Coinbase and the Insider Exchange Dump

Bitcoin is very different from all other cryptocurrencies. In fact, it shouldn’t even be considered the same asset class.

This report was originally published in Swan Private Insight from May 2022. Submit your information here if you’re interested in reading future reports.

A common phrase you’ll often hear from someone getting into Bitcoin is, “I’m going to diversify across cryptocurrencies because I don’t know which one will win.”

This mindset comes from traditional finance where the commonly-held belief is that it’s wise to spread your bets out across an asset class to improve risk-adjusted returns.

The reason that this mindset fails when it comes to Bitcoin is that Bitcoin is very different from all other cryptocurrencies. In fact, it shouldn’t even be considered the same asset class. It has a different value proposition, different assurances, a different use case, different engineering, and a different history from all other cryptocurrencies.

Only Bitcoin has shown the ability to maintain its value over a long period of time due to its unique properties: its hard-capped supply, decentralization, and censorship-resistance. The graphic below displays this reality beautifully. It shows the top 10 coins by market cap from 2013 to 2022.

Whereas other cryptocurrencies come and go, Bitcoin has remained the largest, most liquid, most used, and most secure cryptocurrency for its entire existence.

This fact has not stopped opportunists from creating cryptocurrencies of their own for their own personal gains.

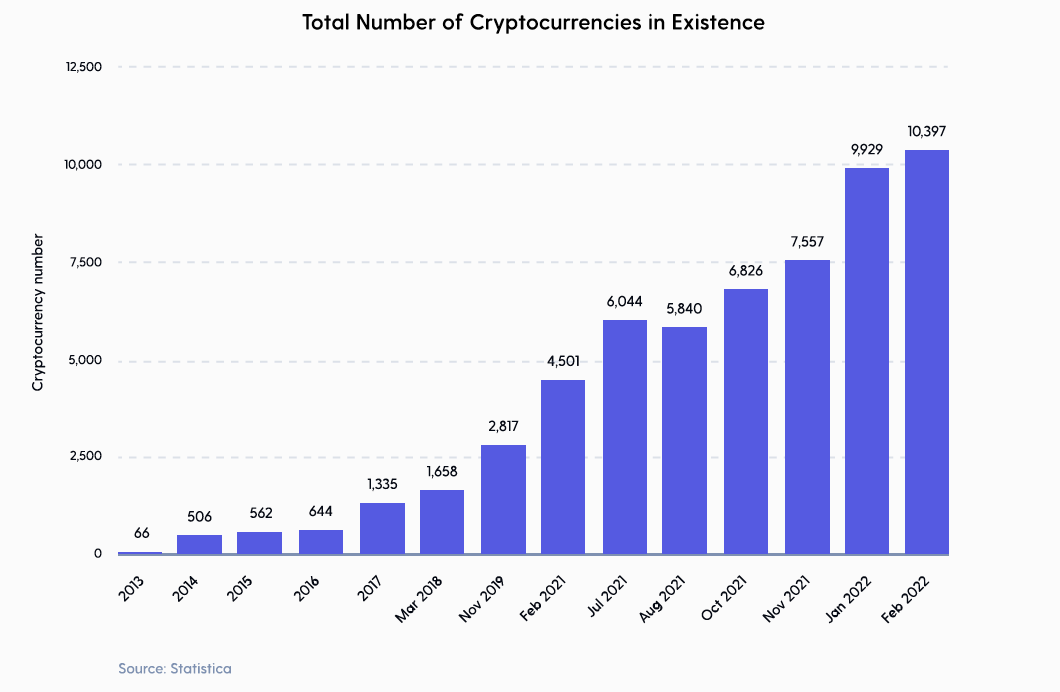

The total number of cryptocurrencies has skyrocketed over the last two years. Over the past year alone, the number of cryptocurrencies has doubled. There are now over 10,000 active cryptocurrencies in existence.

Most of these cryptocurrencies are classic examples of illiquid pump-and-dump schemes manipulated by insiders for short-term profits.

However, this is not the narrative retail investors will hear from popular cryptocurrency exchanges. A perfect example of this is Coinbase, the largest cryptocurrency exchange in the United States, with 98 million verified users.

Coinbase generates most of its revenue through trading fees, listing fees, and custodial fees. Because of this, Coinbase is incentivized to list more cryptocurrencies, promote speculative trading, and discourage self-custody. To put this into perspective, in 2017, Coinbase only listed 4 coins: Bitcoin, Bitcoin Cash, Litecoin, and Ethereum. Today, Coinbase has over 160 different cryptocurrencies available to trade in the US.

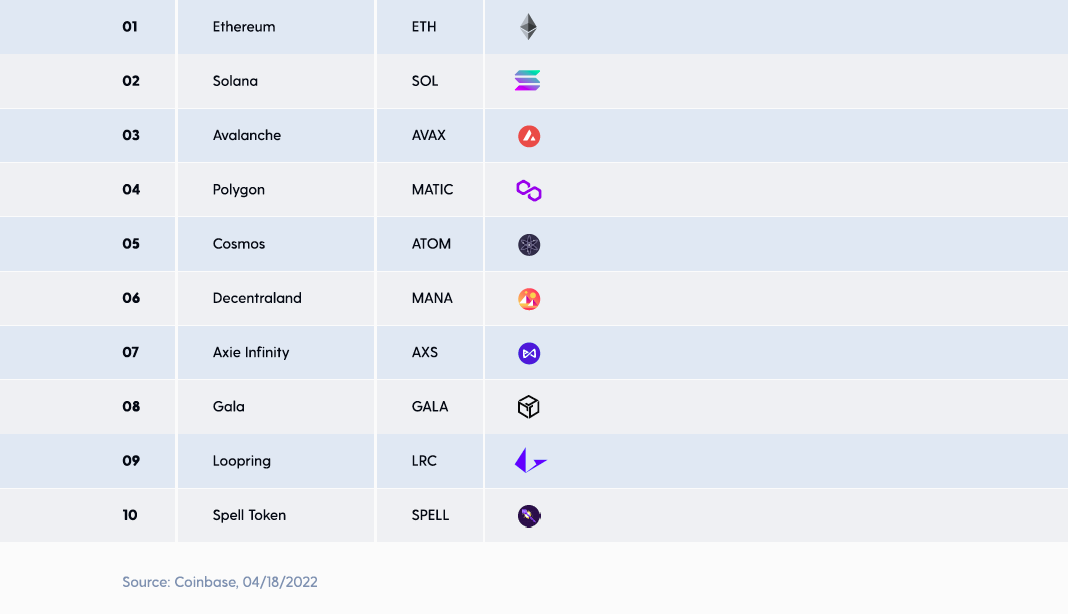

Despite the fact that the data clearly shows Bitcoin is the only long-term investable asset, Coinbase rarely speaks highly of it. For instance, on April 18th, 2022, Coinbase marketed its Top 10 cryptocurrency picks, and Bitcoin was not even included on that list!

Coinbase doesn’t make much money if everyone just buys and holds Bitcoin. But imagine being a newcomer and seeing this list of highly speculative cryptocurrencies as the “top picks” recommended by Coinbase.

It is rather questionable why Coinbase promotes these cryptocurrencies when a majority of them lose value against Bitcoin over longer time frames.

This Coinbase list inspired me to look closer into the data. I wanted to explore exactly how these cryptocurrencies performed against Bitcoin after they were listed by Coinbase and made available for retail investors to trade.

The results…even shocked me.

Before we dig into the performance of these cryptocurrencies, it’s important to understand the game at play here. When a new cryptocurrency is created, early investors typically make investments, a development team is formed, and a percentage of the coins are issued to these insiders at extremely low prices. This is easy to accomplish because there is zero cost to creating a new cryptocurrency.

This insider allocation usually occurs in the form of a “pre-mine.” This is an aptly named term to describe coins that are given to early investors and the team before the general public has the ability to mine or buy them.

Below you will see a graph of some popular cryptocurrencies and the percentage of their total supply that was allocated to insiders at their public launch dates.

After the launch, if the coin gains in popularity and is listed on a large exchange, the VCs and other insiders then have the opportunity to dump their holdings on retail traders who are sold on the narrative that the coin is “the next big thing”, “the next Bitcoin”, or is “better than Bitcoin.”

This strategy has been used under many different names over the years, such as ICOs, DeFi, and NFTs, but the outcome remains the same — the insiders get richer, and the outsiders lose their life savings. Proof of this is in the pudding.

Let’s dive into it.

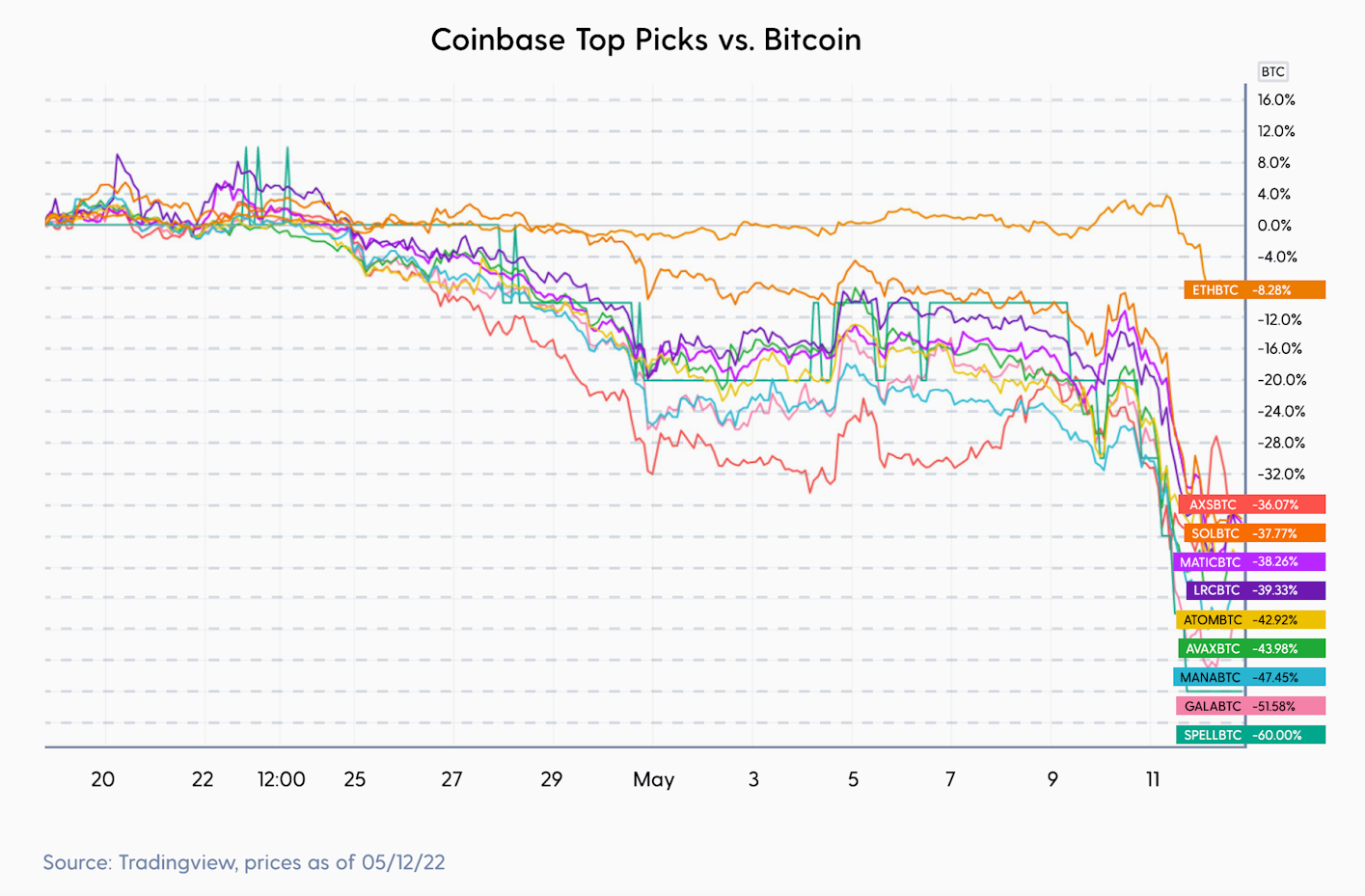

To begin with, let’s take a look at Coinbase’s recent “Top Picks” mentioned above and see how they have fared against Bitcoin since the recommendation was made.

Since Coinbase’s recommendation, every single cryptocurrency that was promoted to retail investors as “Top Picks” by Coinbase is down against Bitcoin, with an average drawdown of -40.6%.

To add insult to injury, Axie Infinity made it on this list nearly one month after it suffered a $625 million dollar hack. How could any honest and knowledgeable party recommend something so obviously insecure and flawed as a top cryptocurrency? Yet, Coinbase promoted it and other massively risky assets to retail investors that underperformed the safer bet, Bitcoin.

These retail investors would have been better off simply buying and holding Bitcoin. But Coinbase would have generated less fees, so…

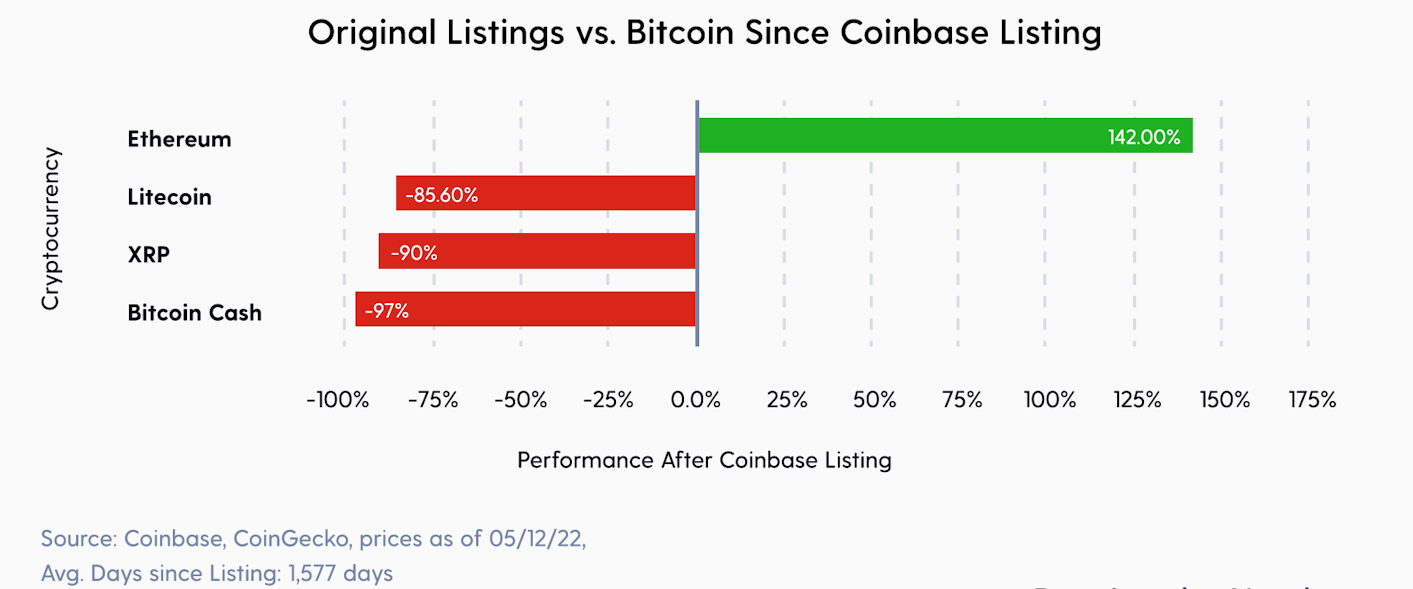

Next, let’s look at a couple of the older altcoin listings on Coinbase — Ethereum, Litecoin, XRP, and Bitcoin Cash.

Back when these coins were first listed, they were marketed as threats to Bitcoin. Rival cryptocurrencies that could one day unseat Bitcoin as the largest and most liquid digital assets.

Litecoin was marketed as a faster, cheaper Bitcoin and was described by many, including its non-anonymous founder who later sold all his Litecoin at the market peak, as the “silver to Bitcoin’s gold.”

Bitcoin Cash was a hard fork of Bitcoin that was supposed to make Bitcoin obsolete due to alleged superior traits that would allow it to scale better than Bitcoin.

XRP was promoted as a faster decentralized cryptocurrency with lower fees that would revolutionize the payments industry.

Ethereum was marketed as a “world computer” that would revolutionize the entire internet as we know it.

Here is how these cryptocurrencies performed after they were listed on Coinbase.

Those that were marketed as investments, Litecoin, XRP, and Bitcoin Cash, have each lost >80% of their value against Bitcoin since they were listed on Coinbase.

XRP was eventually delisted from Coinbase after the SEC charged Ripple and its co-founders with conducting a $1.3 billion dollar Unregistered Securities Offering. This was an unfortunate ending for all the Coinbase users who bought XRP for nearly two years on the platform. During that timeframe on Coinbase’s platform, XRP lost 90% of its value against Bitcoin.

Ethereum is the only older cryptocurrency that has outperformed Bitcoin since it was listed. However, it’s important to note that ETH was not marketed as an investment initially but rather as gas, or “digital oil”, that would power different things that could run on top of it. Demand for Ethereum was driven by the marketing for various use cases, all of which turned out to be disastrous in the end.

Let’s take a closer look at how these use cases that drove Ethereum’s demand have performed for investors against Bitcoin.

In 2017, the cryptocurrency market ballooned as Ethereum became a platform that allowed for the creation of countless Initial Coin Offerings (ICOs) which were marketed as great investments. At that time, ICOs were all the rage as investors were sold stories on how each token would revolutionize the [fill in the blank] industry.

Most of these tokens were able to raise obscene amounts of capital with only a white paper describing all of the wondrous things the team would build with the funds. Of course, many of these teams were more interested in pumping the price of the tokens they had created out of thin air rather than delivering on their promises.

These ICO teams marketed Bitcoin as old and slow technology to entice retail investors to buy their pre-mined tokens instead.

Despite most of these ICO coins having little to no liquidity or even working products, Coinbase listed them on their platform anyways. Coinbase looked past all of these red flags and instead saw this as an opportunity to collect listing fees and expand its product offering. Once the coins were listed on Coinbase and the early investor lock-up periods ended, these insiders had a large platform to dump their positions on unsuspecting mom-and-pop investors and walked away with massive profits.

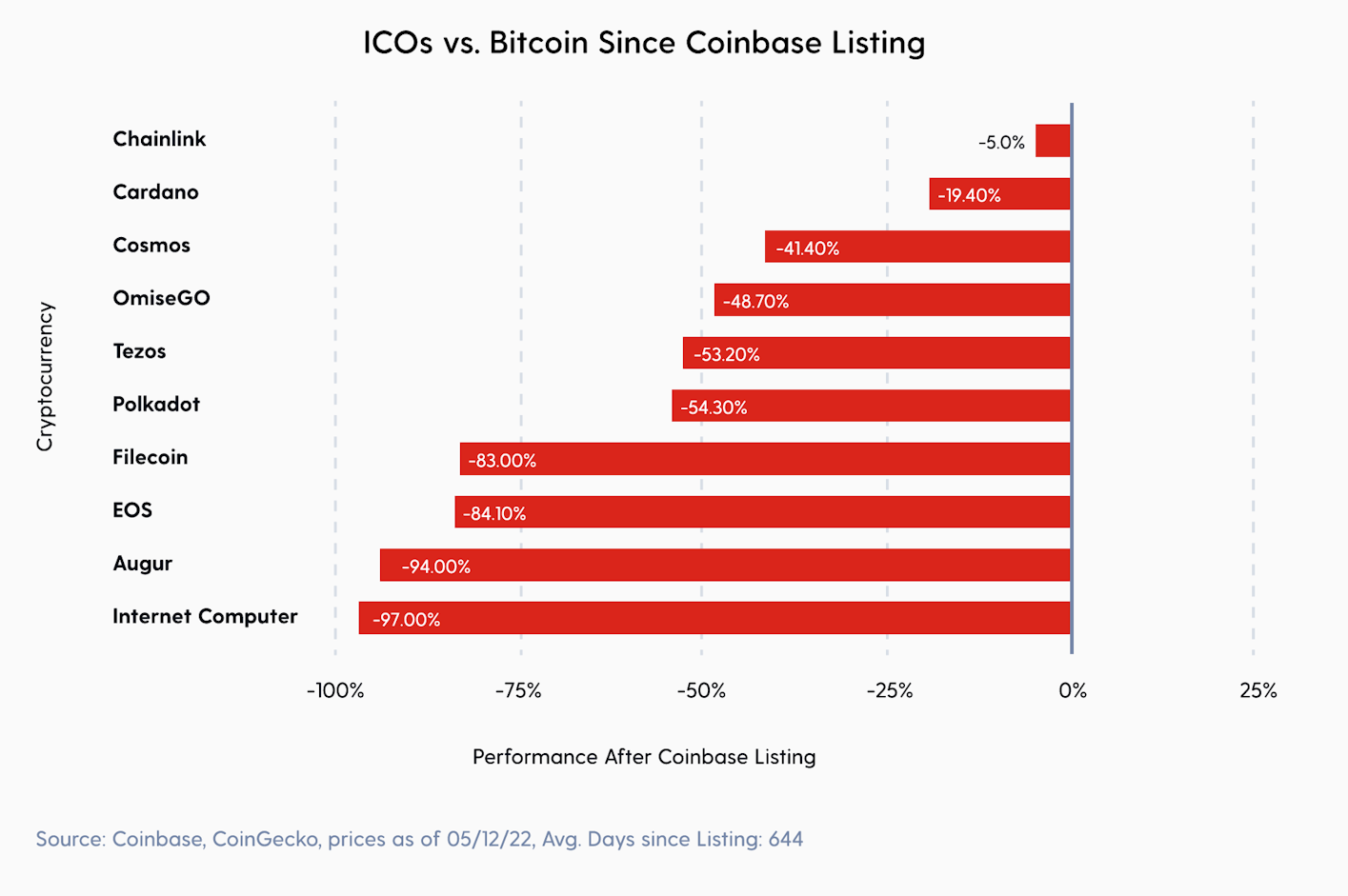

Let’s check back in on ten popular ICOs of that era and see how their performance has stacked up against Bitcoin after being listed on Coinbase.

As you can see, every single one of these ICOs have underperformed Bitcoin since they were listed on Coinbase. A majority of these hyped ICO tokens are deeply negative against Bitcoin, with an average drawdown of -58%.

This chart paints the picture of how retail investors were left holding the bags after they were told to buy these ICO tokens. Instead of buying the least risky cryptocurrency for long-term investing, Bitcoin, retail clients instead lost their money buying ICO tokens on Coinbase.

The more recent speculative wave to hit the broader cryptocurrency industry was that of Decentralized Finance, or “DeFi”. The stated goal of DeFi is to disintermediate several functions of the financial system through a combination of smart contracts and stablecoins, on top of public blockchains, like Ethereum (despite these having a host of their own security and scaling issues).

While many retail investors were sold the dream of open financial markets and massive APYs on yield-farming tokens, DeFi proved to be filled with risks. These risks have manifested themselves in many large hacks with substantial loss of funds, countless network crashes, along with a general downward price action since its peak in Q2 2021.

The most accurate description of DeFi probably came on a recent episode of the Odd Lots podcast from FTX CEO Sam Bankman-Fried, whose description of DeFi’s “yield farming” caused fellow guest, Bloomberg Opinion columnist Matt Levine, to respond with,

I think of myself as like a fairly cynical person. And that was so much more cynical than how I would’ve described farming. You’re just like, ‘Well, I’m in the Ponzi business and it’s pretty good.’

Matt Levine

Life was indeed good in the Ponzi business — for a while. But like all Ponzis, once the interest waned and the funds dried up, the bubble collapsed. Coinbase was quick to offer these tokens to the public despite the heightened operational, security, and regulatory risks that came with them.

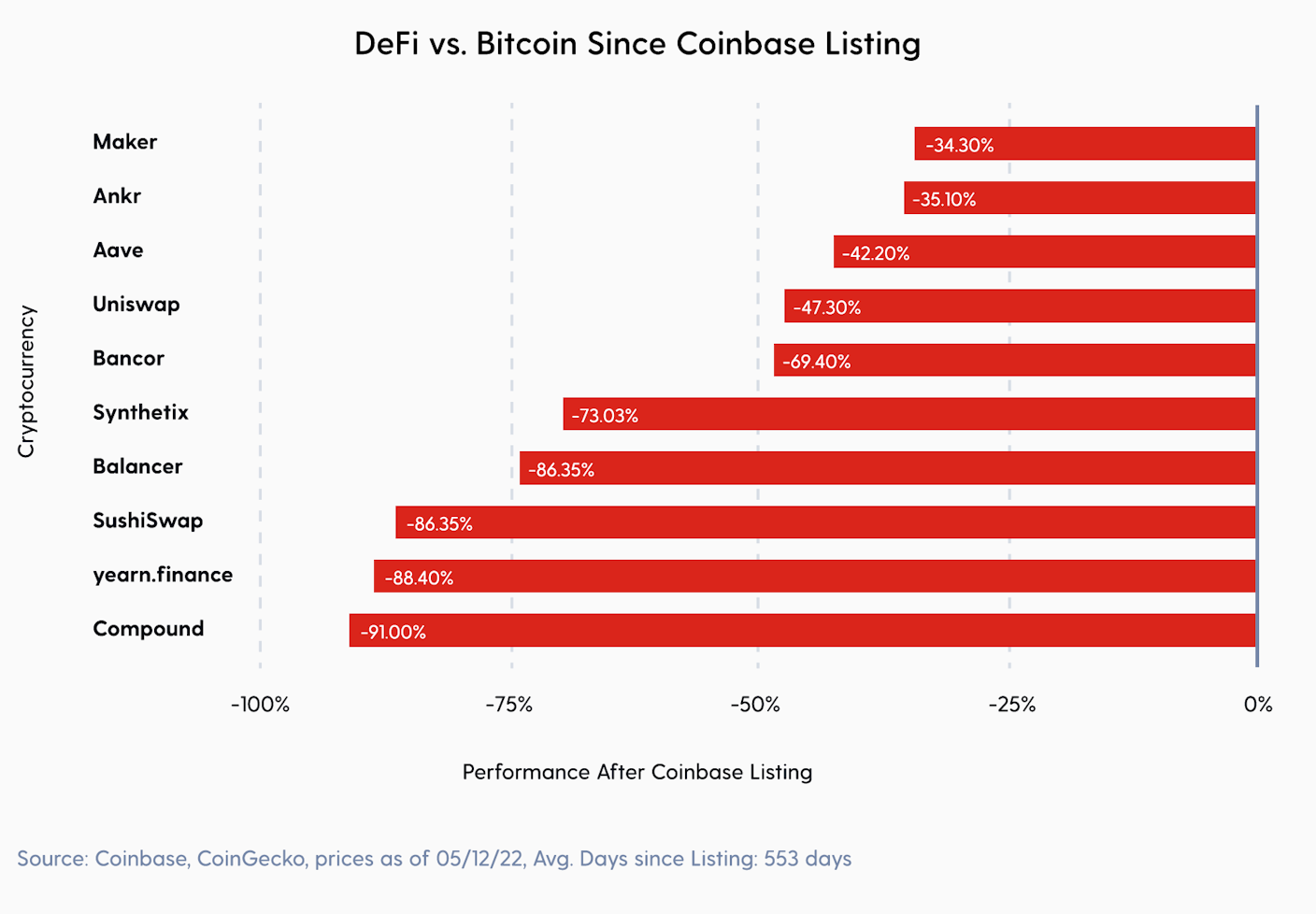

Since the date that each DeFi token was listed on Coinbase, not a single one of them has outperformed Bitcoin.

Since being listed on Coinbase, the average loss against Bitcoin for these DeFi tokens is -61.6%.

Just like the ICOs that came before them, these DeFi tokens only served to harm retail clients who were sold a narrative that these were the next big thing. Anyone who fell for Coinbase’s DeFi advertisements over the last couple of years is deeply underwater on their positions against Bitcoin.

When looking at the performance beyond the more popular cryptocurrencies that were closely associated with the various hype cycles built on Ethereum, it doesn’t get much better for any cryptocurrency not named Bitcoin.

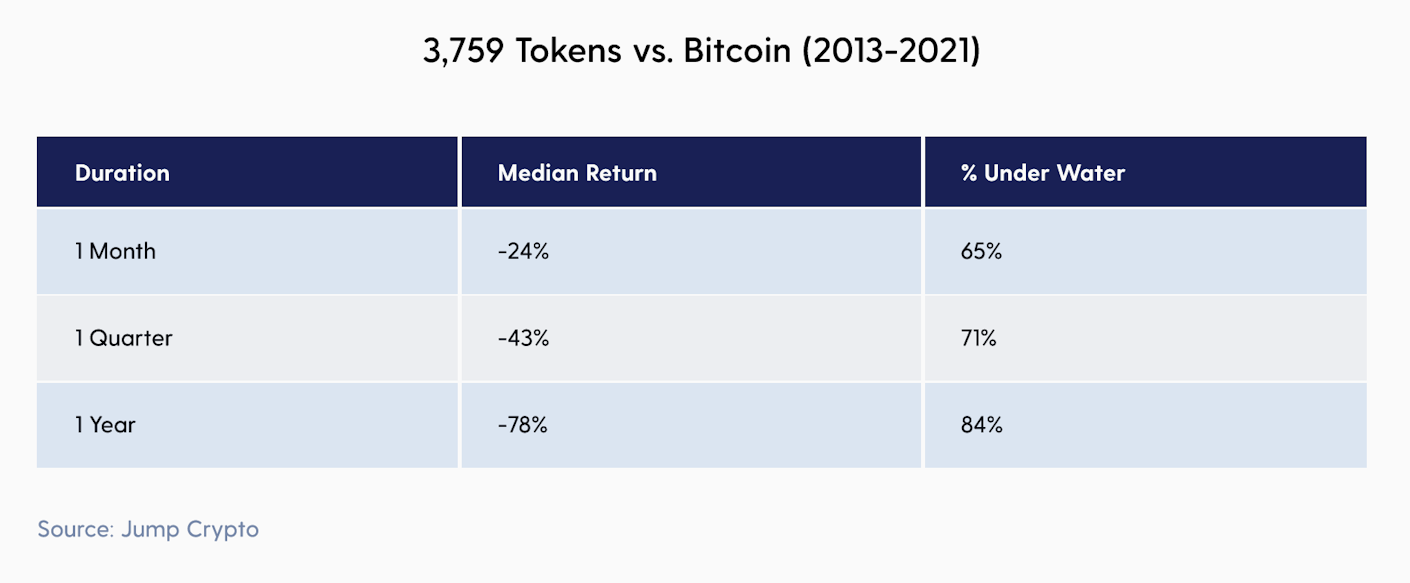

Jump Crypto recently performed a study that analyzed the performance of 3,759 tokens against Bitcoin over the eight years between 2013 and 2021.

The study concluded that 84% of the tokens analyzed were underwater against Bitcoin, with a median annual return of -78%.

This study shows that a large majority of these tokens lose value when denominated against Bitcoin and are more likely to lose value over long time periods. They are not suitable long-term investments compared to Bitcoin.

All of this data is evidence that Bitcoin and other cryptocurrencies should not be considered similar. Bitcoin has unique properties that allow it to hold its value over time. It is provably scarce, resistant to change, has no marketing budget, has no founders looking to exit, and thus can act as a quality inflation hedge within a portfolio. Every other cryptocurrency besides Bitcoin is better thought of as a digital penny stock. These digital penny stocks are full of operational, security, and regulatory risks that do not exist in Bitcoin.

If investors want to gamble on high-risk/high reward VC bets, they can go right ahead. It’s a free market. But they should understand that when an altcoin finally gets listed on Coinbase, a majority of the upside has already been made by insiders via backroom deals. As George Carlin famously said, “It’s a big club…and you ain’t in it!”

Ethereum is one of the older listings on Coinbase, and from its time of listing, it has actually outperformed Bitcoin. But the data above highlights how continued demand for Ethereum has been driven by its switching claims from being a platform for ICOs (which all underperformed Bitcoin), to DeFi (which nearly all underperformed Bitcoin), and then NFTs, which have seen devastatingly negative returns and scams.

In the beginning, Ethereum was never marketed as a long-term investment but rather was promoted as a utility token. Most ETH holders traded their holdings for other cryptocurrencies that were spawned on Ethereum during these various speculative crazes. If Ethereum is, in the end, merely a platform for retail investors to lose money on other digital assets, I would expect its demand and price to eventually go the way of all things that don’t produce any real value for the world.

It’s important to understand what you own and don’t own when it comes to Bitcoin and the rest of the broader crypto industry. It’s about time we separate Bitcoin from other cryptocurrencies and call out the irresponsible, questionable marketing and coin listing practices of Coinbase and other cryptocurrency exchanges like it.

In total, out of the 161 cryptocurrencies (excluding stablecoins) trading on Coinbase in the US today, the median performance against Bitcoin after their listing is -67.3%, with a median days since listing of 274 days.

What retail investors desperately need in today’s macroeconomic environment is a digital sound money that can’t be inflated or censored. They need to be saving in Bitcoin to preserve their wealth — not gambling on unregulated digital penny stocks using bucket shops like Coinbase.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?