Bitcoin: Reuniting a Deeply Divided World

Bitcoin’s unchangeability is the fix we have needed for money throughout history.

Swan Private Insight Update #30

This report was originally sent to Swan Private clients on December 8th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

“Divide and conquer, ” goes one saying. It’s true. If a group is separated into fragments that are unable to cooperate or, worse, that fight with one another, those divided parts are easier to conquer. Those parts may even destroy one another, allowing their conqueror a victory without having to do the fighting himself. All that needs to be done is to sew and nurture the seeds of division.

When we look around at the world today, we see deep and growing divisions. Whether we look globally, nationally, locally, or most sadly, even within families, divisiveness and disagreement are everywhere. The division lines that have been drawn are not merely geographic; they are also demographic — age groups, races, genders, wealth or income levels, etc…; they are religious; they are of course political — left vs right and the like; and they are philosophical.

We have become a deeply divided civilization, fighting over so many things it is hard to even keep track of all of them.

What has led to this division? Are we spiraling toward divisions so great they will tear apart our civilization? Is uncivilized conduct-rudeness, ostracism, violence, and collapse in the direction our civilization is headed towards?

Few people truly want civilization itself to collapse. But many find themselves unable to come to an understanding with groups, they find themselves disagreeing with.

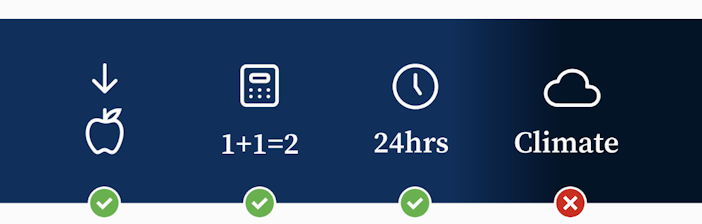

Somewhat ironically, it turns out the things we cannot agree on are the things we believe we can change. Conversely, the things we can’t change are the things we generally agree upon. We are not, for example, divided when it comes to the law of gravity. And there are no global debates on whether one plus one equals two. Nobody denies that days are 24 hours in length.

But as soon as we find ourselves in a realm where we think we might be able to change something, like the climate, for instance, we can fight over whether, in fact, we can, and whether we should, and over how much we should or should not.

It turns out that the power to change things is where division finds its foothold. The more important a thing is to us, and the easier it is to change, the more we find ourselves fighting over it.

Some of the foundational systems of our civilization have been suffering from precisely this ailment. They seem to have devolved away from their primary purposes and into institutions whose incentives foster division.

Consider politics. Politicians seeking to be elected must differentiate themselves from their political opponents. They have come to do so by choosing polarizing platform issues that divide the population along demographic, political, and philosophical lines.

Major media outlets, too, have abandoned neutrality and objectivity. They profit from increased engagement. They know that engagement with their content rises dramatically when there is a dramatic conflict to cover.

Thus, finding and then sensationalizing situations and fanning the flames of division rewards them with that increased engagement. In fact, today’s media environment has been called “the engagement economy.” It is principally characterized by this phenomenon of doing whatever it takes to drive and maintain user engagement, often through radicalized (and untrue) content.

Having differences of opinion is not itself the problem. Instead, it is the belief that we cannot “live and let live” that causes one side of a division to view the other side’s behavior as intolerable.

Yet, if we keep drawing more and more lines of division that make us fear, hate, exclude, mistrust, and separate ourselves from one another, our civilization will continue to fracture and quite possibly collapse.

Is there hope?

Can we heal the wounds of division and reunite groups that have been separated. Can we tolerate our differences of opinion or find peaceful ways to resolve them?

It turns out that throughout history, money has been a great uniter.

The peaceful trade of goods and services, using a shared money between separate groups, whether they were tribes, nations, or religions, united them under a common economy. Money allowed previously separated groups access to the results of each other’s productive efforts, not through conquest or looting, and without resorting to the use of violence.

Rather, money allowed for trade, legendary trade routes, like the Silk Road, the Phoenician Trade Routes, the Spice Routes, or, more recently, the global economy, enriched all those who were united by these trade arrangements (albeit some more than others). And all these routes, regardless of the main products they routed, required money to allow for the peaceful flow of goods.

Money unites precisely because it ignores all the criteria upon which divisiveness exists. After all, money doesn’t ask what your political leaning is, or how old you are, or even what your income is. It doesn’t ask what tribe you belong to or what religion you practice. This is true, at least, of proper, unadulterated money.

We currently live in a world where money has lost its uniting power. It has become a political instrument used to win elections and maintain power. Why has this happened?

It is because what we use for money is subject to all kinds of changes within human control. We can change its supply, its price (aka interest rates), who gets to issue it, to whom it gets issued, what its permitted uses are, and more. And, as we’ve already noted, the ability to change a thing is what leads to divisiveness.

Sadly, then, money, the most powerful unifying invention of humankind, has become a tool of divisiveness.

Fiat money is operating at a cross purpose to money’s most important purpose — uniting us. Yes, money must be a store of value, a medium of exchange, and a unit of account. But more importantly, to do any of these things, money must be a reliable agreement between its users that it will be capable of fulfilling these purposes. And if that agreement can easily be broken, then it is not worth the paper it is printed on.

Money is an agreement. Note both meanings of the word “agreement.” One definition is something we informally agree upon — “We are in agreement.” The other is a formal contract — “an agreement.” Money straddles both these definitions, but the more informal it is, the less reliable it is. And money is an agreement between all its users — all participants in an economy. The less formal it is, the more vulnerable it is to breakdown.

If money keeps changing, then what we are supposed to be in agreement about keeps changing. And how are we to stay in agreement when the agreement keeps changing?

It’s simply not possible. This is made even worse if we are not consulted about the changes, are not informed of them, and do not agree with them.

Do you agree with every change made to the rules of money under the central banking fiat system? Are you consulted, informed about, and asked to agree to them? No.

So is it any wonder that money, whose rules can be changed, has become yet another thing whose changes are constantly fought over, causing more divisiveness?

Not really. This is the inevitable fate of soft (aka malleable) money. And whether we consider ancient history or current events, the later into the life of a soft money we get, the more the battle to control and change the money overtakes real, productive activity in the economy.

What if we couldn’t control the rules of the money? What if money were an iron-clad agreement that nobody had any ability to change? No election, no party, no bureaucrat, no king, no emperor, no supreme leader — Nobody. What if it couldn’t be debased or printed to hand out to people in power or to the people whose votes those in power needed to stay in power?

During humanity’s greatest periods, this was what money was. Most notably, we can look back at times when gold or silver (or even black pepper in the times of the spice routes) was money. During those times, civilization grew. Peaceful trade grew. Productivity grew. Wealth grew.

Money’s purpose is to unite people in peaceful exchanges — to provide a way for them to trade even if they otherwise have nothing in common besides the desire to trade. They may not even speak the same language, so money is an agreement that must transcend the languages they speak.

That is why, throughout history, good money took the form of tokens of verifiable and scarce commodities like gold, silver, and black pepper. Money must, in a sense, be its own language, albeit a language that is constrained to expressing the ideas that money encompasses. (e.g., you don’t need to write a poem about love using the language of money.)

But money, to do its job, must be an agreement that will not be broken or defaulted upon. It must be an agreement that can unify its users across not only time and space but also across religion, political leaning, philosophy, or any other dimension upon which disagreement is possible.

This is precisely what Bitcoin is.

We are very early into our journey through time with Bitcoin — a system of money that we cannot change. Its greatest strength turns out to be its unchangeable nature.

Even the most powerful people and institutions cannot change it.

Think about it. Any of Bitcoin’s other features, like the supply cap, wouldn’t be valuable if they could be changed! There’s nothing magical about a 21 million coin supply cap. Any number could have done just as well. What’s remarkable is that nobody can change it to any other number.

Underpinning the supply cap and all of Bitcoin’s other features is the reliable promise that they won’t be changed! What makes this promise reliable? Is there some politician or emperor who says, “Trust me”?

No. What makes it reliable is each participant’s ability to enforce the rules that guarantee each feature by simply running a Bitcoin node.

This is why, by the way, making it possible for as many people as possible to run a node is also the most important practical consideration in the ongoing progress of Bitcoin’s development. If it became impractical to run a Bitcoin node, it would be impossible to prevent changes to the rules, and Bitcoin would then become changeable by the few who could run a node, which would lower it to the status of all other monies that came before it that found themselves captured or corrupted, leading to a breakdown of the unity that good money creates — a breakdown otherwise known as divisiveness, collapse, and war.

Even in these early days of Bitcoin, we see signs of Bitcoin’s ability to unite and reunite us. We see it on many levels.

One early meme in the Bitcoin community was “Bitcoin doesn’t care.” Bitcoin doesn’t care if you’re black or white, or neither; male or female, or neither; capitalist or socialist, or neither. It treats everyone the same. You get no advantage, no special treatment, or impairment from any distinction you hold. Bitcoiners want Bitcoin. They want more people, regardless of geography, ethnography, and philosophy, to value, use, and accept Bitcoin. It is a hugely welcoming and inclusive philosophy.

is another popular saying.

Can the gradual (or sudden) acceptance of Bitcoin as money heal the divisions that are driving our world apart, or is such talk merely the fanciful dream of idealistic Bitcoiners with misplaced hopes? Or, even worse, are some people pushing false and unrealistic hopes in an effort to enrich themselves in the short term at the expense of others?

Well, let’s not kid ourselves. There are many people who are drawn to Bitcoin in the first instance because it sounds like a way to get rich personally and rather quickly.

Bitcoin has a price, and that price has gone up more than the price of anything else in the past dozen years. There are good reasons to think it will continue to rise quickly.

But why is it that the price is expected to rise, though?

The root reason for Bitcoin’s growing adoption among more people, institutions, and nations is precisely because of the inability of powerful people to hijack it, control it, or inflate it. As Bitcoin grows, it becomes an agreement between these individuals, institutions, and nations — an agreement that none of these participants can unilaterally change, and thus one where it is futile to waste one’s energy trying to change it. Rather, participants use their energy to earn Bitcoin — and this is done by creating value so that those with Bitcoin will exchange it, peacefully and nonviolently, for the value others create.

All around us, we see the damage caused by broken money: divisiveness, depression, war, injustice, and more. Bitcoin won’t directly fix everything, but this inability to be altered will gradually (and perhaps at some point suddenly) draw ever more people towards it so they can deal with each other with the reliable, unbreakable promises it makes and keeps, leading to those people being able to live in lasting peace — and this may then fix a lot of what else is wrong in the world today.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Tomer Strolight is Editor-in-Chief at Swan Bitcoin. He completed bachelors and masters degrees at Toronto’s Schulich School of Business. Tomer spent 25 years operating businesses in digital media and private equity before turning his attention full time to Bitcoin. Tomer wrote the book “Why Bitcoin?” a collection of 27 short articles each explaining a different facet of this revolutionary new monetary system. Tomer also wrote and narrated the short film “Bitcoin Is Generational Wealth”. He has appeared on many Bitcoin podcasts including What Bitcoin Did, The Stephan Livera Podcast, Bitcoin Rapid Fire, Twice Bitten, the Bitcoin Matrix and many more.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?