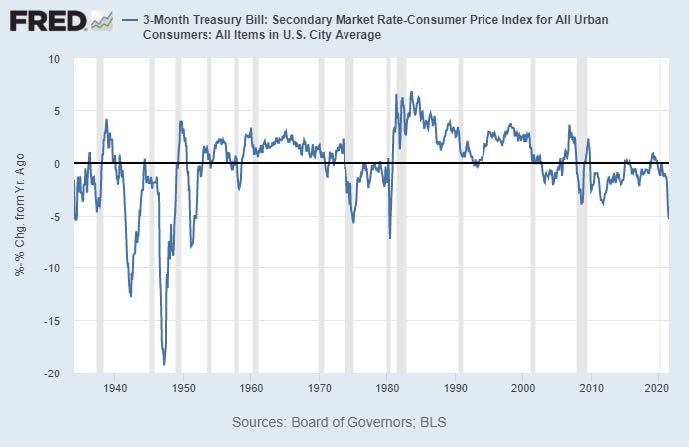

Even in developed markets, which have lower rates of inflation, the population has to deal with negative inflation-adjusted interest rates. For example, the following chart shows the interest rate of US Treasury bills minus the prevailing official inflation rate. When it’s below zero, it means that T‑bills (and usually bank accounts as well) are not paying enough interest to keep up with the official rate of inflation:

Source: St. Louis Fed

While some countries can partially ban Bitcoin by disallowing banks to send money to crypto exchanges or by banning large-scale Bitcoin mining, it’s nearly impossible to stop peer-to-peer trading, especially in countries with reasonable property rights and freedom of expression. Banning individual interaction with Bitcoin is akin to banning information or speech since it’s just an open-source public ledger. People can memorize numbers to access it and use satellite connections to bypass local internet service providers if necessary. It would require a very authoritarian approach with draconian enforcement to truly stamp it out of use.

On the other hand, some countries have embraced it, such as El Salvador, which made it legal tender. This is in significant part because El Salvador is highly reliant on remittance payments. It’s nearly free to send remittance payments via the Lightning network that runs on top of the Bitcoin network since it is open source and keeps getting more developed over time. Several other countries that have previously banned or were about to ban it have stepped back their bans.

My article on bearer assets included a large section on the practical use cases of Bitcoins, both in developed and developing countries. Aside from being an asset with a fixed supply cap, here are some example use cases of the censorship-resistant payment and portability aspect:

Reuters reported in February 2021 how Russian opposition leader and anti-corruption lawyer uses Bitcoin as a censorship-resistant payment, as Putin’s authorities block all of the traditional permissioned payment rails:

Russian authorities periodically block the bank accounts of Navalny’s Anti-Corruption Foundation, a separate organisation he founded that conducts investigations into official corruption.

“They are always trying to close down our bank accounts — but we always find some kind of workaround, ” said Volkov.

“We use Bitcoin because it’s a good legal means of payment. The fact that we have Bitcoin payments as an alternative helps to defend us from the Russian authorities. They see if they close down other more traditional channels, we will still have Bitcoin. It’s like insurance.”

2. The Guardian reported in July 2021 how Nigerian merchants and protest groups used Bitcoin’s censorship-resistant payment attributes to go around FX currency blocks to carry out their business and receive funds even when their bank accounts were suspended.

“The clampdown was financial too. Civil society organisations, protest groups, and individuals in favour of the demonstrations who were raising funds to free protesters or supply demonstrators with first aid and food had their bank accounts suddenly suspended.

Feminist Coalition, a collective of 13 young women founded during the demonstrations, came to national attention as they raised funds for protest groups and supported demonstration efforts. When the women’s accounts were also suspended, the group began taking bitcoin donations, eventually raising $150,000 for its fighting fund through cryptocurrency.”

3. Alex Gladstein, with the Human Rights Foundation, discusses the human rights angle of the Bitcoin network in April 2021:

“So for Venezuelans to go through this has been nothing short of totally heartbreaking. However, there are a lot of folks who got involved early, like earlier, a lot of young people, a lot of young folks figured it out in 2015, ’16, they were mining at the time. One of these guys I interviewed, he actually helped start Ledn, which is one of the larger industry services now based out of Canada.

But he and his brothers were mining bitcoin for a couple of years there and they ended up having to escape. The government came with like an armed squad and seized all their mining equipment. Thankfully no one got hurt. The government was very perplexed. They saw the mining equipment and they thought that they meant they got the bitcoin. But that’s not how it works. So they were able to use the bitcoin to start a new life in Canada. I thought that was really amazing.

I interviewed another guy who escaped to Argentina. He got involved in some sort of dispute with the government where they claimed he was a criminal, even though he wasn’t, but now he’s able to send money back to his mother who is in Venezuela in bitcoin. She uses it to support herself. There’s just so many stories like this.

And I think for me, one of the most powerful things as someone whose family went through the Holocaust, was this idea of like, you could flee your country and back then you only brought what was on your back, like the clothing on your back. But today you can bring your wealth with you, which is truly remarkable.

And I’ve given advice to people who are, for example, leaving Iran these days, help them out on this. People are selling their homes and they’re converting to bitcoin and they’re getting on a plane, getting the heck out, and they’re bringing it with them in this digital format. People are sending money in and out of Syria to people who are stuck there.

People have escaped countries like Sudan. I interviewed a guy from Sudan, which has a horrible inflation problem that their inflation is in the hundreds. They have an inflation rate of something like 150 or 200%. And he’s living in Europe and he’s sending the hardest money around back to his family in Khartoum. And they’re able to get by through that. We’re early here. Again, I think the estimate based on Coinbase numbers is that maybe 10% of Americans have interacted with Bitcoin or cryptocurrency.

The global number is lower than that, especially in these emerging markets. If the global is two percent and America’s 10%, it’s probably way less than that in a lot of these emerging markets, but hey, in some of them, look at Turkey, man, look at Argentina, look at Nigeria. These are huge countries, 200 million, 100 million, 45 million people. They’ve got the highest per capita usage in those countries. So it’s a changing world.”

Perhaps more broadly and concisely, one of Alex’s best quotes about the topic is this:

“We’re at the outset of great digital financial transformation, where the money we use on a daily basis is evolving from a bearer asset — one that doesn’t reveal anything about us — into a mechanism of surveillance and control.

This is more urgent for some people in this world, and maybe less urgent for others, depending on the political regime they live under. When I’m looking at this new form of money that’s not controlled by governments or corporations, I’m thinking about the big picture of today’s world, where we have 4.2 billion people living under authoritarianism and 1.2 billion people living under double- or triple-digit inflation. When we talk about the fact that money is broken, this isn’t theoretical, and it isn’t just about one country.

It’s much bigger than that. This is a world where hundreds of millions of people deal with 15 percent, 20 percent, 25 percent inflation, where their time and energy, and the currency that they earn their wages in, is literally disappearing.

At the same time, you have billions of people whose bank accounts can potentially be frozen based on their opinions or ideas.”

4. The Rise Third Layer Applications

The recent creation of several new third layer applications, such as Sphinx Chat and Impervious Technologies, that use Bitcoin’s Lightning network as a way to transmit data, in addition to just transmitting value. Sphinx Chat is a peer-to-peer messaging platform that runs on Lightning and allows users to attach micropayments with their messages, while Impervious Technologies is releasing a VPN powered by Lightning.

“As an example of what can be developed utilizing the Impervious API, Impervious is releasing a dynamic VPN that leverages the Lightning Network to provide on-demand, high-bandwidth VPN services. The Impervious API can operate from behind hostile networks and denied access areas using the Lightning Network as a credential exchange and transport layer to establish peer-to-peer, secured channels for censorship resistant data transmissions.

Applications being built on the Impervious.ai API include peer-to-peer streaming video, podcasts, live events, news reporting, distributed storage, and VOIP-based communications.”

To summarize, as digital property with a set of censorship-resistant payment rails, Bitcoin is the application of software towards finance. And not just towards the surface layer like fintech, but towards the root layer of bearer assets and settlement networks, which is part of why it’s so controversial.

In addition, BTC/LN is emerging as a decentralized protocol for various layer-three applications focused on transmitting data in a secure and censorship-resistant way as well, similar to how it stores and transmits value.

The firm Chainalysis, which is used by law enforcement to track public blockchains, has found across multiple years that only 0.50% to 2% of crypto transactions are for illegal activity, such as scams, ransomware, or drug purchases (which happens to be lower than most estimates of the percentage of fiat currency transactions that are for illegal purposes). The vast majority of the usage is estimated to be for investment purposes or legitimate payments.

As described above, there are many authoritarian regimes where protesting and certain types of speech are considered illegal and where basic economic interactions can be blocked, and so we could say that bitcoin facilitates those types of “moral yet illegal” behaviors.

Oppressed people having access to open source software to aid in basic human freedoms and economic interactions, making it more complex for authoritarians to deal with them, is not what I would consider unethical, and indeed quite the contrary.

The Bitcoin network is programmed to create a new block on average every ten minutes and add that block to the blockchain, which consists of hundreds of thousands of blocks since inception in 2009.

A new block is produced by a Bitcoin miner (a specialized computer) solving a cryptographic puzzle that the previous block created, and the miner can package thousands of Bitcoin transactions currently in the queue into that block. That’s how transactions get settled. The network is programmed to target average block times of ten minutes, meaning, on average, every ten minutes, a block of thousands of transactions is added to the blockchain.

If miners drop off the network and new blocks, on average, start taking longer than ten minutes to produce, the network is automatically programmed to make the puzzle easier by a quantified amount so that blocks go back to an every-ten-minute average schedule.

Likewise, if a lot of miners join the network and blocks get added to the blockchain faster than every ten minutes on average, the network will make the puzzle harder. This is known as the “difficulty adjustment” and is one of the key programming challenges that Satoshi Nakamoto solved to make the network work properly.

So, at any given time, millions of Bitcoin mining machines worldwide are looking to solve the puzzle and create the next block. There’s a natural feedback mechanism to ensure that blocks are created on average every ten minutes, regardless of how many miners are on the network.

We recently saw in the first half of 2021 that China banned crypto mining, and approximately half the network went offline and started moving elsewhere. Bitcoin’s payment network briefly slowed down a bit but otherwise kept working with 100% uptime. The difficulty adjustment then kicked in and brought the network back up to its target speed.

Imagine if Amazon was told with one week’s notice that it had to move half of its server capacity internationally; it would likely experience uptime issues for its services for the rest of the year as it moved and rebuilt half of the system.

If a miner creates an invalid block, meaning one that doesn’t conform to the consensus rules of the node network, the network discards it. If two miners produce a valid block at around the same time, the winner will be decided by which one gets found by the rest of the network first and has another block produced and added onto it, becoming the longer (and thus official) blockchain.

This process is known as “Proof-of-Work.”

Millions of machines are using electricity to apply processing power to solve cryptographic puzzles left by the most recent block. This may seem like a waste of energy, but it keeps the system decentralized. Work is the arbiter of truth in this case. There is no central authority that decides what constitutes a valid block or a valid set of transactions; the longest blockchain is verifiable at any given time and is recognized as truth by the rest of the network based on code. The longest blockchain is the one with the most work put into it, and that also meets the consensus criteria that the node network checks.

The more energy Bitcoin’s network uses, the more secure it is against most attacks. Many of the tiny non-Bitcoin blockchains have been victims of 51% attacks, where a single entity temporarily or permanently gains control of over 51% of the processing power on the network and uses that majority of processing power to re-organize blocks and performs double-spend transactions (which is essentially theft).

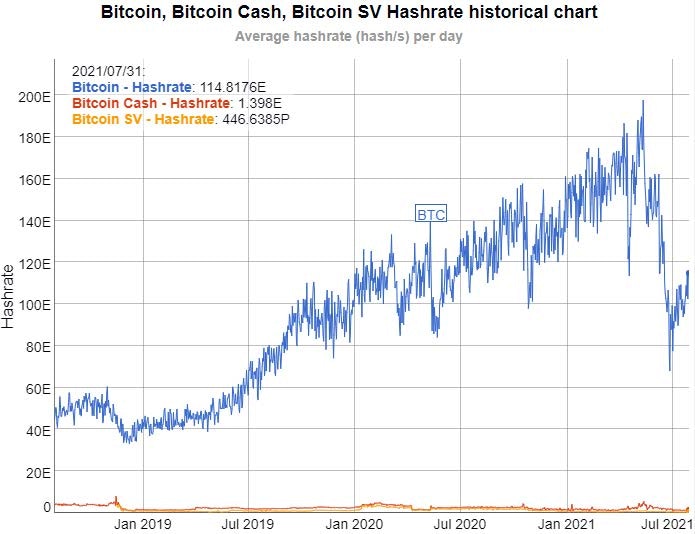

This chart, for example, shows Bitcoin’s network processing power compared to the processing power of some of its hard fork copycats:

Source: BitInfoCharts

Both of those other blockchains only have 1 — 2% or less of the Bitcoin network’s total processing power and have been hit by malicious block re-orgs. In fact, if just 2% of Bitcoin miners decide to do a 51% attack on either of those two hard forks, they can. The same is not true for the other direction since the Bitcoin network has a far larger network of miners and energy usage than them, by two orders of magnitude.

That shows the importance of network effects in the blockchain industry and why Bitcoin’s energy usage has kept it uniquely secure.

When someone asks, “Can’t you just copy Bitcoin?”

“That’s why the answer is ‘no.’

You can replicate the open source code, but you can’t replicate the fact that millions of ASIC miners are securing the Bitcoin network and not your copycat network, and you can’t replicate the fact that thousands of developers are working on making the Bitcoin network better every day rather than working on your copycat network. And Lightning’s number of open channels and liquidity can’t be easily replicated either; it took years to build.

Trying to copy Bitcoin would be like if I copied the content from Wikipedia and hosted it on my website. Technically it could be done, but it wouldn’t do much. It wouldn’t gain the real Wikipedia’s traffic because it wouldn’t have the hundreds of millions of links pointing to it from other websites. And it wouldn’t be updated like the real Wikipedia because there’s no way I could convince the majority of those volunteer editors to come to work on my version instead.

Unless I could somehow succeed in the Herculean task of convincing the majority of the network to move over to my version, it would always just be a shadow of the real one with a tiny fraction of the value.

The same is true if I made a poor mimic of Twitter or something. I could make it look like Twitter, but it wouldn’t really be Twitter, full of users and developers.

When Bitcoin was created, it was designed so that every ten minutes, when a miner produces a new block of transactions, the miner that produced it earns 50 Bitcoins. After four years, it was pre-programmed to drop to 25 new Bitcoins per block. Four years later, it was 12.5 Bitcoins per block. Four years after that, it’s down to 6.25 Bitcoins per block in the current era.

This pattern will continue every four years until new bitcoin generation asymptotically approaches zero, and the hard cap of 21 million bitcoins is reached sometime after the year 2100. Miners will earn a vanishingly small number of fractional Bitcoins for producing new blocks within a few decades. Out of the 21 million, 18.7 million Bitcoins have already been created.

However, miners also earn transaction fees. Senders pay transaction fees, denominated in fractional bitcoin, to ensure their transaction gets into the blockchain in a timely manner.

In the early days, blocks were often not full, so transaction fees were minimal. However, as Bitcoin became more widespread, blocks reliably became full, and transaction fees became a small but more meaningful part of miner fees.

So Bitcoin was highly inflationary in the beginning, but it has an increasingly disinflationary monetary policy until it approaches outright zero inflation, and its security budget scales similarly.

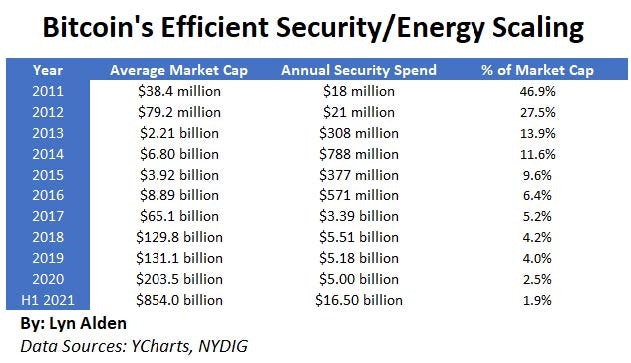

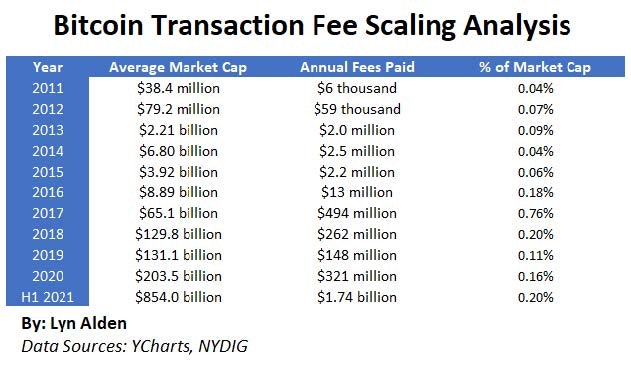

Here is a table of the Bitcoin network’s average market capitalization, annual security spending (total miner revenue, including block subsidies and transaction fees), and the percentage of the market capitalization spent on security each year:

Source: Lyn Alden

Each year so far, the Bitcoin network usually spent more on security than the previous year but always spent a smaller percentage of its market capitalization on security than the previous year. This isn’t a decision by any centralized party; it’s a combination of the algorithm, the value of the network, and individual miner decisions whether to mine or not.

That’s what journalists and other people who don’t understand the algorithm often miss: the declining block subsidy. This results in Bitcoin’s inflation rate going down, along with miner revenue as a percentage of Bitcoin’s total market capitalization.

Any serious analyst that understands Bitcoin’s algorithm would actually be more concerned about the possibility of Bitcoin one day not using enough energy for its security sometime in the future when it relies mostly on transaction fees rather than using too much energy.

Since the security spending represents miners' revenue, and miners spend most of their costs on electricity, that security spending represents the high-end for how much energy the Bitcoin network is using in dollar terms. In reality, it is less than that, due to miners usually making a profit.

Looking at my own Bitcoin miners for example (I have some hosted via Compass Mining), my electricity costs are currently about 20% of my miner revenue. That will vary over time.

Next, we can look at just the portion of the miner revenue that comes from transaction fees, which is a subset of the previous chart:

Source: Lyn Alden

We can see that transaction fees are a tiny portion of Bitcoin’s market capitalization each year. The highest year in percent terms was 2017, during the bubble peak. Efficiency improvements have been made since 2017, so even in the heart of the early 2021 bull run, the network didn’t reach those levels again.

The Bitcoin network is now down to less than 2% of its market cap being spent on miner revenue each year, including a fraction of one percent on fees. In 2024 there will be another block subsidy halving, which will probably bring miner revenue down closer to 1% of market capitalization.

In 2028 there will be yet another block subsidy halving, and another around in 2032. After that point, the block subsidy will be so tiny that a large portion of miner revenue will be made up of transaction fees, and miner revenue will likely be less than 1% of market capitalization, approaching a steady state of maybe 0.25% to 0.50% on average, depending on fee levels.

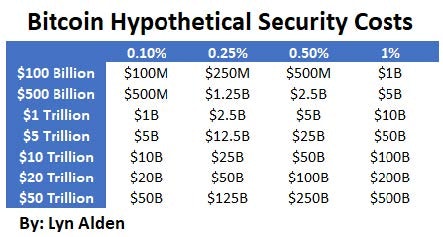

Since we can’t know for sure what the steady state will be due to variable market-driven transaction fees, here’s a table of potential long-term Bitcoin market capitalizations (vertical axis) and annual security spending (horizontal axis) in the future:

Source: Lyn Alden

If Bitcoin fails to grow for one reason or another and becomes a failed project or permanently remains around its current market capitalization of less than $1 trillion, its miner revenue will significantly decrease from current levels as block subsidies diminish. By the 2030s, Bitcoin miner revenue will probably be around 0.50% of market capitalization or less. So the network will be stuck at 2018 — 2020 energy spending levels or less.

If Bitcoin becomes systematically important, let’s say $5-$10 trillion (representing a per-coin price of $250k to $500k) with hundreds of millions of users, then at a 0.50% annual security cost, that would be $25-$50 billion. That would be 2x or 3x as much energy usage as Bitcoin was using at an annualized rate in the first half of 2021. This would represent approximately 0.3% of global energy usage.

If we say it reaches an outrageously high price of one million dollars per coin, for a critically important market capitalization of $20 trillion, with billions of users, then at 0.50% annual security cost, that would be $100 billion, or about 6x as much energy usage as bitcoin was using at an annualized rate in the first half of 2021. This would represent maybe 0.6% of global energy usage, which seems appropriate for a network used by billions of people for multiple purposes, as it would need to be at that point to reach such a high value.

By that point, it would be big enough that it’s likely replacing energy used by parts of the global banking system. There are tens of millions of people working in banks and fintech companies worldwide. The application of software to money at the root layer, just like other industries, brings efficiencies and reduces the need for employment and real estate in certain parts of legacy infrastructure, freeing up those human resources and corresponding energy usage for other productive purposes.

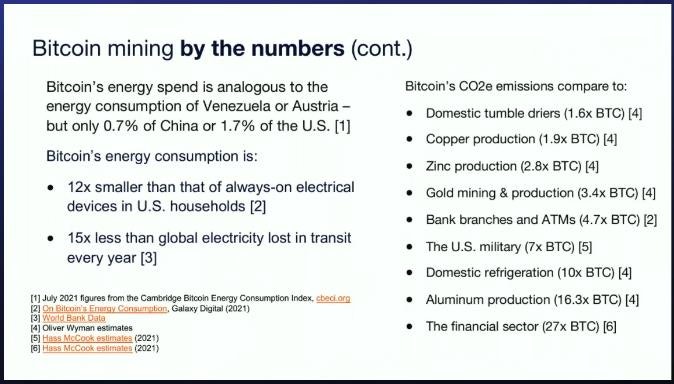

At the current time, the Bitcoin network is estimated to emit less CO2 than random things we don’t think about, like tumble driers or zinc production:

Source: Nic Carter, Demystifying Bitcoin

If Bitcoin becomes wildly successful with trillions of dollars of utility for users, we could potentially see it emit an amount of CO2 that is comparable to or higher than zinc production and likely still below that of aluminum production. In other words, despite reaching a massive scale and serving numerous purposes, it would still be comparable to various other random industries.

The Bitcoin network can do a maximum of a few hundred thousand base layer transactions daily. That’s about five transactions per second. This number has increased slightly over time due to occasional upgrades that improve transaction density.

This transaction limit is often unfavorably compared to a network like Visa, which can process tens of thousands of transactions per second.

Due to that, critics often point out that Bitcoin’s energy usage per transaction is very high, and thus the network is inefficient and should be avoided for ESG reasons. There are two problems with that reasoning, however.

The first problem with that reasoning is that Bitcoin uses energy whether or not transactions are occurring. The way to think about it is that a large portion of that energy is used simply for securing the network as a store of value. One block might have 1,200 transactions. The next block might have 2,500 transactions. The block after that might have 1,800 transactions. Meanwhile, the same number of miners are hooked up to the network between those subsequent blocks, verifying the blocks and paying for electricity. Whether blocks are full or not, they use roughly the same amount of energy.

Whether you make a transaction or not does not materially change how much energy the Bitcoin network is using at that time. Bitcoin’s energy usage comes from miners earning the block subsidy and average transaction fees and is denominated in bitcoin and thus based on the value per bitcoin, which mainly comes from people holding bitcoin as a store of value, not spending it. Transaction volumes only affect the transaction fee portion, and only the longer-run transaction fee average matters.

Think of it like running your dishwasher each night. Whether it’s 50% or 90% full when you run it, it still uses about the same amount of resources per run. The marginal extra dish or utensil doesn’t materially affect the dishwasher’s energy usage.

Another analogy would be keeping your computer on all day and either sending 20 emails or 100 emails. The marginal amount of energy “per email” that you send isn’t relevant because regardless of how many emails you send that particular day, your computer is on and using its baseline resource level.

The second problem with that reasoning is the idea that this limit of about 5 transaction per second is the true limit, which it is not. In reality, the Bitcoin network has multiple layers, just like the current financial system.

Visa is merely a layer on top of a deeper payment network. In the United States, for example, we have the Fedwire system. That’s the gross settlement layer that banks use to perform large transactions with each other. This system only does about 10 transactions per second on average and has scaled up slowly as needed, but those transaction amounts are very large, representing millions of dollars each. On top of that layer are things like Visa, PayPal, people writing physical checks to each other, and so forth.

If you send me a credit card payment, for example, that seems pretty instantaneous to us, but in reality, it’s not. When the transaction seems finished to us, in reality, our two banks just conversed and made an IOU between themselves. Sometime later, they will batch it with many other consumer transactions and settle their books with a big Fedwire transaction.

Effectively, tens of thousands of consumer transactions per second get condensed down to 10 much larger interbank Fedwire transactions at a later time. There’s no limit to how many surface-layer transactions can occur because there is no limit to the size of those massive settlement transactions.

Similarly, the Bitcoin network has additional layers: Lightning, Liquid, Exchanges, and more. However, unlike the banking system that depends on long settlement times and IOUs, many of Bitcoin’s layers are designed to minimize trust via software.

The Lightning network is a trustless smart contract layer that runs on top of the Bitcoin network and is suitable for smaller transactions.

Like the Bitcoin network itself, nobody “owns” the Lightning network; it’s a set of open source standards that multiple companies make open source implementations of. Those Lightning transactions are instantaneous and nearly free and have no upper limit in how many can occur per second as the network continues to grow. It went active in early 2018, and as of early 2021, it finally reached enough channel liquidity, with major apps and exchanges starting to use it, that it became truly functional and reasonably mature:

Source: Lightning Explorer

With Lightning, two people can open a channel with each other using a base layer transaction and then send any number of instant transactions between each other. Days, weeks, months, or years later (whenever they want to), they can close that channel with a second base layer transaction. That means dozens, hundreds, or thousands of mini-transactions can be combined into two base layer transactions. It’s like keeping a bar tab open and settling at the end of the night, or the end of the month, except it doesn’t rely on trust but instead relies on programmed smart contracts that ensure the bar tab is settled.

In addition, you can send a Lightning transaction through the network to someone else. If Alice has a channel open with Bob, and Bob has a channel open with Cody, then Alice can send a payment to Cody through Bob as the intermediary, even though she doesn’t have a channel with Cody. And it’s all trustless; all based on programmed smart contracts using the Bitcoin base layer as the settlement assurance.

If someone has a couple Lightning channels open with well-connected counterparties, she could send and receive many transactions to/from any number of people through the network (including all the vast numbers of people on the network that she doesn’t have any channels open with), and settle them in a small number of base layer transactions when opening or closing those channels.

To give an idea of how efficient Lightning is, there were some gaming demos at the 2021 Bitcoin Conference in Miami involving “sat streaming, ” and THNDR Games processed 13,571 Lightning transactions during the conference for an average fee of 1.4 sats per transaction, or roughly $0.0005 USD per transaction.

And as previously mentioned, layer three developments allow the Lightning network to be used for secure, decentralized, and censorship-resistant data transmission as well.

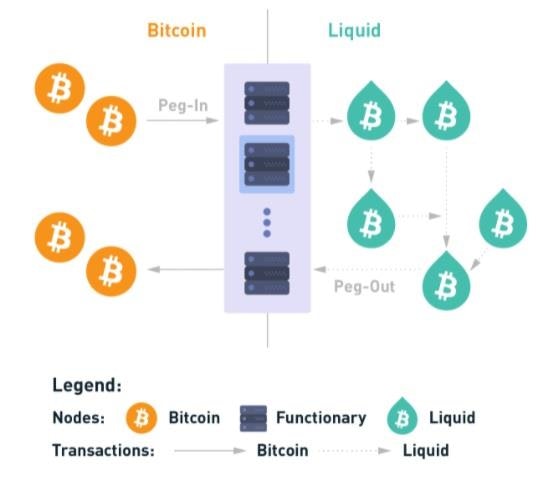

Liquid is an open-source side chain of Bitcoin, meant for large entities like exchanges to settle bitcoins with each other faster and less expensive than base-layer transactions. Beyond that, it has many other uses as well.

With Liquid, bitcoins get locked up into L‑BTC tokens with a “peg-in” transaction. Those L‑BTC tokens can run on this side chain with faster settlement times until an entity decides to unlock the bitcoins from that chain and bring them back to the base layer with a “peg-out” transaction.

Source: Blockstream

A federation of nodes runs the Liquid network. The Liquid network can’t fully replicate the rock-solid security and decentralization level of the bitcoin base layer, but it has a much faster transaction throughput and has a reasonable degree of security and decentralization.

In other words, an entity can make a known trade-off to lock up some Bitcoin and get L‑BTC tokens in return. Those tokens use Bitcoin as their foundation of value but provide additional speed and features. Between each peg-in and peg-out transaction, L‑BTC will typically be used for many transactions.

Similarly, any smart contract platform can lock up Bitcoin in a similar way that Liquid does. The largest one, Wrapped Bitcoin or “WBTC, ” consists of Bitcoins that are wrapped in an Ethereum token and can, therefore, trade-in Ethereum-based DeFi ecosystems, with any advantages or security downsides that may come with that. There are also DeFi projects that run on Bitcoin, using wrapped bitcoins in their ecosystems as well.

Custodial crypto exchanges and Bitcoin platforms are also scaling methods. When millions of people trade on Coinbase, for example, those are not millions of base layer transactions. Those are transactions within Coinbase’s centralized database. Only when people deposit or withdraw Bitcoins to/from Coinbase, or Coinbase sends Bitcoins to or from cold storage or to another exchange in a big batch, would there be an on-chain transaction?

Anyone looking to efficiently accumulate Bitcoin rather than “trade cryptos” should, of course, use Swan Bitcoin instead since the fees are lower, and the customer service is better. It’s optimized for automatic recurring purchases, one-time buys, and self-custody if desired.

As another example, millions of people use Cash App to buy and hold Bitcoins. They can send Bitcoins to another Cash App account for free. Those are not base layer transactions; those are merely transactions within Cash App’s database. It only becomes a base layer transaction if they deposit or withdraw their bitcoins to/from Cash App with an external source or if Cash App moves its users’ Bitcoin around internally, to or from cold storage in large batches.

(As a note, Cash App has tight limits on withdrawals).

Unlike Lightning and Liquid, those types of custodial accounts like Coinbase and Cash App require that you trust the centralized platform, similar to how you trust your bank.

Many exchanges and custodial services already use Liquid between themselves for rapid settlement. Some of them are also starting to use Lightning for their retail clients, so even when people withdraw, it might not need to be a base layer transaction anymore.

If Bitcoin continues to be successful and grows in users and market capitalization, base layer transactions will become increasingly used for settlement transactions, not day-to-day transactions. The fee market is what modulates its usage.

If transaction fees are averaging $1 for the base layer because block space hasn’t been heavily used, for example, then $100 amounts are fine to do base layer transactions with. However, if transaction fees are averaging $50 for the base layer, those small transactions would be better with Lightning. There are many transactions worth hundreds of thousands or millions of dollars on the base layer, and they don’t mind paying a $50 fee.

Ultimately, Bitcoin is comparable to Fedwire as a massive settlement network that can do about 5 transactions per second, with no limit to transaction size and thus no limit to how much value it can settle per day. On top of that, multiple layers ranging from trustless Lightning to semi-trusted Liquid to fully-trusted exchanges can account for hundreds of thousands of transactions per second, with no upper limit. As a result, the cost and energy per transaction can become negligible over time.

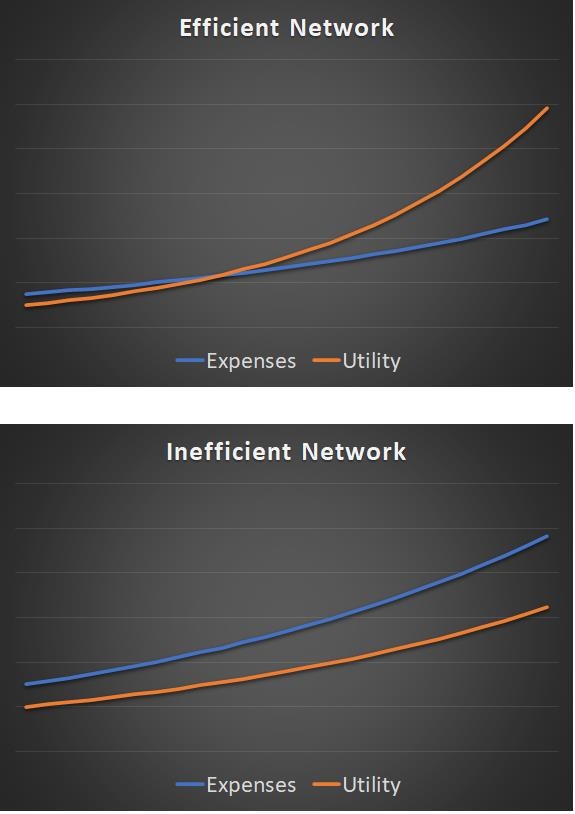

When an investor is picking through early-stage unprofitable tech companies to invest in, they need to model out the future to ensure that, if successful, its revenue will scale faster than expenses.

Consider a new social network, for example.

It will typically be unprofitable or minimally profitable in the beginning because it requires high base expenses to pay a team to run the service. Even if it has zero users in the beginning, it still has those base expenses to get it started and running.

However, if it’s successful and well-managed, it becomes cheaper to add each user. Expenses still grow over time (more employees, more facilities, more servers, etc.). Still, if the company is well-designed, those expenses should grow more slowly than users and revenue, which leads the company towards profitability and robust profit margins.

In other words:

Bitcoin is not a company, but it is an efficient network. By design, its expenses scale more slowly than its utility due to its declining block subsidy that eventually results in a security model based only on transaction fees.

We can’t know for sure how much energy Bitcoin will ultimately use since we don’t know how many people will use it or what the fee market will look like a decade or more in the future. If it’s successful, it will consume more energy than if it’s not successful, but due to its declining block subsidy, its utility will greatly outpace its energy usage in either scenario.

That’s the key takeaway.

Beyond a simple calculation of how much energy Bitcoin uses, we should also consider the details of how it uses energy and the types of energy it uses.

People often imagine bitcoin miners competing with other industries for electricity, as though bitcoin mining must push out some other electricity use. However, because bitcoin miners inherently require extremely cheap electricity sources, they can’t usually compete with normal electricity users. As a result, bitcoin miners seek out inefficiencies around the world where electricity is being underutilized and wasted.

The vast majority of energy consumers can’t go to where the energy is; the energy has to be brought to them. Humans organize themselves based on geography, mainly around shipping channels. We live in coastal or riverside cities, in the suburbs of those areas, and around rural areas of fertile land, not around energy.

We don’t move to where the oil and gas and uranium deposits are; we send folks out to go get the oil and gas and uranium and bring it back to us for consumption in our homes and at gas stations and nearby nuclear stations.

Bitcoin miners are unusual energy consumers in that they can go wherever the energy source is, as long as they can get some sort of basic internet connection, including a cellular or satellite connection if needed. That means they use energy in quite efficient and unusual ways.

Fidelity’s first digital asset analyst and later founding partner of Castle Island Ventures, Nic Carter, described Bitcoin’s energy usage in an insightful way back in 2018:

“An interesting externality of PoW coins — they are always-willing energy buyers at 3 — 5 cents/kWH. And some of the best energy assets are off the grid. This global energy net liberates stranded assets and make new ones viable.

Imagine a 3D topographic map of the world with cheap energy hotspots being lower and expensive energy being higher. I imagine Bitcoin mining being akin to a glass of water poured over the surface, settling in the nooks and crannies, and smoothing it out.”

— Nic Carter

Although some miners use cheap traditional energy, here is a sampling of some novel ways that Bitcoin miners use otherwise stranded or unwanted energy to benefit themselves and their counterparties.

Stranded Hydroelectric Power in China

For a long time, China has been the largest Bitcoin mining jurisdiction. At one point, Chinese miners were estimated to account for over 70% of the network. However, by the spring of 2021, it was estimated to have gradually dipped to under 50% as more competition arose elsewhere. Then, a 2021 ban on Chinese bitcoin mining, likely to enforce their capital controls, has sharply reduced Chinese bitcoin mining exposure, and those miners have gone elsewhere.

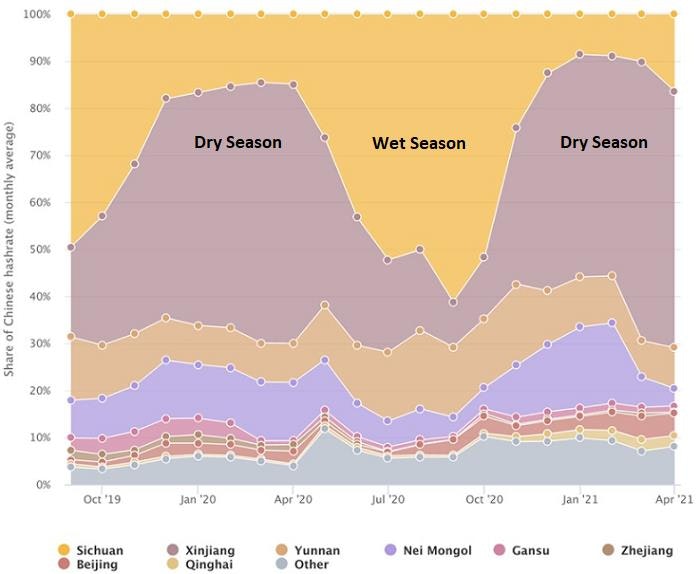

For many years, China was an interesting example of Bitcoin mobility. The province of Sichuan has a ton of overbuilt hydroelectric capacity. During the wet season, they produce more clean electricity than they can possibly use. So it would otherwise be curtailed, wasted.

Since Bitcoin miners can go to where the energy source is, they used to flock to Sichuan during the wet season to use that otherwise wasted energy. Not because they are altruistic environmentalists, but simply because it is cheap and nobody else is making use of it. The electricity that would otherwise be wasted and generate no revenue for the operator can be sold for extremely cheap levels to someone who can find a use for it.

Here is an estimation by Cambridge of how much each Chinese province contributed to China’s overall Bitcoin hash rate throughout the seasons. Sichuan is in yellow at the top:

Source: University of Cambridge, Annotated by Lyn Alden

With the Chinese Bitcoin mining ban that came shortly after the end date of this chart, that hash rate and billions of dollars worth of annual revenue is moving to North America and other countries. But this was a great example of Bitcoin miners mopping up stranded and wasted energy for many years.

2. Flared Gas Bitcoin Mining

Many types of petroleum deposits come with associated natural gas.

If there is a sufficient quantity of this gas, it can be collected and sent via pipeline or other transport networks to be used as a primary energy source since, of course, natural gas is extremely useful for electricity and heating.

However, if it’s a small amount, then it’s not economical enough to build a pipeline or otherwise collect that gas.

So what happens?

It gets vented or flared into the atmosphere, and therefore wasted. Venting means letting it out into the atmosphere, mainly as methane (a stronger greenhouse gas than carbon dioxide). Flaring means it is burned and thus converted into carbon dioxide and emitted into the atmosphere. A complete waste, either way and yet still contributing to global greenhouse gases.

In terms of scale, the US Energy Information Administration estimated in its 2020 natural gas annual report that 1.48 billion cubic feet of natural gas were vented or flared per day on average in the United States throughout 2019. That’s about 150 TWh of energy, which is higher than the estimated total peak level of Bitcoin’s annualized energy usage in 2021, according to the University of Cambridge.

In other words, virtually, the entire Bitcoin network in its peak 2021 form could hypothetically be run off of stranded natural gas in the US, let alone the rest of the world. Considering energy lost in the conversion process to electricity, that’s probably not completely the case, but the point is, this stranded energy source can power a huge chunk of it.

Several private Bitcoin mining companies specialize in hooking up trailers of bitcoin miners to oil producers with stranded gas to use that otherwise-wasted energy.

It’s a win/win scenario for producers and the Bitcoin miners. The producers get to sell their gas rather than waste it while earning higher ESG scores and meeting state flaring limits. Bitcoin miners get a super cheap source of energy.

Alternatively, some of these Bitcoin miners are also willing to sell mining systems to oil and gas producers and set the hardware up for them so that the producer can directly capture any potential upside in bitcoin’s price.

North Dakota, in particular, is a major area for stranded gas mining. According to the EIA, nearly 20% of produced natural gas is flared in North Dakota rather than collected. That wasted gas alone is equivalent to tens of TWh of electricity generation per year. Back in 2014, North Dakota’s wasted amount was more like 35% and the state implemented rules to try to get that number down. Bitcoin miners can soak up much of this otherwise wasted energy, and Bitcoin mining is indeed growing in that state.

I reached out to Marty Bent, the Director of Business Development for Great American Mining, to understand their operations. Great American Mining is a private company that works with oil and gas producers to deploy mobile Bitcoin mining rigs onto the oil and gas production site to use their wasted gas to mine Bitcoin.

Source: Great American Mining

Marty gave a useful clarification on why pretty much only bitcoin miners can make use of this stranded gas, rather than similar industries like data center server farms:

“Since the Bitcoin network is a distributed peer-to-peer network that doesn’t depend on any one miner to facilitate transactions, bitcoin miners are better positioned to take advantage of the flare gas opportunity compared to other energy intensive compute processes like server farms because they can stomach disruptions in the field without affecting the uptime of the network materially. Whereas a server farm would not be able to because uptime disruption could seriously affect critical business operations. Beyond this, miners send the amount of data to mining pools is very small and doesn’t require much bandwidth, so they can operate in very remote areas using cellular data much more trivially than other energy intensive data processes.”

— Marty Bent, July 2021, via email

I asked him which types of producers are better suited than others. His answers are the ones in chillier climates (current generation Bitcoin miners need good air cooling, which uses energy) and/or in jurisdictions that have more stringent flaring requirements. And due to various limitations, on-shore locations tend to be better suited than offshore locations:

“The opportunity is particularly large in jurisdictions with strict flaring regulations because producers are highly incentivized to reduce their flaring. If they flare too much they are forced to shut in their wells for a period of time.

[…]

Yes, shale producers certainly have an advantage over offshore drillers as the electrical requirements and permitting necessary to operate offshore are much more restrictive than onshore drilling. On top of this, the amount of surface area to drop containers and generators on offshore operations is extremely small compared to onshore well pads, so scaling could be an issue. Beyond this, producers in states with relatively cool climates have an advantage, at least in the short to medium term, until immersion setups mature. Also, producers who own the natural gas minerals and the production are better positioned because they wouldn’t have to deal with the headache of paying out royalties to mineral rights owners.”

— Marty Bent, July 2021, via email

In my view, Bitcoin miners using stranded gas (and stranded hydropower) are about the cleanest miners out there. It’s better than solar panels, wind energy, or similar sources because the energy they are using is literally wasted and sent into the atmosphere otherwise, by companies that are extracting petroleum for other purposes.

3. Bitcoin Mining as a Grid Battery

Electrical grids have to compensate for two things: changing supply levels and changing demand levels.

Some electrical sources are very consistent, like baseload nuclear power, which can run 24⁄7. Other sources, like wind and solar or hydro, are more variable based on what Mother Nature feels like providing in terms of wind, sun, and rain during a given timeframe. Due to this partial variability, electrical supply needs to be overbuilt, so that even on a particularly “low” day of supply generation, it’s still sufficient to provide power to the community.

Moving to the demand side, certain days require more electricity than others. Looking at my gas and electric bill, for example, I use a lot more gas in winter than in summer, because in the summer it’s only used for cooking while in the winter it’s used for cooking and heating.

Meanwhile, I use way more electricity in the summer since I’m using it for air conditioning in that season and for lights and electronics consistently throughout the year. Plus, there are peak days, such as the most dangerously hot day of a given year, where just about every single household has the air conditioning system on full blast. Days like that need to be accounted for.

So, due to variability on both the supply side and the demand side, electrical grids need to be overbuilt and have a lot more power generation capacity than is used on an average day. Some of that capacity could be variable, like natural gas peaking plants that can be rapidly turned on or off as needed. Other types might be ones they can’t control, like solar panels and wind turbines. If you overbuild solar capacity and wind capacity and aren’t using the excess or selling it to another grid, you just waste it.

One of the problems with solar and wind power is that the cost of storage is very high. Despite all of our human ingenuity, we still can’t make very cost-effective batteries at a utility-scale. It’s an extraordinary hard physics problem. We can make storage batteries for certain ideal conditions, but it’s not cost effective to use them very broadly.

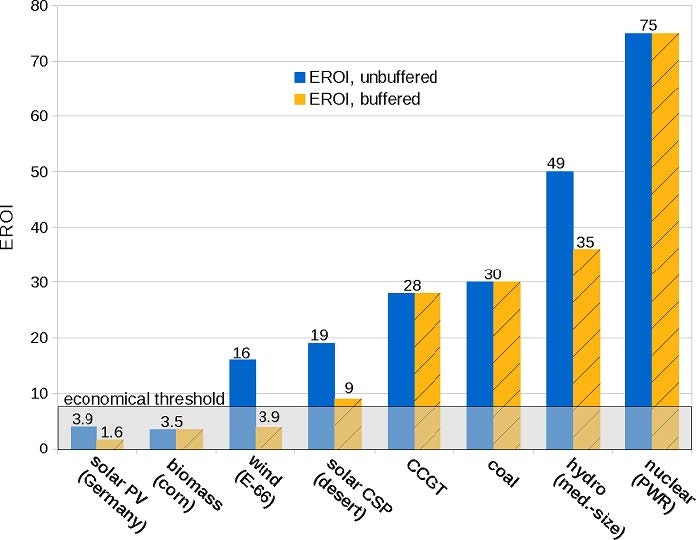

This chart shows the energy return on investment from various energy sources. In other words, it measures the multiple of how much energy you get out of what you put in. The lower yellow bars include the energy cost of storage for variable energy sources. Nuclear is on the far right with a 75x energy multiple (and no buffer/storage costs), while wind and solar are low, especially when the storage costs are considered:

Chart Source: “Energy intensities, EROIs, and energy payback times of electricity generating power plants” 2013 Weissbach et al

Bitcoin mining makes it profitable to overbuild renewable sources of energy production, since it allows that surplus supply to be monetized. Every community that wants reliable power needs overbuilt electric capacity anyway, and for wind and solar and hdyro that’s even more important because they are variable. However, overbuilding is usually not very cost effective, unless you can use it for something profitable and useful when it’s not otherwise needed.

Bitcoin miners are a unique solution to that problem, can make overbuilding profitable, and thus play the indirect role of an energy storage solution.

During the vast majority of the time when there is more supply than demand, bitcoin miners as one of the electricity consumers in the community can power their machines, earn revenue, and pay their electricity costs. If there is a surge in electricity demand or a reduction in supply that would otherwise cause brown-outs in the region, those bitcoin miners can temporarily shut off.

A well-structed commercial rates contract can make this work smoothly. The utility could offer the miner the lowest possible rate in the area, in exchange for them having a higher tolerance for variability and other points of contract flexibility.

Harry Sudock, VP of Strategy at a bitcoin mining company called Griid, explained this to Peter McCormack on his podcast in June 2021:

“Curtailing is not the position you ever want to be in as the energy generator. So, let’s use a wind turbine as a really easy example. The turbine goes around once, generates electrons. The market price in some regions is negative, so what they’ll choose to do is just not to send the energy anywhere. It dissipates.

So, if they’re able to strike a deal with another bidder on that energy who can tolerate some intermittent consumption, can use it some of the time, not the other part of the time, that’s a really valuable customer to be able to bring to a market that isn’t necessarily able to support the energy generation on a broader basis.

So, I think bitcoin miners are special and are a huge technological upgrade from the traditional consumers of electricity. We have two, I think of as “energy superpowers”: the first one is that energy is 80% or 90% of our monthly costs; the second is that we can consume on an intermittent basis without harming our business model particularly. So, if someone tells me I need you to shut off your miners 100 hours a year, or 500 hours a year, we don’t say no, we just say, “We need to reflect that in the energy price we pay.”

So, when I’m looking to negotiate a power contract, the way that I frame this is, “I need you to get me the lowest possible cost that you know how to offer. I’m willing to negotiate on every other part of the profile of the load. How big are we going to build the mine; how often do you need that power back; do you need us to serve any other creative purpose within your energy mix or system; do you need us to split our facility into two and to go locate at two different points within place? Great. Do we need to be able to contribute to the security budget of these other pieces of the operation?”

Our job is to drive that energy price as low and competitive as possible and work with producers on every other variable.”

For clarity, I would add that their third superpower is their ability to co-locate with the source of electricity generation and thus cut down on transmission losses to help keep their electricity cheap. Bitcoin miners are unique in that:

Almost their entire operating expense is electricity.

They can tolerate intermittent consumption.

They are flexible with their location.

As a result, they can sacrifice variables that most other companies cannot in exchange for rock-bottom electricity prices when electricity is abundant.

This is why Jack Dorsey, CEO of Twitter and Square, has made the controversial statement that the Bitcoin network incentivizes renewable power. Right now, Bitcoin is too niche for grid engineers to incorporate it into their plans. Still, if Bitcoin miners become more regular and visible, they can be incorporated into grid designs and rate markets more thoroughly.

In that podcast, for example, Sudock described this situation:

“This is an anecdote that we’re in the midst of working through right now. A community is zoned to have a new hospital built in their area. There are 17,000 energy customers, house to house, in that utility’s jurisdiction. They are going to bring a hospital that will double the amount of energy that this region pulls down. We can all agree that a hospital is a very worthy use of electricity; there is no argument there.

They rebuild the transmission lines, they build a new substation that’s bigger, that can handle the additional load, and after they do all that, the hospital project falls apart.

So they’re left having invested millions of dollars in this area to attract this large customer. They now have to pass that cost back to those 17,000 households unless they can find another use for that energy. So what did they do?

They called our VP of Energy Management and said, “We’ve got an overbuilt supply here. If we don’t bring in a large-scale energy customer, these costs are going to get passed to these households that don’t have the budget to support rising energy prices.”

So, we have this beautiful opportunity to come in, backstop this utility, provide a customer to come in on the back of this deal falling apart, and provide the backbone to this community and to stabilize their energy prices for a decade to come. And so these are the stories of Bitcoin mining that don’t get to rise to the surface. It also happens that this energy source is over 60% carbon-free.”

Due to their ability to go to the source of power, ZBitcoin miners can also fill in unexpected holes in demand or other special situations.

4. Advancing New Energy Technologies

The flexibility of Bitcoin mining allows it to fill in gaps for new clean energy technologies, to help them scale and provide a proof of concept. Here’s a real-world example, and it also fits into the previous topic of acting like a battery to profitably soak up excess capacity.

Oklo Inc is a startup that plans to make innovative new nuclear power facilities. Most existing nuclear facilities are massive multi-billion-dollar facilities. Still, Oklo plans to make micro-reactors with much smaller facilities, lower costs, lower energy output, and quicker construction times.

In addition, Oklo’s reactors are a type that can use the waste of conventional nuclear facilities as their fuel source. It actually reduces the radioactivity of existing nuclear waste.

As ZME Science reports:

“The startup Oklo plans to give us a reliable and cost-effective source of power while also solving the issue of radioactive waste, which needs to be stored and managed in particular conditions for hundreds of thousands of years. Their solution is to reuse the waste in autonomous reactors that don’t try to slow down the nuclear decay of the material. Effectively, such a reactor would be able to extract more power from fuel that has already been spent, giving us a use for the processes that happen naturally in a radioactive fuel dump, instead of letting them waste away as radioactive pollution.

“What we’ve done is take waste that you have to think about managing for 100,000 or a million years … and now changed it into a form where you think about it for a few hundred, maybe thousands of years, ” Oklo’s co-founder Jacob DeWitte told CNBC.”

However, with any new technology, there’s always a catch. You have to ask yourself, “Why hasn’t this already caught on?” especially considering that Oklo is using a proven type of fission technology that has already existed for decades.

Besides the process of going through regulation in an environment that has not been very favorable towards nuclear energy, the catch seems to be that Oklo’s small facilities naturally mean that profit margins are very tight. The company has proposed to operate them via automation, unsupervised by any on-site humans. This has led regulators to raise their eyebrows; unattended facilities with nuclear materials are somewhat of a security hazard, to say the least.

Enter Bitcoin miners because, apparently, Bitcoin fixes this.

Oklo recently announced a 20-year partnership with Compass Mining. Oklo will provide Compass with at least 150 MW of power starting in the early 2020s.

“Cryptocurrency mining offers promising pathways to accelerate the deployment of clean energy technologies, and Oklo is positioned to respond to commercial demands by offering end-users the convenience of buying clean, reliable, and cost-effective power that they can depend on, ” added DeWitte. Oklo’s path to deployment strives to optimize its power plant designs to be cost-competitive with the cheapest forms of energy.

Oklo’s advanced fission powerhouses can produce reliable power for up to 20 years without the need to refuel and have the capabilities to turn nuclear waste into clean energy. This commercial project is scalable, and Oklo can add additional capacity to accelerate Compass’ sustainable mining efforts further while driving the economics of Bitcoin mining activities powered by advanced fission.”

I reached out to Compass’ CEO, Whit Gibbs, to get some details.

He explained to me that, for example, there might be a town that Oklo can do business with, to provide them clean power at a low cost by deploying one of their small facilities on the outskirts of the town. A given Oklo reactor might have 15 MW of output, in this particular hypothetical example, but the town only needs 10 MW. So, Compass comes in and installs 5 MW of bitcoin miners, co-located with the Oklo facility, to monetize the remainder of the power output and make the project cost-effective as a whole. As previously described, bitcoin miners are uniquely suited for this, since they can go to where the power is and operate in remote areas if need be, to fill any gaps.

In addition, all of that bitcoin mining equipment naturally needs some personnel and security onsite and would be co-located with the Oklo facility. Due to that combination, Oklo’s facility now has enhanced security and onsite monitoring as a side-effect of being teamed up with the bitcoin miners that are paying for the extra portion of Oklo’s power. That apparently solves their margin and security problem.

If the town needs more power years later, the Bitcoin miners could reduce their load and move their machines elsewhere. If the town ends up needing less power years later, Compass could bring in some additional miners to fill that gap. This reduces the risk for Oklo.

I don’t know if the Oklo facilities in particular, will catch on or not, but this sort of proof of concept and scaling approach for new clean types of energy will be interesting to monitor, thanks to the flexibility of Bitcoin mining.

As another example, the startup PRTI converts wasted tires into hydrocarbon commodities. The world produces over a billion wasted tires per year, made out of hydrocarbons, and the majority of them are just burned or buried.

PRTI developed a unique sealed boiler process to take those wasted tires and boil them down into their various hydrocarbon commodities, and sell those commodities. However, they also produce some natural gas in this process, which they can use to generate electricity. Since their locations tend to be wherever the tires are rather than in dense population centers, their local electrical grid doesn’t generally have very much use for that electricity. And it’s not enough spare gas to build a pipeline or otherwise use it for many purposes.

So PRTI takes that extra natural gas that they generate and mines bitcoins (and ether, at least until Ethereum switches to proof-of-stake) onsite with it.

As DCD reports:

“Product Recovery Technology International (PRTI) is processing discarded tires at a site in Franklinton, north of Raleigh, to create oil, syngas, carbon char, and steel. It is then using the gas to generate electricity which it uses in Bitcoin miners in its onsite office. The process is scalable, the energy could be used for other purposes, and the company is planning to roll it out in other sites, including Europe.”

The funny thing is that even that article gets it wrong. They went and stuck a random anti-bitcoin section later in the piece:

“Of course, making Bitcoin isn’t an environmental benefit in itself, as cryptocurrencies simply burn energy to produce abstract value. Crypto mining uses more energy than a country the size of Argentina and has a very large carbon footprint because not all the energy they use comes from renewable sources. Even when it is done with renewable energy, it diverts that energy from other uses, thereby increasing the carbon footprint of the human race.”

If that author had researched the subject deeper, he would know why PRTI mines bitcoin and ether with their excess energy rather than send it back to the grid. As PRTI co-founder and former CEO Jason Williams explained on the Investor’s Podcast Network, the local grid providers offer an extremely low price per kWh to buy energy from PRTI since they don’t need that energy because these plants are located near waste sites, not in population centers.

Market prices dictate a lack of demand like that. This stranded energy that PRTI creates from recycling tires that would otherwise be burned or buried is not “diverting” energy from other uses.

Instead, PRTI merely keeps the relatively small amount of energy they create, which would otherwise be wasted or sent non-economically into the grid, and mines bitcoin and ether. This helps keep their business profitable so that they can continue to grow to do the good work of recycling tires and cutting down on that massive global source of pollutants and litter. Crypto mining just happens to be the most economical use of the bit of energy they produce from their innovative process.

5. Old Power Plant Refurbishment

Since Bitcoin miners are mobile and can make use of energy that other sources cannot, sometimes previously shut-off power plants can be refurbished and turned back on to mine bitcoin and make money, create jobs in the community, and send electricity back to the local grid as well.

A particularly popular region for this is Quebec and certain other regions of Canada. They have plenty of unused hydroelectric capacity just like China, so Bitcoin miners have grown in that region.

“For example, British Columbia and Quebec, two of Canada’s largest economies, were built on resource extraction, mainly forestry and traditional mining. But many of the region’s lumber and pulp and paper mills powered by hydroelectric dams have moved on or closed, leaving power sources and infrastructure behind.

Areas of Washington State and Upper New York State have similar advantages — lots of cheap stranded energy from a time when manufacturing dominated the region and factories needed to be near power sources to be economical.”

I can confirm this with Compass Mining.

Looking through their facility list, many of them are in Canada, using some of this underused hydroelectric power.

However, not every old power plant is a stranded hydro asset. Some of them are old coal plants. A May 2021 article from the WSJ gave a controversial example of this:

“One of the most ambitious — and controversial — projects comes from private-equity firm Atlas Holdings. Based in Greenwich, Conn., the firm specializes in turnarounds of troubled companies. It bought the Greenidge coal-fired power station in 2014 after the plant in Dresden, N.Y., had been shut a few years earlier because it was economically unattractive to operate.

Atlas first converted the plant to natural gas from coal. Then, last year, it launched a data center for mining Bitcoin using power the plant generated. The company said it currently has 19 megawatts of mining capacity and plans to raise it to 85 megawatts by the end of 2022.”

On one hand, that Greenidge power plant was unused, and thanks to Bitcoin, it was put back to productive work as a natural gas plant (much cleaner than coal) and able to hire employees in the region. Plus, according to the article, it also sends electricity to the grid.

On the other hand, some folks in the community have observed that the facility heats a portion of the lake nearby, causing a negative local environmental impact. Of course, that facility would have the same negative environmental impact if it was being used for something else, and it was originally built for a purpose other than Bitcoin. Bitcoin miners merely resurrected it.

For any industry of this size, there will naturally be anecdotal examples of environmental issues. That’s for the local jurisdiction to decide whether it happens to be related to Bitcoin, aluminum refining, or anything else.

While some jurisdictions push back on that activity for environmental reasons, other jurisdictions specifically want to attract bitcoin miners. Kentucky, for example, signed a bill into law in 2021 to give tax breaks for Bitcoin miners to come to the state. These activities can use stranded power assets, add power capacity to the grid, hire workers, and give the state a new taxable stream of income. Indeed, Kentucky is one of the states receiving a sizable influx of miners this year.

6. Bootstrapping Developing Country Electricity

Many low-income countries have a lot of energy resources, including hydroelectric capacity. However, they often have a chicken-and-egg problem. It’s often too expensive for them to build the electrical transmission and distribution infrastructure to move that power from where it is generated to where it would be consumed. And they can’t get a lot of capital because there is not a lot of productive capacity sitting there ready to use electricity.

Bitcoin presents an interesting opportunity for some of these developing areas to build out their electrical capacity and generate revenue. If an energy source is developed, bitcoin miners can come in and give that site immediate profits until that electricity is put to better use.

As Alex Gladstein of the Human Rights Foundation described:

“Billions of people in developing nations face the stranded power problem. In order for their economies to grow, they have to expand their electrical infrastructure, a capital-intensive and complex undertaking. But when they, with the help of foreign aid or investment, build power plants to try and capture renewable energy in remote places, that power often has nowhere to go.

In many countries across Africa, for example, there are vast solar, wind and hydro resources. These forces could drive economic activity, but local communities and governments usually lack the resources to invest in the infrastructure to kickstart the process.

Foreign donors and investors are not keen to support projects that do not have a pathway to sustainability or profits. Without strong transmission lines to deliver energy from harvest points to population centers, power plant builders could wait years before they can run without foreign subsidy.

Here is where Bitcoin could be an incentives game-changer. New power plants, no matter how remote, can generate immediate revenue, even with no transmission lines, by directing their energy to the Bitcoin network and turning sunlight, water or wind into money.

As local authorities or customers gradually link up to the power plant, and are willing to pay more for the energy than what miners can afford, the Bitcoin load is lowered, and communities can grow. In this way, economic activity and renewable grids can be bootstrapped by Bitcoin mining. And international aid could provide the spark.”

— Alex Gladstein, May 2021

Overall, I think this is an interesting and under-explored area. The concept got attention in June 2021 when El Salvador made Bitcoin legal tender. Gladstein asked President Bukele during an online event if El Salvador would consider using some of the country’s under-utilized geothermal resources for Bitcoin mining. Bukele responded by saying that it would likely be a good idea and then days later announced that he directed his country’s state-owned geothermal operator to develop a plan for geothermal Bitcoin mining.

It remains to be seen if it will pan out, but if it does, that would be a potential revenue source for the impoverished country, using clean energy. Once those sources are developed for profitable Bitcoin mining, they could later hook up that power source for other purposes in the future if the population centers require more power at some point.

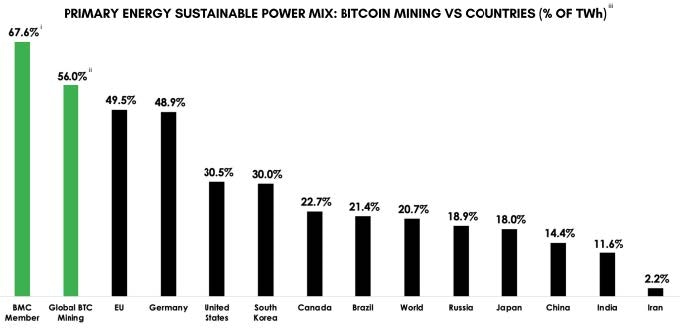

So far, we established that bitcoin uses only a sub‑0.1% fraction of global energy, and a significant portion of the energy it does use is otherwise stranded or wasted, or renewable. It can also help bring new types of energy to market thanks to its flexibility.

But can we make a blockchain that is even more energy efficient?

That’s what proof-of-stake purports to do, compared to Bitcoin’s proof-of-work model. Many newer cryptocurrencies use proof-of-stake as their consensus and security model.

As previously-described, proof-of-work is a system where miners compete with electricity and processing power to build the longest blockchain, which becomes the accepted blockchain.

In contrast to this, proof-of-stake is a system where holders of the cryptocurrency lock up or “stake” their coins, use them to vote on the valid blockchain, and get rewarded with more coins for successfully creating new blocks. Instead of committing electricity and processing power to create new blocks on the blockchain, they’re committing their stake of coins to do so.

Proof-of-work is simple because there is no need to punish bad miners that try to validate the wrong chain or make invalid blocks that don’t fit the rules of the node network. Their punishment is simply that they spent electricity on blocks that weren’t valid or weren’t included in the longest eventual chain, and thus lost money. They self-inflict their own wound, and thus it rarely happens on purpose. There is a tangible connection between the blockchain and real-world resources.

Proof-of-stake is more complex because there is no connection to real-world resources, and the system needs a way to punish stakers that improperly vote on the “wrong” chain.

In addition, they need a way to ensure stakers aren’t voting on all possible chains (which can’t be done with proof-of-work because it takes real-world resources). So, proof-of-stake is a much more complex system that will take away stakers’ coins if they vote improperly and has ways of checking to see if they are voting on multiple chains.

Ben Edgington, a developer for Ethereum and someone who is in favor of Ethereum’s upcoming shift towards proof-of-stake, went on the Compass Mining Podcast and explained the long-term challenges that Ethereum has faced as it undergoes its multi-year (and long-delayed) shift from proof-of-work towards proof-of-stake: