Bitcoin’s Real Energy Expenditure: A Comparative Analysis

We must compare Bitcoin’s enivronmental and socio-economic impacts to the financical systems it aims to replace.

As Bitcoin continues to grow in market capitalization and energy expenditure, it has been the cause of criticism. A common argument is that the mining network uses more energy than some small countries.

The problem with that statement is that it fails to dive deeper into the critical analysis required to fully understand Bitcoin’s energy consumption.

Nuances need to be explored, such as: What is the source of that energy?

Is it environmentally harmful to mine Bitcoin (like gold mining)?

Is that energy consumption a sum zero to the energy already being wasted?

What utility does Bitcoin provide to society?

It is a financial instrument that can be sent internationally between different parties, can be memorized and brought anywhere in the world, and can be stored offline with no counterparty.

Just 13 years into existence, it is the most portable, verifiable, censorship resistant and divisible asset in the world. But perhaps most importantly, it is the most scarce.

We’ve all seen the headlines recently in attempts to cancel and silence anyone that goes against the media narrative. De-platforming, doxxing, and many other strategies have become the norm.

Do we expect it to stop there?

What happens if the government moves forward with Central Bank Digital Currencies? They’ll be able to turn off your account or freeze your money.

Bitcoin is in the full custody of the owner, assuming they keep it in the appropriate storage and maintain their own private keys. Nobody can ever take it from you.

We’re living in an age of soaring inflation. Over 40% of the total fiat money supply has been created out of thin air in the last couple of years. This was decided by a handful of politicians without input from the people who will feel the most significant effect of these policies.

While that has benefited those holding assets like real estate and stocks, it has absolutely crushed those without. Meanwhile, wages are stagnant, and the cost of goods has also soared. If fiat currencies continue as our primary store of value and monetary system, we are heading toward the same inevitability that has plagued the citizens of Venezuela, El Salvador, and Zimbabwe (to name a few).

Bitcoin has a fixed supply of 21M. There will never be any more. It is essentially wealth creation and preservation that is 100% in the custody of the owner.

Seizing assets is a time-honored tradition throughout human history.

Whether it be through property taxation, real estate seizures, or the 1933 forced forfeiture of all personally held gold under penalty of imprisonment.

God forbid your country is invaded, overthrown, or any other number of possibilities…

Do you really think your real estate holdings or 401k would be safe?

Since it is impossible for anyone to seize your Bitcoin without access to your private keys (which can be memorized), it is the only asset class that gives you 100% protection from being confiscated.

Now let’s dive into the energy conversation…

It is conservatively estimated that as much as 74.1% of all Bitcoin mining is produced from renewable energy.

Critics have said that using renewable energy to power Bitcoin mining means it won’t be available to power a home, a factory, or an electric car.

However, the renewable energy that Bitcoin miners utilize is typically linked to the excess energy output from these sources. For example, in West Texas, miners buy excess wind and solar energy from providers when energy is abundant. In so doing, the miners monetize a renewable asset that would otherwise be wasted while maintaining generally high uptime.

The same is true in the recent surge in flair gas energy usage. Miners are continuing to adapt in search of more inexpensive output.

To take it further, nuclear plants are being decommissioned around the world due to their difficulty in remaining profitable in comparison to substations and traditional power grids. What if energy companies harness this untapped resource of wasted energy to power a massive adoption of Bitcoin mining infrastructure?

All of this lends credence to the hypothesis that Bitcoin is galvanizing the use of renewable energy.

Now imagine governments wish to tame inflation in the future without plunging the world into a massive recession. They can’t raise rates to do so, like they did in the 1980s, because most of the world would default on their massive low-interest loans. They will need to choose a new system to back their money. Destroy the economy or destroy fiat currency. That is the question they are currently faced with today.

With its huge renewable energy foundation, Bitcoin will be too good to pass up.

When asking this question, it is important to not put it in a vacuum. While there is still room for improvement on the 26% non-renewable Bitcoin mining sources, the expectation is that this will continue. Conversely, we must compare Bitcoin’s environment impact to its alternatives:

Based on a 2014 study, gold production expends roughly 132 terawatt-hours of energy per year. Compare that to Bitcoin’s 105 terawatt-hours as of 2021. These are fairly similar in energy output. However, the large difference to be seen is just below the surface (no pun intended).

Gold mining activities lead to the generation of large quantities of heavy metal-laden wastes, which cause widespread contamination of the surrounding ecosystem.

Modern industrial gold mining destroys landscapes and creates huge amounts of toxic waste. Due to the use of dirty practices such as open pit mining and cyanide heap leaching, mining companies generate about 20 tons of toxic waste for every 0.333-ounce gold ring. The waste, usually a gray liquid sludge, is laden with deadly cyanide and toxic heavy metals.

Gold doesn’t even come close to competing with Bitcoin in its preservation of the environment or the energy required to create it.

As the world is hungry for more wealth, gold miners are beginning to look to the sea bed and oceans to begin large-scale mining. How do we expect this to turn out, based on the damage already done with land mining?

Answer: Not good.

As Vijay Boyapati pointed out in his article, The Bullish Case of Bitcoin, it is not just the financial systems that must be accounted for, but everything that is needed to uphold it. That is the measure of the true environmental impact of today’s fiat monetary systems.

On the surface, there are people, buildings, banks, computers, and commuting systems to consider. But what backs fiat systems since it came off the gold standard?

Bitcoin has Proof of Work. Fiat currency has politics and the military.

Make no mistake, without the military and the political strength of the nation, there is no way the world accepts the dollar as the world currency.

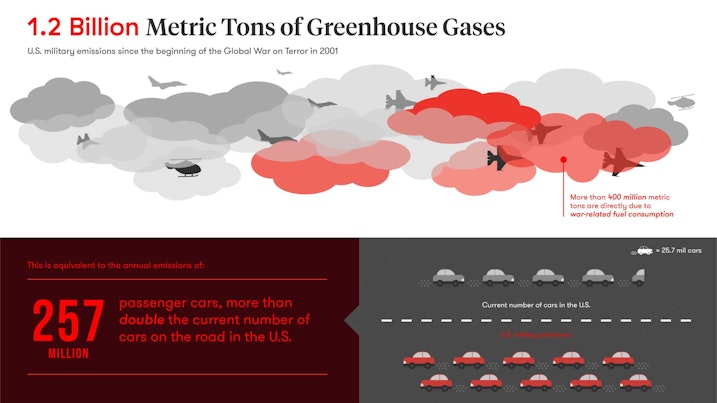

What is the environmental impact of war, planes, carriers, tanks, the gasoline to power them, the steel created to build them, and the millions of service men and women? It’s almost immeasurable.

Bitcoin is housed in data centers spread around the world, typically going where the most available excess renewable energy can be used. All you need is an internet connection, and no military in the world can confiscate it because it is decentralized.

We as responsible investors must look beyond the surface of energy expenditure. Look at how Bitcoin’s energy is created, and the impact trail it leaves behind.

We must compare Bitcoin’s environmental and socio-economic impacts to the financial systems it aims to replace.

We must look at who the current system aims to enrich, and how Bitcoin aims to fix that.

It goes far beyond the surface. And once you understand those impacts, you realize there is only one true solution: buy, hold, dollar-cost-average as much as you can, and leave the world a better place for future generations of your family.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Nick Payton is the Director of Marketing at Swan Bitcoin. He has operated his own consulting agency for over 10 years with a focus on digital campaigns for Fortune 500 companies. Nick’s analysis is shared across social media and native content on Swan.com. He is focused on educating people on the benefits of adopting Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?