Bitcoin’s Moment

Born from the ashes of the 2008 financial crisis, Bitcoin was is an engineered solution to the inherent flaws and vulnerabilities within centralized banking structures.

Like Prometheus stole fire from the Gods, Satoshi Nakamoto took the money monopoly power from central banks and restored it to the people.

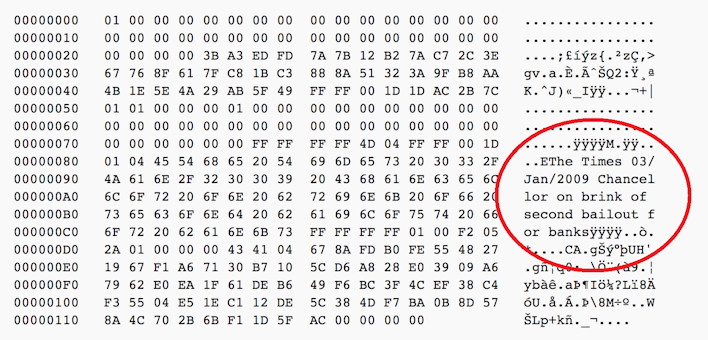

Embedded in the Genesis Bitcoin block was a message that read…

“The Times 03/Jan/2009, Chancellor on the brink of second bailout for banks.”

Fourteen years after Satoshi’s famous words, banks are once again being bailed out.

In case you missed it, we’re in the early stages of a global banking and debt crisis. In the last few weeks, we’ve seen Silvergate Bank, Silicon Valley Bank, Credit Suisse, and Signature Bank blow up. Many others got hit hard and remain vulnerable to rapidly changing banking conditions.

Investors are increasingly fearful about the potential for more bank failures in the near future due to several problems within the US regional banking sector.

Central banks had no choice but to “provide liquidity” (bail out the banks) once our highly indebted and leveraged banking system started breaking down.

The implementation of extraordinary measures by the Fed suggests both desperation and systemic fragility, further pushing investors to seek safe havens during these critical times.

While central banks and governments worldwide are scrambling to bail out failing banks, Bitcoin continues to operate flawlessly.

Not to mention, Bitcoin is up over 48% since this banking crisis came to light (March 10th).

“Nothing is more powerful than an idea whose time has come.”

- Victor Hugo

In a world with increasing uncertainty in the traditional financial system, investors will seek alternatives.

As ordinary people realize the money they put in the bank might not be there when they need it, they’ll start asking questions. Thankfully, Bitcoin is available to protect your wealth. It is immune to bank runs and carries no counterparty risk.

In these times of unprecedented money printing and soaring inflation, the Fed’s actions continue to debase the dollar which erodes your purchasing power. Meanwhile, Bitcoin has a fixed supply of 21 million units. No wonder Bitcoin adoption is growing exponentially.

Banks can easily de-platform their users. Bitcoin cannot de-platform its users, offering a level of security that banks cannot match.

Bitcoin is acting like a hedge against the existing fiat-based credit system (rather than consumer price inflation as some investors thought).

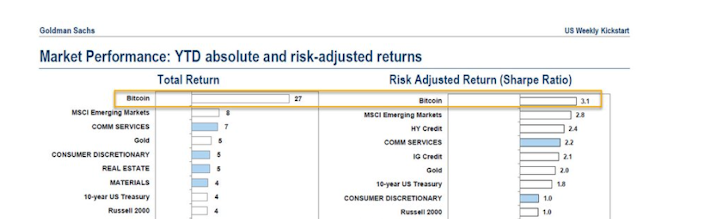

It’s no surprise Bitcoin has been the best-performing asset of the year in both absolute and risk-adjusted terms in 2023.

Recent conditions have even led tech billionaire Balaji Srinivasan to make a public bet that Bitcoin will hit $1 million within 90 days.

Although this outcome is highly improbable, Balaji’s “sound the alarm” actions reflect his concern about the banking system and his efforts to encourage people to transition to the Bitcoin life raft.

Additional reasons to be bullish:

Price action is driven by spot trading rather than derivatives

67.8% of all Bitcoin have not moved in over a year (long-term holders in control)

We’re seeing massive buying volume and a huge inflow of new clients this month at Swan

When traditional banks are failing, when Central Bankers are lost, and when the level of debt in the system is at an all-time high, it’s time to explore an alternative.

Enter Bitcoin.

Born out of the ashes of the 2008/2009 global financial crisis, Bitcoin was made for this moment.

And this current banking crisis will only accelerate Bitcoin’s exponential adoption.

In times of uncertainty, your wealth deserves a safe haven.

Even if you aren’t convinced Bitcoin will be the next global reserve currency, owning an asset outside traditional finance acts as a hedge against the rest of your portfolio.

Swan is your trusted partner as you navigate these challenging times.

As an individual, Swan makes it easy to protect your hard-earned wealth by converting your dollars into Bitcoin. The best approach for most people is to simply set up an automatic recurring Bitcoin savings plan. For example $50/week. Set it and forget it with Swan.

If you’re looking to buy larger amounts, Swan Private is our concierge service providing world-class experience, industry-leading research, and 24/7 access to your personal Bitcoin advisor and our team of experts. Request an introduction today.

As a business entity, Swan helps you sleep easy knowing your assets are safe during any banking crisis. Onboard your company, nonprofit, or trust in 1-2 days.

If you’re saving for retirement, consider adding Bitcoin to a Roth IRA, Traditional IRA, or old 401k with Swan IRA.

If you still don’t own Bitcoin, what are you waiting for? Sign up for Swan here and we’ll give you $10 in free BTC.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?