2030 & 2040 Bitcoin Price Predictions (Insights From Top Experts)

Max Keiser predicts Bitcoin to be worth $200K in 2024. Fidelity Investments predicts one Bitcoin to be worth $1B in 2038, Hal Finney predicted $22M per Bitcoin in 2045. Let’s look into these in detail…

Disclaimer: The Bitcoin price predictions below do not necessarily reflect the views of Swan Bitcoin.

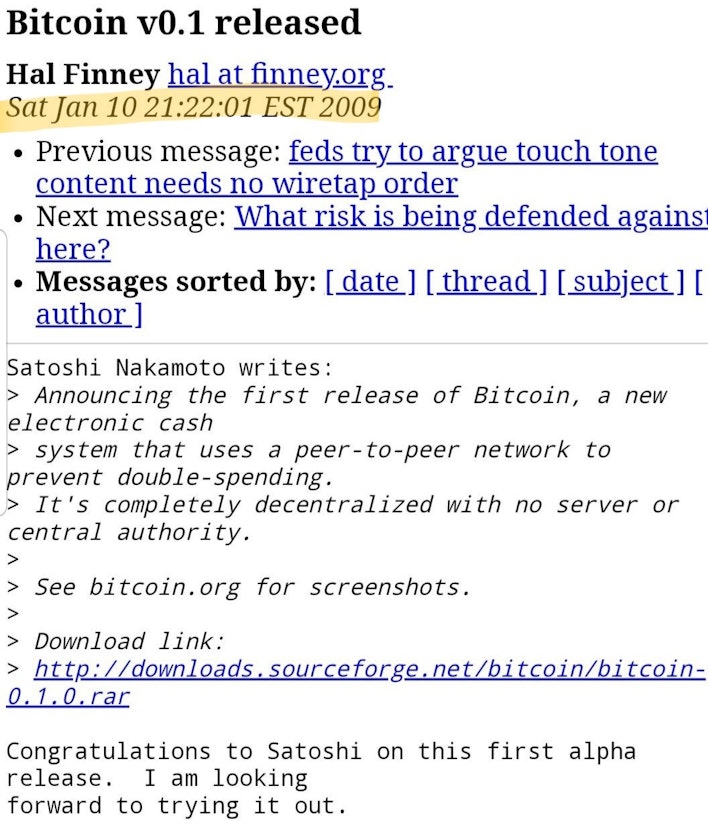

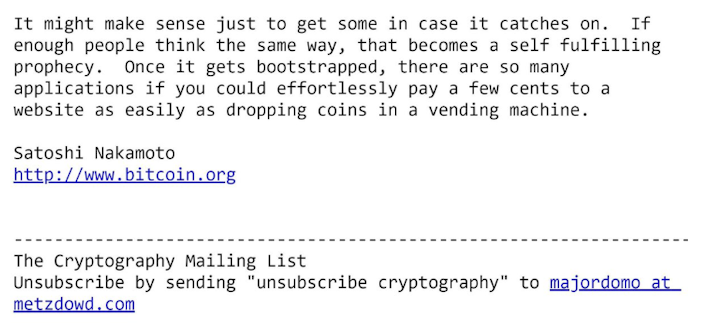

Back in 2009 when Bitcoin was first released, visionary cryptographer and Bitcoin pioneer Hal Finney boldly predicted that each Bitcoin could one day reach a staggering $10 million in value. Take a look at the screenshot below of Hal’s comment on January 10, 2009.

This article examines a range of factors that could forecast the price of Bitcoin in 2030 and 2040 by examining the historical trends to gain deeper insights to assess potential scenarios for Bitcoin’s future valuation.

As of February 22, 2024, here are the latest Bitcoin Predictions by top experts, banks and institutions in the field:

Max Keiser Predicts $200K per 1 BTC by end of 2024

Hal Finney: $22M per 1 BTC by 2045

Fidelity Investments: $1B per 1 BTC by 2038

Chamath Palihapitiya Predicts $1M per 1 BTC by 2040

Hal Finney’s prediction was not based on mere speculation but rather on a thoughtful analysis of Bitcoin’s potential as a global payment system.

He envisioned a scenario where the collective value of Bitcoin would align with the total wealth of the world, which he estimated to be within the range of $100 trillion to $300 trillion dollars at the time.

By dividing this value among the limited supply of 21 million Bitcoin, Finney’s calculation resulted in an astonishing value of $22,074,619 per Bitcoin.

This prediction may have seemed highly speculative or even absurd to a casual observer at the time. However, many people today share Hal’s opinion about Bitcoin’s price potential.

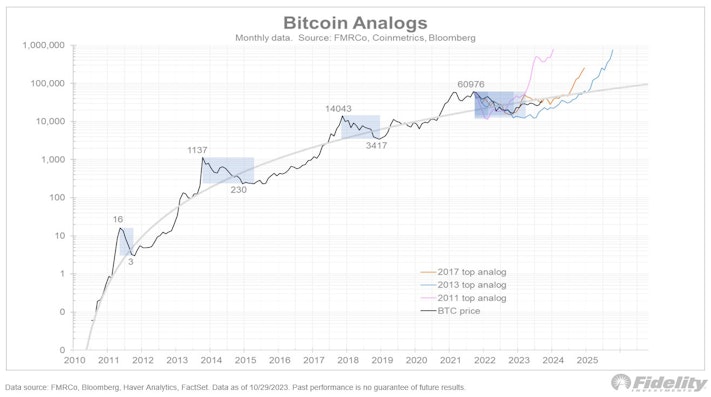

Fidelity has been closely monitoring the development of Bitcoin more than most TradFi institutions. Jurrien Timmer, the Director of Global Macro at Fidelity Investments, thinks the value of a single Bitcoin could reach $1 billion by the year 2038 — 2040.

Chamath Palihapitiya, a prominent venture capitalist and early Bitcoin investor, has made significant waves in the crypto community with his bold predictions. Palihapitiya’s views on the future of Bitcoin offer a captivating glimpse into the potential growth and adoption of this digital asset.

Max Keiser Predicts $200K By End of 2024

Max Keiser, a seasoned financial broadcaster and Bitcoin advocate has long been known for his outspoken and sometimes controversial predictions. Keiser’s unique insights into Bitcoin’s price movements and broader global economic implications provide a thought-provoking perspective.

We’ll keep a close eye on this prediction over the course of 2024.

Jurrien Timmer, the Director of Global Macro at Fidelity Investments, thinks the value of a single Bitcoin could reach $1 billion by the year 2038 — very close to our Bitcoin price prediction 2040 target date.

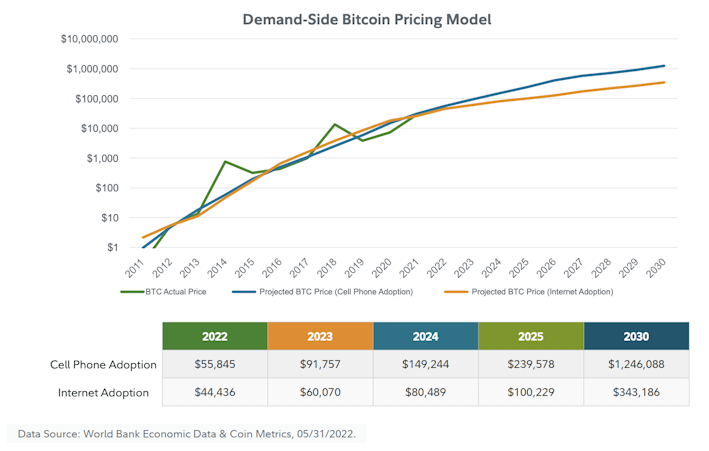

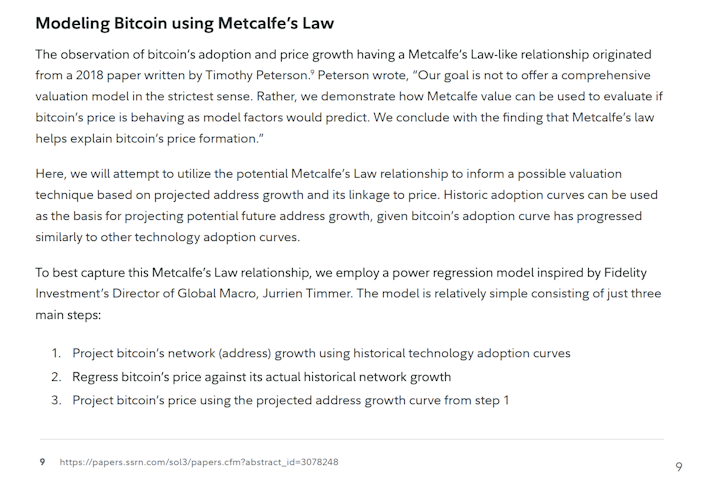

Timmer’s demand model is rooted in Metcalfe’s Law. It claims the value of Bitcoin will grow steadily to about $1 million per full Bitcoin by 2030. A network like Bitcoin comprises a set of nodes that form connections with one another and follow a protocol, a group of rules.

World Bank and Coin Metrics

Metcalfe’s Law states the value of a network is proportional to the square of the number of nodes, or members, in the network. When applying Metcalfe’s Law to protocols, the first protocol to get to this ‘critical mass crossover point’ begins to develop a supermajority feedback network effect.

Jurrien further broke down his reasoning on Twitter.

According to Fidelity, 90% of its largest clients have expressed interest in purchasing Bitcoin and other cryptocurrencies. To cater to the needs of large institutional clients, Fidelity establixshed Fidelity Digital Assets, focusing on developing Bitcoin custody solutions.

In June of 2022, Fidelity Digital Assets division released a price modeling document titled: Valuing Bitcoin — Modeling the Price of Bitcoin as a Monetary Asset Through Market Forces.

Coin Metrics

The following month, in July, Fidelity invested $20 million to acquire a 7.4% stake in Marathon Digital Holdings, a major crypto-mining company based in North America.

UPDATE: The SEC approved a Spot Bitcoin ETF on January 10th, 2024 including Fidelity’s own Bitcoin ETF, Wise Origin Bitcoin Trust.

According to the most recent data compiled by Bloomberg, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) are at the forefront, attracting approximately $1.9 billion and $1.6 billion in investments.

Bitcoin has the largest cryptocurrency user base and network. As institutions like Fidelity help onboard its clients into the Bitcoin network, its value increases exponentially, attracting more users and reinforcing its position as the top digital asset.

On November 1st, Timmer revisited his 2020 thesis in a Twitter thread.

In January 2022, Fidelity outlined Bitcoin’s unique characteristics, why they make Bitcoin fundamentally different from other digital assets, and why this is important for investors to consider.

In October 2023, they released a report titled: Bitcoin First Revisited: about why investors need to consider Bitcoin separately from other digital assets. In it, they double down on why Bitcoin is unique from all other digital assets and belongs in its own category.

Palihapitiya sees Bitcoin as a digital asset with unique properties, positioning it well as a potential global reserve currency. He argues that Bitcoin’s decentralized and borderless nature, scarcity, and inherent security features make it an ideal store of value.

In January 2021, Chamath told CNBC:

“The reason is because, every time you see all of this stuff happening, it just reminds you that wow, our leaders are not as trustworthy and reliable as they used to be… [s]o just in case, we really do need to have some kind of, you know, insurance we can keep under our pillow that gives us some access to an uncorrelated hedge.”

CNBC: Bitcoin going to $100K, then $150K, then $200K says Palihapitiya

As geopolitical uncertainties and concerns about traditional fiat currencies persist, Palihapitiya believes people like Warren Buffet are wrong and that Bitcoin could emerge as a trusted alternative and a reserve currency for nations and corporate balance sheets worldwide.

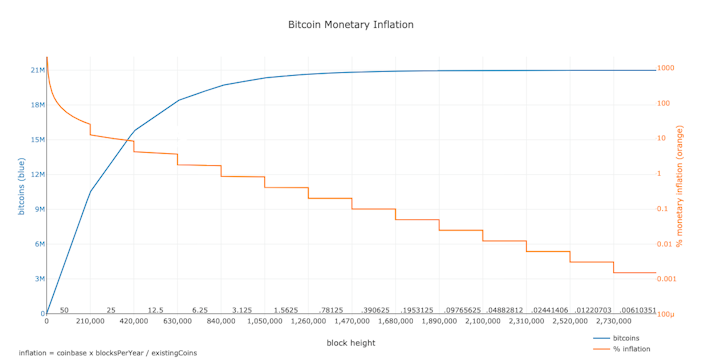

Bitcoin’s limited supply is a crucial factor in Palihapitiya’s prediction. With a maximum supply of 21 million coins, Bitcoin is designed to be deflationary, meaning its scarcity increases over time. Palihapitiya believes this scarcity, combined with increasing global adoption, will drive demand and result in significant price appreciation over the long term.

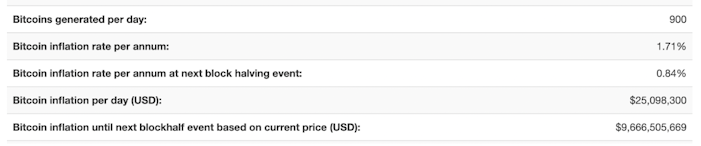

In December 2020, JPMorgan publicly stated that it forecasts that gold will likely suffer directly from Bitcoin for years. The inflation rate on the Bitcoin network is already less than 2%.

In 2021, just before Bitcoin’s all-time-high peak, Chamath said Bitcoin had “effectively replaced gold.” In June 2022, authorities in Uganda revealed a significant find of around 31 million metric tonnes of gold ore within the nation.

This discovery could yield 320,158 metric tonnes of purified gold, with an approximate valuation of $12 trillion - represents more than the entire amount of gold above ground and accounted for in total supply.

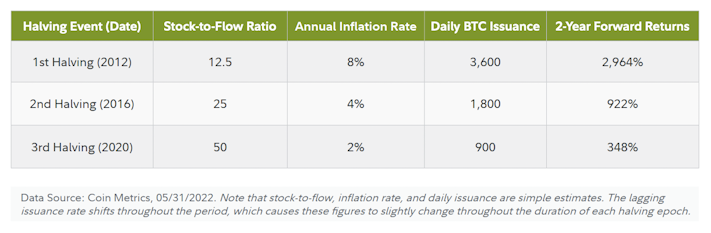

As this gold is recovered, it will begin to dilute the scarcity properties of the metal significantly. Bitcoin was engineered to be deflationary over time. The next block-halving event (which should occur in April 2024) changes Bitcoin’s inflation rate to only 0.84%. This monetary policy makes for an ideal store of value over long periods.

Palihapitiya emphasizes the growing interest and adoption of Bitcoin by institutional investors. The involvement of major financial institutions, such as Tesla, MicroStrategy, and PayPal, has contributed to Bitcoin’s legitimacy as an investment asset.

As more businesses, institutions, and family office-type investors recognize Bitcoin’s potential as a hedge against the legacy banking system and a diversification tool, Palihapitiya expects increased capital inflows and further price appreciation.

He also maintains the Bitcoin network’s continuous development, scalability improvements, and enhanced privacy features will contribute to its widespread adoption and further bolster its value proposition.

Palihapitiya’s Bitcoin price prediction spans 20 years, emphasizing the long-term nature of his outlook.

He doesn’t believe the U.S. dollar will lose its reserve currency status anytime soon and acknowledges Bitcoin’s path to becoming a global reserve currency will likely face numerous challenges and regulatory hurdles.

However, Palihapitiya remains optimistic about its potential to disrupt traditional financial systems and that Bitcoin could achieve significant value appreciation over two decades.

Keiser believes that the global economic landscape, marked by excessive debt levels, currency devaluation, and geopolitical uncertainties, creates a favorable environment for Bitcoin.

He argues that traditional fiat currencies are prone to inflationary pressures and can be subject to political manipulation and is very outspoken in his belief we are at the 300-year end-game for the central banking ponzi scam.

In contrast, Bitcoin’s decentralized nature and limited supply make it an attractive alternative for individuals seeking a store of value and protection against economic volatility. Keiser often criticizes central bank policies, such as quantitative easing and low interest rates, which he views as detrimental to the stability of fiat currencies.

According to Keiser, these policies erode the value of traditional currencies and push investors towards alternative assets like Bitcoin and sees Bitcoin as a hedge against the risks associated with central bank interventions.

Keiser contends Bitcoin is the ultimate insurance policy and hedge against the traditional central banking system.

He highlights Bitcoin’s limited supply and scarcity as a fundamental driver of its price appreciation and argues that as more investors recognize the importance of a deflationary asset in an inflationary world, demand for Bitcoin will rise, pushing its price higher.

Keiser often mentions network effects, stating that its value will increase as more individuals, institutions, and merchants adopt Bitcoin. He believes that as Bitcoin’s user base grows, it will become more widely accepted as a medium of exchange and store of value.

Max is a Senior Bitcoin Advisor to President Bukele of El Salvador to further the country’s goals and commitment to the Bitcoin Standard.

Despite Bitcoin’s reputation for volatility, Keiser sees it as an opportunity rather than a drawback. He argues that Bitcoin’s price volatility gives traders and investors significant profit potential. Keiser often encourages individuals to embrace volatility and use it as an advantage when entering the Bitcoin market.

Kesier is also on record stating he believes Bitcoin will eventually reach $1M per BTC, closer to our Bitcoin price prediction 2040 target date.

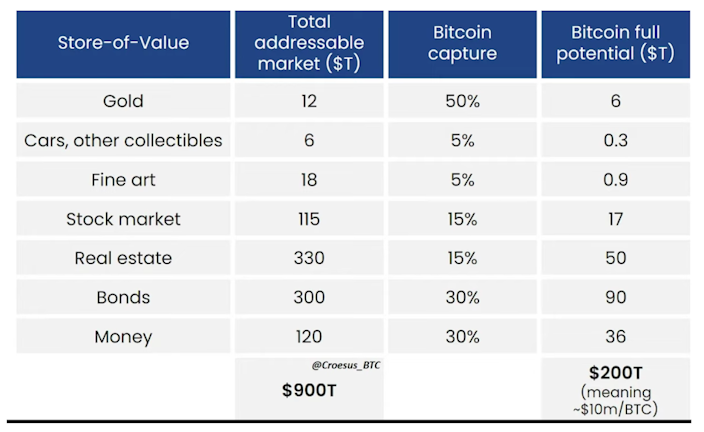

Today, Bitcoin makes up only ≈ 0.05% of the pool of investable assets. If Bitcoin captured (X%) of each, what price prediction conclusions can we draw from this?

Bitcoin Price Prediction Math: $200 trillion / 21 million BTC = $9,523,809.52 per BTC

Before we can provide any Bitcoin price prediction, we first must consider the various factors influencing price movements:

As demand for Bitcoin increases, especially in the face of limited supply, the price likely increases. Conversely, when demand falls or stagnates, Bitcoin faces downward pressure, and the prices may drop.

Due to Bitcoin’s automatic 'Difficulty Adjustment' mining algorithm component, it’s supply curve is deterministic. This adjusts the difficulty of the mining process such that no matter how little or how much mining hash power is applied, the average block interval remains anchored for around 600 seconds or 10 minutes.

Bitcoin halving events, which occur roughly every four years, reduce block rewards for miners by half. This automatically programmed periodic decline in newly minted Bitcoin further restricts supply. It usually sparks a period of very bullish price action.

In the year leading up to Bitcoin halving events, many investors come out with their own Bitcoin price predictions. So, what other factors should we consider?

Power Law is “the relationship between two quantities such that one is proportional to a fixed power of the other.” The relationship should occur irrespective of the initial size of those quantities, meaning it scales indefinitely in a straight line.

"Think about it, cities attract talent and capital and people work together for a common goal. Same with BTC, even earlier on people were joining for free, lending time and talent, using electricity to run the system and this brought in other talent and resources…

[F]inally, BTC was used as a mean of exchange and a store of value that made the price go up and so on. This creates all kind of feedback loops and make the system a network. Cities are network, BTC is a network. The math and science is the same. It is an amazing thing that you should tell everybody that tells you BTC is a scam, has no value, it is not back by anything. BTC is the most reliable investment in the history of humankind."

— BTC Power Law, (@Giovann35084111)

As with any asset, market sentiment significantly impacts Bitcoin’s price.

Positive news, recommendations from influential figures, or institutional investments can trigger FOMO (Fear Of Missing Out) among investors and lead to price increases.

Conversely, negative news, regulatory uncertainties, or security breaches can lead to panic selling and, thus, price falls.

Bitcoin’s value is linked to its adoption and utility. Technological developments that improve the network’s scalability, security, and efficiency can enhance confidence in Bitcoin and potentially drive its price upwards.

Moreover, increased merchant acceptance and widespread use cases contribute to the perception of Bitcoin as a viable payment method, further impacting its price.

The regulatory landscape significantly impacts the cryptocurrency market. Favorable regulations that provide clarity and legitimacy can attract institutional investors and contribute to price growth.

Conversely, adverse regulations or prohibitive measures may dampen market sentiment and negatively affect Bitcoin’s price. They can dramatically change Bitcoin price predictions as new developments come to pass.

Since its inception, Bitcoin’s price has seen extreme fluctuations. In its early days, the cryptocurrency traded for fractions of a cent, but in late 2013, it skyrocketed to about $754.01, up a whopping 5,481.1% for the year.

This meteoric rise was followed by a sharp decline known as the "Bitcoin bubble,” which saw the price plummet to around $200 in 2015. The most notable surge in Bitcoin price occurred in late 2017 when it hit an all-time high of nearly $20,000.

However, the ensuing market correction caused the price to drop back to the $3,000 to $4,000 range in subsequent years.

Recently, Bitcoin price has seen robust growth and consolidation periods, underscoring its ongoing volatility.

Bitcoin’s historical price charts show recurring patterns and cycles, such as halving-induced supply shocks and boom-and-bust cycles after periods of rapid growth.

Example: Historically, halving events have been followed by significant price increases due to reduced supply and increased demand. However, past performance does not guarantee future results.

Additional factors include:

Macroeconomic conditions

Technological advances

Regulatory developments

Previous attempts to predict Bitcoin’s price have yielded mixed results. While some analysts accurately predicted large price movements, others missed critical turning points in the market. These differences highlight the inherent challenges of predicting an asset as complex and volatile as Bitcoin.

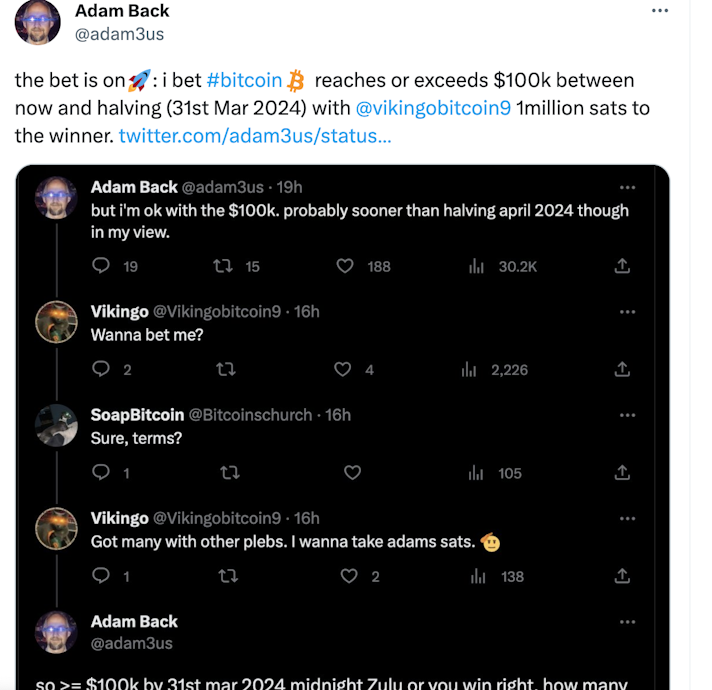

Adam Back, CEO of Blockstream, suggests the recent spot Bitcoin ETF approval could boost Bitcoin’s price to $100,000 in the very near future.

NOTE: Spot Bitcoin ETFs smashed records on their first day trading seeing over 4.6 Billion in trading volume, the highest ever for an ETF launch.

Spot Bitcoin ETFs from BlackRock and Fidelity Investments each saw more than $2 billion of net inflows during their first 12 trading days, while Grayscale Bitcoin Trust suffered more than $5 billion of net outflows.

Adam Back might be on to something here!

Echoing this optimism, Jan3 CEO Samson Mow suggested in a recent interview with Cointelegraph that the new spot Bitcoin ETF vehicle in the U.S. could potentially escalate Bitcoin’s value to as high as $1 million shortly after its introduction, within days to weeks.

What Will Happen to Bitcoin Now That ETFs Have Been Approved?

It means Bitcoin is leveling up. As Swan Bitcoin CEO Cory Klippsten told Yahoo Finance:

“The top-of-funnel for investor class is going to change from something that is contrary to Bitcoin, which is all of the crypto scams and pump-and-dumps of the last six years, FTX and the like… Now you’re going to see a new era where some of the most credible, some of the most well-funded, trust brands in the world are going to be shouting from the rooftops with tens, maybe hundreds of millions of dollars of marketing expense, just talking about Bitcoin.”

Achieving a Bitcoin price of $1 million represents a staggering 2,500% rise from its current position around $40,000.

Investors must understand that all Bitcoin price predictions are speculative and subject to numerous variables. Getting a balanced and comprehensive outlook based on available data and expert insight is essential while emphasizing the importance of prudent and well-informed investment decisions.

Closing Thoughts

The adoption of spot Bitcoin ETFs by institutional investors, such as BlackRock’s Larry Fink, Fidelity’s clients and holding Bitcoin as a reserve asset like MicroStrategy continues to bolster its legitimacy — this attracts additional capital inflows.

Bitcoin’s decentralized nature, limited supply, and superior store of value properties make it an appealing alternative to traditional fiat currencies in a world plagued by inflation and economic uncertainty.

Network effects play a vital role in Bitcoin’s trajectory. As more individuals, institutions, and merchants embrace Bitcoin, its value increases, driving further adoption. With each new participant, Bitcoin’s network effects strengthen, reinforcing its position as the premier cryptocurrency.

While volatility is often a concern, experts like Max Keiser see Bitcoin as an asset unlike any other and views price fluctuations as significant profit opportunities for those willing to embrace the volatility and enter the market strategically.

Although, precise price predictions will remain elusive, the overall consensus points toward a positive trajectory for Bitcoin, despite what many skeptics think.

Despite the vastly different timeframes of these predictions, the overall consensus points toward a positive trajectory for Bitcoin. The once audacious projections of early visionaries like Hal Finney are beginning to warrant serious consideration.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?