BitcoinIRA Review 2024: What to Look Out For!

Investing in Bitcoin with a tax-advantaged IRA is a smart move to preserve and grow your wealth. BitcoinIRA has the brand name but offers many altcoins with big red flags! Let’s see how compares to Swan Bitcoin in 2024.

Swan Bitcoin IRA

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Get started in less than 2 minutes. Book a call with one of our Bitcoin IRA specialists today!

Schedule a CallInvesting in Bitcoin through a tax-advantaged individual retirement account (IRA) is a smart move to capitalize on Bitcoin’s long-term potential.

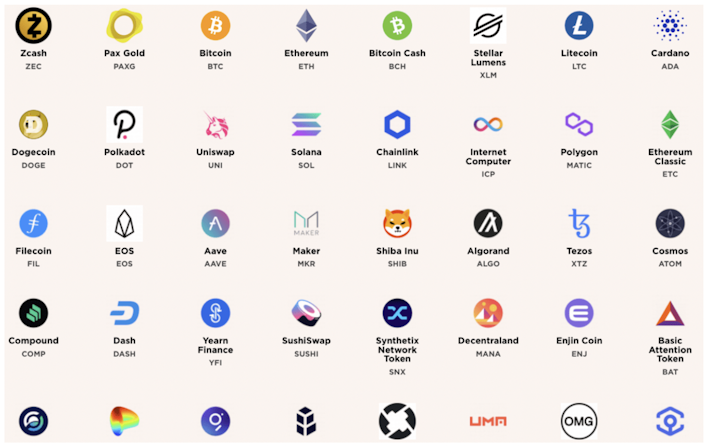

BitcoinIRA is a leading self-directed platform that lets you trade more than 60 cryptocurrencies within your retirement account; however, it isn’t a one-size-fits-all solution to your retirement savings.

In this BitcoinIRA review, we’ll explore its features, fees, pros and cons, risks, and other crucial factors to consider.

We’ll also review the Swan Bitcoin IRA product and highlight why Bitcoin-only options have a competitive edge over broad crypto IRAs so you can invest confidently.

BitcoinIRA is a crypto IRA platform that allows you to trade many different cryptocurrencies, as well as Bitcoin, through an IRA and add them to your retirement savings.

BitcoinIRA offers crypto IRA, 401k, Roth IRA, a Saver IRA, and various alternative assets options.

Unlike traditional IRAs, which primarily focus on stocks, bonds, and other conventional assets, a Bitcoin IRA enables investors to diversify their portfolios by investing some retirement funds into Bitcoin and other digital currencies, cryptocurrencies, and altcoins as a tax-saving vehicle.

Self-Directed IRA: Investors control their investment decisions. They can invest part of their IRA funds in cryptocurrencies, such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin and others.

Tax Advantages: Enjoy tax benefits such as tax-deferred or tax-free growth, depending on the type of IRA (such as traditional IRA or Roth IRA) and your specific circumstances. Consult a tax professional to understand the tax implications.

Custodian Services: BitcoinIRA works with qualified custodians who ensure compliance with IRS regulations and facilitate purchasing, storing, and safekeeping digital assets on your behalf.

Security: BitcoinIRA’s robust security measures, such as multi-factor authentication, cold storage, encrypted wallets, and insurance coverage, protect your assets.

BitcoinIRA charges a one-time setup fee ranging from 0.99% to 4.99% of the funds invested (the initial deposit transaction fee).

Additionally, there is a 2% transaction and a 0.08% security fee.

What are some of BitcoinIRA’s pros and cons?

Pros

Diversification benefits

Tax advantages

Cons

Promotes low-quality digital currencies

Volatility and risk

High fees

A learning curve

Slow trade processing

Poor customer service

Over 170,000 users have joined the platform, making it one of the biggest crypto retirement platforms. BitcoinIRA is for investors who want to invest in more than Bitcoin.

BitcoinIRA is one such type of IRA that promotes and asks investors to diversify their investments into all sorts of risky fly-by-night altcoins.

If you’re a true believer in Bitcoin and its long-term potential, you will be irritated with BitcoinIRA.

If you have a higher risk tolerance, okay paying much higher fees, and can navigate the complexities of self-managed retirement accounts, BitcoinIRA might be right for you!

Using a Bitcoin-only platform like Swan Bitcoin, as opposed to a broad crypto IRA platform like BitcoinIRA, offers an array of advantages.

Simplicity and Focus: Bitcoin-only platforms offer a simplified user experience and focus all their resources on Bitcoin-related services. If you only want to invest in Bitcoin, a streamlined platform without the complexity of managing multiple cryptocurrencies.

Specialized Expertise: Bitcoin-only platforms like Swan Bitcoin deeply understands Bitcoin’s technology, market dynamics, and trends. These platforms offer more customized advice, research, and support specific to Bitcoin investing.

Enhanced Security: They also prioritize and optimize security measures explicitly designed for Bitcoin. This may include robust encryption, multi-signature wallets, cold storage solutions, and other security practices to protect Bitcoin holdings.

Access to Specific Bitcoin Features: You get unique features or services exclusive to Bitcoin. For example, access to Bitcoin lending, staking, or other specialized investment options is unavailable on broader platforms.

Lower Fees: Bitcoin-only platforms may incur lower fees than broader platforms supporting multiple cryptocurrencies.

Users trust Swan Bitcoin for it’s:

Ease of use

Best in industry security practices

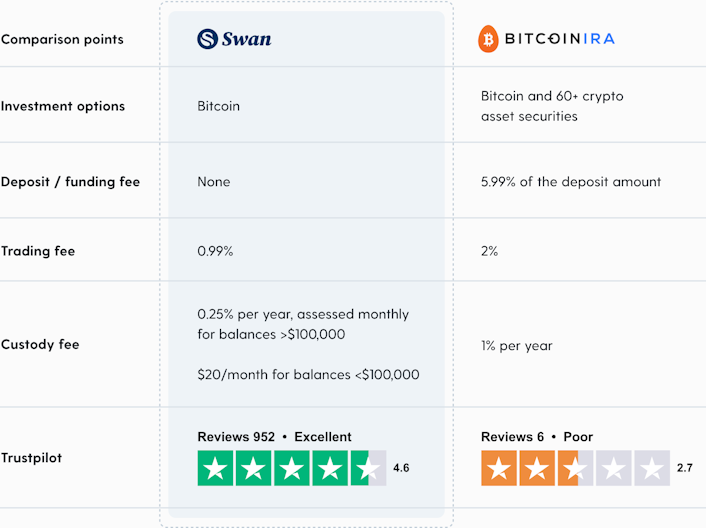

Also, notice the customer ratings difference on Trustpilot…

While BitcoinIRA scores a commendable 4.1 rating, they only have 21 reviews.

Swan Bitcoin scores 4.5 out of 5 stars from 1K reviews.

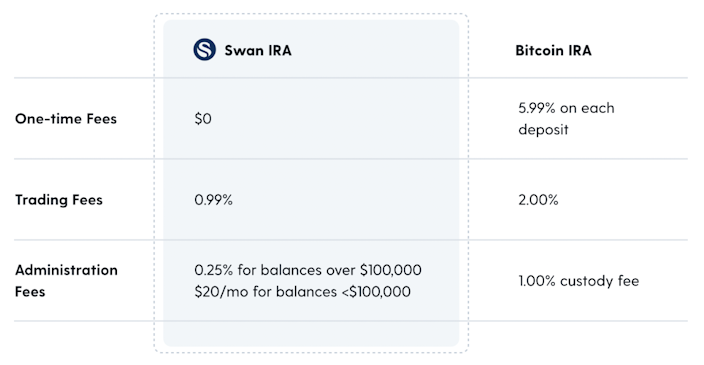

Fee Comparison

While all BitcoinIRA fees are very high compared to other providers, account minimums and the funding fee are both particularly egregious.

BitcoinIRA requires a $3,000 minimum account balance starting fee + charges a 5.99% funding fee and a 2% trading fee (plus a hefty spread). There’s also a 1% custody fee charged annually.

Swan IRA offers lower fees across the board, with no one-time or upfront fees, a 0.99% trading fee, and a 0.25% annual administration fee for balances over $100,000.

Example: If you transfer a $100k IRA balance to BitcoinIRA, you’ll be charged 7.99% on Day 1.

How?

A 5.99% funding fee to transfer USD to their custody. Another 2% trading fee to convert the remaining USD balance into Bitcoin.

Worse still, every time you transfer new money to BitcoinIRA and purchase Bitcoin, they clip another 7.99%. Imagine this fee structure applying to your new contributions yearly until you retire.

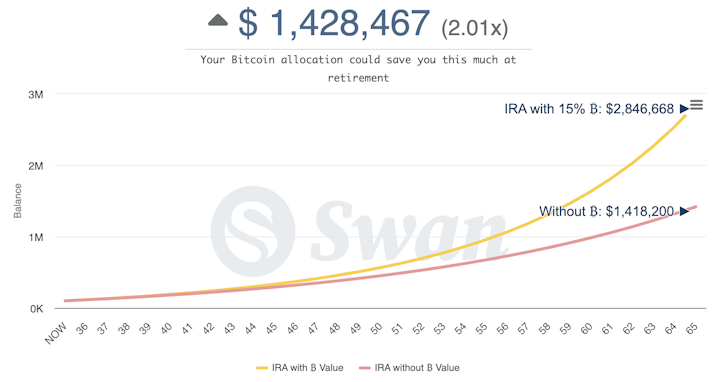

Consider a 25-year-old. We’ll call them Mike.

Mike plans to retire at 67 and allocates $100,000 toward Bitcoin in their IRA. He also make additional annual contributions of $6,500 toward Bitcoin.

Let’s assume a 15% annual appreciation of Bitcoin in USD.

In this scenario, choosing Swan IRA over BitcoinIRA could mean a massive difference of >$900,000 in your Swan IRA vs. your BitcoinIRA ending balance!

25-year-old, single

Planning to retire at 65 (40-year time horizon)

IRA starting balance of $0

$6,500 annual contribution

Projected annual returns (BTC) = 10%

Projected annual returns (60/40 portfolio) = 7%

Projected BTC price by the time of retirement (2063) = $1.3M

Despite implementing the same investment strategy—buying and holding Bitcoin and accumulating it in a retirement account over the years — the result will be massively different based on Mike’s IRA provider.

With a 0% (BTC) allocation, Mike expects to have $824k by retirement

With a 100% (BTC) allocation, Mike expects to have $3.2M by retirement

$2.3M more in his retirement account (3.8x more money) should these projections become true

Jack Bogle, the founder of index investing, once said:

“In investing, you get what you don’t pay for.”

This holds for Bitcoin saved in retirement accounts. Your future retiree self will thank you for paying close attention to the costs of having Bitcoin in a retirement account.

NOTE: This analysis was completed using tools from Swan Research, a new department at Swan Bitcoin focused on bringing deep research and analytics to Bitcoin. You can read our previous Swan Research piece explaining Why Bitcoin is the Ultimate Asset For Your IRA.

If you’d like to explore the model and modify the inputs, you can see the details using Swan Research’s Portfolio Modeling Tool.

The Nakamoto Portfolio is a set of powerful portfolio construction and investment tools to help you explore Bitcoin’s effects on your financial life.

An IRA is a financial product you’ll use for many years, even decades. So, think about the features of the product beyond fees.

Here’s where Swan shines over BitcoinIRA when it comes to features:

Simplicity: Swan IRA is best-practices driven, guided by an inherent principle: “Do what’s right for Bitcoin and Bitcoiners.”

High-Quality Information: Swan Studio’s, the Swan YouTube channel the Signal Blog and the Welcome to Bitcoin: 101 Series provide some of the best insight and content in the industry.

Compliant and Risk-Focused: Swan minimizes the potential risks of investing in Bitcoins and keeping them in custody, handling adverse regulatory or compliance developments concerning your IRA.

Made for Bitcoin: With Swan IRA, you stick to a Bitcoin-only strategy rather than exposing your retirement holdings to volatile altcoins with BitcoinIRA. Many of these altcoin securities carry significant regulatory and counter-party risk, as evidenced by recent SEC actions.

No Promotion of Altcoins: Crypto IRA providers often promote multiple digital assets to encourage more trading activity by investors.

Best in Industry Customer Support: Our Swan Support team of Bitcoin experts is responsive, answers all your questions, and loves talking about Bitcoin!

BitcoinIRA shills more than 60 altcoins. It’s exciting to look at first, but when you really dive deep, you learn how its usually not worth the risk.

Nevertheless, BitcoinIRA regularly markets these to its customers.

Your retirement should preserve and increase your wealth long term. You may not want to use your retirement portfolio like a day trader. The key is to stop following around in crypto.

Unlike BitcoinIRA and similar crypto IRA companies, Swan doesn’t make fancy price predictions or send you marketing promotions pitching alternative investments.

BitcoinIRA manages +$2 billion of crypto assets with BitGo Inc.

Investing in too many of the altcoins BitcoinIRA provides a poor risk: reward financial return ratio.

It also comes with huge regulatory risks. If you hold your retirement funds in a crypto IRA, those funds could be at risk of action from regulators and prosecutors over the next few years.

Another risk to consider is the viability of platforms selling unregistered securities. The U.S. Securities and Exchange Commission (SEC) or other regulatory agencies may crack down on trading on altcoin products.

This adversely affects the platforms that offer altcoins and may result in the forced liquidation of assets the investor holds.

On November 15th, BitcoinIRA announced a strategic acquisition of Shrimpy.io. Shrimpy.io. allows users to connect your exchanges and wallets to completely transform the way you invest in crypto.

BitcoinIRA’s upgraded platform features included:

Founded in March 2015, BitcoinIRA is owned by entrepreneurs Chris Kline, Johannes Haze, and Camilo Concha.

BitcoinIRA is a well-known trading platform that specializes in various crypto-based IRA services.

The platform offers a self-directed IRA, enabling investors to integrate digital assets into their retirement portfolios.

Yes, you can open a new account with BitcoinIRA or rollover funds from an existing IRA or retirement account such as 401(k) and allocate those funds toward cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash (BCH), or Litecoin.

There’s no maximum investment limit but there is a minimum initial investment of $3,000.

You are exempt from taxation as long as the money and assets stay within your account.

The primary risks include market volatility, regulatory and legal challenges, security and fraud risks, and tax implications.

Before investing in BitcoinIRAs, speak to your financial advisor and carefully review the terms and conditions of any financial institution you wish to work with.

Bitcoin isn’t a typical investment. Given its many benefits and lucrative growth, more companies will start offering a BitcoinIRA or crypto IRA product sooner or later.

Before investing in a riskier option like BitcoinIRA, continue conducting additional research to ensure you protect your savings while exposing yourself to a long-term price appreciation in a secure asset like Bitcoin.

Mixing your retirement portfolio with the unregistered securities and altcoins BitcoinIRA platforms is extremely risky.

Consider going Bitcoin-only when choosing an IRA provider. Also, understand the fees involved and how the costs will affect your long-term retirement goals.

Learn more about Swan IRA and how it can help you reach your retirement goals while maximizing your savings. Contact the team at ira@swanbitcoin.com for more info.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Nick Payton is the Director of Marketing at Swan Bitcoin. He has operated his own consulting agency for over 10 years with a focus on digital campaigns for Fortune 500 companies. Nick’s analysis is shared across social media and native content on Swan.com. He is focused on educating people on the benefits of adopting Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Why Bitcoin is the Ultimate Asset for Your IRA

By Rapha Zagury and Brandon Quittem

Adding Bitcoin to your IRA can provide asset diversification, as well as the potential for higher returns and a measure of protection against monetary debasement.

The Right Questions to Ask to Avoid Bitcoin IRA Icebergs

By Terrence Yang and Jeremy Showalter

The Swan IRA is uniquely designed and features a distinctive account setup that incorporates various levels of legal compliance, regulatory oversight, custodial services, and high-level institutional security measures.